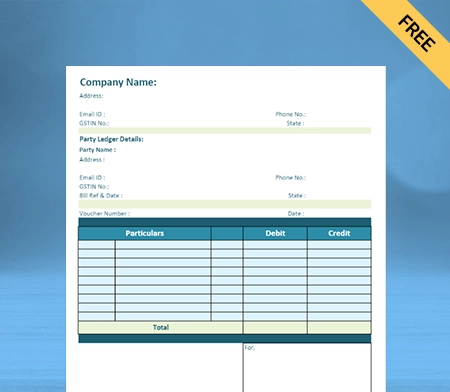

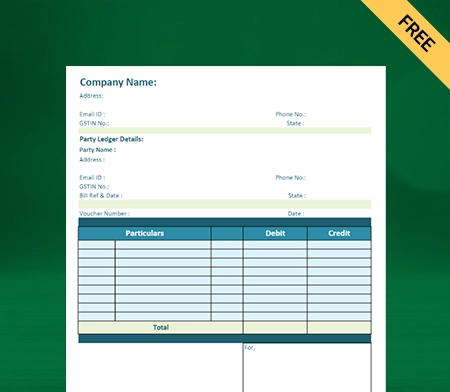

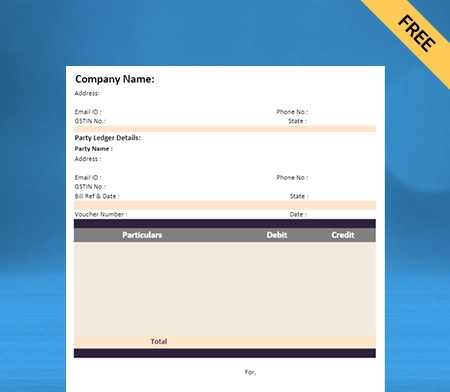

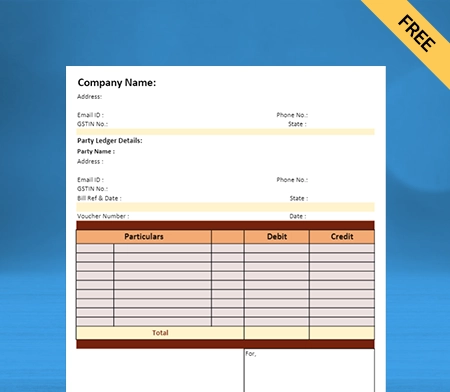

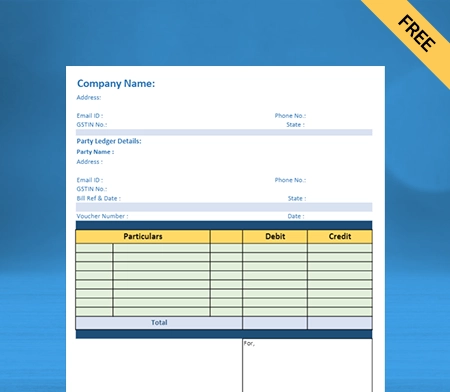

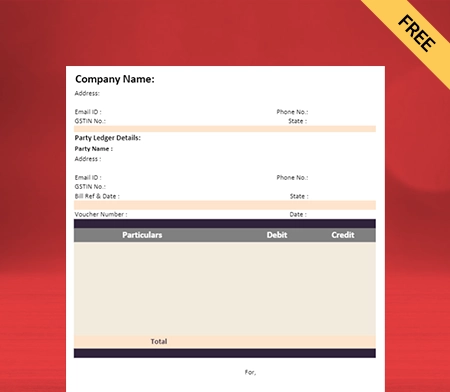

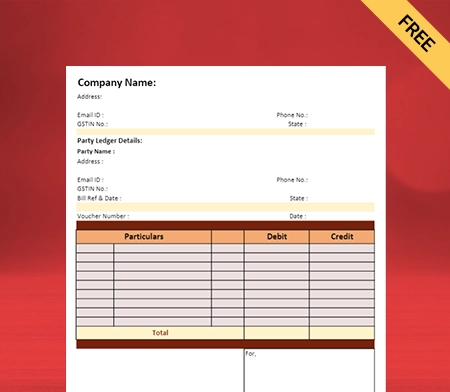

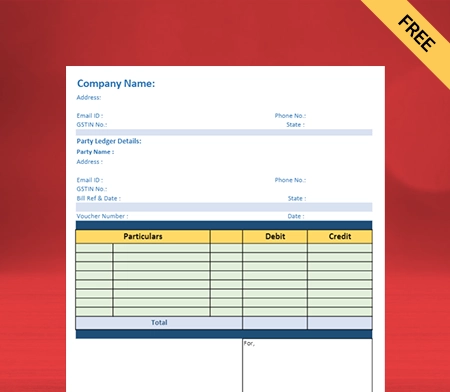

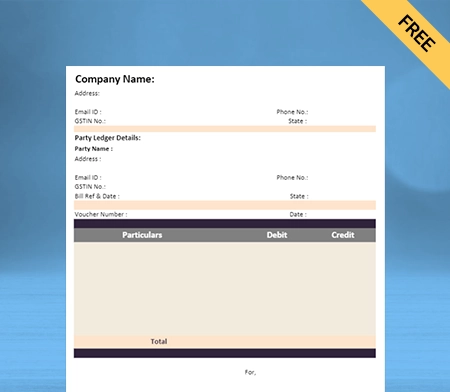

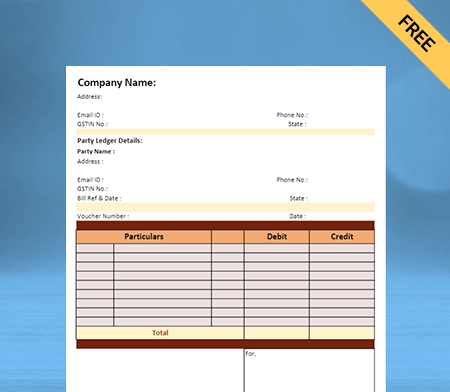

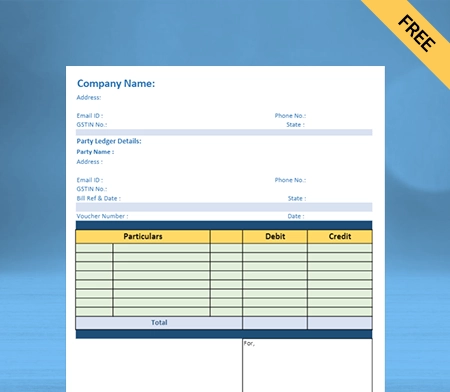

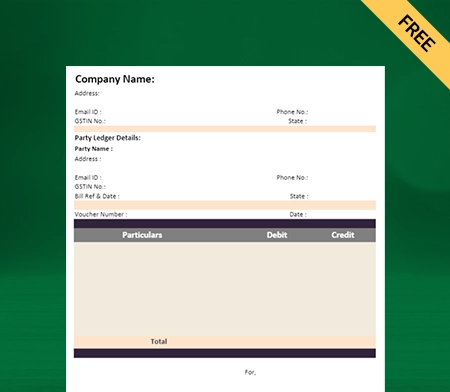

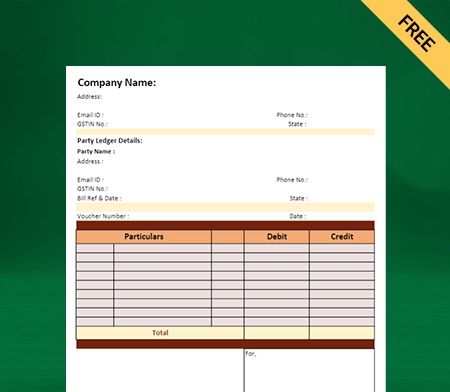

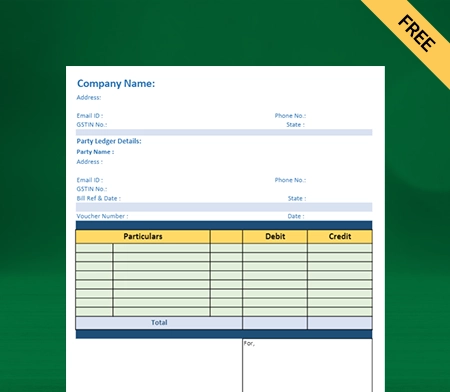

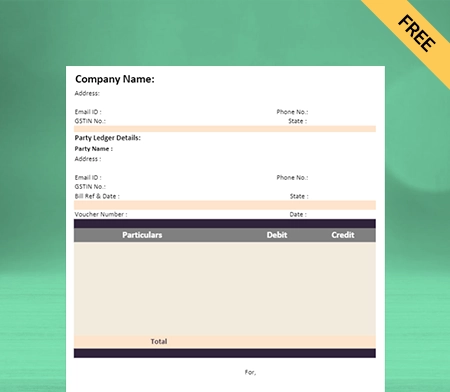

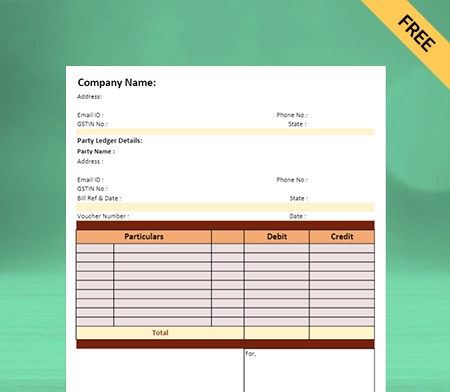

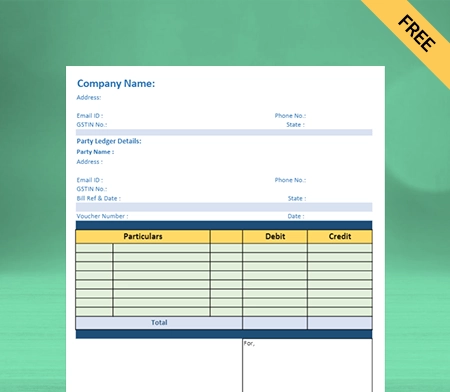

Double Entry System Format

Download the Double Entry System Format to check your accounting activities. Or use the Vyapar App to track your bookkeeping easily and grow your business faster! Avail 7 days Free Trial Now!

- ⚡️ Make personalised bills using 50+ themes

- ⚡ Benefit basic features for lifetime

- ⚡️ Complete financial view in just 30 seconds

Highlights of Double Entry System Format

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built from scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Download Double Entry System Format

Download the double entry system format, and customize according to your requirements at zero cost.

What is the Double Entry System?

A double-entry system in accounting is a method of recording every transaction on both the debit and credit sides. The double-entry accounting method is based on the idea that every transaction has two elements and impacts two ledger accounts.

Two or more accounts handle every business transaction in the double-entry bookkeeping method. The goal of double-entry bookkeeping is to prevent financial errors and fraud. The entries in a double-entry system are made to satisfy the equation: Liabilities + Equity = Assets.

The double entry mechanism requires debits and credits. In accounting, a debit entry is one on the left side of an account ledger, and a credit entry is one on the right side. Debits do not necessarily imply gains, and credits do not always indicate declines.

For example, if a company has a sales revenue of Rs 30,000, it will need to make two entries when recording the data:

Debit cash: Rs 30,000

Credit sales revenue: Rs 30,000

Principles of Double Entry System of Bookkeeping

The principles that you must follow while recording the double-entry system are as follows:

- The debit is on the left, and the credit is on the right.

- Every debit entry must have a corresponding credit entry.

- The benefit is received by debit, and the benefit is provided by credit.

There are guidelines to follow when posting double-entry transactions in the bookkeeping process. The rules for the various sorts of accounts are as follows:

- PERSONAL ACCOUNT: Debit the receiver, credit the giver

- REAL ACCOUNT: Debit what comes in, credit what goes out

- NOMINAL ACCOUNT: Debit all the expenses, credit all the incomes

Personal Accounts are general ledger accounts associated with individuals, associations, and businesses.

Real Accounts are generic ledger accounts associated with assets and liabilities.

Nominal Accounts are general ledger accounts that provide information about all expenses, incomes, gains, and losses.

Types of Accounts in the Double Entry System Format:

Double entry bookkeeping is essential in modern accounting procedures since it allows for transparency and in-depth financial analysis. Here are the various types of accounts in the double-entry system:

Asset Account

Asset accounts record the valuations of the company’s assets, long-term and short-term. It is a general ledger account that records transactions involving business capital. Generally, debit entries increase asset account balances, and credit entries decrease them. Asset accounts include cash accounts, inventory, real estate, equipment, cars, and investment capital.

Liability Account

Liability accounts detail the company’s amounts owed for short-term and long-term to external entities. Generally, a debit to a liability account indicates a reduction in the liability, whereas credit to a liability account suggests a rise in the business’s present liabilities. Accounts payable, salary and wages, and income tax are all examples of liability accounts.

Equity Account

Equity accounts represent ownership of a business in terms of its value. Shareholder’s equity, also known as net worth, is the value of a firm after all liabilities are deducted from its assets. Owner’s equity = Assets – Liabilities is the basic formula. It demonstrates how much the corporate owner has invested in the entity financially or by keeping earnings over time.

Income Account

Income or gain accounts document the company’s earnings. Cash balance inflows into the company are shown in the income account. A sale is an example of an income account. Other examples are interest income and service revenue.

Expense Account

Expense accounts detail the money spent on running the firm daily. This account shows the cash outflow from the firm. Salaries, utility payments, rent, and insurance are all examples of expense accounts.

Advantages of Double-Entry System of Bookkeeping:

Every business must have a bookkeeping system to manage the accounts properly. Small businesses might have a single-entry bookkeeping system, but a company with more than one employee or several reports should follow a double-entry bookkeeping system. The advantages of a double-entry bookkeeping system are as follows:

Get a Complete Financial Picture:

A double-entry bookkeeping system helps prepare the income statement and balance sheet financial reports. You can quickly get complete information about all the business transactions. The preparation of trial balance becomes easy with a double entry system. Trial balance a short arithmetic accuracy of accounting by ensuring an equal and corresponding credit and debit entry for each transaction.

Helps Make Financial Decisions:

Companies can maintain their accounts in detail with the help of a double entry accounting system. This way, making reports, analyzing them, and getting a sense of the profit and loss scenario is easier. It also helps to make better financial decisions because it shows the profitability and financial strength of various parts of the business. Owners can also utilize the extensive records of accounts kept under the double-entry system for comparison.

Reduce Errors:

A double entry system maintains transparency in the accounting system. Both debit and credit sides should be equal as per the rules. If they do not tally, it indicates a mistake in the journal or ledger entries. Double entry systems make it easy to detect fraud. As a result, the double-entry system assures that the books of accounts and the final balance sheet are accurate. Furthermore, it assists accountants in reducing errors by being precise.

Preferred Method:

The double-entry system is more transparent. It makes it easier for firms to attract investors and secure finance. The reports generated by the double-entry bookkeeping system provide banks and investors with a thorough and accurate picture of the business’s financial health. The Income Tax Department prefers this bookkeeping technique. It becomes easier for companies and tax authorities to calculate comprehensive income and levy appropriate and accurate taxes.

Difference Between Single and Double Entry System:

Single entry bookkeeping is the easiest method of maintaining books of accounts. It records each item as a single line item in a journal. Double-entry accounting is a method of documenting transactions in which each transaction, such as a debit or credit, is recorded in two accounts.

A single-entry method is insufficient because it does not record all the aspects. On the contrary, a double-entry system records all the sides, maintaining transparency.

The single entry system only records cash, debtors, and creditors. The double entry system records all the financial transactions of the entity.

The cost of maintaining the single-entry books is lower because it has fewer accounts. A double entry system is expensive as it records all the transactions.

Any individual can conveniently maintain the accounts in a single-entry manner. The double-entry system requires accountants to maintain the records.

You cannot determine the accuracy of the single-entry method, but a trial balance can examine the accuracy of books in the double-entry system.

It is difficult to determine a company’s financial status in the single-entry system. As the balance sheet is prepared in the double entry system, it is easier to check the company’s financial health.

A single entry system raises the possibility of fraud because anyone can modify it easily. No one cannot change the double entry as it has its reconciliation method, so it detects omission and fraud quickly.

If there is any dispute, single-entry books do not become admissible evidence, while double-entry books are valid proof.

You can maintain account privacy as there are a limited number of accounts. It is challenging to maintain confidentiality as all the financial accounts are involved.

The single entry system is ineffective and outdated, whereas the double entry system is dynamic and adapting.

The single entry method is not acceptable to tax officials, whereas the double entry system is acceptable.

Generally, a cash book is maintained in a single entry system. The double entry system has several subsidiary books such as cash, purchase, sales, etc.

Advantages of Using a Double Entry System Format by Vyapar:

It Saves Time:

Recording transactions manually might take a long time, increasing the possibility of math errors and mistakes. You may need to hire many employees to manage the double-entry bookkeeping system.

You can avoid this issue by using the Vyapar app. The software calculates automatically and precisely, records your transaction on both sides, and creates precise reports.

You may rapidly review your company’s income statements and analyse them. You don’t need to hire additional personnel because anyone on your team can handle the program.

Online/Offline Software:

You can run your business without an internet connection by utilising various specific invoice-generating program capabilities. You can now create invoices for your clients using the Vyapar app offline.

Vyapar’s software may generate invoice templates and bills even without an internet connection. Because of these capabilities, our clients’ businesses no longer have to rely on the internet for accounting.

The only time a consumer has to connect to the internet or use the online edition of Vyapar is when they want their data to be synchronized across various devices.

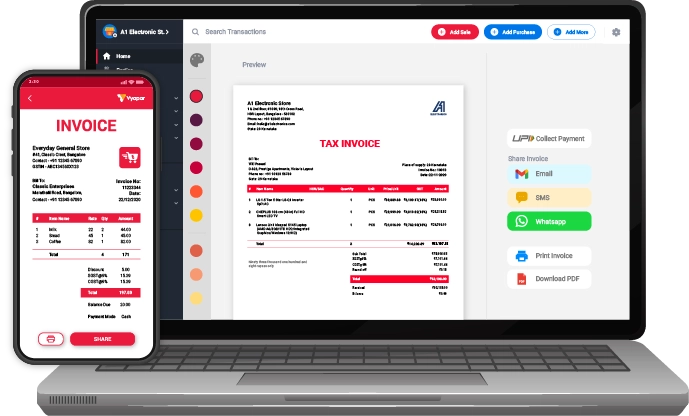

Make Personalised Bills:

Vyapar enables you to make invoices in seconds. The app allows you to personalise your bills while still seeming professional. You can save time by using the app to auto-fill repetitive debit entries.

Using professional bill book formats you can make your bill book one-of-a-kind for your business. Your company’s logo, email address, phone number, payment methods, customised themes, address, and name can all be included on the invoice.

Using this application, you can contact your consumers in whatever way you desire. You will be able to give a better customer experience and reply faster.

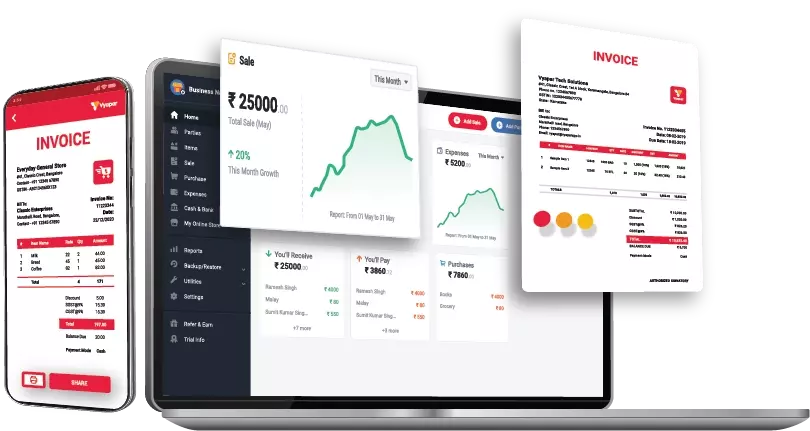

Attractive Dashboard:

Vyapar’s billing software for PC and mobile app offer a comprehensive company dashboard that displays all critical data from your daily business activities in one place.

Everything, from cash in hand to open cheques, stock value, bank balance, and sales orders, may be analysed swiftly. It lets you handle low-stock inventory, purchase order formats , delivery challan formats, and expired products, among other things.

It is the most effective inventory and order management system, billing, and invoicing. This complete setup will enable you to monitor your firm’s financial health and make educated decisions.

The Free Primary Usage for Life:

The essential elements of our business accounting program are free. The free services are available to Android users indefinitely. Unrestricted access is part of our mission of integrating millions of small company owners into the digital economy.

You can use the business accounting software for free if you register and get a free copy from the Play Store. On the other hand, a business can use a subscription to gain access to premium functions and desktop apps.

Following each transaction, you and your client will receive a free SMS with transaction details such as credit and debit amounts. It keeps both parties transparent and on the same page. The desktop version is free for 7 days, but users must pay for subsequent access.

Eliminate Human Error:

In any firm, an invoicing error can cost you a lot of money. It is vital to use the right software to run your firm efficiently. Vyapar allows your company to collect data much more swiftly.

Automation speeds up the process while removing human mistakes. You can focus on other chores and save a significant amount of time. The Vyapar ledger balance sheet formats have a simple user interface.

Importing and exporting data from appropriate programs is possible. It also sends reminders to collect payments and repay debts, which helps to avoid future issues.

Valuable Features of the Vyapar App:

Get Comprehensive Business Reports:

Business owners must make intelligent decisions. Managing all of the operational activities and finances at the same time might be difficult. Vyapar is the answer to all of these concerns.

Vyapar allows you to create 40+ different reports. You can generate reports such as GST reports, sales or purchase reports, expense or revenue reports, and balance sheets.

You can examine the reports and assess the company’s situation. It allows you to find and maintain the most popular product in stock.

The Ledger balance sheet format can make it easier to file your taxes. You can keep the company’s cash flow steady while avoiding workflow disruptions.

Data Protection and Security:

Every business must emphasise safety, especially now that everything is digital. You may protect the data in the application by setting up an automatic data backup with the Vyapar invoicing tool.

For increased security, you can create a local backup regularly. Your Vyapar data can easily be synced and saved in your Google Drive account. It decreases the risk of data loss and keeps your financial information safe.

The Vyapar software handles data and guarantees security by utilising three factors: password protection, data encryption, and continuous backup. The encryption system only allows the data to be accessed by the owner.

Vyapar will not keep or disclose user login data for future usage. The software is required to secure user privacy so that no one can access the user’s data, not even Vyapar. We recommend changing passwords regularly and storing backups offline for added security.

Inventory Management:

The Vyapar app has several novel inventory management functions. You can use the app to track your company’s sales. It allows you to make the best use of your inventory space.

Business reports can assist you in measuring the effectiveness of your management. Items that do not sell can be removed to conserve space.

Vyapar inventory management simplifies establishing sales or purchase orders by providing a due date for easy tracking. Enabling auto stock adjustment ensures that inventory products are always available.

It increases employee productivity and guarantees that orders are filled on schedule. Vyapar assists you in keeping enough reserved stock on hand to execute the order.

Keep Track of Expenses:

The expenses of a corporation help in determining its growth. You can better run your organization by examining costs. The software has a component for managing payments.

You can identify areas where you are overspending and find solutions to save money. Keeping track of spending is also necessary for accounting and tax purposes.

Our app is perfect for growing businesses. It aids in their financial management. By tracking expenses using Vyapar, the company can save time and money.

It also helps to reduce costs. Furthermore, keeping track of expenditures will aid in developing better plans and increasing the entity’s earnings.

Send Reminders for Payments:

With the Vyapar app’s reminder feature, you can ensure on-time payments and keep your company’s cash flow in check. When a payment is due, the app will notify you.

You can send payback alerts to your customers straight from Vyapar via Whatsapp or email, reminding them of their past-due balances.

Vyapar also accepts a range of payment methods. Cash, credit cards, debit cards, e-wallets, NEFT, RTGS, and UPI, are all accepted.

Allowing your customers or clients to use their preferred payment method ensures faster payouts and strengthens your corporate ties. It gives your customer the choice of selecting a suitable payment method.

Send Estimate & Quotations:

With our program, you can effortlessly create essential documents. It contains correct GST invoices, quotations, and estimations. Users can automate most tasks using accessible challan formats to save time and effort.

The built-in features of the GST billing software allow you to send quotations to customers at any time via WhatsApp, email, SMS, or printing.

Users can convert estimates and quotations into sales invoices at any time. The invoice tracking system can specify a due date for payment reminders. It eliminates mistakes in quotes.

Vyapar’s free billing software offers a comprehensive solution for saving time and obtaining quick quotes for organizations. Systematic bookkeeping enhances your valued clients’ professionalism, enticing them to return.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Download Free Double Entry System Format

Double Entry System Format in Word

Double Entry System Format in PDF

Double Entry System Format in Google Docs

Double Entry System Format in Excel

Double Entry System Format in Google Sheet

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

In the double-entry bookkeeping system, every transaction has a dual effect. It would help if you recorded it on both the debit and credit sides with the appropriate amount. The rule is that both sides must tally to maintain accuracy.

Double entry accounting lowers errors and increases the likelihood that your accounts will balance. Companies greatly benefit from double-entry bookkeeping because it reduces errors and aids financial reporting and fraud prevention.

A double-entry accounting system records a transaction in at least two accounts. It is founded on a dual aspect, namely Debit and Credit, which dictates that in any transaction, there must be an equal and opposite credit for every debit. The fundamental rules of double-entry bookkeeping with examples are as follows:

PERSONAL ACCOUNTS: Debit the Receiver and Credit the Giver. Personal accounts encompass the accounts of any individual, such as an owner, debtor, creditor, and so on. When we pay our creditors, we debit the receiver account, and when we get payment, we credit the giver account.

REAL ACCOUNTS: Debit what comes in and Credit what goes out. Pantry & Machinery, Buildings, Furniture, and other asset accounts are examples of real accounts. So when we buy Machinery, we debit the Machinery account, and when we sell Machinery, we credit the Machinery account.

NOMINAL ACCOUNTS: Debit all Expenses and Losses and Credit all Incomes and Gains. Expenses, Income, Profit, and Loss are all examples of nominal accountancy. The Salary Paid account, for example, is debited, while the rent received account is credited.

In a double-entry system, one party provides the benefit, and the other receives it. Each transaction has two or more accounts according to this method. With Vyapar, you can easily record the dual effect of each transaction and generate a PDF of that file.

STEP 1: Create accounts for posting your financial transactions.

STEP 2: Enter all transactions using debits and credits.

STEP 3: Ensure each entry has two components, a debit entry, and a credit entry.

STEP 4: Check that financial statements tally and reflect the accounting equation.