E way Bill Software & App For PC

Unlock seamless logistics management with the e way software for pc. Our software is a must-have tool for businesses that transport goods. It allows quick, accurate, and compliant e-way bill generation with just one click.

Top 4 Features of Vyapar E way Bill Software For PC

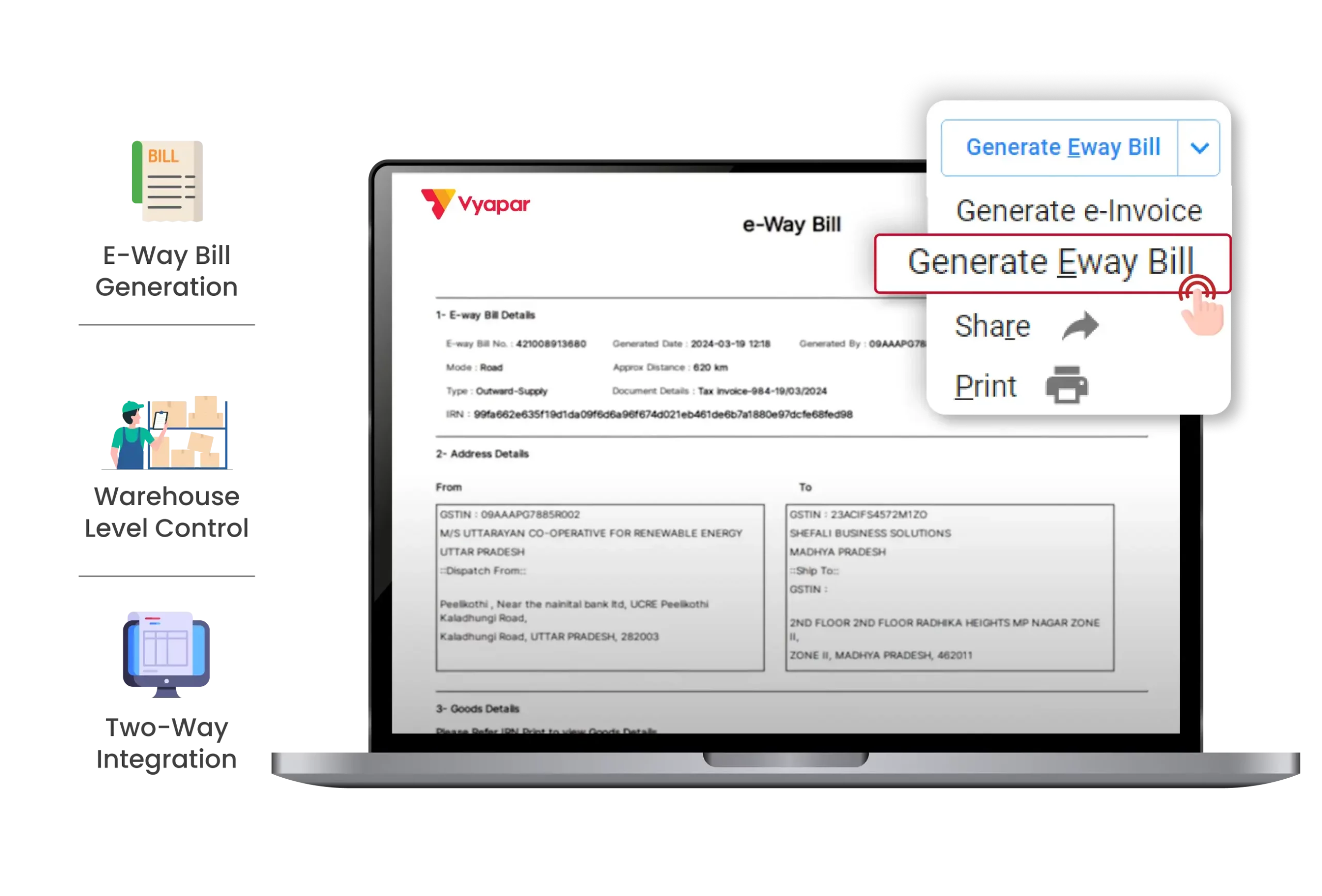

One-Click e way Bill Generation

Easily generate e way bills with a single click. Our Vyapar easy-to-use invoicing software integrates directly with your GST invoicing system, auto-filling essential details to save time and reduce errors.

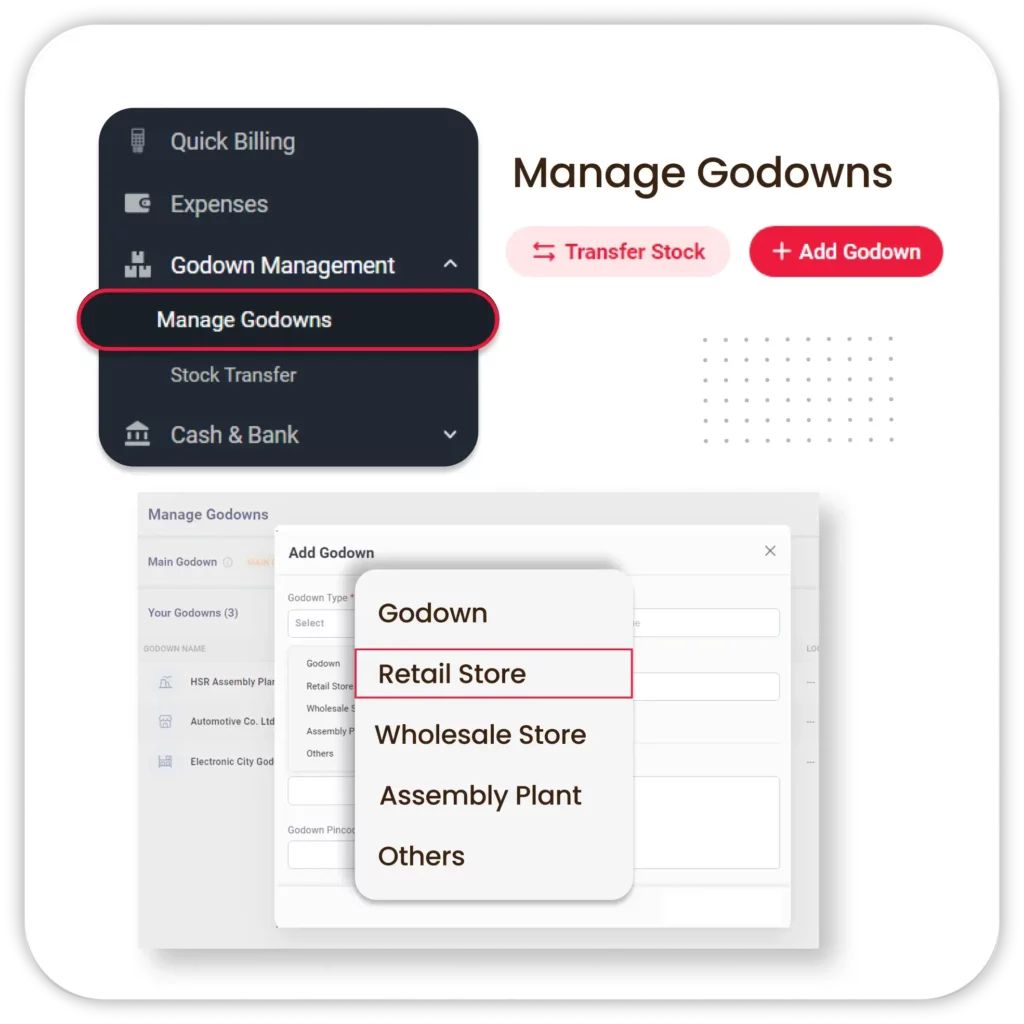

Warehouse Level Access Control

Keep control over who can generate e way bills with warehouse-level access control. Ensure accountability and compliance across multiple locations.

Two-Way Integration

Your e way bill systems integrate seamlessly with accounting tools for a smooth data flow between platforms.

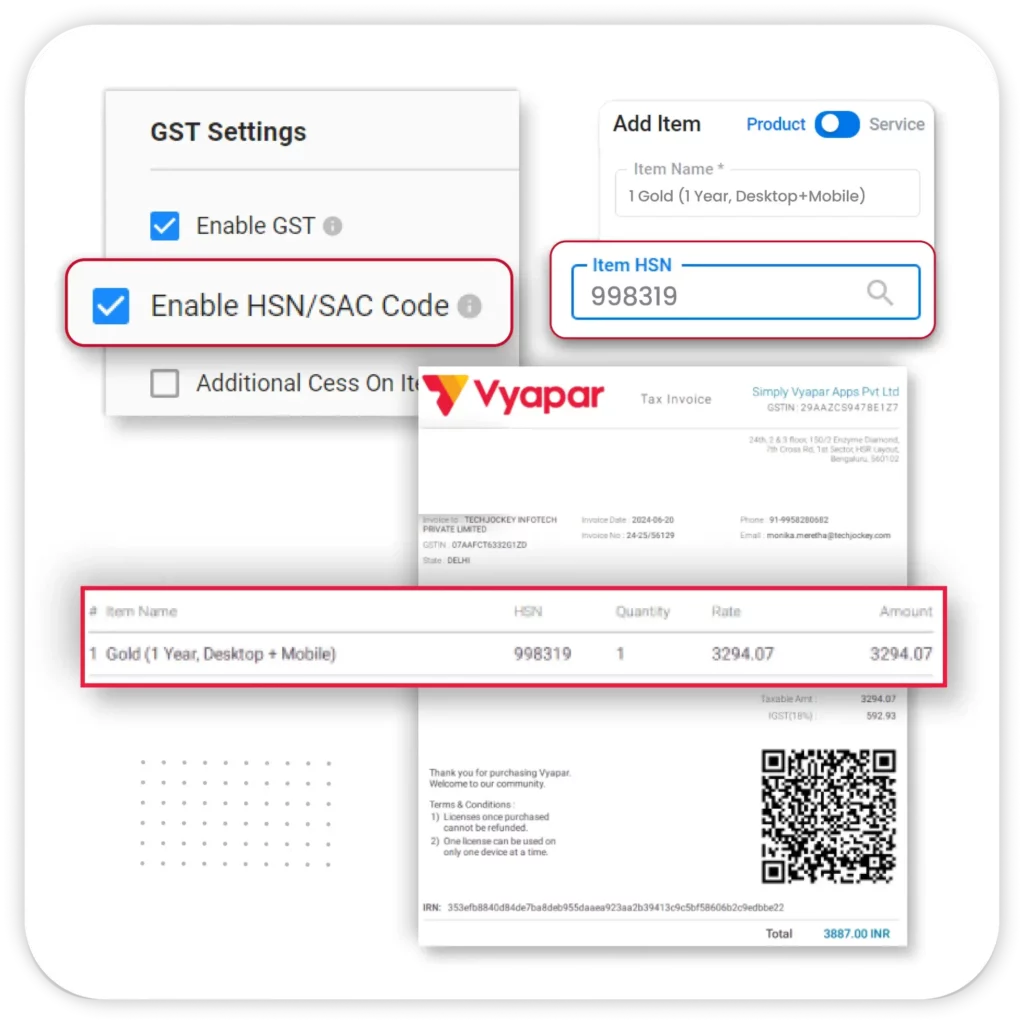

HSN Code Validation

Eliminate manual errors with automatic HSN code validation, ensuring your invoices and e way bills comply with GST regulations.

How to Generate an E-Way Bill Using Vyapar?

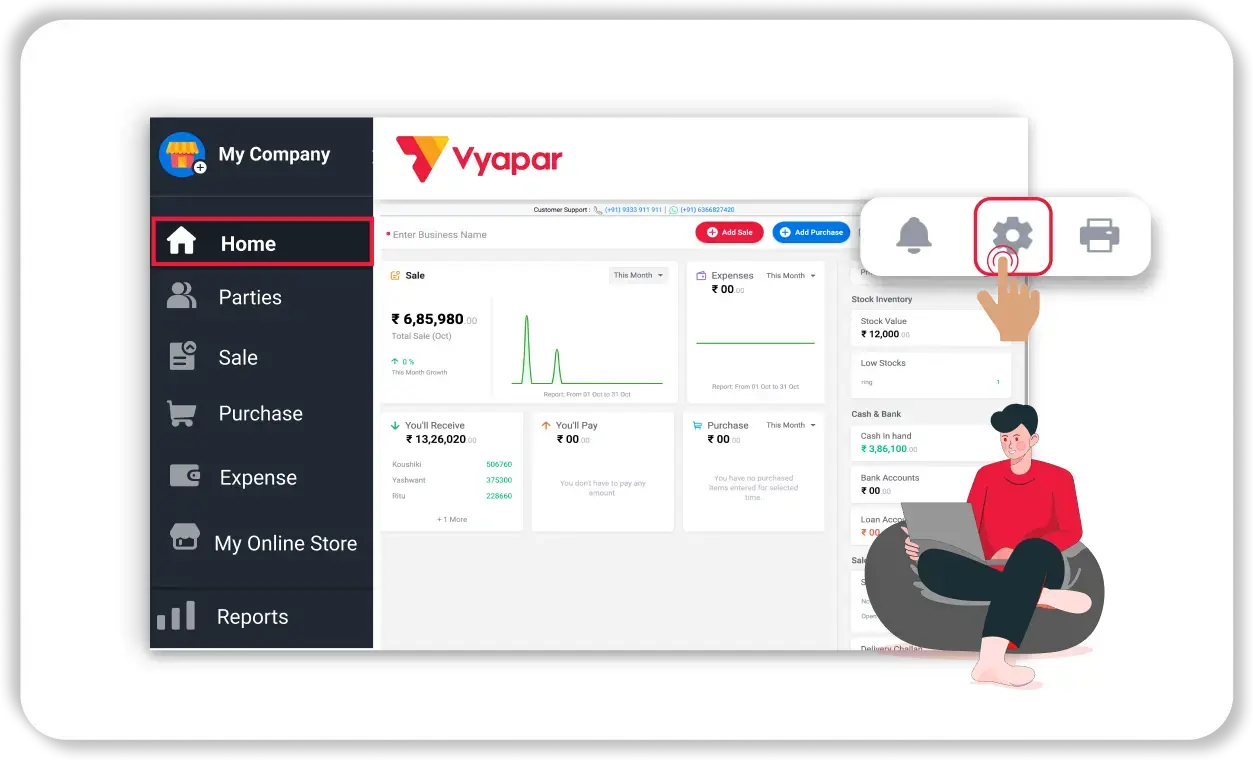

Open the Vyapar App on Your Desktop:

Launch the Vyapar app and log in if necessary. Click on the “Settings” button located in the upper-right corner of the screen.

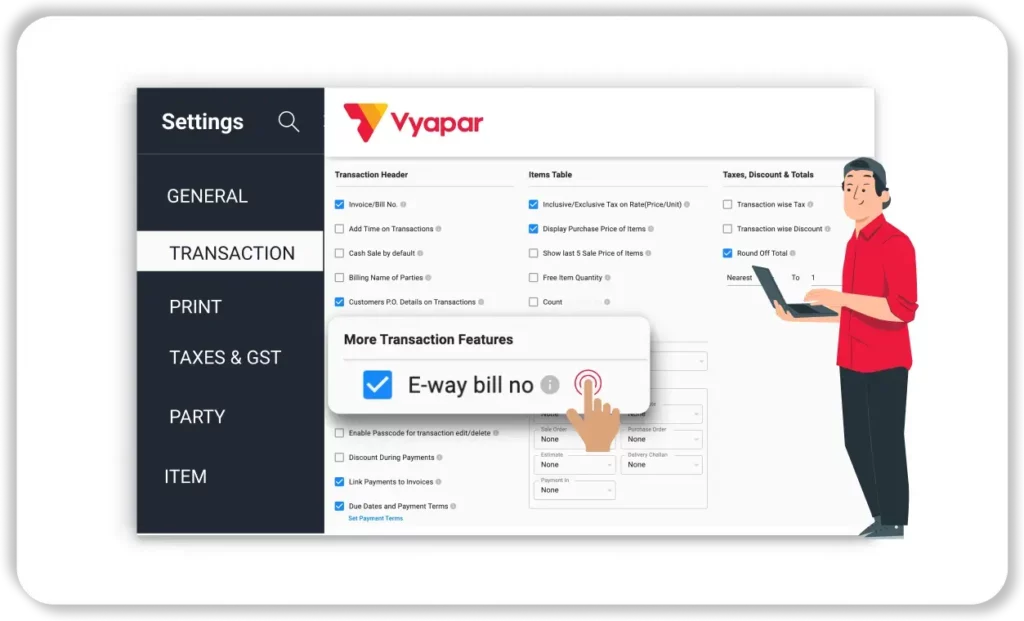

Enable E-Way Bill Option:

In the “Settings” page, go to the Transaction tab and enable the “E-Way Bill Number” option.

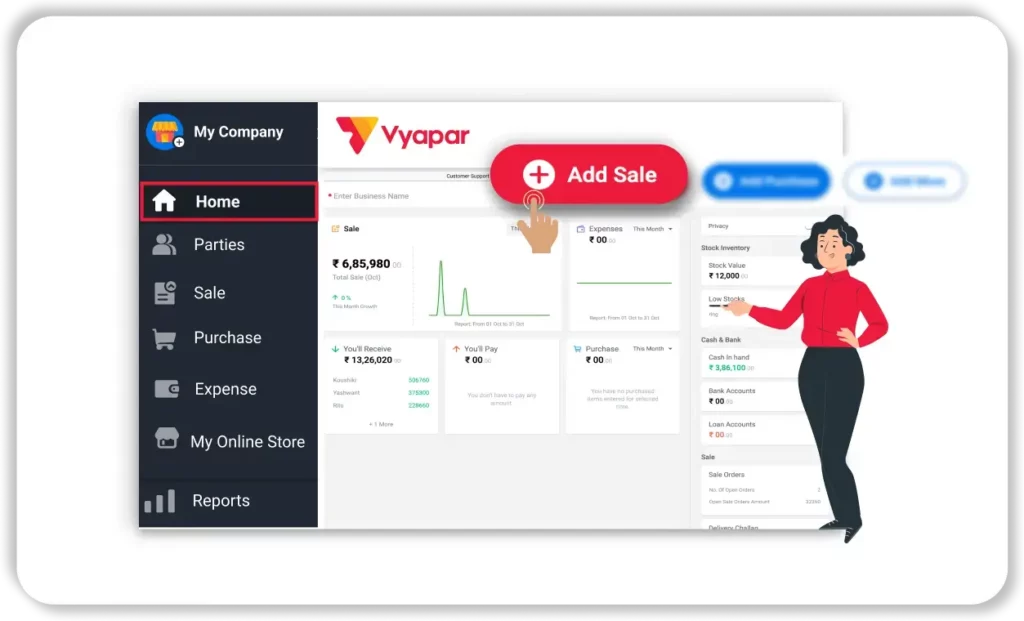

Create a Sale Invoice:

Return to the home page and click on the Add Sale button to create a new sale invoice.

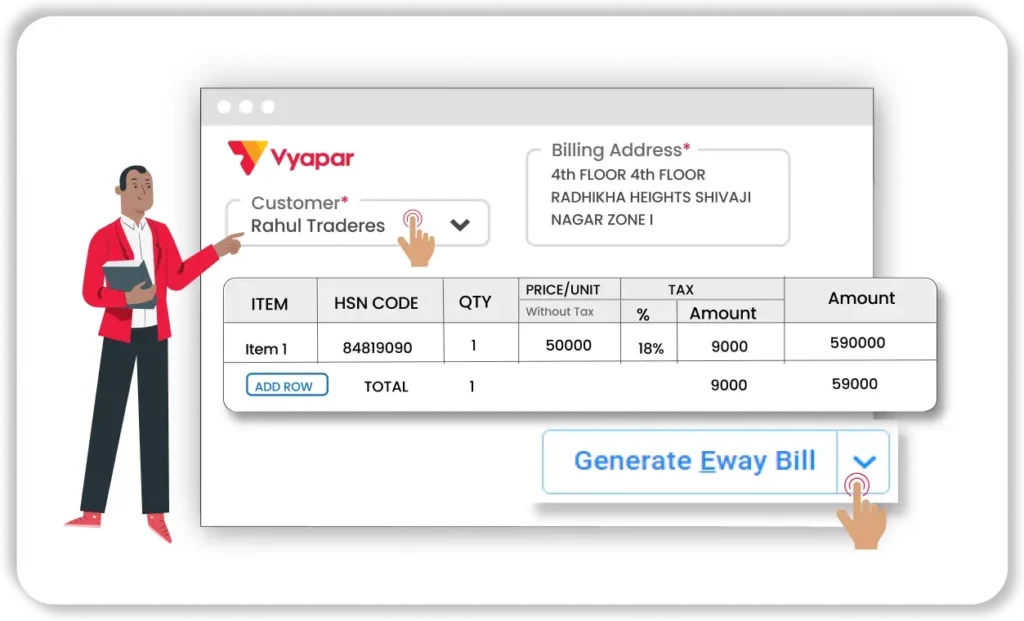

Add Party and Item Details:

If the transaction exceeds the threshold limit, then click on the option to Generate E-Way Bill No. will appear.

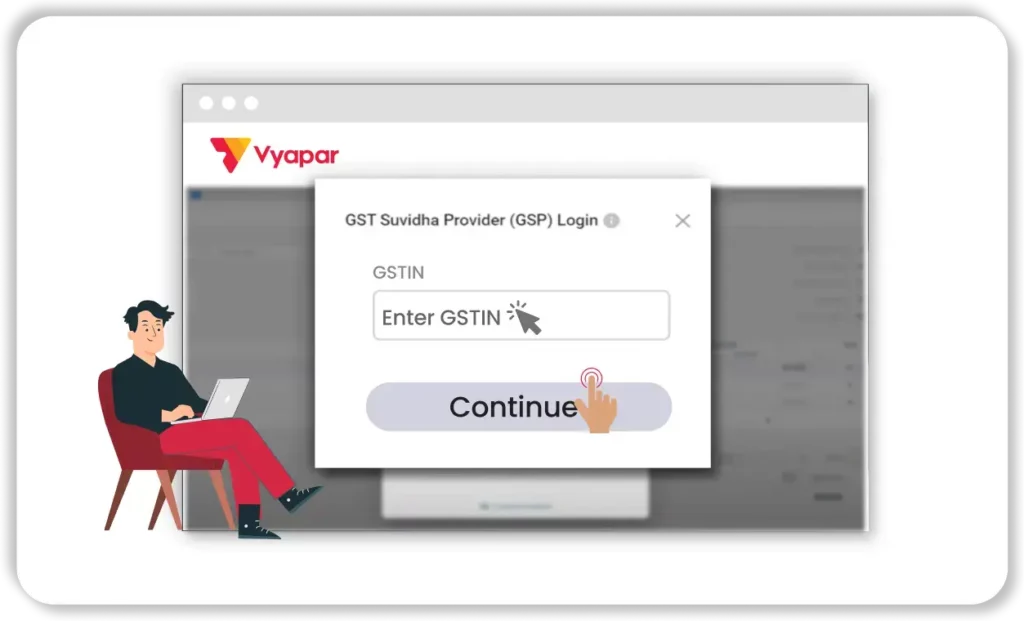

Log in to Vyapar (If Needed) or Enter GSTIN No.:

If you are not logged in, follow the Vyapar login steps by entering your GSTIN number and clicking Continue. If already logged in, simply enter your GSTIN number.

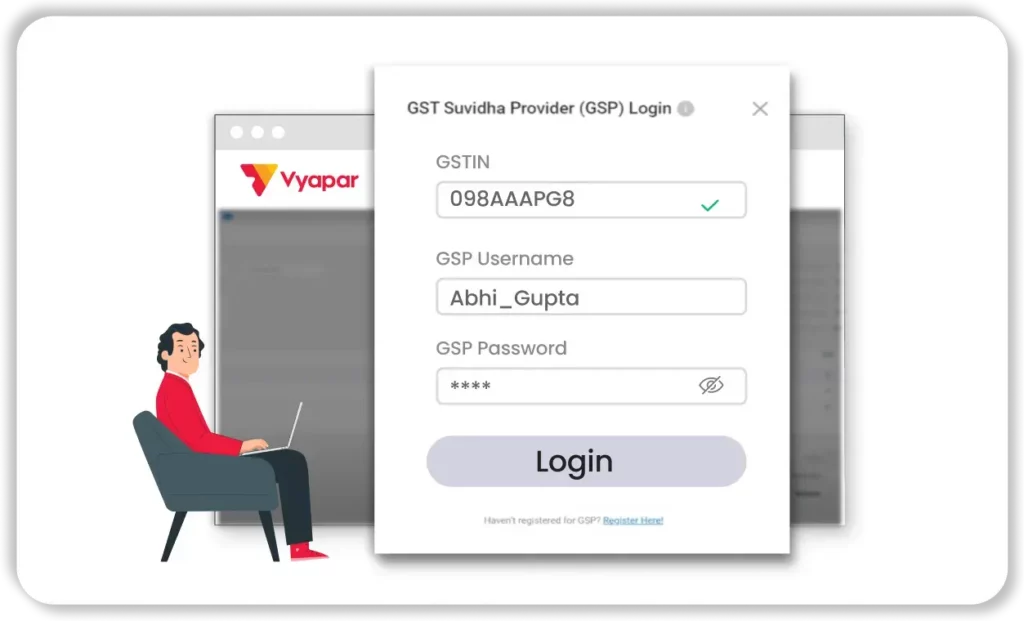

Enter GSTIN Credentials:

Input your GSTIN username and password to log in.

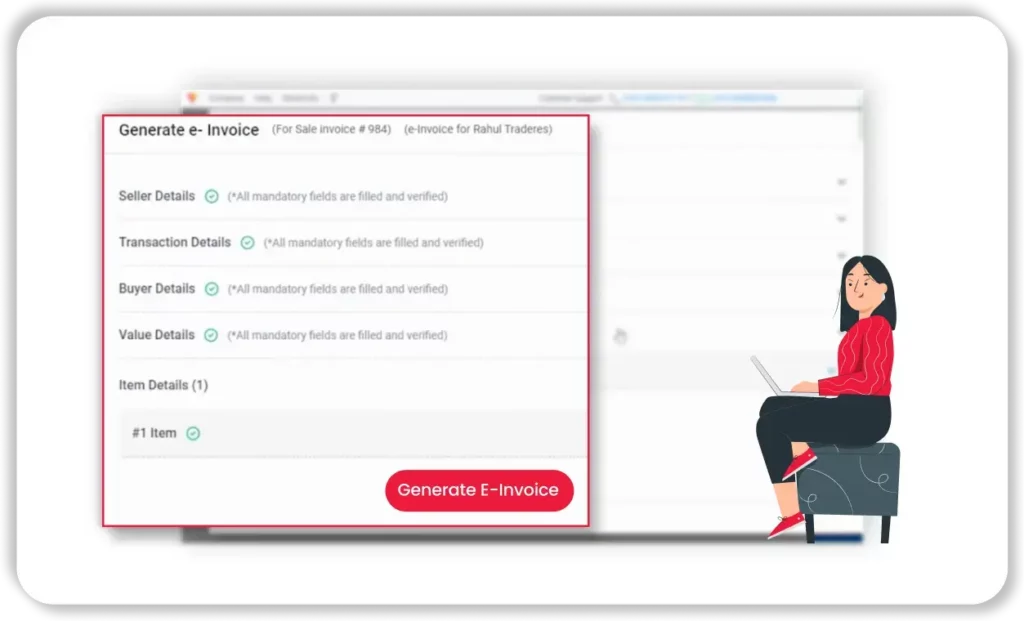

Verify E-Way Bill Details:

After logging in, review the “Generate E-Way Bill” screen to ensure all invoice details are correct.

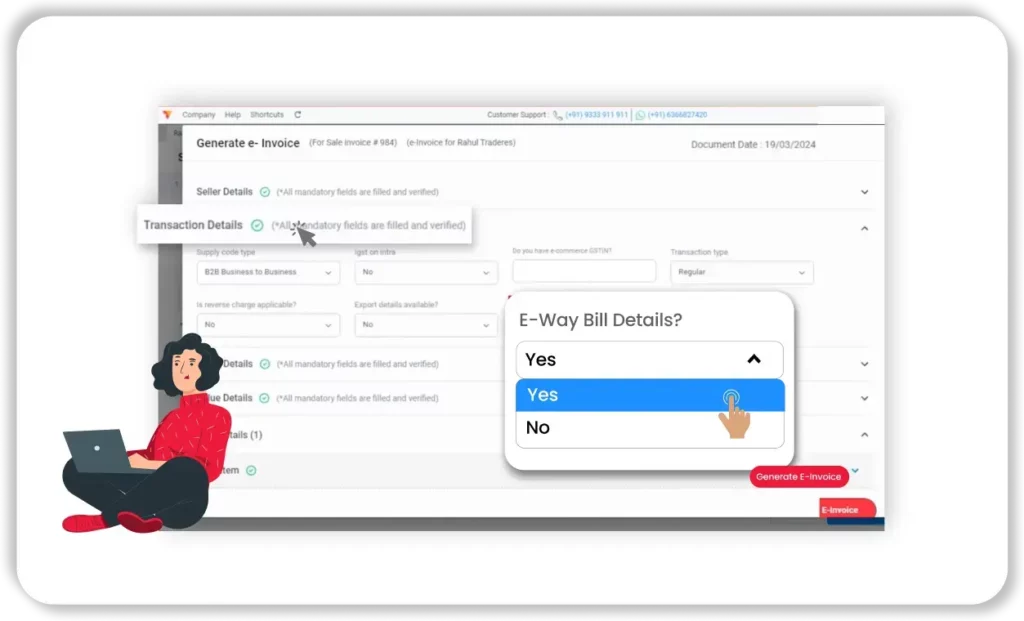

Enter Transactional and E-Way Bill Details:

Click on the transactional details and select “Yes” under the E-Way Bill section.

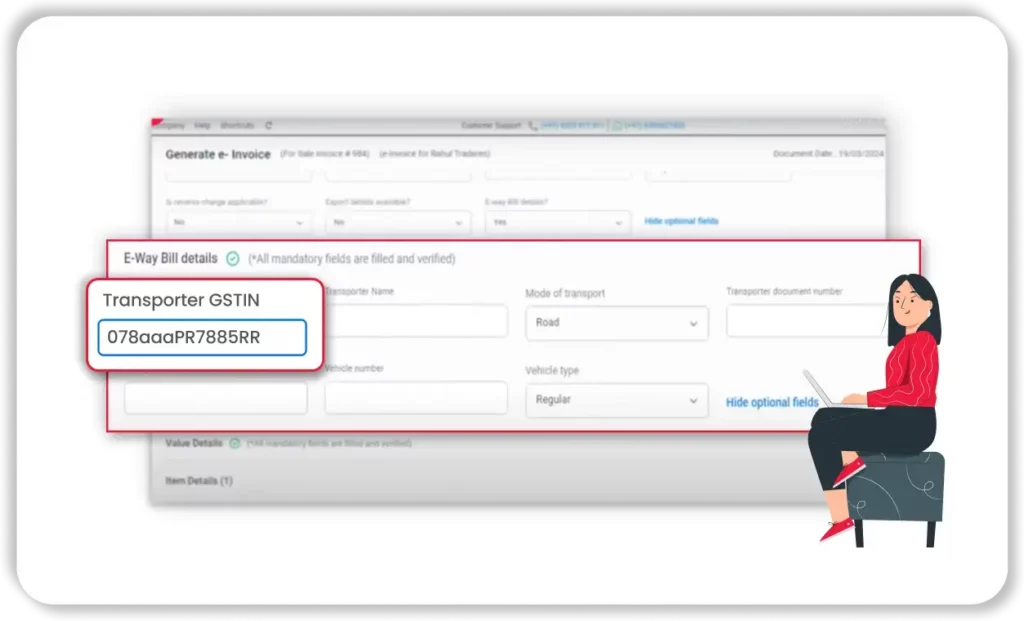

Fill E-Way Bill Fields:

The E-Way Bill details field will appear. Enter all the necessary details.

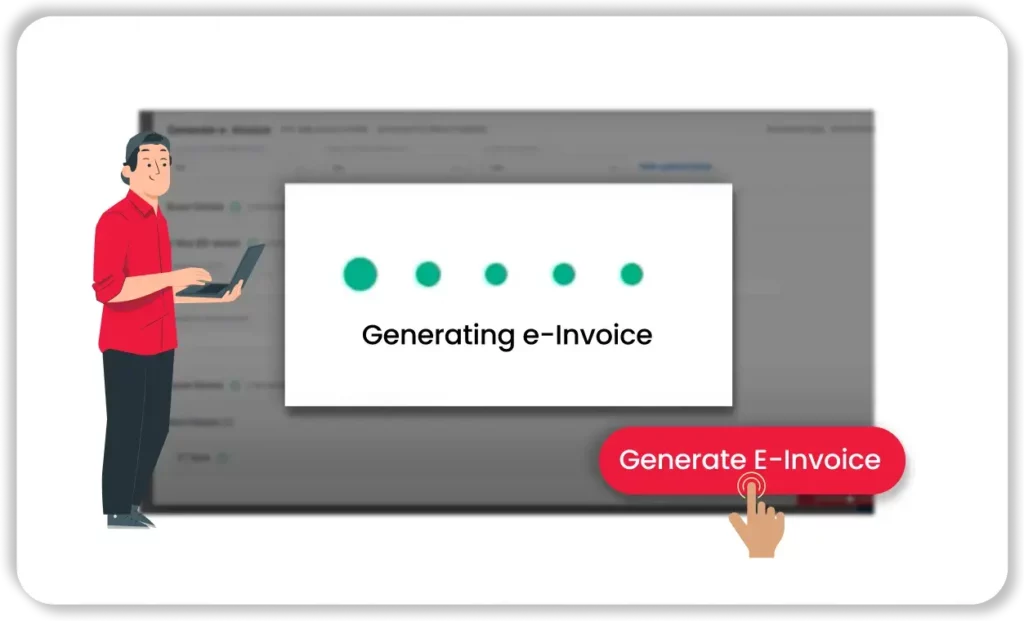

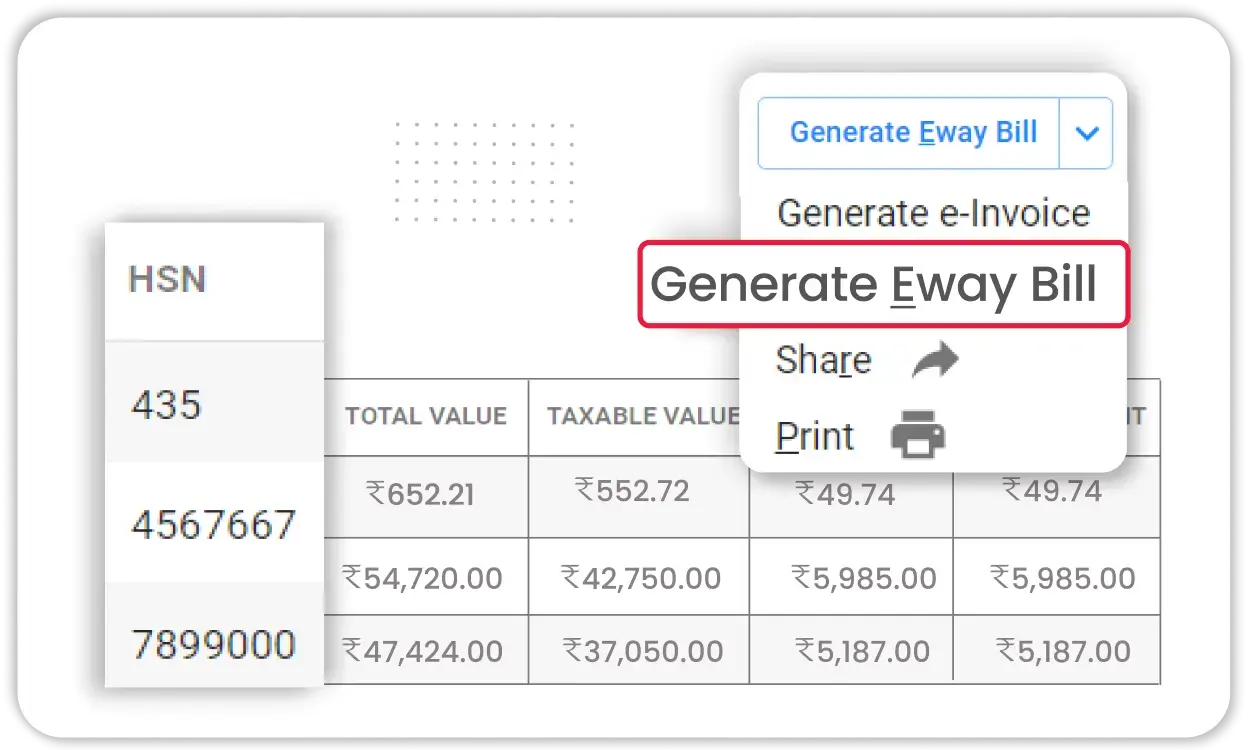

Click Generate E-Way Bill:

After filling in all required fields, click the Generate E-Way Bill button at the bottom-right corner.

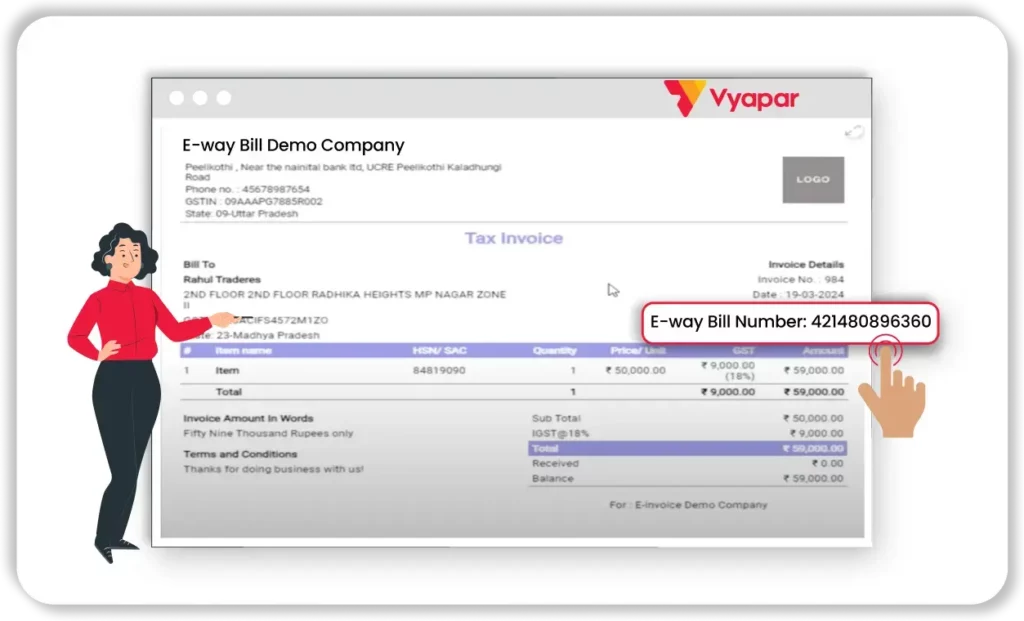

E-Way Bill Generated:

Your E-Way Bill will be generated, complete with an E-Way Bill number.

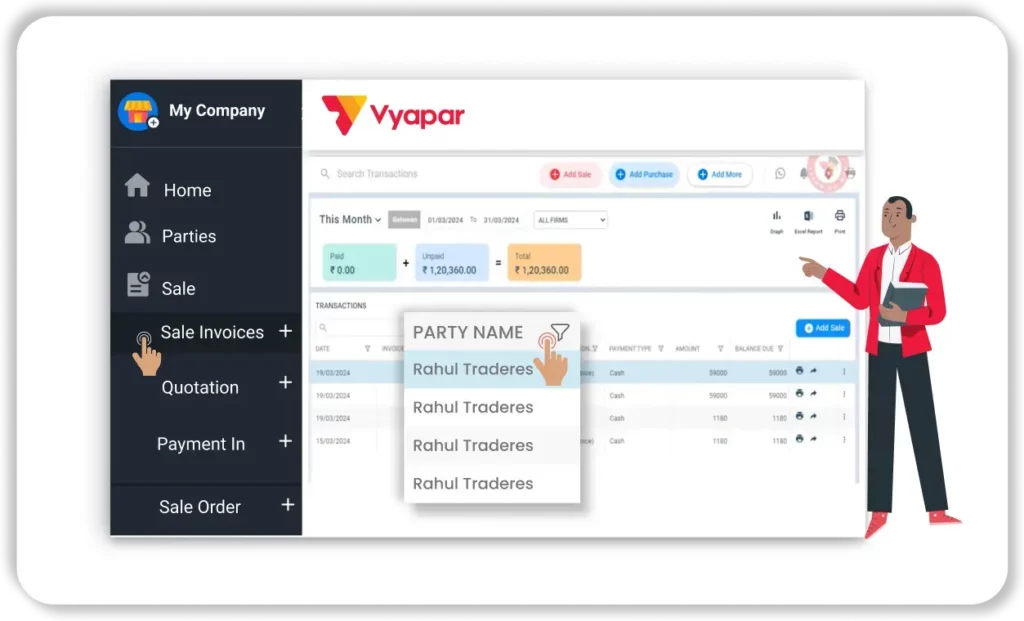

Return to the Sale Invoice:

Go back to the home page, open the sale invoice, and click on the party’s name.

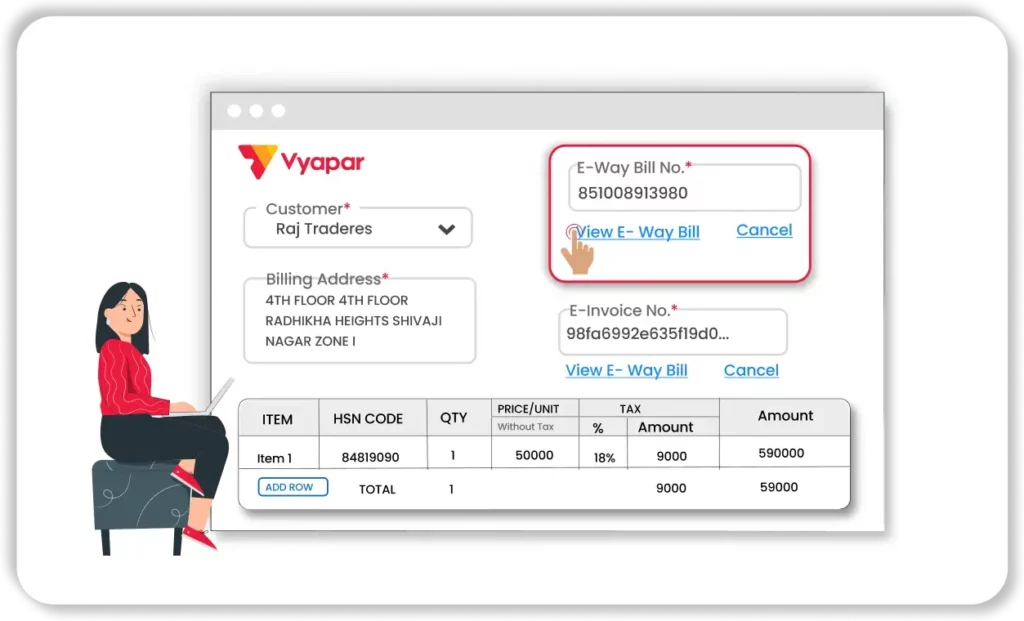

View the E-Way Bill:

Click on View E-Way Bill to check the E-Way Bill.

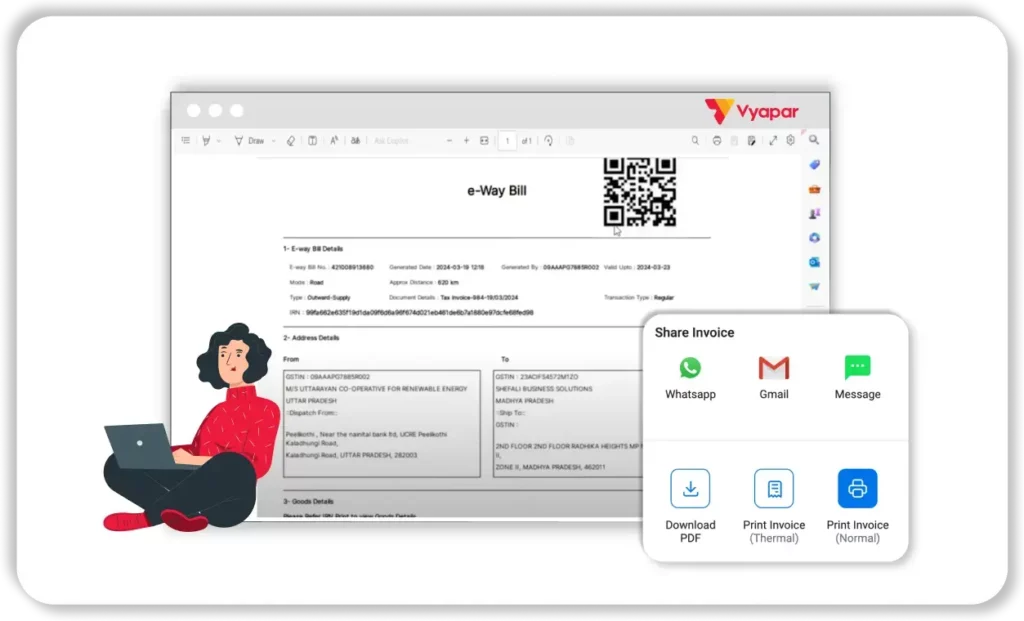

Print & Share the E-Way Bill:

After, reviewing your E-Way Bill, then select the option to print or share it as needed.

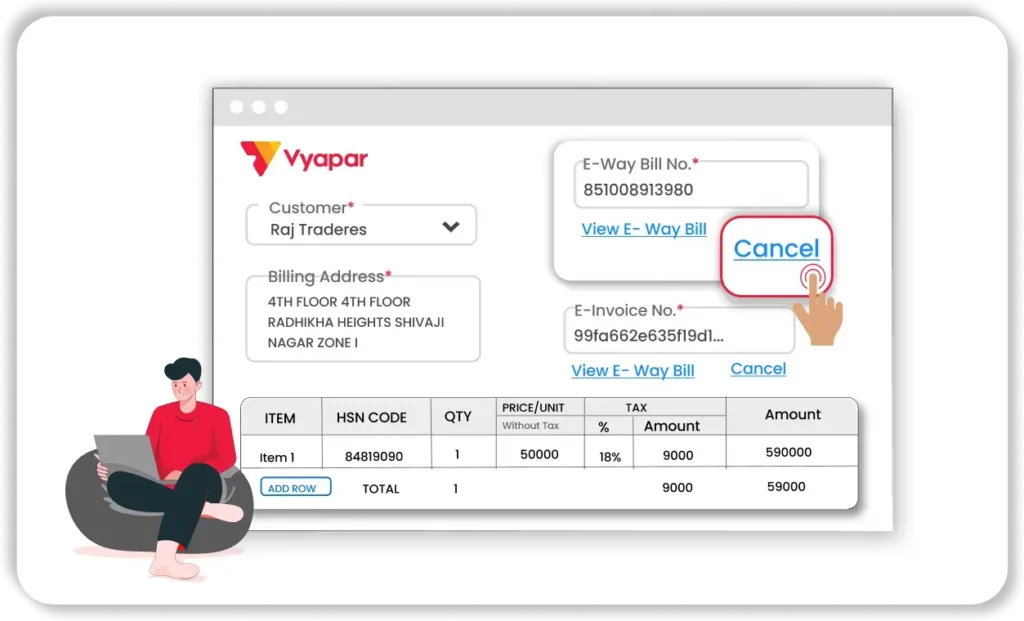

Cancel the E-Way Bill (If Needed):

If you need to cancel the E-Way Bill, simply click the Cancel button to proceed with cancellation.

Key Features Of Vyapar E way Bill Software For PC

Distance-Based Validity Check

Schedule e-way Bill Generation

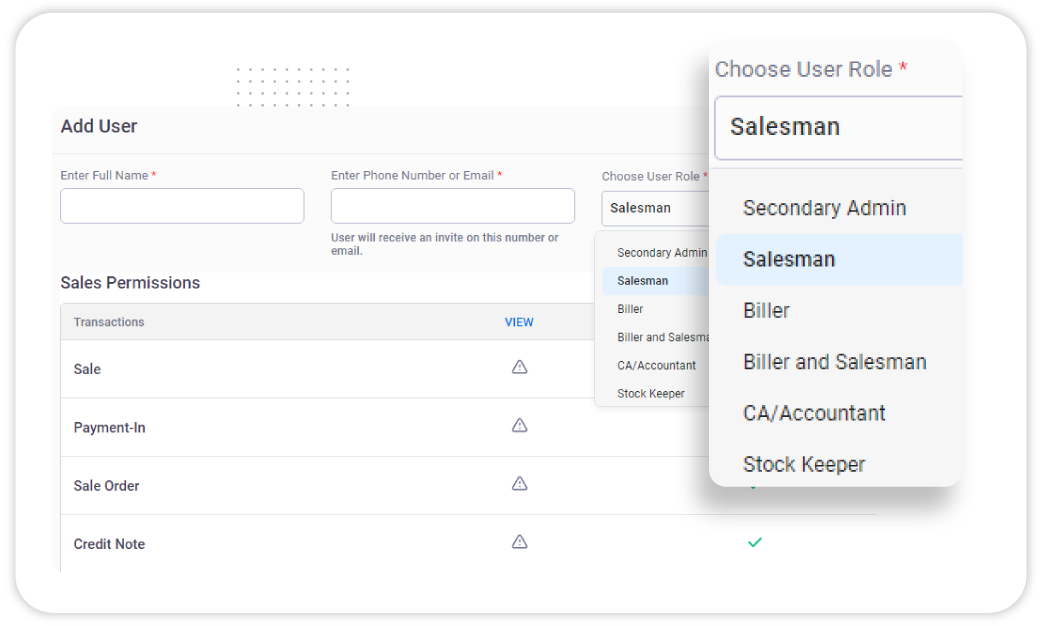

Multiple User Access

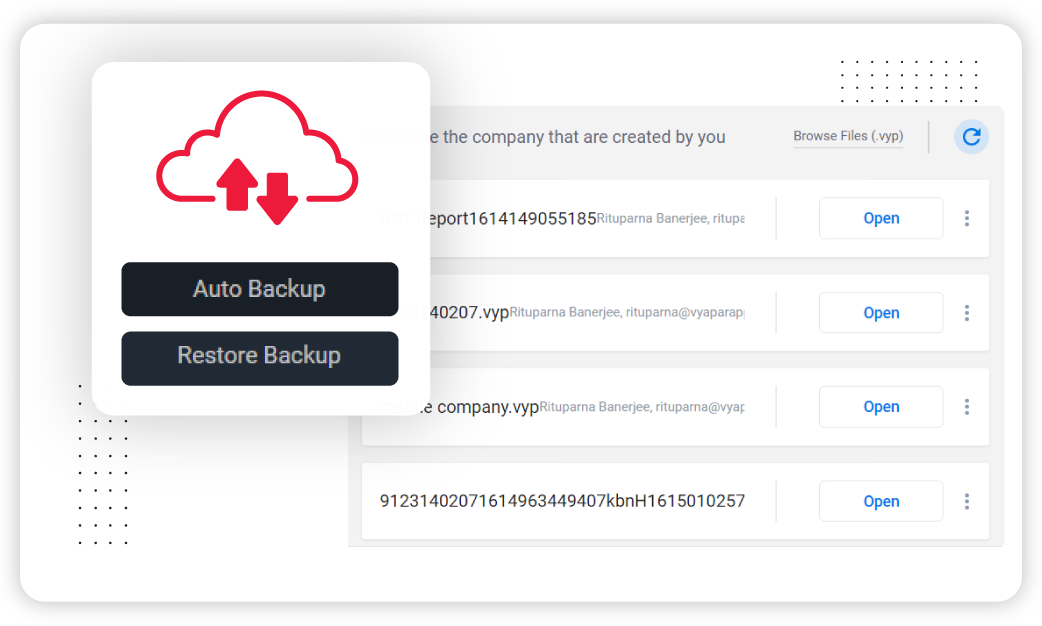

Data Backup & Security

GST Invoicing Integration

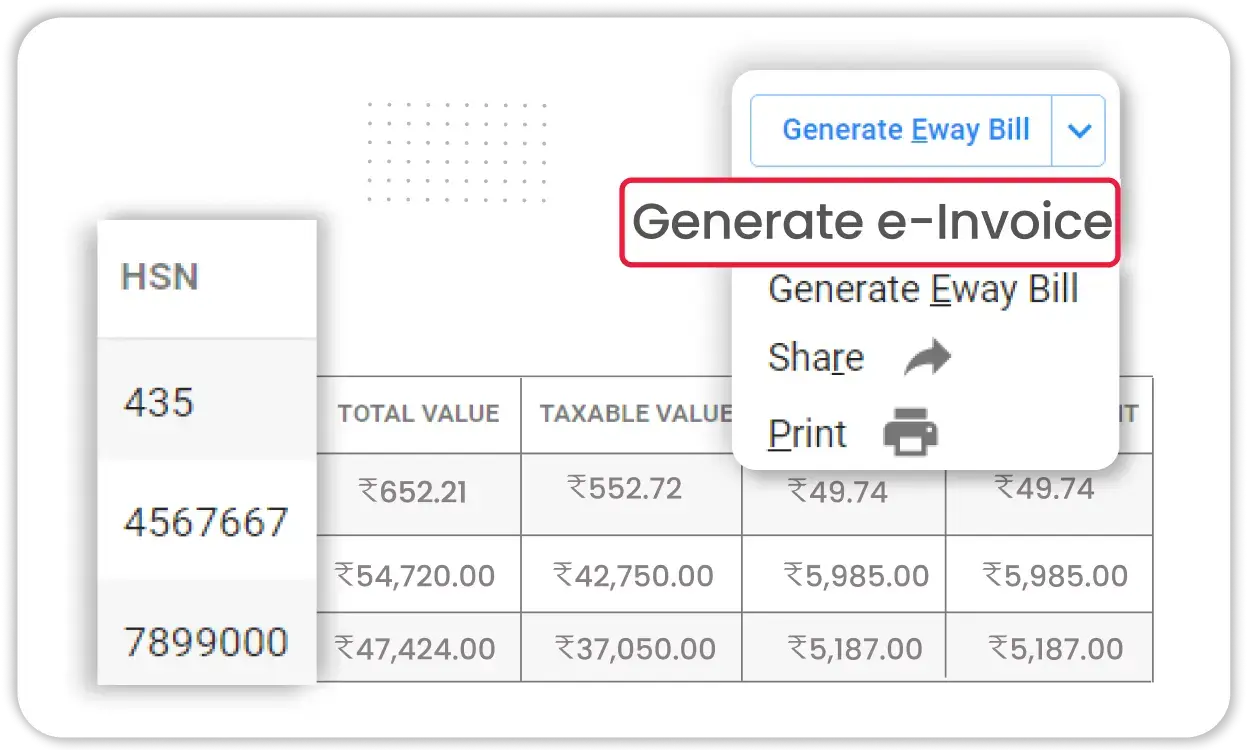

E-Invoice Integration

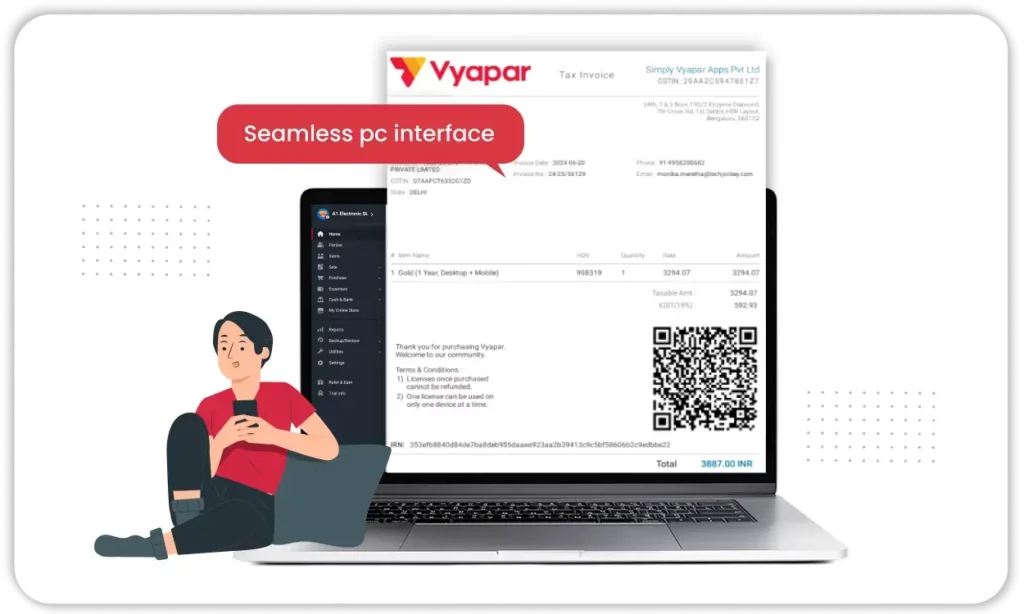

Seamless PC Interface

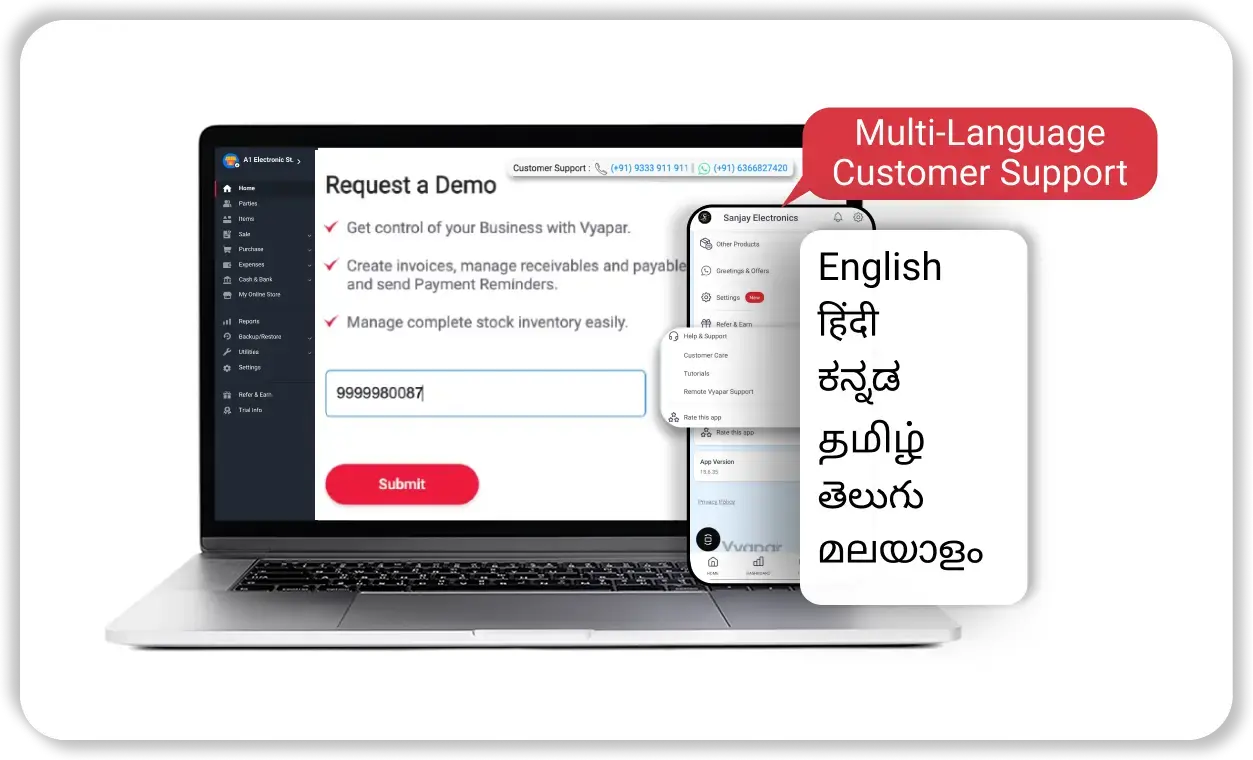

Native Language Support

Additional Features of Vyapar Best E way Bill Software For PC

Distance-Based Validity Check

Ensure your e way bills are valid based on the distance traveled, avoiding potential penalties for expired bills.

Schedule e way Bill Generation

Set up e way bills to generate at scheduled dates and times, streamlining large-scale or routine shipments.

Multiple User Access

Allow multiple team members to manage e way bills without compromising security or control.

Data Backup & Security

Your data is safe with automatic backups and industry-standard encryption, protecting it from unauthorized access.

GST Invoicing Integration

Integrate with GST invoicing to simplify billing and reduce the chances of errors in e way bill generation.

E-Invoice Integration

Enjoy seamless e-invoice integration, auto-generating e way bills based on B2B invoice data.

Seamless PC Interface

Our intuitive PC interface makes it easy to generate e way bills without any technical expertise.

Native Language Support

Generate e way bills in multiple languages, enhancing ease of use for diverse teams across India.

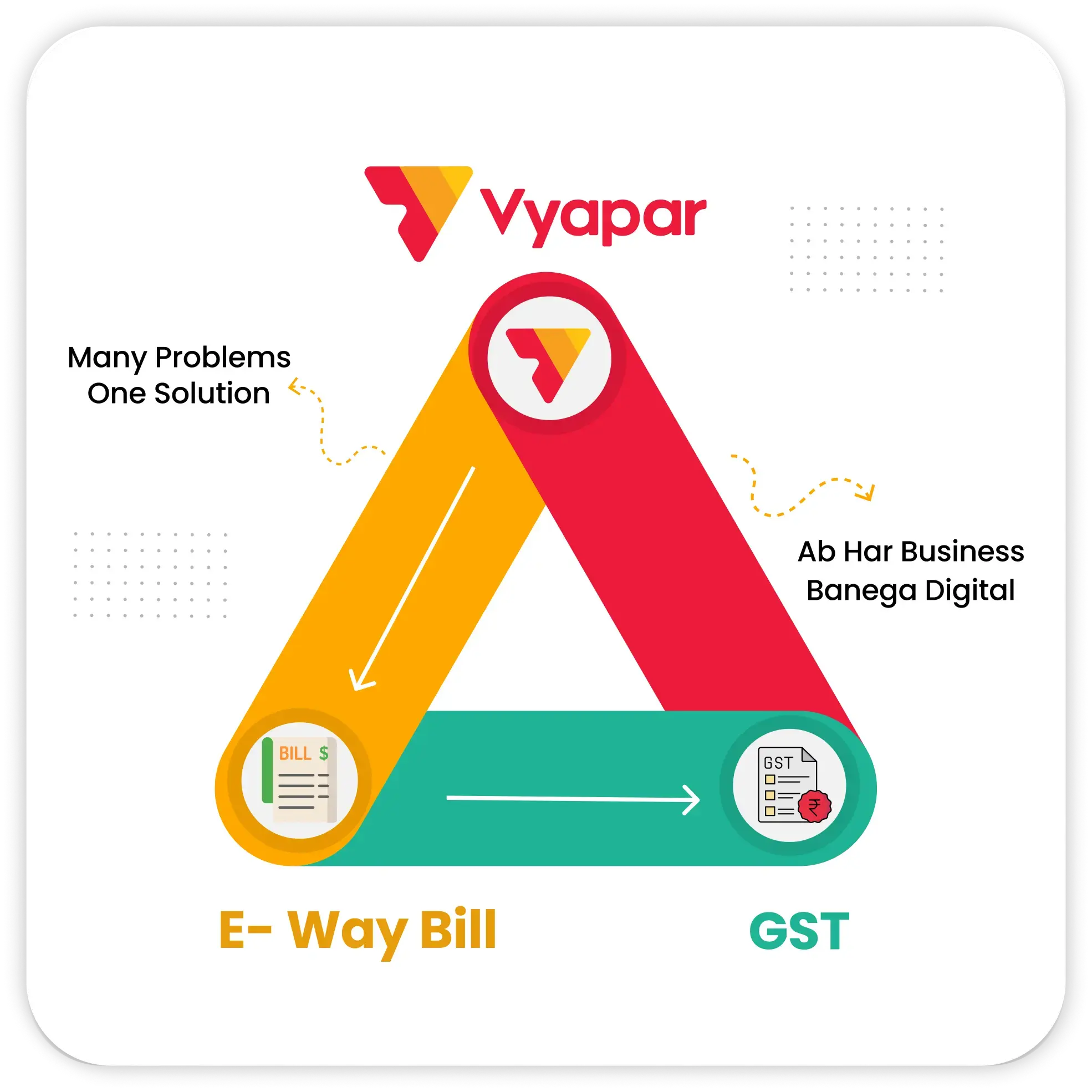

Why Choose Vyapar for E Way Software for PC?

User-Friendly Interface

Vyapar has a simple and easy-to-use interface. You don’t need any technical skills to generate e-way bills. This makes it easy for everyone to use.

Comprehensive Data Integration

With Vyapar, your e way bill software connects with accounting, billing, and inventory tools. This makes data sharing easy and cuts down on manual work.

Scalable Solution

Vyapar designed its software for all businesses, from small to large. It easily manages the growing number of e-way bills you need to generate.

Data Security & Backup

Vyapar ensures the security of your sensitive business data with encrypted backups and robust security protocols.

GST and E-Invoicing Support

Vyapar’s all-in-one solution supports GST compliance, including e-invoice generation, making tax filing smoother.

Real-Time Validation

Get real-time validation of HSN codes, invoice details, and other key information to avoid costly errors.

Multi-User Access

Give access to multiple users while maintaining control over their permissions, ensuring compliance at every level.

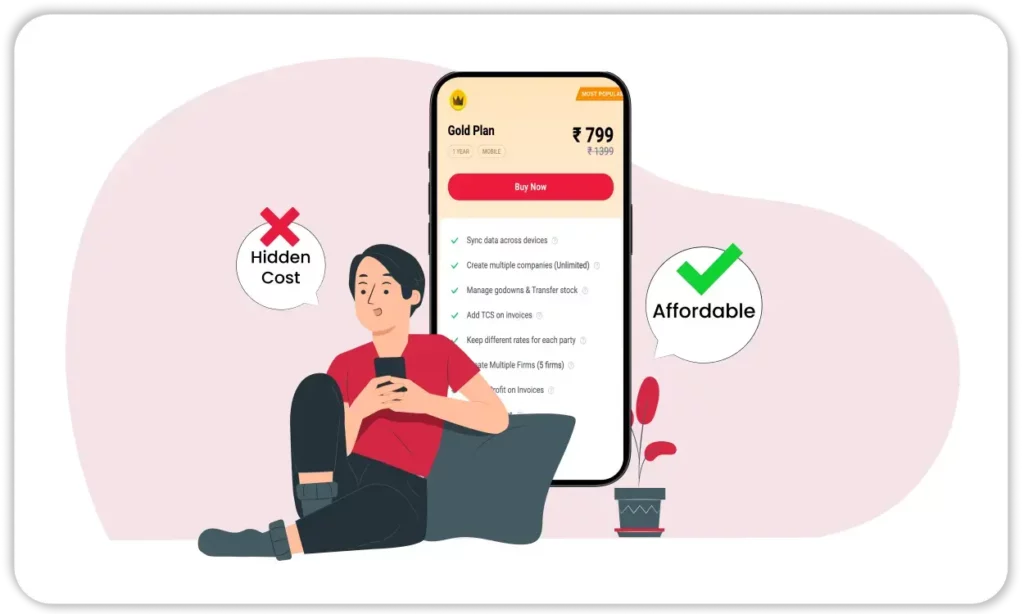

Cost-Effective Plans

Vyapar offers affordable pricing plans, allowing businesses to manage compliance without breaking the bank.

365*7 Customer Support

Vyapar offers round-the-clock customer support to assist with any issues, ensuring minimal disruption to your business.

Desktop Compatibility

Access your e way bill software from multiple desktops and PC, making it convenient for on-the-go users.

Benefits of Vyapar E Way Software for PC

1. Increased Compliance

Vyapar automates repetitive tasks like invoicing and expense tracking, saving you time and reducing the risk of manual errors.

2. Time-Saving

Gain access to real-time financial data that helps you make informed decisions about your business.

3. Error-Free Billing

With automated GST calculations and invoicing, you’ll always stay compliant with the latest tax regulations.

4. Scalable for Any Business Size

Track expenses, profits, and cash flow to optimize your financial performance and make strategic decisions for growth.

5. Improved Data Security

Automation reduces the risk of human errors, ensuring that your financial data is always accurate.

6. Seamless Integration

Vyapar’s cloud backups and data encryption ensure that your financial data is safe and secure.

7. Customizable Access Controls

Vyapar is designed to be the best inventory management software for small businesses, offering an affordable and powerful accounting solution..

8. Real-Time Updates

Manage multiple locations or branches easily with Vyapar’s multi-company accounting software features.

9. Automated Data Entry

Track your cash flow in real-time, ensuring you have a clear picture of your business’s financial health at all times.

10. Accessible Anywhere

Generate and manage e way bills from anywhere, whether you’re in the office or on the go with desktop support.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

In case of an error, you can cancel the e way bill and generate a new one with the correct details.

The Vyapar E Way Bill App is a comprehensive solution for generating and managing e-way bills seamlessly. You can create, track, and store e-way bills right from your computer. This helps you follow GST rules.

To create an e-way bill online with Vyapar, just enter the needed transport details. This includes invoice numbers, transporter information, and vehicle details. Vyapar’s E Way Bill Generator makes this process easier. You can quickly create accurate e-way bills for your business needs.

Yes, Vyapar offers a dedicated E Way Bill Software for PC that allows you to manage your e-way bills directly from your desktop. You can download the E Way Bill App for PC from the Vyapar website. It offers features like bulk e-way bill generation, real-time tracking, and easy GST compliance.

Yes, Vyapar provides a free e-way bill software download option for users. The free version has basic features for creating and managing e-way bills. However, advanced features like bulk generation and GST integration are only in the premium version.

Vyapar’s Bulk E-Way Bill Generation Tool allows businesses to generate multiple e-way bills at once. This is especially useful for companies handling multiple consignments or shipments, saving time and reducing manual work.

Yes, you can download the Vyapar E Way Bill App for PC from the official Vyapar website. The app is easy to use on desktop computers. It helps users manage e-way bills, create invoices, and ensure GST compliance from their PCs.

Vyapar’s E Way Bill Generator offers many features. It allows real-time e way bill generation and integrates with GST invoicing. You can also generate bills in bulk, correct errors, and track them in real time. The tool is designed to help businesses comply with GST regulations while making the process efficient and error-free.

To download the E Way Bill generation Tool, visit the Vyapar website and navigate to the download section. Vyapar provides a mobile app and e way bill software for PC. This allows users to pick the platform that fits their business needs best.

Many people consider Vyapar one of the best eway bill software solutions for businesses. It has many features. These include easy e way bill generation, bulk upload, real-time tracking, and integration with GST invoicing. This makes it a great choice for businesses of all sizes.

Yes, Vyapar’s GST E Way Bill App makes it easy to generate e-way bills on the go. You can enter all necessary transport and GST details, generate the e-way bill instantly, and track its status in real-time.

Vyapar’s E Way Billing Software has many benefits. It allows you to create e-way bills quickly. You can also generate multiple e-way bills at once. The software integrates with GST invoicing. Plus, it lets you track e-way bill statuses in real time. It helps businesses stay compliant with GST regulations while saving time and reducing errors.

Vyapar’s E Way Bill Generation Software is easy to use. Enter the necessary details, such as the goods, transporter, and vehicle information. The software will then automatically generate the e-way bill. You can also manage multiple e-way bills and track them within the platform.

Yes, Vyapar’s E Way Bill Generate App allows you to create e-way bills directly from your desktop device or PC. You can input all required details and generate e-way bills that are fully compliant with GST rules.

Vyapar is one of the best e way bill software options. It is easy to use and has many features. These features include bulk e way bill generation. It also integrates smoothly with GST invoicing. It helps businesses in various industries. It ensures compliance with GST and improves the e-way bill management process.

Absolutely! Vyapar’s software integrates seamlessly with e-invoicing, simplifying your GST compliance efforts.