E-Invoicing System Software

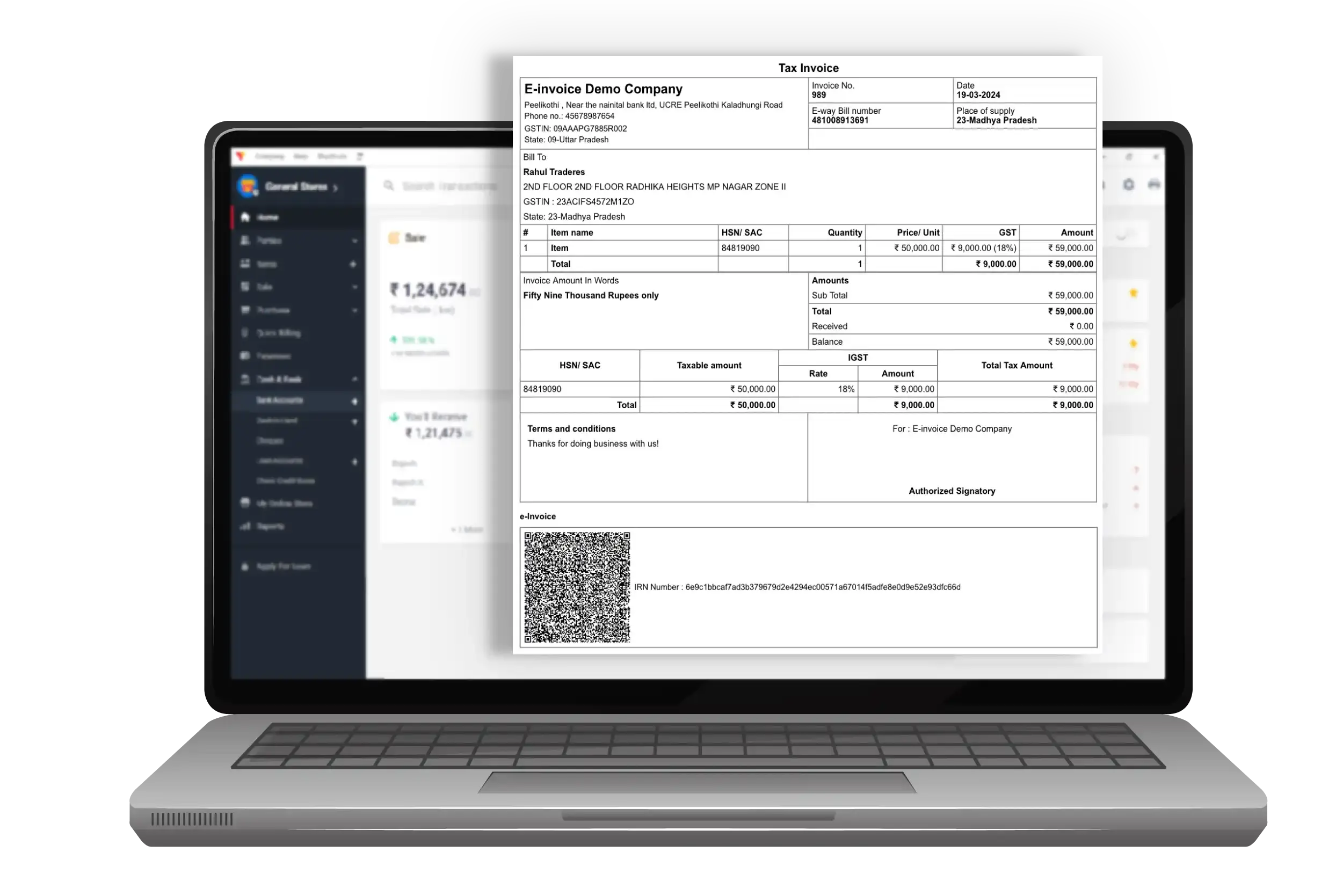

Vyapar’s e-invoicing software ensures faster, secure and easier e-invoice creation in just under 2 minutes and streamlines all your other invoicing operations. Avail a free trial and get started today!

Key Features of an E-Invoicing Software

Auto Invoice Fetch

Vyapar’s e-invoicing software, the auto invoice details fetch feature automatically populates invoice fields with data from existing records. When creating an invoice, it pulls relevant details like customer information, item descriptions, pricing, and tax rates from the database.

This feature streamlines the invoicing process, reduces manual entry errors, and saves time by ensuring all necessary details are accurately included without needing repetitive input.

GSP Integration

GSP (GST Suvidha Provider) integration in invoicing software facilitates seamless e-invoice generation by connecting with the GSTN (Goods and Services Tax Network).

This integration allows automatic submission and validation of invoice details, ensuring compliance with GST regulations, reducing manual errors, and speeding up the invoicing process through secure, real-time communication with the government’s e-invoicing system.

Invoice Reference Number

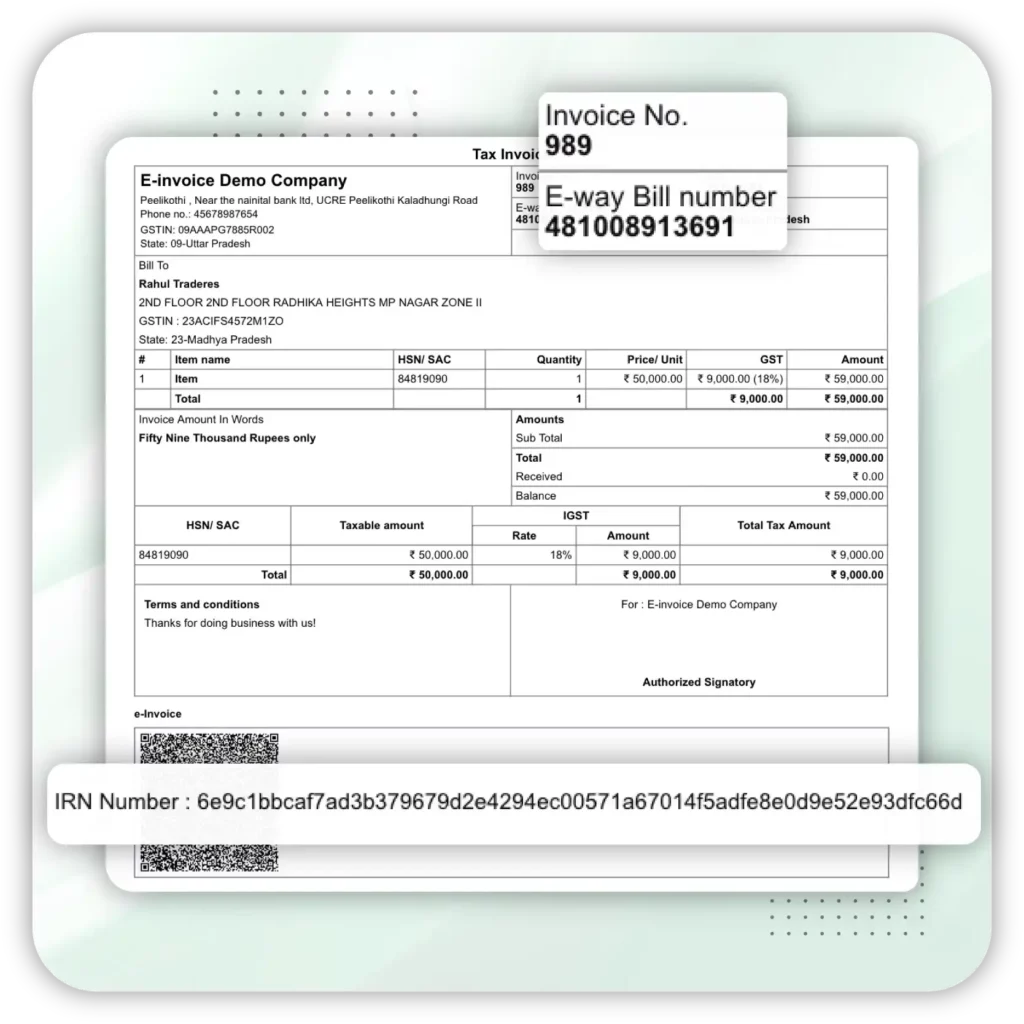

The e-invoicing system’s Invoice Reference Number (IRN) generation feature assigns each invoice a unique identifier. This number, created through a GSP API integration, ensures each invoice is distinct and traceable.

The IRN is crucial for tracking, auditing, and complying with regulatory requirements, helping maintain organised records, and preventing invoice duplication or fraud.

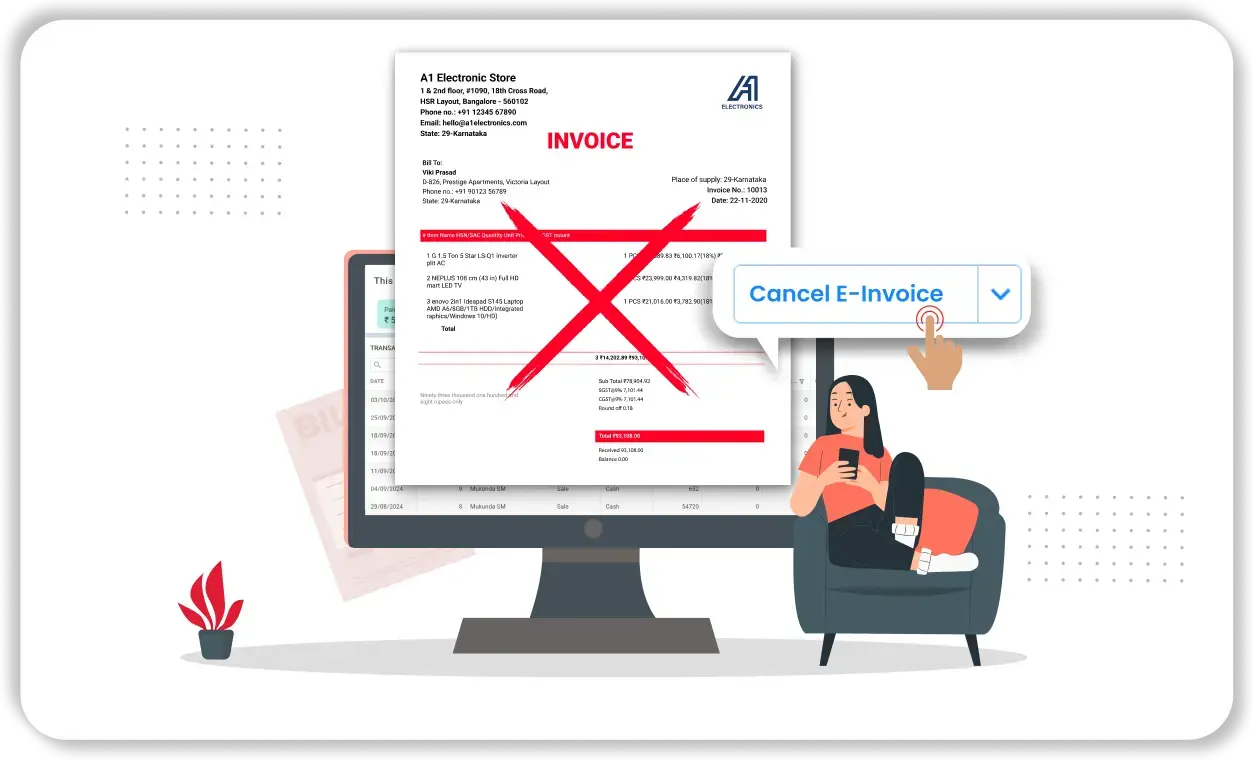

e-Invoice Cancellation

If the created invoice has mistakes or wrong data, the Vyapar e-Invoice app allows users to cancel the generated e-invoice & resubmit with the right invoice. Cancellations are restricted to a specific time frame (usually 24 hours).

This feature ensures compliance, corrects errors, and provides flexibility in managing invoices, thereby preventing potential penalties for incorrect submissions.

Join the Millions Who Have Transformed Their E-Invoicing

1 Crore+ Businesses

Trusted by over 1 crore businesses across the globe.

20 Million+ E-Invoices Processed

We’ve facilitated the processing of over 20 million e-invoices, streamlining finances for countless businesses.

Reduced Processing Time

Experience a significant reduction in invoice processing time with our automated features.

Faster Payments

Get paid faster with on-time invoice delivery and easy payment options.

How Do You Create an E-Invoice on Vyapar E-Invoicing Software?

You can access the Vyapar app’s electronic invoicing software in many ways. There are a few steps that you need to follow to gain full access:

Step-by-Step Guide To Generate E-Invoice

Launch Vyapar

Step 1: Open Vyapar Software

• Launch the Vyapar e-invoice app on your device.

Step 2: Create a Sales Invoice

• Add Party Details: Ensure that the party’s GST details are already added to the system.

• Create Invoice: Generate a sales invoice for the transaction, ensuring it is taxed appropriately.

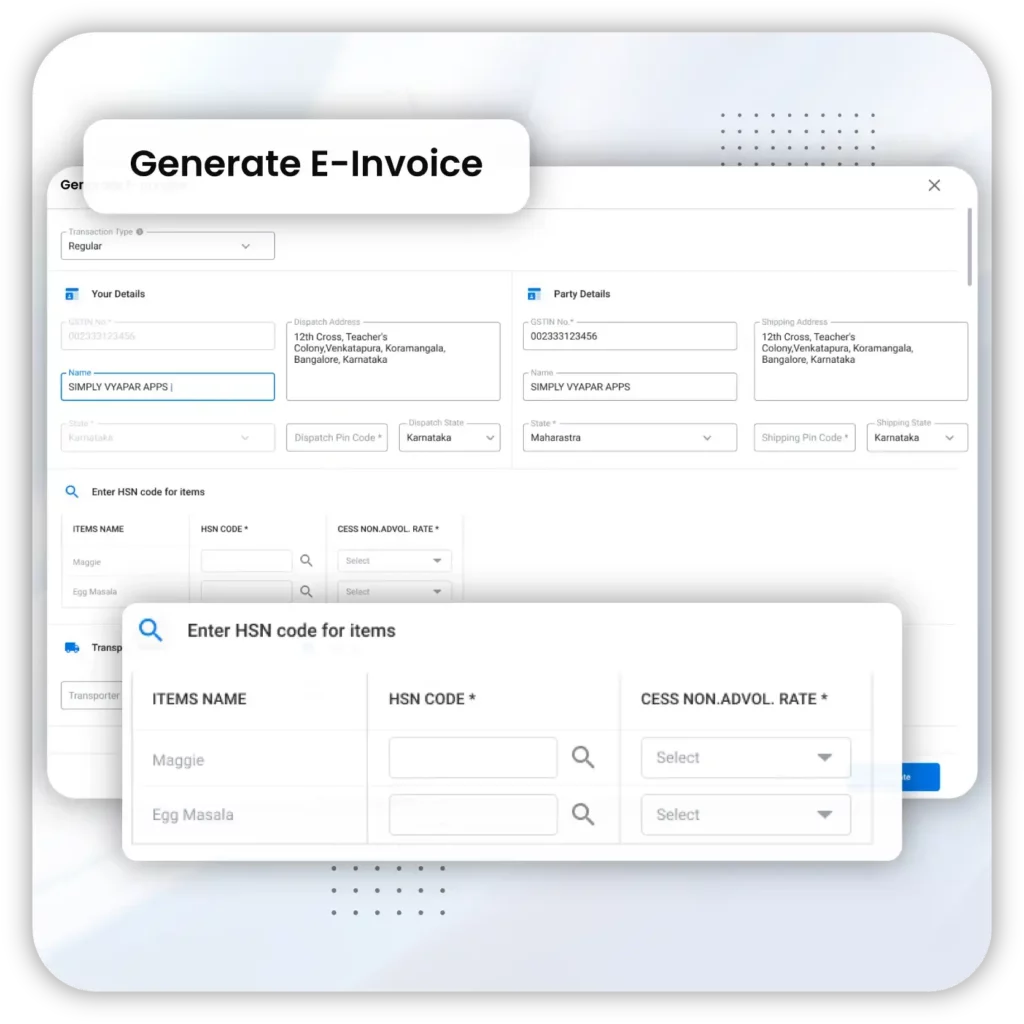

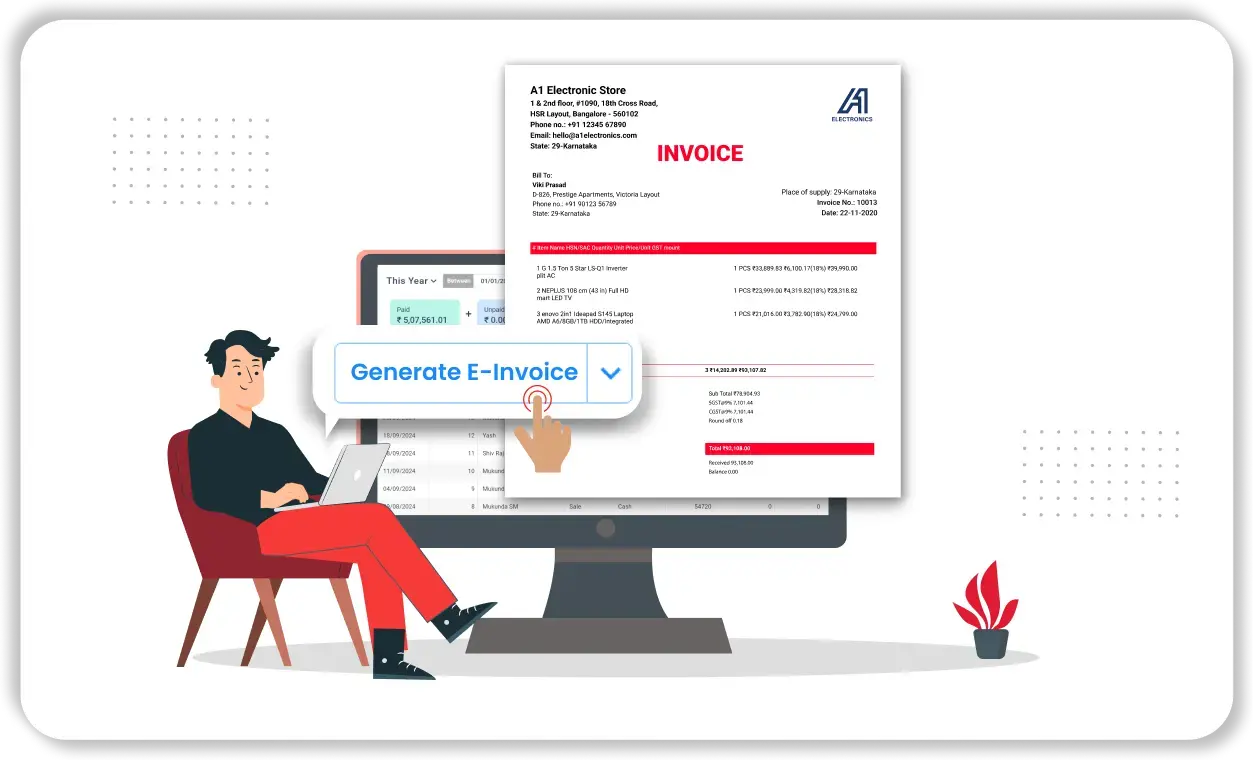

Create E-Invoice

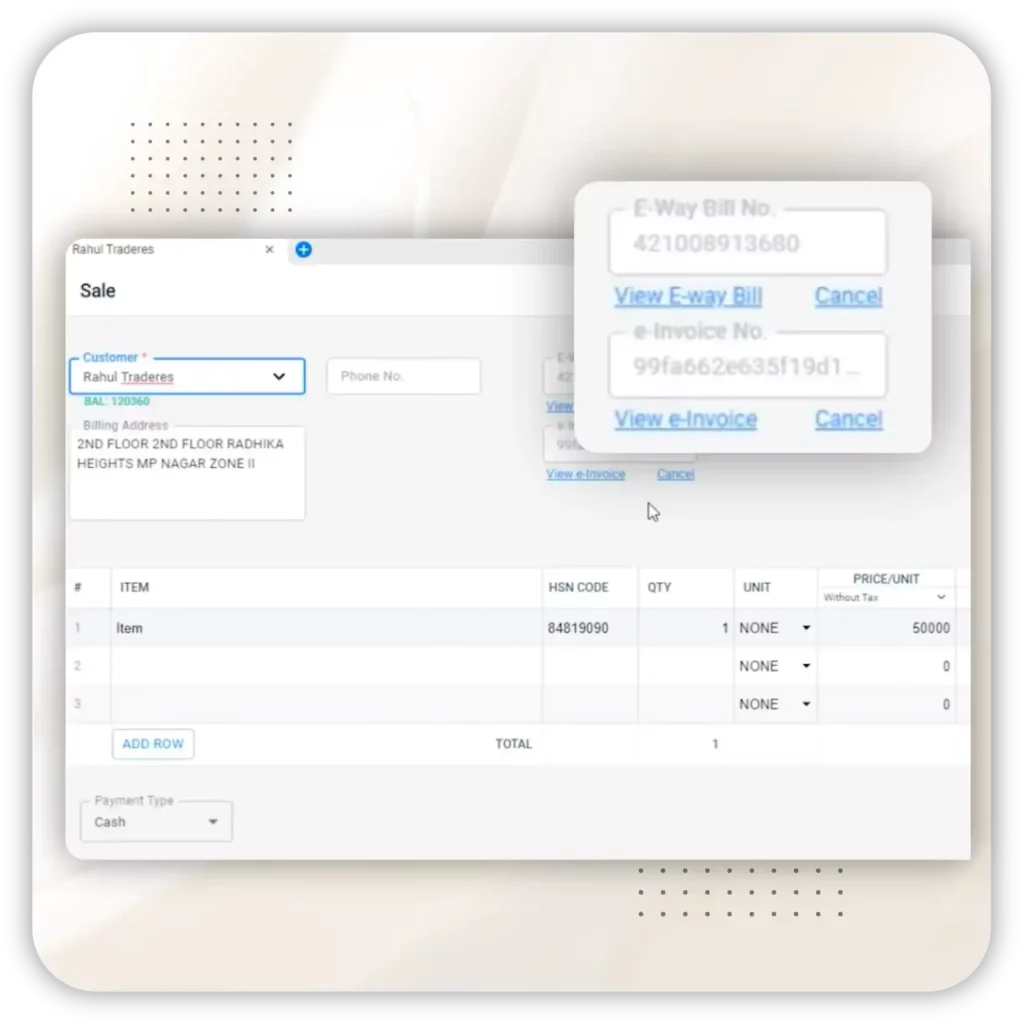

Step 3: Generate E-Invoice

• Locate E-Invoice Option: Below the transaction details, find and click the “Generate E-Invoice” button.

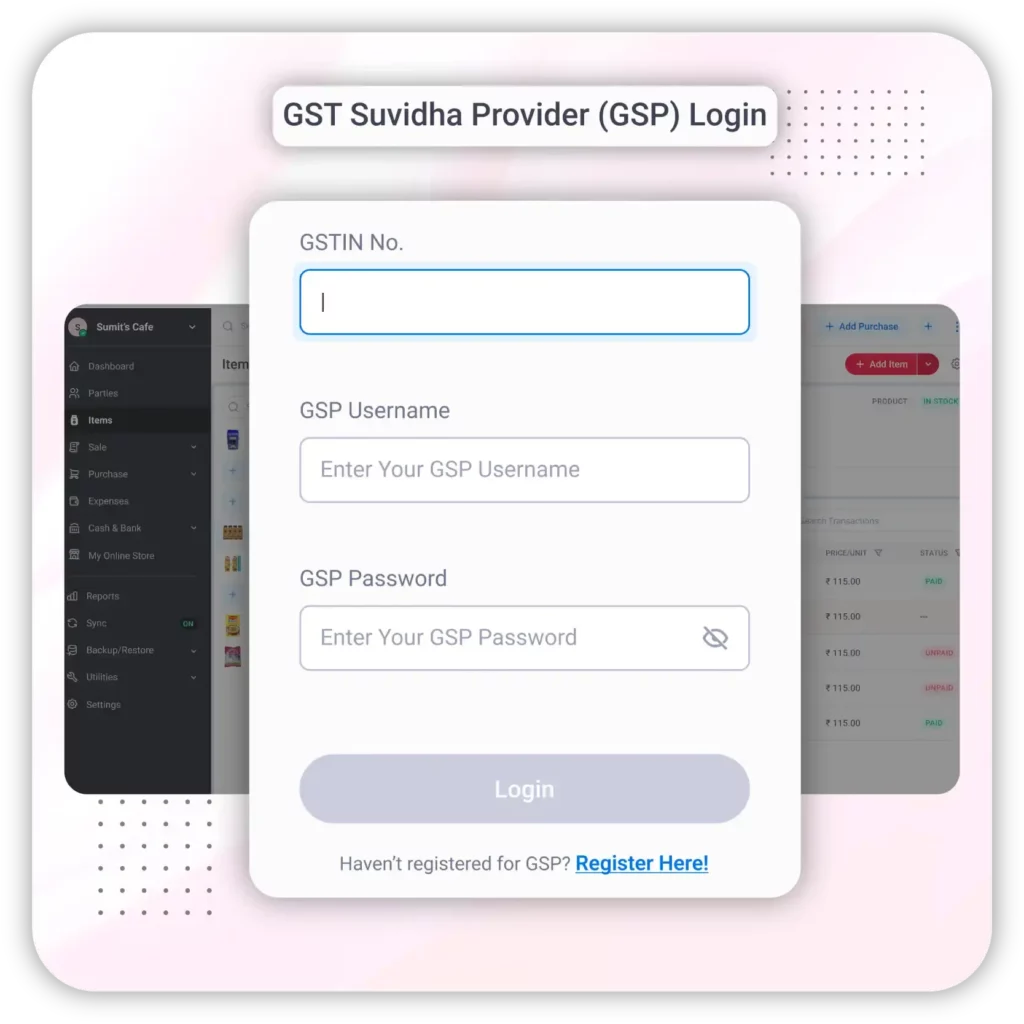

Step 4: Log in to the E-Invoice System

• Enter Login Details: Log in with your GSP credentials.

• If you do not have GSP login credentials, register on the GSP portal.

• Verify Login: Once you have entered the details, log in to access the e-invoice system.

Verification

Step 5: Verify Invoice Details

• Check Pre-Filled Details: Ensure all the necessary details (seller, transaction, buyer, item details) are correctly filled.

• Mandatory details must be completed, while optional details can be left blank if not applicable.

• Verify Each Section: Confirm that all mandatory sections are marked as verified.

Step 6: Correct Missing or Incorrect Details

• Enter Missing Details: If any section is unverified, enter the missing details (e.g., HSN code of the item).

• Resolve Errors: Check for and resolve errors such as duplicate invoice numbers, incorrect details, or wrong tax codes.

Download

Step 7: Generate E-Invoice

• Click Generate: After verifying and correcting all details, click on the “Generate E-Invoice” button.

• Save E-Invoice: Ensure the e-invoice is saved and note the unique Invoice Reference Number (IRN) and QR code provided.

• Print, Share, or Download: Provides an option to print, download, and share the e-invoice generated via WhatsApp, email, and SMS.

Note: If errors occur during generation (e.g., duplicate e-invoice, incomplete details, wrong tax codes), correct the issues and attempt generation again.

Step 8: Generate E-Waybill (Optional)

From the e-invoice screen, you can also generate an e-waybill if needed.

Cancel and Resubmit

Step 9: Cancel an E-Invoice

• Open Existing Invoice: Locate and open the invoice you wish to cancel.

• View Invoice: Use the “View Invoice” option to see the invoice in the government’s standard format.

• Cancel Invoice: Click the “Cancel” option to cancel the e-invoice.

Note: You can only cancel an e-invoice within 24 hours of generation.

Step 10: Resubmit the E-Invoice

To resubmit, repeat from step 2 and generate.

What Will Be Included in Creating E-Invoicing?

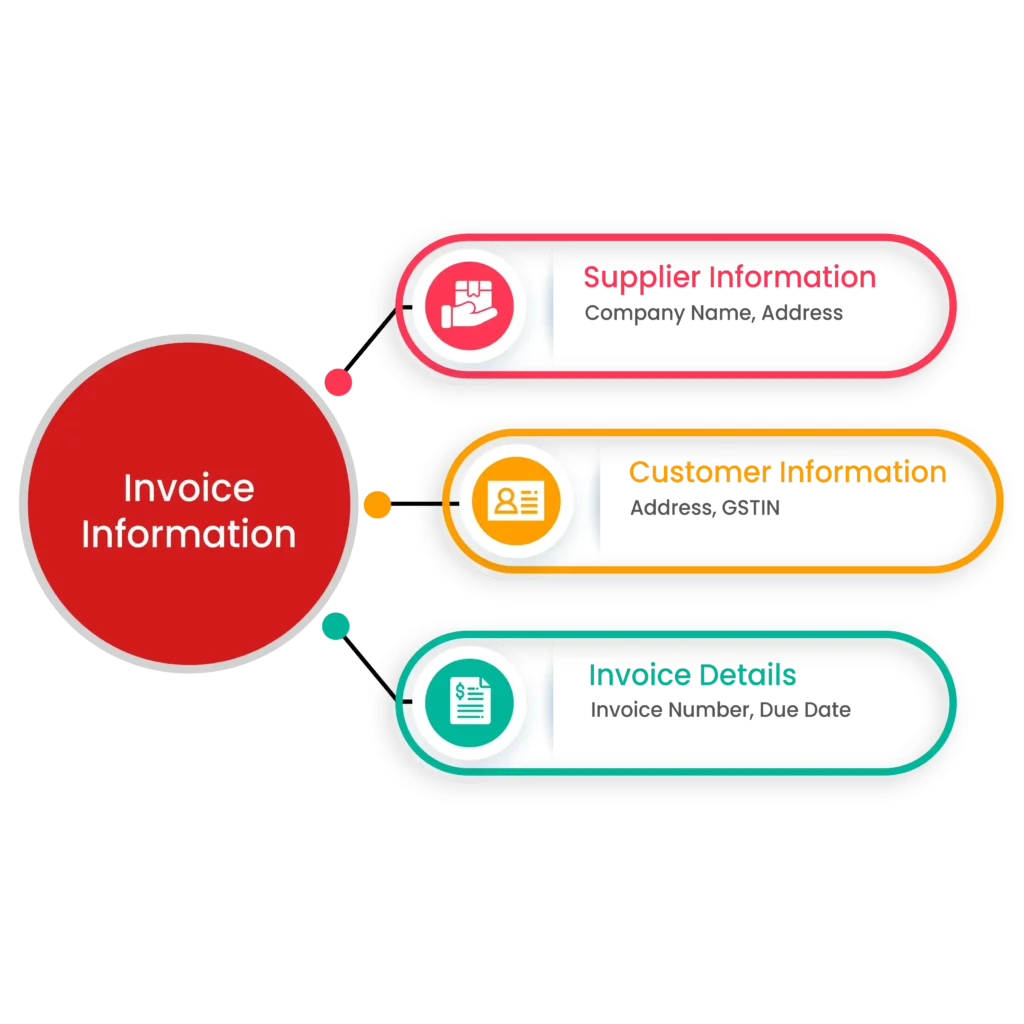

Basic Invoice Information

- Supplier Information: Your company name, address, and GSTIN (if applicable).

- Customer Information: Buyer’s company name, address, and GSTIN (if applicable).

- Invoice Details: Invoice number, date of issue, and due date.

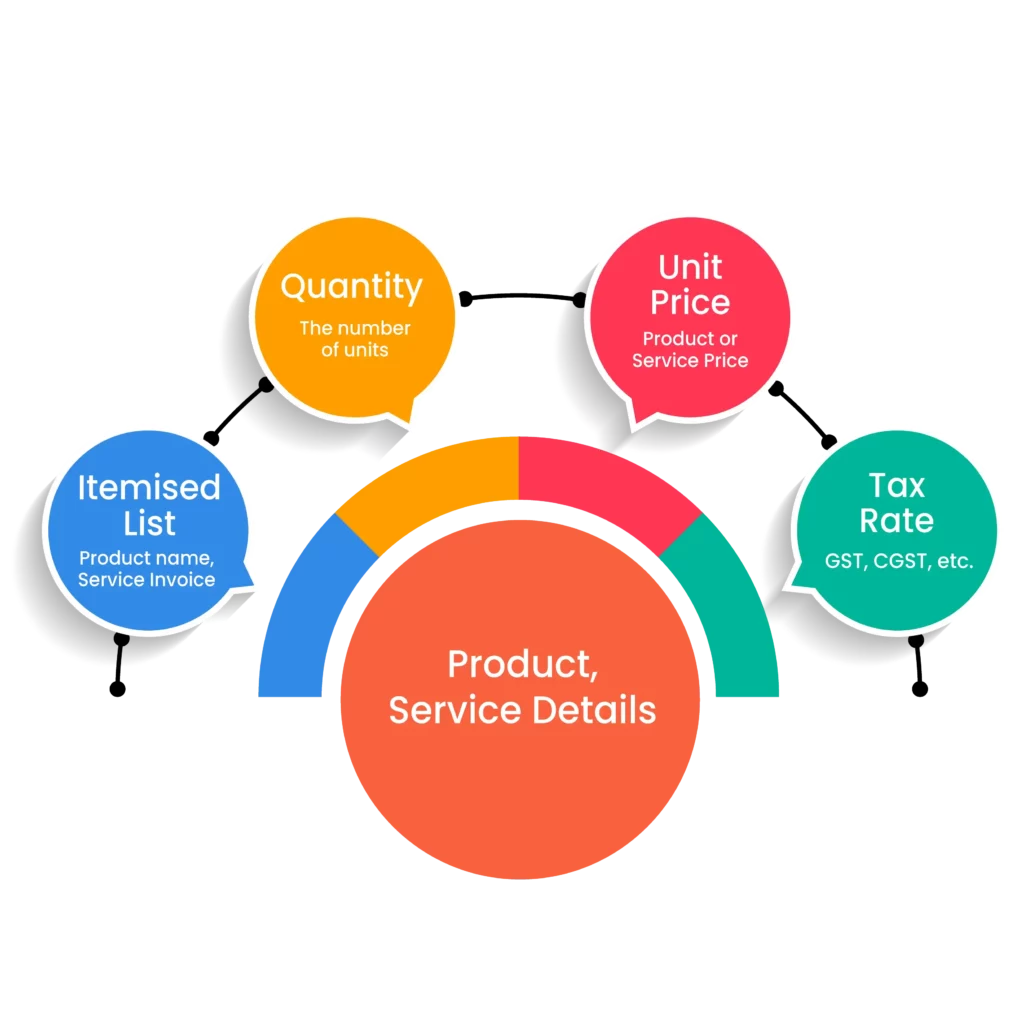

Product or Service Details

- Itemised list of products or services: Product name or service being invoiced.

- Quantity: The number of units of each product or service provided.

- Unit Price: The price per unit of each product or service.

- Tax Rate: Applicable tax rates for each item (e.g., GST).

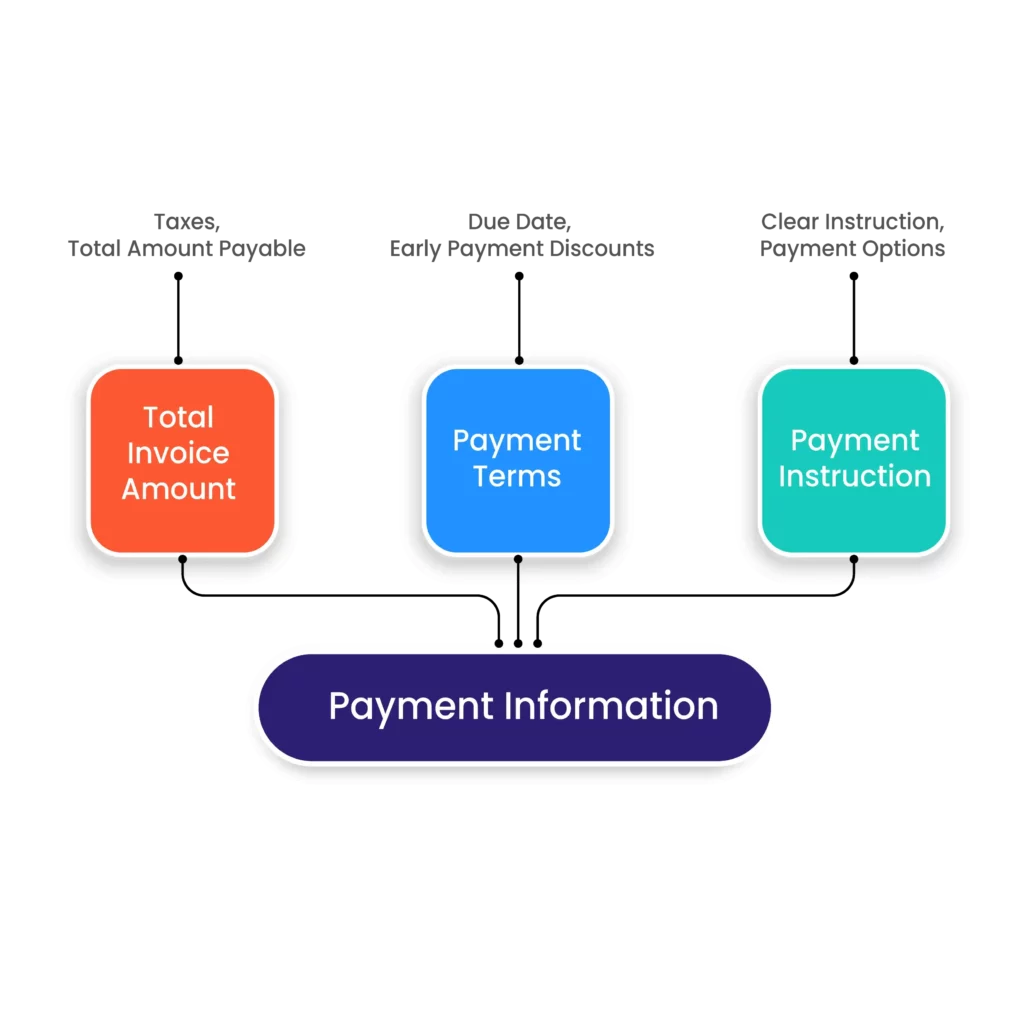

Payment Information

- Total Invoice Amount: The total amount payable, including taxes.

- Payment Terms: Clearly state the payment terms, such as net due date or early payment discounts.

- Payment Instructions: Provide clear instructions on how the customer can make the payment (e.g., bank account details, online payment portal).

Quickly Create an E-Invoice with the Vyapar App

Why is the Vyapar Electronic Invoicing System the Best for Your Business?

Quick and Easy E-Invoice Creation

- Streamlined process: Vyapar simplifies the e-invoice creation process, making it easy for businesses to generate invoices efficiently.

- Time-saving: By automating many of the manual tasks involved in invoicing, Vyapar helps businesses save time and resources.

Generate Multiple E-Invoices

- Bulk creation: Vyapar allows you to create multiple e-invoices of your sales, saving you time and effort.

- Customisation: You can customise your invoices to match your business branding and requirements.

Generate E-way Bills

- Integrated solution: Vyapar’s e-way bill generation feature works smoothly with the e-invoicing system. This offers a complete solution for your business.

- Compliance: E-way bills are mandatory for interstate movement of goods, and Vyapar helps you comply with this requirement.

Cancel E-Invoices

- Flexibility: Vyapar offers a simple and efficient process for cancelling an e-invoice.

- Error Correction: You can easily correct any errors in your invoices before you send them to customers with our e-invoice system.

Best E-Invoicing Software for Business Management

Multiple Features

Vyapar’s e-invoicing app offers small businesses features like multi-invoice formats, sales reporting, data storage, and GST bill printing, making it a versatile tool for various business needs.

People-Efficient

Starting small businesses often means managing tasks alone or with a tiny team. Vyapar’s e-invoicing app keeps your business organised and synced across all devices, updating data in real-time efficiently.

Easy-To-Use

Starting a business with no knowledge of e-invoicing can be complex. Vyapar simplifies it for MSMEs, making e-invoicing and account management easy for anyone, regardless of their sales, marketing, or accounting experience.

Better Control and Invoicing Procedure

Vyapar’s e-invoicing software solution centralises your invoices, accessible anytime on any device. Its business dashboard and automated reports offer real-time insights into your cash flow and financial health.

Track Invoices Easily

Vyapar’s electronic invoicing system simplifies invoice tracking, allowing you to monitor sending, viewing, and payment status. The business dashboard tracks pending payments and sends reminders to maintain cash flow.

Seamless Auditing

Vyapar’s cloud invoicing dashboard lets you manage estimates, expenses, and invoices from one place. Easily handle multiple businesses or clients by adding them to a single account for streamlined management.

Benefits of Vyapar’s E-invoicing System

Saves Time and Cost

Vyapar’s e-invoicing boosts productivity by eliminating unnecessary steps, saving time for you and your customers. It also cuts costs related to paper, printing, postage, and manual handling, resulting in long-term savings for your business.

Curbs Tax Evasion

E-invoicing under GST helps prevent tax evasion by providing real-time billing data and reducing invoice manipulation. Vyapar’s e-invoicing minimises fake GST invoices and ensures legitimate ITC claims, aiding tax officials in detecting fake input tax credits.

Brings Simplicity

Generating e-invoices is complex, but Vyapar simplifies it, taking only 2 minutes. The app stores invoices, generates reports, automates inventory tracking, and offers multiple payment methods, eliminating the need for multiple apps. Save client data in the cloud and create invoices with a click.

Reduces Error

Vyapar’s e-invoicing system automates billing accurately, ensuring no errors. Unlike manual methods lead to mistakes, even with experienced users, Vyapar’s system provides reliable invoicing operations with minimal risk of errors.

Improves Brand Identity

Cloud-based billing software strengthens brand identity by allowing customisation of logos, colours, and fonts to reflect your brand’s tone. This enhances prompt payments by integrating your brand into the billing system. Vyapar’s e-invoicing app offers tools for personalised invoice creation to suit your requirements.

Simplified Administration

Successful cash flow management involves automating one’s invoicing process and reducing administrative costs. Compared to a manually prepared bill from scratch, quick and automated invoice processing software like Vyapar reduces the margin of error. This can also save the firm much time, which the firm can put towards other critical corporate tasks.

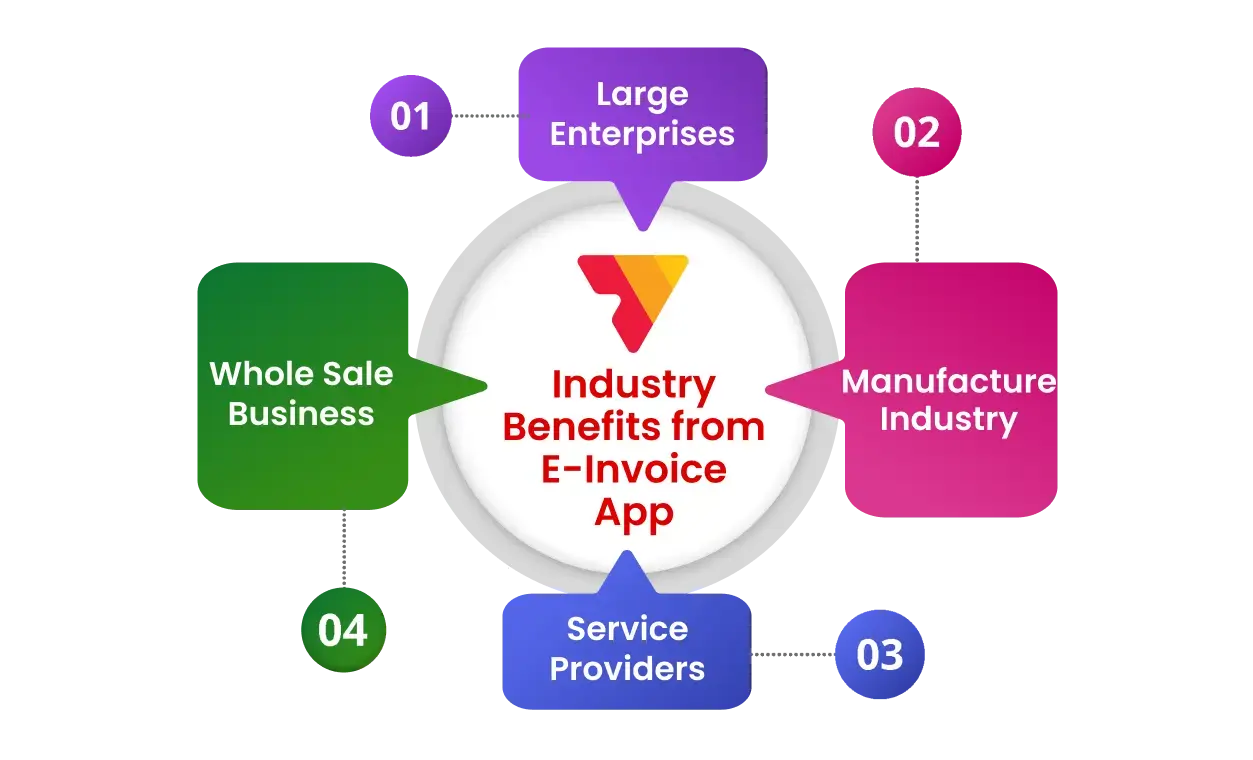

Industries Benefiting from GST E-Invoicing Software

Vyapar shows which industries can get the most value from our free e-invoicing software. It also explains how e-invoicing helps different sectors.

- Large Enterprises: Helps manage a high volume of transactions efficiently.

- Small and Medium Enterprises (SMEs): Simplifies invoicing, reducing the burden on limited staff.

- Manufacturers: Streamlines the supply chain and maintains proper records for GST.

- Wholesale Businesses: Enhances efficiency and speed in generating invoices.

- Service Providers: Simplifies service invoicing and ensures compliance.

For each industry, the content would detail specific challenges that e-invoicing helps resolve. For instance, manufacturers can eliminate manual entry errors, while wholesale businesses can achieve quicker transaction turnaround.

Ensure Real-Time GST Compliance with Vyapar’s E-Invoicing Software

Vyapar e-invoice generation software helps businesses follow government rules easily. This is especially important for India’s Goods and Services Tax (GST) requirements.

E-invoicing is a system created by the Indian government. It aims to make submitting invoices under GST easier and more uniform. Here’s how Vyapar’s e-invoicing software solutions ensure compliance with these government regulations:

1. Real-Time Integration with GST Portal

- Vyapar’s e-invoicing system connects with the government’s Invoice Registration Portal (IRP). This connection is essential for creating valid e-invoices. It allows businesses to upload invoices in real-time, ensuring that they instantly register all transactions with the government.

- When Vyapar generates an invoice, the software sends it directly to the IRP for validation. Once validated, the portal gives a unique Invoice Reference Number (IRN) and a QR code for the invoice. The system automatically adds these to the invoice created through Vyapar.

2. Automatic Generation of IRN and QR Code

- Government rules state that every invoice must have a unique IRN and a QR code to be an e-invoice. Vyapar’s electronic invoice app automatically incorporates these elements into invoices to meet compliance requirements.

- The QR code has important information. It includes the supplier’s GSTIN, the buyer’s GSTIN, the invoice value, and more. Authorities or other parties can scan and verify this information.

3. Adherence to Standard E-Invoice Schema

- The government mandates that all e-invoices follow a specific format or schema, which includes mandatory fields and structures. Vyapar e-invoicing software uses a standard format. This ensures that you fill out all required fields correctly. It also helps submit invoices according to the e-invoice rules set by the GST Council.

- Vyapar software updates automatically to accommodate any changes in the schema or government requirements, ensuring ongoing compliance.

4. GST Compliant Fields and Calculations

- Vyapar makes sure that all the information needed for GST compliance is in the invoice. This includes HSN codes, GST rates, and tax breakdowns. It also does accurate calculations automatically.

- The software helps businesses use the right GST rates for each product or service. This reduces errors and makes compliance easier.

5. Direct Upload to GST Returns

- E-invoices generated in Vyapar can be directly used to file GST returns (GSTR-1). This integration makes it easier to enter invoice data during filing. It keeps the data accurate and up to date.

- It automatically connects e-invoice data to the GST return filing system. This ensures compliance and makes filing returns easier and quicker each month or quarter.

6. Auto-Updating Features for Compliance Changes

- Government agencies frequently update regulations around GST and e-invoicing. Our team frequently updates the Vyapar GST e-invoicing software. This helps businesses stay compliant. They do not need to change their sales invoice formats or processes manually.

- By keeping up with the latest government guidelines, Vyapar helps users avoid penalties. This prevents problems that can come from using old systems.

7. B2B and B2G Compliance

- Vyapar’s best e-invoicing software meets the rules for both B2B (Business to Business) and B2G (Business to Government) transactions. This makes it easier for businesses to work smoothly across different sectors.

- It offers tools to create invoices that other businesses and government departments accept. This ensures that transactions are standard and follow national rules.

8. Audit Trail and Record Keeping

- Government regulations require businesses to maintain accurate and detailed financial records. Vyapar makes a digital record for each e-invoice. This ensures that we document every transaction and make it easy to trace. It also makes audits simpler.

- The electronic invoicing system stores all e-invoices safely. This makes it easy to access them later. Easy access is important for businesses during audits by tax authorities.

Take Your Business to the Next Level with Vyapar E-Invoice System! Try FREE!

Frequently Asked Questions (FAQ’s)

E-invoicing, also known as electronic invoicing, is a system wherein B2B invoices are electronically authenticated by the GSTN/IRP portal of the Government of India. This is accomplished by assigning/validating an identification number (IRN) and QR code to each invoice for use by various government portals such as GSTN or e-way bill portals.

The e-Invoice system (Electronic Invoicing system) is a government-regulated framework introduced by the GST Council of India to standardise the way B2B invoices are reported. With Vyapar, this process becomes fully automated, error-free, and compliant.

To generate various types of invoices online, e-invoicing software is used. It is mainly used in businesses and organisations to maintain records effectively. They typically include several built-in templates for tracking daily tasks, revenues, and prices.

The best e-invoicing software in the market today is provided by Vyapar, offering multiple solutions and services for record-keeping and business management.

E-invoicing is the procedure for GST-registered businesses to upload all the B2B invoices in real-time methods of payment are eliminated in the e-invoicing process.

They usually include a graphical representation of the billing data. They can, however, be rendered temporarily during handling or transposed into visual formats.

You can generate the e-invoice very quickly with Vyapar e-invoicing software. The following are the steps to generate an e-invoice. Make sure you don’t skip any particular steps.

1. Click on “Add sale” and update items & sale-quantity

2. Select a GST-registered party

3. Click on “generate e-invoice”

4. Login using GSTIN, GSP username and Password (For the first-time user).

The primary difference between an e-invoice and a simple invoice system is that a simple invoice mechanism applies to all taxpayers. Even a non-GST business is required to create an invoice.

In contrast, an e-invoice system applies to businesses with more than 5 crores annual turnover from August 2023.

The Indian government announced a phased reduction in the annual turnover threshold for mandatory e-invoice issuance for businesses, beginning with INR 50 crore and gradually decreasing to INR 20 crore (April 1, 2022), INR 10 crore (October 1, 2022) and present with INR 5 crore (August 1, 2023).

This change is expected to impact smaller businesses, which will now be required to issue electronic invoices. The following sections cover the policy change and the method for creating e-invoices.

The e-Invoicing portal to which you must send your invoice details is the Invoice Registration Portal (IRP). The IRP will generate a unique Invoice Registration Number (IRN) and QR code for each invoice submitted.

For invoicing under GST, registered businesses must first register on the IRP and create an account.

The Invoice Reference Number (IRN) is a unique identification number (also known as a hash) created by the Invoice Registration Portal (IRP) under the e-invoicing system using a hash generation algorithm.

Yes, generating IRN does hold some importance. Suppose a company meets the e-invoicing threshold but does not generate an e-invoice. In that case, i.e. the invoice does not include the official billing reference number from the IRP, the invoice is invalid.

Non-issuance of IRN, despite being under the limit, will also result in penalties.

The IRP will respond to the seller with a signed IRN. The IRP will also return a QR code containing the IRP’s digital signatures.

E-invoice applies to all B2Bs (i.e. supply of goods or services or both to registered businesses). E-invoicing aims to reduce tax evasion, auto-populate various returns, and reduce the reconciliation problem that is currently prevalent under GST.

E-invoicing is mandatory for companies with a turnover of more than 5 crores beginning August 1, 2023.

Aside from the IRN-related QR code, the Supplier is free to include any other QR code required for business purposes or mandated by any other statutory requirement.

Vyapar offers a range of pricing plans for its e-invoicing software in India, catering to different business needs. The cost may change depending on the plan you choose. This plan could include features like e-invoicing, GST compliance, and other accounting tools. You can explore their e-invoice software pricing details on the official Vyapar website or within the app.

Yes, Vyapar provides a free trial that includes access to e-invoicing features. This allows users to explore the software’s functionality before committing to a paid plan.

Vyapar offers transparent pricing with no hidden charges. The pricing plans clearly outline all features, including e-invoicing. However, you should check the details of your plan to ensure it covers everything you need.

Vyapar offers a cost-effective solution for small and medium businesses. Its pricing is usually more affordable than some e-Billing Software with many features. However, it still offers all the essential tools for GST compliance, invoicing, and financial management.