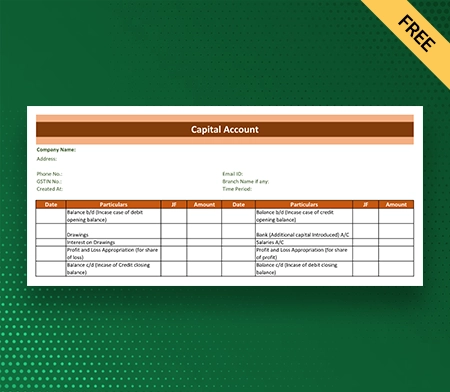

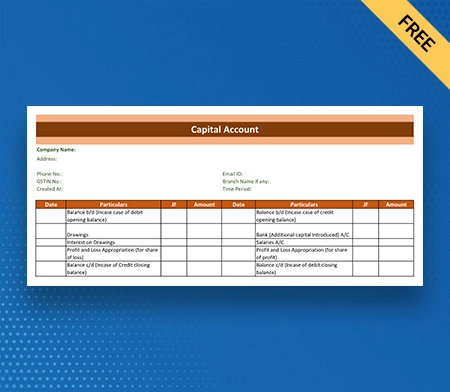

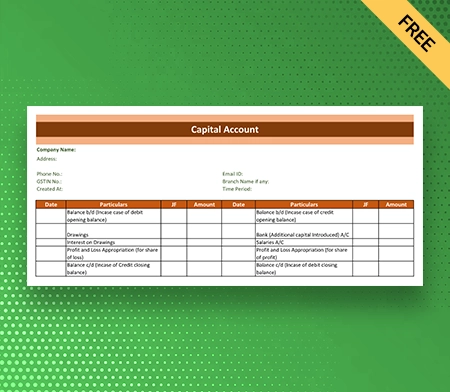

Capital Account Format

Use Accounting Software Vyapar to track your finances and make the best decisions for your business. Look no further than Vyapar for the best capital account format. Download the Vyapar app and access your 7-day free trial.

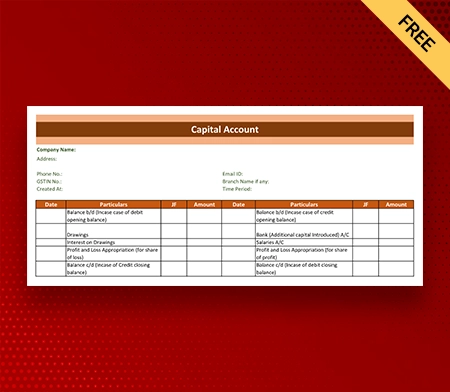

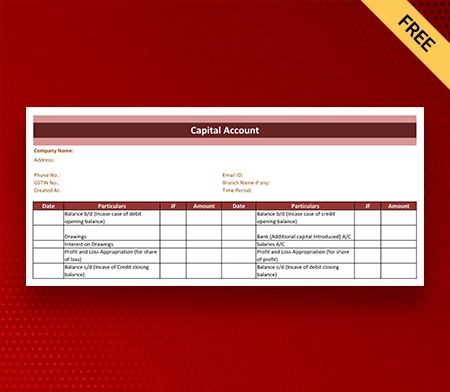

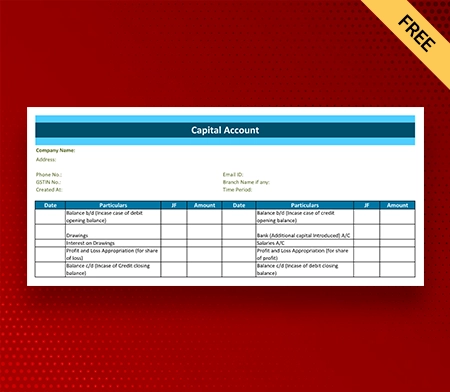

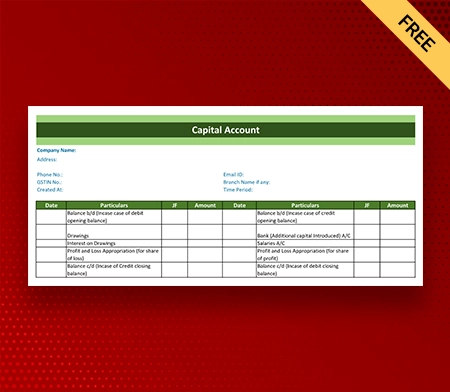

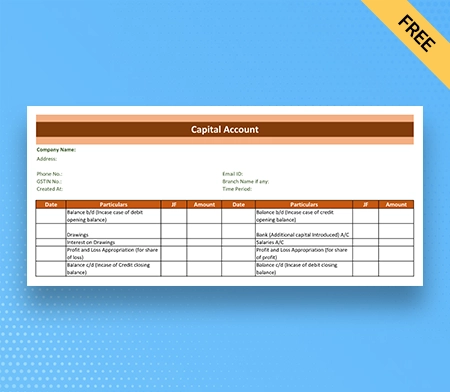

Download Capital Account Format in Excel

Download Capital Account Format in PDF

Download Capital Account Format in Word

Download Capital Account Format in Google Docs

Download Capital Account Format in Google Sheets

What is a Capital Account?

A capital account is a simple record of every investment made by the owners or partners of a business. This record can be later used to track the company’s financial position and determine the profits or losses at the end of each financial year.

A capital account also includes all the funds invested in the business, including cash, property, and equipment. Capital is one of the most important aspects of a business. It represents the funds invested in a company by its owners or partners.

To understand a capital account, we also need to understand some terms related to capital accounts which are as follows:

1. Capital Invested And Initial Capital Investment:

The term capital invested is used to define the amount of money invested by the owners or partners of a business. It includes the initial capital investment and any additional funds invested in the business.

The initial capital investment is the amount of money the owners or partners invested when the business was first established. The ratio of investment amount by individuals helps determine the initial equity ratio of ownership.

2. Capital Account Balance And Debit/Credit Balance:

The difference between the total capital that has been invested and the total amount of money that has been withdrawn from the business over time is known as the capital account balance. The balance can be either a debit balance or a credit balance.

A debit balance occurs when the amount of money withdrawn from the business exceeds the total capital invested. It means that the business has incurred losses, and the owners or partners have withdrawn more money than they have invested.

A credit balance occurs when the total capital invested exceeds the money withdrawn from the business. This means that the business has generated profits, and the owners or partners have invested more money than they have withdrawn.

3. Partners And Profit Sharing Ratio:

Partners are individuals who have invested in the business and share the profits and losses of the company. The profit-sharing ratio is the percentage of profits that each partner is entitled to.

The agreement between the partners usually determines the profit-sharing ratio. The partners can choose to invest the surplus profit for business growth or take the money out as dividends.

4. Fluctuating And Fixed Capital Account:

There are two types of capital accounts, namely, fluctuating capital accounts and fixed capital accounts. A fluctuating capital account is used in a partnership firm, where the capital account balance changes every year based on the profits or losses incurred by the business.

This account is used in the case of a sole proprietorship, where the capital account balance remains the same throughout the business’s life.

5. Capital Contribution And Capital Interest On Drawings:

A capital contribution refers to the total amount of money invested by all the partners in the business. As the business grows, the company can raise funding at a higher valuation to fuel further growth.

Capital interest on drawings refers to the interest charged on the amount of money withdrawn from the business by the partners. It is calculated on the base amount withdrawn.

6. Sole Proprietorship And Partnership Firms:

When a single individual owns and runs a business, it is known as a sole proprietorship. As the owner of the proprietorship, the owner is responsible for every debt and liability related to the business.

A partnership firm is a business owned and operated by two or more individuals. Although, the partners do share the profits and losses of their joint business venture and are jointly responsible for the debts and liabilities of this business.

7. Capital Account Records And Account For The Capital:

Capital account records are used to track the financial position of the business. The details of all the investments made by the owners or partners of a business, the profits and losses incurred by this business, and the amount of money withdrawn from the business are contained in the record.

Accounting the capital refers to the process of recording all the investments made by the owners or partners in the business. It includes the initial capital investment and any additional funds invested in the business.

What is the Capital Account Format?

The Capital Account Format is a financial tool used to record the capital accounts of partners in a partnership firm or the sole proprietor’s fixed and fluctuating capital accounts. This account format is crucial for businesses looking to keep track of their initial capital investment, capital contribution, profit-sharing ratios, and more.

Essentially, the Capital Account format serves as an account on which all transactions related to the capitals of partners are recorded. It tracks debit balances when withdrawals exceed investments and credit balances when investments exceed withdrawals.

By maintaining accurate records using this format, business owners can easily calculate their profits and losses at any time. They’ll be able to see exactly how much each partner has invested in the business and their current interest against their drawings.

Implementing a Capital Account Format into your accounting system will give you greater clarity over your finances. It’s an essential tool for any business looking to stay organized and profitable.

What is Capital Account Format Software?

A Capital Account Format Software can help businesses keep track of the capital accounts of their owners or shareholders. A professional tool makes the entire process seamless and helps eliminate manual errors.

The venture capital accounting software can help businesses create and maintain an accurate record of the investments made by the owners, the profits earned, and the losses incurred. It helps businesses make better financial decisions by keeping their capital accounts up-to-date.

Features Of A Capital Account Software

Some of the features of Capital Account Format Software include:

1. Capital Account Management:

The software can help businesses manage their capital accounts by tracking the investments made by the owners or shareholders, the profits earned, and the losses incurred.

2. Capital Account Reporting:

The software can generate reports that provide an overview of the capital accounts of the business. These reports can include information on the investments made, the profits earned, and the losses incurred.

3. Capital Account Analysis:

The software can analyze the capital accounts of the business and provide insights into the financial health of the business. It can help businesses make better financial decisions and improve their profitability.

4. Capital Account Integration:

The software can integrate with other financial accounting software to provide a comprehensive view of the financial health of the business.

5. Security:

The software can provide security features to protect the financial information of the business. This software might include various features like password protection, data encryption, and multi-factor authentication.

Capital Account Format Software can be beneficial for businesses of all sizes. It can help businesses manage their capital accounts efficiently, make better financial decisions, and improve profitability.

Underrated Benefits Of Using Capital Account Format

For A Business

When it comes to managing the finances of a business, accuracy, and organization are the keys. The capital account format in Vyapar provides numerous benefits for businesses looking to keep track of their financial data.

One significant benefit is the ability to easily track capital contributions from partners or sole proprietors. It ensures that each individual’s investment is accurately recorded and can be referenced if needed.

Another advantage is the ability to monitor profit-sharing ratios among partners. By recording this information, businesses can ensure that profits are distributed relatively according to each partner’s contribution.

The capital account format also allows for easy tracking of capital interest on drawings, which helps avoid confusion and discrepancies when calculating profits and losses.

A fixed or fluctuating capital account can help businesses more accurately calculate their balance sheet. It ensures that all financial data is regularly updated and accurate at any given time.

Utilizing the capital account format in Vyapar improves accuracy and saves time by providing an organized system for managing financial data.

How Does Capital Accounting Software Work?

Capital accounting software is a financial accounting tool that helps businesses manage their capital accounts. It automates tracking investments made by owners and shareholders, profits earned, and losses incurred, allowing businesses to make the best financial decisions and manage their finances more efficiently. Here’s how capital accounting software works:

1. Set Up:

The first step is to set up the software by entering the basic information about the business, including the capital account details of the owners or shareholders. This information includes the credentials of the owner or shareholder, the amount invested by them and the date of investment.

2. Record Transactions:

Once the capital accounts are set up, the software records all transactions related to the capital accounts, such as investments, withdrawals, and profits and losses. The software automatically updates the capital account balances based on the transactions recorded.

3. Generate Reports:

The software generates reports that provide an overview of the capital accounts of the business. These reports can include information on investments, profits earned, and losses incurred. The reports can be customised to meet the specific needs of the business.

4. Analyse Data:

The software analyses the data collected from the capital accounts and generates insights into the business’s financial health. The analysis can help businesses make better financial decisions, identify areas for improvement, and optimize their financial performance.

5. Integration:

Capital accounting software can integrate with other financial accounting software to provide a comprehensive view of the business’s financial health. This integration ensures that all the financial data related to the business is accurate and up-to-date.

6. Security:

The software provides security features to protect the business’s financial information. This includes a multi-factor authentication feature and data encryption for added protection within the system.

Overall, capital accounting software simplifies the process of managing capital accounts through the electronic recording of transactions, the generation of reports, and by providing insights into the business’s financial health. This helps businesses make better financial decisions, optimize their financial performance, and manage their finances more efficiently.

Why Capital Account Format By Vyapar?

Are you looking for an effective way to keep track of your capital investments and profit-sharing ratios? Look no further than the Capital Account Format by Vyapar.

The Vyapar free accounting app is perfect for keeping accurate records of all your capital account balances, whether you’re operating a partnership firm or a sole proprietorship. Get ready to take control of your finances with the help of a professional capital account template.

The capital account format by Vyapar includes the following details:

1. Name of the partner

2. Capital invested by the partner

3. Capital contribution

4. Capital interest on drawings

5. Profit-sharing ratio

6. Fixed capital account balance

7. Fluctuating capital account balance

8. Debit/credit balance

The capital account format by Vyapar provides a comprehensive view of the financial position of the business. It allows the owners or partners to track the investments made in the business, the profits and losses incurred, and the amount of money withdrawn from the business. It helps in making informed decisions about the future of the business.

Why is Capital Account Format Essential For Small Business Owners?

A capital account template is an essential tool for small business owners. It helps them keep track of their investments and earnings. Vyapar, a leading accounting software company, offers a comprehensive capital account format that simplifies the management of capital accounts.

The capital account template by Vyapar is designed to provide a clear and concise overview of a business’s capital investments and earnings. It includes various components such as capital contributions, withdrawals, and profits or losses. The format can be adjusted according to the needs of one’s business and is very easy to handle.

Vyapar’s capital account format effectively allows businesses to manage their capital accounts. It provides a clear and concise overview of a business’s capital position, simplifies financial reporting, and improves financial management and decision-making.

However, businesses should still understand financial management principles to avoid complacency and over-reliance on accounting software. Whether running a sole proprietorship or a partnership firm, keeping accurate records of your capital accounts is crucial for measuring profitability and making informed financial decisions.

With Vyapar’s easy-to-use interface and comprehensive reporting features, managing your capital accounts has always been challenging. So, to stay on top of your finances and make smarter business decisions, use the capital account format in Vyapar today.

Everyday Use Of Capital Account Format In Vyapar

Integrating the capital account format into your Vyapar accounting software can be seamless. To begin with, you must set up individual capital accounts for each partner or sole proprietor in your business. It is essential as it helps you track their initial capital investment and subsequent transactions related to Profit-sharing, drawings, and interest.

Once the accounts have been created, ensure that they are regularly updated with any changes in partners’ contributions or withdrawals. You can easily record these transactions using. Vyapar’s intuitive interface ensures accuracy while maintaining real-time updates on the capitals of the partners.

Another crucial aspect of utilising this feature is effective in managing profit-sharing ratios accurately, as profits and losses will directly impact each partner’s capital account balance. Make sure to allocate earnings based on predetermined agreements between all parties involved.

Remember to track interest. On drawings for each partner – an often overlooked element that may lead to discrepancies if not diligently recorded. Incorporating this detail will provide a comprehensive picture of how every transaction impacts partners’ capital within your firm.

Key Features of Effortless Capital Account Management

Vyapar offers you more than simple balance sheet formatting. In addition to essential functions, using the capital account format by Vyapar is an added benefit. The format is organized and makes it easy to track the financial position of a business.

The Vyapar capital account management app is designed for small and medium-sized businesses. Here are some amazing features of the Vyapar app:

1. Accurate Data With Business Dashboard:

The Business Dashboard feature provides an overview of your business, including sales, expenses, and profit/loss. With this feature, you can enjoy an overview of your whole business, which also includes sales, expenses, and profits/losses.

The software brings the data in one place accurately, minimising the possibility of errors. Further, you can get an idea of your everyday business performance by taking a look at the business dashboard.

2. Real-Time Tracking:

One of the key benefits of using Vyapar’s capital account format is that it helps businesses keep track of their investments and earnings in real time.

This is particularly important for businesses that must make quick decisions based on their financial position. With the capital account template, businesses can easily monitor their business cash flow and make the right decisions about upcoming investments and expenses.

3. Simplified Processing:

The capital account template by Vyapar is user-friendly and easy to use. The app automatically calculates GST for you, generates GST reports, and helps you file your GST returns. The software automatically calculates the debit/credit balance, saving time and effort.

Another benefit of using Vyapar’s capital account format is that it simplifies preparing financial statements. The format provides a clear and concise overview of a business’s capital position, which can be used to prepare financial statements like balance sheets. Using a professional tool help saves time and reduces the manual risk of errors in financial reporting.

4. Helps With All Business Tasks:

Using the Vyapar app, you can store customer information, creates customer groups, and track customer payments. You can send payment reminders to all clients with a few clicks and get paid on time.

Further, you can generate reports like sales reports, purchase reports, stock reports, and more and get insights into your business performance. You can add assets and liabilities for a quick overview of the business outlook, allowing you to make adjustments to enter additional content.

5. Track Inventory And Stock Details:

The capital account management app helps you keep your inventory in check. The app comes with a powerful inventory management system that helps you get accurate information regarding supplies.

Further, using the Vyapar app, you can track your business expenses, including bills, rent, office supplies, and more. You can also categorize expenses and generate expense reports.

6. Fully Customised Formats:

Using the Vyapar app, you can manage and create custom capital account formats in MS Excel, Word, Google Docs, and PDF formats. You can customize the formats entirely to fulfil your unique business needs.

Many businesses rely on balance sheet formats created using the Vyapar app to foster the growth of their business. It helps them monitor assets and liabilities to determine shareholders’ equity.

7. Complimentary Recording Of Your Data:

With its daybook, Vyapar Solutions provides added benefits to enterprises. This cost-free application eliminates the need for manual data entry. You can keep your data secure with Google Drive backups.

It provides a superior option for keeping financial records. It will guarantee smooth productivity. Also aided in avoiding a debt quagmire caused by poor financial management.

8. Billing And Inventory Management:

Create professional-looking invoices, estimates, and purchase orders. This also provides you with the chance to customize the invoices to add your company logo and other details.

You can keep an eye on your inventory stock levels, get notifications when stock is low, and generate purchase order formats easily. It makes the entire inventory management effortless.

Frequently Asked Questions (FAQs’)

A capital account format is a financial accounting format used to record the investments made by the owners or shareholders in a business and the profits earned and losses incurred.

A capital account format is important because it helps businesses keep track of the capital invested by their owners or shareholders. This information is important for making financial decisions and determining the business’s value.

A capital account format typically includes information on the investments made by the owners or shareholders, the profits earned, and the losses incurred. It may also include information on any distributions to the owners or shareholders.

A balance sheet is a financial statement summarising the current financial position at a given time. It includes the listing of all its assets, liabilities and equity.

Contrary to that, a capital account is a record containing all the information related to the investments made by owners or shareholders and the profits earned and losses incurred.

Yes, small businesses can benefit from using a capital account format to keep track of the investments made by their owners or shareholders. This information can help businesses make better financial decisions and determine the value of the business.

Yes, a capital account format can be used for tax purposes, particularly for calculating the basis of the stock or ownership interest in the business.

Yes, there are several software applications available for managing capital account formats. One of the best options available in the market is the Vyapar app.