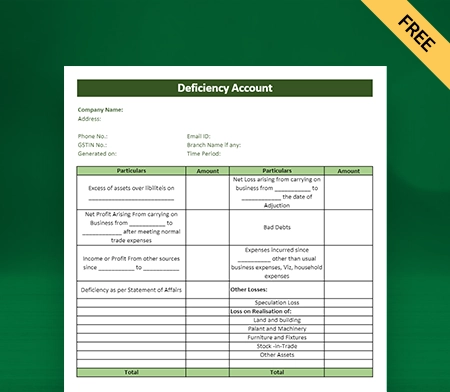

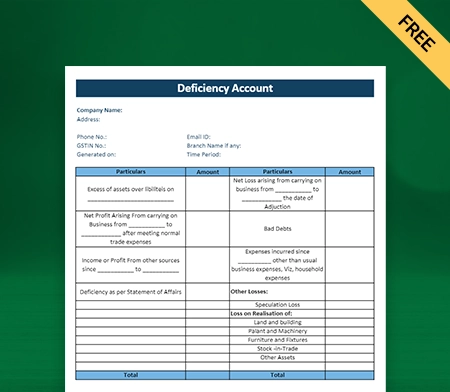

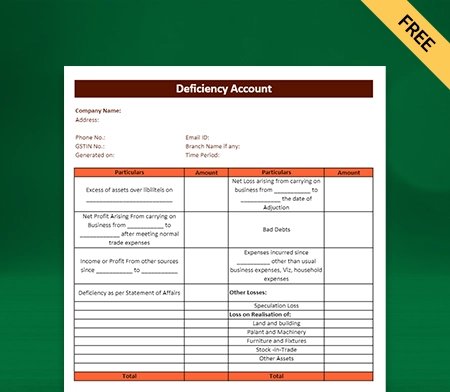

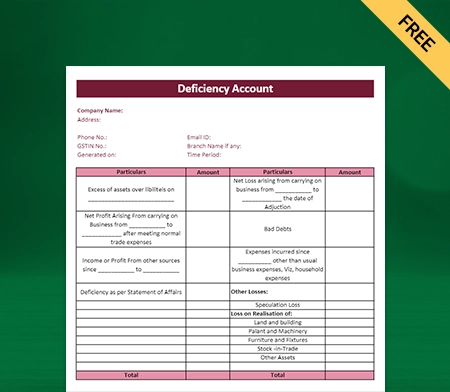

Deficiency Account Format

Use accounting software to manage your business cash flow. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all deficiency account format for free.

Download Deficiency Account Format in Excel

What is The Deficiency Account Format?

A deficiency account format is a financial statement that shows how much money a company or an organization has lost in a specific period. Companies generally use it when they have conceded more significant losses than their revenue or profits, as it leads to a negative balance in the equity part of the balance sheet. This format helps stakeholders determine how healthy the company’s finances are and shows how big the deficit needs to be fixed.

Components Of Deficiency Account Format

Here are the following essential components of the deficiency account format:

1: Opening Balance

In a deficiency account format, the opening balance represents losses carried forward from the preceding period. It is the starting point for recording and monitoring a company or organisation’s deficits.

This balance represents historical losses that profits or recovery must still mitigate. It provides crucial context for evaluating the entity’s overall financial position and stability and is essential for determining the magnitude of the deficit that must be addressed.

2: Amount Adjustment

Adjustments are additional trading losses or expenses incurred during the current period that contribute to the overall deficit in the deficient account format. These adjustments are recorded separately from the initial balance and represent financial activity or events that have escalated the accumulated losses even further.

Adjustments can include operating losses, write-offs, impairment charges, or other relevant expenses affecting the company’s financial health. The deficiency account format, by including adjustments, gives a thorough and up-to-date picture of the entity’s financial condition and the size of the deficit.

3: Closing Balance

In a deficiency account format, the closing balance represents the total cumulative losses at the end of the reporting period. It is the sum of the initial balance (accumulated losses carried forward) and the period adjustments.

The closing balance represents the final amount of the deficit or gap in the balance sheet’s equity column. It provides a clear snapshot of the company’s financial condition, stressing the severity of the accumulated losses that must be addressed or rectified in order to improve the organisation’s financial health and stability.

4: Deficiency Reserve

In deficiency account format, a deficiency reserve reflects a percentage of the equity set aside to cover cumulative losses. It serves as a reserve fund to address the company’s deficit and improve its financial status.

The deficiency reserve protects against future losses and funds potential recovery or restructuring activities. The specimen of the deficiency account reflects the company’s commitment to addressing the deficit and reestablishing financial stability and profitability.

5: Recovery Plan

In deficiency account format, the recovery plan shows the strategic steps and actions needed to deal with the company’s accumulated losses and improve its financial situation. It includes a detailed plan to cut costs, make more money, improve operations, restructure debt, and take other steps to help the business become profitable again.

The recovery plan helps the company get back on its feet after the loss by giving it direction and a set of goals. It shows the company is very serious about its cash flow and quickly wants to recover the losses and get back on track.

6: Reporting Requirements

In deficiency account format, reporting requirements refer to the obligations and guidelines established by accounting standards and regulations to disclose and present to disclose and present the deficiency account. These requirements specify the required information, including the initial balance, adjustments, and closing balance, as well as the format and presentation guidelines.

Reporting requirements ensure transparency and consistency in financial reporting, enabling stakeholders to assess the financial health and size of the deficit with precision. Compliance with these requirements is essential for maintaining regulatory compliance and providing users with accurate financial data.

Steps To Prepare Deficiency Account Format

Here are the following steps for preparing a well-detailed and professional deficiency account format:

1: Collect Financial Data

In order to prepare a deficiency account format, it’s important to gather relevant financial statements like balance sheets, income statements of affairs including assets and liabilities, and information from the equity section. It requires every essential detail, such as what you need to know about the company’s finances, income, and equity.

By looking at these documents, you can get the information you need to correctly calculate and record the losses and shortfalls in the Deficiency Account Format. This step ensures that the format perfectly shows the financial health and standing of the company.

2: Identify Accumulated Losses

While preparing a deficiency account format, it’s important to figure out and include the total amount of losses from earlier reporting periods that have been carried forward. This number is the total amount of losses that have not been made up for by profits made earlier.

By including these accumulating losses, the format of the deficiency account shows a full picture of the problem that needs to be fixed. It gives a place to start tracking and evaluating the company’s finances and figuring out how big the deficit is in the current reporting period.

3: Analyse Adjustments

When preparing the deficiency account format, it’s important to look at and analyse any new losses or costs during the current reporting period and add to the total deficit. This step includes carefully looking at financial records, transaction details, and expense reports to find any new factors that might be causing the deficit.

By looking at how these additional losses or expenses affect the company’s finances, the deficiency account format gives a clear picture of the total deficit for the reporting period. You can easily prepare the statement within a few minutes by using the online application.

4: Calculate Opening Balance

While preparing the deficiency account format, you must sum up the opening amount. This means adding up the losses from earlier periods carried forward and any changes made during those periods. By adding up these numbers, the starting balance shows the total amount of the deficit built up over time.

This step ensures that the format of the deficiency account starts with an exact picture of the company’s past losses and gives a place to start recording and keeping track of the deficit in the current reporting period.

5: Determine The Closing Balance

Determining the closing balance is essential for creating the deficiency account format. This is accomplished by adding any adjustments made during the current reporting period to the opening balance (accumulated losses carried forward). The closing balance shows the total cumulative losses at the end of the reporting period.

It is crucial to analyse the company’s financial position each quarter and act as a crucial indicator for its revenue and deficits. The closing balance, which shows the overall size of the deficit, is an essential part of the deficiency account format.

6: Separate Deficiency Reserves

It is vital to find and use the specific deficiency and affairs in stocks or funds set aside to cover the losses and shortfalls that have built up. These reserves or funds are used to compensate for the loss and get the finances back on track.

By clearly naming and assigning them, the deficiency account can correctly show the available resources to deal with the deficits and give a full picture of the financial situation. It would help if you considered preparing your deficiency account in online accounting software that allows you to access important data easily.

7: Comply With Reporting Guidelines

It is critical to conform to accounting standards and regulatory requirements to present and disclose the deficiency account format during its preparation. Rules and regulations state how the account format should be formed, what should be included, and the format information.

The deficiency account format guarantees financial openness, correctness, and comparability by adhering to these principles. It also aids in regulatory compliance and offers users trustworthy and consistent data for assessing the company’s financial health.

8: Provide Explanatory Notes

It is important to include notes or disclosures that explain the deficiency account style to make it easier to understand. These details provide more information about the deficit and any other linked factors. Explanatory notes can clarify the causes of the deficit, the significant events or transactions that impacted the losses, and the steps taken or planned to resolve the issue for the trade creditors.

By adding these explanations, the structure of the deficiency account becomes more informative, letting stakeholders learn more about the financial situation and making it easier for them to make decisions based on accurate information.

Benefits Of Using Deficiency Account Format

Here are the following benefits of using the deficiency account format:

1: Provides Financial Transparency

The deficiency account format improves financial transparency by emphasizing deficits and offering a thorough perspective of the company’s financial health. It provides a clear and comprehensive picture of the accumulated losses and deficits so that stakeholders have an explicit knowledge of the organization’s financial issues.

The deficiency account format encourages openness and accountability by explicitly displaying the deficiencies, allowing stakeholders to make well-informed decisions based on a comprehensive understanding of the company’s financial condition.

2: Decision-Making Support

The deficiency account format is critical in decision-making because it provides stakeholders with a clear image of the financial issues and the extent of the deficit. It is a valuable tool for assessing the magnitude of the deficit and understanding the financial situation. This information enables stakeholders to establish educated plans and make appropriate decisions to address the gap effectively.

Stakeholders can create targeted and well-informed methods to improve the company’s financial health and tackle the difficulties by using the deficiency account structure.

3: Compliance With Regulations

The Deficiency Account Format ensures compliance with reporting and disclosure regulations and accounting standards. By adhering to these guidelines, financial reporting remains transparent and accountable. The format ensures that the presentation of accumulated losses and deficits conforms to the prescribed rules and regulations, providing stakeholders with accurate and trustworthy information.

Compliance with accounting standards and regulatory requirements promotes transparency and instills confidence among stakeholders in the company’s financial reporting practices, fostering accountability and trust within the organization.

4: Performance Evaluation

The deficient account format helps evaluate the effectiveness of deficit reduction and tracking progress in resolving financial issues over time. The format allows stakeholders to analyze the impact of adopted measures and quantify their success in managing the deficit by tracking and recording accumulated losses and deficits.

This review aids in making informed changes to tactics, finding areas for improvement, and guaranteeing consistent progress toward financial stability and recovery. Your creditors can make intelligent decisions based on your deficient account format.

Features That Make Vyapar Best Choice For Your Business

1: Record Business Expenses

By using Vyapar accounting software, you can easily track and record all expenses in the business, as keeping your expenses accurate is essential for accounting and tax filing. With the accounting programme, it is easier to keep track of money spent and make a correct report.

Keeping track of costs is easy with our free accounting app. the advanced features of this app, and businesses can easily find ways to spend less and save more. With our free accounting tools, you can keep track of both GST and non-GST costs.

Also, Vyapar’s options have a number of advantages over those of competitors who need to focus on these crucial aspects. It helps you cut costs and make as much money as possible. The free programme is a good way to keep track of expenses and it also helps keep track of them in the future.

2: Manage Your Business Cash Flow

Businesses can keep track of their cumulative losses with accounting tools. It helps keep track of money and provides essential tools that help with better cash flow management. Many businesses use Cash Flow management for billing, budgeting, and many other useful things in your business.

Vyapar’s accounting software helps you gain better insight into your incurred losses and ensures the accuracy of your accounts. If you buy this programme, you can easily keep track of your profits and losses and your business’s cash flow. Vyapar accounting software has everything you need to handle cash transfers, as it has benefits like tracking bank withdrawals and deposits.

Our free billing software is better for making a cash book in real-time. It can help a business keep making money and add information about costs, payments, purchases, and other things. With this GST accounting programme, it’s easy to keep track of cash.

3: Tax And Discounts

Using the Vyapar software, you may track the payment status of each bill by using our sophisticated functionality. Vyapar assists in establishing invoice due dates, guaranteeing that your company will continue with stable cash flow. It provides tax and discount alternatives based on the item or transaction. You can also enter the contract in our sophisticated accounting software.

Vyapar software allows you to add or change the tax group or rate. Our accounting software allows you to manage discounts effectively. It enables you to accept/make partial and full payments based on your business needs. Our accounting software allows you to manage loans and checks.

It has an easy-to-use user interface and automates repetitive business procedures in your company. Vyapar provides its users with over 40+ reports. You can perform a wide range of procedures with our accounting tool without incurring additional costs.

4: Composition Party Management

You can effortlessly maintain party Email, phone number, registered address, shipping address, and GST number using Vyapar Software. Additional fields can be filled out to manage the PAN/Registration/DoB, etc. It also allows you to add and allocate the appropriate party in our advanced accounting software.

On Vyapar, you can also undertake a part-to-party transfer, which allows you to send payment reminders as the due date is near. You may manage the party opening balance, receivables, and payables using our comprehensive accounting tool.

You can have up to five firms and up to five companies within a company. Using Vyapar app you to create both GST and non-GST transactions. You can get a business overview using our invocing software’s business dashboard. You can access your party data from a single or numerous devices.

5: Add And Manage Multiple Bank Accounts

Vyapar accounting software allows for companies to swiftly add, manage, and track online and offline payments on their given business dashboard. The tasks get easier if people use an easy-to-use accounting app for mobile. You may easily enter data into the free software without worrying about your data safety, whether your revenue comes from banks or e-wallets.

Using the advanced software, you manage your cash flow by sending and receiving money from bank-to-bank transfers. As a result, which makes it perfect for firms to keep track of their losses and manage all cash-ins and cash-outs. After receiving payment, Vyapar also sends a free transaction message.

To use the bank accounts feature within Vyapar, you first have to add a business account in your bank in software. The Vyapar free Inventory management app makes handling credit cards, OD accounts, and loan accounts simple. This is the best method for keeping a complete bank account book without any bother.

6: Create Various Transaction

Vyapar accounting software is a versatile application for its app users to generate a variety of transactions. It provides features for sale and purchase transactions, enabling users to generate sales invoices and register purchases easily. In addition, it helps manage expenses by providing tools for accurately tracking and categorising business expenditures.

Additionally, Vyapar facilitates the creation of sale/purchase orders in order to expedite the ordering process and maintain a systematic approach. Before finalising transactions, users can generate estimates/quotes before finalising transactions to provide clients with pricing information. In addition, the platform facilitates the creation of credit and debit notes to document financial transaction adjustments.

Finally, the Vyapar transport billing system facilitates the generation of waybills necessary for transporting products and ensuring compliance with taxation regulations. With Vyapar’s extensive transaction features, businesses are able to efficiently manage their financial operations and keep a transparent record of their transactions.

Frequently Asked Questions (FAQs’)

A deficiency account format is a financial statement that displays the difference between a specific asset’s actual and desired levels, such as cash, inventory, or capital. It aids in tracking and analysing the causes of the deficiency and provides information on corrective actions.

A deficiency account format is typically utilised when there is a significant difference or shortfall between the actual and intended levels of an asset, liability, or equity item. It is utilised frequently in financial analysis, budgeting, and decision-making.

A deficiency account format includes the name of the account or item being looked at, the desired level or goal, the real level or balance, and the shortfall amount. It should have additional details in the document, such as what caused the problem and what steps should be taken to fix it.

Common reasons for deficiencies in a deficiency account format are bad financial management, unexpected losses or expenses, inefficient processes, poor planning or forecasting, economic downturns, poor control systems, inaccurate data or reporting, lack of capital or funding, and outside factors like changes in market conditions or regulatory requirements.

A deficiency account format is beneficial because it helps identify and quantify differences between desired and actual asset, liability, or equity levels. It offers invaluable insights for decision-making, financial analysis, and risk evaluation. Organisations can take corrective action by identifying deficiencies to enhance financial performance, mitigate risks, and optimise resource allocation.

The frequency of preparing a deficiency account format depends on the organisation’s requirements and circumstances. It can be generated monthly, quarterly, annually or as needed for particular initiatives or financial evaluations. The frequency should be determined based on the significance and relevance of the analysed deficiency.