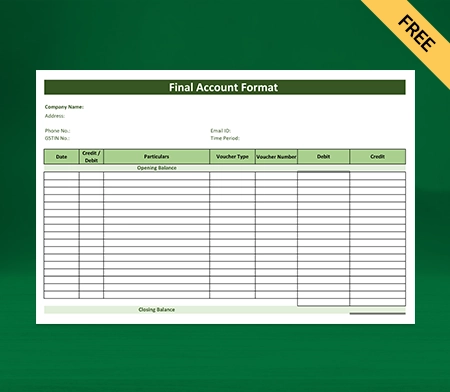

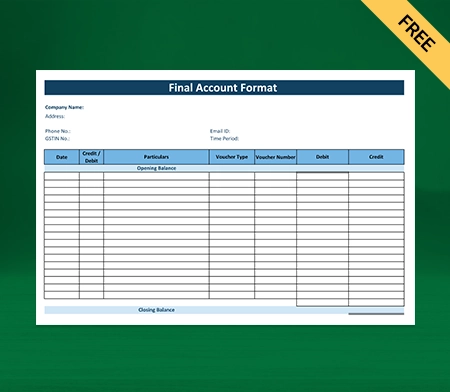

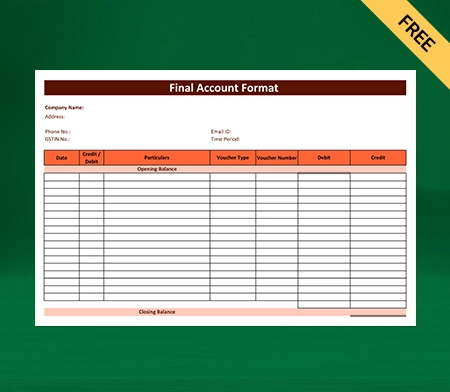

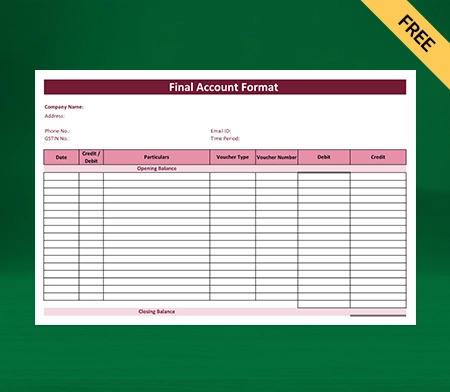

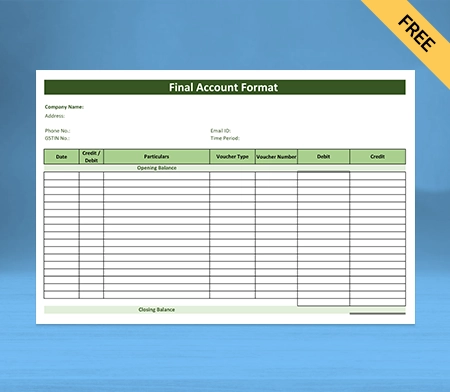

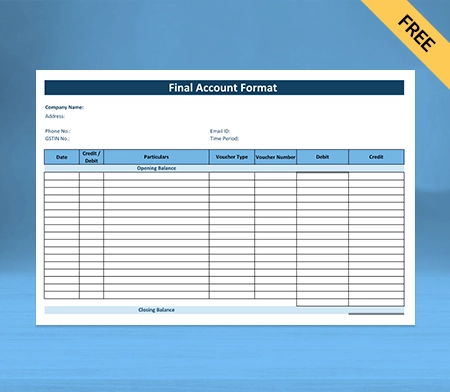

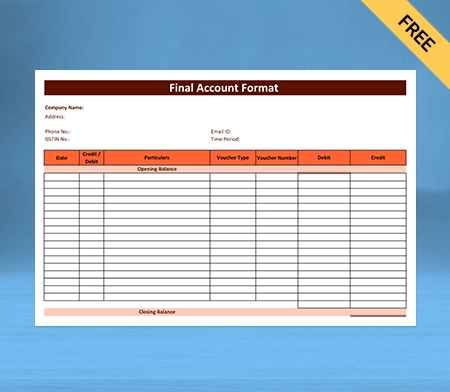

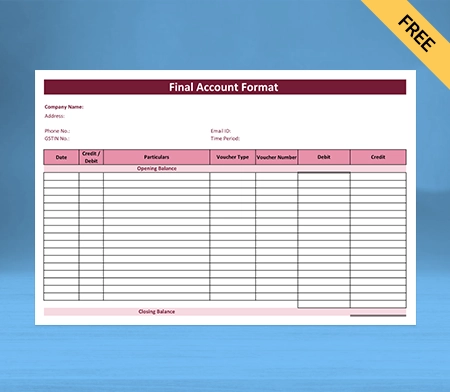

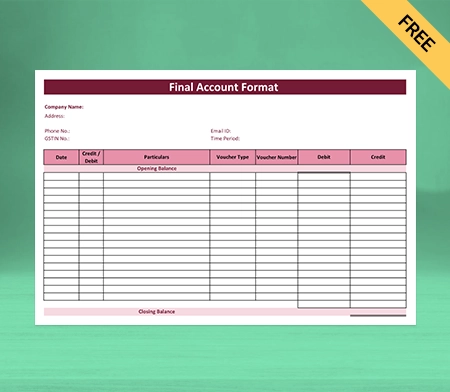

Final Account Format

Vyapar is an innovative accounting app that offers a comprehensive solution to capture a company’s financial statement of production by assessing the balance sheet, income statement, and cash flow statement. Get started with the best Final account format for free. Grab a free trial for 7 days!

Download Final Account Format in Excel

Download Final Account Format in Google Docs

Download Final Account Format in Google Sheets

What is the Final Account Format?

The final account format, a financial statement, is a total summary of a company’s financial performance and position over an accounting period, such as an accounting year (ending on 31st March) or quarter.

Financial statements consist of three important parts: the income statement, the balance sheet and the cash flow statement. The final account format helps cover all details and make the business management process seamless for all.

1. The Income Statement:

An Income statement includes the company’s expenses, revenues and profitability period. People also prefer to call an income statement a profit and loss (P&L) or an earning statement. The Income Statement basically consists of the revenues earned from selling goods or services.

The next step notes down the expenses incurred or done by the company to carry out that revenue, such as General and Administrative (G&A) Expenses, cost of goods sold, and selling and administrative expenses.

Net income is the difference between revenues and expenses. The income statement makes it easier to find profit and loss. If expenses exceed revenues, the company is at a loss, whereas higher revenue shows a higher profit.

Thus the income statement is important because it shows a company’s profitability over a specific period or accounting period. It is the choice of the company to maintain it quarterly, annually or monthly.

2. The Cash Flow Statement:

Cash flow statements are financial statements that detail cash inflow and outflow during an accounting process. The incoming and outgoing cash in a business is called cash flows. This information is used to record, track, and report these transactions.

We all know that cash flows in a company because of its core business which generates cash, such as sales of goods and services they provide. Cash flow also occurs from purchasing and selling long-term assets like property, machinery, equipment, etc.

Cash flow also occurs from the financing activities like paying equity to shareholders, repaying or issuing debt. The cash flow statement is essential as it handles the sources and uses of cash for a business. People prefer to prepare it annually, but Vyapar provides various period options, such as quarterly or monthly, to prepare it.

3. The Balance Sheet:

The balance sheet is prepared to show a company’s assets, liabilities and shareholder equity. The balance sheet is one of the main financial statements among the three to evaluate a business. It provides a short statement or snapshot of a company’s finance with the date and duration of time.

The balance sheet is divided into two sections which are as follows:

Assets: the resources owned or purchased by the firm or company, such as cash, inventory, vehicles, furniture, machinery etc.

Liabilities: the resources that are payable for the company, such as accounts payable, interest payable, income tax payable, bills payable, etc.

Thus, the balance sheet is important for any company to describe its position and financial ability to pay its debts. It is typically prepared on an annual basis but also prepared quarterly or monthly.

Types Of Statements Of Accounts

Three types of financial statements are crucial to be maintained by any firm. These accounts are :

1. Income Statement:

An Income statement includes the company’s expenses, revenues and profitability period. People also prefer to call an income statement an earning statement or profit and loss(P&L).

Examples of income statement accounts used in a business consist of sales, returns and allowance, service revenue, cost of goods sold, fringe benefits expense, interest expense etc.

2. Cash Flow Statement:

Cash flow statements prepare the financial statement showing the cash inflow and outflow during an accounting. The incoming and outgoing cash in a business is known as cash flows. This information is used to record, track, and report these transactions.

Some examples of cash flow are paying wages and salaries to employees, purchasing or investing in new equipment or any asset, receiving dividends from investments, payments from customers for goods and services and so on.

3. Balance Sheet Statement:

The balance sheet maintains a company’s assets, liabilities and shareholder equity. The balance sheet is one of the main financial statements among the three to evaluate a business. It provides a short statement or snapshot of a company’s finance with the date and duration of time.

Statement Of Change in Equity

The change in the equity statement could occur during an accounting period or quarterly basis. Statement of changes in shareholder equity is another name for the statement of change in equity. It is not part of financial statements. It is presented as a separate financial statement of the company.

The statement of change in equity could occur for a few obvious reasons, such as either the changes in equity occurring because of profit and loss or the change in equity resulting because of transactions with the owner due to their capacity as owners.

Changes in equity because of profit or loss consist of net income or loss and other incomes such as foreign currency translation adjustment and revaluation of assets.

Changes that occur in equity from transactions with owners in their capacity as owners include the issuance or repurchase of shares, the distribution of profits or losses to shareholders and even the payment of dividends.

Thus, the statement of change in equity is important to calculate because it keeps track of changes in equity during a specific period.

Importance Of Final Accounts For Small Business Owners

1. Assist Shareholders:

The final account helps in assisting shareholders in evaluating their investments which could help them to make appropriate decisions regarding the financial performance of the company. Shareholders prefer to learn and know more about the liquidity position of the organization and the amount of profit and loss earned by them.

Liquidity positions refer to how much your company can earn by simply selling off your assets or taking loans on an urgent basis to meet your liabilities. In simple words, how much can your firm access if you have to pay off today?

2. Helpful For Tax Department:

We all know that the tax refers to the amount of money people need to pay the government according to their income, the value of their property, the revenue generated by the organization, etc.

So Final accounts help any company to make sure that they make payment of various taxes and additional duties punctually on the due date without any delay to the tax department. Thus it is important to prepare final accounts for computing tax.

3. Helps To Find Facts And Figures:

The members of the team/company plan and coordinate their activities in an organized and concerted way. It happens by following a plan and schedule and through the division of functions to reach the team’s common goal.

Final accounts provide essential facts and figures regarding the financial position, progress, deposition of the enterprise, liquidity and performance. It helps the internal management to have quick, informed and accurate future decisions based on data information shown in the final statement.

4. Keep Lenders And Creditors Stress-Free:

No doubt your company would attract lenders and creditors towards your company but on what basis would trust be formed between the company and them? Final accounts come into play here.

The final account helps the lenders and creditors go through the company’s financial health and performance of the organization. Creditors use this final statement to be sure whether the firm will be able to pay back its debt on time or not.

5. Help in Staying Aware Of Company’s Growth:

For every employee, it is important to be sure about their company’s profitability and, basically, the financial position.

Thus, final accounts help employees know about the company’s profitability and the adverse circumstances of job security, transfers, increment, incentives and many other conditions.

6. Helps to Achieve Steady Growth:

Every business wants to stay up and running smoothly. It means that every company goals to achieve consistency/growth in revenue generation, improve cash flow, and win new customers.

Final accounts help to take care of all this. It helps the organisation focus on its steady growth and performance by updating its strategies and techniques for improving revenue, providing more employment opportunities, and developing a strong customer base.

Benefits Of Using Vyapar For Final Account Format

To experience the best accounting software, Vyapar has built customisable account formats. Using, Vyapar accounting software for big business or small business you can manage all their accounting-related needs on a single platform easily.

The motive behind developing this mobile app is to make accounting less tiring for businesses and more convenient & error-free.

Let’s discuss a few benefits of using Vyapar for your final account format needs:

Offers Profit And Loss Insights:

One of the most beneficial features of using Vyapar for the final account format is that it directly provides information related to the revenue generated by the organisation by using income statements. The final statement consists of all the revenue and expenditure-related details in a proper format during an accounting year.

It shows all the information related to taxes, expenses, interest to be paid and day-to-day operations expenses. This is the most convenient way to manage the documentation of the final account format.

Helps To Forecast:

The Final statement helps predict the next accounting period by looking at the performance of the previous final account format. It helps a company make a budget plan that could be for one year, five years or even according to the accounting app.

It helps companies to be careful about future problems that have not been seen but have some chance to occur in the future accounting app. The Final account statement format helps conveniently handle the possible problems a company can face in the future.

Provides Better Finance Knowledge To Financers:

The Final statement format would provide potential financiers with a better overview of the financial analysis of your company. Just by going through it, the finance analyst could analyse the overall financing condition of your business. They would also prefer to create a company’s financial trends to create its profile.

It could also help you to get a loan at a low-interest rate if you show steady net sales growth and rising profit. If the situation goes the opposite, you might face high limitations in getting a loan; that is, you may get it at a higher interest rate.

Easy To Calculate Receivables And Payables:

Vyapar is a professional, free accounting & inventory management software allowing users to keep all accounting details and a proper cash flow. Over one crore people claimed Vyapar to be the best billing software, with a rating of 4.7 out of 5.

A final account format is available in Vyapar for free, which helps their client to keep party-wise track of receivables and payables. In your dashboard, you can track the money you need to collect from your clients and the money you need to pay others.

With the help of this app, you can easily keep track of people who didn’t pay you even after the due date of payment. You can also send free payment reminders to your clients via sms, email, WhatsApp, and other social media apps as well. Further, it also saves time and effort to review the entire account.

Helps To Get Automatic Data Backup:

In this era where people cannot keep their offices piled up with files, Vyapar helps to keep all their accounting and final account format safely saved online within their ID. Our app helps you save your data by creating local, external or online Google drives.

Not only it keeps your data safe but secure as well. You can easily recover all your data if you were a user of Vyapar with a click. Furthermore, Vyapar in India comes with hassle-free automatic backup, so you need not worry about anything.

Various businesses in India have used this free accounting software to keep their data secured. The app also provides 24/7 services with ease to use from anywhere, and even multiple users can use different features simultaneously.

Building Goodwill Of Your Company:

Vyapar comes with a final account format with accounting software and other features which helps to build the company’s brand name. Vyapar provides attractive and genuine quotes and estimates for your company, attracting investors to invest in your company.

Professional final account format helps include the business logo, terms and conditions, and all details clearly, which helps to build a positive image of your brand. The professional app helps you customise your invoice, directly influencing the investors and showing you as a professional seller.

Vyapar also provides the facility to use business logos, fonts, styles, colours etc., which helps in presenting your brand identity perfectly. A buyer or investor is more likely to get attracted to a professional and well-presented company. And that is where the role of building goodwill arrives.

Provides Easy Online And Offline Billing:

Vyapar is a platform with several services and features at a minimum cost. This platform not only works in online mode but also in offline mode. Yes, you can easily use the offline features of this app to get your work done.

Vyapar can generate invoices for your clients even in offline mode. You can make changes and trust the Vyapar app to update it whenever your internet connectivity becomes strong.

With access to this software, you can also create bills as soon as possible for your customers to make any purchase. This app is most beneficial for people living in low internet connectivity areas as it works in those areas conveniently.

Helps To Save Time And Cost:

Vyapar helps make the final statement process easiest for the company owners by reducing the time taken to manage accounts. Our final accounting format can help you automate tasks like calculating the profit and loss, estimating the cost and budget of the future, managing expenses, etc.

The software helps you to store and manage all your legal documents in this app. With easy access to documents, you can conveniently carry out any transaction, bill, or information and share it as soon as possible.

The final account formats help you to save time and workflow. This increased efficiency could help you focus more on your core business.

Purpose Of Final Accounts For Businesses

The final account formats help in many ways, but let’s get some pointers to know about the objectives of the format of the final accounts:

- The final account format helps find out the net profit and net loss incurred by the organization during an accounting year. The profit and loss account is one of the major parts of final accounting.

- The data collected by the final account helps compare the current year’s gross profit and net profit with the previous year’s. This helps in analyzing the growth and performance of the organization, which ultimately helps in framing the future decisions and policies of an organization.

- The final account format provides detail regarding the direct/indirect expenses and direct/indirect incomes by preparing the trading account and profit and loss account, having all the details about the organization. This also helps the organization to apply various strategies to reduce expenses and strengthen incomes.

- Financial ratios are also calculated with the help of the format of the final account. Yes, preparation of financial ratios is prepared by using trading and profit and loss account information. For instance: operating ratios, net profit ratios, gross loss ratios etc.

- Final accounts also help meet or be aware of an organization’s ascertained financial and liquidity position by reflecting the exact value of assets and liabilities on the sheet. The current position or values are shown under various heads of the balance sheet, which is compared with the previous year’s balance sheet to evaluate changes in the financial position.

- Solvency position is also determined by preparing the final account of a business. Solvency refers to the long-term financial position. A solvent business refers to one that has a positive net worth; that is, the total assets are more than the total liabilities. It helps to meet short-term solvency by calculating the current and liquidity ratios. Furthermore, long-term solvency could be achieved by determining and calculating differences between the debt-equity and proprietary ratios.

Frequently Asked Questions (FAQs’)

The final account format is prepared at the end of the fiscal year by the company to get a clear picture of the organisation’s financial position and also to keep a record of the organisation’s performance.

The final accounting is the final marksheet of the company, which shows all the cash flows and their impact on generating profit and loss.

A balance sheet provides a formatted ending balance in a company’s asset, liabilities and equity accounts as per the time phase stated on the report. Thus, it captures a snapshot of what a company owes or owns and the amount of investment made during the accounting period.

The balance sheet is one of the most important elements in the final accounting statement, with income statements and statements of cash flows.

A final account and a final statement both provide a summary of a company’s financial performance during an accounting period or on a quarterly basis.. The final account format helps summarise the balance sheet, income statement and cash flow statement.

The final accounts of the entity include a trading account as one of its components. In a simple explanation, a trading account keeps track of total sales, total purchases and direct expenses relating to sales and purchases of the business. Thus trading account format for the year or quarterly basis consists of particulars amount, debit, credit, sales, etc.

The general ledger summarizes all the transactions journalized in a particular account and serves as the book of final entries. This format includes all the debit and credit side transactions concluding with their ending balance. The ending balance is crucial to carry out as the company needs to make its reports with it.

Some examples of profit and loss accounts consist of sales tax, maintenance, depreciation, administrative expense, selling and distribution expense, closing stock, provisions, wages, carriage on sales etc.

Generally Accepted Accounting Principles (GAAP) refers to the basis of accounting, clarifying the basic principles and rules of accounting. At the same time, creating a general ledger, trial balance or any other account, it is important to follow GAAP.