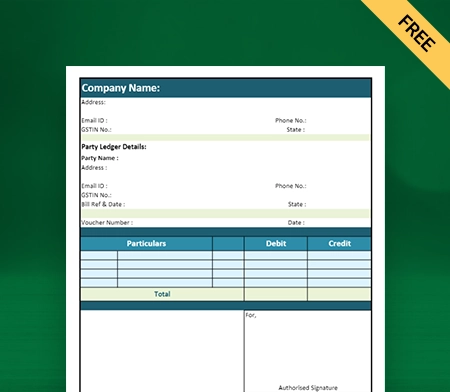

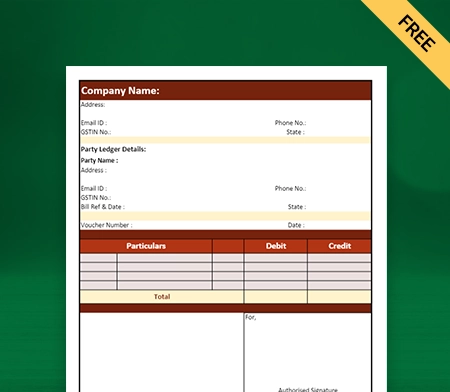

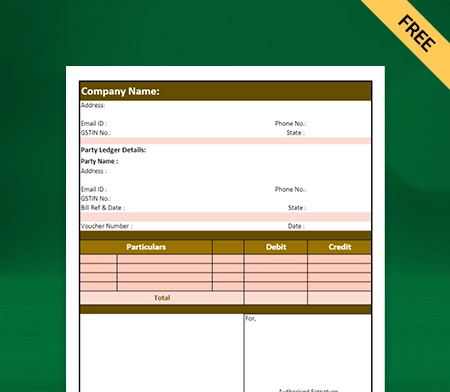

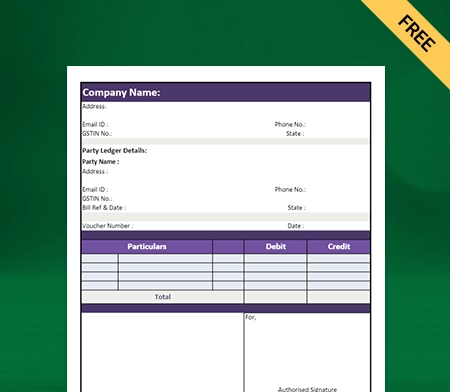

Journal Account Format

Use the best accounting software to record all your business transactions in one place. The Vyapar app makes the entire process seamless and helps you manage your work. You can download Vyapar now and access journal account formats for free.

Download Journal Account Format in Excel

What is a Journal Account Format?

A Journal account format is a document that consists of transactions that are either credit or debit transactions. The number of debit and credit journal entry transactions must be more balanced. Journal accounts can be used to record either one-time or recurring transactions.

As a result, journal account transactions directly impact the balances of general ledger accounts. After that, the records are integrated into a general ledger. This data is then utilized to create financial statements at the conclusion of the fiscal year.

Essential Details Required in a Journal Account Format

Here the following information should be included in a Journal Account Format:

1: Transaction Date

The transaction date should be written in your company’s journal account. The transaction date is the actual date of the transaction, so the reported date is distinct from the reported date.

2: Journal Entry

The term “journal entries” refers to the practice of applying the fundamental principles of bookkeeping to record the activities and transactions that occurred in a company on a specific day. We include a concise narrative detailing the transaction at the bottom of our journal Entry format.

3: Folio Number

The folio number denotes the reference number used to identify the specific primary entry inside the relevant ledger accounts. This reference number may be either numeric or alphabetic in its representation.

4: Debit Amount

Your company’s Journal account must show the debit amount by which the respective account is debited in the transaction. The debited column is generally added on the left side of the journal book.

5: Credit Account

Ensure the amount to be credited is recorded on the right side of your journal account format column. The unit of measurement, that is, the country’s currency, is written in this column.

6: Narration

Your company should mention the short description of the transaction written under each entry called narration.

Types of Entries in Journal Account

Here are the following types of journal entries:

1: Single Entry: A single entry involves only two accounts; one account is credited, and the other is debited.

2: Compound Entry: A compound entry is an entry that involves more than two accounts. Either multiple accounts are debited, or multiple accounts are credited, or both.

3: Opening Entry: Through an opening entry, the amounts of assets and liabilities at the end of the previous accounting year are carried over to the current accounting year.

4: Closing Entry: Nominal accounts are closed when their balances are moved to the trading account or the profit and loss account at the conclusion of the accounting period. The Trading Account receives all cash flows that are both direct and indirect. The Profit & Loss Statement now includes both indirect costs and gains.

5: Rectifying entry: it is generally passed to make corrections of errors in accounting.

6: Adjusting Entry: Adjusting entry refers to the entries made for unrecorded transactions or requiring adjustment after closing the accounts for the accounting year.

7: Transfer Entry: Transfer entry refers to an entry in which an amount is transferred from one account to another.

Steps to Enter the Transaction For Journal Accounting

Here are the following details that assist you in entering the transaction in your journal account format:

1: Keep Copies of the Financial Record

The accountant must collect all accounts involved in the transaction and supporting documentation before recording a business or financial transaction in an accounting journal. Collect the bills, purchase orders, receipts, recordings from the cash register, and invoices for accurate journal entries. Start collecting the documents at the beginning of each fiscal year, and keep them all together in one folder. It ensures that you remember to make any necessary journal entries.

2: Determine the Impact on the Account

Before posting, locate the accounts in the general ledger that the journal entry will affect. Sort your transactions so that the appropriate accounts are visible. Organizing journal entries according to transaction types can make data entry significantly simpler. New workstations and computers affect a business’s cash and office supply accounts.

3: Establish the Type of Account

To create a journal account format, identify the account type from which money is debited and credited. Typical account types consist of assets, liabilities, revenues, and expenses. In the preceding illustration, the accountant records expenses for office supplies because the business made purchases. Therefore, The cash account is an asset, while the office supply account is an expense.

4: Order the Transaction on the List

Begin putting your recent transactions on the list and then ensure that all financial transactions are recorded precisely in the correct order. After you’ve gathered and reported your transactions, make your journal account by entering the correct date, account number, account name, and credit and debit information. Because Indian Accounting Standards use the double entry system format, each transaction must have an expense and a credit.

The items from which money is debited should be on the left, and the ones to which money is credited should be on the right. After making all the notes, an accountant ensures that the amounts on the debit and credit sides are the same.

Benefits of Using the Journal Account Format

Here are the following benefits of using the journal account format:

1: Clear Organisation

The journal account format is very useful for your business when you record your financial transaction with a clear and organized structure. It ensures that every transaction is organized and clear and does not confuse the clients. Businesses frequently use it for organized bookkeeping in the process of recording the transaction.

The journal account format removes the hassle of simultaneously keeping track of various transactions and accounts. By using it, you can keep track of each account and transaction quickly.

2: Ensures Effective Communication

Using the journal account format makes communicating effectively easier for accountants, auditors, and other financial experts. It makes communicating and collaborating on financial concerns easier by providing a standard framework for discussing and analyzing financial transactions.

It makes it possible to discuss and analyze financial transactions. Suppose there is any legal dispute in the possible future. In that case, you can use the journal account format as legal evidence for your disputed transaction in your business.

3: Provides Better Comparative Analysis

Companies often use the journal account format for effective and accurate comparative analysis by providing historical account balances. Using inventory management software, you can compare the balances over different periods, identify trends, assess financial performance, and make informed decisions.

Based on your comparative analysis, you can make informed decisions about budgeting, forecasting, and strategic planning for your financial year. It offers a historical perspective and enables evaluation of the efficacy of fiscal plans and policies in earlier times.

4: Enhanced Audit Trail

By documenting the changes that occur in individual accounts over the course of time, the journal account format offers a transparent audit trail. Auditor and accountant efficiency is increased due to being able to evaluate and verify the accuracy of the recorded transactions.

Auditors can use the journal account format to compare account amounts and transactions from different time periods. It also helps inspectors match financial documents like bank statements, invoices, and purchase orders.

5: Simplifies the Trial Balance Preparation

The journal account format makes it easier to prepare trial balances by making available account balances. The account balances can be directly transferred to the trial balance sheet format because each transaction is recorded in its T-account. It simplifies the procedure by removing the need for intricate calculations or adjustments.

Account balances are simply organized and straightforward to transfer using the journal account format, making the production of the trial balance more effective and precise. You can easily use the accounting software, which already has all the advanced tools, to prepare your journal.

6: Reduces the Errors

Using the normal balance sheet can be time-consuming and prone to human errors. To ensure that your company can avoid such costly mistakes, you can use journal account format, which can easily help your business to find inconsistencies and inaccuracies in the accounting records.

If the account balances are off or the debits and credits are not recorded in the journal, a problem must be fixed. You can use software like Vyapar, which allows your business to digitize your business platform and remove these errors.

7: Accurate Posting and Balancing

Using the journal account format is known to promote accuracy in posting transactions. Each debit entry has a corresponding credit entry, ensuring that the accounting equation (assets = liabilities + equity) remains balanced.

It simplifies your accounting process significantly, and when you start to perform your journal account operations using the software, it may be less time-consuming as it already comes with all tools and technology that allow you to quickly generate your journal and devote your precious time to productive sectors of your business.

8: Easy Identification of Debits and Credits

The journal account format makes the clear separation of debits and credits possible. Debits are entered on the left side of the journal, while credits are entered on the right. This delineation lets bookkeepers easily ascertain whether a transaction adds to or reduces an account balance.

By clearly separating debits from credits, the journal account format improves accuracy and reduces the likelihood of making mistakes when documenting and analyzing financial transactions.

Features that Make Vyapar App Best Suited For Journal Account Formats

1: Business/Accounting Software

Unlike other apps you can run a single or whole network of business stores with the help of Vyapar. It makes no difference if your shop is officially recognized or not. Vyapar allows you to access your information from single or several devices simultaneously.

Billing Software Vyapar is a great programme to use if you need to make your journal account in a different format in a professional fashion; it includes all the necessary details required to create and manage your journal account. Vyapar allows one corporation to have up to five sub-companies.

Vyapar can be used for both GST and non-GST transactions. Billing, invoicing, generating reports, and other accounting tasks are all simplified with the help of this programme. It also provides you with a business dashboard to help you monitor your company more effectively.

2: Create Your Journal Account in Different Format

Using our professional tool, you can make your Journal Account in Word, Excel, PDF, or Doc file. You can change your journal’s theme, details, and format to fit your needs and send it quickly to your clients. Using the Vyapar-made journal account format in doc ensures the dialogue is consistent and clear.

You can also use the compact and easy-to-store journal account in PDF. It is very safe from a security point of view because you can only get to it with the password you make. Using our cutting-edge technology, you can make a professional job order form.

You can also make your journal Account in Excel with the Vyapar programme. Excel’s tabular style makes it easy to keep track of details. Users can add columns and rows to Excel, which is set up like a grid, to store information such as project details, quantities, costs, and due times.

3: Manage Your Cash Flow Seamlessly

Vyapar’s accounting software helps to manage your business cash flow seamlessly. It ensures each possible way to keep accounts accurate and up to a point. If you buy this accounting programme, keeping track of your business’s cash flow will be easy. This software has everything you need to handle cash transfers, as it has benefits like tracking bank withdrawals and deposits.

Our free GST accounting software is better for adjusting entries in real-time. It can help a business keep making money and adding up all of the information about costs, payments, purchases, and other things. With this GST accounting programme, it’s easy to keep track of cash.

The daybook that comes with accounting solutions is a bonus for businesses. With this free accounting program, you don’t have to enter data manually. It gives a better way to keep track of the money numbers. We can make choices at the right time with the cash flow data. It will make sure that work goes smoothly. Also, ensure that you avoid getting trapped in a cycle of debt due to poor money management.

4: Offer Multiple Payment Options and Get Paid Quickly!

To manage your business cash flow and maintain your journal account, it is vital to get paid on time. It is crucial to explore every possible way to ensure prompt payment. One way is to offer various payment alternatives to your clients that are less likely to default on payments. You can offer options such as UPI, QR, NEFT, IMPS, e-wallet, and credit/debit cards.

Customers value convenience, and the most essential convenience you can provide is the ability for them to pick how they pay you. It also builds clients’ trust in your business. You may manage your cash flow with numerous payment choices using the Vyapar accounting software.

You can choose which payment choices your clients will likely choose, or you can offer them all. You can include a QR code within the invoice as one of the payment choices to assist your users in sending a payment to the UPI id associated. You can also enter your bank account information into the app.

5: Get Real-Time Business Updates Instantly!

Vyapar’s business dashboard ensures you can easily and conveniently handle everything in a single place. You can check your business’s cash flow, inventory, open sales, and payment status. It will save you valuable time wasted in keeping yourself updated with different features.

With free GST accounting software and invoicing software you can manage your business using mobile and Windows devices. This free programme makes doing the books and double entry for your business easy and quick. Save all the information and prepare your journal account format.

Using the business platform, you can quickly get full information about your business anytime. In our payment app, it’s free to use the dashboard. Also, our accounting software has enough features, which include: Cash-flow, Bank Status, Stock/Inventory Status, and Open Orders.

6: Manage Your Online Store

Using the Vyapar free billing software, you can set up your online/window store in a few hours. Using our mobile application, you can present a catalogue of all the services/products you sell to your consumers and increase your online sales. Your products and services, by using our software, quickly reach millions of its users across India.

In addition, the Vyapar software does not charge for using online store features that assist you in taking your business online. Typically, the journal account format includes columns for the date, the account name, a description, and the sums debited and credited. It helps your business to expand quickly and increase the cash flow in your business.

Using the online store feature and billing app for your business will reduce customer wait time at the store counter, as you will have the customer’s package packaged before they arrive. You can attract more local customers by using the Vyapar online store to introduce your business online.

Frequently Asked Questions (FAQs’)

A Journal account format is a document that provides the structure and layout used to record financial transactions in a journal. Typically, the journal account format includes columns for the date, the account name, a description, and the sums debited and credited. It simplifies your ledger account.

To set up a journal account format, first, identify the required columns. The date, account name, description, debit amount, and credit amount are all regular columns. Or you can use the Vyapar software, which already comes with predefined templates and details required to set up a professional-looking journal account.

Using the Vyapar software, you can easily customise your journal account format per your business requirements. Our professional software allows you to add or remove columns, adjust widths, and include any additional information relevant to your accounting processes.

Millions of business owners across India recommend our Vyapar software to set up their journal account format. It allows you to use PDF, Excel, Word, and Doc formats. You can also customise your journal by using our professional tool Instantly.

Yes, now millions of businesses across India have started to use electronic journal entries, which removes the considerable workload for the business. Secondly, there are meagre chances for manual mistakes as they may be detrimental to your business. Lastly, it allows you to customise your journal account per your business requirements. These three things are not possible in a physical journal book.