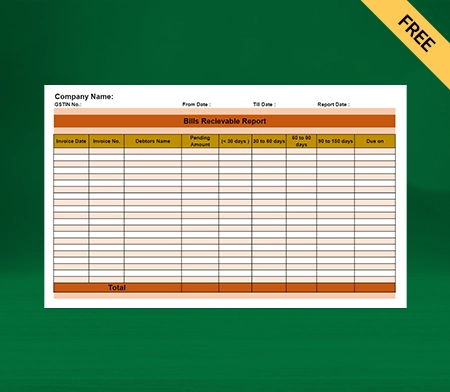

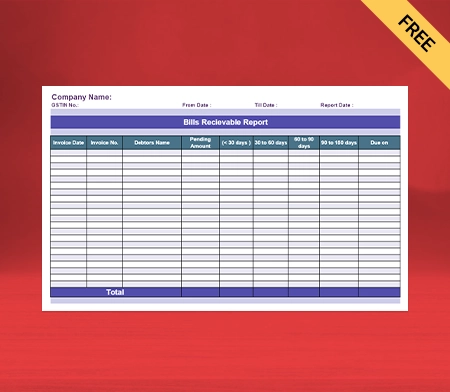

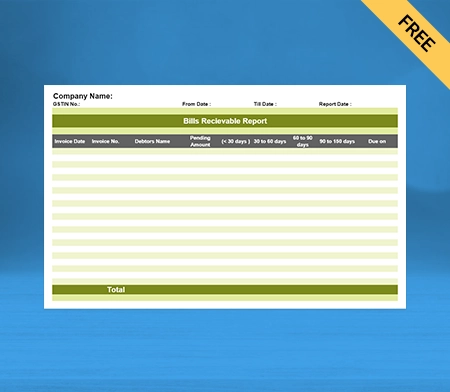

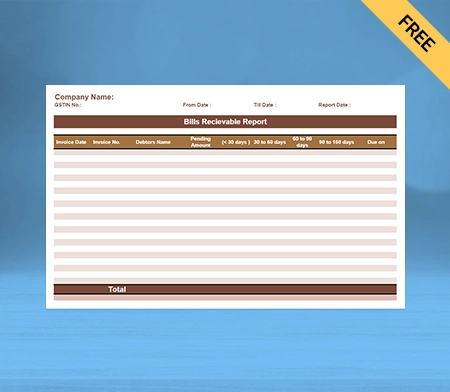

Bills Receivable book format

Download Bills Receivable book Format for your customers. Or use Vyapar App to manage billing, invoicing, accounting easily and grow your business faster! Avail 7 days Free Trial Now!

- ⚡️ Create professional bills with Vyapar in 30 seconds

- ⚡ Share bills automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Bills Receivable Bill Book Formats

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Bill receivable book?

The bills receivables book is also known as the B/R book. It is a Bill of exchange mainly issued by the trader to its customers, and the bill’s receivables book serves as the proof of debt when the drawee (client) accepts the bill and sends it back to the drawer (trade).

In these circumstances, it becomes a bill receivable for the drawer simultaneously as the money is receivable for him. Meanwhile, it becomes a bill payable for the drawer(customer) as it is a liability for him. The drawer (customer) can make the following use of a bill receivable:

- The drawer can retain the bill till maturity and collect the money from the drawee.

- The drawer can endorse the bill in favour of his creditors.

- The drawer can discount the bill with a bank.

Generally, it refers to a legal arrangement between the seller and buyer to recover a debt.

What are the Benefits of Using the Bill Receivable Book?

It is a particular purpose book used to maintain and keep records of bills received from the debtors. It accommodates details such as the acceptor’s name, date of the bill, due date, amount, etc., used for future references. It is totalled periodically, and its balance is conveyed to the drawer side of the bills receivable account.

Here are the benefits of maintaining the Bill receivable book format given down below:

Accessibility to information:

All the details related to the bills receivable, such as amount, due date, etc., are recorded in one place. Hence, they are easily accessible to the trader.

Reduces the chances of Fraud:

Since all the bills are recorded in one place and can be maintained properly, the possibility of fraud is minimized.

Responsibility for maintaining the bill of receivables book:

The person who keeps up with the bills receivable book will also be responsible for any errors or omissions in the book. Therefore, a higher degree of accountability and responsibility exists upon that person. Also, if any mistakes or errors are detected, they can be fixed quickly.

It is time efficient:

Recording receivables using the format for bills receivable book by Vyapar is less time-consuming than the journal entry. Therefore, it helps save a lot of time for accountants to record numerous transactions of repetitive and routine nature.

What is the Format for Bill’s Receivables Book?

These bills are maintained in chronological order. When multiple transactions occur in an organization simultaneously, it is the first appropriate to carry day books. These days bill receivables books are used to post individual trade receivable accounts.

Further, in case bills receivable fall due on different dates, some may not be honoured for multiple reasons. Bills receivable day books are usually used to keep track of outstanding bills and analyze the reasons for non-payment.

Create your first Bills Receivable Bill Book with our free invoice Generator

Bills receivable In the Balance Sheet

Bills receivable in Balance Sheets are referred to as short-term bills receivable- Bills due within one year from the balance sheet date are classified as current assets in the balance sheet.

he long-term bills receivable- Bills due for more than one year from the balance sheet date are classified as non-current assets in the balance sheet.

Accounting or Journal Entry

Let us try to understand this section through an example of the journal entries on bills receivable. Company X sells goods worth Rs. 10,000 to Company Y. After that, Company X draws an account receivable of Rs.10,000- on Company Y to be paid after two months.

Journal entry for credit sale:

Account receivable Dr. 10,000

Sale Cr. 10,000

When a Journal entry is used for drawing bills receivable:

Bills receivable Dr. 10,000

Account receivable Cr. 10,000

On approved the Journal entry bill, after two months:

Bank Dr. 10,000

Bills receivable Cr. 10,000

In case the journal entry is dishonoured on maturity:

Account receivable Dr. 10,000

Bills receivable Cr. 10,000

Journal entry if Company X needs cash and discounts the bill with a bank

Bank Dr. 9,000

Discount charges Dr. 1,000

Bill receivable Cr. 10,000

Bill Receivable vs Bill Payable

- The Bill receivable book refers to the amount expected to be received by the company or trader for goods and services sold or rendered to the customer credit. On the other hand, Bill payable book refers to the amount to be payable to the company or the trader for the goods and services bought from the suppliers on credit.

- Bill receivable in the balance sheet refers to the asset to the trader or company. Meanwhile, Bill payable refers to the liability to the trader or company in the balance sheet.

- Bill receivable is the outcome of the credit sales. On the other hand, Bill payable is an outcome of debt sales.

- Bill receivable results in cash inflows; meanwhile, Bill payable simultaneously refers to the cash outflow.

Additional Benefits of Using the Vyapar app.

Vyapar provides you with the transaction, party, and GST report:

Vyapar’s best bill book app helps you with all sorts of reports, such as transaction reports; under sales report, you can check all the sales you made throughout the day/month and year, and you can even find the outstanding and sale amount. Under the transaction day book report, you can check all the Business transactions and money earned and spent in your small business.

There are many other reports under the transaction report, such as the purchase report, all transactions report, profit and loss report etc. It also has party reports under which you can check all sorts of transactions between you and your client simultaneously, such as party statements, party-wise profit and loss party report items, sales purchases by party group etc.

Third and most important, the Vyapar is also geared toward the GST reports, which follow all the Government of India guidelines. There are ten different GSTR reports in the Vyapar app like GSTR1, GSTR2 etc. Vyapar also gives all sorts of item and stock reports like the stock summary report, low stock summary report, item details summary report etc., for the supply of the goods and services.

Business status by Vyapar app:

Vyapar app provides a bank statement where you can check the day you withdraw and the day you are credited with the amount. It provides you with the discount report you allow to your clients, and at the same time, it will enable you with the tax report with the help of which you can check all the purchase tax paid and sales collected at the same time.

It also helps you with your cash book. With the tax rate report, you can check the rate-wise tax you ordered and paid. So Vyapar smoothes your road for your business so that you can focus on the critical areas of your business and issue bills of exchange simultaneously by using the platform of the Vyapar app seamlessly.

Receivables and Payables:

Vyapar app billing software assists you in easily and quickly differentiating the accounts receivables and payables. Vyapar guides you to stay on top of your finances and quickly determine the amount of money you have to “receive” or “pay” for the goods and services you provide.

By providing the service to your clients, you can accept the bill. Vyapar app users can keep all the transaction details safe and secure and issue bill receivable amounts seamlessly. You can set up payment reminders for every party that purchases from you to ensure that everyone pays back in time.

Vyapar helps you with multiple transaction modes, through which you can quickly credit your account with the amount. Users can send their payments via UPI, emails, WhatsApp or SMS. You can convey due dates to all your customers using the current payment reminder feature.

Bank Account Management:

Vyapar bills receivable bookmaker app helps you manage multiple bank accounts. It gets easier with the Vyapar billing software for P.C. It also supports all transaction modes, from cash and cheque to all digital platforms like online banking, UPI etc., and e-wallets to ensure efficient payments.

Vyapar also has a service for cheque management as you receive from your clients while transferring goods and services. It allows banks to cash and cash bank transfer seamlessly, and at the same time, it assists you with the bank-to-bank transfer.

Vyapar also provides you with loan account management, so you can focus on essential aspects of your business and issue the bills of exchange smoothly and seamlessly.

Vyapar bill receivable features allow you to set up automatic data backups of their data, so you don’t have to worry about your data or bank details being compromised. You can use the app to make a local backup for added data safety.

Vyapar allows you multiple payment services:

There are many times when you face the issue of modes of payment with your customer upon your goods and services. You may not meet the case of payment methods with your customers, so here Vyapar app allows you multiple modes of offline and online payments.

The Vyapar app will enable you to receive payments from clients for your goods and services in cash and cheque. It also supports all major debit cards and credit cards on its platform. Vyapar also assists you with your online banking platforms, such as net banking, IMPS/RTGS and all major E-Wallets. You can also credit the amount in your bank account UPI payments from your mobile phones or printed Q.R. codes.

You can also issue the GST invoice format from the Vyapar best billing software, which follows all the mandatory rules and regulations of the Government of India. You can create the GST in both online and offline mode without difficulty, and you can easily send it to your clients within minutes via Email, Whatsapp etc., and you can use both your mobile phones and the desktop to create your invoices.

Multiple Themes:

The Vyapar Billing software includes two thermal invoice themes and twelve regular printer invoice themes. The app allows you multiple invoice themes so you can easily customize and improve the look of your invoice by your preference.

You can enhance your brand identity and make it more inclusive and professional by using themes for creating invoices for your small business platform. You can share your customized Invoices PDF through Whatsapp, Email etc.

In Vyapar, there are multiple theme options for thermal and regular printers. They are free, and you don’t have to pay a single dime from your pocket for using such a professional invoice theme so that all businesses can access them. Vyapar’s GST Invoicing Software is suitable for all commercial retailers, pharmaceutical companies, gyms, restaurants, and other enterprises.

Further, all themes are fully customisable as per user need(users can enable/disable the information they want to print over their invoice using the regular printer for the goods and services)to meet unique business requirements.

Vyapar’s Online-store:

Vyapar GST billing software lets you create beautiful product/service catalogues for your clients. Thus, helping you accept online orders from your customers, Vyapar increases the radius of customers for your goods and services.

You can list all the essential services/products you sell to your customers, and Vyapar assists you in presenting a catalogue of all the services/products to customers. By using the online modes of payment, your clients can credit the amount in your bank account by purchasing the items from your online catalogue.

Furthermore, the Vyapar bill receivable bookmaker app does not charge fees for using an online store. You don’t have to pay to enjoy the services of Vyapar’s Online Catalog. These features assist you in taking your business online. You can send the link to your customers, and they can pick products and place orders online from your store.

Online/Offline software:

Our bill receivable bookmaker app allows you to perform your business operations online and offline. The major problem of network connection is mainly faced by those traders who belong to hilly areas or densely forested regions or where there is a poor internet and network connection.

You can use the Vyapar app to create and send your customers’ bills receivables using professional formats. Further, you can manage your cash book and record expenses quickly without technical knowledge.

You don’t have to worry about network and internet connections while traveling throughout India for your business purposes. By using the Vyapar billing software, you can get real-time details of your essential commodities on your smartphone screen online and offline in just a single click.

Frequently Asked Questions (FAQs’)

You can create the bill receivable book by using the details given down below:

* You have to put the date: In the column.

* Then the date of the acceptance of the bill is recorded.

* Later by whom it is received: In this column.

* Finally, the debtor’s name, who has accepted the bill and promised to make its payment, is recorded.

With Vyapar, it becomes easier to make the bills receivable book as the app comes with multiple bills receivable book formats.

The Bill receivable book refers to the amount expected to be received by the company or trader for goods and services sold or rendered to the customer credit. On the other hand, Bill payable book refers to the amount expected from the company or the trader for the goods and services bought from the suppliers on credit.

Bills receivable book is considered the subsidiary or secondary book of accounting, where all bills of exchange, which are receivable for the business, are recorded simultaneously. The total value represented by all the bills receivable for an accounting period gets transferred to the books of accounts. Bills receivables are referred to as assets to the company on the balance sheet.

Bills receivable book format is a secondary book or subsidiary book of accounting, where all bills of exchange, which are receivable for the small business, are recorded, or in simpler terms, bills receivable format by Vyapar is used to record the bills received from debtors by creating bill receivable book with ease. When a bill is received, details of the items are recorded in the bills receivable book. The total value of all the bills receivable for an accounting period is then transferred to the accounts books.

There are about seven different columns shown on the balance sheet, and you have to fill in the details given below:

Date: In the date column, the date of the acceptance of the bill is recorded.

From whom received: In this column, the name of the drawer or debtor, who has accepted the bill from you and promised to make its payment, is recorded. The bill legitimately came into existence after its acceptance.

Term or period: The bill is drawn for a specified period. This period may vary from one month, two months, three months, etc., or even it can go for periods of days between 60 days, 90 days, 120 days, etc. The billing period for which the account has been drawn is mentioned here.

Due date: Due date is the date on which the bill’s payment is due, and it is also known as the date of maturity to traders. To calculate the final due date for payment, three days of the grace period are added to the term of the bill.

Ledger Folio (L.F.): This column of Ledger Folio contains the page number of the ledger in which the account of the acceptor of the bill appears. Amount of the bill: The actual amount of the bill is recorded in this column in the balance sheet.

Remark: At last, the column of remarks contains the details of the disposal of the bill, whether the bill has been discounted or endorsed, honoured or dishonoured etc.

A bills receivable book is a ledger or register used by businesses to record and track all incoming bills or promissory notes that they expect to receive payment for in the future. This book helps businesses monitor their accounts receivable and keep track of payments due from customers or other entities. It typically includes details such as the bill amount, due date, payer information, and any relevant terms or conditions associated with the bills.

To prepare a bills receivable account:

* Create a separate account for bills receivable.

* Record incoming bills with details like amount, due date, payer’s name.

* Assign unique account numbers for tracking.

* Monitor due dates and follow up on payments.

* Update balances as bills are paid or become overdue.

* Reconcile the account with other accounts for accuracy.

The different types of bill receivables include:

* Trade Bills: Bills receivable arising from sales transactions where goods or services are delivered on credit terms, and a promissory note is issued for future payment.

* Accommodation Bills: Bills receivable endorsed by a third party, such as a bank, to facilitate credit transactions between parties.

* Demand Bills: Bills receivable payable on demand without a specified maturity date, typically used for short-term credit arrangements.

* Usance Bills: Bills receivable with a specified maturity date, allowing the payer a certain period to make payment after the bill’s issuance.

* Clean Bills: Bills receivable not supported by any underlying document or transaction, relying solely on the payer’s promise to pay.

A bill payable book is a ledger or register used by businesses to record and track all outgoing bills or liabilities that they owe to suppliers, creditors, or other entities. It is the counterpart to the bills receivable book, which tracks incoming bills or promissory notes that the business expects to receive payment for. The bill payable book typically includes details such as the bill amount, due date, payee information, and any terms or conditions associated with the bills. It helps businesses manage their accounts payable and ensure timely payment of obligations.

Another name for bills receivable is accounts receivable. Both terms refer to the amounts owed to a business by customers or clients for goods sold or services rendered on credit. These amounts are typically documented through invoices or promissory notes and represent future cash inflows expected by the business.

Bills receivable are recorded in the balance sheet of a business under the current assets section. They represent the amounts owed to the business by customers or clients for goods sold or services rendered on credit. This asset is recorded at its nominal value, which is the amount expected to be received in cash from the customers or clients in the future. The bills receivable account is an important component of the business’s financial records, reflecting the amount of money the business is entitled to receive from its credit sales.