Accounting Software for Financial Services

Your one-stop solution for all your accounting needs is Vyapar’s financial accounting software. The Vyapar accounting software for your financial services enables rapid reporting, analysis, and thorough tracking of financial transactions. A 7-day trial is available right away, so get started!

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

Best Features of Financial Accounting Software

Financial Estimates and Quotes

Using our free accounting software, you can quickly create quotes, estimates, and accurate financial invoices. Customers can receive quotes and estimates anytime via WhatsApp, email, SMS, or printing. Users can automate most processes with the system, eliminating errors in quotes and estimates.

Additionally, you can change your quotes and estimates into sales invoices at any time. The free financial accounting software from Vyapar gives the company a complete option for quickly getting instant quotes and saving more time.

Manage Multiple Bank Accounts

Online and offline payments can be added, managed, and tracked quickly for businesses. The tasks get easy with our free financial accounting features.

You can send or receive money using bank accounts and conduct bank-to-bank transfers for seamless cash flow management with Vyapar. To use the app’s bank accounts feature, the user must add a business account in the bank with the accounting software. Additionally, it permits withdrawals and deposits into bank accounts.

Generate Financial Reports

You can choose wisely with the help of the Vyapar automated accounting system. The accounting function of the Vyapar app allows you to generate more than 37 reports.

Using the financial software, you can look at balance sheets, total expense or revenue reports, and GST business reports. Analysing accounting reports can help you assess the business’s financial information.

Explore Key Features of Vyapar Financial Accounting Software

Track Payables and Receivables

User-Friendliness

Stock Management

Bookkeeping Abilities

Cloud-Readiness

Data Protection and Privacy

The company’s shareholders want to guarantee security and appreciation in the value of their investment. Financial accounting, therefore, aims to inform the shareholders about the company’s past successes and potential for the future.

The following key features that set Vyapar apart from other Accounting Software for Financial Services:

Track Payables and Receivables

Vyapar, the top accounting app, aids in error prevention and business plan creation. Keeping track of receivables and payables is possible.

Financial advisors can manage and monitor their financial data with the help of professional accounting software for financial services from Vyapar. They can record all cash, bank, and credit transactions and monitor growth.

You can keep track of the money you receive and owe using the automated system. You can also set payment reminders to ensure that these clients pay their debts on time.

You can save time by reminding all of your customers to make payments at once using the bulk payment reminder feature. Calculations are done automatically by Vyapar’s accounting software for financial services.

Bookkeeping Abilities

A top-notch accounting package will take care of most of the daily tasks in routine bookkeeping. Update ledger entries to track income and expenses, bank reconciliation, asset depreciation/amortisation, tax calculation, etc., are all included. Vyapar accounting software for financial services is equipped with error-prevention features like automatic calculation.

User-Friendliness

Vyapar financial accounting application is handcrafted in such a way even a regular admin team, whether in-house or freelance, should be able to handle daily accounting entries. The user interface of the app is so elegant and one can easily understand and start using it.

Cloud-Readiness

Vyapar accounting software for financial services is programmed to be used locally and can be used in the cloud. The Cloud-based accounting software feature allows remote working more accessible for users. It is crucial for SMEs because few have internal accounting or finance departments, but most rely on independent contractors.

Data Protection and Privacy

Using our free app, you can create local, external, or online backups of your Google Drive data.

You can configure an automatic data backup in the free financial accounting software from Vyapar to ensure the security of the data saved in the application.

You can use the Vyapar Application to guarantee your company’s security by setting up automatic backups or performing secure backups regularly.

You ought to occasionally make a local backup for your security. You can more effectively secure your data on a hard drive or other storage devices with Vyapar.

Manage Stock

Vyapar financial software makes stock management simple for small and medium-sized enterprises.

A central dashboard view, easy new stock entry, straightforward product categorisation, and low stock alerts are all features of the financial accounting system.

All new items can be added quickly and easily, including their names, descriptions, stock levels, batch numbers, prices, dates of manufacture, MRPs, and wholesale prices.

The Vyaapr accounting software generates reports to monitor inventory performance. The records for item sales, low stock, and stock summary are available for review.

Why Choose a Financial Accounting Software by Vyapar?

Vyapar financial software ought to allow you to control your company’s operations. Managing sale/purchase, keeping track of inventory, producing reports, and carrying out various other tasks are all made simple by the Vyapar software for financial accounting.

The Basic Functions of Vyapar are Free

All features of the Vyapar financial system are freely accessible. Android mobile users will always have access to all of the free features.

After downloading the accounting app for free from the Play Store, users can sign up to use it for free. A business owner can use a subscription to access the premium features and desktop applications.

The System’s Automation Decreases Errors

One of the most significant advantages of an online system is its automation. You can avoid incorrect processing amounts or billing the wrong client using an online app.

You can remind your clients to make payments by following up with emails. You can concentrate on expanding your business because it saves you time.

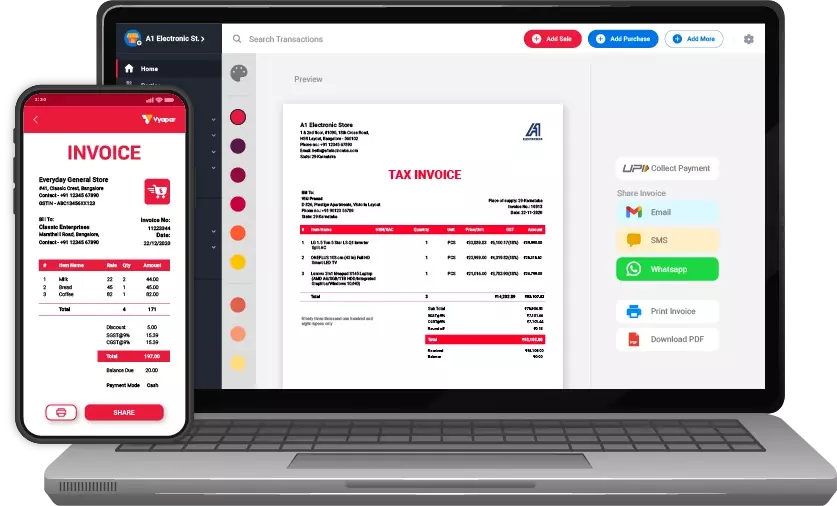

Print or Download Documents in a Variety of Formats

You can send invoices to your clients directly via email, printing, or WhatsApp. You can print them using your printer in the A4, A5, 2, and 3-inch sizes.

The app’s 10+ invoice formats let you create polished and unique documents like reports and bills. For small businesses, the system accelerates the procedure.

Financial Accounting is Made Simple

With the help of Vyapar’s financial accounting system, it is possible to track unpaid invoices and remind customers to pay their bills. Using the app’s valuable features, you can keep track of all open orders.

Gaining the trust of your clients will be easier if you use reputable billing software. The app manages your projects because you can access all required features through the business dashboard in a single app.

Users Have a Variety of Methods for Making Payments

The automated software from Vyapar enables business owners to begin accepting all forms of electronic payment. Customers value convenience, which you can provide by letting them select the payment method.

A single QR code can accept all payment methods. Cash, a credit card, debit card, UPI, NEFT, RTGS, QR codes, e-wallets, options for deferring payment, and multi-currency payments are available to customers for making payments.

Quickly Create Customised Financial Invoices

With the help of Vyapar accounting software for financial services, financial advisors can create a professional brand identity for their business. You can send customised invoices to your customers using it.

Thanks to business computer programmes, accounting is error-free. You can create invoice formats that work for your business in simple steps. It helps to guarantee data security for your business.

How Does Accounting Software for Financial Services Help?

- Accounting software identifies and differentiates financial transactions as well as records these transactions systematically. The software records every transaction in the general journal, and then, to preserve it permanently, it is always kept in general ledger accounts.

- If accountancy documents are not properly prepared and maintained, estimating a company’s profit and loss account is impossible. Furthermore, it is impossible to make firm decisions for an organisation without having the proper picture of the profit and loss account. An automated accounting system helps here.

- Using software for your business, you can quickly analyse the growth of the organisation based on economic data. Its goal is to help set objectives based on a company’s financial information.

- This cash book serves as a record for both cash payments and cash receipts. The goals of accounting software are to keep track of daily cash transactions, expenses, and cash balances in hand and at the bank so that you can view them at any time.

- The businessman invests in assets like buildings, land, equipment, and so forth to ensure the company’s smooth operation. Here, the goals of the accounting system are to regulate different accounting ratios, which can help to lower an organisation’s liabilities.

- When systematic financial records are kept, fair trial and error are carried out; you can prevent errors and correct any upcoming mistakes in the books of accounts.

- Preparing trustworthy financial statements is crucial because owners can make decisions based on them. For this reason, such an accounting system should depict accurate and fair business transactions and events.

- One of the goals is to guarantee adherence to local tax laws, the Companies Act, and other statutory requirements. The system ensures all applicable laws and regulations are followed when conducting business.

Why Do You Need Accounting Software for Financial Services?

They Bring Convenience

The software for financial accounting keeps all crucial financial data on a single server. Only authorised personnel can access the server, which is accessible from various devices. Since this system has only one consistent source of information, monitoring is made simpler and faster.

Computerised systems are reliable to employ. When you don’t have the time to manage your accounts, you can rely on your automated system to do it for you.

Helps in Business Organisation

Suppose a transaction in manual accounting has the potential to affect several accounts. It is necessary to record multiple times to impact all relevant ledgers.

Financial accounting tools aid in a business organisation. All integrated processes are handled correctly in automated accounting with just one data entry.

Accurate Accounting

Manual keeping of financial accounts is prone to errors. You could enter the prices or taxes incorrectly, affecting the total. The financial software allows for better data processing than accounting professionals.

Accounting that is computerised increases accuracy by eliminating calculation mistakes. Cash flow, time tracking, payment collection, and inventory management can all be improved by computerised accounting.

Data Safety

Data can be stored by users quickly with financial applications. System backups are carried out routinely by businesses to guard against data loss. All transactions can be saved and backed up.

Your business grows if it has an automatic system, no matter how big it gets. Automated systems also make it possible for data loss recovery to happen more quickly in the event of an accident.

Increases Productivity

Complicated and time-consuming tasks include computations, report creation, financial analysis, future financial projections, and other related tasks.

Because they are more efficient than other methods, accounting software for financial services is less expensive. Because the work is automated, you can finish everything quickly and save money on various accountants’ fees.

Access Data Quickly

You can access your data files when necessary, and the software for financial accounting is simpler to use. Everything is easily accessible with a few clicks. There is no need to dig through files and stacks of paper.

You can quickly access your accounts by pressing a button. Moreover, you can create any statements, reports, analyses, or other documents you need.

Advantages of Using Financial Accounting Software

- Financial accounting software can give you some valuable insights into your finances. It stores and organises your data in one place so you can track your performance in real-time.

- The best accounting software packages frequently allow you to automate invoicing. You can send follow-up reminders, create recurring invoices, and accept digital payments right from the invoices themselves. You can keep tabs on your unpaid invoices.

- Connecting to your bank accounts is a crucial feature of accounting software. It allows you to access your bank statements from your accounting programme directly. Additionally, you can automatically compare and reconcile bank transactions.

- Even though tax preparation is challenging, small business owners may find compliance even more difficult. The application computes sales tax automatically and prepares tax forms for you.

- Your accounting programme gathers a lot of data through integrations as you manage your business. You gain profound insight into your company as a result. Most accounting software has reporting features that make it simple to analyse data and monitor performance.

- The last thing you want to experience is a cash flow crisis due to out-of-control expenses. By automating expense tracking, accounting software can assist you in averting that situation. Financial accounting solutions can track expenses incurred and scan and record receipts.

- By creating a balance sheet at the end of the period, the software assists in reflecting the business’s financial position. It gives management access to financial data and information. Therefore, it aids in the management’s decision-making and financial planning processes.

- Keeping an eye on your inventory is necessary. Financial accounting software can keep track of products that have been sold or are trending and generate reports on which products are performing well and which are not.

Recommended by Leading Industry Experts

5.0/5.0

4.4/5.0

4.6/5.0

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

The process of recording, compiling, and reporting the numerous transactions resulting from business operations over time is known as financial accounting.

The financial statements, including the balance sheet, income, and cash flow statement, summarise the company’s operating performance over a given period.

The statements and reports that the company produces should be accurate and credible because financial accounting is used for disclosing a company’s financial information.

Financial accounting software helps bookkeepers and accountants record and report a company’s financial transactions. It records a company’s assets, liabilities, income, and expenses.

The Software enables fast reporting, analysis, and thorough tracking of financial transactions. Additionally, accounting software enables the storage of large volumes of data without requiring physical space.

There are mainly three types of financial accounting software:

1. Enterprise resource planning (ERP) software

2. Billing & invoicing software

3. Payroll management software

Here are the benefits of financial accounting software:

1. Automation reduces manual errors

2. Streamlines the approval process for invoices and cash disbursements

3. Saves staff time and money on manual accounting

Accounting software is crucial for your business’s financial data, from basic invoicing and billing to tax calculations and project management. Additionally, it helps in client management, bank account reconciliation, and the creation of insightful financial reports.

The financial statements only record events with a financial component or those you can express in monetary terms. Non-monetary items or events are not measured or recorded in accounting, even if significant.

There are two types of financial accounting:

– The accrual method

– The cash method

Accrual Method of Financial Accounting

The accrual method of financial accounting is a technique for creating financial statements that record transactions independently of cash usage. A financial accounting principle may consider the effects of a transaction over time, even before an item is paid for.

Cash Method of Financial Accounting

Financial accounting’s cash method is a simple, less rigid way to create financial statements. The cash method only records transactions involving cash. When using the cash method, you typically report income in the tax year you receive it and claim expenses as a deduction in the tax year you incur them.

Explore Other Accounting Software for Your Businesses: