SaaS Accounting Software

Simplify your business finances with Vyapar’s SaaS Accounting Software—efficient, cloud-based, and GST-ready. Automate invoices, track expenses, and manage accounts anytime, anywhere. Start your free trial today and take control of your company’s finances effortlessly!

Vyapar SaaS Accounting Software’s Best Key Features

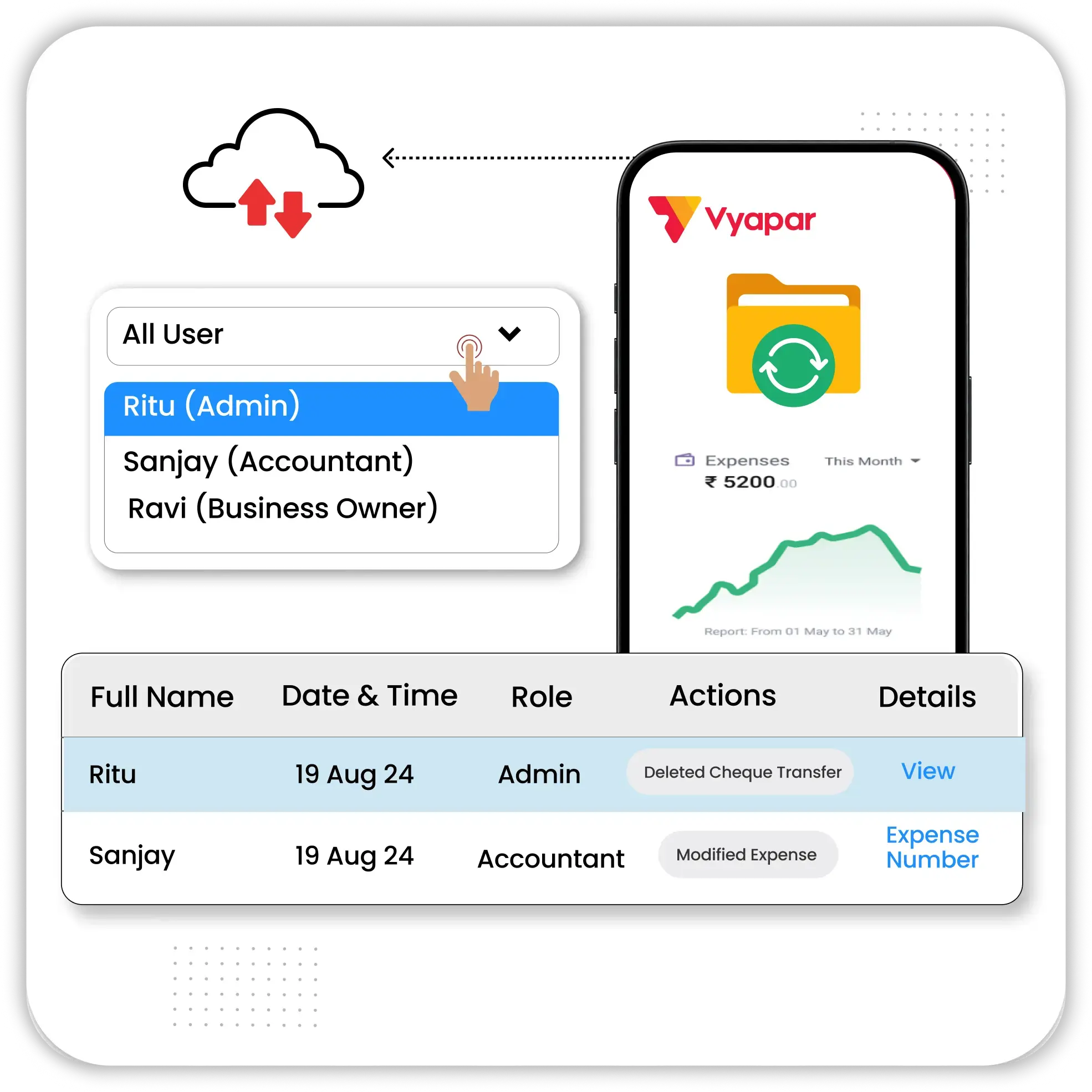

Cloud-Based Accounting

A SaaS-based accounting software like Vyapar provides cloud-based accounting, enabling businesses to manage financial records from anywhere with real-time data access, ensuring seamless operations for SaaS companies.

- Anywhere Access for SaaS Finances: With Vyapar’s cloud storage, SaaS founders can manage accounts from multiple locations, ensuring control over financial data, invoices, and payments without device restrictions.

- Automatic Cloud Backup & Security: All financial data is encrypted and automatically backed up, preventing loss. This ensures SaaS businesses never lose crucial revenue or client payment records.

- Real-Time Collaboration: Multiple users, such as accountants and business owners, can work simultaneously. Role-based access ensures only authorized personnel can edit or view specific financial data.

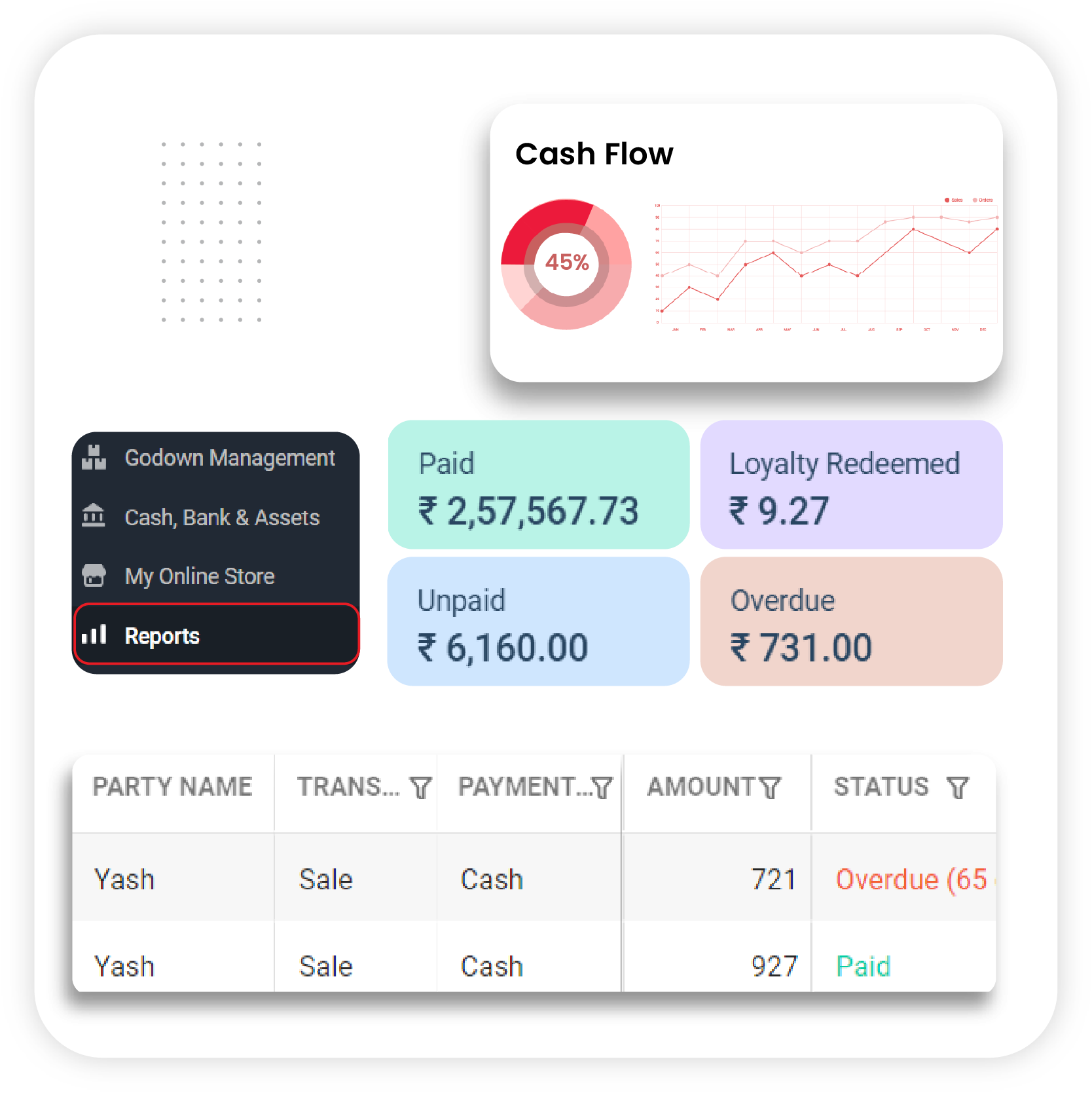

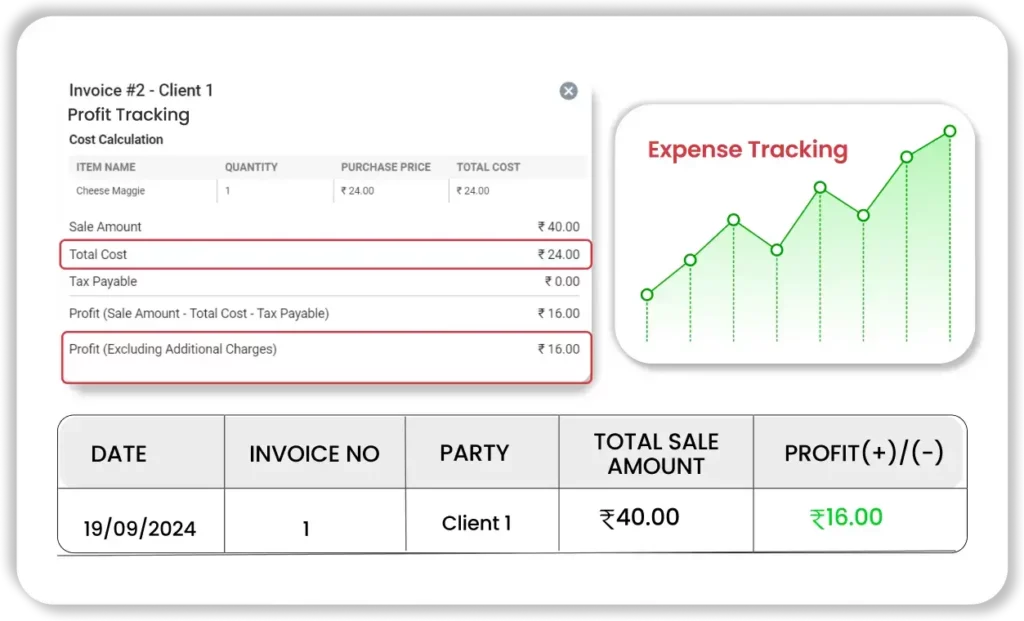

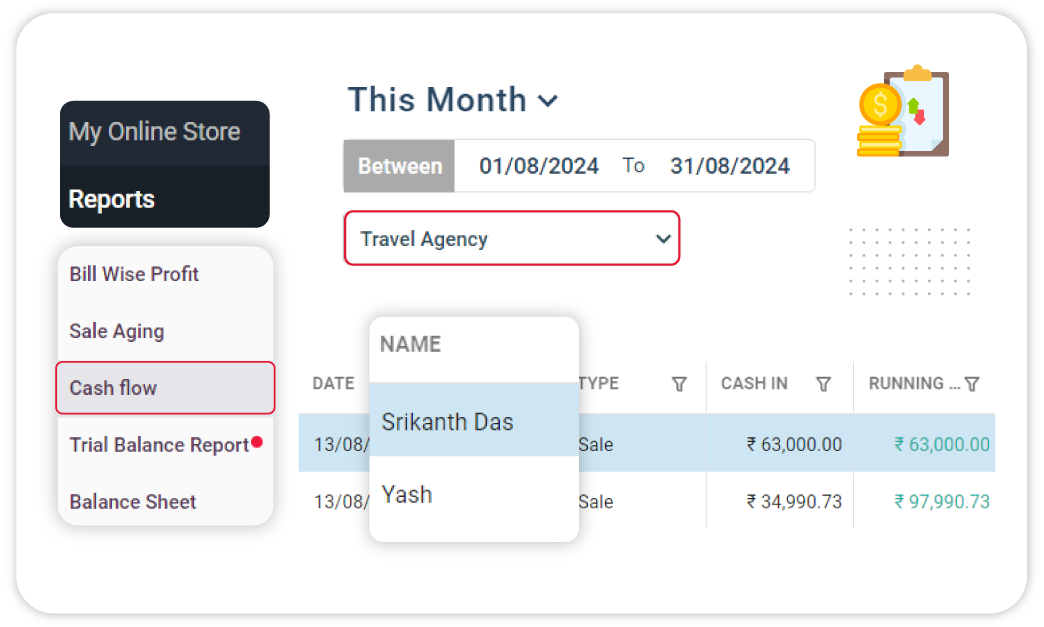

Financial Reports & Revenue Tracking

Vyapar, one of the best SaaS accounting software options, offers detailed reports on revenue, profit & loss, and expenses, helping SaaS businesses track financial performance and optimize development costs.

- Revenue & Profit Analysis: Generate reports to assess revenue trends and operational costs, allowing SaaS businesses to optimize pricing and forecast future earnings efficiently.

- Cash Flow Management: Monitor incoming payments and outgoing expenses to ensure a steady cash flow. Vyapar’s SaaS accounting solutions categorize transactions, making financial forecasting easier.

- Customizable Financial Reports: Businesses using SaaS accounting software for small businesses can generate custom reports, tracking revenue from different subscription plans, licensing fees, and service charges.

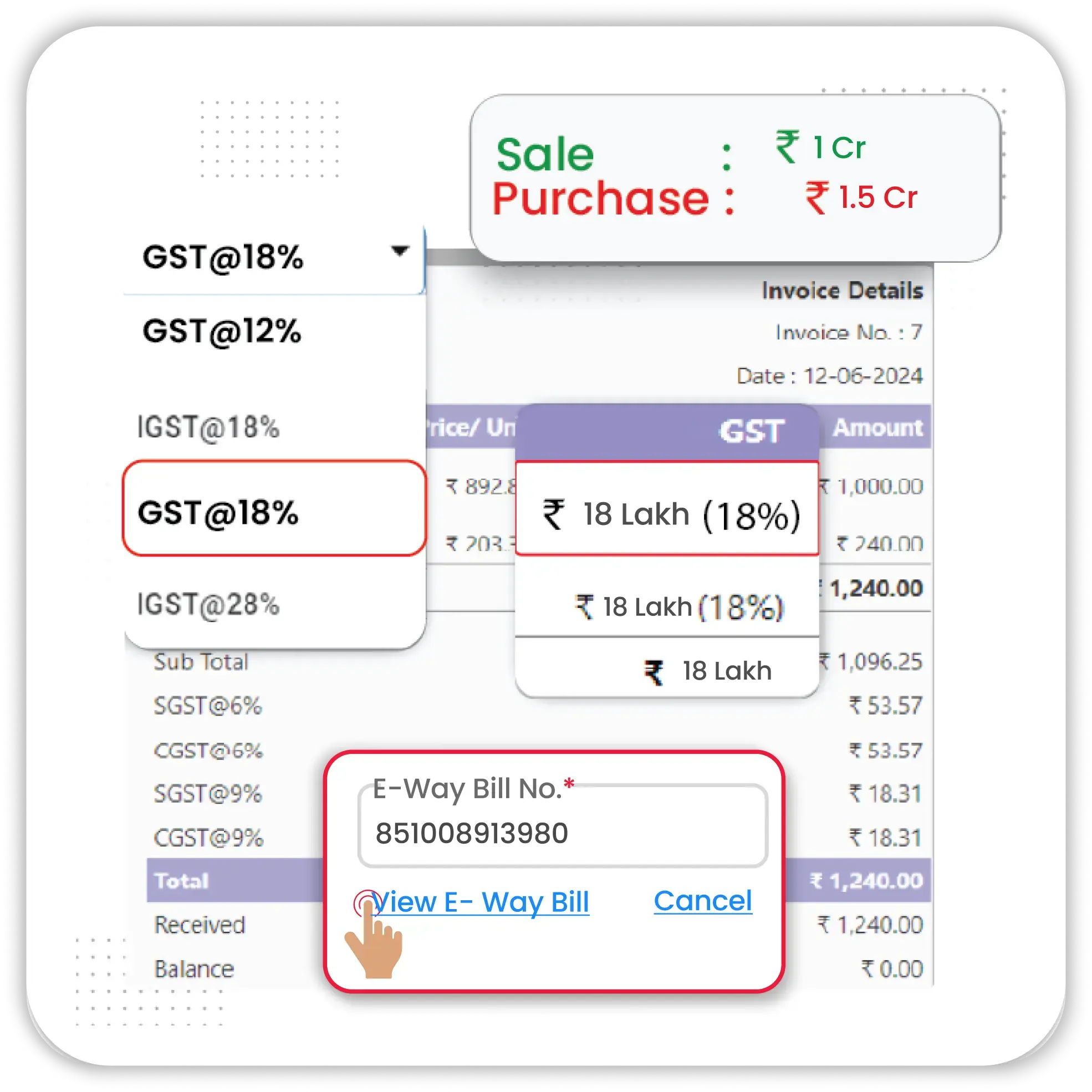

GST & Tax Compliance

Vyapar’s SaaS accounting system ensures effortless tax compliance by automating GST calculations, managing TDS deductions, and simplifying tax filing for SaaS businesses of all sizes.

- Automated GST Calculations: Vyapar applies correct GST rates based on service type, ensuring error-free tax records and reducing compliance risks for SaaS-based businesses.

- E-Invoicing for Tax Compliance: Generate GST-compliant invoices instantly, meeting legal requirements. Vyapar ensures accurate tax inclusion in invoices for hassle-free filing.

- TDS Deduction & Tax Reports: Vyapar helps SaaS founders calculate and record TDS deductions for vendor and employee payments, simplifying compliance.

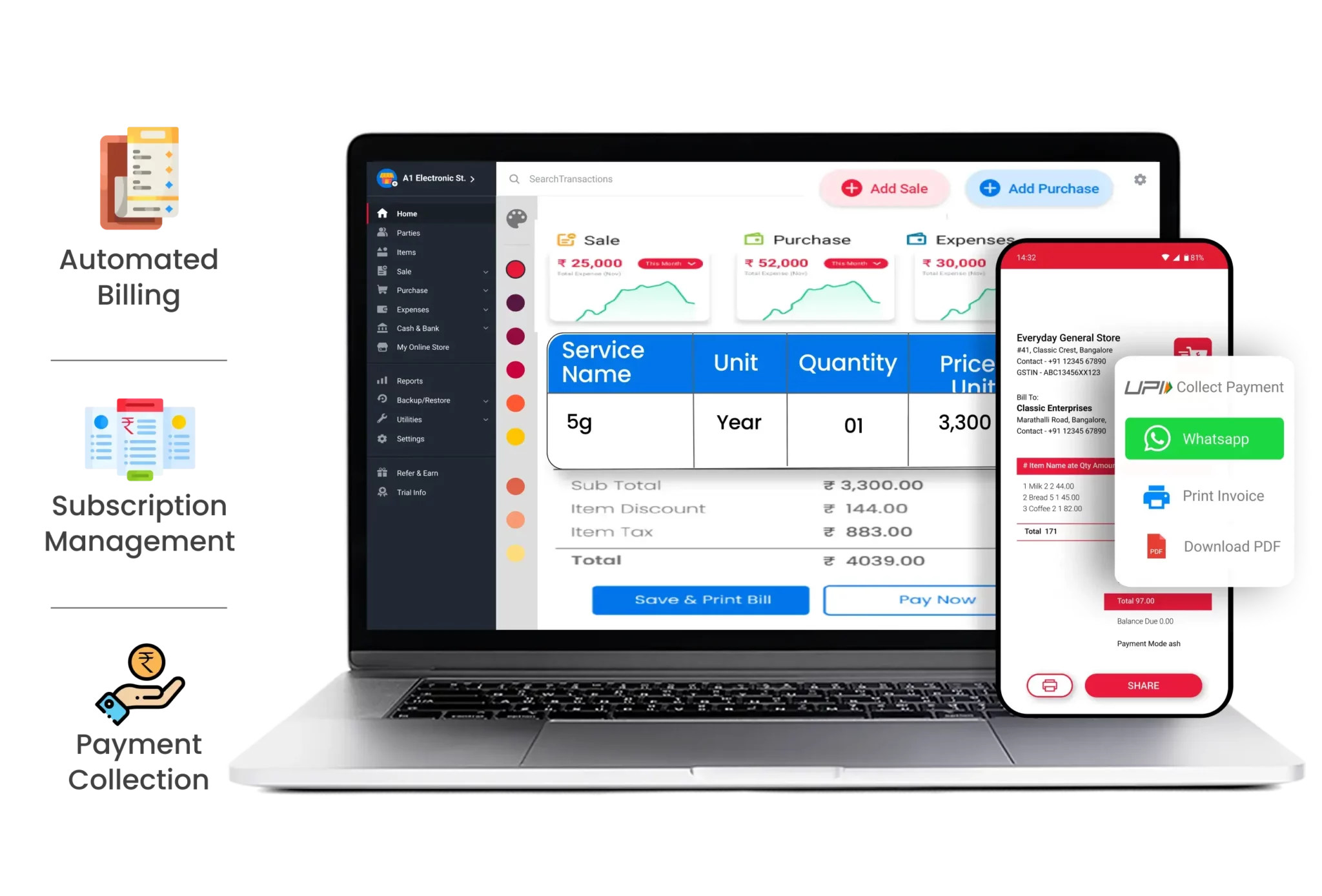

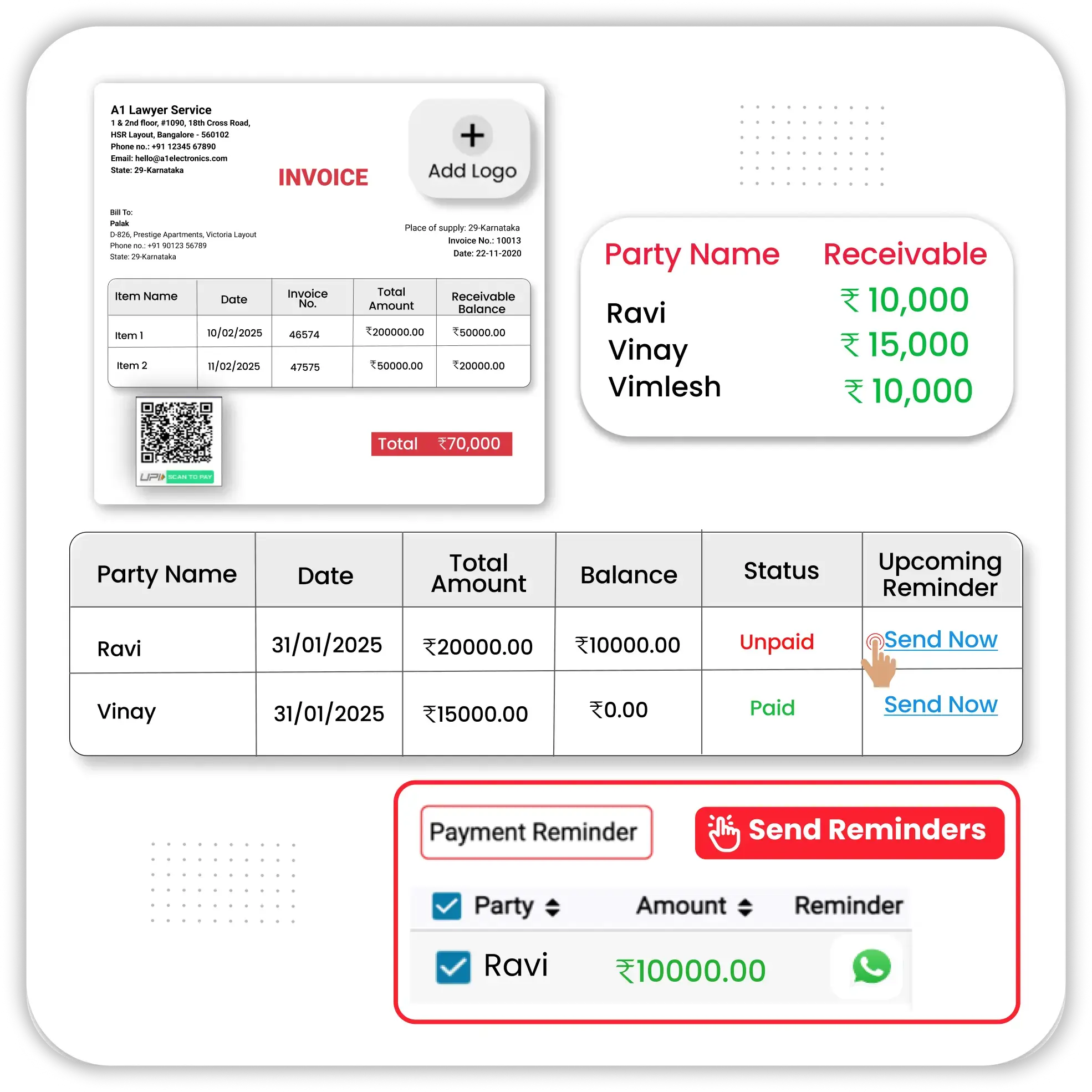

Customizable Invoices & Payment Tracking

Vyapar, a free SaaS accounting software, allows businesses to customize invoices, track payments, and manage outstanding balances with ease.

- Custom Invoice Templates: Businesses can personalize invoices with logos, branding, and custom fields. Vyapar ensures professional invoices for both local and international SaaS clients.

- Real-Time Payment Tracking: Track pending, completed, and overdue payments in one dashboard, helping businesses manage outstanding dues and maintain steady cash flow.

- Automated Payment Reminders: Vyapar sends automated reminders via WhatsApp, SMS, or email, reducing delayed payments and ensuring customers clear invoices on time.

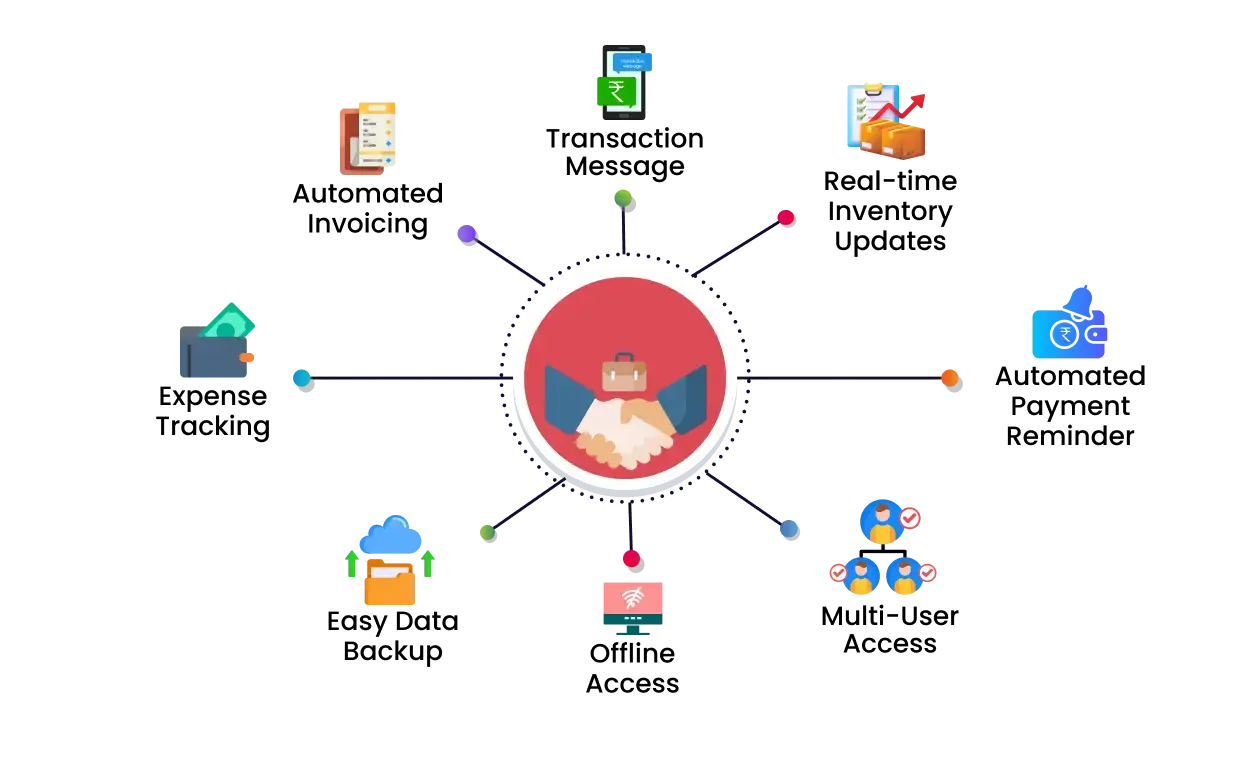

Add-On Features of Vyapar SaaS Accounting Software

Expense Management

Customer Ledger

Multi-Currency Transactions

Automated Payment Reminders

Cash Flow & Financial Forecasting

Inventory & Stock Tracking

Auto-Backup

Mobile App Access

E-Way Bill & E-Invoicing

Offline Accounting

Drive Company Success with Vyapar SaaS Accounting System Features

Expense and Vendor Management

One of the key features of any accounting software for SaaS companies is efficient expense and vendor management. Vyapar ensures real-time tracking of business expenses and cost optimization.

- Detailed Expense Categorization: Track business expenses, including development costs, cloud hosting, and SaaS infrastructure expenses, to optimize financial planning.

- Vendor Payment Monitoring: Vyapar helps businesses track purchases of third-party SaaS tools, software development costs, and other vendor payments, ensuring accurate financial records.

- Expense Reports & Analysis: Generate detailed expense reports to monitor business spending, helping SaaS startups cut unnecessary costs and increase profitability.

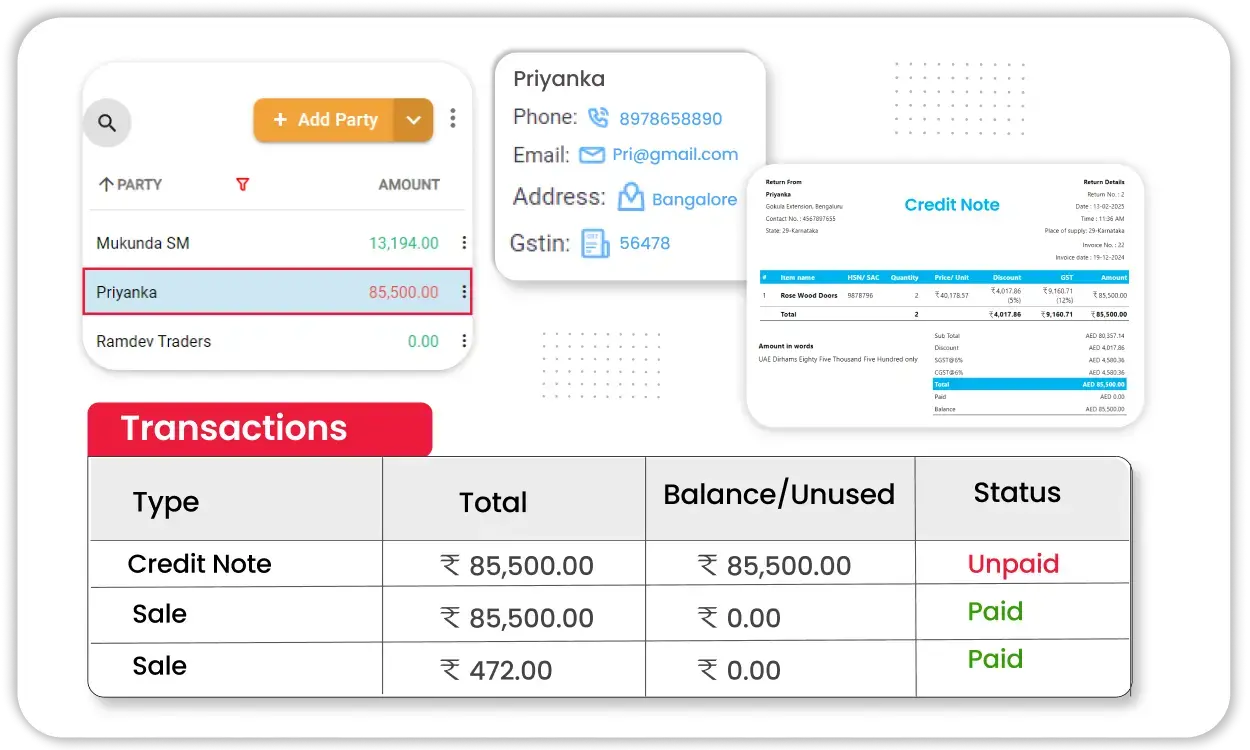

Customer Ledger and Credit Management

Vyapar, an ideal SaaS accounting solution, provides a detailed customer ledger, enabling SaaS businesses to track invoices, payments, and outstanding dues efficiently.

- Complete Customer Transaction History: Maintain a record of all transactions, including invoices, refunds, and credit adjustments, helping SaaS businesses manage customer accounts effectively.

- Outstanding Balance Monitoring: Vyapar highlights pending dues, allowing businesses to follow up on unpaid invoices, and ensuring cash flow stability.

- Credit Adjustments & Refunds: Businesses can apply discounts, refunds, and loyalty credits directly within Vyapar, ensuring accurate and up-to-date financial records.

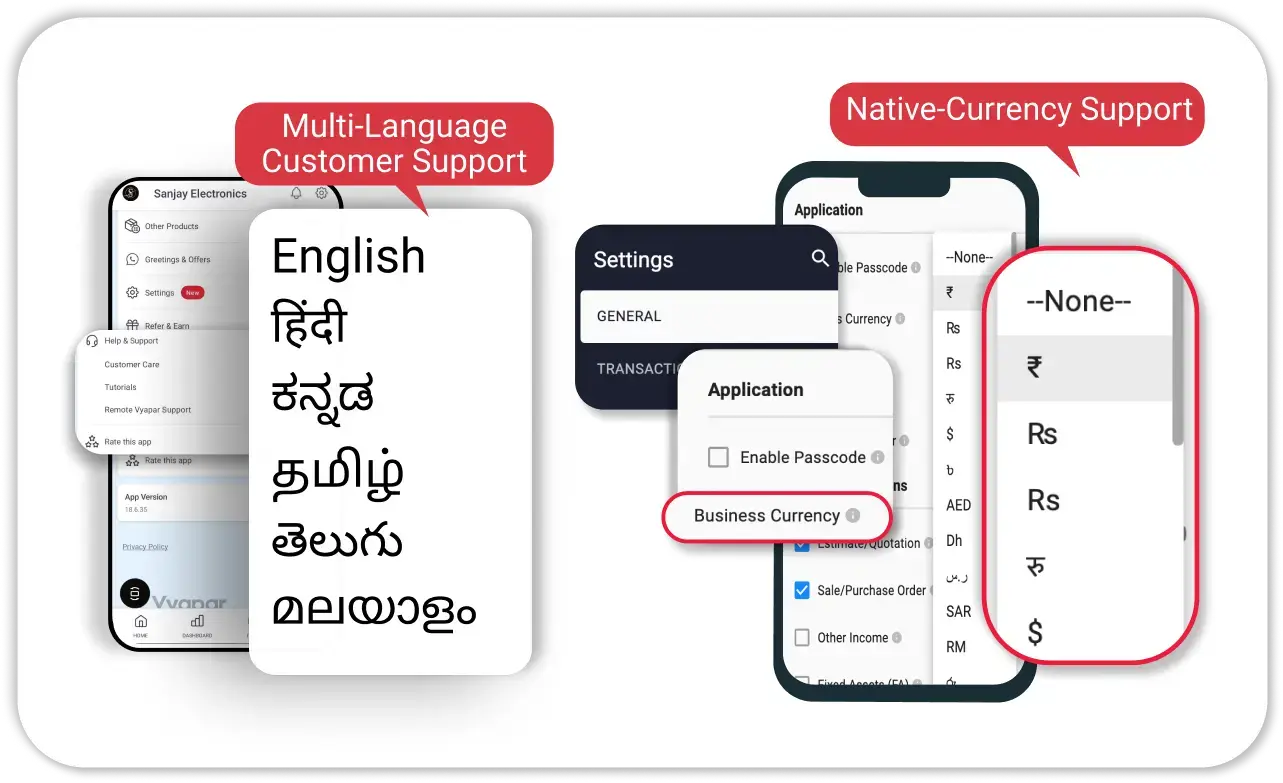

Multi-Currency Transactions

Vyapar, a SaaS accounting software for small businesses, supports multi-currency transactions, making it easy for businesses to invoice international clients and track revenue.

- Invoice Generation in Multiple Currencies: Create currency-specific invoices for global clients without manual conversion, making cross-border billing seamless.

- Ledger for Global Transactions: Maintain separate ledgers for different currencies, helping businesses track revenue across various international markets.

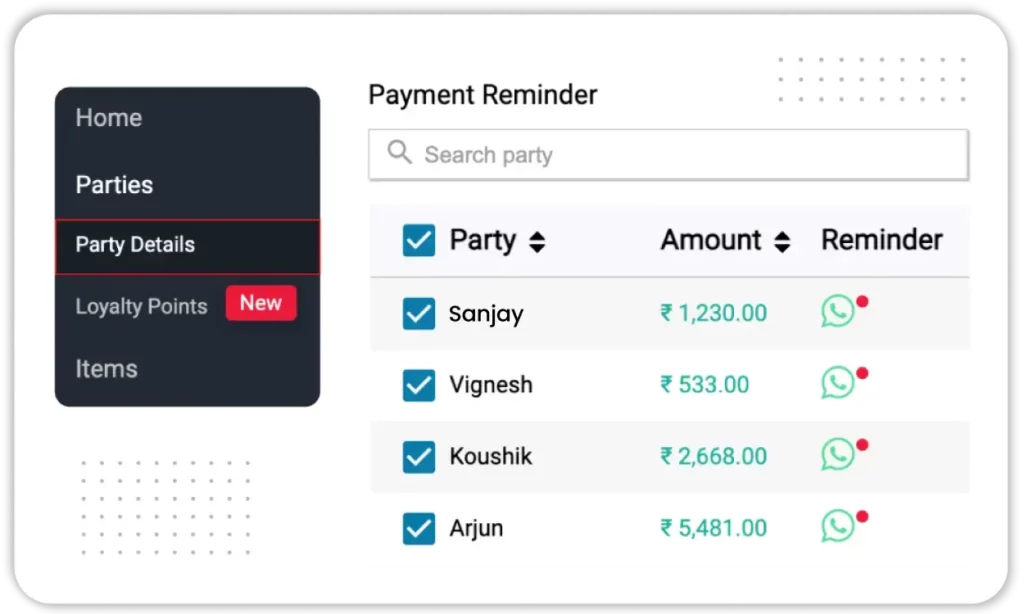

Automated Payment Reminders

Vyapar, a leading SaaS accounting system, ensures businesses get paid on time by automating payment reminders and follow-ups.

- Customizable Reminder Settings: Businesses can set automated payment reminders before or after due dates to ensure clients settle their dues on time.

- Multiple Reminder Channels: Vyapar allows businesses to send reminders via WhatsApp, SMS, and email, reducing manual follow-ups.

- Instant Invoice Links for Payments: Clients receive direct invoice links, making it easier to complete payments without unnecessary delays.

Cash Flow and Financial Forecasting

Vyapar’s SaaS-based accounting software provides real-time cash flow insights, allowing SaaS founders to plan growth strategies and manage operational expenses.

- Track Income in Real-Time: Monitor subscription revenue, incoming payments, and duplicate invoices effortlessly, ensuring steady cash flow and financial stability for your SaaS business.

- Revenue Prediction & Planning: Analyze historic sales data to identify trends, forecast future revenue, and make informed business decisions for steady growth and financial stability.

- Budget Optimization & Cost Reduction: By analyzing past expenses, Vyapar allows businesses to cut unnecessary costs and improve profit margins.

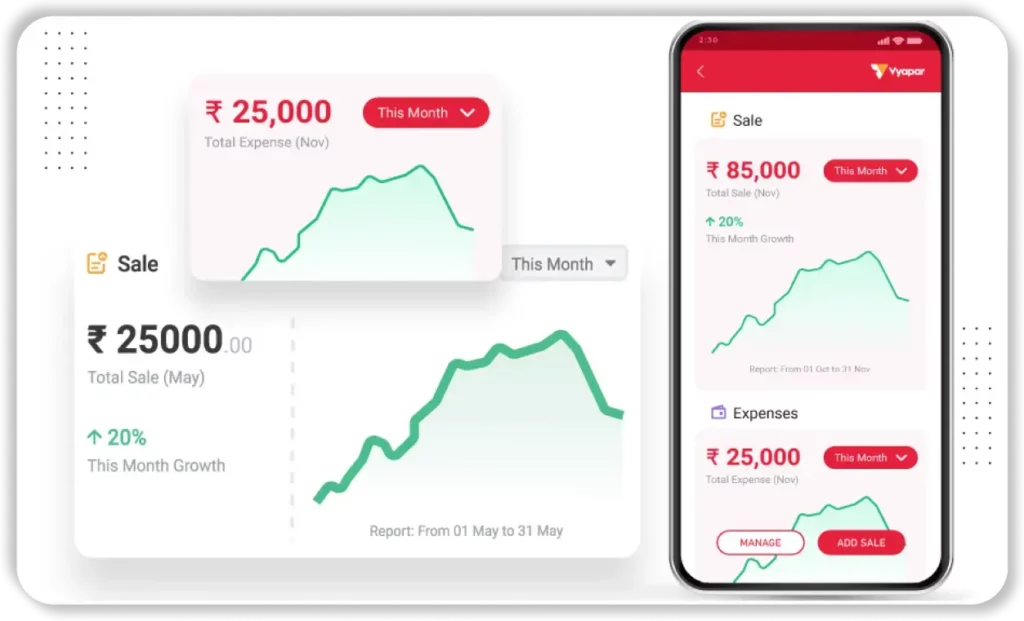

Mobile App Accessibility

Vyapar’s mobile app allows on-the-go access to invoices, reports, and customer payments, helping SaaS founders manage finances from anywhere without being tied to a desktop.

- Create & Send Invoices Instantly: SaaS businesses can generate invoices directly from their phone and send them via WhatsApp, SMS, or email, ensuring instant billing and professional service.

- Track Payments & Expenses on Mobile: With an easy-to-use mobile dashboard, business owners can view pending payments, settled invoices, and real-time business expenses, keeping financial records up to date.

- Seamless Data Sync Across Devices: Vyapar syncs data across multiple devices in real time, ensuring consistency whether accessed from mobile, tablet, or desktop.

Data Security and Auto-Backup

Vyapar provides end-to-end security and encrypted backups, ensuring that SaaS businesses never lose critical financial data due to system crashes or cyber threats.

- End-to-End Encryption for Data Protection: All financial transactions, invoices, and customer payment details are encrypted, preventing unauthorized access and ensuring data security for SaaS businesses.

- Automatic Daily Backups: Vyapar automatically creates cloud backups, meaning that even if a device crashes or data is lost, the financial records remain safe and can be recovered instantly.

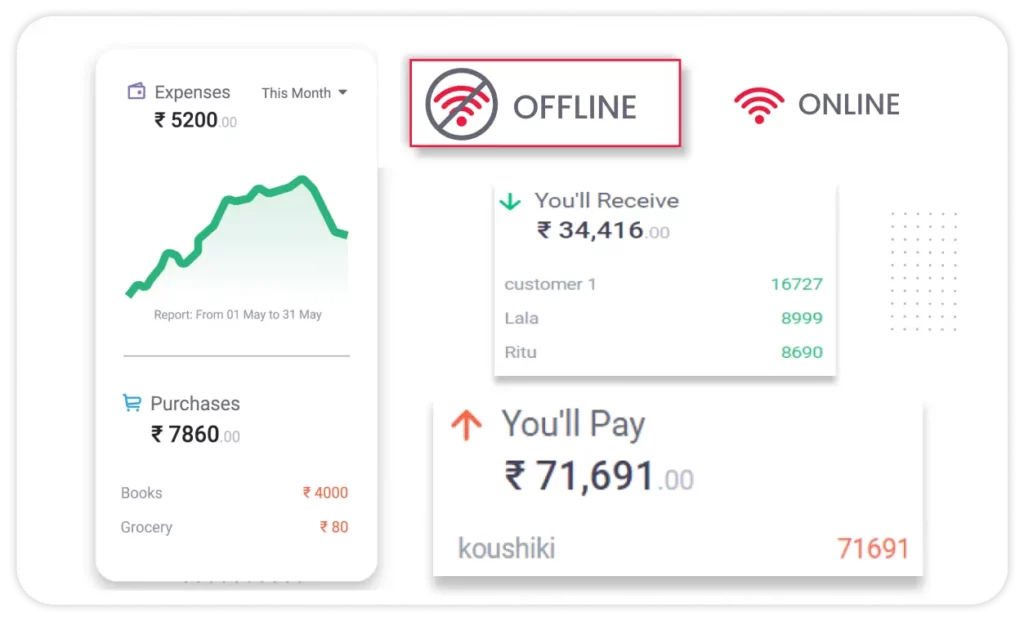

- Offline to Online Data Sync: If the internet is down, users can continue working offline. Once online, Vyapar syncs all transactions, ensuring data remains updated without manual intervention.

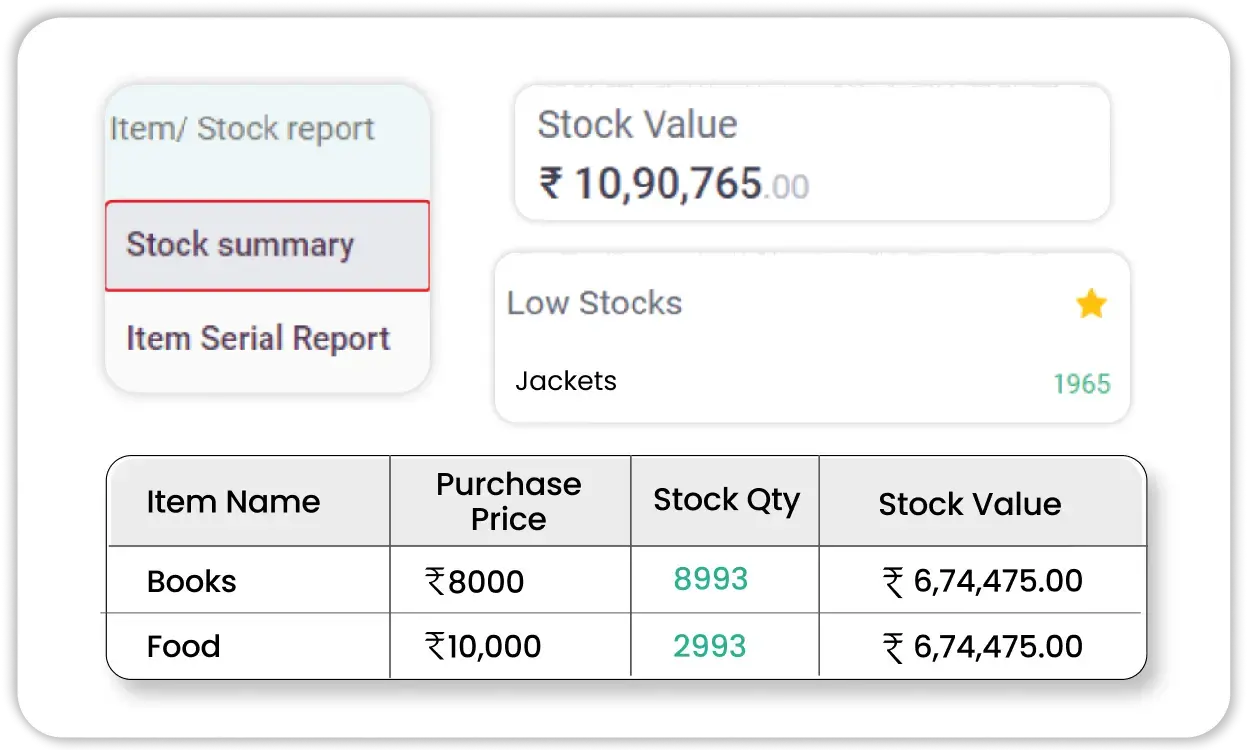

Inventory and Stock Tracking

Vyapar helps SaaS companies manage software licenses, digital product inventory, and physical stock, ensuring accurate tracking and sales reporting.

- Track Digital Product Licenses & Subscriptions: Businesses can log sold software licenses, renewal periods, and activation details, ensuring accurate billing records.

- Stock Level Alerts & Management: If a SaaS company also sells hardware (e.g., storage devices), Vyapar provides stock alerts to prevent shortages.

- Seamless Integration with Invoicing: When a digital product is sold, inventory records update automatically, ensuring accurate stock and revenue reports.

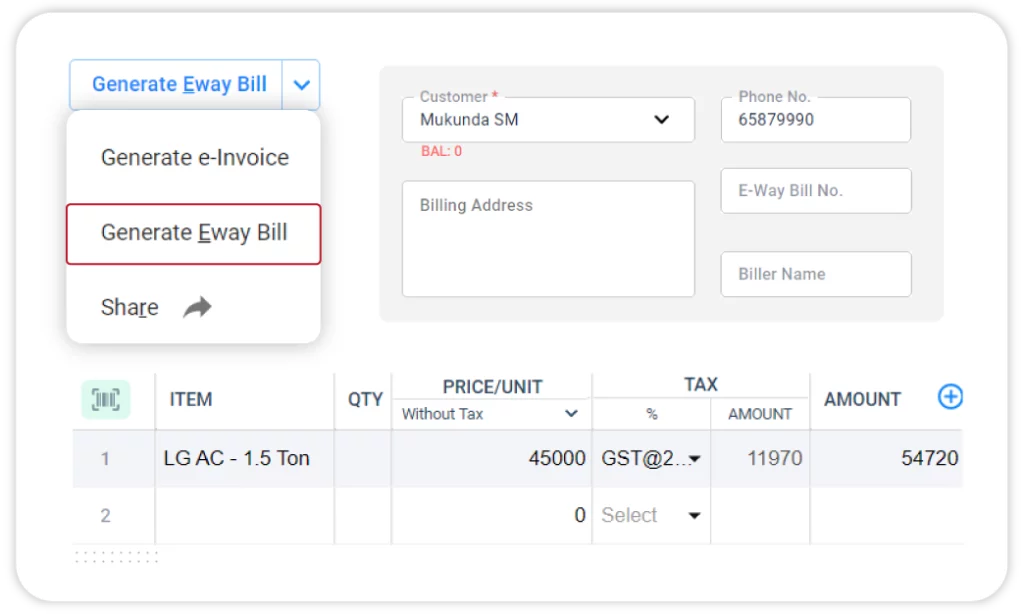

E-Way Bill and E-Invoicing Support

Vyapar’s SaaS accounting solutions simplify e-invoicing and e-way bill generation, ensuring businesses remain compliant with legal regulations.

- GST-Ready E-Invoices: Generate tax-compliant e-invoices instantly, ensuring accurate record-keeping and smooth filing.

- Instant E-Way Bill Creation: Businesses shipping software-related physical products can generate e-way bills within Vyapar, reducing paperwork.

- Automated Tax Reporting for Compliance: Vyapar auto-generates GST reports, simplifying tax filing and preventing compliance errors.

Offline Accounting Support

Vyapar ensures uninterrupted accounting access, even without an internet connection, allowing businesses to manage invoices, payments, and reports seamlessly.

- Create & Manage Invoices Without Internet: Businesses can generate invoices and record expenses offline, ensuring continued productivity.

- Auto-Sync Once Online: Vyapar automatically syncs all offline transactions once an internet connection is restored.

- Reliable Backup & Storage Protection: Local storage ensures financial records remain secure, even when working offline.

Unlock Your Business Potential – Vyapar Powerful SaaS Accounting Tool!

Smart Accounting for SaaS: Vyapar is The Perfect Solution

Growing a SaaS business isn’t just about having a great product—it also needs proper financial management. Vyapar Accounting Software helps SaaS companies stay organized, reduce errors, and make smarter business decisions. By keeping track of cash flow and expenses, businesses can manage their money better and grow faster.

Vyapar also makes business operations smoother by improving financial clarity. Founders and teams can easily understand their revenue, profits, and spending, helping them invest wisely and plan for the future. With less time spent on managing accounts, SaaS companies can focus on improving their services and attracting more customers. Vyapar ensures that businesses run efficiently, stay profitable, and scale successfully in a competitive market.

How Vyapar SaaS Accounting Solution Benefits Your Company

Faster Revenue Growth

Vyapar simplifies financial management, so SaaS businesses can focus on acquiring customers, increasing sales, and scaling operations without worrying about accounting.

Improved Financial Clarity

Get a clear view of your income, expenses, and profits in one place, making it easier to plan and manage business finances effectively.

Stronger Business Stability

By keeping track of cash flow, Vyapar helps SaaS businesses avoid financial ups and downs, ensuring smooth and steady operations.

Simplified Financial Monitoring

No more juggling spreadsheets! Vyapar keeps all your financial data organized, making it easy to track transactions and stay on top of your accounts.

Enhanced Business Efficiency

Automating financial tasks reduces manual work, helping SaaS companies save time and improve overall productivity.

Reliable Financial Forecasting

Vyapar provides insights into revenue trends, helping businesses predict future earnings and make smarter investment decisions.

Vyapar’s Growing Community

Take Your Big Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQs’)

SaaS accounting software is cloud-based, offering automated financial management, real-time insights, and subscription billing, unlike traditional on-premise accounting systems.

SaaS companies rely on recurring revenue models, requiring automated billing, revenue recognition, and subscription tracking, which standard accounting tools don’t offer.

Look for features like automated invoicing, tax compliance, cash flow tracking, and scalability to support your business growth effectively.

Vyapar simplifies financial management for SaaS businesses with automated invoicing, real-time expense tracking, and tax compliance, ensuring smooth cash flow and scalability.

Yes, Vyapar supports duplicate invoicing, making it easy to manage subscription-based payments without double manual effort.

Vyapar offers cloud backup and multi-device access, allowing SaaS companies to manage their finances from anywhere with ease.

Vyapar automates GST calculations, generates tax reports, and ensures accurate filing, helping SaaS businesses stay compliant effortlessly.

Yes, Vyapar allows secure financial data access, enabling smooth collaboration between accountants, finance teams, and business owners.