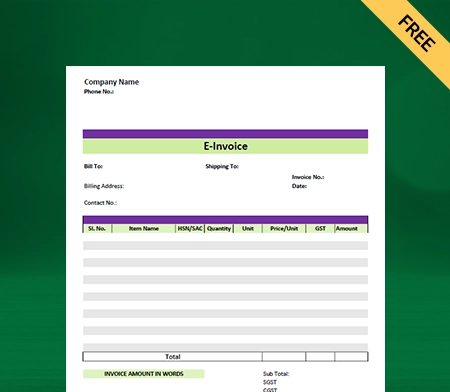

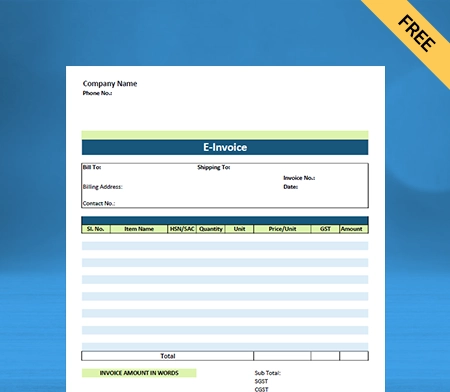

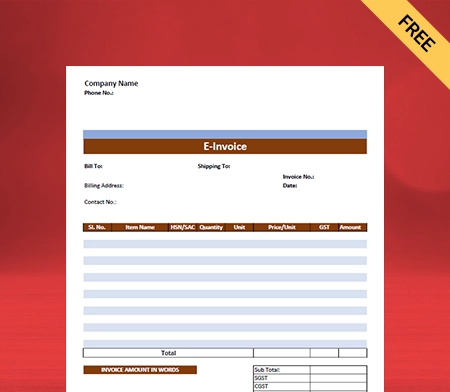

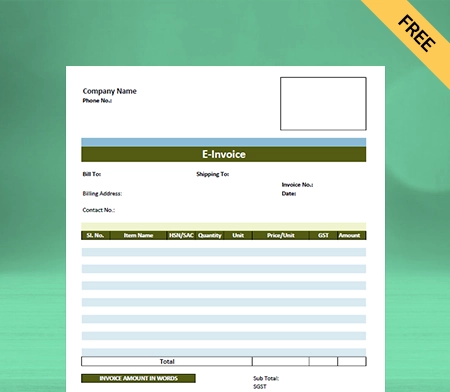

Customize E-invoice Format

Vyapar can help you manage and issue e-invoices seamlessly. Over 5 million small business owners trust Vyapar in India. Using the app to create e-invoice formats is effortless.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of E-Invoice Format

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What Is an E-invoice Format?

Electronic invoicing, also known as e-invoicing or e-invoice, is a model of electronic billing. E-invoicing methods are mainly used by trading partners, such as customers and their suppliers.

It is used to generate unique transactional documents between one another and ensure the terms of their trading agreements are being met. These documents include invoices, debit notes, credit notes, payment terms, payment instructions, purchase orders, and remittance slips.

E-invoicing encompasses different technologies and entry options and is used as an umbrella term to describe any method by which an invoice is electronically presented to a customer for payment.

What Is The Purpose Of Using The E-invoice Format?

The primary liability of the accounts payable department is to ensure all outstanding invoices from its suppliers are approved, processed, and paid. Processing an invoice is not an armchair job as it includes recording relevant data from the invoice and feeding it into the company’s financial or bookkeeping system. The feed is accomplished, and the invoice is ready to go through the company’s business process to be paid.

An e-invoice can be known as structured invoice data issued in Electronic data interchange (EDI) or XML formats, possibly using Internet-based web forms. The documents are exchanged in numerous ways, including EDI, XML, or CSV files. They can be uploaded by utilizing web applications, emails, virtual printers, or FTP sites.

The company may use imaging software to capture data from PDF or paper invoices and input it into their invoicing system. It helps streamline the filing process while positively impacting sustainability efforts. Some companies may have their in-house e-invoicing process. However, companies hire a third-party company to implement and support e-invoicing processes.

The different sorts of formats and delivery channels complicate the use of e-invoices. To simplify this operation, the file extension.INV could be used, which would make.INV files easily accessible in accounting software. The INV file can be used in standards-compliant XML format.

What Are The Benefits of Using The E-invoice Format?

Streamlined & efficient processes:

Using e-Invoice format, organizations can accept invoices in any format from many suppliers, including image-based invoices. Electronic invoicing helps you to provide a single platform for managing all accounts payable information and processes.

Further, it helps make room for strategic tasks that add value. However, overall efficiencies result in more significant savings for the organization in terms of optimal utilization of resources and increased productivity.

Sync Data Seamlessly:

Business users can quickly and easily sync and aggregate information between various systems. They can operate multiple devices without duplication of content.

Executing it ultimately results in a much faster turnaround time. It enables the team to leave behind tasks that are often repetitive and time-consuming by nature.

Better Visibility and Transparency:

Electronic invoicing improves visibility into the invoices, supporting documentation, purchase orders, and contracts. It keeps track of the invoices and provides detailed audit trails. The functionality is available through an end-to-end native mobile e-invoicing application.

E-invoicing is essential as it assists organizations in streamlining their invoice processing cycles. It helps in reducing the person-hours needed for invoice processing, approving, tracking, and chasing invoices and human errors.

Increased Accuracy:

You can ensure accuracy due to improved visibility and end-to-end tracking. You can keep track of your invoice validation, approvals, and payment in real-time. It remarkably reduces the errors and issues.

So, it helps avoid delayed payments or duplicate payment requests. E-Invoice is thus an essential factor for enabling a closed audit trail to simplify tracking and settlement.

Better compliance and green invoicing:

An e-Invoice system is much greater than just a platform for filing digital invoices. E-Invoices leads you to a higher level of compliance with ease. It is essential to regulatory compliance.

By switching to e-Invoice, you can drastically eliminate the requirement of paper-based invoices. In addition to being energy-efficient and eco-friendly, you can reduce the waste and costs associated with paper-based processes used within your supply chain.

Reduced risk with insights:

Greater visibility into trade and transactions also reduces the risk of human error, duplication, invoice fraud, oversight, etc. Organizations can save countless hours and resources for the time taken to cross-check the verification and due diligence when an efficient system is in place that does not leave much scope for such risks to enter the processing cycle.

E-invoice helps you with every last dollar spent and saved. It allows the leadership and procurement teams to keep track, gather strategic insights on cost centers, and identify opportunities to save more, like early payment discounts. The data available in front of you helps in better and more informed decision-making, saving time and resources.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

How Many Types Of E-invoice Format are There?

There are two types of ‘true’ e-Invoice format that you must understand with or without compliance.

E-Invoicing without compliance

The process for electronic invoicing without compliance is:

- When the buyer and supplier agree on the format that the e-Invoice will take and the data to be included

- The data will be correctly into the design (X12, Edifact, XML) using modern technology such as EDI or simple web forms for web invoicing.

- As the supplier here creates and sends an electronic invoice either directly from their Accounts Receivable (AR) system or via a web-based form.

- When the buyer receives the e-invoice format ready to be processed by the Accounts Payable (AP) system

In these circumstances, the e-Invoice confirms only the data formats that the trading partners. It does not contain the regulatory obligations of the country where the electronic invoice is issued or received. However, it’s better for businesses to choose to incorporate compliance methods in e-invoicing.

E-Invoicing with compliance

The process for electronic invoicing with compliance is very similar to the operation of e-invoicing without compliance except for:

- The format of the e-Invoice data is here, mainly determined by the legislation and regulations of the territories in which both parties are trading.

- The e-Invoices are mainly regulated to government-specified guidelines or by a government portal for e-Invoice content validation, security, non-repudiation, and archiving.

- The invoices for audit and VAT purposes are very readily available.

- The use of paper is entirely removed from the process.

It ultimately makes sense for an organization to accept this approach as it will facilitate their VAT obligations. However, there are no standards available for regulating the governing e-Invoicing.

What Is The Process Of Getting An E-invoice Format?

The following are the steps involved in generating or raising an e-invoice.

The taxpayer must use the reconfigured ERP system as per PEPPOL standards. He can also coordinate with the GST software service provider to assimilate the standard set for e-invoicing, i.e., e-invoice scheme, and should have the mandatory parameters notified by the CBIC at least.

Any taxpayer has got mainly two options for IRN generation:

- Your PC’s IP address is listed on the e-invoice portal for a direct API integration or integration via GST Suvidha Provider (GSP) such as ClearTax.

- You should download the bulk generation tool to bulk upload invoices. It will prepare the JSON file that can be uploaded to the e-invoice portal to generate IRNs in size.

The taxpayer should, after that, raise a proper regular invoice on that GST software. It will give all the essential details like billing name and address, GSTN of the supplier, transaction value, item rate, GST rate applicable, tax amount, etc.

Once all the above options are chosen, you should raise the invoice on the respective ERP GST software or billing software. After that, you can upload the invoice details, especially for the compulsory fields, onto the IRP using the JSON file, via an application service provider (app or GSP), or through a direct API.

The IRP shall act as the central registrar for e-invoicing and its authentication. There are a variety of other modes of interacting with IRP, such as SMS-based and mobile app-based.

IRP will also help validate the critical details of the B2B invoice. You can check for duplicates and generate an invoice reference number (hash) for reference. There are mainly the four types of parameters based on which IRN is generated: Seller GSTIN, invoice number, FY in YYYY-YY, and document type (INV/DN/CN).

IRP assists you in generating a unique invoice reference number (IRN), which helps you to digitally sign the invoice and creates a QR code in Output JSON for the supplier. On the other side, the supply seller will get informed of the e-invoice generation through email if it is provided in the invoice.

IRP will send the authenticated payload to the GST portal for GST returns. In addition, details will be forwarded to the e-way bill portal, if applicable. The GSTR-1 of the seller gets the option to be auto-filled for the relevant tax period, which regulates the tax liability.

A taxpayer can also continue to print his invoice as it is being done presently with a logo. The e-invoicing system can only mandate all taxpayers to report invoices on IRP in electronic format.

How To Create An E-invoice Format By Using The Vyapar App?

Here are a few simple ways to create an e-invoice format in the Vyapar app. You can follow the points given below to make a perfect e-invoice format for you:

- Go into the Vyapar app, and click on the add sale button. The sale form will be opened. You can also use the shortcut key (Alt+S).

- Over here, the first thing you need to do is to select a cash or credit sale. For now, we are creating a credit sale. Once it is done, you can choose the customer name from the list. The customer details would get filled over here automatically.

- If you create an invoice for any customer for the first time, type out the name or you will get the “Add Party” option when you click the “customer” tab and update the party details. It will create a new party, and later on, you can edit the party details.

- On the right side, you will find the invoice number, date, and place of supply, which can be changed if needed.

- Then, for now, you need to add items to the invoice. You need to go to the item line and select the item; along with this, you can see the item quantity price per unit, discount, tax and amount, these can be changed if needed, and similarly, you need to add the other items too.

- After this, you can select the payment type. If you need to ensure, enter any additional details in the invoice, and you can use the description box for additional information. You will get an image option below the “description” tab, with the help of which you can add any invoice-related image.

- If you want to add any additional field option then go to settings>transaction settings>Additional Charges>enable charges as per your requirement like shipping, packaging or any additional charges. The additional charges will then reflect before the total amount.

- If you need, you can round off the invoice amount if required using the round-off option. This option, too, has to be turned on beforehand from the transaction set.

- Now, you can note it down in the received amount column. Then click on the Save button.

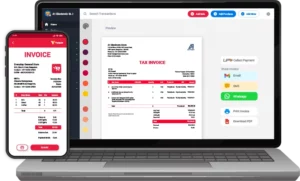

Your e-invoice is ready, and now you can easily share in all three formats (PDF, Word, and Excel) with your clients.

Additional Benefits Of Using The Vyapar App:

Custom Invoicing and Billing:

Using free inventory software Vyapar, you can generate unique e-invoices on the spot. Additionally, you can add contact information, item details, and prices. The Vyapar app makes sure your Invoicing system works at its full potential.

E-invoices can be generated within 20 seconds, printed, and shared with clients via WhatsApp or email from your invoicing portal. You can use the QR code scanner from image and shortcut keys to speed up the billing process.

“Bill-wise payment” is one of the essential features of the Vyapar App, making it simple to link payments to GST e-invoices. The free GST Mobile App allows multiple parties to manage each client by your invoicing system easily.

This feature allows you to track all the generated invoices easily. The Vyapar App enables any business to identify any overdue payments quickly.

Recover Dues with reminders:

Vyapar’s accounting and billing software help you to maintain cash flow and ensure timely payments through your GST software. You can send repayment reminders to your customers.

You can use WhatsApp and email notifications to remind them of the total amount owed and the due date. Vyapar provides you with all technical field specifications, so you need not worry about the technical knowledge. With reminders, you can share payment links with customers to collect payments.

Vyapar’s best invoicing portal software includes various payment options to help your customers pay on time. It provides a payment link to accept all sorts of payment methods. The e-invoice software enables cash, credit cards, debit cards, e-wallets, NEFT, RTGS, UPI, QR codes, and other GST e-invoice payment methods.

The best e-invoicing app ensures that your customers can pay in the most convenient way by using your invoice portal. With the payment reminder feature, many small and medium business owners reduced payment delays. You can create reports to adjust your business plans based on available cash flow.

Automatic data backup:

The Vyapar app helps with automation, and you can store your data securely. Our free app allows you to create local, external, or online Google Drive backups to keep your data safe.

Furthermore, the GST software makes data recovery simple. For added security, the data is encrypted to avoid third-party use. If you use the offline version, you must enable the auto-backup feature to receive backups to your registered email address.

Vyapar’s “auto-backup” feature simplifies backups in the e-invoicing software. When you enable this mode in the Vyapar app, a daily backup is created automatically. They provide backup options, including Local Drive, Google Drive, and email.

The app has an encryption system that ensures the data is only accessible to the owner. You can use the app to create customized data backups and help ensure the security of your data. Your data cannot be accessed by any third party or even our team.

Frequently Asked Questions (FAQs’)

E-Invoicing ensures the real-time reporting of invoices on the Government Portal, reducing the chances of insincere behavior to avoid the tax. Secondly, it also facilitates auto-reporting of invoice details in GSTR-1 of the supplier and GSTR-2A of the recipient. Facilitating the auto-generation of e-way bills.

A digital invoice is a PDF or Word file that sometimes refers to a scanned paper invoice. A digital invoice is easy to understand, and an electronic invoice (or e-invoice) is usually a data file transferred between computers and is not easy to understand for humans.

The Government of India (GoI) has made the QR (Quick Response) Code compulsory for GST Invoices as per Notification No. 72/2019. According to the notification of Gol, the assessees who should provide QR codes are those having a turnover of more than five hundred crore rupees and making a supply to unregistered persons.

Yes, an IRN can be made within a few days after the date of the invoice, but it is not recommended because you will be violating the Time of Supply rules by doing so. Without having an unique IRN, the invoice on hand will not be counted. It is suggested to generate IRNs as and when invoices are raised.

Electronic invoicing (e-invoice) generally refers to exchanging a bill and payment details between a supplier and a buyer in e-invoice format. It means that the invoice is issued, transmitted and received in a structured electronic layout, allowing for automatic and electronic processing.

Those registered persons whose aggregate annual turnover in any preceding financial year from 2021-22 onwards exceeds Rs. 20 Cr are liable for e-Invoicing. E-Invoicing is applicable to supply goods or services or both. Applies to B2b transactions only.

A digital invoice is usually a Portable document format or Word file that is sometimes a scanned paper invoice. A digital invoice is quicker and easier for a human to understand. An electronic invoice (or e-invoice) refers to a data file that is transferred between computers and is not easy to understand for humans. The Common file formats in e-invoices are XML and EDI.

In the e-Invoicing system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal. Under the electronic invoicing system, an identification number will be generated against every invoice by the Invoice Registration Portal (IRP) to be managed by the GST Network (GSTN).

* First, log in to the E-Invoice Portal. Under this step, you will need to enter the credentials you received from the E-Invoice Portal.

* Second download GSTZen XLSX Template.

* Then upload Invoices to GSTZen.

An electronic invoice (e-invoice) format typically includes sender and recipient details, invoice number and date, itemized list with descriptions, quantities, prices, taxes, subtotal, total amount due, payment terms, and any additional notes.

To create an e-invoice:

1. Use invoicing software like Vyapar.

2. Enter sender and recipient details, invoice number, date, and items/services.

3. Add item descriptions, quantities, prices, taxes, and discounts.

4. Review and send the e-invoice digitally to the recipient.

5. Track payments and manage invoices using Vyapar’s features for efficiency.

E-invoicing rules typically include using specific electronic formats, complying with tax regulations, ensuring data security and privacy, and supporting interoperability between systems.

To create an e-invoice for GST:

1. Use invoicing software like Vyapar, which supports GST invoicing.

2. Enter GSTIN (Goods and Services Tax Identification Number) for both sender and recipient.

3. Include GST rates and amounts for taxable items/services.

4. Ensure the invoice format complies with GST e-invoicing requirements.

5. Review and send the e-invoice digitally to the recipient, maintaining GST compliance.

6. Vyapar can simplify this process with its GST-ready invoicing features.

The e-invoicing limit varies by country and is based on annual turnover or revenue. For instance, in India, businesses with a turnover exceeding INR 500 crore are mandated to generate e-invoices. For efficient GST-compliant e-invoicing, Vyapar offers robust features.

To print an e-invoice:

1. Open the e-invoice in your invoicing software, such as Vyapar.

2. Click on the “Print” or “Download” option.

3. Choose your preferred print settings, such as paper size and orientation.

4. Click “Print” to generate a physical copy of the e-invoice.

Vyapar provides easy printing options for e-invoices, ensuring convenience and compliance with GST requirements.