Freelancer Invoice Format

With Vyapar, you can produce excellent freelance invoices for your business. Send your clients fully personalized, automatic invoices, and build a positive brand image.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Freelancer Invoice Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

Download Free Freelancer Invoice Format

Download free freelancer invoice formats, and make customization according to your requirements at zero cost.

Customize Invoices

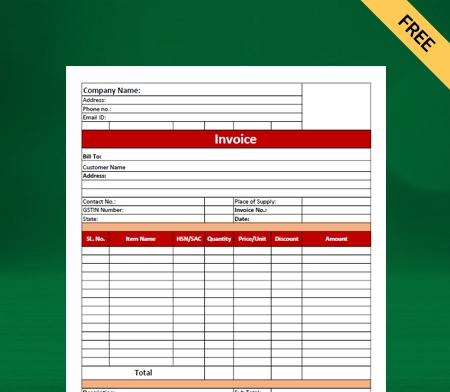

Freelancer Invoice Format Type I

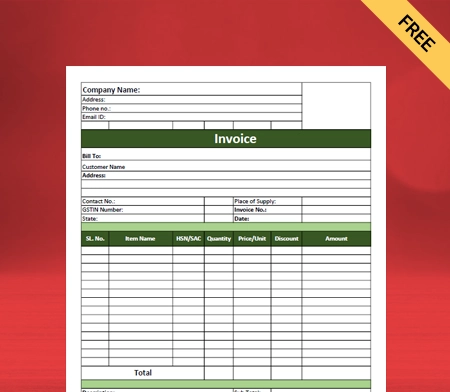

Freelancer Invoice Format Type II

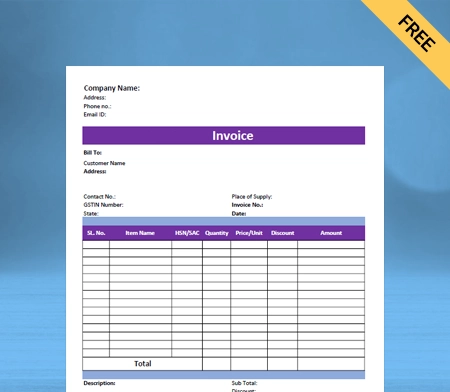

Freelancer Invoice Format Type III

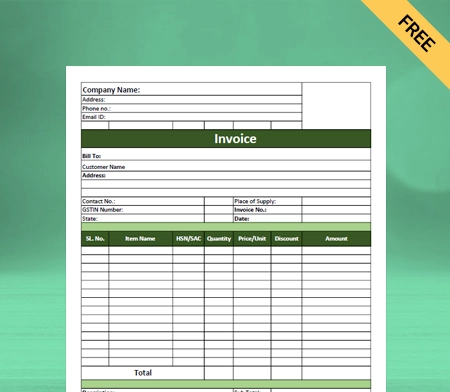

Freelancer Invoice Format Type IV

Generate Invoice Online

Who is a Freelancer?

A freelancer or freelance worker is a self-employed individual. A freelancer does not work for a specific company; instead, they take on assignments from different agencies. A freelancer provides services in various areas on a short-term, long-run, and project basis. Freelancers are essential members of today’s business community.

Accounting data, bookkeeping, software development, technical services, content writing, data entry, designing, marketing, and management consultancy are some services freelancers provide. The charges depend on the extent of their work and the conditions of their contract with the client.

For instance, if a potential client approaches you with a job that appears complex and does not pay well, you can decline. You are not required to take on any projects you do not want. A freelancer can issue an invoice using a freelancer invoice format by Vyapar.

As a freelancer, you need to issue invoices because it determines the total dues and ensures that you receive payment on time. It also helps remove any ambiguity or misunderstanding between the freelancer and the client.

Contents of an Invoice Raised by a Freelancer:

A printable invoice template makes it easier to print suitable invoices for your customers. Here are some key reasons why you should use the printable invoice:

A freelancer invoice format must include the following details:

Title:

Every invoice should have an appropriate title and include the words’ Invoice’ or ‘Tax Invoice‘ or any similar title, as applicable.

Name and Logo:

If available, the freelancer’s and their companies’ names must appear at the top of the invoice. If the company has a logo, it must include it as well. This way, anyone can know who you are.

Contact Details:

The next thing freelancers must add to their invoice is their contact details. Your email, mobile number, postal address, and other contact details should appear below the freelancer’s name.

If the freelancer has a tax identification number, such as a GSTIN, it should be listed here. It helps clients to contact you in case of any problem or if they have any doubts.

Client’s name and information:

The freelancer invoice template must also include the client’s name and information such as their address, contact number, email, and GSTIN.

Date of Invoice:

The date you make the invoice is the invoice date. Sometimes, the payment terms in the contract are based on the invoice date, so it is essential to mention the date.

Invoice Number:

An invoice number is a serial number that freelancers and recipients use to refer to an invoice. Remember to include the year and month you raised the invoice when numbering invoices. For example, an invoice raised in July 2022 could have an invoice number such as 12345/07/2022.

Description of services:

The next step is listing the services you provided to your client and charges for the same. It could be a list of topics written, as well as the word count and rate per word if the freelancer is a writer.

If the freelancer is a graphic designer, it could be a list of completed creative projects. Add the actual work done or the number of hours put in, and the rate per project or hour worked. The goal is to be as specific as possible so that clients know what they’re paying.

Tax rates, if applicable:

If the freelancer has a GST registration and is required to pay tax on the services provided, each service’s tax rate and amount due should be specified separately.

You can mention only the applicable rate and amount of tax at the end if all of the services fall under the same tax bracket and service code. Ensure that you levy CGST and SGST separately.

Total Amount:

The total amount will be the sum of the billed hours/assignments multiplied by the rate per unit plus any applicable GST.

Payment Details:

Including the bank account information or other information determining where the client will transfer the payment is necessary. If the method of payment is cash, you must specify this. Discussing the charge mode with the client before printing it on the invoice is preferable.

Signature:

The invoice must have a space at the bottom so that the freelancer issuing the invoice can sign it.

Create your first invoice with our free Invoice Generator

The Impact of GST On Freelancer Services:

Freelancers under GST who provide taxable services must register compulsorily according to GST guidelines if they exceed the GST exemption limit for Indian Freelancers.

The freelancer must obtain GST registration in the following situations:

- When the turnover exceeds INR 20 lacs in prevailing circumstances and INR 10 lacs in specific cases of North-eastern states

- The GST registration is mandatory for all services under Online Information and Database Access and Retrieval services (OIDAR). It includes internet advertising, cloud services, e-books, music, movie, software, and other digital goods, or providing information to another person electronically through a computer network, online gaming, etc.

- In cases where the freelancers provide an interstate supply of services

- The service providers engaging in the export of services must obtain the registration.

The GST on Freelance Work is 0%, 5%, 12%, 18%, and 28%, with all services taxed according to the applicable slab rates. If there is no specific slab rate for a service, the applicable levy is 18%. Freelancers can include GST in invoices easily with freelancer invoice formats.

All invoices a freelancer raises must comply with GST laws for Freelancers. The invoice should include all necessary information such as the supplier’s and recipient’s GSTINs, SAC of services, date, value, and signature.

Benefits Of Being a Freelancer:

Freelancing has become more popular recently, with more than one-third of people pursuing it. The majority of people choose the freelance lifestyle because it has excellent advantages. They are:

You get to be your boss:

The primary benefit of freelancing and working for yourself is that you have much more freedom than when you work for someone else’s company. You’re essentially running your own business and have complete control over which new clients you accept. Also, you can fix your charges according to the work you provide.

Flexible hours:

Freelancing gives you the ability to set your working hours. So if you want to take off on Monday and work on Saturday instead, you have the option to do it. You can choose when and how to do your work, as long as you finish the job by the agreed deadline.

Self-management:

When you are your boss, you can choose your workload, schedule, dress code, and every other aspect of handling things. But one thing you need to remember is that freelancing is not a vacation. You must make your clients happy, keep track of the budget, and seek new clients. Freelancer invoice formats make it seamless for freelancers to manage accounting requirements.

Work from anywhere:

You can choose to live anywhere or even travel while working as a freelancer. You are not bound to a single company, so you have the location flexibility that corporate jobs do not offer. While sometimes it is essential to live near your clients, you can easily find clients wherever you go. Since most freelancers work online, you can have international clients and work from anywhere.

Improved skills:

As a freelancer, you accept projects from a variety of clients. Each project brings new experiences and allows you to broaden your skill set. You’ll most likely discover new things as you go.

You may feel more stagnant in a traditional full-time job that does not always require continuous learning and development. As you work in a broader range of project types, you will have many more opportunities for advancement.

Earning control:

There is no need to request a raise as a freelancer. You can set your prices. You can also choose how much work you do. However, rates and the amount of work are subject to market forces.

You can’t demand unreasonable pay without reducing your list of potential clients. However, freelancers can gradually raise their rates as they do more work, gain experience, and build a strong reputation.

Start your own business/agency:

Freelancers can build their client base and grow their businesses successfully. As a freelancer, you can try out different services to see which ones make you the most money and bring in the most clients. If you want to expand your client base further, you can turn to a freelance agency once you’ve learned the ropes of freelancing.

How To Generate An Invoice Using The Freelancer Invoice Format?

You can improve the perception of your brand by sending attractive invoices to your clients. Creating an invoice for your customer doesn’t have to take much time. You can create a professional invoice in three easy steps with Vyapar.

Step 1: Enter Details

Include the billing date and other relevant data about your business and clients. You can add any items and make notes about the invoice in Vyapar to ensure everything is clear.

Step 2: Preview

You can view the preview of your invoice after entering the details to see how it will appear. You can make any necessary adjustments by going to the previous tab in the online invoice creator.

Step 3: Share/Download

Using the Vyapar online free invoice generator, you can send the completed invoice to your client or print and download it.

Advantages Of Using Freelancer Invoice Format by Vyapar:

Custom Invoices:

One of our app’s primary advantages is the customisation it provides for your business. Custom invoicing for freelance businesses allows you to create a simplified invoice.

It allows you to display your service’s branding: logos, style, headers, footers, colour, etc. Custom invoices can also serve as an excellent marketing tool.

You can include client-specific messages, display your other services, and any additional information per your client’s needs.

You can create invoices in 20 seconds. You can print them or share them with clients via WhatsApp or email addresses.

Effortless and Saves Time:

The Vyapar freelancers accounting software does not require any special accounting knowledge. The user-friendly interface of the app makes it easier to use freelance invoice formats for freelancers.

It is possible to access data instantly from a mobile device to a desktop and vice versa. GST registered and unregistered entities both can use Vyapar.

Manual bookkeeping is time-consuming and prone to human error. You can avoid this issue by using Vyapar’s automated software. It will accurately generate the reports you require.

Anyone on your team can manage transactions in Vyapar. The Vyapar app automatically records all of your transaction data. You can quickly check the reports and analyze your company.

Offline Access

Most accounting apps are difficult to access in remote areas without internet access. Because the Vyapar Accounting App is an offline application, you do not need internet access or connectivity to use it.

You can create free invoices format by using the app’s offline billing features. The Vyapar app allows you to create invoices for your clients without remaining online.

Vyapar automatically validates your transactions and updates your database when you connect it to the internet. Additionally, it streamlines the billing process because you can easily record transactions.

You can generate bills for your customers as soon as they make purchases. The Vyapar app’s online and offline features are helpful in rural areas where network and connectivity problems are common.

Lifetime free basic usage:

The basic plan of the Vyapar app is free for Android users. You can access accounting tools and essential features without any cost.

Free access is part of our effort to bring millions of small business owners into the digital economy. Our invoicing tool is the best choice for small and medium enterprises.

Vyapar makes it easy for freelancers to manage and scale their business operations. Our goal at Vyapar is to provide our clients with the best possible service.

You can sign up to use the free accounting app for android and download the app for free from the Play Store. However, you can take a subscription to access the premium features and desktop programmes.

Other Valuable Features of Using The Vyapar App:

Safety and Security:

Safety is essential for freelancers as all their work is done digitally. You can set up an automatic data backup using the Vyapar software for invoicing, allowing you to protect the data in the application.

You can set up an automatic backup of your data using our free GST invoice software in India, which will help protect the security of the information you store there.

You can occasionally make a local backup for added security. Keeping your data on a hard drive or pen drive would help you secure it.

The accounting features of the Vyapar billing software further ensure that you can analyse your data. You can develop a business strategy after viewing the business reports.

Provide multiple payment options:

Freelancers frequently deal with issues like incorrect payment amounts or late payments. Therefore, while freelancing, they must be able to create an accurate invoice.

If you offer various convenient payment options to your clients, payment default is less likely to occur. Options like UPI, QR, NEFT, IMPS, e-wallets, and credit/debit cards are available in the Vyapar app.

Your clients will be more inclined to take advantage of your consulting services if you extend them better credit. Customers will trust you more and choose you over competitors who do not offer various options.

Customers need convenience, and the most considerable comfort you can give them is letting them choose how to pay you. You can create invoices with various payment options using the Vyapar invoicing app.

Send Estimates & Quotations

With our software, producing documents is simple. It contains precise GST quotations format, invoices, and estimates. The straightforward delivery challan generator from Vyapar provides expert formats.

Users can automate most processes using accessible challan formats to save time and effort. The built-in features of the GST billing app let you send quotes to clients at any time via WhatsApp, email, SMS, or printing.

It eliminates mistakes in estimates and quotes. Additionally, you can convert your quotes and estimates into sales invoices anytime. The billing app gives your valued clients a sense of professionalism that encourages them to return.

With the Vyapar software, billing only requires a few clicks. With the help of the free billing software from Vyapar, trading companies have access to a complete time-saving and instant quote solution.

Frequently Asked Questions (FAQs’)

Download any freelancer invoice format from the Vyapar app. Enter all the relevant details with the price, and save and share it with customers.

Use the best type of invoice for your freelance writing business. Your customers will value that you took the time to personalize your invoices to meet their needs and include the appropriate information. It enables you to present a personalized, thorough invoice that guarantees timely payment.

Make each invoice number distinct; you can begin with any number. Give invoices sequential numbers. Number the invoices in chronological order. Any format is acceptable for invoice numbers. You could write 001, 002, 003, etc., or include the customer’s name, such as CN001, CN002, etc.

Include your name, address, phone number and email address. Add a business logo if you have one. You should also include the name and address of your client or your client’s company.

Make an invoice header with the details of your business. Include Your Client’s Contact Details. Give the invoice’s details. Describe Your Terms for Payment. Include a list of services with items. List All Taxes That Apply. Think about adding notes.

Yes, Google Docs does offer a valuable and user-friendly invoice template. Using invoicing software is a safer option if you need to keep track of multiple repeat customers and your invoices. You can download invoice templates for freelancers from the Vyapar website.

Yes, freelancers need invoices to document their services, specify payment terms, and ensure they get paid for their work. Vyapar can help freelancers with invoice generation by providing customizable invoice templates, automated invoice creation and sending, tracking payment statuses, managing client information, and generating reports for financial tracking and tax purposes.

Whether freelancers need GST (Goods and Services Tax) registration depends on their annual turnover. In India, GST registration is mandatory for freelancers whose annual turnover exceeds a certain threshold, which varies based on the state they operate in. If freelancers have any confusion regarding GST registration or related tax matters, they can talk to experts at Vyapar.

Yes, as a freelancer, invoicing is crucial for documenting services, specifying payment terms, maintaining records, and ensuring legal protection. If you’re unsure about invoicing practices or have questions, experts at Vyapar can provide guidance and assistance.

Yes, you can work as a freelancer without a GST number, especially if your annual turnover does not exceed the threshold that requires GST registration. However, it’s important to check the regulations in your country or region, as the requirements for GST registration may vary based on factors such as turnover, type of services offered, and local tax laws. If you have specific questions or need clarity on GST-related matters, consulting with experts at Vyapar can be beneficial.

As a freelancer, it’s recommended to invoice clients promptly after completing a project or milestone. Common invoicing frequencies include per project, weekly, biweekly, or monthly, depending on your agreement with clients and the nature of your work.