Bank Reconciliation Statement Format in PDF

Vyapar is a software used for efficient and effective management. It is used for bank reconciliation statement format pdf to reconcile seamlessly. The Vyapar free billing software is used for all business requirements. It can be used for invoices, bills, inventory management, reconciliation, and delivery challans. Avail of the 7-day free trial now.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

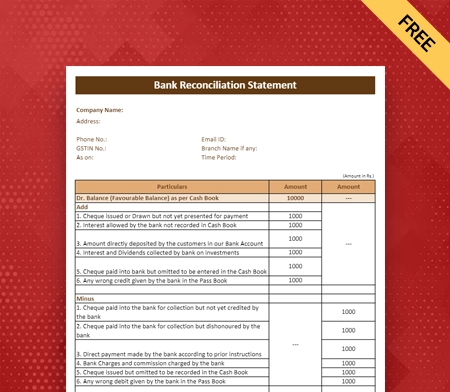

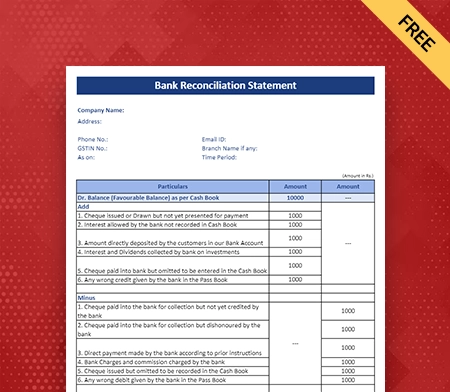

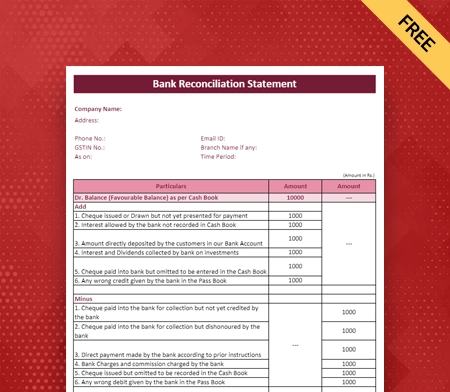

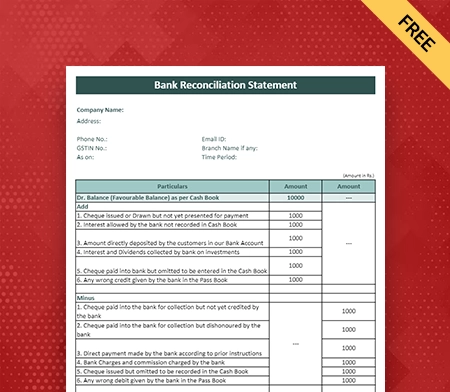

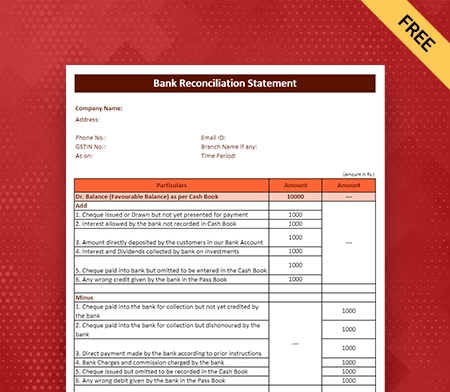

Download Bank Reconciliation Statement Format PDF

What is a Bank Reconciliation Statement (BRS)?

A bank reconciliation statement is a business activity that reconciles the bank account of an entity with its financial records. The statement defines the deposits, withdrawals, and other tasks affecting a bank account for a period.

Further, it helps to check the accuracy of the transactions recorded by the business and the bank transactions. It is prepared periodically to identify errors a business might have made while recording transactions in the cash book.

A professional bank reconciliation statement format PDF is a financial internal control tool to prevent fraud. A bank reconciliation statement format is a report businesses prepare to reconcile the bank transactions recorded with the bank statement.

The bank reconciliation statement helps to check the accuracy of the entries recorded in the books of accounts. It further ensures the accuracy of bank balances. The cash book and the passbook of the company record it.

A bank reconciliation statement summarises banking activity prepared by an individual or company. It compares the balance in their records with their bank account balance. The bank reconciliation statement shows reasons for any differences between the two books. A company should prepare a bank reconciliation statement format PDF during its financial period.

Why is a Bank Reconciliation Statement Required?

A bank reconciliation statement format PDF is required to reconcile the bank transactions recorded along with the bank statement. It is required for the reasons mentioned below:-

- It is needed when there is a difference in the amount of cheque credited and deposited.

- It is required when a mistake has been made in recording the bank transactions in the books of accounts.

- Some cheques are issued or received without bank clearance.

- It is needed to detect any fraudulent transactions.

- There are errors in the debit or credit transactions from the bank side.

- It is required to keep track of accounts receivable and payable of your business.

- The date of publishing the cheque for payment differs from that of debiting.

- It is necessary to compare your business’s cash book with the bank’s passbook. It is done to track the differences between the two balances.

- It is also required to help the auditors undertake annual audits.

- It is needed to track the cheques that have been bounced, cashed, altered, or stolen without knowledge.

- Lastly, adjusting the bank balance of your business’ cash book is necessary. It is done when there exists a difference between the balance as per the cash book and the balance as per the passbook.

Thus, a bank reconciliation statement (BRS) is required to avoid all the problems mentioned above. A bank reconciliation statement format in PDF would eliminate the difference between the actual and closing bank balances in the books of accounts.

What Are The Benefits Of A Bank Reconciliation Statement?

The Bank reconciliation statement format in PDF often identifies errors and accidental differences. The bank reconciliation format is an effective tool for detecting and analyzing fraud. For instance, if a cheque is altered, the payment made for that cheque will be larger than you anticipate. Bank reconciliation statement format also helps to identify errors that could negatively affect financial reporting.

Financial statements portray the health of a company for a specific period. They are often used to calculate the profitability of a business. An accurate bank reconciliation statement allows investors to make informed decisions. It gives companies a clear picture of their cash flows.

Reconciling bank statement format also helps identify errors affecting tax reporting. Companies may need to reconcile the bank statements before paying too much or too little taxes.

There are several factors for the importance of a bank reconciliation statement. The Bank reconciliation statement format provides a mechanism of internal control over cash flow.

Additionally, bank reconciliation statement brings into focus the irregularities while dealing with cash. The bank reconciliation statements format also reflects the actual position in terms of bank balance.

Bank reconciliation statement format PDF helps to safeguard against fraud in recording banking transactions. They also help to detect any mistakes in cash books and bank statements. They explain any delay in the collection of cheques and identify valid transactions recorded by one party but not the other.

How Do You Create A Bank Reconciliation Statement Format In PDF?

A Bank reconciliation statement is straightforward to create. The steps involved in creating a bank reconciliation statement are as follows:-

1. Gather All Records:

The first step is reconciling your data and creating a bank reconciliation statement. The two sets of records you will need are the company’s records and your bank records.

Your bank-related information is available through online banking—for instance, a bank statement or a bank that exchanges data with your bank reconciliation accounting software.

The company records will be in your company’s ledger, known as its books. It is stored as a logbook, spreadsheet, or accounting program.

2. Check Your Ledger For Mistakes:

The next step is to check and analyse your ledger account for errors and differences. Review your ledger account and rectify errors before completing your bank reconciliation statement.

See if you must deduct bank charges like account maintenance, late payment, and transfer. If you have missed a transaction, then go ahead and deduct them from the ledger.

For instance, you posted a payment that did not reach completion. So, you amend this later. You need to check before adding it to the bank statement.

3. Compare Your Deposits:

You must differentiate between the records in the cash ledger account and the company’s bank statement during reconciliation. Next, check whether all the records in the ledger align with the bank account statement.

Apart from this, you should also check a few things. You should check that your bank statement includes all your withdrawals and deposits. If something is missing from the records, then try to re-enter it.

Lastly, you compare your books to your bank statements. It is done to ensure that every transaction’s correct accounting is made.

4. Change The Bank Statements:

You should change the bank statement balance to reflect the updated balance in the book. You can do this by subtracting outstanding cheques, adding deposits in transit, and adding or reducing bank errors.

Outstanding cheques are written and recorded in the cash account of the company but have yet to be cleared by the bank. Deposits in transit are amounts received and recorded by a business but have yet to be recorded by the respective bank.

Bank errors are differences committed by the bank during making the bank statement. It is acquired by comparing the ledger of the cash account to the bank statement.

5. Make Changes To The Cash Account:

Next, you need to adjust the cash balances of your business. This is done by subtracting monthly charges or adding interest and overdraft fees while creating a bank reconciliation statement. The charges you need to consider are bank charges reduced by the bank to process the business’s checking account.

Non-sufficient funds arise when you request a withdrawal from your bank and your account does not have funds to pay it. Cash account mistakes are indifferent amounts you omit or enter from the records. It is done when errors or differences exist in the individual’s cash account.

6. Evaluate The Final Balances:

After adjusting the balances according to the books and bank, the corrected amounts should be matched. However, it would be best to review the bank reconciliation statement again. If they are still not equal, identify the errors and rectify them.

Once the balances are equal, the firms must produce journal entries for the changes to the balance per book. The bank reconciliation statement format PDF allows you to verify all your receipts.

It helps you avoid situations and identify entries for receipts you did not deposit. The bank reconciliation statement format PDF helps you to track receivables and receipts to evaluate final balances.

What Are The Different Types Of Bank Reconciliation Statements?

Bank reconciliation statement format is the process of verifying the bank balance in the books of account of a business. It is done by comparing them with the statement of account issued by the bank. Here, each transaction in the bank statement is compared with the cash account of the company.

It is done to check that both records match. Periodic bank reconciliation is vital to overcome calculation mistakes and omitted payments. It will also help to identify any theft and fraud and track the payments and receivables of accounts. The different types of bank reconciliation statement formats are mentioned below:-

Vendor Reconciliation:

A vendor reconciliation statement format ensures that the entries are passed into the vendor’s books. It is done to align with the accounting entries passed in our books.

Customer Reconciliation:

A customer reconciliation statement is prepared to check whether the customer’s books align with the bank. Customer reconciliation is quite similar to vendor reconciliation. Most customers consider reconciliation as a priority over vendor reconciliation. It is because money is receivable from customers. So, it is better to reconcile so that payments are not pending due to issues regarding accounting entries.

Credit Card Reconciliation:

In credit card reconciliation, an organisation matches the credit card receipts with the state of the credit card issued by the bank. It helps financial institutions to ensure that the amount billed in the credit card statement aligns with the original payments. If the credit card company makes an error, it should be analyzed and rectified.

Inter-Company Reconciliation:

Inter-company reconciliation is prepared by group companies like subsidiaries and holdings. In this case, they have to prepare consolidated books of accounts. These books are necessary to eliminate inter-company transactions such as a sale from the holding company to its subsidiary. The books of accounts must be reconciled before the consolidation process is completed.

Cash Reconciliation:

It is the process of verifying if the amount of cash in the cash register equals the actual cash on hand. The actual cash on hand is seen at the close of the business.

Business-Specific Reconciliation:

Every business requires preparing other reconciliations based on specific requirements. The cost of goods reconciliation is a good example. A business that has any form of inventory should prepare this reconciliation statement. It is done to match the balance on the cost of sales of goods calculated.

It is calculated using two methods. The cost of goods sold is equal to sales, reducing the profit. The cost of goods sold is opening stock, with purchases reducing the closing stock—the two methods of calculation lead to an equal amount. If not, records should be analyzed to determine the reasons for the difference.

Features Of Vyapar’s Bank Reconciliation Statement Format PDF

Saves Time And Efforts:

Using Vyapar’s customized bank reconciliation statement format in PDF helps to save time for your company. Vyapar small business accounting software provides access to various bank reconciliation statement formats with fully customizable templates. Users do not need to create a format from scratch every time.

Creating a bank reconciliation statement manually is time-consuming and prone to error. Using the accounting app, you can focus on other important aspects of your business needs. Using Vyapar’s format, you can avoid beginning over each time you require a statement.

Vyapar provides ready-made bank reconciliation statement formats to fill in the reconciliation details. You can also edit and save the bank reconciliation statement format in PDF to update the information about your company. The customized format can be saved and used as and when required to save time effortlessly.

Easy To Use For All:

Businesses can easily use the bank reconciliation statement without complicated methods. They can do this by using Vyapar’s bank reconciliation statement format. You can make the reconciliation format by downloading a free copy.

Users can also choose the template that best fits the company’s needs. So, fill in the necessary details in the bank reconciliation statement format. It is easy to use the format in the Vyapar software. It is simple to update the information about your company in the customisable template.

With the help of Vyapar’s free bank reconciliation statement format PDF, anyone can easily create a unique statement that fits your business needs. Vyapar software is easy to use and convenient for business owners. After creating the bank reconciliation statement format in PDF, users can view, download, and save the format.

Minimises Manual Errors:

One of the main benefits of using our bank reconciliation statement format PDF is that it minimises errors. Errors may occur when you manually enter every detail in the reconciliation statement. Using bank reconciliation statement format in PDF helps to prevent manual mistakes.

By eliminating errors, you can provide a seamless experience to customers. It will help improve your brand image as customers will feel satisfied. Further, it can help eliminate possible disputes too.

The automation feature on the Vyapar free inventory management software increases effectiveness and minimises human error. Following Vyapar’s format lets you focus on the crucial errors that demand your attention.

Fully Customisable Format:

Vyapar’s professional bank reconciliation statement format is customisable and enhances the brand’s reputation. The format can be customised easily and is convenient for the users.

Building an image using a professional bank reconciliation format is beneficial and easy. A customised format created effortlessly can help you stand out from competitors and portray a professional brand image.

Vyapar’s bank reconciliation statement format can incorporate your company’s logo, font, and style. Using the bank reconciliation statement format of the Vyapar app builds brand reputation.

Save Or Print On Your Device:

You can send your bank reconciliation statement format PDF electronically instead of physically. It can be done by using the Vyapar app. You can fill in the details after printing a digital copy. It only takes a few minutes to be printed.

The user can download the bank reconciliation statement format in PDF for business use. This feature on the Vyapar software is effective and efficient. It makes you appear more professional, which increases your brand image and worth.

You can also customise the bank reconciliation statement format to suit your unique business needs. You can also print the customised reconciliation format and manually enter the data. You can print bank reconciliation statement format in PDF with both standard and thermal printers.

Manage Bank Accounts:

Using the Vyapar app, you can easily manage bank accounts. You can quickly add, manage, and track online and offline business payments. You can quickly enter information into the free billing and reconciliation software. It is done regardless of whether your revenue comes from banks or e-wallets.

You can send or receive money through bank accounts or conduct bank-to-bank transfers; it is done for seamless and effective cash flow management. Vyapar’s bank reconciliation statement format PDF is efficient with all the cash inflows and outflows.

To use the bank accounts feature, you must link the Vyapar software to your business account. Using the Vyapar software, it is easy to manage credit cards and loan accounts. You can use it to deposit or withdraw money from your bank account.

Frequently Asked Questions (FAQs’)

A bank reconciliation statement account is not considered a ledger account. There are no debit or credit sides like in a ledger account.

A bank reconciliation statement compares the transactions from financial records with records on a bank statement. Companies can identify and rectify the source of errors in case of differences.

For example, say XYZ Ltd. recorded a closing balance of Rs 480,000 on its records. However, the bank statement shows a closing balance of Rs 520,000. After carefully analysing, XYZ Ltd. found that a vendor’s check for Rs 20,000 had yet to be presented to the bank.

Also, an Rs 20,000 deposit made by a client should have been included in the company’s records. So, XYZ Ltd. adjusted its records by stating the check as outstanding and adding the omitted deposit.

A bank reconciliation statement should at least be prepared monthly. It should be prepared to identify and rectify errors quickly. They can also be prepared as frequently as the bank statements are generated. However, it should at least be performed monthly.

Infrequent reconciliation statements make it difficult to address problems when they arise. It is because the required information may be limited. Also, when the transactions are not recorded accurately and when bank charges apply, it causes differences in the account’s records. So, this is a common problem with bank reconciliation statements.

It is necessary to prepare a bank reconciliation statement for a company. It is because it helps businesses to identify errors in transactions recorded by a business. It also helps to identify the differences between the bank statement and the accounting records. A bank reconciliation statement helps businesses to identify potential risks to safeguard the business against losses.

Preparing a bank reconciliation statement format in PDF is the process of identifying the transactions individually. It then matches it with the bank statement so that the closing balance of the bank matches the bank statement. Suitable corrections are done in the books to match the transactions that are not matched.

A bank reconciliation PDF is a document that outlines the process of comparing and reconciling a company’s bank statement with its internal financial records. It includes details such as:

1. Beginning and ending balances of the bank statement and the company’s records.

2. Deposits in transit and outstanding checks that have not cleared the bank.

3. Bank fees, interest, and other adjustments.

4. Reconciliation adjustments made to ensure the bank statement balance matches the company’s records.

This PDF serves as a formal record of the reconciliation process, ensuring accuracy and transparency in financial reporting

Related Posts: