Total Creditors Account Format

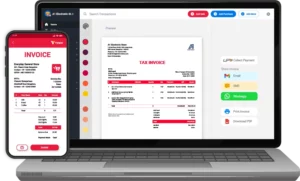

Use accounting software to manage and record your creditor’s data in your financial statements. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access total creditors account formats for free.

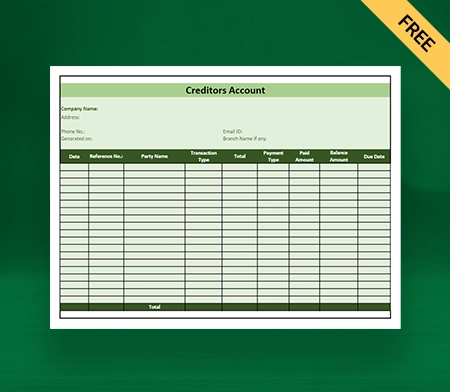

Download Total Creditors Account Format in Excel

What is the Total Creditors Account Format?

The Total Creditors Account Format is a document that includes information about the Creditors’ entire liabilities. Creditors are also referred to as commodities merchants and money lenders. These commodities and sums are categorized as current liabilities on the balance sheet.

The Total Creditors Account should be reviewed regularly to ensure that no improper credits have been made to anyone. There can never be a negative balance, and all liabilities must be reflected.

Benefits of Using the Total Creditors Account Format

Here are the following benefits of using the total creditors account format:

1: It Gives a Simplified Presentation

When simplifying the presentation of your company’s payables, giving your firm a Total Creditors Account Format might give you an advantage over your competitors. It alleviates the burden of keeping track of each creditor’s list and managing your account simultaneously.

Your customers will be able to have a quick and easy knowledge of the entire payable balance if you provide them with a streamlined presentation. It will also enable stakeholders to grasp the company’s financial status.

2: Enhanced Decision-Making

Regarding critical decision-making in essential business areas, such as budgeting, forecasting, and allocating resources more precisely, there is no better option than using the total creditors account format for your business.

It combines all your debts into one account, gives useful information, and helps you make smart financial choices. Keeping track and managing payment dates becomes more straightforward using the Total Creditors Account Format. It makes sure that decisions about payment priorities can be made quickly.

3: Improve Debts Tracking

When your business uses the Total Creditors Account Format, tracking and monitoring your due payment dates becomes much easier, enabling timely payments and reducing the risk of late fees or penalties.

The Total Creditors Account Format offers a centralised view of all outstanding payables, simplifying the tracking process and paving the way for more effective management of payment responsibilities.

4: Better Auditing

Auditors can more readily verify payable balances when all Creditors are rolled into one central account. Because of this, fewer individual accounts need to be evaluated while reconciling supplier statements.

The consolidated account makes it easy for auditors to check the status of all receivables at once. This simplified method reduces auditing time and improves the accuracy with which a company’s financial obligations to its Creditors are determined.

5: Ensures Enhanced Reporting

The Total Creditors Account Format makes reporting easier by placing all Creditors into one account. It makes it easier to report, as instead of showing and keeping track of separate accounts for each creditor, financial statements can easily include individual Creditors who owed the respective sum to your company.

This streamlined method saves time and effort when making reports for stakeholders like shareholders, investors, or regulatory bodies. It gives a clear and straightforward picture of the company’s debts, making it possible for the right people to get accurate and timely financial information.

6: Offers Simplified Reconciliation

The Total Creditors Account Format streamlines and improves the efficiency of your reconciliation process. The consolidated format decreases the number of accounts that must be reconciled by matching and reconciling individual accounts for each creditor. It streamlines the work, saves time, and reduces the possibility of mistakes or discrepancies.

As auditors or finance employees focus on reconciling the total payable amount and verifying that it fits with supplier statements and other supporting documents, reconciliation becomes easier. This simplification increases the accuracy and efficiency of the reconciliation procedure.

7: Gives a Comprehensive Overview

The Total Creditors Account Format offers a comprehensive perspective of a company’s payables. The consolidated view provides an all-encompassing comprehension of the overall payable balance, enabling stakeholders to quickly understand the company’s obligations.

It gives an all-encompassing picture of the company’s financial status concerning Debtors and paves the way for more informed decision-making and more efficient administration of payables. You can easily create and maintain your Total Creditors Account using an advanced online accounting software system.

8: Helps With Effective Budgeting

Consolidated data in the Total Creditors Account Format aids in forecasting future payment commitments and liabilities. It enables firms to correctly forecast their cash flow, allocate resources, and create realistic budget targets. It reduces the hassle of keeping accounts of separate clients.

Understanding the overall payable balance allows management to make informed expenditure decisions, negotiate better terms with suppliers, and optimize financial strategies to ensure the company’s budget corresponds with its due commitments.

Best Practices for Updating and Maintaining the Total Creditors Account

Here are the following best practices your maintain your Total Creditors Account Format:

1: Regularly Update The Account

Create a timetable to ensure that the Total Creditors Account is updated at predetermined intervals, such as once per week or once per month. It guarantees that the information is always correct and up to date, including the current outstanding balances, payment history, and any changes in creditor details that may have occurred.

2: Reconcile Creditors Statement

Look at the details while preparing Total Creditors Account and the statements from the Creditors. Reconciliation helps find any problems, like wrong amounts or payments that should have been included. Fix any mistakes right away if you want to keep correct records.

3: Organise The Supporting Document

Maintained an orderly and straightforward system for storing and retrieving all supporting documentation, including but not limited to invoices, purchase orders, and payment receipts. When the account is updated, this enables the quick reference and verification of previous transactions.

4: Implement A Backup And Data Recovery System

Setting up a backup system for the overall Total Creditors Account is crucial in case of data loss. Make frequent secure copies of your account data. In addition, you should prepare for data recovery in case of disaster or technical difficulties. You can easily create the Backup of your data using advanced billing software like Vyapar, which is cost-effective and highly secure for your business.

5: Maintain A Clear Communication Channel

Create efficient communication channels with the Creditors to resolve any questions or issues they may have. Maintain accurate contact information for them in the account format and quickly respond to any questions or requests for information that may be raised.

6: Analyse Payment Pattern

Utilize the Total Creditors Account information to determine the payment methods and identify any potential problems. Look for patterns, like payments that are always late or sudden changes in how people pay. If you notice these trends early, you can deal with any underlying problems and maintain good relationships with Creditors.

7: Utilise Financial Analysis Tools

Consider using financial analysis tools or software that can provide insights into the performance of Creditors. These tools can enhance decision-making when negotiating terms or developing financial plans by helping to evaluate payment trends, the creditworthiness of Creditors, and payment trends.

8: Train And Educate The Relevant Staff

If more than one person handles the management of the total creditor’s account, you must ensure that you provide adequate training to each person on the account’s structure and how to maintain it. It is essential to provide standards and training sessions to foster consistency, accuracy, and an understanding of the relevance of the account.

Creditors Account Format Vs Debtors Account Format

- Total Creditors Account shows the company’s obligation to pay its suppliers or lenders. In contrast, Total Debtors Account shows the company’s ability to collect from those who owe it money, such as customers or borrowers.

- Total Creditors Account frequently appears in the liability portion of the balance sheet. In comparison, the Total Debtors Account is typically located in the asset section.

- The Total Creditors Account balance shows the total amount the entity owes from its respective Creditors. On the other side, the Total Debtors Account shows the total amount owed by the Debtors from the company itself.

- Total Creditors Account assists your business platform in tracking the amount owed to external parties, such as suppliers or financiers. Total Debtors Account assists in tracking the amount owed by external parties, such as customers or borrowers.

- Total Creditors Account keeps track of purchases, payments, and other transactions that involve money due to outside parties. On the other hand, Total Debtors Account keep track of sales, receipts, and other transactions involving money owed by outside parties.

Features that Make Vyapar Creditors Account Formats Best For Business

1: Send Payment Reminder To Get Paid Quickly!

Our advanced software enables you to get paid on time by allowing you to send reminders for payment to your clients using the app’s reminder feature. Using WhatsApp and e-mail will reduce the probability of payment default by reminding them of the entire amount due and the due date. We send reminders to customers to ensure they remember to pay. This allows you to maintain cash flow in your company and prevent unneeded delays.

Vyapar accounting software includes a variety of offline/online payment methods to aid in prompt payment from your clients. Vyapar offers payment options such as cash, net banking, credit cards, debit cards, e-wallets, NEFT, RTGS, UPI, and QR codes. Customers can pay conveniently using various cash and online payment methods. It guarantees that your consumers can pay using the method of choice.

Since it automates the process, it has emerged as the top option for small and medium-sized firms looking to sustain cash flow. Together, the app’s functions ensure that the dues don’t affect the company’s cash flow. You can generate reports to modify your business strategy per the available cash flow.

2: Filing GST Get Simpler And Faster

Every month, many business owners across India invest huge amounts of time and effort to file GST. Its purpose is to verify that they follow tax regulations. They must, after all, maintain track of their monthly invoices, expenses, and accounting information. In addition, manually enter them while filing GST returns. Additionally, they must keep themselves informed about the creditor’s accounts to keep their liquidity steady.

Vyapar accounting software solves multiple difficulties single-handedly by assisting in creating specialised GSTR reports and saving time through automation. Vyapar can let you directly prepare reports such as GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9 from the app. It is an all-in-one software that instantly lets you track total Debtors’ and Creditors’ accounts.

Use the information you saved when creating and maintaining your creditor’s account without putting much effort. Every business owner saves time by using professional accounting software to prepare GST reports. They may rely on automation to accomplish all accounting chores correctly.

3: Create Multiple Data Backup

The “auto-backup” feature of the Vyapar accounting software in India offers a hassle-free backup solution. Once you turn on this mode in our mobile and Windows app, the system quickly generates a daily automated backup, making it simpler for you to get a backup of all your data and ensure you don’t lose anything.

Most businesses in India utilize this free accounting software to complete tasks quickly and perform their business operations without worrying about compromising your data. The software contains an encryption technology that enables it to keep the owner’s access to the data to increase further security.

Your business data is secure for future use because no one outside the Vyapar team can access it. You can create an account on Vyapar that allows you and your trusted employees to access it through your created e-mail address and password. Use our professional tools and stay one step ahead of your business competitors.

4: Add Multiple Bank Accounts

Vyapar inventory management software offers your clients various online and offline payment options to steady their cash flow. The tasks get quicker and simpler if they choose our free billing and invoicing software that is simple to use. You may easily enter data into the free mobile software, regardless of whether your revenue comes from banks or e-wallets.

For seamless cash flow management, it allows you to send and receive money via bank accounts and conduct bank-to-bank transfers. With all of the cash-ins and cash-outs using the Vyapar all-in-one software, it is perfect for businesses. Our tool offers quick loan account management and cheque management.

To use the bank accounts feature in the app, you must add the business accounts in your bank with our GST Accounting Software. Using the Vyapar app, managing credit cards, OD, and loan accounts is simple. You can efficiently perform bank-to-cash and cash-to-bank transfers with our accounting software.

5: Manage Your Receivables And Payables

Our advanced accounting software lets you track bills receivable and payables by party. You may keep track of the money you “have to receive” and the money you “need to pay” in the mobile/windows software by using the business dashboard in the GST mobile app. It is completely free and requires no additional cost.

Whoever failed to repay you is simple to find and send the payment reminders to them. To ensure prompt payment, you can create payment reminders. Any party can receive free payment reminders via e-mail, SMS, and WhatsApp. You can offer various online payment alternatives to collect payments conveniently.

Additionally, it will enable you to save time for daily duties. You may save time by sending payment reminders to your clients at once using the bulk payment reminder option. It improves your business cash flow, and its features allow you to perform multiple business operations.

6: Online/Offline Software

When there is poor internet access, you do not need to halt your business operations, as our accounting software offers features that allow you to keep your business operations in steady mode. The offline accounting software is most suited for India’s remote regions because it will enable you to collect payment from Creditors using cash and eWallets without needing an active internet connection.

You may generate due payment notifications for your clients to ensure they get all the payment dates. The Vyapar app’s online and offline features are useful in rural, hilly, and areas where network and connectivity problems are frequently recurring.

Your business appreciates the convenience of the app features since you get various use tools with our all-in-one software. You can manage your inventory, create bills and invoices, and manage your receivables and payables anywhere across India. Vyapar is easy-to-use software and requires no technical expertise.

Frequently Asked Questions (FAQs’)

The Total Creditors Account Format is a type of financial statement that lists everything a company still owes to its Creditors. It gives your business essential details such as who the Creditors are, the terms and conditions of the debt, how much they owe from your business, etc.

The Total Creditors Account Format assists a company in keeping track of outstanding debts and obligations. It gives a comprehensive view of the company’s financial liabilities, which is essential for making informed financial decisions and effectively managing cash flow.

The format for the Total Creditors Account includes details such as the names of the Creditors, the amounts owed to each creditor, the due dates of the debts, and any other pertinent terms or conditions related to the outstanding obligations.

The Total Creditors Account Format typically lists the outstanding debts in an organized sequence, such as alphabetically or by the amount owed. It displays the outstanding amounts, due dates, and other relevant information in separate columns.

Our Vyapar software makes it possible to customise the format to fit any given business’s requirements better. By adding columns or categories for payment status or other pertinent information, the company can better manage its outstanding debts.

A company mainly uses the Total Creditors Account Format for its own reasons. It helps the management team understand the company’s financial responsibilities and make intelligent choices about which bills to pay first and how to deal with debt.

While businesses typically use the Total Creditors Account Format internally, they can utilize specific versions or summaries for external reporting, including financial statements or reports provided to lenders, investors, or regulatory agencies.

The Total Creditors Account Format helps estimate future cash flow, despite its primary focus on current outstanding debts. Businesses can forecast future cash outflows by assessing payment terms, due dates, and other pertinent data.