Sale Bill Format in Excel, PDF, Word

Get 200+ professional sales bill templates & more! Vyapar generates invoices and quotes in seconds, monitors business health, and streamlines bookkeeping.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

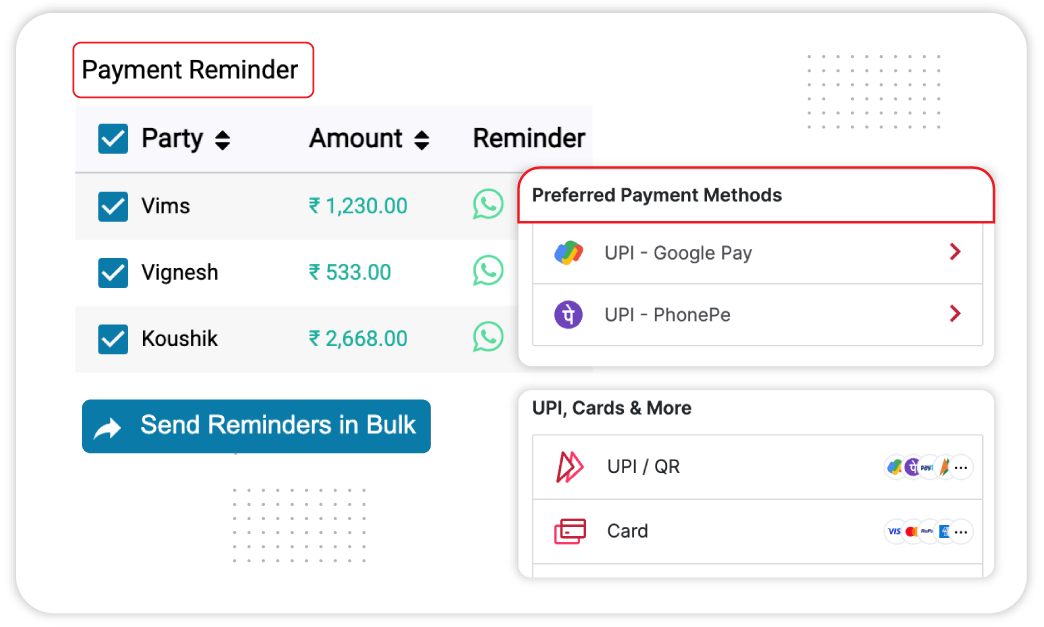

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Sale Invoice Format Vs Vyapar App

Features

Format

200+ Professional Formats

GST Reports

Auto Calculation

Real-Time Updates

Accounting Integration

Auto Backup

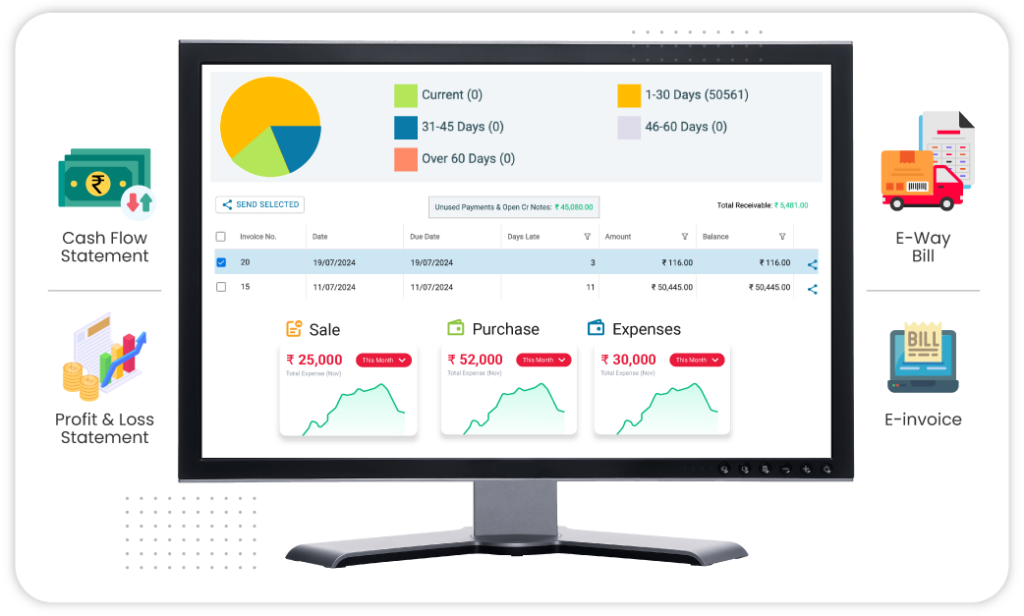

Real-Time Business Insights

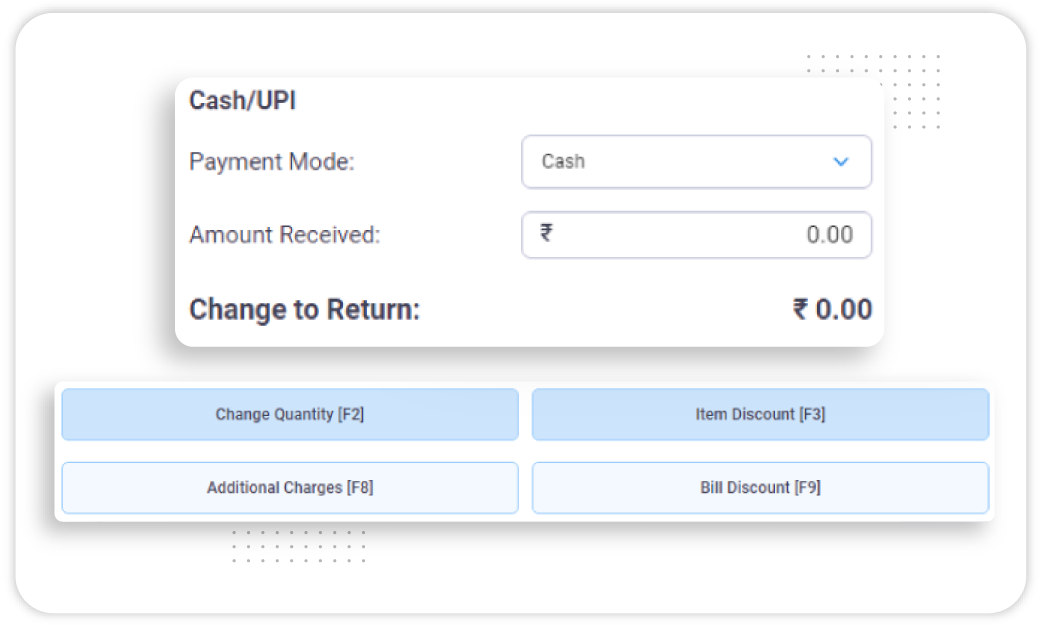

Multiple Payment Mode

Free Support and Assistance

Instant Data Sync

Download Free Professional Sale Bill Format In Word, Pdf, Excel

Download professional free sales bill format, and make customization according to your requirements at zero cost.

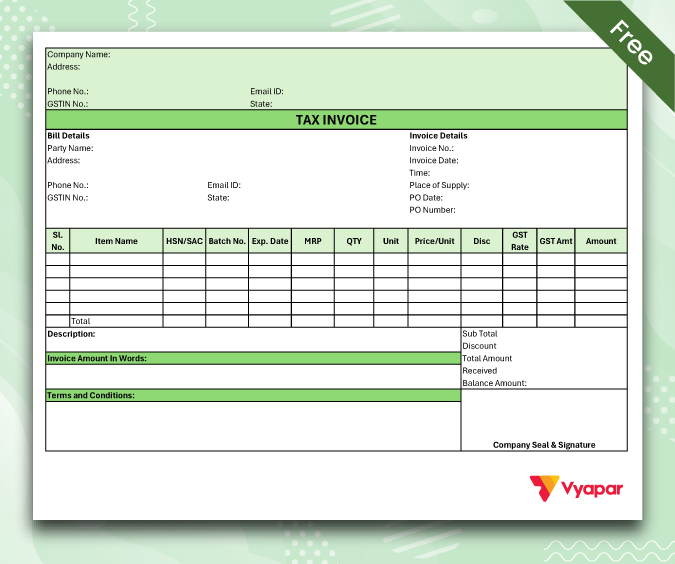

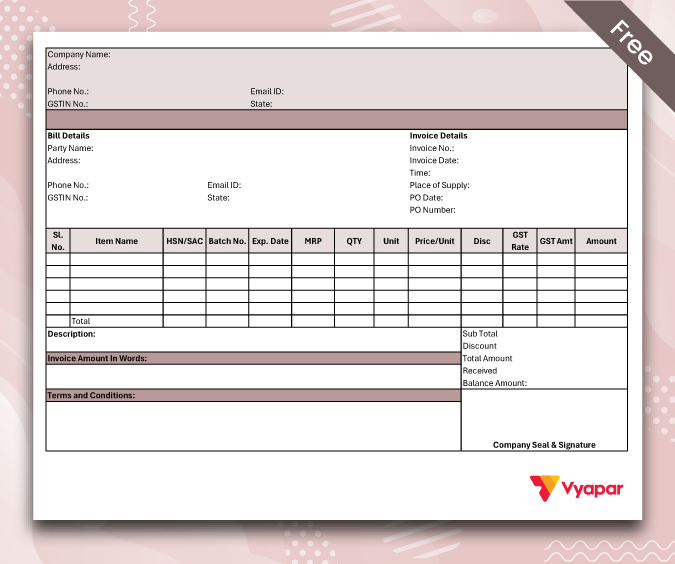

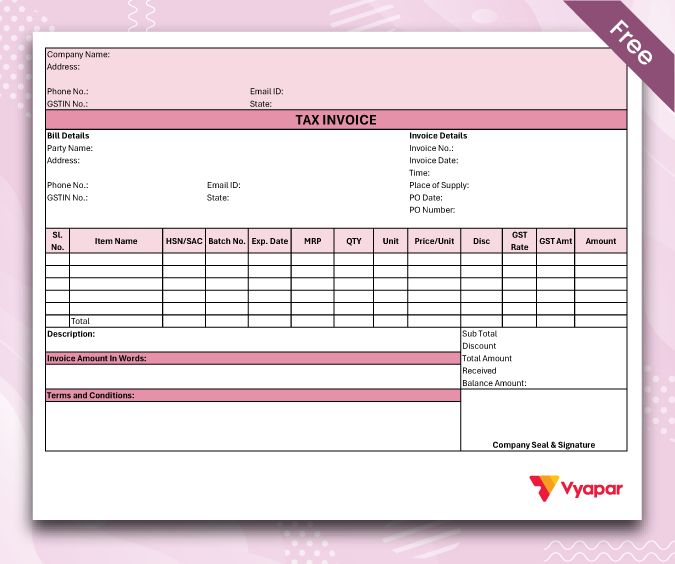

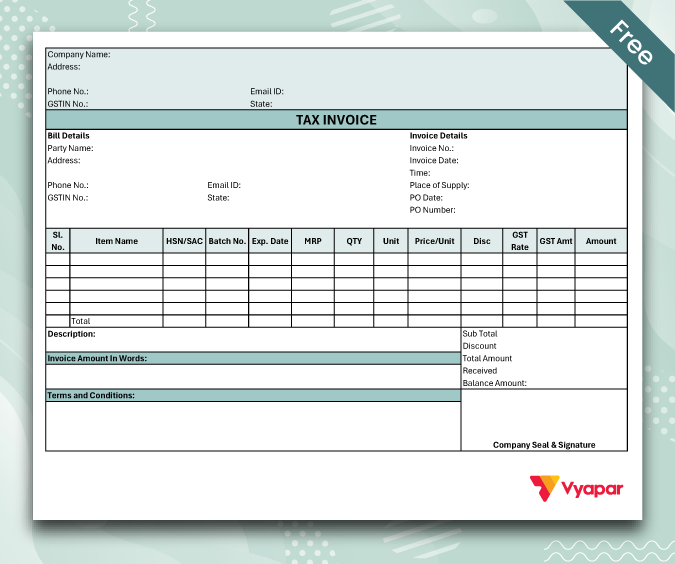

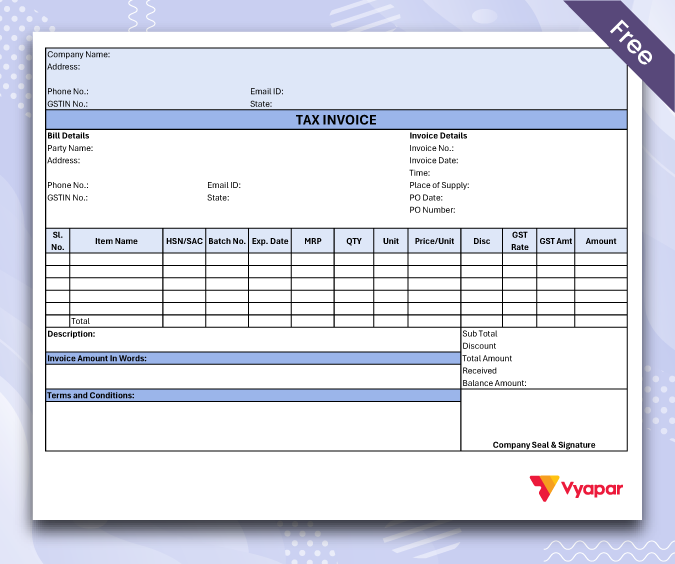

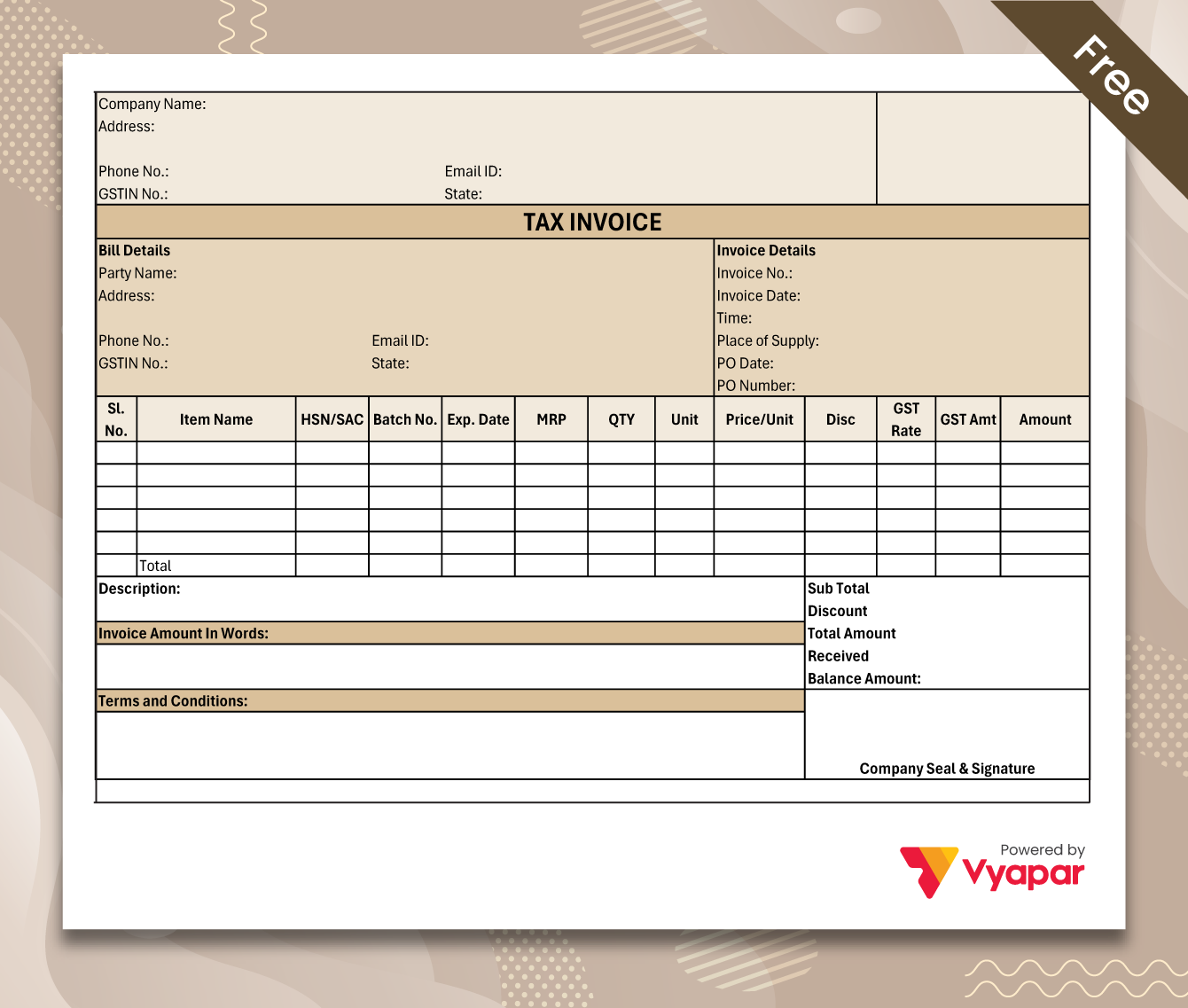

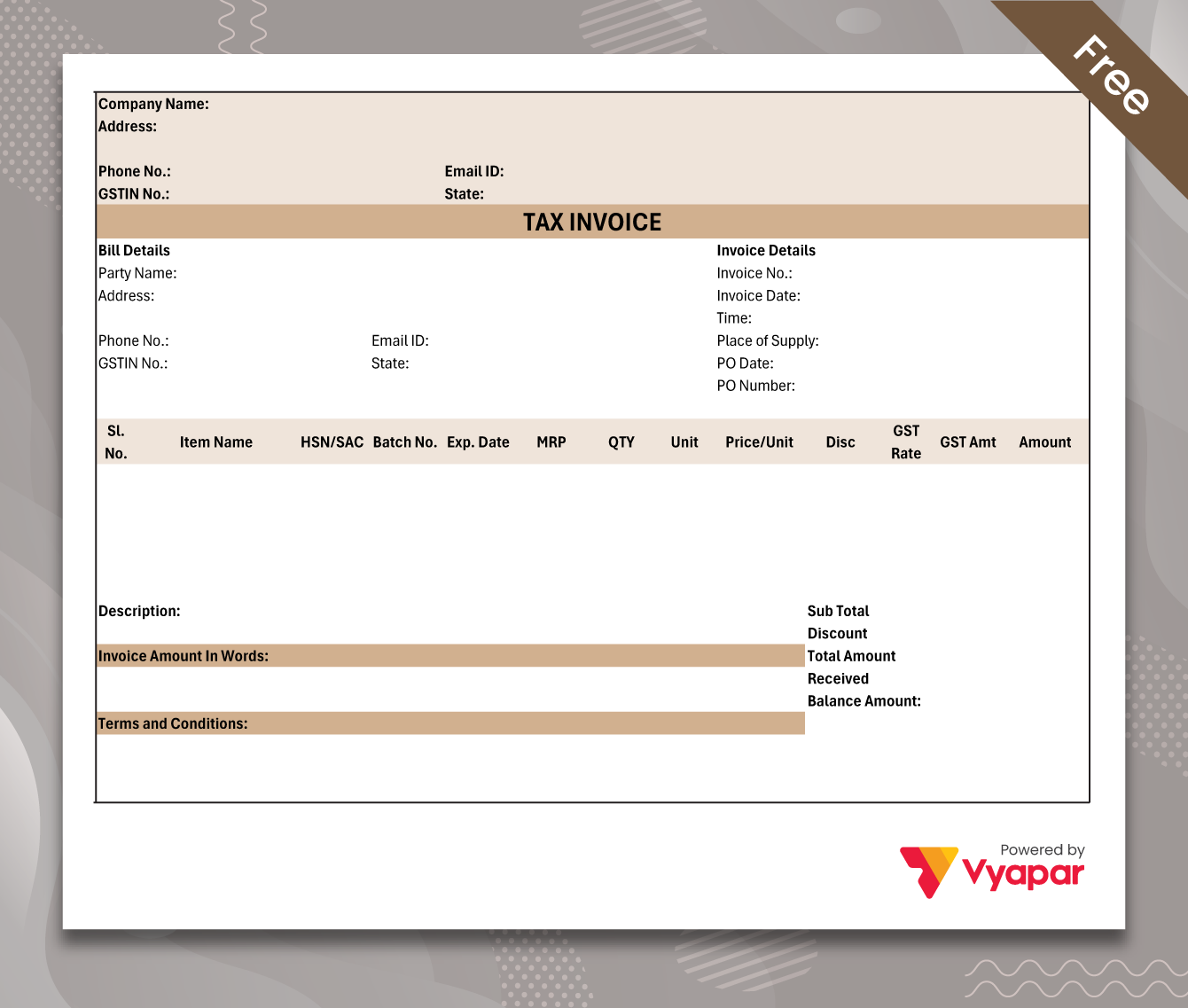

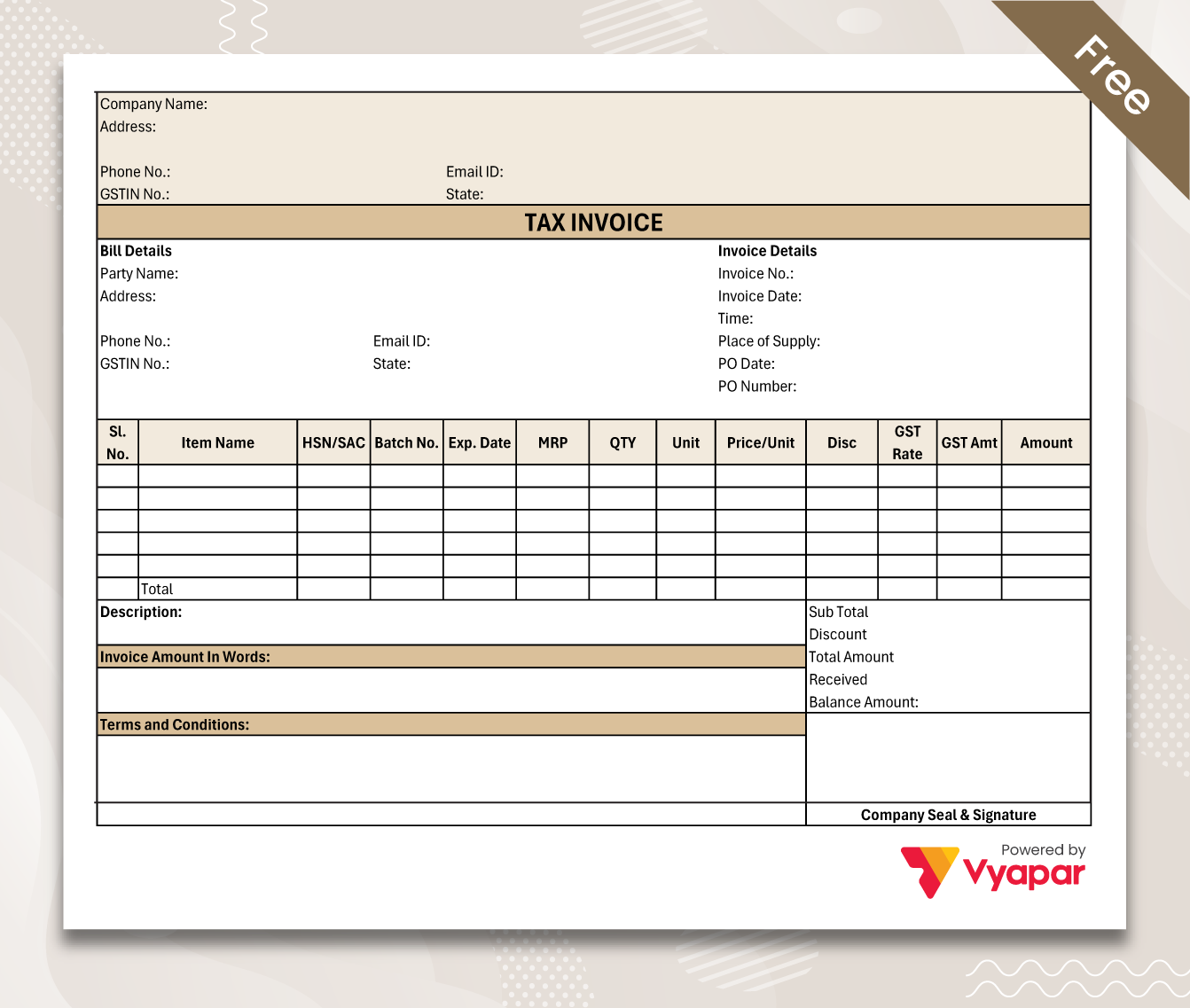

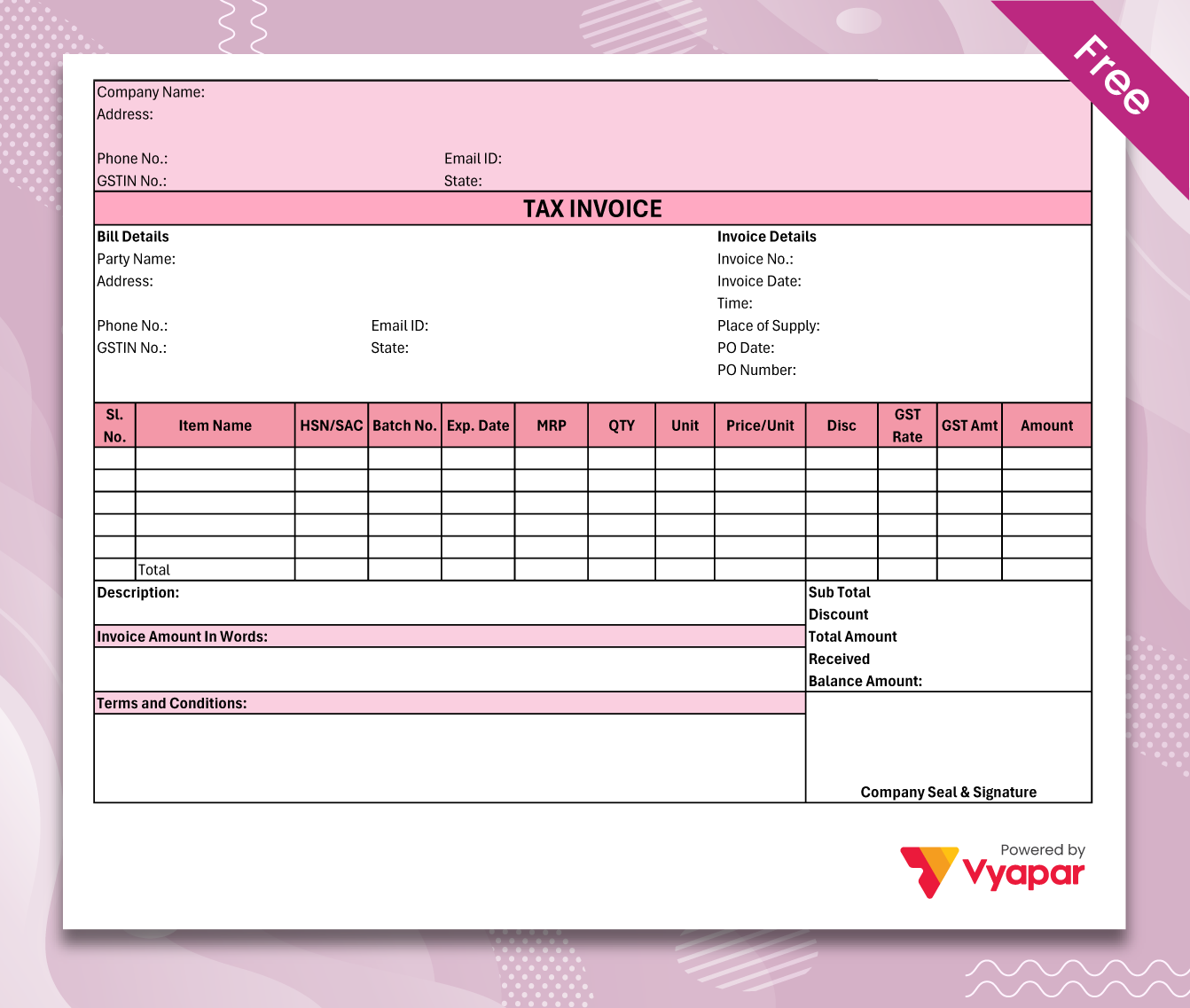

Sale Invoice Format – 01

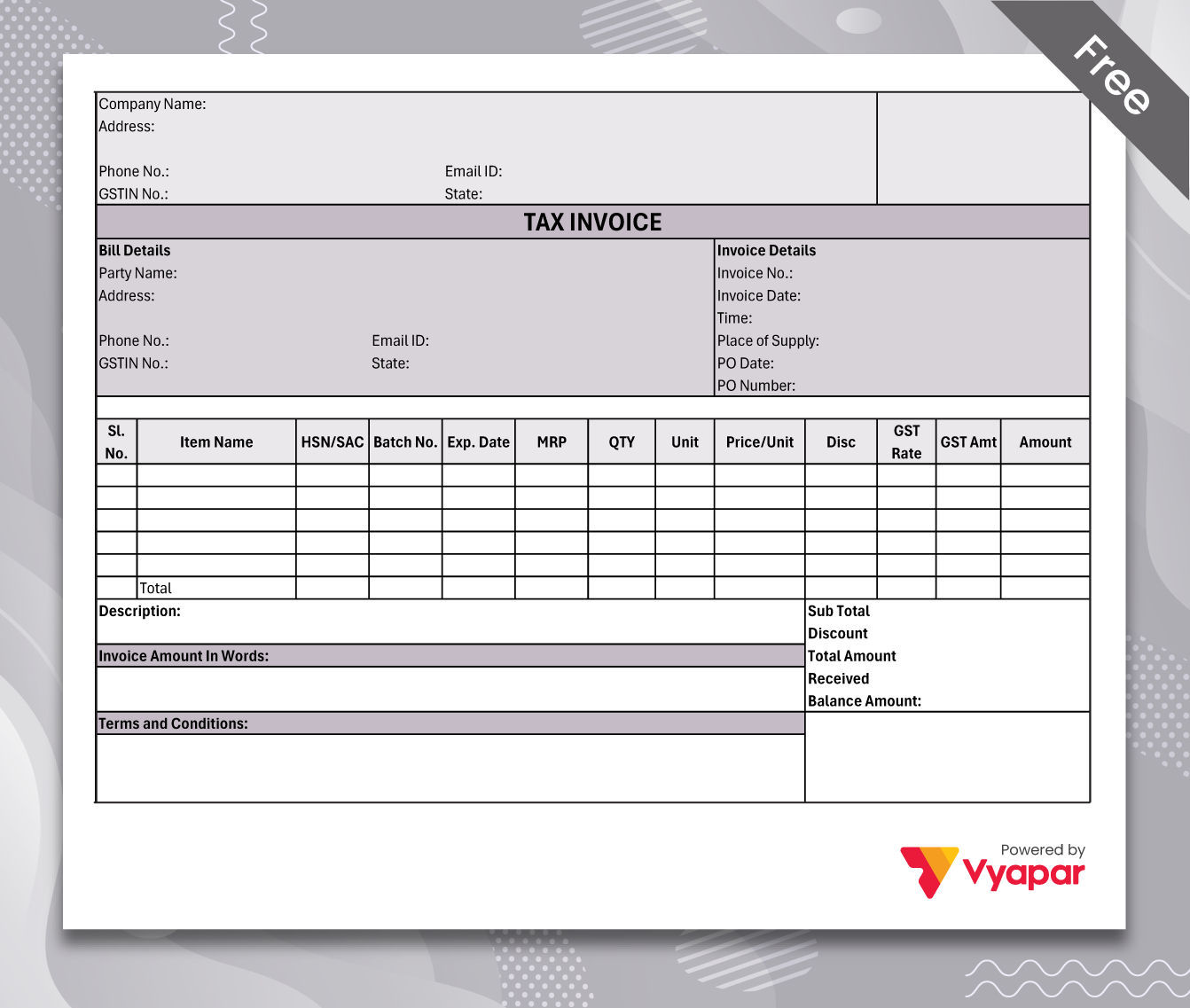

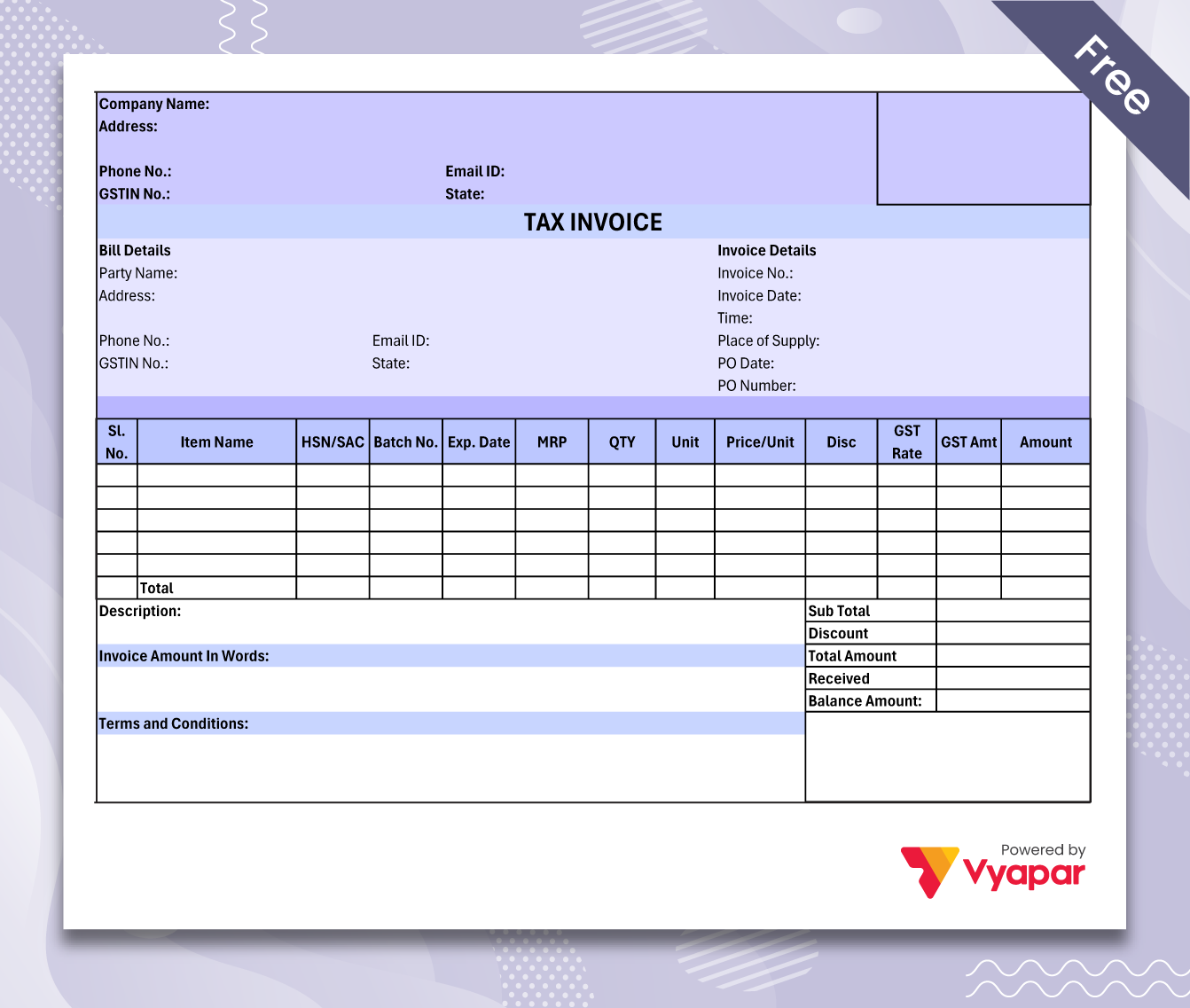

Sale Invoice Format – 02

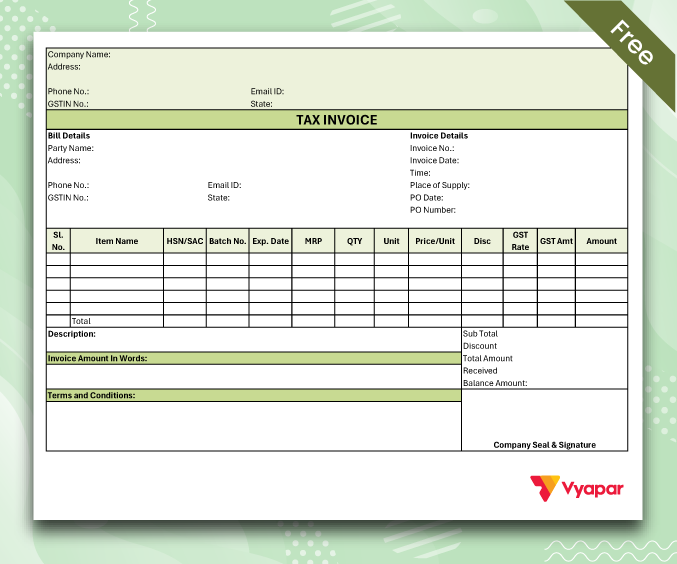

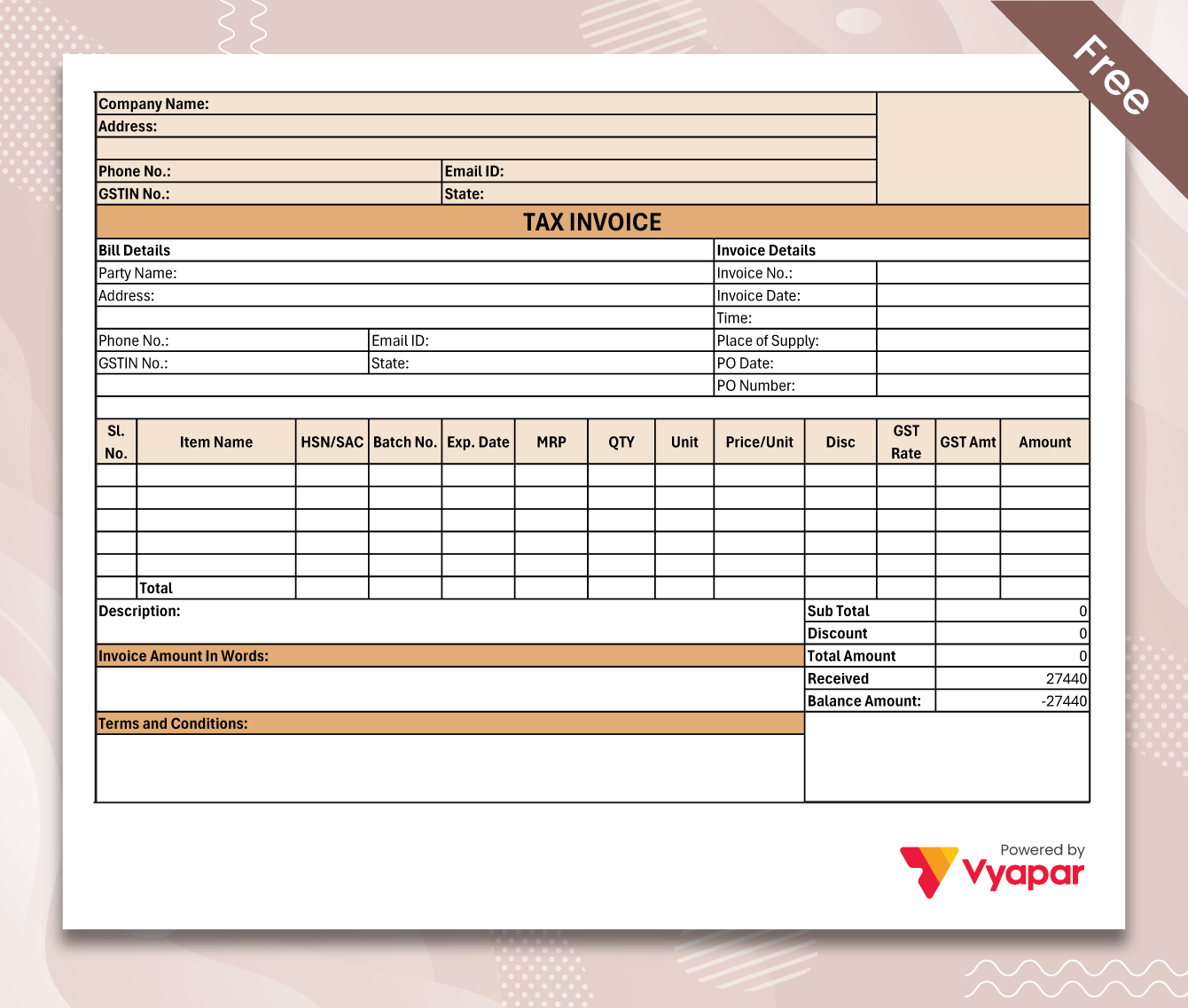

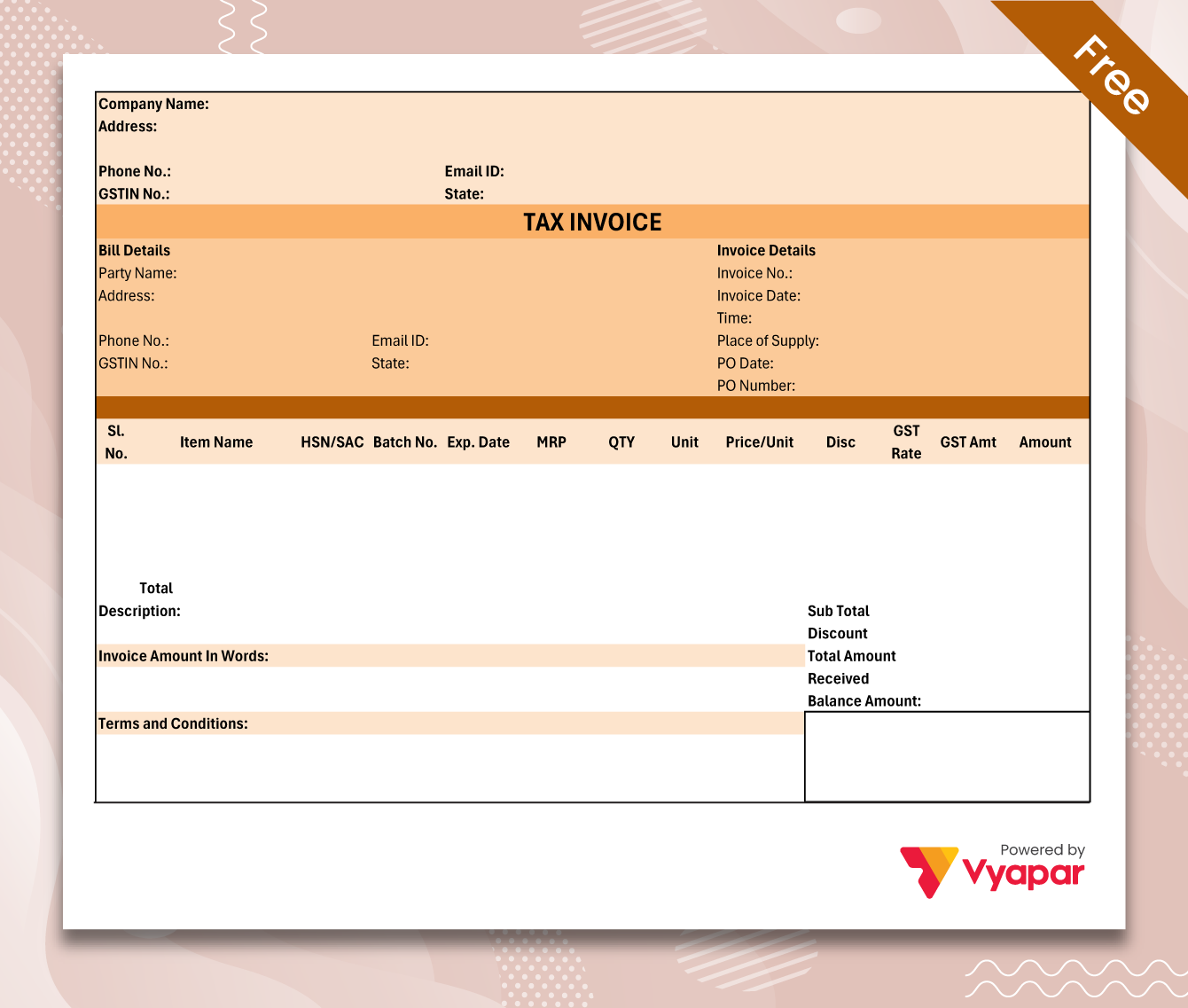

Sale Invoice Format – 03

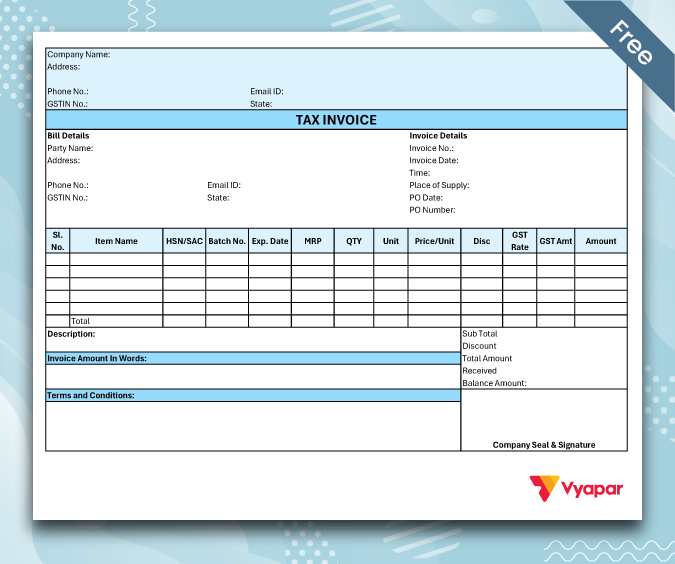

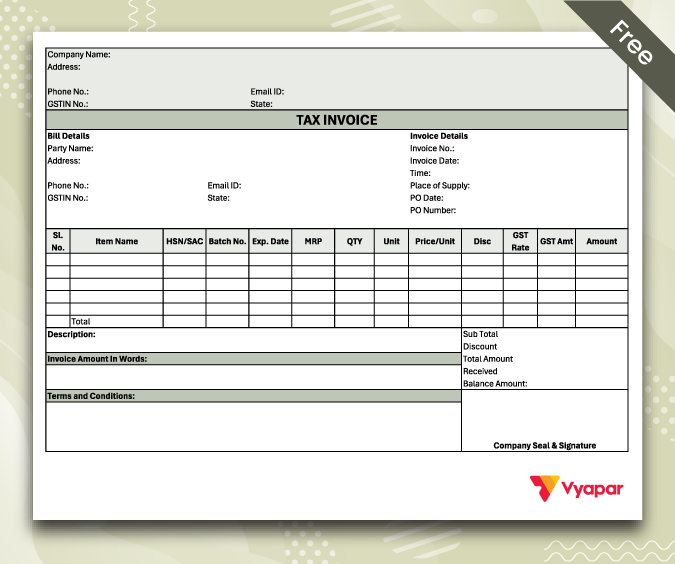

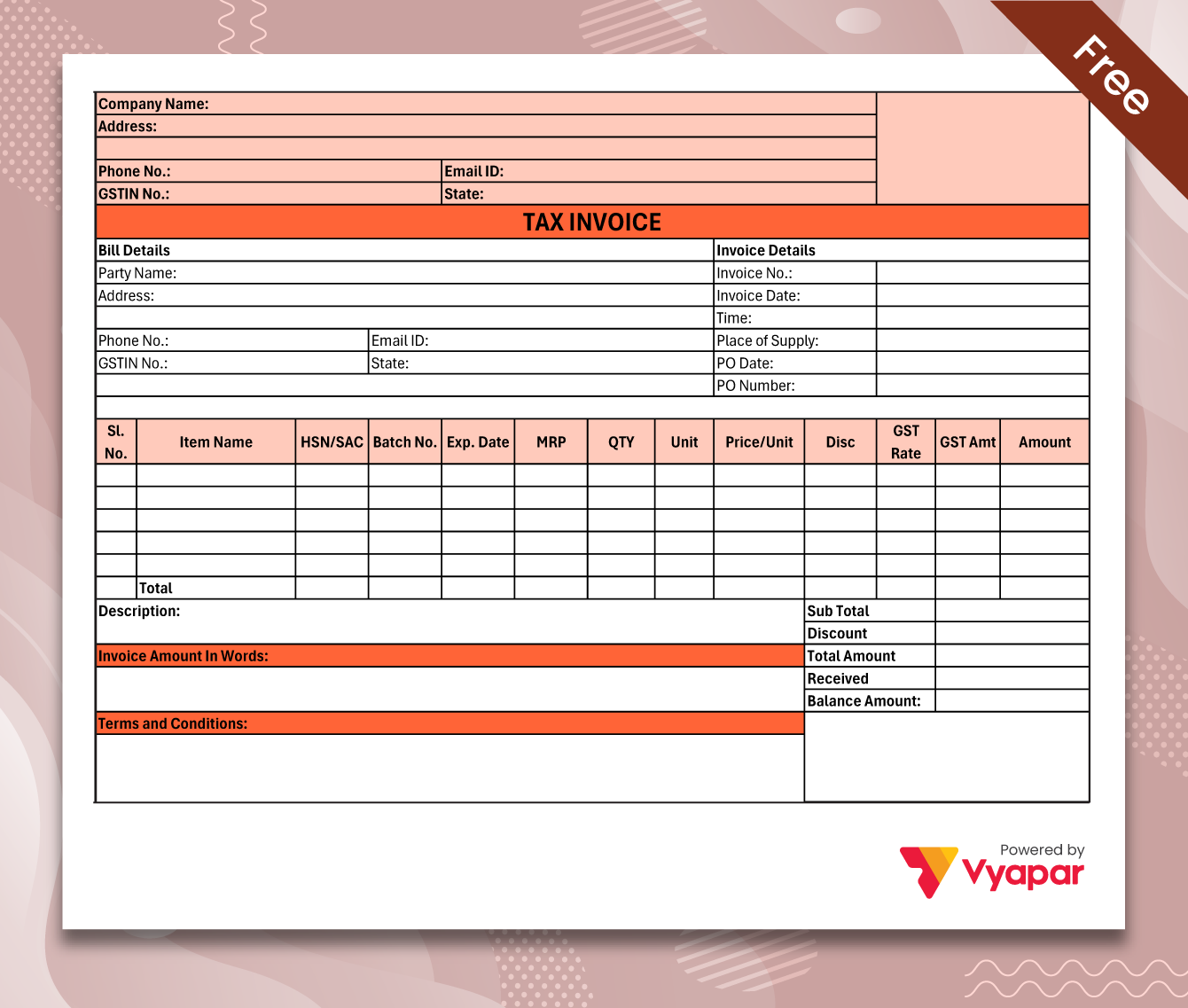

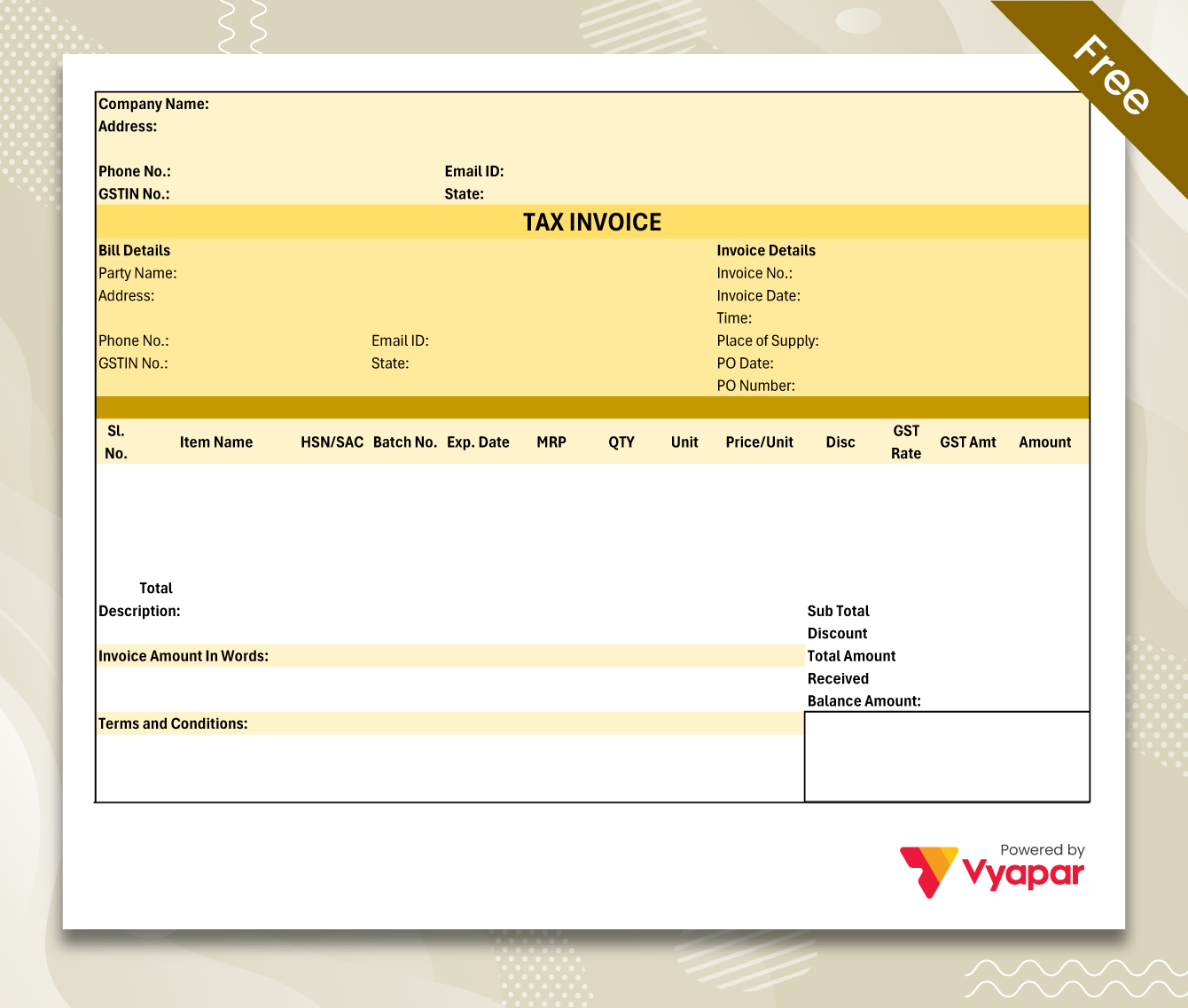

Sale Invoice Format – 04

Sale Invoice Format – 05

Sale Invoice Format – 06

Sale Invoice Format – 07

Sale Invoice Format – 08

Sale Invoice Format – 09

Sale Invoice Format – 10

Sale Invoice Format – 11

Sale Invoice Format – 12

Sale Invoice Format – 13

Sale Invoice Format – 14

Sale Invoice Format – 15

Sale Bill Format – 16

Sale Bill Format – 17

Sale Bill Format – 18

Get 100+ Sales Invoice Themes to Customize. Try it Vyapar for FREE!

What is a Sale Invoice?

A sales invoice, also known as a sales bill, is a document issued by a seller to a buyer, outlining the goods or services sold, quantities, prices, total amount due, and payment terms, serving as evidence of the transaction and outlining payment obligations.

What is a Sale Invoice Format?

A sales invoice format in Excel, Word, or PDF typically includes several key elements to ensure clarity and completeness. It begins with a header containing the invoice title and the seller’s business information, such as name, logo, contact details, and more. The invoice details section follows, providing a unique invoice number, billing date, and payment due date.

Next, the buyer’s information is listed, including their name, address, contact details, and GST number for GST-registered buyers. The Description of Goods or Services section outlines the items sold, specifying quantity, unit price, taxes, and applicable discounts. The Total Amount section summarizes subtotals, taxes, and any additional fees, resulting in the final amount due.

Finally, the payment terms outline conditions regarding the payment method and deadline, while the footer may include additional notes, terms, conditions, or thank-you messages. This format ensures that all necessary information is presented clearly and is easily accessible to both parties involved.

Key Components of a Sale Invoice

Definitely! Here’s a different perspective on the key components of a sales invoice:

- Invoice Title and Contact Information: Displays the invoice title along with the vendor’s information, including the business name, logo, and contact details, positioned at the top.

- Invoice Number: A unique identifier assigned to the invoice for tracking and identification purposes.

- Date: Includes both the date of issue and the payment due date.

- Buyer Details: Provides the buyer’s information, including their name, address, and contact details.

- Itemized List: Details each product or service provided, specifying the quantity, unit price, taxes, and any discounts.

- Subtotal: Represents the sum of all goods or services before taxes and additional fees.

- Taxes and Fees: Lists any applicable taxes and additional charges added to the subtotal.

- Grand Total: The final amount the buyer is required to pay after taxes and fees are applied.

- Payment Instructions: Specifies how and when payment should be made, along with any specific terms.

- Additional Information: The footer may include notes, terms and conditions, or a thank-you message.

Why Vyapar is the Ultimate QR Code Inventory Management Solution?

Using a free sales invoice template word, excel, pdf offers several benefits:

Cost Savings

Free templates remove the need for costly invoicing software or custom-designed invoices, offering a budget-friendly option.

Time Efficiency

Pre-designed templates simplify the invoicing process by offering a ready-made format, enabling you to quickly input the details and create an invoice without starting from scratch.

Consistency

Templates provide a consistent appearance for all invoices, helping maintain a professional image and making transactions easier to track and manage.

Ease of Use

Most free templates are easy to use and require minimal effort to customize, even for individuals with limited design skills or technical knowledge.

Accuracy

Templates automatically calculate the taxes and final price for the item-quantity, reducing the chances of human error.

Customizability

Many free templates provide customization options, enabling you to tailor the invoice to your business needs by adding your logo, adjusting colors, and modifying fields.

Professional Appearance

Even though they are free, templates are often created to appear sophisticated and professional, enhancing the credibility of your business.

Quick Updates

As your business needs evolve, you can easily update or modify the template, ensuring your invoices stay relevant and effective.

Importance of Sales Invoices for Small Businesses

Sales invoices are important for small businesses for several reasons:

- Financial Tracking: Sales invoices offer a detailed record of transactions, aiding small businesses in tracking revenue, managing cash flow, and maintaining accurate financial records.

- Legal Documentation: They act as legal proof of sales, which can be required to resolve disputes, meet legal requirements, and conduct audits.

- Professionalism: Organized invoicing improves the professional image of a business, enhancing trust and credibility among customers and consumers.

- Payment Collection: Invoices clearly specify the amount due, payment terms, and due dates, ensuring timely and efficient payment collection.

- Tax Compliance: Sales invoices support accurate tax calculations and reporting, ensuring compliance with tax regulations and simplifying the tax filing process.

- Inventory Management: By detailing items sold, invoices assist in managing inventory levels and analyzing sales trends, guiding purchasing decisions and stock management software.

- Record-Keeping: Retaining copies of invoices facilitates effective record-keeping practices, making it easier to review past transactions and providing evidence for financial or business analysis.

- Customer Relations: Issuing clear and accurate invoices maintains transparent communication with customers, enhancing satisfaction and fostering long-term relationships.

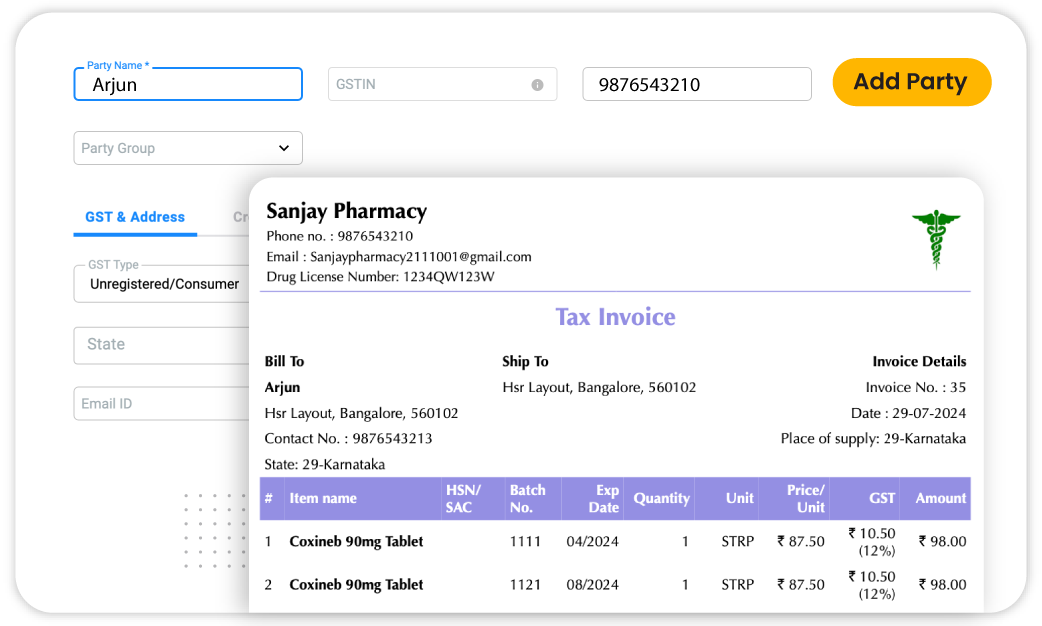

How to Create a Sale Invoice in Vyapar

Creating sales invoices in business is a simple and efficient process. Follow these steps to create a professional invoice:

- Download and Install Vyapar: Ensure you install the Vyapar app on your device. You can download it from Google Play Store or Vyapar website.

- Setup your Business Profile: Open the app and enter your business details, including your business name, logo, address, and contact information. This information will be automatically included in all your invoices.

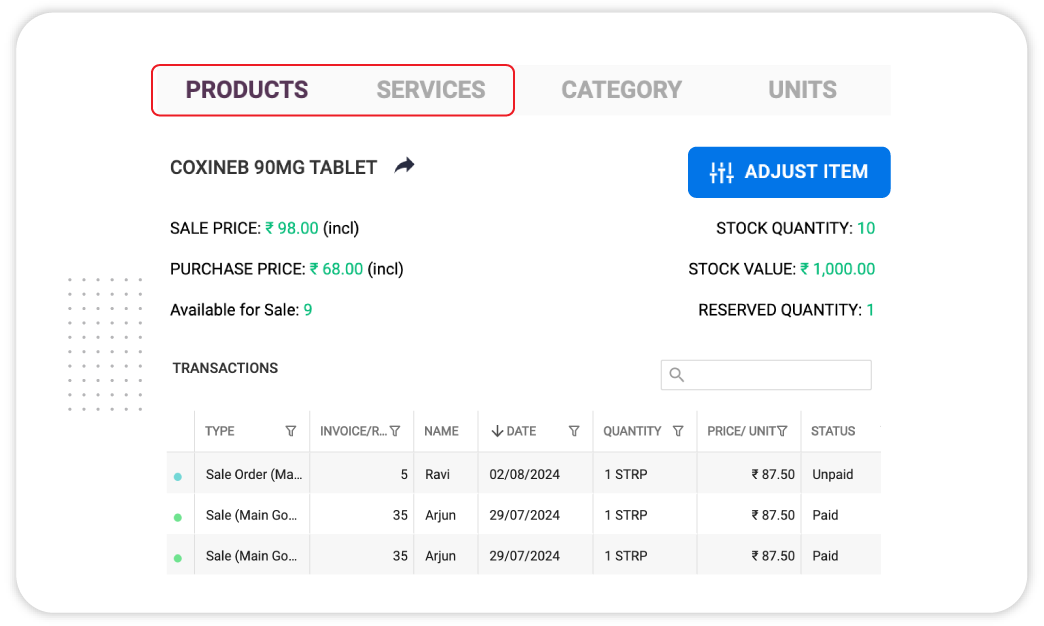

- Add Inventory Information: Navigate to ‘Inventory’, and add product details.

- Navigate to Invoice: On the main dashboard, select the “Invoices” option to start creating a new invoice.

- Enter Customer Information: Select a customer to bill or add the customer’s details manually, including their name, address, and contact information. This ensures that the invoice is personalized and directed to the correct recipient.

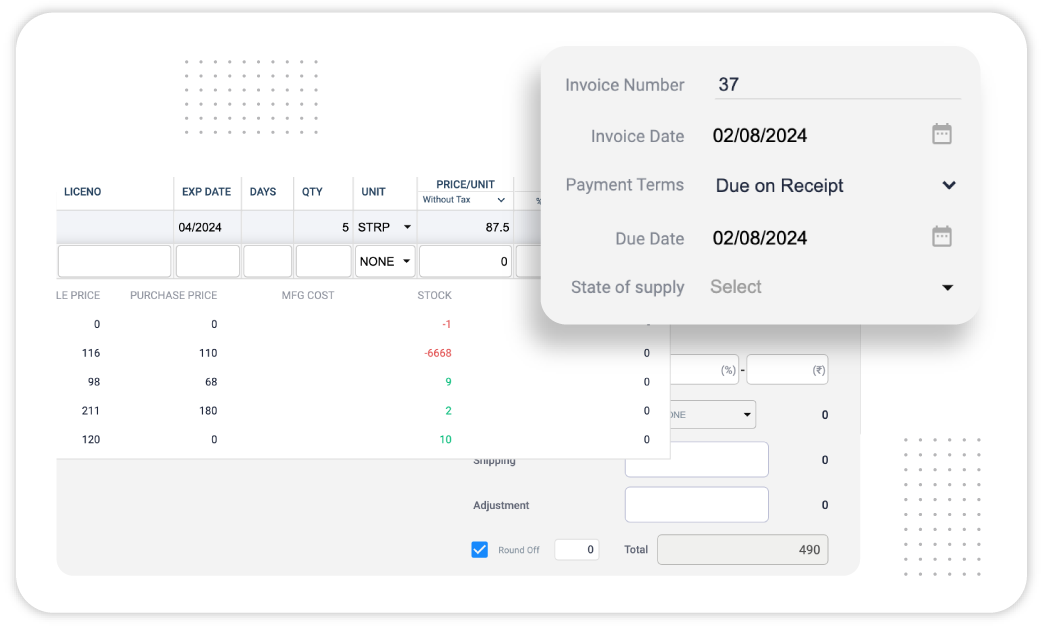

- Add Invoice Details: Vyapar automatically populates a unique invoice number, invoice date, and payment due date, but you can adjust this information if necessary.

- List Products or Services: List the products or services provided, including description, quantity, unit price, and any applicable discounts. The app will automatically calculate the total amount for each item.

- Apply Taxes and Discount: Add any taxes or discount, if applicable. The software will calculate sub-totals, taxes and the final total amount due.

- Additional Charges(if any): Include any extra charges like shipping or handling fees.

- Define Payment Terms: Specify payment terms, including accepted payment methods, payment deadlines, and any late fees or early payment discounts.

- Review and Save: Review all details to ensure accuracy. Make any necessary adjustments before saving the invoice.

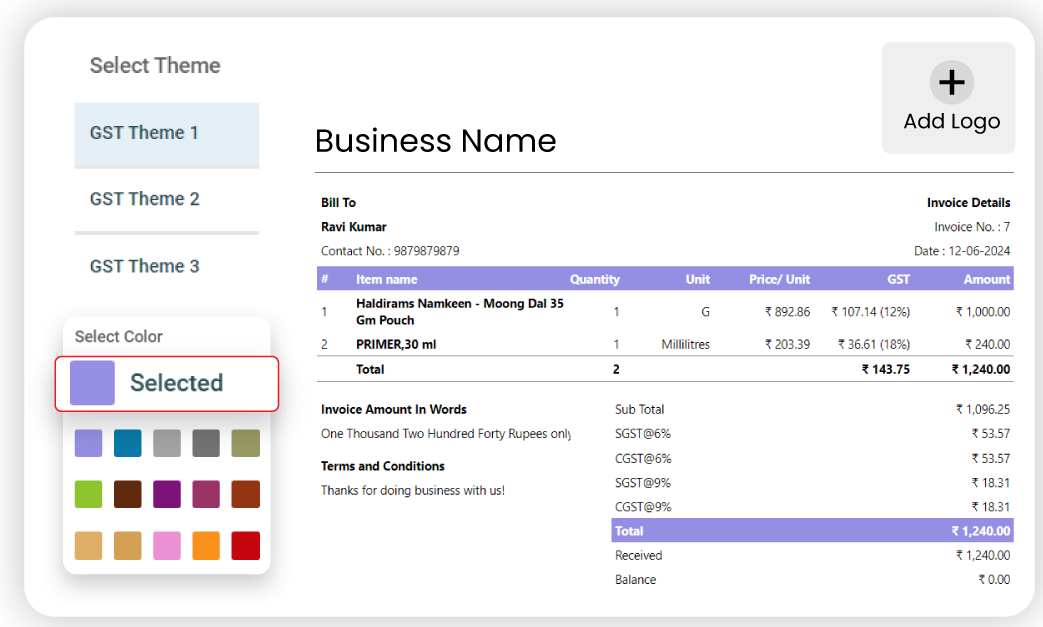

- Choose and Customize your Template: Choose an invoice template that suits your business needs. Vyapar offers many variety of customizable templates to match your brand’s style.

- Preview and Share Invoice: Once finalized, you can review the invoice for accuracy and share the invoice to your customer via email, WhatsApp, or take a print out of it for physical delivery. Business also allows you to share the invoice link with your customer for easy access.

How to Create a Sale Invoice Using a Sale Invoice Template

Creating your sales invoice template doc, sheet, excel, word, pdf involves several steps to ensure it meets your business needs and reflects your brand. Here’s how to do it:

- Choose a template: Start by selecting a template that closely matches your needs. You can find free templates online or use templates provided by invoicing software.

- Add your business information: Include your business name, logo, address, contact details and any other relevant information at the top of the invoice to give it a professional look.

- Include customer details: Make sure there are fields for the customer’s name, address, and contact information. This personalizes the invoice and makes it clear who the invoice is for.

- Set invoice numbers and dates: Customize the template to include a unique invoice number for tracking and fields for the invoice date and payment due date.

- List goods or services: Modify the section where you list the products or services sold. Include columns for description, quantity, unit price, and any applicable discounts.

- Calculate grand total: Make sure the template automatically calculates subtotals, taxes, additional fees, and the final total amount due. This reduces the risk of errors.

- Payment Terms: Customize the Payment Terms section to clearly state accepted payment methods, payment deadlines, and any late fees or early payment discounts.

- Add notes and conditions: Include a section for additional notes, terms, and conditions. This may include return policies, warranties, or special instructions for the customer.

- Personalize the design: Adjust the template’s design elements to match your brand’s colors, fonts, and overall style. This makes your invoices visually appealing and in line with your branding.

- Review and Testing: Before using the template, review it thoroughly to make sure all fields are labeled correctly and are functional. Test it by creating a few sample invoices to check accuracy and ease of use.

Common Mistakes to Avoid in Sales Invoicing

When it comes to sales invoices, there are several common mistakes to avoid to ensure smooth transactions and timely payments.

- It is important to accurately include all the required details, such as invoice number, date, customer information and item description.

- Missing or incorrect information can cause confusion and delays in payment.

- Additionally, always specify clear payment terms to set reasonable expectations, including due dates, accepted payment methods, and any applicable late fees.

- Providing a detailed description of goods or services, including quantities and unit prices, helps customers understand charges and reduces the potential for disputes.

- Double check all calculations to avoid errors in subtotals, taxes, discounts and final amount due.

- Remember to include all relevant taxes and additional fees to ensure compliance and accurate revenue reporting.

- Using a professional-looking template with consistent formatting and your business logo adds credibility to your business.

- Delays in payment can be avoided by issuing invoices immediately after the goods or services are provided. Regularly keep track of overdue invoices to maintain steady cash flow, and be mindful of any client-specific invoice requirements to avoid rejections or delays in processing.

- Finally, always keep copies of all sent invoices for record keeping and tracking purposes.

How Do You Use Sales Invoices for Small Businesses?

Sales invoices are crucial for every small business and serve multiple purposes. Here’s how you can use them effectively:

- Track sales and revenue:

Sales invoices document each sale, helping you keep track of your revenue. They are provide a clear record of what was sold, to whom and at what price, making it easy to monitor the financial health of your business.

- Manage Inventory:

By listing products sold, invoices help you manage your inventory. You can see which items are selling well and need restocking and which aren’t selling so fast.

- Maintain Professionalism:

Issuing detailed, well-organized invoices creates a professional image for your customers. It shows that you take your business seriously and that helps build trust and credibility.

- Ensure Prompt Payments:

Clearly, stated payment terms on invoices, including due dates and accepted payment methods, encourage customers to pay on time. Following up on overdue invoices ensures steady cash flow.

- Legal and Tax Compliance:

Sales invoices serve as legal proof of transactions and are required for tax reporting. They provide the needed documents for audits and help you follow tax rules.

- Customer Relationships:

Detailed invoices help maintain transparent communication with your customers, reducing the chances of disputes. They also provide customers with a record for reference, which can increase trust and repeat business.

- Financial Analysis:

Regularly reviewing your sales invoices can provide insight into your business performance. You can analyze trends, identify your best customers, and make informed decisions to boost growth.

- Facilitate Returns and Refunds:

Invoices provide a record of sales that can be referenced in case of returns or refunds. This helps manage such processes smoothly and maintain customer satisfaction.

- Simplify Accounting:

Sales invoices are provide essential data for your accounting records. They help to track your income, manage accounts receivable, and prepare financial statements.

Invoice Types for Retail Sales

Different business models require the use of different types of retail sales templates. Using Vyapar’s free bill book formats, you can choose the best sales invoice template free download. You can choose from standard recurring commercial and credit invoice templates as per your business needs.

1. Standard Invoice

Standard invoices are suitable for most retail businesses. It includes all basic needs of a retail store to bill the customers like a list of products, price of items, and total amount due with tax disclosure.

2. Recurring Invoice

Recording bill format in word, excel, pdf are best for businesses that offer scheduled subscription services. If your customers place orders every month or your services are available on a recurring payment basis, you can use our bill of sale invoice templates.

3. Commercial Invoice

Commercial invoices are best for businesses that ship goods across borders. Commercial invoices are meant to meet international regulatory requirements and include custom and duty charges for cross-border sales.

4. Credit Invoice

Credit invoices are best for issuing a refund to a customer. Using credit invoice templates, you can record a refund as a credit transaction. It can surely help you maintain your books efficiently.

5. Proforma Invoice

A proforma invoice issued before a sale is finalized provides an estimate of the cost of goods or services. This is not a request for payment, but rather a preliminary document to inform the buyer of expected costs.

6. Retail Receipt

Commonly used for cash or card transactions in physical retail stores, a retail receipt is a simplified invoice that provides proof of purchase. It includes every type of transaction details such as items purchased, prices, and total amount, but often lacks the detailed item descriptions found in standard invoices.

7. Debit Invoice

Used to request additional payment from the customer, a debit invoice is issued when there are additional charges or corrections needed beyond the original invoice. It indicates the extra amount due.

8. Electronic Invoice (E-Invoice)

A digital version of standard invoices, e-invoices are used for electronic transactions and are often integrated with accounting or ERP systems. They are streamline invoicing processes and facilitate faster payments.

Each& Every type of invoice serves a specific purpose and helps businesses effectively manage different aspects of their retail sales transactions.

Why Vyapar is the Best Alternative for Sale Bill Format

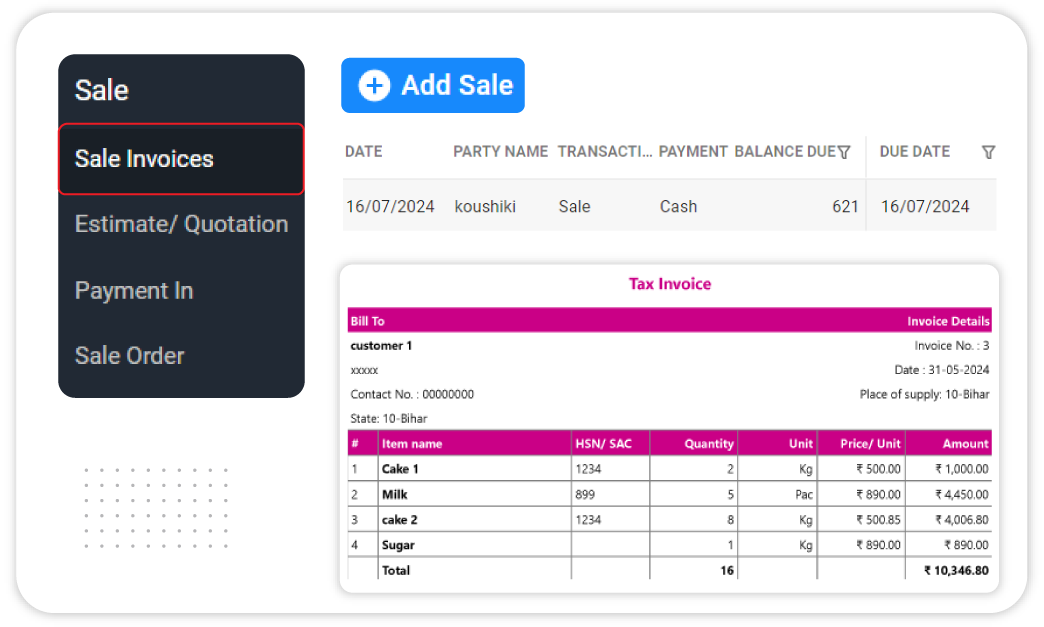

Quick Invoicing

Create sales invoices for your customers using the templates available in the Business app. You can easily create an invoice using the business app and send it to your customers by email or WhatsApp.

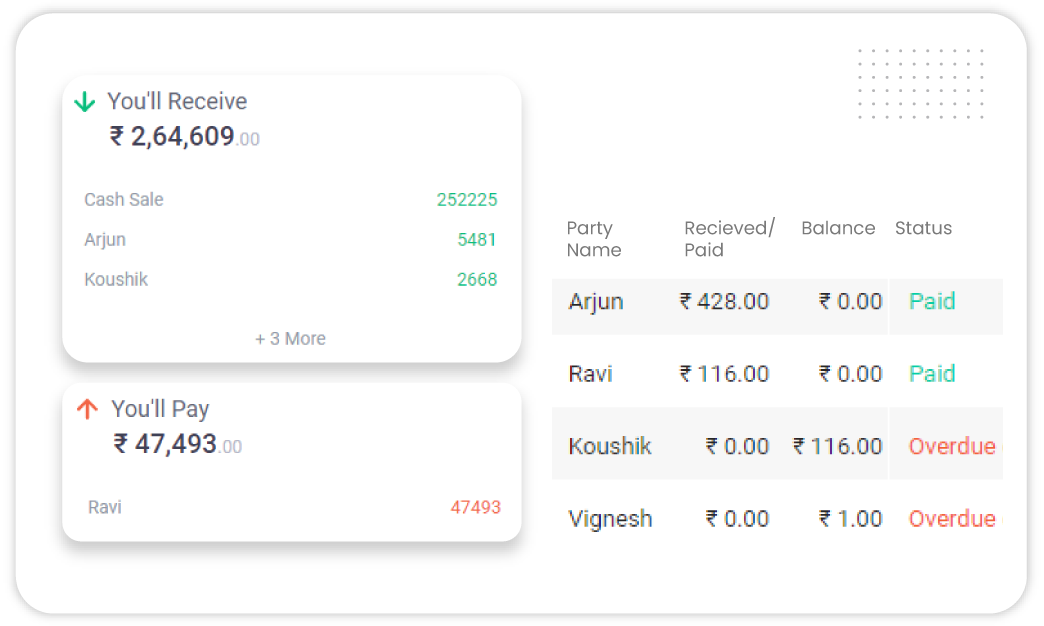

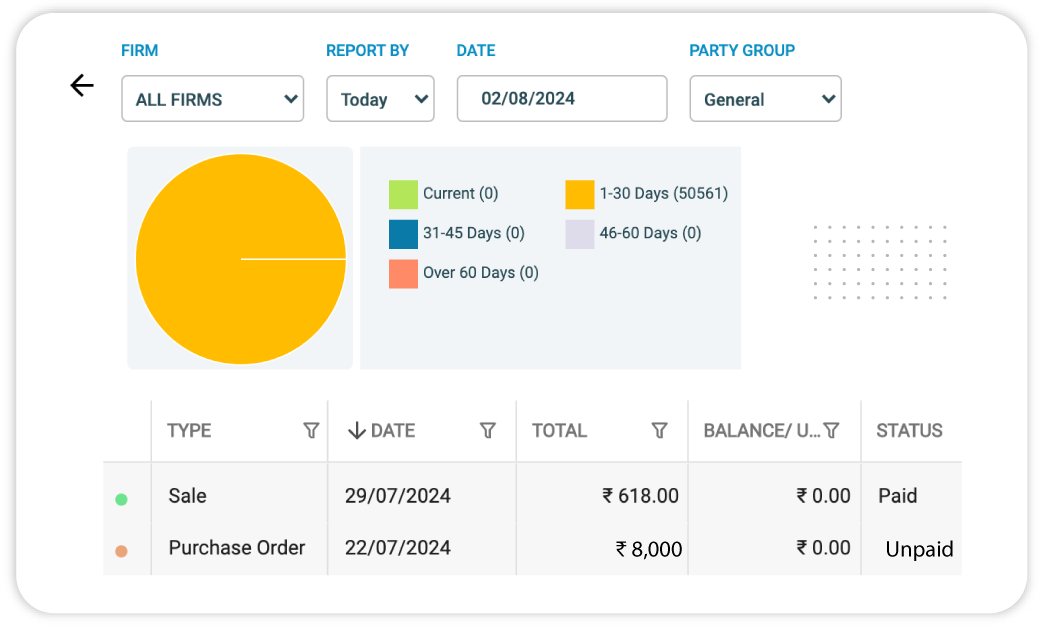

Receivables and Payables

The billing software helps you track all account receivables and payables in one place to help you manage your customer effectively.

Automatic Invoice Numbering

Each invoice is automatically assigned a unique number, ensuring accurate tracking and easy reference. You can configure the numbering format based on your business needs.

Detailed Customer Information

Easily input and store comprehensive customer details, including names, addresses, contact numbers, and email addresses. This information is auto-filled in invoices to save time and reduce errors.

Comprehensive Product/Service Management

Maintain a detailed catalog of products and services. For each item, you can record descriptions, unit prices, and inventory levels. This ensures accurate pricing and tracking on invoices.

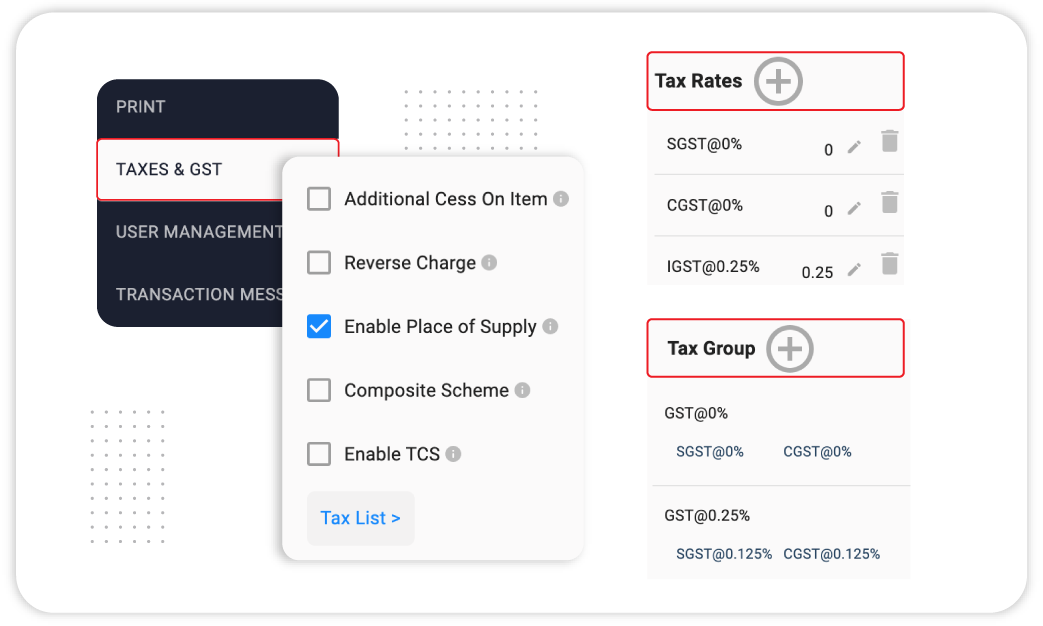

Tax Management

The business supports multiple types of taxes including GST, VAT and others. You can configure tax rates and have them automatically applied based on product or service, ensuring compliance with local tax rules.

Real-Time Invoice Generation

Generate invoices in real time with instant calculation of grand total, taxes and discounts. This key feature allows you to create and send invoices to customers instantly without any delay.

Invoice Tracking and Status Updates

Track the status of invoices (e.g., sent, paid, overdue) in real-time. Vyapar provides notifications and reminders for pending payments to help you manage receivables effectively.

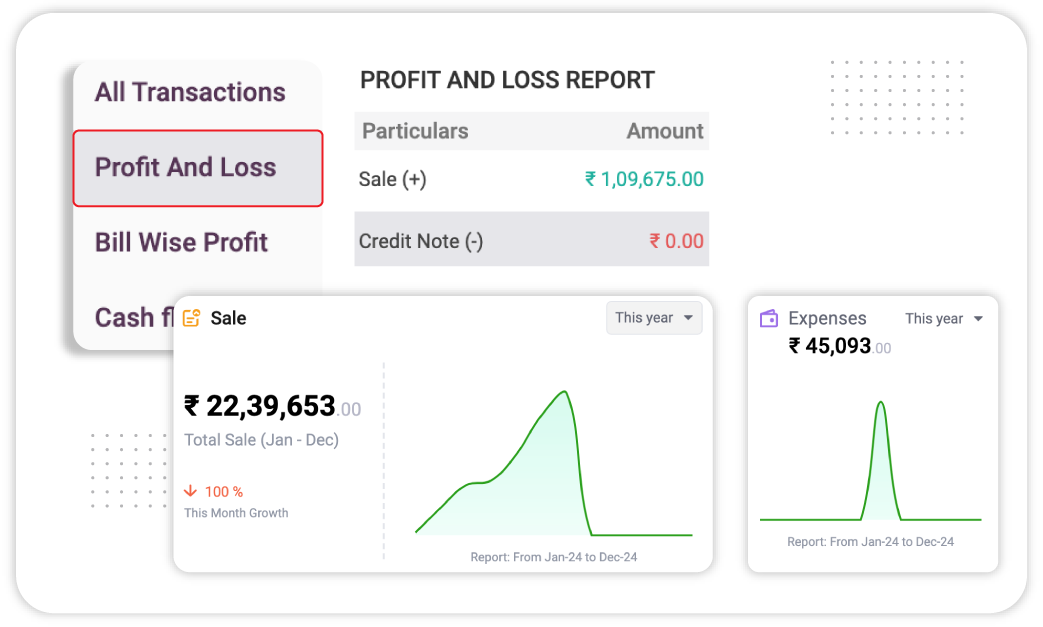

Detailed Reports and Analytics

Access comprehensive reports on invoice performance, outstanding balances and sales trends. Business analytics definitely helps you monitor financial health and make informed business decisions.

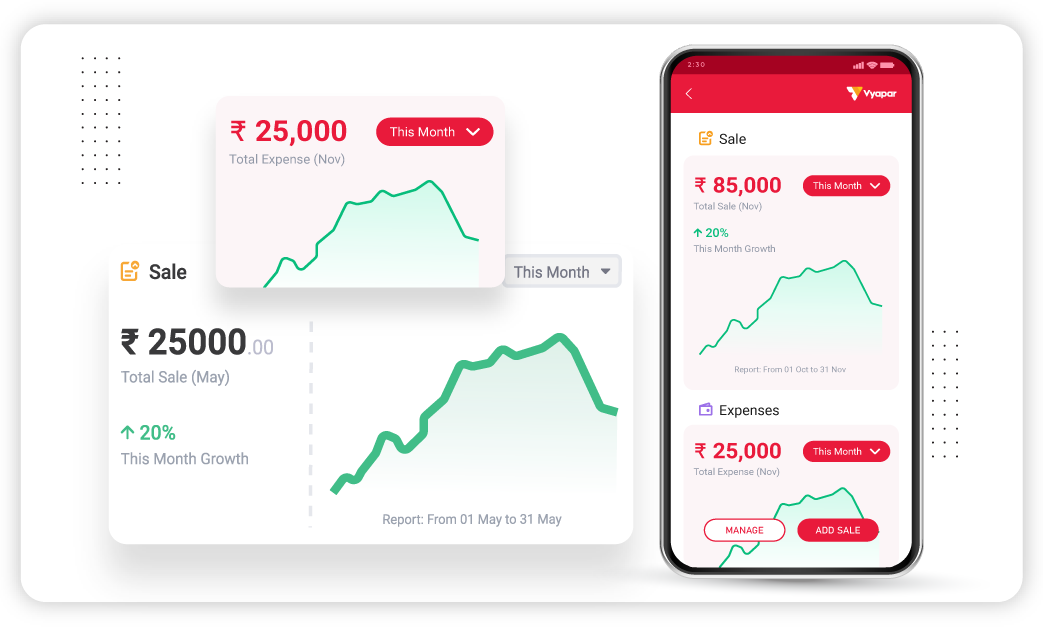

Mobile Access

The Vyapar’s mobile app allows you to create, manage and track invoices on the go. This is a one useful feature is especially useful for businesses that need to handle invoicing while away from the office.

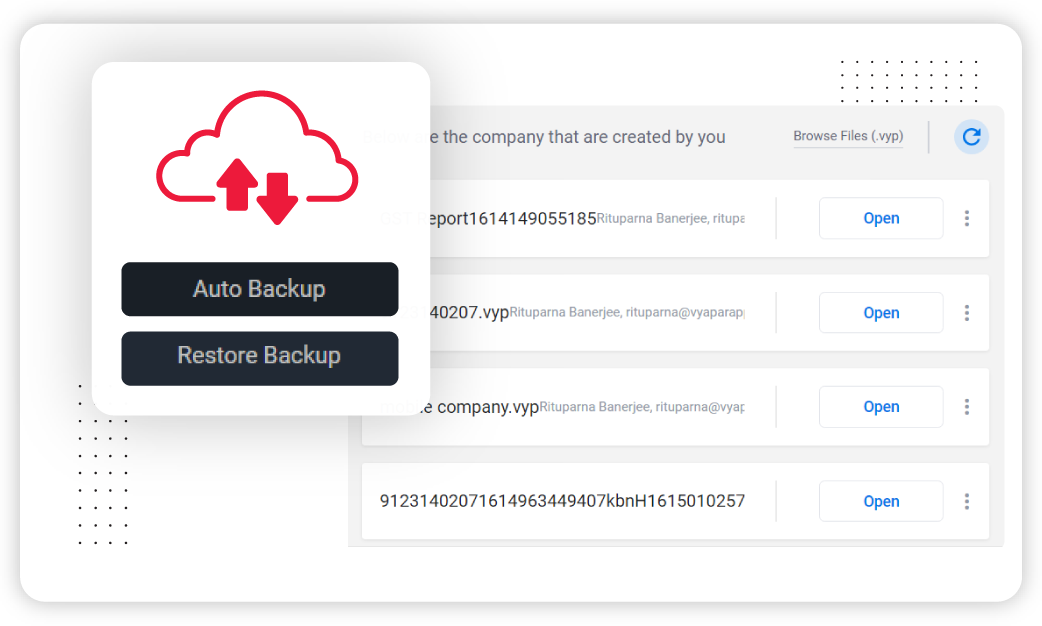

Secure Data Storage

Vyapar ensures that all your invoice data is securely stored and backed up. This guarantees data integrity and protects against data loss.

Customization

Personalize invoices with your branding and specific fields.

Efficiency

Real-time tracking, automated reminders, and integrated payment options enhance workflow. Vyapar simplifies invoicing, improves accuracy, and integrates seamlessly with other business tools.

Inbuilt Accounting

Effortlessly integrate invoicing with business accounting features. Track payments, manage cash flow and reconcile accounts with ease.

Frequently Asked Questions (FAQs’)

Yes. Using sale invoice templates is free on Vyapar. You can create as many invoices for your customers.

Yes. We provide fully customisable templates so that you can make them compatible with your business requirements. It can help you make a positive impact on your customers.

Yes. Vyapar app keeps your data encrypted, and only you can access the data stored in your account. You can create a local backup on your PC or create an automated backup on your Google Drive.

Yes. Sales invoice template excel, PDF, and Word formats are available. You can create them according to your convenience and send them over to your customers to get paid.

You can use the Vyapar app to create sale invoice bill for free on your Android device and web browser. You do not need to pay for a sale invoice bill. You can opt for premium features on our PC software for a small monthly fee.

To create a sales invoice, include your company’s details, customer information, items sold with descriptions and prices, calculate totals, add payment terms, review, and send. Vyapar software can automate this process for streamlined invoicing.

A sales invoice, also called a sell bill format, is a document from a seller to a buyer, detailing the goods or services sold, quantities, prices, total amount due, and payment terms, serving as proof of the transaction and outlining payment obligations.

Use a professional format with clear payment instructions, send invoices promptly via email or postal mail, and include timely reminders. Ensure accuracy in details and maintain data security.

A sales invoice template pdf, word excel serves as a formal document that records the details of a transaction, including the products or services provided, the amount due, and the terms of payment. It serves as a request for payment from the buyer and a record of the sale for both the seller and the buyer.

Vyapar simplify sales invoicing with a customizable sales invoice template excel free download, automatic calculations, tax management, real-time tracking, and secure, mobile access.

Yes, it is essential to include tax information on your sales invoices to ensure compliance with tax regulations, accurate record keeping, and clear financial documentation for both parties.