What Is Unearned Revenue? #

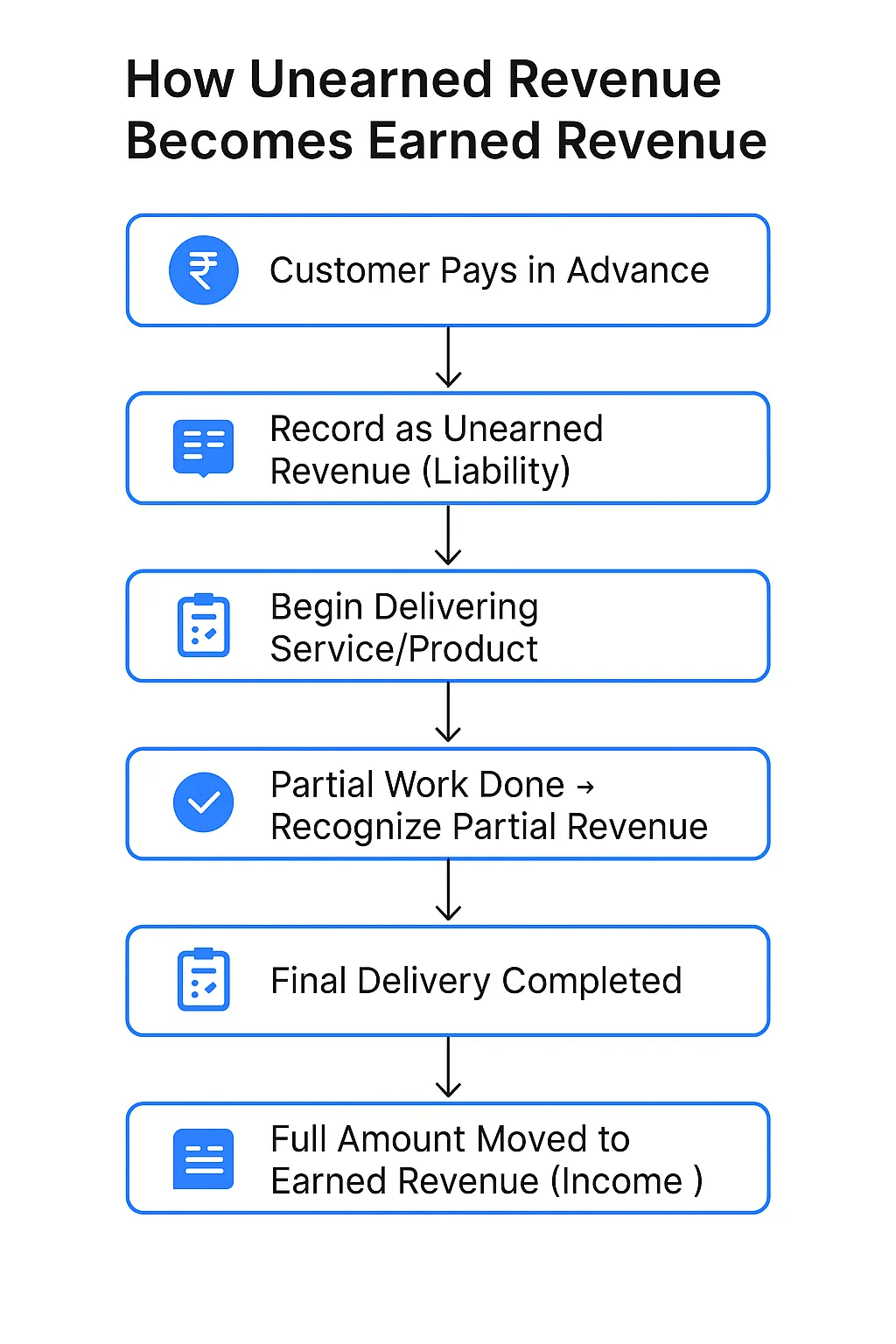

Unearned revenue means money a business gets before giving goods or services. People also call it deferred revenue. For example, if a customer pays today for a service next month, that money is unearned revenue.

This money helps small businesses get cash early. But it’s not income yet. The business still has to do the work or send the goods. They consider it a liability until they complete the job.

Knowing how to manage unearned revenue can help small businesses in India grow. It also helps them follow the rules and plan their money better.

Why Unearned Revenue Matters for Small Businesses #

Unearned revenue can be extremely helpful. It gives businesses money they can use right away. This early cash helps pay for supplies, staff, or rent.

Receiving early payment also demonstrates that customers trust the business. It can help build long-term relationships. Businesses that handle unearned revenue well look more trustworthy and organized.

Key Benefits

- Better Cash Flow: Businesses can use the money right away to run daily activities.

- Builds Customer Trust: Customers feel good when they can pay in advance and trust you to provide the service or item.

- Makes Future Planning Easier: Knowing how much money is coming in helps businesses plan for the future.

- Follows the Rules: Handling this the right way helps businesses follow Indian tax and accounting rules.

What Does Unearned Revenue Look Like? #

Advance Payments

This situation arises when a client makes a payment upfront, yet the company has not yet provided the service or product. For instance, a customer pays ₹10,000 for a service lasting three months. The business records this amount as “unearned revenue” until it fulfils the service.

A liability.

A company must provide something to the customer in exchange for their payment. Therefore, until the service provider renders the service or the seller delivers the product, the company records it as a liability. This indicates the business must fulfil its obligation before retaining the funds.

From Liability to Income

Once the business delivers part or all the work, it earns that portion of the money as revenue. For example, after completing the first month of a 3-month service, you earn ₹3,333 out of ₹10,000.

Follows Accounting Rules

In India, unearned revenue must follow the Indian Accounting Standards (Ind AS). Global rules like IFRS and GAAP also exist. These rules help businesses stay legal and accurate with their accounts.

Helps with Cash Planning

Getting payments early means the business has money on hand. This helps with paying bills or growing the business.

How to Track and Manage Unearned Revenue Smartly #

- Use Tools like Vyapar App: Vyapar App helps small businesses by tracking who paid what and when. It keeps records, sends reminders, and even shows reports.

- Keep Unearned Separate from Earned: Make sure you don’t mix unearned revenue with actual income in your books. This keeps reports clear and truthful.

- Adjust Records Regularly: Every time part of the job is done, adjust how much of the unearned revenue becomes real income.

- Use Clear Contracts: You should write each sale or service. That way, both you and the customer know what to expect and when.

- Check Your Books Often: Make sure to go through the business books at least once a month or during each quarter. Keep everything updated.

Steps to Manage Unearned Revenue Effectively #

- Spot Unearned Revenue: Learn where in your business people might pay in advance. This could be from subscriptions, bookings, or long-term services.

- Write Clear Terms: Make sure both you and the customer know the start and end of services. List everything in invoices or contracts.

- Collect Money Safely: Use trusted systems for collecting payments. Apps like Vyapar help track, collect, and record money safely.

- Record It Correctly: Mark advances money as ‘unearned revenue’ in your books. Don’t put it under income just yet.

- Finish the Job On Time: Complete the work or give the service when due. This keeps customers happy and helps change unearned revenue into actual income.

- Keep Your Books Updated: Update your books every time you complete work. This makes sure your finances are always right.

- Do Regular Checks: Audit your books—check them every few months. This helps catch errors early and follow rules.

Common Problems and Their Simple Fixes #

- Mixing Up Revenues: Some businesses mistake unearned revenue as payment already earned. Train your staff. Use software to track income correctly.

- Too Much Cash at Once: Sudden cash can be hard to manage if you don’t track where it goes. Use a system like Vyapar app to keep records and plan cash use.

- Legal Troubles: If contracts are not clear, it could lead to customer fights. Always explain payment plans. Give written proof to customers.

- Late Service Delivery: If work gets delayed, customers become unhappy. Use reminders, timers, or project trackers to stay on schedule.

- Complicated Accounting: Some businesses struggle to calculate how much to change from unearned to earned. Use accounting tools or apps that do the math for you.

Best Ways to Handle Unearned Revenue #

- Use Tools Like Vyapar App: It handles tracking and updates automatically.

- Keep Your Team Informed: Hold short lessons or training so your staff knows what to do.

- Do Book Reviews Often: Don’t wait for a problem. Check your numbers every quarter.

- Talk Openly With Customers: Tell customers when they are paying in advance and how it works.

- Offer Different Ways to Pay: Let customers choose how to pay—monthly, half-yearly, or yearly. This flexibility can attract more people.

How Vyapar App Helps #

- No more writing in notebooks: Everything is logged in real-time.

- Gives Instant Reports: See how much unearned revenue you have at any time.

- Follows Legal Rules: It keeps your accounting in line with Indian and global standards.

- Easy to Use: Even if you’re not a finance expert, you can use the app easily.

- Payment Gateway Support: Accept payments through many options and record them in one place.

FAQ’s: #

What is unearned revenue and how is it different from income?

Unearned revenue is money a business gets before giving the product or service. The team hasn’t completed the work, so it’s not real income yet. So, the business keeps it as a “liability” until it finishes the job. After completing the work, the money becomes income.

Why is unearned revenue important for small businesses in India?

Small businesses can access money early, which they can use for things like rent, stock, or salaries. It also shows that customers trust the business enough to pay in advance. Handling this money properly also helps follow tax and accounting rules in India.

How can a business manage unearned revenue properly?

Businesses should keep track of who paid and what for. They should not treat this money as income right away. Using tools like the Vyapar app makes it easy to record and update these payments. Also, writing clear contracts is good so both the business and the customer know what to expect.

What are the common problems with unearned revenue?

Sometimes businesses mix up unearned and earned money, which can lead to confusion. Others spend the money too quickly or delay the service, which makes customers unhappy. Some also forget to update their books. These mistakes can cause trouble later, so it’s important to be careful.

Conclusion #

Handling unearned revenue might seem challenging, yet with the correct approach, it becomes straightforward. Accurately recording it, timely service delivery, and utilizing tools such as the Vyapar App can strengthen your business.

By adopting these straightforward measures, small enterprises throughout India are experiencing improved cash flow, enhanced clarity, and increased trust. Give it a try and transform every advance rupee into genuine success.

Use Vyapar App to handle billing, stock & payments all in one place.

Make bills, track stock, and handle payments in one place.