Table of Contents

- Key Takeaways on Double Entry System

- How the Double Entry System Works

- History of the Double Entry System

- Importance of the Double Entry System

- Benefits of the Double Entry System

- Challenges of the Double Entry System

- How to Apply the Double Entry System in Accounting

- Examples of Double Entry in Real Life

- Single Entry vs. Double Entry System

- How Vyapar App Can Help with the Double Entry System

- FAQ’s

What is the Double Entry System of Accounting?

Estimated reading time: 10 minutes

The double-entry accounting system is a way of recording financial transactions that help businesses keep their accounts balanced. In this system, every transaction affects at least two accounts.

For each transaction, the system debits one account on the debit side and credits another account on the credit side. This ensures that the books are always added correctly. The double-entry system is popular because it provides a full view of a business’s finances. It helps catch mistakes and shows the real financial situation.

In simple terms, the double-entry system means:

- Debit Entry: Shows what the business receives.

- Credit Entry: Shows what the business gives away.

The main rule of double-entry accounting is that total debits must equal total credits for every transaction. This keeps the records balanced and accurate.

Key Takeaways on Double Entry System

- The double-entry system records every transaction in two places, as a debit entry and a credit entry.

- It makes sure that the accounting books are always balanced.

- This system helps catch errors, gives a complete view of the business’s finances, and makes financial reports more accurate.

- You need to prepare important financial statements, like the balance sheet and income statement.

How the Double Entry System Works

In the double-entry system, every transaction has two sides or “entries.” Here’s how it works:

- Identify the accounts involved: For every transaction, pinpoint the two accounts that you impact. For instance, if you purchase office supplies using cash, you affect the accounts “Office Supplies” and “Cash.”

- Apply Debit and Credit: Debit the account that increases in value, like “Office Supplies.” The system credits the account that decreases in value, like “Cash.”

- Balance the Books: Check that the total debits match the total credits. This keeps the records accurate.

For example:

- Example 1: A company buys a computer for ₹30,000 in cash.

Debit: Equipment (₹30,000) – Asset Account

Credit: Cash (₹30,000)

- Example 2: Consider a business that sells products worth ₹10,000 on credit.

Debit: Accounts Receivable (₹10,000) – Asset Account

Credit: Sales Revenue (₹10,000) – Revenue Account

In both examples, the total debits equal the total credits, keeping the accounts balanced.

History of the Double Entry System

The double-entry system dates back to the 15th century. An Italian mathematician named Luca Piccioli, often called the “Father of Accounting,” described it. He explained this system in his book, Summa de Arithmetical, in 1494. Although Piccioli didn’t invent the system, he popularized it and showed the importance of recording debits and credits. His work laid the groundwork for modern accounting. Today, businesses still use the double-entry method to track transactions reliably.

Importance of the Double Entry System

The double-entry system is important for accurate and clear accounting. Here’s why:

- Keeps Records Accurate: Since each transaction has two parts, mistakes are easier to find. If the total debits don’t equal the total credits, it’s a sign that something may be wrong.

- Prevents Fraud: This system keeps a record of every transaction. This makes it harder for anyone to hide or change information.

- Shows a Complete Financial Picture: The double-entry system shows where the money came from and where it went. This gives a complete view of the business’s finances.

- Needed for Financial Statements: Double-entry accounting helps create financial statements, such as the balance sheet and income statement. These statements show how the business is performing financially.

Benefits of the Double Entry System

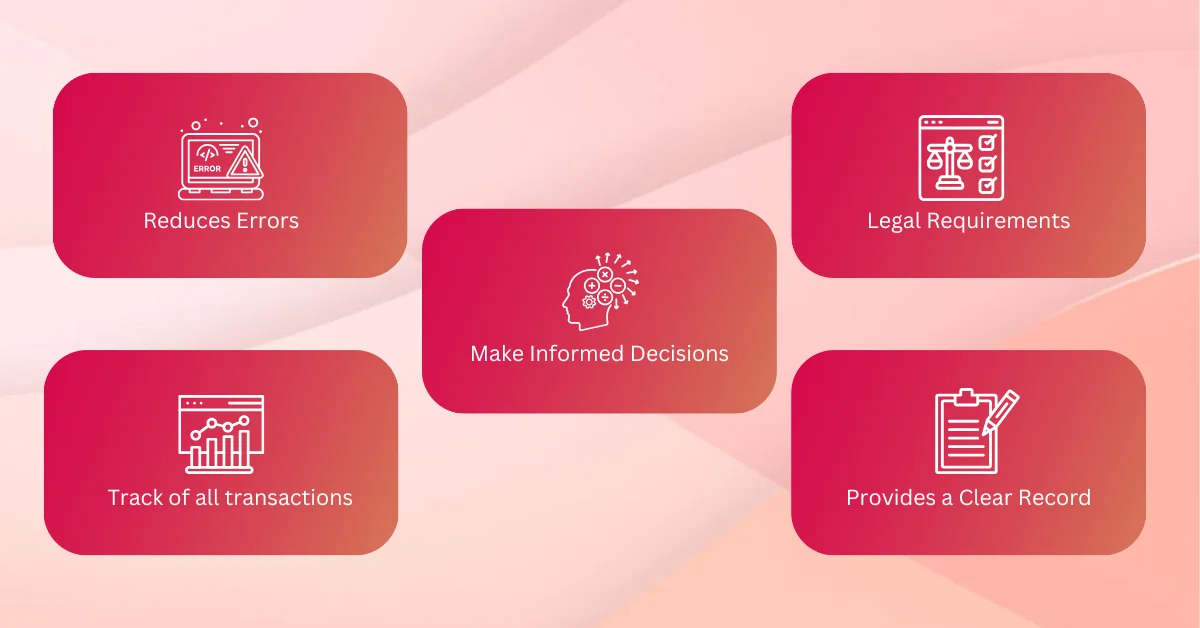

Many advantages of the double-entry system make it widely used:

- Reduces Errors: Since each transaction is recorded in two places, mistakes are easier to find and correct.

- Keeps track of all transactions: Each financial transaction, whether a sale, acquisition, cost, or borrowing, documents itself.

- Helps Make Informed Decisions: The system provides accurate records that help business owners understand income, expenses, and overall performance.

- Helps with Legal Requirements: Double-entry accounting is essential for meeting legal standards and for audits.

- Provides a Clear Record: It shows a record of every transaction. This makes it easier to review and understand financial activities.

Challenges of the Double Entry System

While the double-entry system is highly beneficial, it does have some drawbacks.

- Time-Consuming: Recording each transaction in two places and balancing the books takes more time than single-entry bookkeeping.

- Requires Some Accounting Knowledge: The double-entry system can be complex. It usually needs basic knowledge of account types and how to use debits and credits.

- Costs More for Small Businesses: Because it’s more detailed, this system can cost more, especially if a business needs to hire an accountant.

- Not Necessary for Small Finances: The single-entry accounting system is simple and easy to use. Perfect for personal finance or small businesses.

How to Apply the Double Entry System in Accounting

The double-entry system follows some basic steps to keep records clear and accurate:

- Identify the Accounts: Decide which accounts are affected by the transaction.

- Classify the Accounts: Typically, you can categorize accounts into five primary groups: Assets, Liabilities, Equity, Revenue, and Expenses.

- Record Debit and Credit: Debit the account that receives value and credit the account that gives value.

- Ensure Equality: Make sure total debits equal total credits.

Examples of Double Entry in Real Life

Here are a few examples of business transactions and how they’re recorded using the double-entry system:

- Example 1: Paying Rent

Debit: Rent Expense (amount)

Credit: Cash or Bank (amount)

- Example 2: Taking a Loan

Debit: Cash (amount received)

Credit: Loan Payable (amount)

- Example 3: Receiving Customer Payment on Credit Sale

Debit: Cash (amount received)

Credit: Accounts Receivable (amount)

Each entry keeps the books balanced, making financial tracking easier and more accurate.

Single Entry vs. Double Entry System

In single-entry bookkeeping, an accountant records only one side of a transaction, usually cash. This method is simpler but less detailed. The double-entry system gives a complete view of a business’s finances. It displays the inflow and outflow of cash.

In single-entry accounting:

- Only one account is affected per transaction.

- No balance check exists between debit and credit entries.

- Financial statements are harder to prepare and may not be entirely accurate.

In contrast, the double-entry system:

- Records both sides of each transaction (debit and credit).

- Balances each transaction to ensure accuracy.

- Provides the basis for creating prepared financial statements.

How Vyapar App Can Help with the Double Entry System

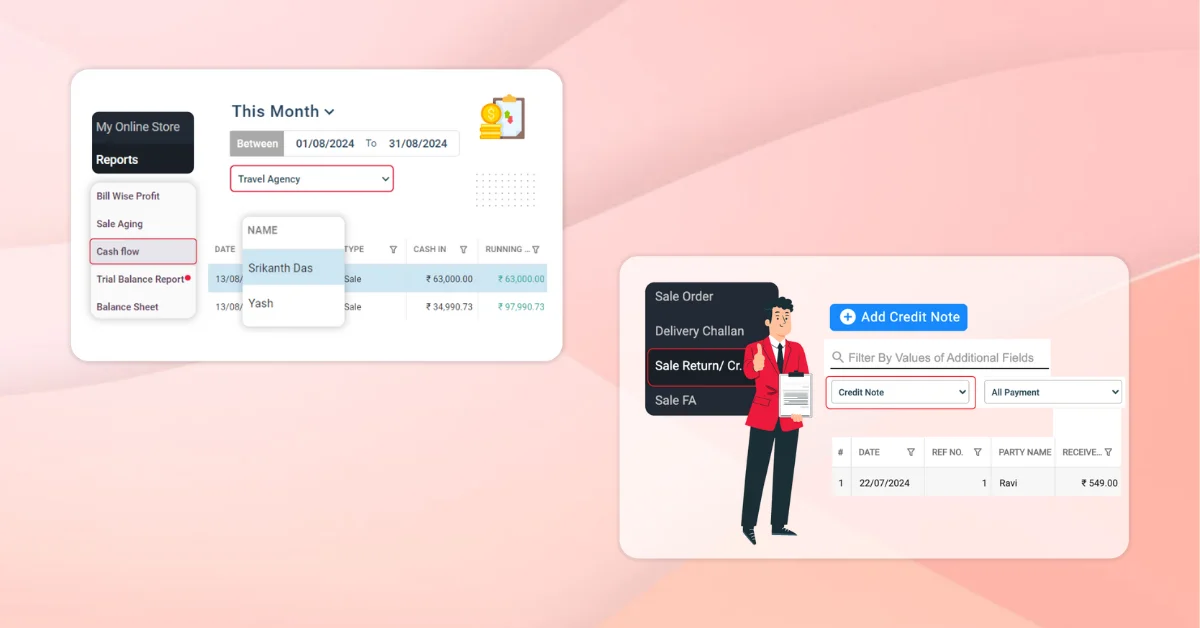

Vyapar App makes the double-entry system simple for small businesses by automating debit and credit entries. Here’s how Vyapar can help:

- Automatic Debit and Credit Entries: Vyapar automatically balances entries, which reduces mistakes and keeps the records accurate.

- Real-Time Financial Tracking: The Vyapar App uses a double-entry system. This helps business owners track every rupee coming in and going out. It gives them a clear view of their finances.

- Easy Financial Statements: Vyapar generates balance sheets, income statements, and cash flow statements based on double-entry records.

- Simplifies Auditing: Vyapar App’s double-entry setup makes it easier to track transactions, ensuring compliance with accounting standards.

Using Vyapar for double-entry accounting saves time and keeps finances organized. This allows business owners to focus on growing their business.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free!

Try our Android App (FREE for lifetime)

FAQ’s

The double-entry system records each transaction in two places—debit and credit—to keep the books balanced.

It keeps records accurate, prevents fraud, and gives a full view of a business’s financial health.

Luca Piccioli, an Italian mathematician, described the system in 1494, making him known as the “Father of Accounting.”

The double-entry system records both sides of each transaction. In contrast, the single-entry system only records one side. This makes single-entry simpler but less complete.

Vyapar automates debit and credit entries, generates financial reports, and simplifies financial tracking for small businesses.

Related Posts: