Table of Contents

- Key Takeaways of Financial Accounting

- Understanding Financial Accounting

- Why Businesses Use Financial Accounting

- The Role of Financial Accounting in Decision Making

- Types of Financial Statements

- Elements of Financial Accounting

- Principles of Financial Accounting

- Financial Accounting Standards

- How Vyapar App Can Help with Financial Accounting

- FAQ’s

What is Financial Accounting? A Brief Explanation

Estimated reading time: 12 minutes

What Is Financial Accounting?

Financial accounting is a type of accounting that deals with collecting, recording, and presenting a business’s economic activities. The main goal is to create accurate financial reports that show a clear picture of the company’s financial health. These reports include documents such as balance sheets, income statements, cash flow statements, and statements of retained earnings.

The reports help to give a clear view of the business’s financial position and activities. External parties, such as investors, regulators, lenders, and other stakeholders, use them to assess the business’s financial strength. This helps them make informed decisions.

Unlike other types of accounting, financial accounting follows specific guidelines, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). These standards help ensure that the reports are consistent, accurate, and easy to understand.

Key Takeaways of Financial Accounting

- Produces financial statements for use by people outside the company.

- Follows rules such as GAAP to ensure accuracy and consistency.

- Provides a summary of the company’s financial position.

Understanding Financial Accounting

Financial accounting is mainly about keeping a full and accurate record of all a company’s money transactions, including sales, purchases, salaries, and other financial activities. Financial accounting creates clear reports that help business owners and other stakeholders understand the company’s finances better.

Accurate records are essential for legal reasons, as they help businesses meet regulatory requirements. Without proper records, companies can face fines or other penalties. Financial accounting reports help businesses check their financial health. They can compare it to past periods and make improvements when needed.

Why Businesses Use Financial Accounting

Financial accounting is important for several reasons. Companies need it to:

- Secure loans and attract investors: Financial reports provide banks, investors, and other lenders with the information they need. This helps them decide if they should lend money or invest in the business.

- Meet legal and regulatory requirements: Many laws require businesses to keep financial records. They must also prepare reports that follow certain accounting standards.

- Build trust with stakeholders: Clear and accurate financial reports show that the company is stable and trustworthy.

- Analyze business performance: Entrepreneurs can utilize financial reports to identify the successful areas and those that require improvement.

The Role of Financial Accounting in Decision Making

Financial accounting is more than just tracking numbers. It gives a strong base for understanding and managing a company’s finances. It follows standard guidelines that make it easier to trust the information in the reports.

Using the same rules for financial reports is important. When companies in the same industry follow the same rules, it becomes easier to compare their reports.

- Preparing Financial Statements: This includes creating balance sheets, income statements, cash flow statements, and statements of retained earnings. These documents provide a full picture of the company’s financial activities. They cover different periods, such as a month, a quarter, or a year.

- Tracking Revenues and Expenses: Financial accounting helps businesses see how much money they make. It tracks all the money coming in, called revenue, and the money going out, known as expenses. It also ensures that the business follows tax laws and accounting rules.

- Analyzing Financial Health: By using ratios and metrics from financial statements, businesses can check their financial stability. For example, they can calculate profit margins, check their debt levels, or see how much cash they have on hand. This approach helps businesses make smart decisions and avoid financial problems.

Types of Financial Statements

- Balance Sheet: This financial statement shows a company’s assets, liabilities, and shareholders’ equity at a specific time. It gives a snapshot of what the company owns and owes and shows the financial strength of the business.

- Income Statement: Also called the profit and loss statement, it shows the company’s income and costs over a specific time. It helps show whether the company made a profit or a loss during that time.

- Cash Flow Statement: This statement tracks the flow of cash into and out of the business. It helps show how well the company manages its cash to meet its day-to-day expenses.

- Statement of Retained Earnings: This statement explains how the company uses its net income. Shareholders can either keep it as retained earnings or receive it as dividends. It helps understand the company’s profit reinvestment strategy.

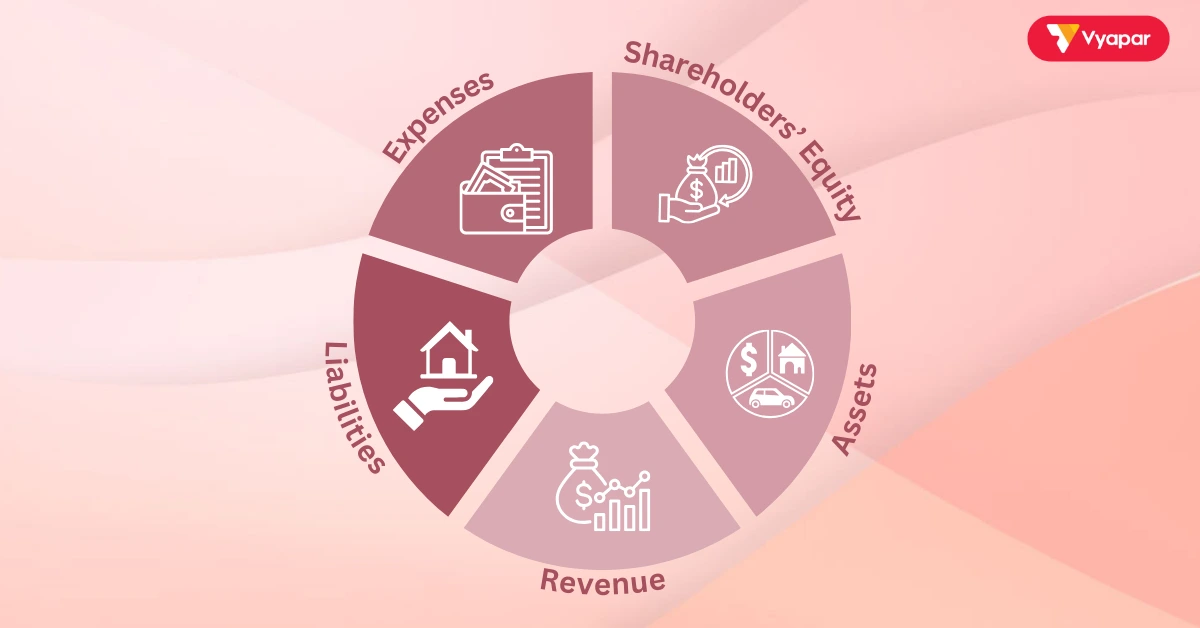

Elements of Financial Accounting

- Assets: Resources owned by the business that can provide future benefits, such as cash, inventory, equipment, and buildings.

- Liabilities: debts or obligations that the company needs to pay, including loans, accounts payable, and other forms of debt.

- Shareholders’ Equity: The owners’ share in the company. You calculate it by subtracting liabilities from assets.

- Revenue: Money earned from the company’s main business activities, such as selling products or providing services.

- Expenses: Costs that the company incurs to earn revenue, like rent, wages, and utility bills.

Principles of Financial Accounting

- Accrual Principle: This principle says that we should record revenues and expenses when they occur. We should not wait until we receive or pay cash. This helps provide a more accurate picture of the company’s finances.

- Consistency Principle: The company should use the same accounting methods over time. This allows for easier comparison of financial statements from one period to another.

- Going Concern Principle: This principle assumes that the company will keep running shortly. It means the company does not plan to close down soon.

- Matching Principle: This rule requires companies to record expenses in the same period as the revenue they create. This ensures that the financial statements show a complete picture of the business’s profitability.

Financial Accounting Standards

- GAAP (Generally Accepted Accounting Principles): These are rules used mainly in the United States to prepare financial reports. GAAP aims to make financial information consistent, reliable, and easy to understand.

- IFRS (International Financial Reporting Standards): Many countries outside the U.S. use these standards. They help make it easier to compare financial reports of companies worldwide.

- Indian Accounting Standards (Ind AS): Based on IFRS, tailored for Indian companies to ensure standardized financial reporting.

How Vyapar App Can Help with Financial Accounting

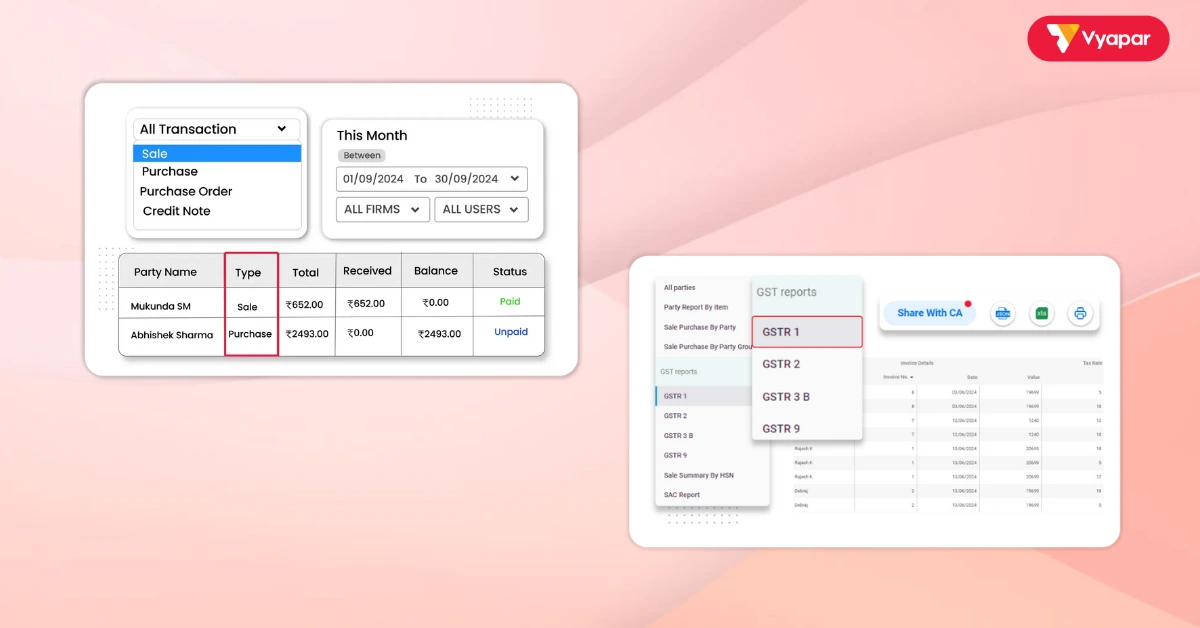

Vyapar is an accounting software that helps business owners manage their finances easily. Especially useful for those with little accounting experience. It provides features that help businesses keep accurate records. It also helps generate financial statements and follow accounting standards like Ind AS.

One of the most helpful features is recording transactions. With Vyapar, business owners can easily record every business transaction, including sales, purchases, and payments. This ensures that the financial records are always up-to-date, and no transaction goes unrecorded. Having accurate records not only helps in tracking daily finances but also ensures the company complies with regulations.

Vyapar also makes it easy to prepare financial statements. The app can automatically create important financial reports, including the balance sheet, income statement, cash flow statement, and statement of retained earnings. These reports give business owners a clear understanding of their financial condition without hiring an accountant.

The app’s tax management tools simplify the process of calculating taxes, like GST. It generates tax reports automatically, which reduces errors and helps with timely tax filing. This feature is especially useful for small businesses that may not have a dedicated finance team.

Vyapar supports internal accounting as well. It allows businesses to track cash flow in real time, monitor expenses, and even set financial goals. For instance, users can compare their actual earnings with their targets to see if the business is meeting its financial goals.

Vyapar also helps manage shareholders’ equity. It lets companies see how much profit they keep in the business. It shows how much profit companies pay out as dividends.

This feature helps businesses see how they use their net income. It also shows if they are reinvesting enough into the business.

The Vyapar app gives small businesses the tools for financial accounting. Users do not need much accounting knowledge to use it. It simplifies tasks, saves time, and ensures that the financial information is always accurate and up-to-date.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free!

Try our Android App (FREE for lifetime)

FAQ’s

Financial accounting is the process of recording, summarizing, and reporting a company’s financial transactions over a specific period. It provides crucial information to external parties like investors, lenders, and regulators.

Financial accounting creates reports for people outside the company, like investors. Managerial accounting helps business owners and managers make decisions about running the business.

The main financial statements are the balance sheet, income statement, cash flow statement, and statement of retained earnings. They help show the company’s financial position and profitability.

Double-entry accounting means that every financial transaction affects at least two accounts. This system ensures the accounting equation (Assets = Liabilities + Shareholders’ Equity) remains balanced.

Financial accounting helps businesses keep detailed records and prepares financial reports based on standards like Ind AS. Following these standards is essential for regulatory compliance.

Standards like GAAP make financial statements consistent, reliable, and comparable. This helps stakeholders understand the company’s financial health more easily.

The income statement shows the company’s revenues, expenses, and profit or loss for a specific time. It gives a clear view of how profitable the company is.

Financial accounting shows how healthy a company is financially. This helps stakeholders make better choices about investments, credit, and management.

Depreciation is how we spread the cost of an asset over its useful life. It shows how the asset’s value decreases over time. It impacts both the income statement and balance sheet.

Financial statements help investors assess the company’s profitability, risks, and overall financial stability, guiding them to make better investment choices.

Related Posts: