Table of Contents

- Key Takeaways of Cost Accounting

- How Cost Accounting is Used

- Types of Costs in Cost Accounting

- What is the Purpose of Cost Accounting?

- Elements of Cost Accounting

- Cost Accounting Systems

- Types of Costs

- Different Costing Methods

- Formulas and Examples for Cost Accounting

- How Vyapar App Can Help with Cost Accounting

- FAQ’s

What is Cost Accounting? A Brief Explanation

Estimated reading time: 18 minutes

Cost accounting is a special part of accounting that helps businesses figure out the cost of producing goods or services. It involves recording, evaluating, and tracking different expenses. Unlike financial accounting, which is used for creating reports for external stakeholders (like investors or tax authorities), cost accounting focuses on the company’s internal management. It provides valuable insights that help businesses make better decisions on things like pricing, budgeting, and controlling expenses.

If you’re running a business, knowing exactly how much it costs to produce your product or service is critical. This type of accounting helps you set the right prices, manage your costs effectively, and, ultimately, increase your profit margins.

Key Takeaways of Cost Accounting

- It helps track and manage production costs.

- Provides insights to improve profitability and operational efficiency.

- Used internally to guide decisions about pricing, budgeting, and cost control.

Understanding Cost Accounting

At its simplest, cost accounting helps businesses understand where and how their money is being spent. It categorizes different types of costs so they can be analyzed more easily. Breaking down costs into smaller parts helps you better manage them, so you can find areas where you might be overspending or where you can make things more efficient.

Why Businesses Use Cost Accounting

Most businesses rely on this method to get a clearer understanding of their costs. By knowing where their money is going—whether it’s into raw materials, labor, or overhead costs—business owners can make informed decisions about setting prices, managing budgets, and planning for the future.

The Role of Cost Accounting in Decision Making

Cost accounting is more than just numbers—it plays a crucial role in business decisions. It helps business owners and managers decide the best ways to produce goods, where they can cut costs, and how they can improve overall profitability without sacrificing quality.

How Cost Accounting is Used

Cost accounting isn’t just about adding up expenses—it’s a powerful management tool that helps improve how a business operates. By understanding costs in more detail, you can take action to increase efficiency and save money.

Tracking Production Costs

One of the primary functions of this accounting method is tracking the total cost of production. This includes direct costs (like raw materials and wages) and indirect costs (like utilities and rent). By tracking these, businesses can better understand how much it costs to make a product.

Budgeting and Forecasting

By looking at past expenses, businesses can create more accurate budgets and forecasts for the future. This helps allocate resources better and ensures that no money is wasted.

Improving Operational Efficiency

Cost accounting can highlight areas where your business may be overspending or not being as efficient as it could be. By pinpointing areas for improvement, you can reduce waste, optimize labor, and use your resources more effectively.

Types of Costs in Cost Accounting

Direct Costs vs. Indirect Costs

- Direct Costs: These are expenses that can be traced directly to the product or service, like the cost of raw materials.

- Indirect Costs (Overhead): These are expenses that aren’t directly tied to a specific product but are still necessary for production, like electricity, rent, or equipment maintenance.

Fixed Costs vs. Variable Costs

- Fixed Costs: These are expenses that don’t change regardless of how much you produce, like your monthly rent.

- Variable Costs: These change with production volume, like the cost of raw materials or shipping.

Operating Costs vs. Non-operating Costs

- Operating Costs: These are the expenses that are part of running your business day to day, such as utilities, labour, and supplies.

- Non-operating Costs: These are costs that are unrelated to the core operations, like interest on loans.

Cost Accounting Explained

This accounting method is all about breaking down and analyzing costs to better understand how much it takes to run a business. It’s not just about the numbers—it’s about using those numbers to make smarter decisions. For example, if you know how much it costs to produce a product, you can set a competitive price that still earns you a profit.

The Process of Recording and Allocating Costs

The first step is to record every expense related to the business’s operations, from buying raw materials to paying workers. After recording these costs, you allocate them to specific products or cost centres (departments or units) to get a clearer picture of where the money is being spent.

How It Affects Pricing

Understanding your costs helps you set competitive prices that ensure you’re making money on every sale. By knowing exactly how much each product or service costs to produce, you can make sure your pricing covers your expenses and gives you a healthy profit margin.

What is the Purpose of Cost Accounting?

The main goal of this method is to help businesses manage their expenses and boost profitability. With accurate cost data, businesses can make informed decisions about pricing, production, and financial planning.

Controlling Expenses

Cost accounting provides a detailed look at where your expenses are coming from. This lets you identify areas where you might be overspending and make adjustments to improve your overall financial management.

Increasing Profitability

By understanding exactly where your money is going, you can find ways to reduce expenses, which can directly lead to increased profit margins.

Facilitating Better Financial Planning

With detailed cost information, you can create more accurate budgets and long-term financial plans, ensuring that your business stays on track and remains profitable.

Elements of Cost Accounting

Material Costs

These are the costs associated with the raw materials used to make a product. For example, if you’re making furniture, the cost of the wood would be a material cost.

Labor Costs

This includes the wages paid to employees who are directly involved in the production process. Labour turnover refers to the rate at which employees leave and are replaced, which can impact costs.

Overhead Costs

These are the indirect costs required to run your business, like rent, utilities, and office supplies.

Cost Accounting Systems

Job Costing

This system is used when production is based on specific jobs or orders, such as in custom manufacturing. Each job is treated as a unique project, and costs are tracked separately for each one.

Process Costing

Process costing is used in industries where production is continuous, such as in oil refining or food processing. This method averages costs over all units produced during a period.

Activity-Based Costing (ABC)

ABC allocates overhead costs more precisely by assigning them to specific activities that drive costs. This method helps businesses get a more accurate understanding of what activities are costing them the most money.

Types of Costs

Sunk Costs

These are costs that have already been spent and can’t be recovered. For example, if you buy a piece of machinery that later breaks down, the initial cost of the machine is a sunk cost.

Opportunity Costs

This is the cost of choosing one option over another. For instance, if you choose to invest in one project, the opportunity cost is the potential benefit you could have received from investing in something else.

Marginal Costs

The marginal cost is the additional cost of producing one more unit of a product. It’s important in decision-making when determining whether increasing production is worth it.

Relevant Costs

These are costs that will be affected by a business decision. For example, if you’re deciding between two suppliers, the price difference would be a relevant cost to consider.

Different Costing Methods

Standard Cost Accounting

Standard costing uses historical data to set benchmarks for future costs. These standards are then compared to actual costs to identify any variances.

Lean Accounting

This method is aligned with lean manufacturing principles and focuses on eliminating waste. It helps businesses streamline processes and reduce unnecessary expenses.

Marginal Costing

Marginal costing focuses on the cost of producing one additional unit. This method is especially useful for businesses trying to determine how changes in production levels will affect their profitability.

Formulas and Examples for Cost Accounting

Cost of Goods Sold (COGS) Formula and Example

COGS = Beginning Inventory + Purchases – Ending Inventory

This formula helps businesses calculate how much it costs to produce the goods that were sold during a certain period.

Let’s say a business starts the year with an inventory worth ₹10,000, buys ₹50,000 worth of products, and ends the year with ₹15,000 in inventory. Using the COGS formula, the cost of goods sold would be:

₹10,000 + ₹50,000 – ₹15,000 = ₹45,000.

Contribution Margin Formula and Example

Contribution Margin = Sales Revenue – Variable Costs

The contribution margin tells businesses how much revenue is left over after covering variable costs, which can then be used to cover fixed costs and generate profit.

If you sell a product for ₹100 and the variable cost to produce it is ₹60, the contribution margin is ₹40. This means for each product sold, ₹40 goes toward covering fixed costs and profits.

Break-even Point Formula and Example

Break-even Point = Fixed Costs / (Sales Price per Unit – Variable Cost per Unit)

This formula helps businesses figure out how many units they need to sell to cover their fixed costs and start making a profit.

To calculate the break-even point, you need to know the fixed costs, variable costs per unit, and sales price per unit.

Let’s say a company has fixed costs of ₹50,000, variable costs of ₹200 per unit, and sells each unit for ₹500.

The break-even point can be calculated as: Break-even Point = Fixed Costs / (Sales Price per Unit – Variable Cost per Unit)

Break-even Point = ₹50,000 / (₹500 – ₹200) = ₹50,000 / ₹300 = 167 units.

This means the company must sell 167 units to cover all its fixed and variable costs, and anything beyond that would be profit.

Principles to Know

- Matching Costs to Revenues: Expenses should be recorded in the same period as the revenues they help generate.

- Prudence Principle: Expenses should not be understated, and income should not be overstated.

- Objectivity Principle: Accounting information should be based on facts and verifiable data, not opinions or estimates.

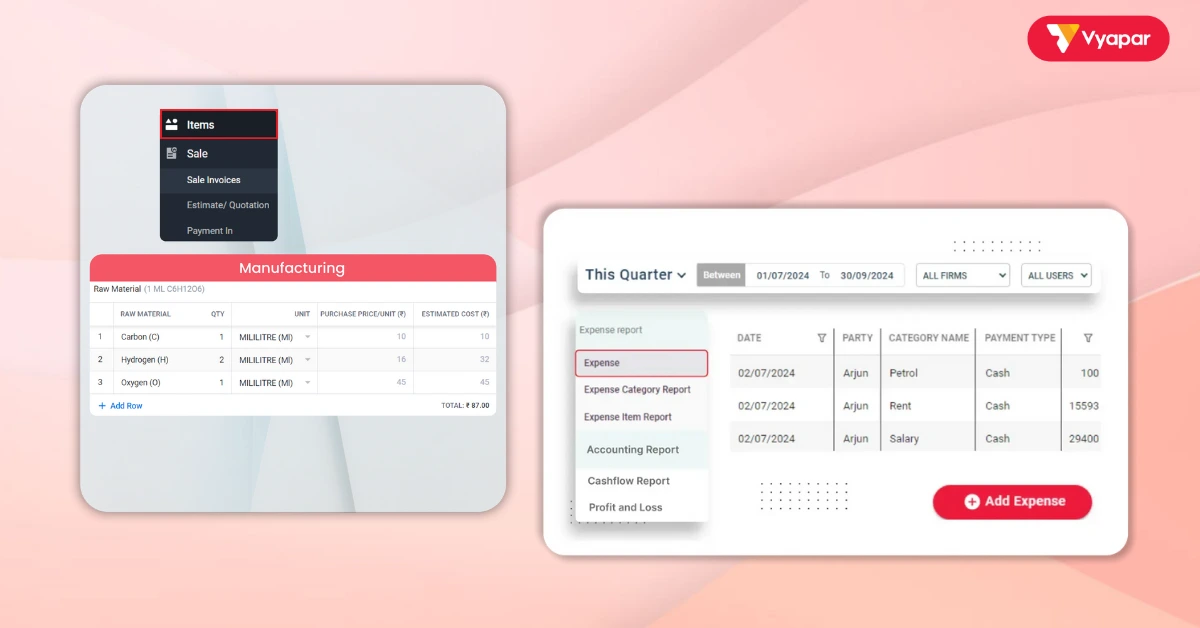

How Vyapar App Can Help with Cost Accounting

Vyapar is a business accounting software designed for small and medium businesses. It simplifies the process of managing expenses, tracking inventory, and calculating the cost of goods sold in real time.

Features of Vyapar for Cost Accounting

Vyapar helps businesses automate tasks like expense tracking, generating financial statements, and calculating production costs. It’s especially useful for small businesses that need an easy-to-use tool for financial management.

Benefits of Vyapar for Small Businesses

With Vyapar, business owners can streamline their accounting processes, making it easier to monitor costs, manage budgets, and improve profitability.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free!

Try our Android App (FREE for lifetime)

FAQ’s

Overhead refers to the indirect costs of running a business that cannot be traced directly to a product or service, such as rent, utilities, and administrative expenses.

A cost center is a department or unit within a business that is responsible for managing its expenses, such as a production department.

Idle time refers to the period when employees or machines are not being used for production but still incur costs, such as wages during machine breakdowns or downtime.

A cost sheet is a document that shows the detailed breakdown of the cost of producing goods or services, including materials, labour, and overhead.

Labour turnover refers to the rate at which employees leave and are replaced in a business. High labor turnover can affect production costs and efficiency.

Material control refers to the process of managing the purchase, storage, and use of raw materials to ensure that production runs smoothly without excess costs or shortages.

Job costing is a system used to track costs for specific jobs or projects. Each job is treated as a unique project, and costs are tracked separately.

A reconciliation statement is used to compare two sets of records to ensure they agree. It is commonly used to reconcile differences between financial and cost records.

Cost accounting focuses on internal processes and controlling production costs, while financial accounting is used for external reporting and compliance, such as preparing financial statements for investors and regulators.

Related Posts: