GSTR-3B Format In Excel, PDF And Word

Struggling to prepare your GSTR-3B return? Download Vyapar’s ready-to-use GSTR-3B formats in Excel, PDF, Word, Docs and Google Sheets to simplify your GST filing. Start your free trial today and file with confidence!

GSTR-3B Format Vs Vyapar App

Features

GSTR-3B Format

Auto-filled invoice data

GSTIN auto-verification

Smart HSN Code suggestions

Multi-Device Access

Tax Auto-Split

Supports Nil Return Filing

Reverse charge tracking

Offline Usage

User-friendly interface

Download Free & Easy-to-Use GSTR-3B format in Excel, PDF, and Word

Join thousands of smart businesses using ready GSTR-3B formats in Excel, Word, and PDF—your shortcut to stress-free, on-time GST filing

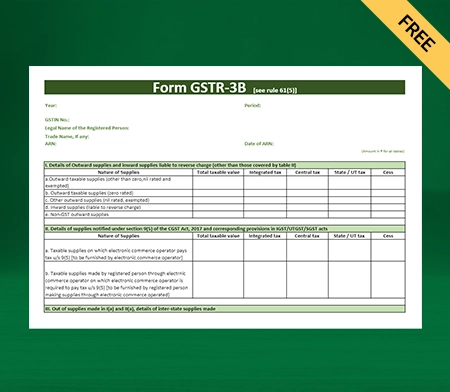

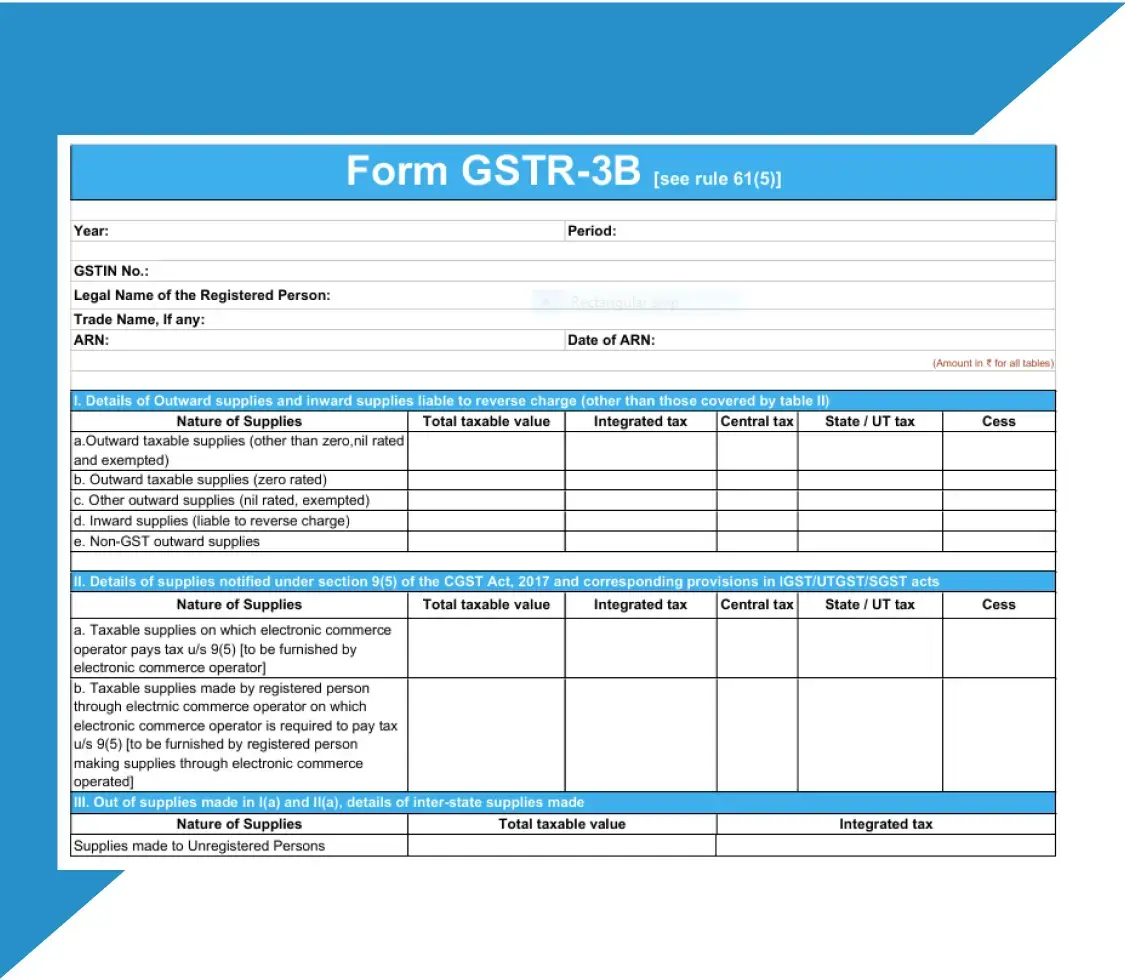

GSTR-3B Format – 1

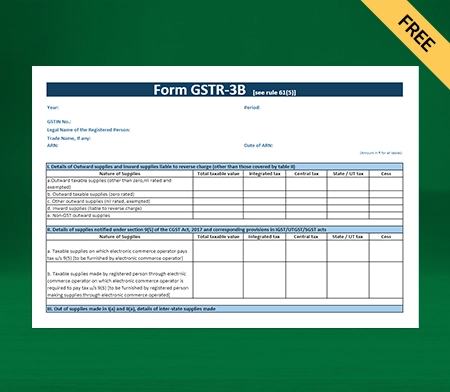

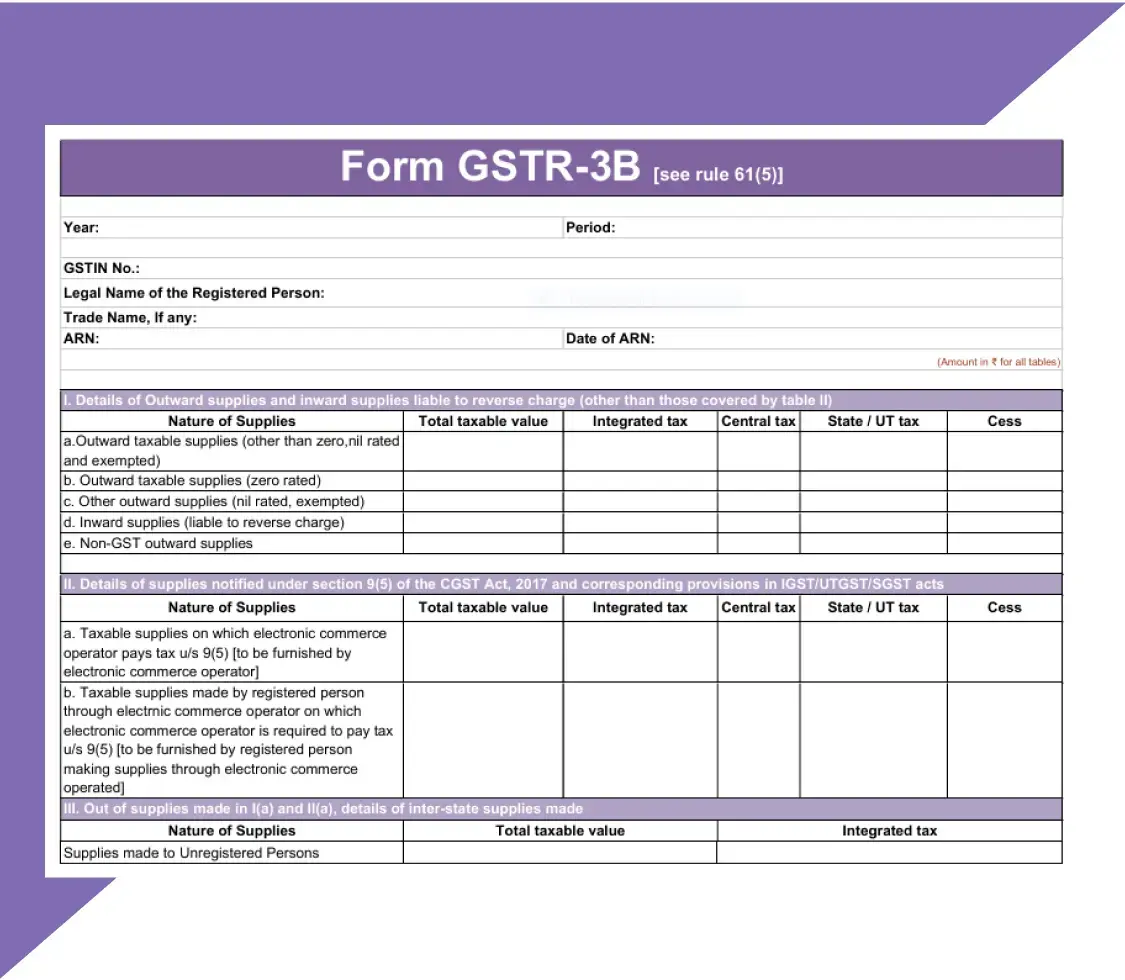

GSTR-3B Format – 2

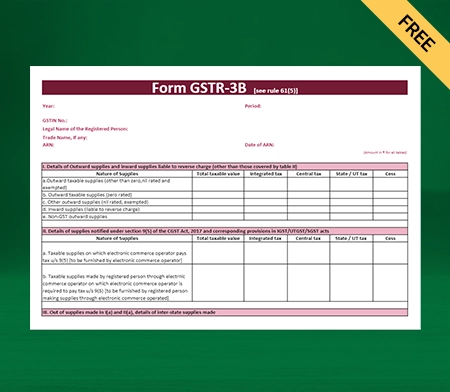

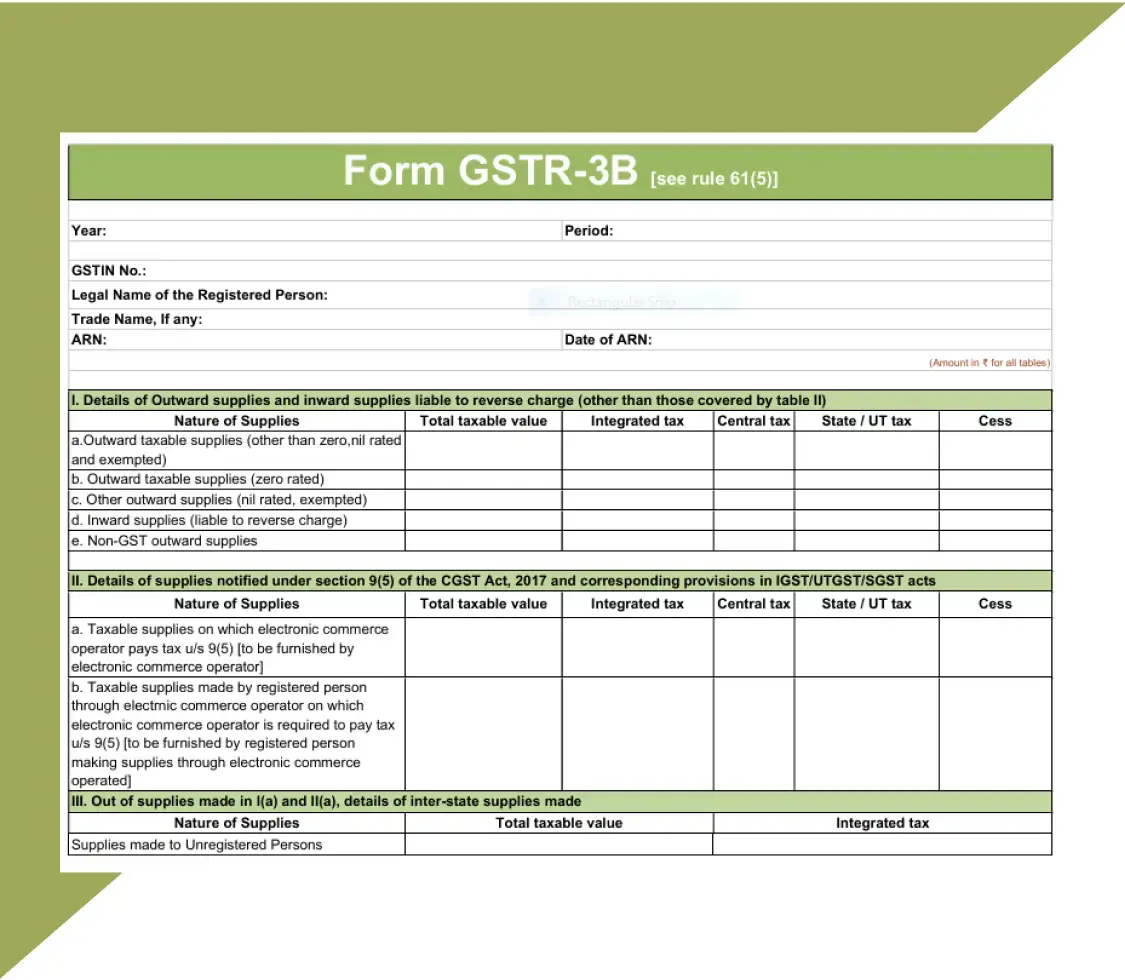

GSTR-3B Format – 3

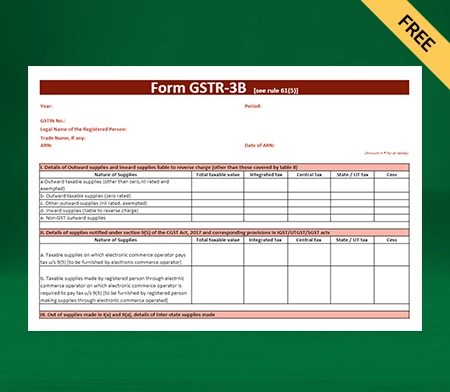

GSTR-3B Format – 4

GSTR-3B Format – 5

GSTR-3B Format – 6

GSTR-3B Format – 7

GSTR-3B Format – 8

Auto-Generate Your GSTR-3B with One Click!

What is GSTR-3B?

GSTR-3B is a monthly summary return that GST-registered businesses in India need to file. It captures key details like sales, purchases, input tax credit (ITC), and taxes paid. Filing it on time ensures you stay GST-compliant and avoid penalties—even if you haven’t had any business activity during the month.

GSTR-3B form includes 19 fields spread across 7 main tables that taxpayers must fill out every month. Fields are divided into six sections as follows:

1. Taxpayer & Return Details

- GSTIN

- Legal Name of the Taxpayer

- Tax Period

2. Outward Supplies

- Outward taxable supplies (other than zero-rated)

- Outward taxable supplies (zero-rated)

- Supplies to composition dealers & UIN holders

- Non-GST outward supplies

3. Inward Supplies & Reverse Charge

- Inward supplies liable to reverse charge

- Inter-state supplies to unregistered persons

- Inter-state supplies to composition dealers

- Inter-state supplies to UIN holders

4. Input Tax Credit (ITC)

- ITC on import of goods/services

- ITC on inward supplies from registered dealers

- ITC from ISD (Input Service Distributor)

- ITC on reverse charge purchases

5. ITC Reversal & Tax Utilization

- Reversal of ineligible or blocked ITC

- Tax payment using ITC/cash

- TDS/TCS credit

6. Interest & Late Fee

- Interest and late fee

GSTR-3B Table-Wise Breakdown

GSTR-3B Due Date (Monthly & Quarterly)

Monthly Filing (Regular Taxpayers)

Who Should File: Businesses with turnover above ₹5 crore

States Covered: All states and UTs

Due Date: 20th of the following month

QRMP – Group A

Who Should File: Turnover up to ₹5 crore (under QRMP Scheme)

States Covered: Chhattisgarh, Madhya Pradesh, Gujarat, Maharashtra, Karnataka, Goa, Kerala, Tamil Nadu, Telangana, Andhra Pradesh, Daman & Diu, Dadra & Nagar Haveli, Puducherry, Lakshadweep, Andaman & Nicobar Islands

Due Date: 22nd of the following month

QRMP – Group B

Who Should File: Turnover up to ₹5 crore (under QRMP Scheme)

States Covered: Delhi, Haryana, Punjab, Uttar Pradesh, Bihar, Jharkhand, Odisha, West Bengal, Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, Sikkim, Uttarakhand, Himachal Pradesh, Jammu & Kashmir, Ladakh, Chandigarh

Due Date: 24th of the following month

Late Fee & Penalty for GSTR-3B

If you fail to file your GSTR-3B return on time, you’ll have to pay a late fee and interest as per GST rules. The late fee is ₹50 per day (₹25 CGST + ₹25 SGST) if there’s any tax payable. For Nil returns—where there is no tax liability—the late fee is reduced to ₹20 per day (₹10 CGST + ₹10 SGST). This fee is calculated from the day after the due date until the actual date of filing, and it can go up to a maximum of ₹5,000 per return.

In addition to the late fee, interest at 18% per annum is also charged on the outstanding tax amount. This interest is calculated from the due date until the date of actual payment. Even if you have no transactions in a given tax period, you must still file a Nil return on time to avoid penalties.

How to File GSTR-3B Return Online

- Visit www.gst.gov.in

- Use your valid GSTIN, username, and password to log in

- Navigate to Returns Dashboard

- Choose the financial year and return filing period

- Under the “Monthly Return” section, click on GSTR-3B

- Select Prepare Online or Prepare Offline (using the utility tool)

- This opens the main GSTR-3B format with editable tables

Here, you need to manually fill in all the fields under the GSTR-3B return format, including:

- Table 3.1 – Details of outward and reverse charge supplies

- Table 3.2 – Inter-state supplies to unregistered, composition, and UIN holders

- Table 4 – Eligible ITC (Input Tax Credit)

- Table 5 – Exempt, nil-rated, and non-GST inward supplies

- Table 6.1 – Payment of tax using cash/credit

- Table 6.2 & 7 – TDS/TCS and late fees/interest (if applicable)

- Click on Preview Draft GSTR-3B to download a summary PDF

- Double-check all values, especially tax liability and ITC claimed

- Fix any mismatches with GSTR-1 or purchase records

- Once verified, click Submit – status will change to “Submitted”

- Then click Proceed to File

- Choose your filing method: DSC or EVC (OTP-based)

- After filing, you’ll receive an Acknowledgement Reference Number (ARN)

- Post-filing, download the final filed GSTR-3B PDF

- This serves as a record for your business and GST audits

How to File the Return Using the Vyapar GSTR-3B Format?

- Open Vyapar Desktop Software.

- Go to Reports > GST Reports > GSTR-3B.

- Choose the correct month for which you’re filing the return.

- Review data for outward, reverse charge, and interstate unregistered supplies.

- Ensure ITC (Input Tax Credit) details are visible and accurate.

- Go to the GST Portal > Downloads > GSTR-3B Offline Tool.

- Open the offline tool, input or paste Vyapar Excel data, validate it, and generate JSON.

- Return to the portal and go to the Returns Dashboard.

- Select “Prepare Offline” for GSTR-3B, and upload the JSON file.

- Preview the return, then submit it.

- Use DSC or EVC to complete the filing.

Importance of Filing GSTR-3B

It’s Mandatory for GST Compliance

Filing the GSTR-3B return is compulsory for all regular and casual taxpayers registered under the Goods and Services Tax (GST) regime in India. Regardless of your monthly sales, you must file this summary return every month or quarter (under QRMP) to remain compliant. Missing even one GSTR-3B filing can lead to issues like GSTIN deactivation, ITC blockage, and government notices.

Helps You Avoid Late Fees and Penalties

Failing to file GSTR-3B on time can attract late fees of ₹50 per day (₹20/day for nil filers) and interest at 18% per annum on the unpaid tax amount. Timely GSTR-3B filing ensures your business doesn’t incur unnecessary financial losses due to non-compliance.

Ensures You Can Claim Input Tax Credit (ITC)

Claiming eligible Input Tax Credit (ITC) is possible only when GSTR-3B is filed accurately and consistently. This return reflects your ITC from purchases and expenses, and a mismatch or delay can block your ability to offset your tax liabilities. Filing GSTR-3B is essential to unlock and utilize the full value of your ITC.

Keeps Your GSTIN Active and in Good Standing

Continuous non-filing of GSTR-3B returns (for six months or more) can result in your GST registration being suspended or cancelled. This affects your business credibility and restricts you from issuing valid tax invoices. Regular GSTR-3B filing keeps your GSTIN status active and legally valid.

Helps Reconcile Data with GSTR-1 and GSTR-2B

GSTR-3B should match data reported in GSTR-1 (outward supplies) and GSTR-2A/2B (ITC data from vendors). Any mismatches can delay ITC claims and even lead to scrutiny. Filing an accurate GSTR-3B helps with seamless reconciliation, reducing audit risks.

Improves Cash Flow Management

Since GSTR-3B determines your net tax liability after adjusting ITC, it directly impacts your monthly cash outflows. A correct and timely filing ensures proper utilization of available credits and avoids overpayment of taxes, helping you maintain a healthier cash flow.

Builds Trust with Vendors and Financial Institutions

Many businesses and banks check your GST compliance before working with you or offering credit. Regular and timely filing of GSTR-3B boosts your tax credibility, making it easier to get loans, attract vendors, and grow your business network.

Benefits of Using Vyapar’s GSTR Format for Filing GSTR-3B

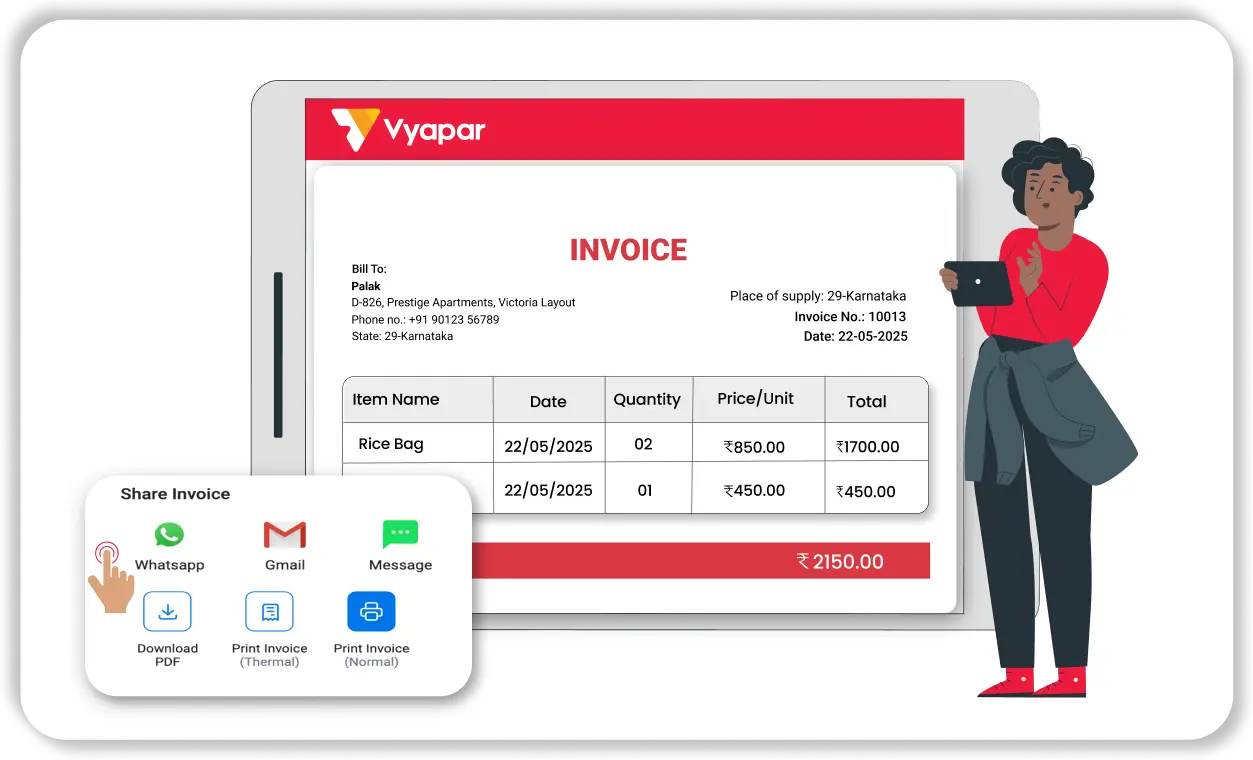

Simple and User-Friendly GSTR-3B Format for Businesses of All Sizes

Vyapar’s GSTR-3B filing format is built with simplicity in mind. The software features a clear, section-by-section layout that mirrors the government’s official GSTR-3B form.

Even users with no prior GST knowledge can file returns confidently. The guided layout helps small business owners, startups, and non-accountants.

Save Time with Automated GSTR-3B Return Preparation

The app auto-compiles your transactions into the correct fields of GSTR-3B, including:

- Outward supplies

- Inward supplies

- Reverse charge liabilities

- Non-GST supplies

This generates a ready-to-file summary report for manual upload or offline utility.

File GSTR-3B Accurately And Stay Compliant

Vyapar includes validation checks, tax matching, and ITC auto-calculation to ensure accuracy. This minimizes chances of rejections and penalties during GST filing.

Real-time summaries let you verify totals before final submission.

Maintain Consistency in Your GSTR-3B Filing Format

Vyapar follows a government-compliant structure. Every time you generate a report, it follows the same format—helping CAs and auditors review quickly.

This eliminates format errors common in manual compilations.

Structured Format with GST Compliance Built-In

Vyapar includes auto tracking of:

- HSN/SAC codes

- GSTINs

- Taxable values

- Input Tax Credit

It creates a structured and complete GSTR-3B report that’s exportable in Excel or usable in JSON utility.

Affordable and Flexible Filing Solution for GSTR-3B

Vyapar offers affordable plans for small businesses. You can generate Excel/PDF reports and print with any printer.

Whether filing yourself or via a CA, Vyapar’s format is reliable and cost-effective.

Features That Make Vyapar the #1 Choice for Indian Businesses!

Generate Invoices Easily

Create professional and branded invoices with automated calculations and real-time tracking.

- Customise invoice templates with logo, colours, and payment terms

- Auto-calculate taxes, discounts, and totals with accuracy

- Track invoice status, send reminders, and offer multiple payment options (UPI, card, cash)

.

Inventory Management

Track, organize, and manage your stock in real-time with Inventory Management Software to ensure smooth and efficient business operations.

- Get low-stock alerts and categorise inventory by type, vendor, or location

- Use barcode scanning for faster item tracking and stock updates

- Generate purchase orders and detailed reports on sales, stock, and purchases

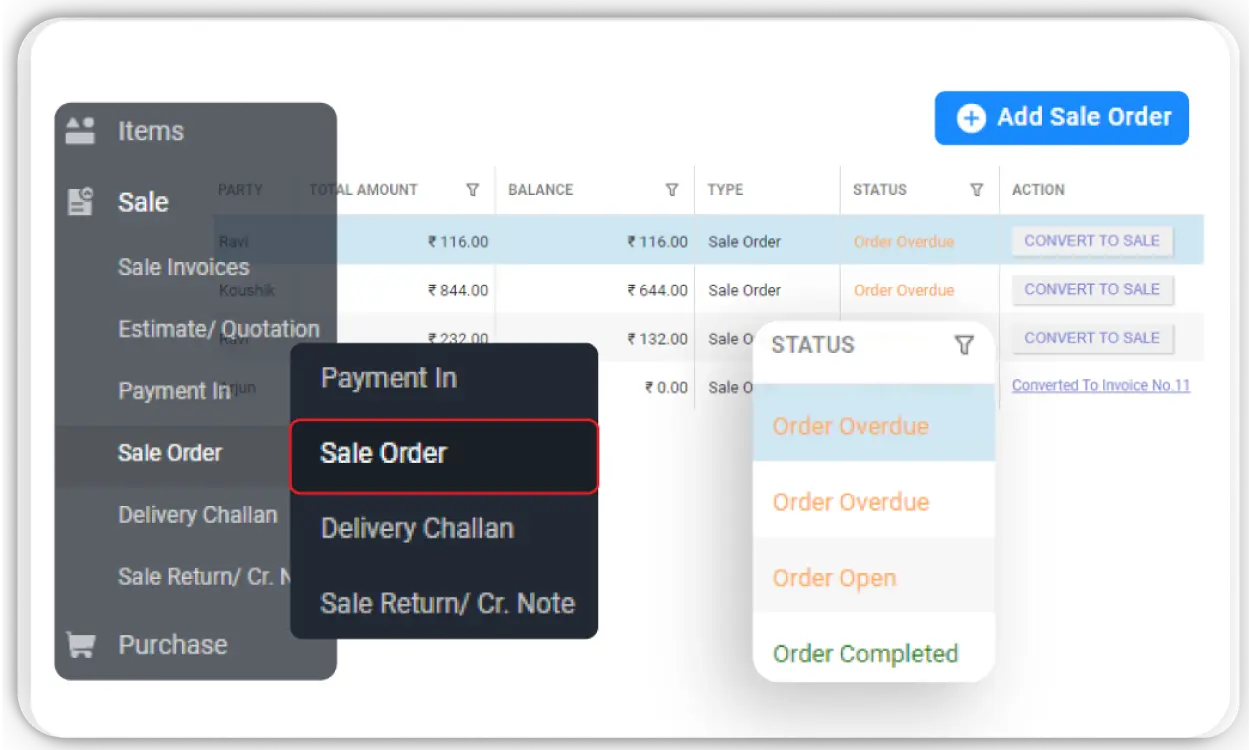

Order Tracking & Management

Excel needs multiple files and updates for tracking sales and purchase orders. Vyapar automates the full order management cycle.

- Convert sales/purchase orders into invoices without duplication.

- View pending, completed, or overdue orders in one place.

- Get reminders for pending payments or stock status.

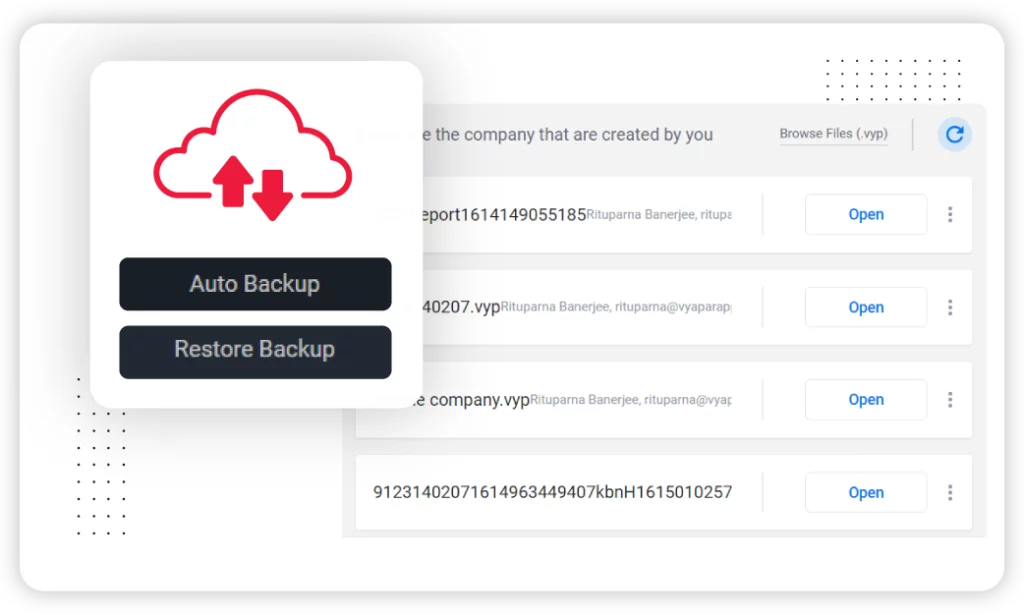

Data Security

Vyapar protects your business data with encryption, backups, and advanced access control.

- Auto cloud backup and password authentication ensure secure access

- Set user permissions to control who can view or edit sensitive data

- Encrypted storage and secure data transfers prevent unauthorised access

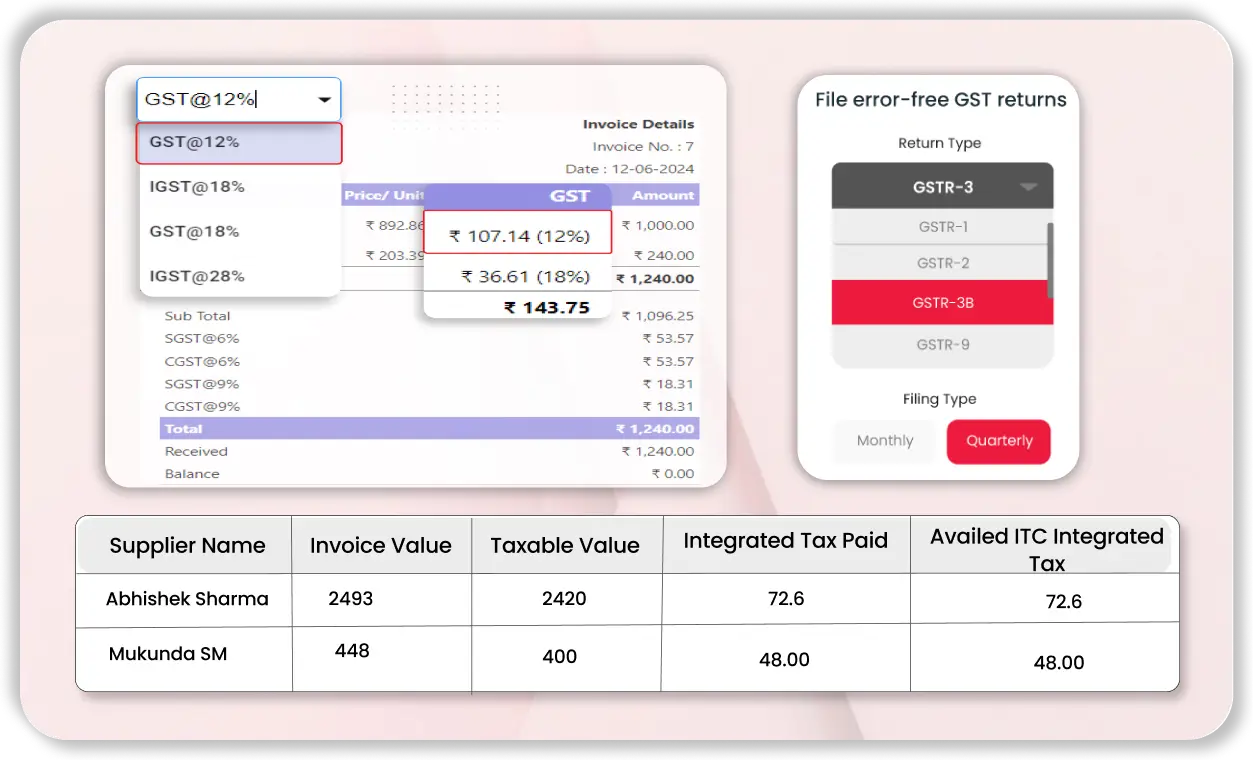

GST Compliance

Ensure hassle-free GST billing, filing, and reconciliation with built-in compliance tools.

- Generate GST-compliant invoices with HSN/SAC codes and tax breakdowns

- Get GST reports, generate e-way bills, and export GST reports to Excel.

- Stay updated with the latest GST rules and access detailed compliance reports

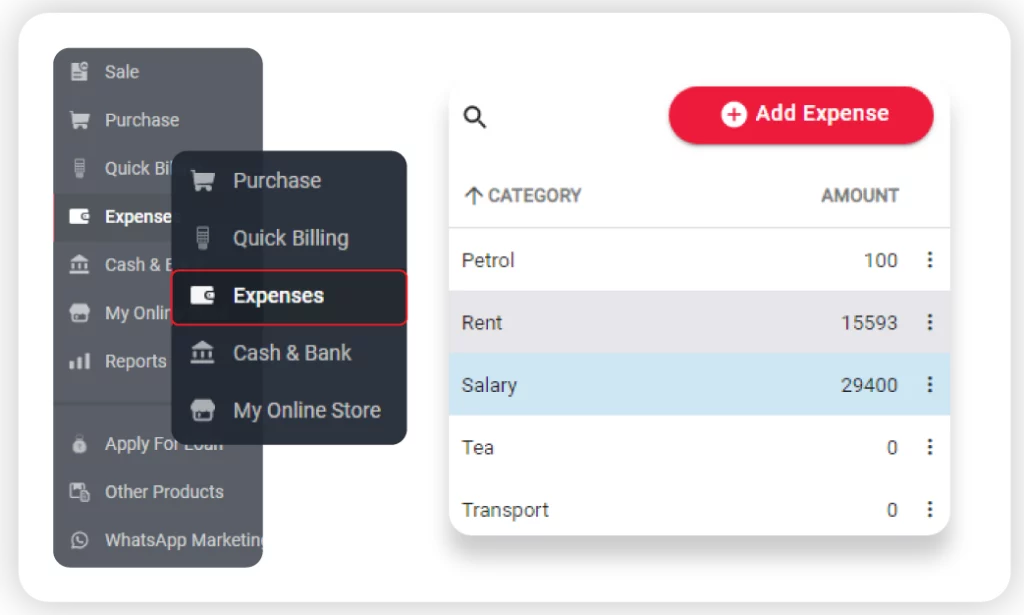

Track and Control Expenses

Easily record and categorise expenses to stay on budget and manage cash flow efficiently.

- Add bills, purchases, and receipts with OCR support.

- Monitor daily, monthly, and project-wise expenses in one place

- Generate real-time reports for better financial decision-making

Frequently Asked Questions (FAQ’s)

What is GSTR-3B, and who needs to file it?

What is the purpose of the GSTR-3B format in Vyapar?

Is GSTR-3B auto-filled in Vyapar, or do I need to enter data manually?

Can I file GSTR-3B directly from Vyapar?

How do I convert the GSTR-3B Excel file from Vyapar into JSON format for filing?

– Download the GSTR-3B Offline Utility from gst.gov.in

– Copy your data from Vyapar Excel into the offline tool

– Validate and click “Generate JSON”

– Upload this file on the GST portal to complete your filing

What details are included in the GSTR-3B format from Vyapar?

– Outward taxable supplies (inter/intrastate)

– Inward supplies liable to reverse charge

– ITC (input tax credit) details

– Exempt and nil-rated inward supplies

– Tax liability payable and paid

Is GSTR-3B filing mandatory even if there are no transactions in a month?

Can I revise a GSTR-3B return after submission?

What is the due date for filing GSTR-3B?

Why is the GSTR-3B format from Vyapar ideal for small businesses?