Service Invoice Format / App

Vyapar app simplifies the process of developing a service invoice with its professional touch. A service invoice app helps you to get access to several useful features.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download Free Service Invoice Format

Download free service invoice formats, and make customization according to your requirements at zero cost.

Customize Invoices

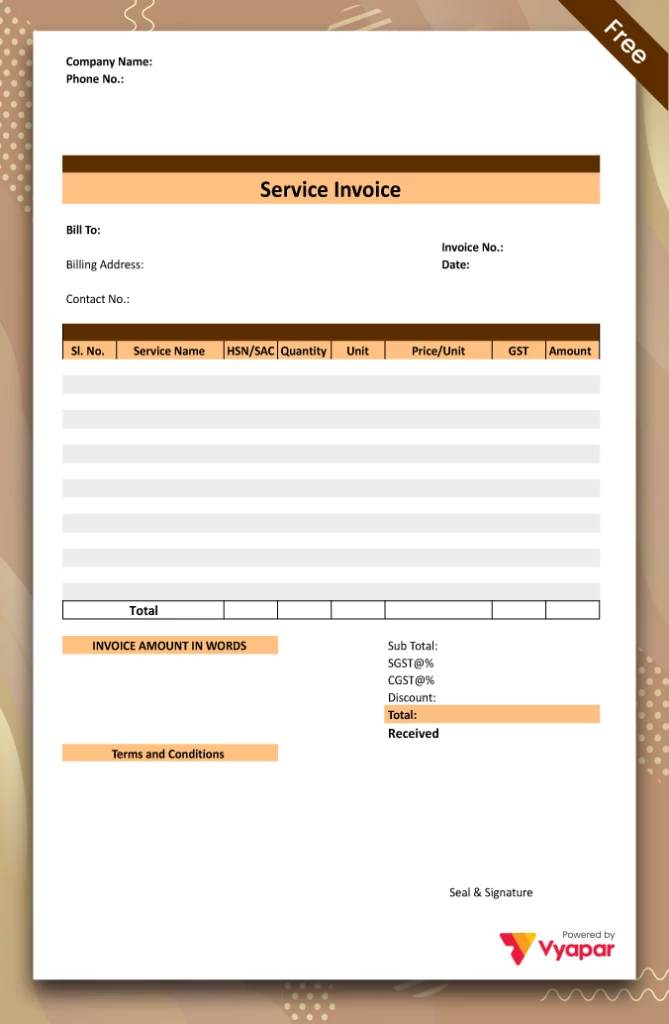

Service Invoice Format Type I

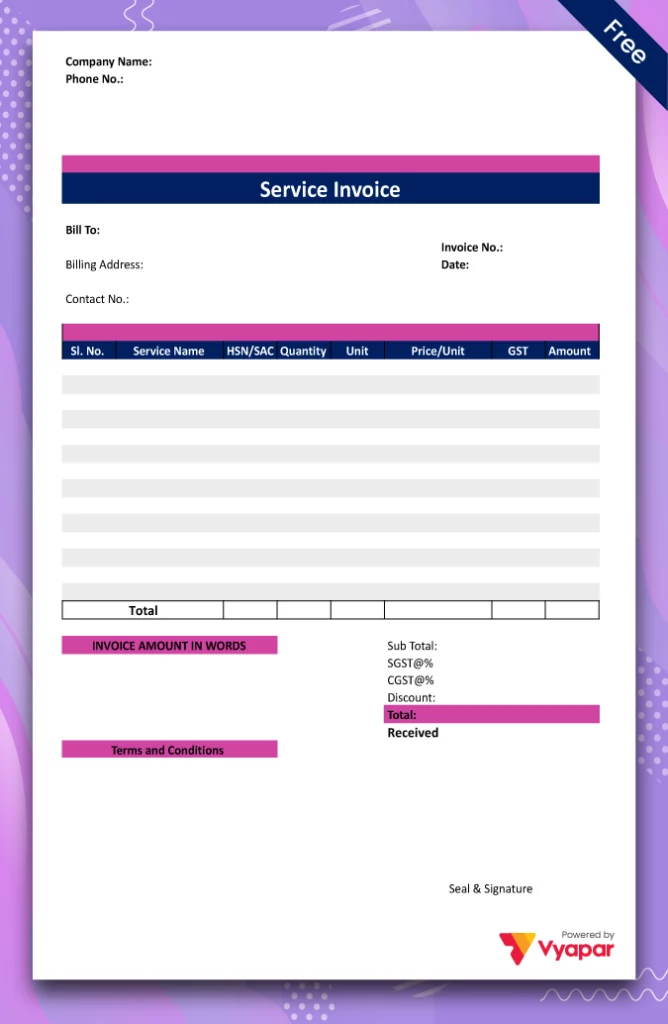

Service Invoice Format Type II

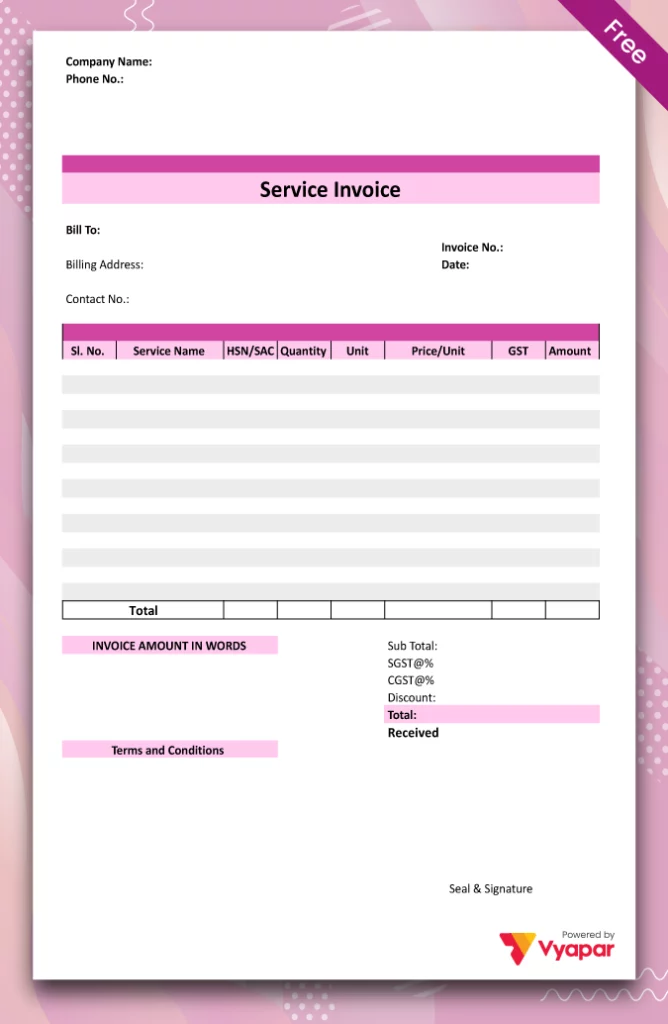

Service Bill Format Type III

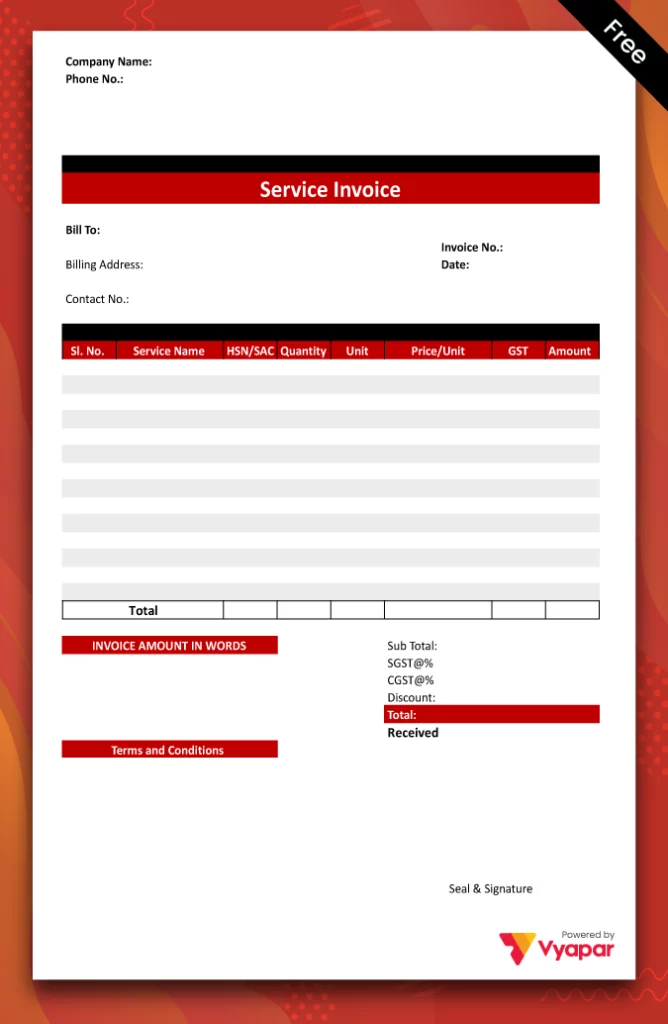

Service Bill Format Type IV

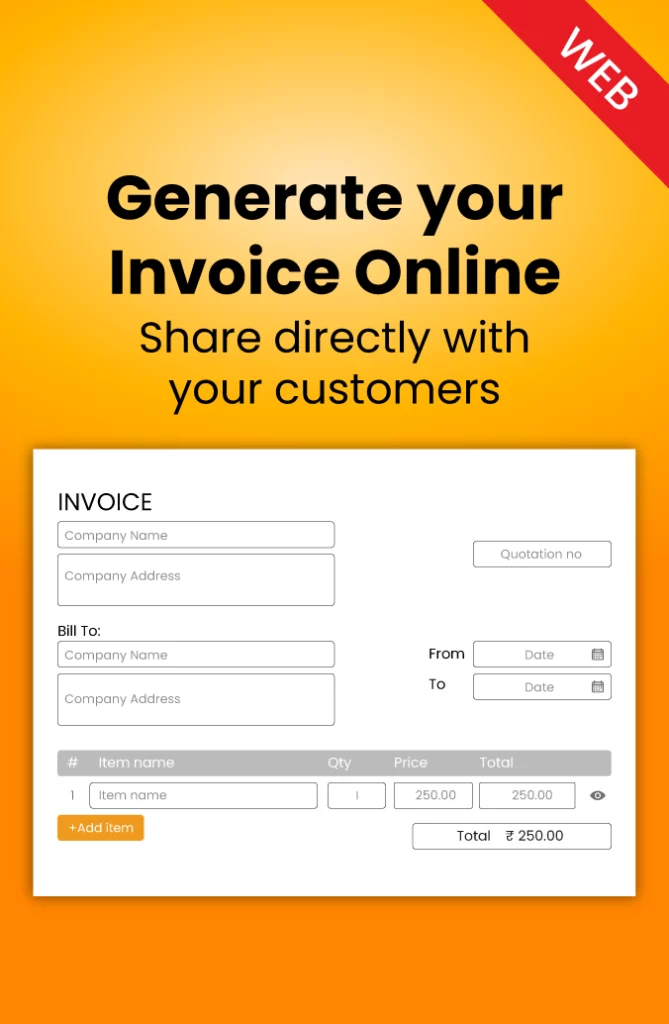

Generate Invoice Online

Get 50+ Editable Service Invoice Templates. Try Vyapar for FREE!

Highlights of Invoice Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

What is Service invoice Format?

A legal document that contains all information about a transaction in a detailed form is known as a service invoice. The transaction may include services, trade, etc. You can use a sample service invoice template to create a professional invoice for services you provide to your customers.

Businesses worldwide tend to record their expenses and the time spent on various projects. In such a case, a service invoice comes in handy. These invoices can also be printed and filled out physically. So, it serves as a bill and a record of services in a single document.

A document copy is kept with both parties involved in a transaction. Using Vyapar service invoice format makes it easier to keep a record and provide proof if needed.

Know The Different Types of Service Invoices

Different businesses use various types of service invoices for their transactions. These different types depend on the kind of industries these businesses belong to.

The type of service invoice format used also depends on the kind of service and the choice of mode of payment.

Standard invoice:

A standard invoice is a sale document created by a business to be later submitted to a client. It is also known as the most common form of service invoice used. This type of sample invoice is more flexible in nature which helps it to be implemented in various industries. Using customer invoices is best in a standard format.

The details of a standard invoice are as follows:

- Name of business and contact details

- Name of client and contact details

- An Invoice Number

- The amount of money charged by the industry to the client or the amount of money the client needs to pay to the company.

Credit invoice:

This type of invoice is also known as a credit memo. A business provides this type of invoice in cases where they want to give a :

- Refund.

- Discount.

- Correction for a mistake in the previous service invoice.

A notable fact about this type of invoice is it always writes a negative number for the total charge. This means if a client is being returned, say ₹200. Then it will be reported as -₹200.

Debit invoice:

This type of invoice is also known as a debit memo. This type of invoice is usually issued by businesses where they intend to increase the amount owed by the client to them.

A debit invoice can make enormous differences for many small businesses and freelancers who are looking forward to making some adjustments to pre-existing bills. It might happen in cases where a freelancer charges their client based on their work hours.

Later, it so happens that they put in additional hours to complete the project. So, now the freelancers can use freelancer invoicing software and send the client a debit invoice to adjust the charge for the extra hours. It is a notable fact that the debit invoice always carries positive numbers.

Commercial Invoice:

This type of invoice is used by businesses that have international clients. It is the most appropriate type of service invoice for international deals because the details in this document include the determination of all customs duties to be paid on international sales. The information that is mentioned in this sample invoice is as follows:

- Quantity of shipment.

- Volume/weight.

- A brief description of goods.

- Total value.

- Format of packaging.

Timesheet invoice:

This type of invoice mentions the charge put up by a business or a freelancer according to the hours put in by them. That is, the billing is according to the standard rate of pay which is wholly based on the number of hours they have worked.

Clients pay the other party according to the hours mentioned in the timesheets. This type of invoice is mainly used in industries where the consumers are billed hourly, including freelancers, psychologists, lawyers, etc.

Expense report:

This type of invoice is usually used by employees to bill their employer for the reimbursement of something related to the business.

For example, if a company sends their employee to a business lunch meeting, then he can form an invoice for the same. The invoice can include a meal, parking, and travel charges.

Pro Forma Invoice:

This invoice is also known as an estimated invoice as this is sent to the client before providing them with the services. It is an estimate of the charges that will be incurred after the services are delivered.

In many cases, a Pro forma Invoice template may have to be altered according to the business’s work hours. It is done so that the document’s details are accurately mentioned.

Interim invoice:

This type of invoice is used mainly by large businesses for high-level projects. These high-level projects include the agreement of multiple payments agreed upon by both parties in the contract. In this type of invoice, certain milestones are made where the business provides interim invoices.

Using interim invoices ensures that the business or freelancer is paid in parts as they progress towards the project completion. This invoice also helps many companies manage expenses, cash flow, and budget. It is helpful while working on projects that take longer to complete.

Final invoice:

This type of invoice is a final document. A business submits it to the client after completing a project for a payment request. A final invoice is more detailed than a pro forma or interim invoice. This type of invoice includes:

- A detailed list of all the services provided ( item-wise).

- The total cost incurred for the completion of the project.

- The invoice number.

- Invoice due date.

- The different methods of payment accepted.

Past due invoice:

This type of invoice is provided by a business on the non-payment of dues by the client. Mostly, there is some fixed due date set in the final invoice. The other party can provide a past due invoice if the client doesn’t abide by it.

This type of invoice should be sent to the clients as soon as they miss the payment due date. This invoice includes all the unpaid dues of the past with the details of the services provided. It refers to the payment details as mentioned in the final invoice. This document also includes the interest charges and late fees, if any.

Recurring invoices:

Recurring service invoices benefit businesses that charge the same amount from their clients regularly in exchange for their services. Making recurring invoices using service bill formats can help save time with automation.

This type of invoice is prevalent for IT businesses who request the same payment from their clients or freelancers who deliver services according to a standard package.

Purchase invoice:

A purchase order invoice format is a commercial document provided by the seller to the buyer. This document includes the goods and services purchased with proper details of quantities purchased and their sale price.

This document is produced as proof of services bought and they were paid for. A professional purchase invoice can be created using a professional service invoice template maker app.

Sales invoice:

A sales invoice is a type of document sent by businesses to their clients as a request for payment. This document contains details about the goods or services sold to the client with the mention of quantity and price.

You can create a customisable invoice for sale using a service invoice format. This document is also taken as an official sales record for both the seller and the buyer.

E-invoice:

E-invoice is a general term given to a type of service bill format sent via a digital medium. The service invoice app sent electronically can be of any kind. The format is customisable to meet unique business requirements.

Nowadays, E-invoicing software is becoming more and more popular among different businesses. These are easier to create and share, making it possible for a business to get paid faster than physically prepared invoices.

So What are you waiting for?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

The Essential Elements Of a Service Invoice Format:

The details mentioned in a service invoice format are usually not standardized. They vary from business to business. But, five major components need to be included in every service invoice created using Vyapar formats to make them professional. These are as follows:

Invoice number:

It is necessary to assign an invoice number to every invoice that is issued. Having an invoice number ensures that the information can be tracked through this number. This feature comes in handy for both the seller and the client.

You should always serially assign invoice numbers so that there is a clear idea about the number of invoices issued.

A date:

The date specifies the exact time and date when the business or supplier has officially recorded the transaction to bill its client. It is a crucial document detail as it controls the due date of payment and duration of credit in a transaction.

Usually, the due date is made 30 days after the date given in the invoice. But this date can also be flexible as decided by both the parties.

Contact information for the business:

The contact information for the business includes the name, address, contact phone number, email address, and any other contact information accompanied by the client’s information.

Details of the goods and services:

The description of each item or goods/service provided by the business in the document in the form of a list. The list includes all information about the goods and services, such as price and quantity.

At the bottom of the document, all the lined-up items are added. Here, the extra charges or taxes are also mentioned and applied, if any.

Terms of payment:

If a business wants to increase its chances of receiving payment within a stipulated time, it should focus on this document area. The payment terms must specify the date decided by both parties to pay dues.

Benefits Of The Service Invoice Format

Increases client satisfaction:

Every business focuses on client satisfaction as its first priority. A business owner usually wants to do anything to make their client happy. You can build a positive brand image by providing your client with a professional service invoice using Vyapar.

Professional service invoice formats will help you create a good impression on your customer. They will further help you keep a record of transactions. The different details in a service invoice will turn out to be very useful in the future for both parties alike

Strengthens business relations:

Service invoices reflect professionalism. They also signify that the business is invested in doing the work the right way. A carefully drafted service invoice ensures that you stand out from the crowd in terms of quality.

This quality of your will give you leverage over other businesses in the eyes of the client. It also becomes a part of your communication with your client. So, you should make the most out of it.

Legally Beneficial:

As mentioned before, these are legal documents. So, they will surely help you with your client’s trifling situation.

If shortly you encounter a situation of non-alignment with your client regarding transactions, then this document will help you solve the problems.

Ease of access:

This format is easy to use and share. You will not require extensive training to understand the procedure of developing a service invoice format.

Further, you can send payment reminders with links to customers on WhatsApp, SMS, and email. So, it will make your transactions with your clients very easy.

Flexibility in managing cash:

A service invoice app by Vyapar gives you a heads-up about the time of payment. It also helps you to keep a record of all your expenses, payments, etc.

These things, in turn, help you to manage and direct your cash flow accordingly. You can track your receivables and payables from the business dashboard. Further, you can create a business strategy suitable for your current cash flow. time, it should focus on this document area. The payment terms must specify the date decided by both parties to pay dues.

The Other Benefits Of Using The Vyapar Application For The Service Invoice Format:

Customize your payment options:

Using the best service invoice format maker app, you can also choose to collect half payments in advance. Or you can receive partial payments till the completion of the project. It ensures that the businesses receive early payments without any risks.

Never miss out on payments:

An application with a service oriented invoice feature can help you automatically create recurring invoices over time. This application can even send out the invoices on the day you decide for every month. Using free service invoice templates, you can reduce stress from work and focus on core business requirements.

Access from anywhere:

This accounting software allows you to access it from anywhere and on any device. It ensures that you can develop your service invoice and share them while doing whatever you want to. You can also communicate with your clients through this app while on the go.

Keeps your business organized:

Keeping things online saves you from all the hustle of completing paperwork. Switching to the Vyapar application can help you keep your business records at all times.

Frequently Asked Questions (FAQs’)

While writing a service invoice, you need to keep in mind five essential points that need to be included in your document. These crucial points are:

1. Invoice number.

2. A date.

3. Contact details of the business.

4. Details of the goods and services provided.

5. Terms of payment.

A service invoice is a detailed legal document. This document contains details about the goods and services and provides a deadline for payment.

A sales invoice contains details of the sale of goods, whereas a service invoice contains details of the sale of services. Simply put, a sales invoice can be treated as the primary document, whereas the service invoice is a supplementary document.

A service invoice in GST is a bill of items or services a business gives to the consumer.

A service invoice template is a pre-designed format that freelancers or businesses can use to bill their clients for services rendered. It typically includes sections for the service description, rates or fees, quantity or hours worked, total amount due, payment terms, and other relevant details. Service invoicing template download easily and help streamline the invoicing process and ensure consistency in billing practices.

The purpose of a service invoice is to formalize payment requests for services provided, maintain organized records, track payments, serve as legal documentation, and enhance professionalism in client transactions.

Yes, issuing an invoice for services is generally mandatory for legal and financial purposes. Invoices serve as official documentation of the services provided, specify payment terms, track payments, and fulfill tax requirements. They also help maintain transparent and professional relationships with clients.

To create a service invoice in Tally, you can follow these general steps:

1. Open Tally software.

2. Select Sales Voucher.

3. Choose the service ledger.

4. Enter invoice details (number, date, client, service description, rate).

5. Add tax details if applicable (GST, etc.).

6. Save and print the invoice.

IRN (Invoice Reference Number) is mandatory for service invoices in India generated using the e-invoicing system. The e-invoicing system under the Goods and Services Tax (GST) regime requires certain taxpayers to generate invoices through the GSTN portal and obtain an IRN. However, the specific requirements for IRN and e-invoicing may vary based on the turnover and nature of the business. It’s important for businesses to comply with the relevant tax regulations and consult with tax professionals or authorities for accurate guidance on IRN and e-invoicing requirements.

To create a service invoice in SAP, follow these general steps:

1. Log in to SAP.

2. Access the Accounts Receivable or Financials module.

3. Create a new invoice or billing document.

4. Enter customer details.

5. Select service items and enter details (description, quantity, rate, taxes).

6. Review and finalize the invoice.

7. Save and issue it to the customer.

If you encounter any difficulty while creating a service invoice in SAP, you can connect with Vyapar for assistance. Our team can provide guidance and support to help you navigate through the invoicing process in SAP or address any specific challenges you may face.