Tally Bill Format in Excel

You can download the Tally Bill Format in Excel to invoice your customers. Or use the Vyapar App to do billing, inventory, and accounting easily & grow your business faster. Avail 7 days Free Trial Now!

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download Easily Editable Tally Bill Format in Excel

Download the tally bill format in excel, and make customization according to your requirements at zero cost.

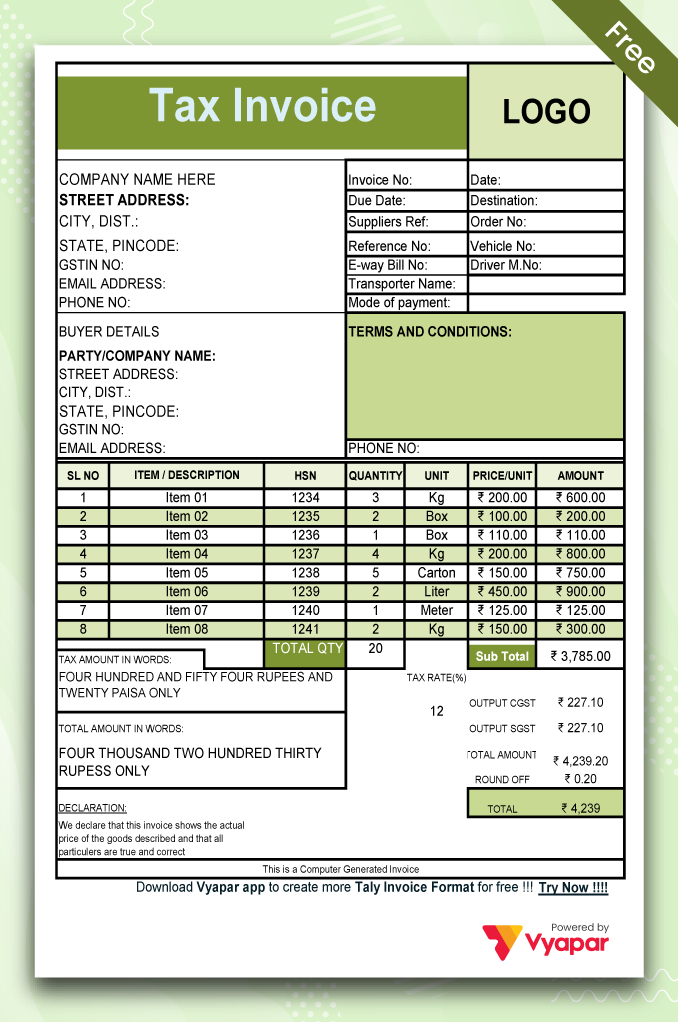

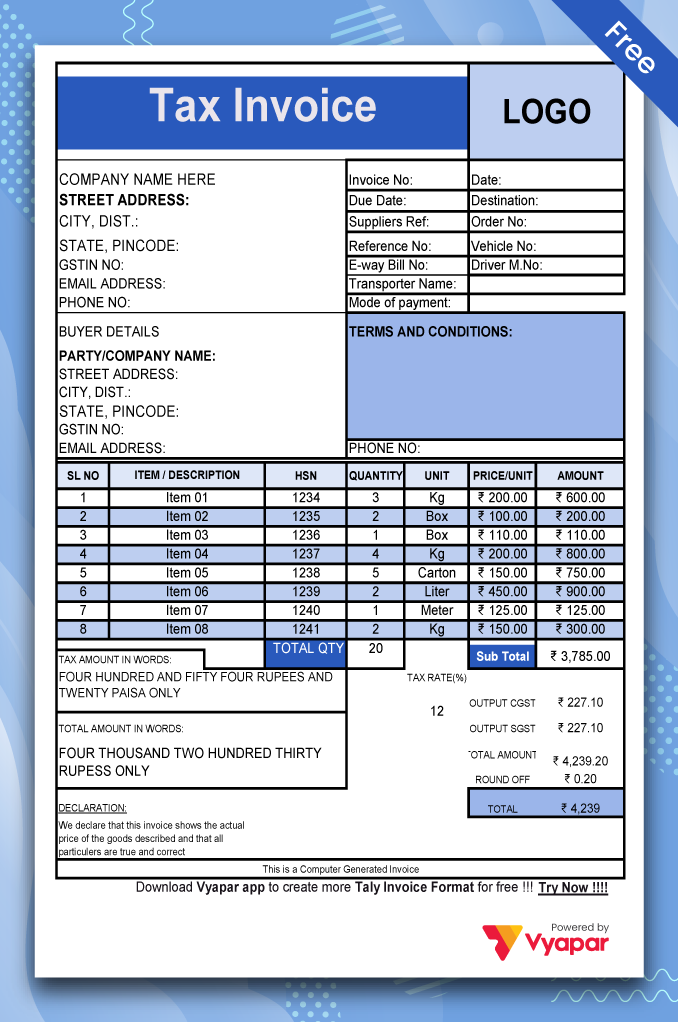

Tally Invoice Format In Excel – 01

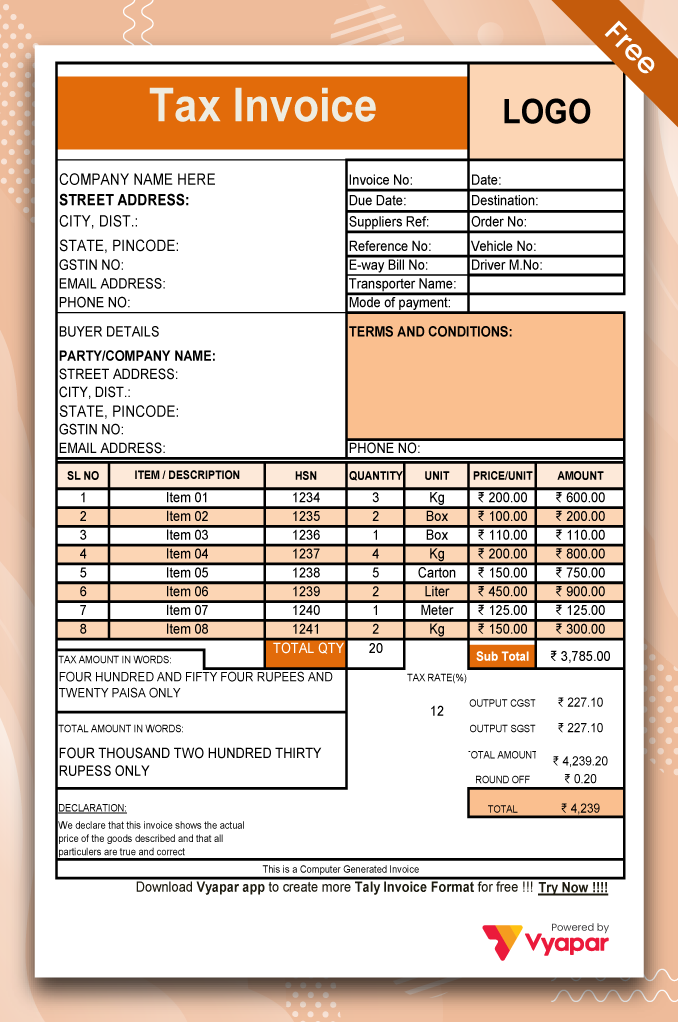

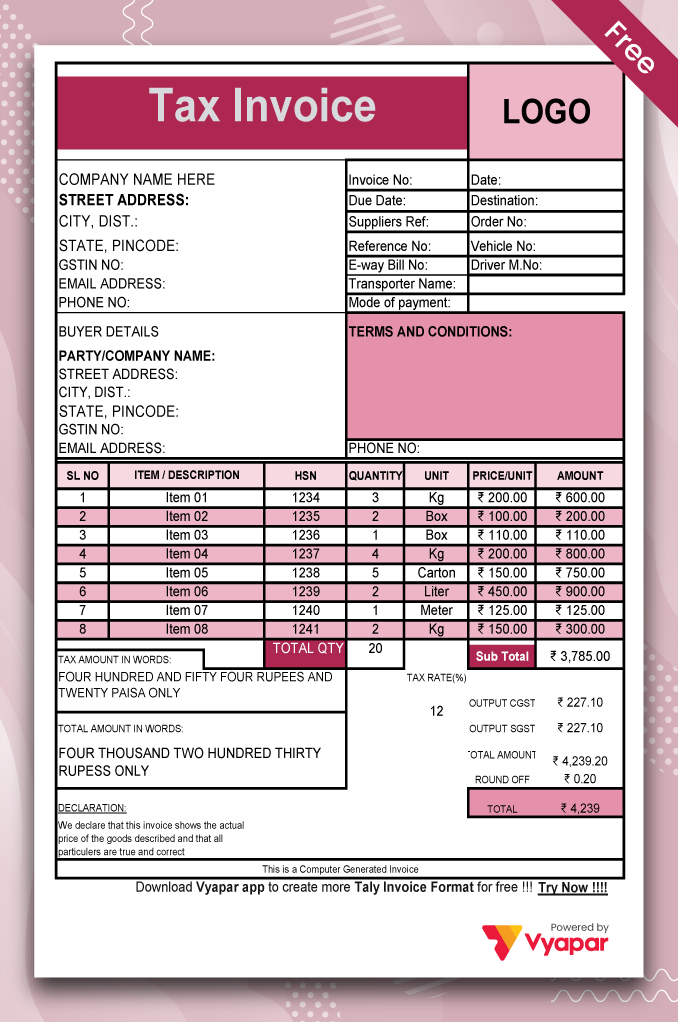

Tally Invoice Format In Excel – 02

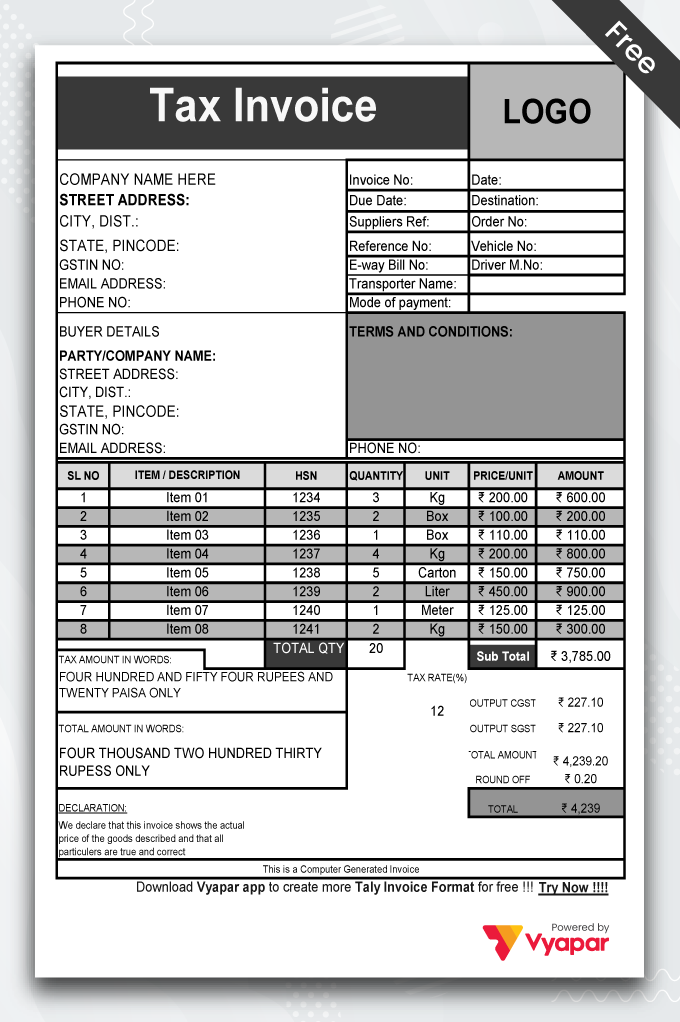

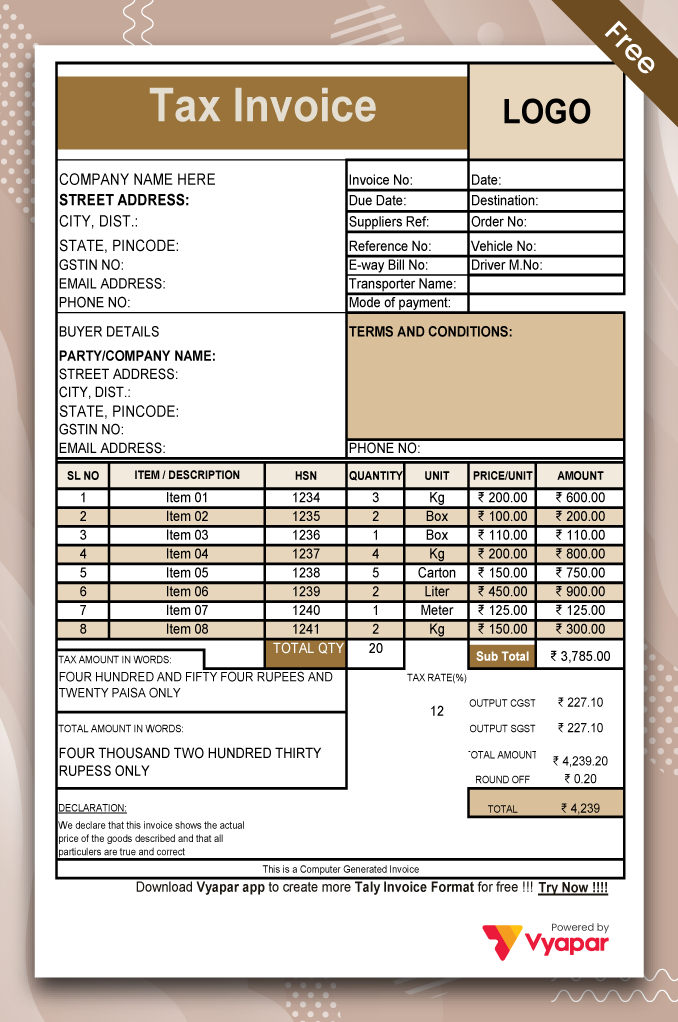

Tally Invoice Format In Excel – 03

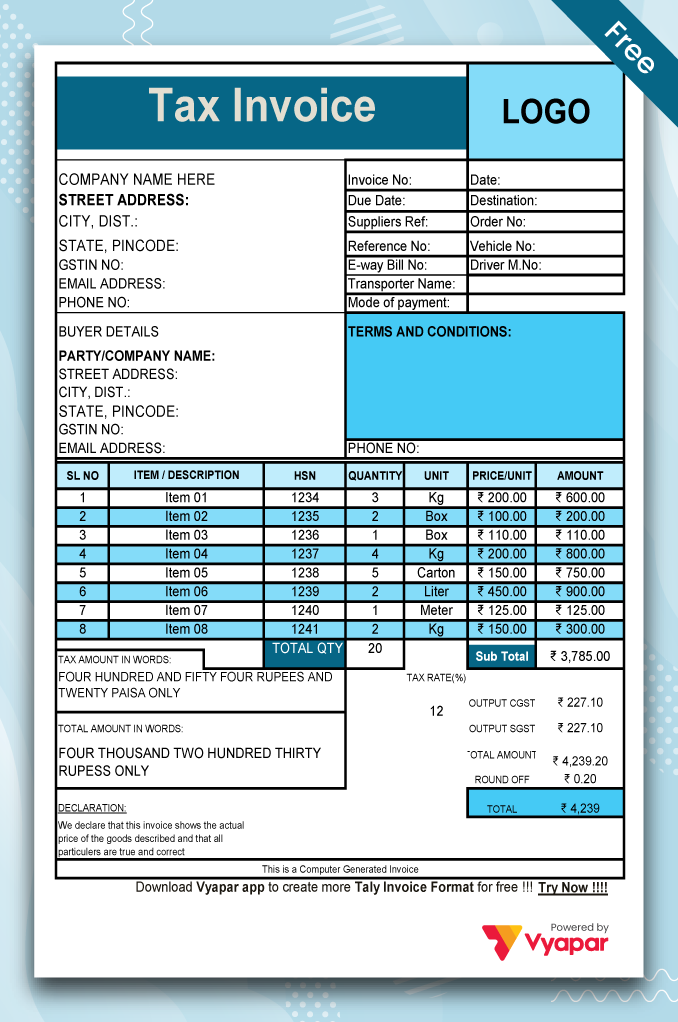

Tally Invoice Format In Excel – 04

Tally Invoice Format In Excel – 05

Tally Invoice Format In Excel – 06

Tally Invoice Format In Excel – 07

Generate Invoice Online

Use 10+ Tally Invoice Templates to Customize. Try it Vyapar for FREE!

Highlights of Tally Bill Format in Excel

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Tally Bill?

A tally bill is a certified document that serves as evidence of different transactions involving the buying and selling of goods. It is an official record of the transfer of ownership from one party to another, indicating that the goods have been successfully sold.

Vyapar software offers free Excel billing software, specifically tailored for businesses to facilitate efficient billing processes. The tally bill acts as confirmation of billing customers for their purchases as stated in the sales invoice.

A tally bill is utilized for a variety of business transactions, specifically involving the transfer of tangible goods. It is referred to by various names such as bill, tax invoice, invoice, or bill of supply.

By using a tally bill, business owners can easily monitor expenses and keep track of payments due or received. This document is instrumental in tracking the specifics of outstanding payments or payments made. It serves as a useful tool for maintaining financial records and ensuring timely payments.

Why Do You Need a Tally Bill?

A tally bill is a legal document showing a transfer of goods ownership. The transfer is from the seller to the buyer in exchange for compensation. The bill contains all the necessary details of the transaction of goods.

It includes the name, address, contact details of the seller and buyer, date of purchase of goods, price of the goods, description of the goods being sold, and the signatures of the buyer and seller.

There is much importance in the tally bill. The reasons why you need a tally bill are as follows:-

1. Document Proof of Transfer of Ownership of Goods:

The tally bill is primarily utilized for the transfer of ownership of goods from one individual to another. In these exchanges, it is necessary to have legal evidence confirming the transfer of goods.

Therefore, the tally bill functions as a legal proof document. Serving as an officially documented agreement between the seller and buyer, the tally bill holds legal validity in court. As long as it complies with the specific state regulations under which it was created, it is considered valid proof of transaction.

2. Detailed Customization or Requirements For Certain Situations:

An invoice can be customized in Excel to suit the requirements of both the seller and buyer, based on the completion of transaction terms. It also includes a detailed list of any warranties or guarantees provided with the sale.

A customized invoice is a crucial legal document when using the customization options in the Vyapar app. It is used to record the transfer of ownership of goods from the seller to the buyer when necessary.

3. Acts as a Record of the Sale Of Goods:

The essential document for a seller is a tally bill, as it contains crucial details about the buyer, such as their name, contact information, the date of purchase, and the total amount of goods bought. This information serves as evidence that the goods were indeed sold to the buyer.

A tally bill is used as legal proof to depict the sale of goods. It is a bill that will have details of all the goods bought along with their total amount.

If your company requires invoicing solutions to serve data into existing systems, ensure that the vendor can supply you with safe and seamless software integration.

Benefits of Using the Vyapar App For Tally Bill Format in Excel

- Vyapar app constitutes accounting, inventory, and invoicing software. There are a lot of benefits of using the Vyapar app for tally bill format in excel. Vyapar software allows you to track day-to-day business transactions. It also allows you to create customized GST invoice formats.

- The Vyapar app ensures that you can create professional and customizable GST bills. These bills can be shared with your respective customers. You can even manage your cheques and bank accounts. Vyapar has several invoice formats and bill templates that you can choose from.

- Vyapar GST billing and accounting software allows you to create an online store. By this, you get to accept online orders directly from customers. It ensures that you are generating sales throughout the day. Vyapar software is easy and compatible with all forms of printers. So you can print the bill formats and invoice templates easily.

- The Vyapar app is handy in managing the inventory of a business. The billing software gives you low-stock reminders and lets you view your business growth and progress with several reports. The inventory quantity is visible along with the stock value. You get to keep your stock in control while you are doing your invoicing and billing.

- Vyapar GST billing and business accounting software is an excellent app for small business owners. The app has great benefits and features that will help you handle your business smoothly. Vyapar billing and free inventory management software are ideal for all your business accounting needs.

Features that Make Vyapar the Best App For Creating Tally Bills in Excel

Vyapar’s billing and accounting software is user-friendly and simple to navigate. It streamlines the process of generating invoices in excel by utilizing the different templates provided. Vyapar reduces the necessity of using multiple programs and platforms.

The software addresses various accounting challenges that businesses face, such as GST filing, monitoring cash flow, managing information, collecting payments, tracking inventory, building brand recognition, tracking expenses, expanding reach, and ensuring product availability.

Here are some features that make Vyapar best for your tally billing requirements.

1. Manage Cash Flow Seamlessly:

Vyapar billing software allows businesses to record business transactions. It ensures that you can track payments efficiently. Cash flow management is mainly used for billing and accounting requirements.

The GST invoicing software is beneficial for creating and maintaining a business cash book. Tallying can also be done with the data available on the expenses, purchases, payments, etc. Efficient cash management with this GST billing and accounting software is easy.

The Vyapar billing software helps automate management. By using this invoicing and customizable billing software, businesses get to manage their cash flow efficiently. It is an all-in-one software that ensures efficient management of cash transactions. Lastly, it helps in avoiding a debt trap that may occur due to the mismanagement of funds.

2. Manage Your Inventory Space:

Inventory management is critical for any business. Vyapar accounting and free billing software are beneficial in such cases. Using the free GST invoicing and billing software, you can track all the available items in your store. It helps you to set up low inventory alerts. This is done so that you can place orders in advance and detect possible theft.

Utilizing a professional inventory management tool can assist in effectively organizing and managing warehouse items. This tool streamlines stock space organization to meet customer demands. You get to save space by eliminating the goods you do not need. The feature available on the billing software helps you detect theft in your store.

Often the stock of goods is reduced in the inventory as the sales are made. Periodic checks on the Vyapar software also help in finding any inventory mismatch. This is done by using the inventory management system available in the free GST billing software.

3. Data Safety and Backup:

Keeping your data safe and secure should be the utmost priority of any business. It is because your data is the backbone and the most critical aspect of a business. Data reports can be generated and analyzed for future growth and progress using sales data.

You can set up an automatic data backup using the Vyapar billing and accounting software. This feature on the software allows you to secure and safeguard the stored data. You can create a local backup for additional safety and security.

Losing critical business data can harm your sales numbers. So it is an utmost priority to make data backups to ensure you have all the data safe and secure. Hence, GST billing and free invoicing software allow you to set up an automatic data backup. By using the automated data backups feature, you can ensure the safety of your business.

4. Track Orders:

This advanced GST billing and accounting software generates sales or purchase orders efficiently. It helps businesses to set up a due date for tracking orders seamlessly and conveniently.

An auto stock adjustment feature is available on the Vyapar accounting software. This feature helps in ensuring the availability of inventory goods. Businesses can track all sorts of orders, like open, overdue, and closed, using the Free GST billing software. It is a perfect choice for businesses as it is an important aspect.

Using this feature makes the tracking process seamless and convenient for businesses. It further helps improve the overall performance of the company and its employees. A lot of time can be saved by converting orders to purchase or sale invoices using automation.

Enhancing sales and purchase order formats on the Vyapar app is made easier and more efficient. The app offers a variety of options such as PDF, Word, and Excel. Utilizing the GST billing and invoicing software can reduce the amount of labor and costs involved.

5. Online Store:

You can set up your online store within a few hours using the Vyapar billing and accounting software. Vyapar billing app can list all the goods and services you sell to customers in the online store. It helps businesses to present a catalogue of all the products and services they sell. It eventually boosts your sales online.

Using the online store feature in the Vyapar app for your business will help you reduce the waiting time at the store counter. It allows you to bring in more customers by taking your business to an online platform.

The Vyapar billing and accounting software does not take any charge for using the online store feature. It helps you take your business online in a seamless manner.

You can share the link to your online store with your customers. By using the link, customers can place orders online. Your customers can pick up the orders from the store once they are packed, or you can deliver them to their doorstep.

6. Bank Accounts:

Businesses can effortlessly include, control, and monitor online and offline payments through the Vyapar application. These are followed and handled very efficiently and quickly. Vyapar is an easy-to-use free GST billing and invoicing software. The revenue from banks or e-wallets can be sent seamlessly. Users also get to enter the data into the Vyapar accounting software.

The Vyapar accounting software is easily accessible anywhere to users with internet connectivity from their mobile. Vyapar software allows for manual adjustment of amounts and management of cheque payments. Money can be sent or received using bank accounts.

Vyapar also allows you to perform bank-to-bank transfers for efficient cash flow management. Hence, it is ideal for businesses to use the Vyapar billing app for all the cash-ins and cash-outs. Vyapar also ensures that you can deposit or withdraw money in the bank accounts smoothly.

7. Send Estimates And Quotations:

Vyapar billing app develops professionalism concerning your business for your valued customers to attract them back. Investing in advanced GST billing software is a wise choice for any business looking to streamline operations.

Essential documents can be created and generated using the billing software. The documents include estimates, quotations, and GST invoices. The inbuilt features in the Vyapar app allow users to send estimates and quotes to customers anytime. You can send it to customers through email, printing, SMS, or WhatsApp.

Vyapar accounting software provides a professional outlook to your business. It helps in automating most of the business processes. The quotes, invoices, and estimates are error-free. Sending quotes and estimations are simplified on the Vyapar app.

8. Choose Themes:

Enhancing your brand’s image and identity by using professional invoice formats with your customers is key. The Vyapar app offers two invoice themes specifically designed for thermal printers, as well as twelve themes for regular printers. It is the top choice for managing accounting and inventory.

Vyapar had various GST invoice formats that could meet the necessary business requirements. Using the Vyapar software builds a professional brand image for your company.

Vyapar is efficient in gaining the highest invoice standard quickly and easily. It provides users with several theme options for both thermal and regular printers.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

What are the Key Contents of the Tally Bill Format in Excel?

The critical contents that a tally bill format should consist of are as follows:-

1. Name, Addresses, and Contact Details of the Seller and Buyer:

The inclusion of this element in the invoice is essential. It serves as a safeguard for both the vendor and the purchaser in case of any legal issues down the line. Therefore, it is crucial for a well-structured professional tally bill format to include the seller’s and buyer’s names, addresses, and contact information.

2. Price of the Good:

The overall cost of the items sold must be clearly stated in the invoice, and utilizing a tally bill format in excel can streamline this process. Calculate the total amount and indicate the final payment required for the transfer of goods ownership

3. Description of the Goods:

The tally bill must include a detailed description of all items sold, including quantity. It is essential to provide a comprehensive description of the goods being transferred. The tally bill should accurately list all goods sold with their respective quantities.

4. Date of Purchase of Goods:

Another essential component of a tally bill is the date of purchase of the goods. It cannot be missed in the format.

5. Method of Payment:

You can mention the payment methods provided to the customer in the tally invoice ftemplate in excel. It may include cash or wire transfer.

6. Signature of Both Parties:

The buyer and seller’s signature is included in the tally bill template in Excel. It helps make the tally bill authentic and reliable for both parties.

7. Warranty Details:

Generally, a tally bill contains the condition of the goods sold and the warranty thereof. It also guarantees that the items in question are free from all claims.

8. Guarantee Details:

A tally bill also guarantees that the good is free from all claims. It is also vital content in a tally bill template in excel.

9. Tax-Related Information:

Ensure that any information pertaining to taxes is included in the tally bill template. This is a crucial element of the tally bill template in Excel. For example, make sure to specify any state, local, or sales taxes that are included in the total purchase amount.

10. Signature of the Notary Public:

The signature of the notary public is only applicable in some cases. However, if required, then it is a must to be stated in the tally bill. In cases like these, without the signature of the notary public, the tally bill may not be valid.

Frequently Asked Questions (FAQs’)

A tally bill is an essential legal document proof. It is proof of all the goods sold and purchased. A tally bill format in excel is created efficiently. It helps in tracking bills for the business. It is an invoice format in excel that is legal proof.

You need to follow the steps given below to make a tally format in excel:-

1. Create a Bill Header along with Company Details:

Here, you must enter the necessary company details such as name, company logo, address, contact details, etc.

2. Add Bill Details to Tally Bill Format in Excel:

In this part, you have to enter the company bill number, the due date of the payment, the date of issuance, the proforma invoice, etc.

3. Enter the Customer’s Details in Tally Bill Format:

Here, you will have to enter all the necessary details of the customer. It includes the customer’s name, address, contact details, unique customer ID, and GSTIN No.

4. Description of the Goods provided to the Customer:

It is an essential aspect of the tally bill format. Here, you should describe the goods and services to the customers. You should include everything about the goods provided, such as the names, quantities, prices, etc.

5. State the Total Amount:

Here, you need to add the total amount of the goods and services provided. If you apply any taxes to goods and services, you must also state that amount.

6. Mention any Notes or Payment Terms in the Tally Bill Format:

In this section, you can state all the payment terms or any notes about the payment. For instance, if you have any late fee policy or mode of payment related to the service provided. These things can be stated in this part.

By following these steps, you can make a tally format in excel. Do not forget to miss out on any steps.

Once the registered dealer issues a tax invoice format in excel to another, based on this invoice, the purchasing dealer can claim the input tax credit.

Tally offers pre-defined invoice formats, but customization is limited. You can try “Account Information > Personalized Invoices” for small changes. For advanced formatting, consider third-party add-ons or explore Vyapar’s user-friendly invoice creation within the app.

Tally itself does not determine the size of the invoice. It depends on your chosen format and printer settings. Use pre-sets, customize margins, or adjust printer settings for the desired size.