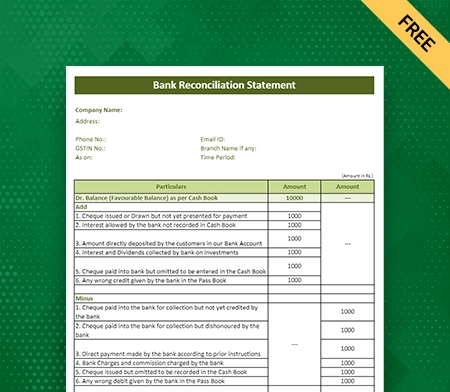

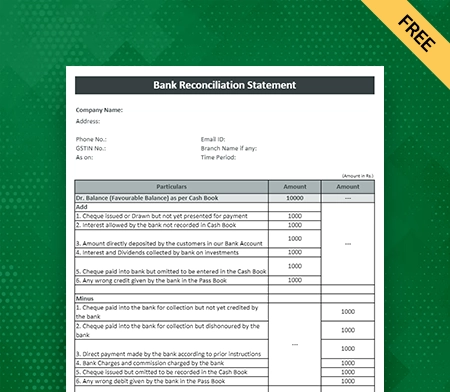

Bank Reconciliation Statement Format in Excel

Use the best accounting software to create your processional-looking bank reconciliation statement format in excel. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all formats for free.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download Bank Reconciliation Statement Format in Excel

What is the Bank Reconciliation Statement Format In Excel?

A bank reconciliation statement format in Excel is used as a document that matches a company’s bank account with its financial records. It usually has several sections where you can write down the bank statement balance, the company’s adjusted book balance, outstanding checks or deposits, bank fees or interest, and other items that need to be reconciled.

The bank reconciliation statement template helps determine the differences between “bank statement” and “company’s records” easily. This helps to find and fix differences, which is important for correct financial reporting.

The Benefit Of Using The Bank Reconciliation Statement Format In Excel

Here are the following benefit of using the Bank Reconciliation Statement Format In Excel:

1: Enhance Accuracy

Bank reconciliation statement format in Excel is a reliable platform for doing calculations. It provides companies with tools that allow you to automate repetitive calculations, so you don’t have to do them manually, which eliminates the possibility of having any mistakes in the document.

Users can easily reconcile transactions using Excel’s accuracy and precision, ensuring the bank reconciliation statement template matches the company’s records. It will save your company valuable time and effort and assists you in having better financial management in your business.

2: Provides Efficiency

With Excel’s formula features, calculations are done automatically, which saves ample time and effort compared to doing calculations by hand. With built-in functions like SUM, AVERAGE, and VLOOKUP, users can quickly do complicated math without entering or changing data by hand.

The Excel sheet speeds up the reconciliation process and makes it less likely that any mistakes will happen in the balance sheet. Excel’s ability to handle large data sets well means that users can reconcile their bank statements faster, giving them more time to work on other important financial chores.

3: High-Level Customisation

Excel allows you to change the format of your bank reconciliation statement to fit your needs. Users can add or remove fields, change the order of the data, and add more formulas as needed. It allows the creation of a customised reconciliation statement that fits the organisation’s specific accounting practices or reporting tastes.

Templates in Excel allow users to create a bank reconciliation statement format that works best for them, including specific calculations, accounting records, summary tables, and conditional formatting. It makes the bank reconciliation process more efficient and accurate.

4: Better Organisation

Excel has a structured and organised setup for recording transactions and putting them into different categories. It is a strong base for keeping track of internal financial status and analysing financial data. Users can make clear columns and rows to enter transaction information like date, description, amount, and category.

This organised setup makes it easy to sort, filter, and group data, making it easier to track and analyse financial information. With Excel’s data editing tools, users can summarise and combine transaction data, make pivot tables, and make reports. It enables them better understand the reconciled bank transactions and make more informed decisions.

5: Helps In Maintaining Audit Trail

By keeping track of and writing down all changes to the balance statement, Excel makes it easy to keep a clear audit trail. Using features like cell comments or revision history, users can easily keep track of changes, including the times and names of the people who made them.

It makes it possible to keep records in an open and accountable way, which protects the purity of the reconciliation process. Excel’s audit trail shows a full history of changes in case of mistakes or discrepancies, making it easier to find problems and figure out what went wrong. This feature makes it easier to see who is responsible for what and to check that the bank balance statement is correct.

6: Seamless Record Management

The structured and organised bank reconciliation statement templates make it easy to record and sort transactions, making it easier to track and analyse financial data. Users can create columns for transaction information like date, description, amount, and category. It makes sure that everything is clear and consistent.

Bank reconciliation Statement format in Excel functions and tools allows you to do calculations, summaries, and visualisations. Data records will enable users to gain insights, spot patterns, and make smart choices based on reconciled bank transactions. Using data can help manage a business efficiently.

7: Gives You Data Analysis

Bank reconciliation statement format in Excel’s built-in features and tools gives you a lot of ways to analyse data on reconciled statements, which can provide useful information about your financial situation and help you spot trends. Users can figure out specific data points’ totals, averages, and counts using tools like SUM, AVERAGE, and COUNT.

Also, tools like pivot tables and charts make it easy to see patterns, trends, and outliers in the corrected data because they make it easy to see how they fit together. With these analysis tools, Excel users can learn more about their financial situation, make choices based on data, and improve their financial strategies.

8: Better Presentation

Excel’s Bank reconciliation statement template provides various formatting options, including charts and graphs, which can be used to effectively present reconciled data visually, thereby enhancing its comprehension and interpretation. Users can select from various chart types, including bar charts, line graphs, and pie charts, to illustrate various aspects of the reconciliation statement.

These visualisations enable the identification of data trends, comparisons, and patterns, facilitating the communication and comprehension of financial information. Using Excel’s formatting capabilities, users can present reconciled data aesthetically pleasing and intuitively, thereby reducing improved decision-making and analysis.

Steps To Create An Bank Reconciliation Statement Format In Excel

Here are the following steps to create a professional-looking bank reconciliation statement format in Excel:

Step 1: Set Up The Necessary Column And Header

To set up the appropriate columns and headers for a bank reconciliation statement format in Excel, make columns called “Date,” “Description,” “Bank Statement Amount,” “Company Records Amount,” “Additions,” “Deductions,” and “Reconciled Balance.” With these headers, entering transaction information and doing calculations will be easy. You can also add back any transit deposit in transit.

The “Date” column will notify the transaction time, the “Description” column will have a short description of the transactions, and the “Bank Statement Amount” will give details about the opening and closing balances. The “Additions” and “Deductions” columns will be used to deduct any outstanding checks, while the “Reconciled Balance” column will show the current balance.

Step 2: Enter Company Records Information

Fill in the information about the company records in the right boxes. In the “Date” column, write the dates that each transaction in your company’s books was entered. Give a short description of each transaction in the “Description” field. Then, based on your company’s records, put the amounts for each transaction in the “Company Records Amount” column.

In the next steps, this information will be used to compare and match up with the data from the bank account. It will help find any differences and ensure the financial records are correct.

Step 3: Perform Additions And Deductions

Next, you must determine how to add and subtract your bank reconciliation account. Use a formula in the “Additions” column to find any deposits or credits on the bank account but not in your business’s records. It could be made up of things like customer deposits or interest earned.

Use a formula in the “Deductions” column to find any withdrawals or debits on the bank account but not in your business’s records. There could be bank fees, returned checks, or activities that were not authorised. By adding and removing these amounts, you can find and fix any differences between the bank statement and your company’s data.

Step 4: Calculate The Reconciled Balance

Use the Bank reconciliation statement format in Excel to figure out the reconciled amount. Start by taking the total number of deductions away from the total number of increases from Step 4. This will tell you how much your account has changed after adding and taking away money.

Then, starting with the amount on the first bank statement, add or subtract the net change to get the reconciled balance for each transaction. The current balance will help you keep track of the exact accounting records, which includes all deposits, withdrawals, and other transactions so that it matches the balance on your bank statement.

Step 5: Format And Finalise The Reconciliation Statement

In Step 5, use your bank reconciliation statement format in Excel to finish the reconciliation statement process. Format it in ways that make it easier to read, like making headers and totals strong or shading them. Think about adding borders to separate parts and make things easier to see. It enhances the customer experience and builds trust in your business.

You can also use conditional phrasing to make any differences or differences stand out so they are easier to find. Include any other information or notes that might be important to the balancing process, such as checks that still need to be cashed or deposits that still need to be made. Check the figures twice and ensure that the final statement shows the correct reconciled balance and clearly shows how the process worked.

Features Of Vyapar That Make It Best App For Reconciliation Processes

1: Manage Your Business Cash Flow

Businesses can keep track of transactions with Vyapar free billing software to efficiently perform their bank reconciliation statement format in Excel. Vyapar helps you keep track of funds and allows you to compare the Bank balances per bank statement. More than a billion businesses have used our free billing tools.

Vyapar’s programme helps to automate management and removes repetitive tasks. It is done to keep accountants from making mistakes and identify the uncleared check and deposits in transit. By buying this billing programme, you can easily keep track of your business’s cash flow. This software has everything you need to manage cash transfers, as it has features like keeping track of bank withdrawals and transfers.

Creating a real-time cash balance is easier with our free accounting software. It can help a business keep its cash flow going and keep track of the information about costs, payments, purchases, and other things. With this GST accounting programme, it’s pretty easy to keep track of cash. You can also customise your bank reconciliation statement in various formats.

2: Create Your Bank Reconciliation Statement In A Different Format

Vyapar software is a flexible way to create bank reconciliation statements in different formats such as doc, Excel, Word, and PDF. This programme makes it easy for users to make bank reconciliation statements that are just right for them. These formats are professional looking and well-detailed.

Vyapar accounting software for bank reconciliation allows you to make your reconciliation statement in the format you want, whether you like the freedom of an Excel spreadsheet, the look of a Word document, the portability of a PDF file, or the compatibility of a doc format.

It allows users to easily add the statement to their financial routines, share it with others, or save it for later. Vyapar inventory management software gives users multiple ways to make bank reconciliation statements quickly and easily. It helps users improve their accounting processes.

3: Tax And Discounts

Using the software’s sophisticated features, you can monitor the status of each payment. Vyapar aids in establishing tax due dates, ensuring that your business maintains a healthy and consistent cash flow by automating repetitive tasks. Depending on the time frame of the transaction, your company offers a variety of tax and discount options to your clients.

The Vyapar software for bank reconciliation statement format in Excel permits businesses to modify or add tax categories and rates. Our accounting software allows you to manage discounts effortlessly and effectively. It will enable you to accept/make partial and complete payments based on the requirements of your business. Our accounting software simplifies the administration of loans and payments.

It features an intuitive user interface and automates repetitive business processes within your organisation. Vyapar provides its clients with over 40+ reports. Our accounting software allows you to perform multiple tasks at no extra charge. You can be miles ahead of your competitors by not focusing on these aspects.

4: Add Multiple Bank Accounts

With Vyapar, you can easily add, manage, and monitor online and offline payments. If your business chooses our easy-to-use, free mobile app for bank reconciliation statement templates, the tasks become simpler. Whether your revenue comes from bank accounts or e-wallets, you can easily enter information into the free accounting software.

You can send or receive money using cash-to-bank accounts or bank-to-bank transfers for seamless cash flow management. Therefore, it is optimal for businesses using the Vyapar accounting app to track all cash-ins and cash-outs.

A business bank account must be linked to the Accounting Software to use the app’s bank accounts feature. Using the Vyapar app, you can manage everyday business tasks effortlessly. It is the best way to keep track of all bank accounts in one place.

5: Keep Your Data Safe With Multiple Backup

The Vyapar accounting software is 100% safe and secure, and it is simple to store your bank reconciliation data effortlessly. Our free application allows you to safeguard your valuable bank reconciliation statement data by creating local, remote, and online Google Drive backups. Your company data is encrypted for added security, and the Vyapar app is the most advanced free accounting and invoicing software available.

The “auto-backup” function of the Vyapar accounting software in India makes data backups effortless. After activating this mode in the Vyapar app, a daily backup of your data is created automatically, making it simpler to back up all your data so you do not lose anything.

Most enterprises trust Vyapar to save time and protect their data while creating balance sheets and reconciliation forms. The app has an encryption system that restricts data access to the proprietor alone, enhancing security. Using Vyapar, you can easily reconcile the bank reconciliation statement in Excel.

6: Create And Send Receivables And Payables

Using our professional accounting software allows you to keep track of all transaction details for the bank reconciliation process and monitor cash flow without difficulty. Vyapar will give you a more secure method for protecting your transaction details.

Our free invoicing and accounting Software permits the monitoring of receivables and payables by the party. Using the business dashboard in the GST mobile app, you can monitor the money you ‘have to receive’ and ‘need to pay’ in the Vyapar app. Using our Vyapar accounting software, and you can easily track your real-time bills, invoices, inventory and financial reports.

By using Vyapar, you can determine who has not repaid you. You can set payment reminders to ensure timely payment from these customers. You can send any party free payment reminders via WhatsApp, SMS, and email. By using Vyapar can offer all types of online and offline payment options for seamless dues collection.

Frequently Asked Questions (FAQs’)

The Bank reconciliation statement format in Excel is how the bank statement balance and the cash book balance are structured. It has columns for writing down transaction details, making changes, and figuring out the reconciled balance. It makes it easier to track and find differences between the two balances.

You can use Vyapar software to create and customise your bank reconciliation statement format in Excel. Vyapar allows you multiple formats, tools and features to create a professional-looking bank reconciliation statement format for your business. If you perform your operation from an Android phone, you don’t have to pay additional fees to use our app.

A bank reconciliation statement format in Excel is made up of the following basic parts:

1. The opening balance.

2. The transactions made to the account (deposits, withdrawals, and fees).

3. Any checks or deposits that are still due.

4. Any adjustments made to the account for bank errors or timing inconsistencies.

5. The final account amount.

Discrepancy explanations and a comments box for adding more information are two examples of optional extras.

Compare the transactions documented in both documents to reconcile the bank statement balance with the cash book balance in Excel. Add or subtract as necessary to account for any outstanding items or discrepancies. Ensure that both records accurately reflect all deposits, withdrawals, fees, and other relevant transactions to achieve a balanced reconciliation.

Vyapar can easily create and customise your Excel bank reconciliation statement format to suit your business needs. Vyapar gives you all possible tools and features required to create and customise your professional-looking bank reconciliation statement format.

Related Posts: