Debtors Account Format

You can easily download Debtors Account Format for your customers. Or use the Vyapar App to manage billing, invoicing, and accounting easily and grow your business faster. Take advantage of our free 7-day trial offer!

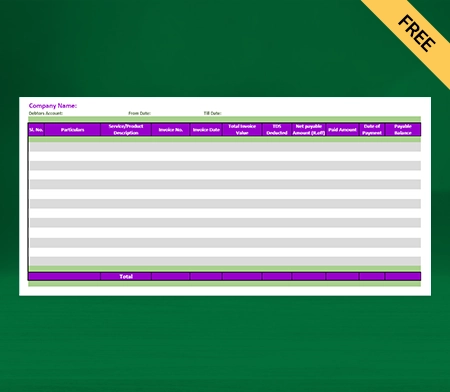

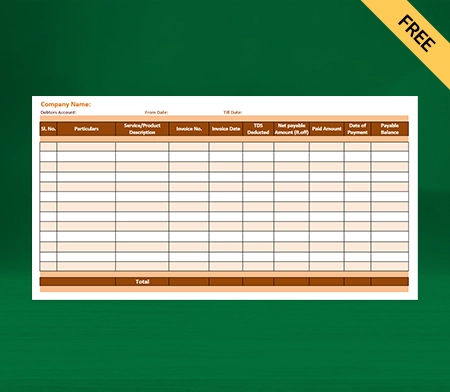

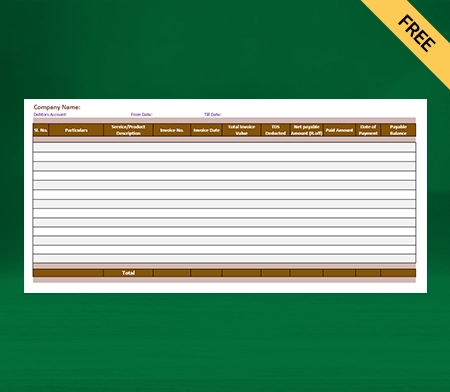

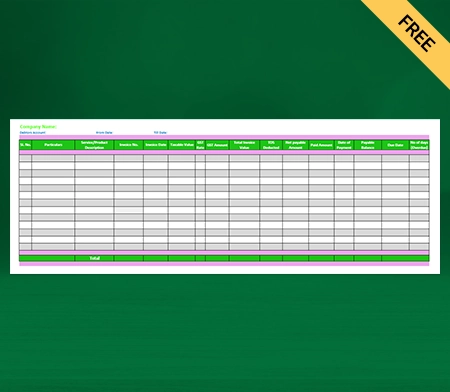

Download Debtors Account Format in Excel

What is a Debtors Account?

A legal person or entity that owes money to another is a debtor. The entity could be a person, a business, a government, a corporation, or another type of legal person. In simple terms, debtors are customers who have purchased goods or services and owe the supplier payment.

Debtors are also known as customers or bills receivable. The person who extends credit can give discounts to the debtors.

The debtor owes the firm cash, and the firm receives payments from them. The other party is a creditor. Besides a client of goods and services, a debtor is also someone who borrows money from a bank. When a bank is a co-partner in a debt composition, the bank is a borrower.

The counterpart would be referred to as an issuer if it consisted of shares and securities. The balance sheet records the debtors or account holders as assets under the ‘current assets’ section.

Types of Debtors

There are various classes of debtors. However, the primary debtors are of two types:

1. Short-term Debtor

Short-term debtors have debts that are provided for short periods (mostly less than a year). This kind of debt is shown on the balance sheet as short-term receivables under current assets.

2. Long-term Debtor

Long-term debtors have debts that are provided for extended periods (mostly more than a year). This kind of debt is shown on the balance sheet as long-term receivables under long-term assets.

Difference Between Debtor And Creditor

- A debtor is a person who owes you money in exchange for goods and services. A creditor is the one who you owe money in exchange for any purchase.

- A debtor’s account is an account receivable and is on the asset side of the balance sheet. A creditor is an account payable on the balance sheet’s liability side.

- People prefer credit purchases, so debtors’ accounts help increase customers. Creditors allow the firm to use the goods or services before the payment date and thus enjoy a credit period before the confirmed payment.

- Debtors negatively affect cash flow as the payment will be received later, while creditors positively impact cash flow as the payment you can pay later.

- Working Capital and liquidity ratios benefit from higher debtors. The working capital and liquidity ratios suffer from higher creditors.

- For debtors, businesses need to make provisions for doubtful debts. Creditors require no such provision.

Responsibilities of A Debtor

A debtor must know how much money he has and what he needs before taking on debt. He must refrain from taking unneeded obligations.

It is the debtor’s responsibility to pay his debts. In the case of late repayments, he should not make excuses.

A wise consumer only takes out debts when they are necessary. He shouldn’t go around requesting money from everyone.

Your prompt payment of loans and interest displays your responsibility as a borrower. To pay off debts on schedule, one must reduce excessive spending.

Debtors can build the trust of the creditors when they pay timely. It will also ensure easy credit next time.

Advantages of Debtors

A debtor is the asset of the business who has the following benefits:

- Consumers purchase goods and services on credit, which means they pay later. It encourages them to come back to you and increases sales.

- It has become a trend for businesses to sell on credit. Modern times require creditors to adopt this competitive strategy to survive the competition.

- A company that sells goods on credit to its clients shows that it trusts them. It helps build good relationships between customers and sellers and increases the firm’s goodwill.

Accounting of Debtor Account

Businesses often supply goods or services to clients before receiving the payment. A debtor account in accounting represents a client who owes the business money for goods or services purchased on credit.

A debtor account is an asset because it represents future revenue from a credit sale. As a result, it appears on the debit side of accounting statements like the balance sheet. Businesses measure how long it takes to recover money from credit sales in debtor days.

An excessive amount of accounts receivable and total debtor days will impact a company’s capacity to access cash. It won’t be simple to handle the company’s working capital needs in such circumstances.

A debtor account is where businesses keep all the information of debtors who purchase or borrow goods and services and then repay the money after a specified time. Companies maintain the debtor’s account to keep track of all credit sales made by a firm over a certain period.

A debtor account is a representative personal account; you can refer to it as a personal account since you cannot include all of the people you owe money to on the balance sheet. A debtor is someone who regularly owes you money after receiving an invoice from you for the goods and services they received.

Any credit sales we make result in a credit to the sales account and a debit to the debtor account. Additionally, when a sales return occurs, the debtor’s account is credited, and the sales return account is debited. On the balance sheet, it shows up as an asset.

Debtor in Bankruptcy

One of the main concerns of the creditor is the debtor’s bankruptcy because it makes it more challenging to collect the outstanding debt in such a circumstance. The debtor must meet three requirements before filing for bankruptcy:

• He continues to manage his company.

• He hasn’t paid off his obligations in a very long time.

• The debtor no longer qualifies for the credit.

The debtor’s bankruptcy does not guarantee that the creditor won’t get payment of the debt, but in such an event, a court-appointed official will determine how the debtor will make the payments.

How Can You Manage Debtors More Effectively?

Set your payment conditions in advance:

Your payment terms should be clear in your estimates and contracts. Ensure that your invoices and statements include the necessary payment information so that customers may pay you more easily. The things you need to mention in your quotation are:

- The total amount and due date of payment

- Your bank account information and billing address

- Provide all possible payment options, such as credit cards or online payments.

- Provide information on any discounts you’re offering to promote on-time payments or interest rates to deter late payments.

Send invoices and reminders:

You should send your invoice once you have completed the work or the customer has received the product. Additionally, send payment reminders when you aren’t getting money on time. Everyone will feel better if you send polite reminders rather than a harsh demand after payments is overdue.

The first reminder might not result in a response or fee. So after that, pick up the phone and have a conversation anyway because it can simply be a matter of a missed email. That is all it takes to get paid occasionally.

Pick out doubtful debts proactively:

Make sure you check for indications that your clients are experiencing financial difficulty. Occasionally, industry rumors reveal a lot about a company’s financial situation.

Getting the customer to acknowledge a payment issue is the next step. After that, you can collaborate to earn money. It’s preferable to stop supplying if they don’t start paying after you have new knowledge (this is something you can lay out in your initial contract).

Discuss the terms of future payments if you wish to restart services. Even though you could eventually think about using a debt collector or filing a lawsuit, that’s the last resort!

Set criteria for late payments:

You must check references before agreeing to anything. Once authorized, be sure to specify your credit terms in detail. Your quotation should determine whether you charge interest on past-due sums (there may even be legal requirements; it’s advisable to verify with your accountant or lawyer).

Then adhere to your terms at all times. If you provide a discount for on-time payments, enforce it strictly, and it shouldn’t be applicable if the payment is even a day late. If you decide to break this rule for a client, state that it is an exception because you value the connection.

Stay in your debtor’s thoughts:

You want to be at the top of the list when payments are due. Make yourself a priority by demonstrating that you will always get in touch—many times, if necessary—when a payment is overdue. They’ll pay you on time because they respect your boundaries and don’t want to deal with the trouble of further communication.

If you value the overall health of your company, you must take debtor management seriously and consistently. On contracts, quotes, and invoices, include the details of your payment conditions and state them upfront. Don’t give credit to anyone without checking their credit history, and don’t keep giving them things without expecting payment.

Other Benefits Of Using The Vyapar App

Provide multiple payment options:

Your clients can pay you in the usual ways, such as bank transfers (NEFT, RTGS, IMPS). You can accept cash, cheques, debit cards, and credit cards, and it’s best if you can give clients access to all available payment methods.

You can include a QR code as one of the payment options within the invoice. Additionally, you may enter your bank account details into the app to help ensure that your clients pay you on time.

It will allow you to extend your customers better credit and entice them to do business with you more regularly. Customers will trust you more because of this since they will choose you over rivals that do not offer various options.

Eliminate human error:

A self-invoicing error could cost you a lot of money. Making the right choice of accounting software is essential to avoid errors. With Vyapar, your company can handle data much more quickly.

Automation simplifies the process and eliminates human error. You may focus on other chores and save a lot of time. The Vyapar ledger balance sheet formats’ user interface is simple.

Data can be imported and exported from compatible programs. It also sends reminders to collect payments and reimburse debts, which helps avert further disputes.

Generate Reports:

Business owners need to choose carefully. It could be challenging to manage the money needed for daily operations, analyze data, and assess business activity. You can resolve each of these listed problems by using the Vyapar app.

Using free inventory software Vyapar, you can create 40+ distinct types of reports. Reports including balance sheets, expense or income reports, and GST reports are all possible to prepare. You can maintain the company’s cash flow and stop workflow interruptions.

You can review the reports and determine how the company is doing. By doing this, you may find out which product is popular and stock up on it. Making income tax filing simple may involve using the Ledger balance sheet structure.

Other Valuable Features Of Vyapar

Receivables and Payables:

Vyapar’s free billing and accounting software enables customers to maintain all transactional information. You can smoothly monitor the cash flow of their businesses. You may keep track of payables and receivables by the party using Vyapar.

You can keep track of the money you “have to receive” and the money you “need to pay.” You can get the reports of the customer who still needs to clear the payments. You can create payment reminders to ensure that these consumers pay their debts on time.

Any party can receive free payment reminders via email, SMS, and WhatsApp. You can offer various online payment alternatives to collect payments conveniently. Additionally, it will enable you to save time for daily duties.

Additionally, with the bulk payment reminder option, you may save time by sending payment reminders to all of your clients at once. The GST Billing and Invoicing software makes calculations automatically.

Choose Themes:

When you share a professional sale invoice format with your clients, it improves your brand image and identity. Our Vyapar software consists of two invoice themes for thermal printers and twelve for regular printers.

You can instantly enhance the visual appeal created by your invoice with the help of this debtor’s account format. It is easy to use the customizing options that are offered. You can efficiently prepare the client’s invoice. The creation of business bills might better impress a client.

It is effortless to use. To match your business needs, pick from the best GST invoice formats. Most companies use our free billing software to help them appear professional. It is the best technique to create a favourable brand image.

Vyapar offers a variety of theme options for both thermal and standard printers. Any business enterprise can utilize it. Retailers, pharmacies, gyms, restaurants, and several other companies are on the list.

Send Estimates & Quotations:

Our Vyapar app contains quotes, projections, and accurate GST invoices. The built-in features in the GST billing software can help send clients quotations and estimates whenever you want. You can print them out and send them by WhatsApp, email, or SMS.

The billing software from Vyapar offers a professional appearance with immediate estimates and quotes. The software automates most operations and eliminates errors from quotations and estimations.

Additionally, you can change your quotes and estimates into sales invoices at any moment. The business has a wide choice for fast, saving more time, and obtaining instant estimates thanks to Vyapar’s free billing software.

You can operate your company more productively with business accounting software. For your cherished consumers, the billing app offers professionalism to entice them to return. Estimates and quotes are made simpler with the help of our billing software.

Safety and Security:

Safety must always come first in any organization, especially in this digital age. You can set up an automatic data backup using the Vyapar program for billing, protecting the data in the application.

You can create an automatic backup of your data with our free GST software in India, which will increase the security of the information you store there.

You can occasionally make a local backup for additional security. By keeping your data on a hard disc or flash drive, you can protect it.

The Vyapar billing software’s accounting features allow you to guarantee further that you can assess your data. You can develop a business strategy after looking at the company reports.

GST Invoicing / Billing:

Using the Vyapar App, you can create GST invoices customized to your needs and send them to your clients. Thanks to the app’s fantastic features, the recipient may rapidly generate invoices and share them with the supplier.

You can considerably benefit your firm by automating your billing processes with our free GST billing software. It helps small and medium-sized businesses in cutting down on accounting time drastically.

During the billing process, repetitive operations can be sped up using the barcode scanner and shortcut keys. A crucial component of the Vyapar app is bill-wise payment, making connecting payments to sales invoices simpler.

Because the software can generate and manage several parties at once, it’s simpler to instantly access earlier invoices when needed to maintain track of all the invoice due dates. Any business can instantly locate any outstanding invoices thanks to the Vyapar app.

Plan your inventory space:

Businesses that sell a variety of goods need to manage their inventory well. Using our free invoicing software, you can keep track of the merchandise currently on hand at your shop. You can identify theft in your store with Vyapar’s features.

You might check your security cameras when you realize that particular objects are missing. You may more efficiently manage the things in your warehouse using a professional inventory management solution. It can assist you in planning the setup of your stock area per consumer needs.

Utilising the best excel billing software is an excellent idea because you can use the data to generate sales reports and determine how much inventory is optimum given current trends and sales from the previous year.

When employing the inventory management system of the GST accounting software, periodic inspections might help in identifying inventory inconsistencies. You can set up notifications to help you place an order before you run out of necessities if your inventory starts to get low.

How to Track Bills And Receivables With Vyapar?

- Open the Vyapar App.

- You will see a business dashboard where you will find two sections.

- The “You’ll get” section is for the debtors.

- It will show you the list of people who owe you money.

- If you want to check the receivables and payables together, go to the report section in the left menu.

- Under the section, party reports, click on “all parties report.”

- You can sort the list based on names and amounts.

- You can convert the list into Excel or PDF format from the icons in the top right corner.

Frequently Asked Questions (FAQs’)

In accounting, the customer who owes the company money after making a credit purchase of products or services is noted as a debtor account. A debtor account represents pending revenue from a credit sale, making it an asset.

In books of accounts, create separate columns for debtors. Record all the credit sales in that column.

Balance sheets show debtors as current assets under the current assets section. A debtor is an account receivable.

The credit sales are recorded in the debtor’s account, so preparing the debtor’s account is essential to determine the number of total credit sales.

The three types of debtors are:

Bills Receivable

Doubtful Debts

Bad Debts

A person who owes money from another person, entity, or organization is known as a debtor. It is considered an account receivable. Thus, the debtors are an asset to the business.