Debit Note Format in GST

Vyapar’s great accounting features will assist you in managing your bookkeeping. Vyapar is a one-of-a-kind software that provides professional debit note formats in GST that are free to use and modify. Vyapar will make it easy for you to handle your company’s finances. So, if you don’t want to waste time learning complex and advanced software, Vyapar is the app you need.

Highlights of GST Debit Note Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Download a Free GST Debit Note Format

Download professional free GST debit note formats, and make customization according to your requirements at zero cost.

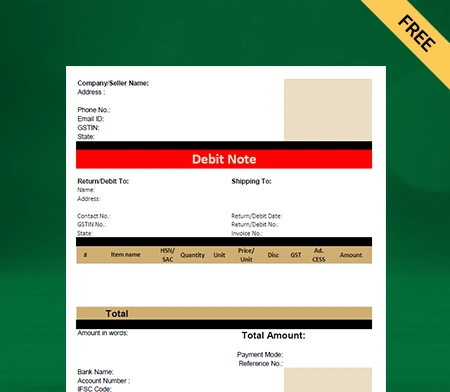

GST Debit Note Format – 1

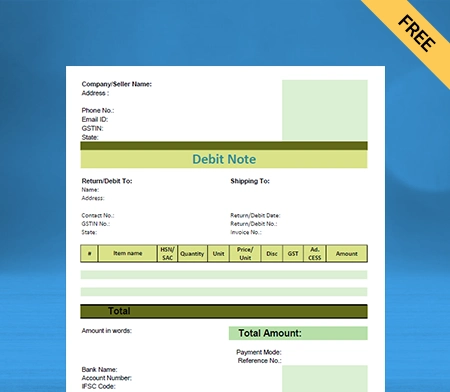

GST Debit Note Format – 2

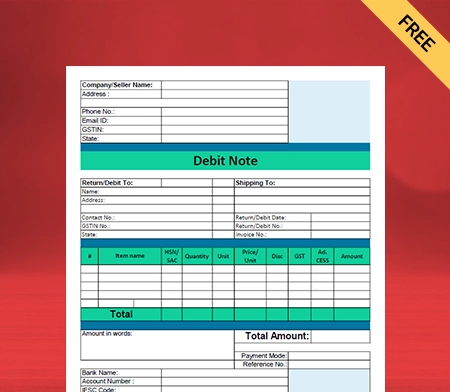

GST Debit Note Format – 3

Generate Invoice Online

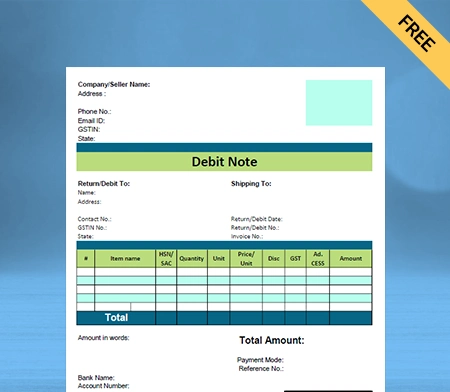

GST Debit Note Format – 4

What is Debit Note in GST?

According to section 34(3) of the CGST act 2017, a debit note in GST is a document that a supplier issues to the recipient for the following reason:

- A tax invoice was issued for any supply of goods, services, or both, and:

- The invoice’s taxable value or tax liability is less than the supply’s taxable value or tax credited.

- The quantity of goods or services is more than that of the initial invoice.

Importance of Debit Note Under the GST Law

The GST law permits the issuance of a debit note in two circumstances:

(a) a change in tax rates after the invoice has been issued.

(b) A change in the taxable value of the goods or services following the issuance of the invoice.

A debit note is included in the information for GSTR-1, the month in which the provider supplied the items. The specifics are included in the recipient’s Forms GSTR-2A and GSTR-2B. Once the verification is complete, the recipient can accept it and include it in his GSTR-3B.

Previously, citing the original invoice number was required when reporting a debit note. You must quote it in Form GSTR-1 and Form GSTR-6 on the GSTN portal.

The change relating to the delinking of debit notes from their original invoice, on the other hand, provides that:

- The issuer might give the place of supply for a specific debit note to identify the supply type.

- Simply entering the tax and the amount is sufficient when the debit note is sent due to a discrepancy in tax rates.

The delinking amendment also impacted how debit notes were treated for Input Tax Credit (ITC). The invoice date before the modification was the time limit for claiming ITC. However, following the modification, the time restriction for claiming ITC is now computed based on the debit note.

When is a Debit Note Issued?

A registered person must always issue a tax invoice when providing goods or services. However, when providing the tax invoice, a registered supplier is obligated to issue a debit note/revised invoice to the recipient if any of the following conditions are met:

- In the invoice, the supplier charges a value for products or services less than the real value of such goods or services.

- The supplier charges a lower tax rate than the goods or services supplied.

- The quantity of goods debited to the recipient is more than indicated on the initial tax invoice.

- For any other reason

If a customer purchases products from a vendor or supplier and wishes to return them for any valid reason, they may submit a debit note.

A customer begins a purchase return for products when the following conditions exist:

- The seller delivers faulty or damaged goods; the shape, size, or quantity is incorrect;

- The vendor failed to provide goods or services on schedule;

- A bill contains calculation errors;

- Suppliers levied higher taxes on goods or services;

- The buyer does not wish to buy the goods or services.

Create your first debit note with Vyapar App

The Limit for Issuing a Debit Note

A buyer can generally issue a debit note at any time. According to Section 34(2) of the CGST Act, a buyer may issue a debit note on or before September 30th or on or before the date on which the annual return is due.

If the buyer fails to issue a debit note within the specified time frame, the buyer’s tax duty, interest charge, and penalties will grow. To make the debit note generation process seamless, you can use professional debit note formats in GST by Vyapar.

Format of a Debit Note in GST

A debit note format in GST issued by a supplier must include the following information:

- Supplier’s name, address, and GSTIN

- The nature of the document

- A debit note must have a serial number that is not more than sixteen characters long. Alphabets, numerals, and special characters such as hyphens, dashes, and slashes can all be used in a combination.

- The date you issued the debit note

- Name, address of delivery, and, if registered, the recipient’s Unique Identity Number (UIN) or GSTIN.

- The name and delivery address of the receiver will be provided by the individual issuing the debit note. If the recipient is not registered, the name and code of the state.

- The serial number and date of the associated tax invoice or bill of supply

- The amount of tax deducted from the recipient, the value of the taxable supply of goods or services, and the tax rate

- Digital Signature of the supplier’s or his authorized representative

Records

An issuer must keep the records of the debit note or additional invoice for seventy-two months after the due date for filing the annual return for the year relevant to such accounts and records.

Where such accounts and documents are kept manually, they must be stored at every associated business mentioned in the registration certificate. They must be available at every related place of business where such accounts and documents are held digitally.

Features of Debit Note in GST

A debit note is a buyer’s request for a credit note to the supplier. The document suggests a purchase return in the buyer’s accounting books.

Here are the essential features of a debit note:

- A debit note is provided when goods or services are purchased on credit.

- In most circumstances, the debit notice is sent to the seller by the buyer. A seller can also issue a debit note.

- A seller may issue a debit note when an invoice has an error.

- A debit note contains all the purchase return information.

- It becomes valid when the supplier accepts the debit memo and changes their records appropriately.

- In the debit memo, the buyer must state the reason for the return of the items.

- A debit note reduces the credit purchase amount of the customer while increasing the purchase return.

- A debit note is a positive amount that reduces the buyer’s liability to the seller.

How to Create a Debit Note Format in GST Using The Vyapar App?

Open the Vyapar App. Two options are available to do the entry for debit notes in GST format.

Click on Add More (+) Button.

- You’ll see a purchase return option. Click on it.

- You can also open the debit note format by pressing the shortcut key (Alt+L).

- Enter the customer’s information, such as name, date, and invoice number.

- The system will adjust your note against the invoice.

- Then, provide the information about the products for which the debit note is issued.

- The details must include the item’s name, price, and quantity.

- Save the format for future reference.

This process is time-consuming, so Vyapar provides an alternative. It is useful when adjusting a debit note to a specific invoice.

Go to The Left Menu.

- Click the purchase option in the purchasing section.

- There will be a list of all invoices.

- Find the invoice whose product you want to return in the search bar.

- You can narrow your search by party name, invoice number, date, amount, or invoice balance.

- The invoice will appear on your screen; click the three dots to the right.

- Select the option to convert to return.

- You’ll notice that the debit note is filled with all the necessary ==information.

- You can modify the item list to meet your requirements.

- After making the necessary adjustments, save it.

Advantages of Using Debit Note Format in GST by Vyapar

Data Entry Made Simple

Manual bookkeeping and debit note creation necessitates you to write entries by hand. You will spend most of your time filling cash registers and spreadsheets as a bookkeeper. Using Vyaar debit note formats in GST, you can automate the process for your business.

Fortunately, the accounting software Vyapar app automates these time-consuming tasks, allowing you to concentrate on what matters most to you. The debit note maker software may alter your bill amounts and track the changes.

The user-friendly interface of the app makes it easy to use. Data may be accessed instantaneously from mobile to desktop and desktop to mobile. Both GST-registered and unregistered firms can use Vyapar.

Multiple Themes

Using professional themes might help you strengthen the identity of your brand. Vyapar debit note format in the GST maker app includes two thermal invoice templates and twelve traditional printer invoice styles. Furthermore, all themes are completely customisable to meet specific corporate requirements.

Both thermal and conventional printers offer several theme possibilities. GST Invoicing Software is suitable for all types of business owners. You can personalize and improve the appearance of your invoice using the software.

When you share professional invoices with your clients, it improves your brand image and identity. Also, you can manage your inventory and choose the best themes and GST invoice formats through a single app.

Online Store

Using the Vyapar debit note in the GST maker app, you may set up your online store in several hours. Using our billing software, you can list all the services/products you sell to your consumers.

It will help you display a catalogue of all the services/products you sell and enhance your online sales. Furthermore, Vyapar debit note format in GST does not charge extra fees for using individual features like online stores. So, you can simply have the subscription and use the online store to take your business online.

Using the online shop feature in our debit note generator app for your business can help you save time at the store counter by having the package ready for your clients before they arrive.

Business Reports

Entrepreneurs must make sound business decisions. Managing the money needed for daily operations, analyzing data, and evaluating business activity can be challenging. Vyapar can assist you with all of these concerns.

Vyapar allows you to create more than 40+ distinct types of reports. Balance sheets, spending or income reports, and GST reports can all be created. You can maintain the company’s cash flow and avoid workflow disruptions.

You can examine the reports to evaluate how the organization is performing. It enables you to assess which product is in high demand and stock up on it. You can use the Vyapar app to make income tax filing easier.

Offline Software

You can continue to run your import-export business without an internet connection by utilizing various specific invoice-generating application capabilities. You can now create commercial invoices for your clients using the Vyapar app while offline.

Even if no internet connection is present, Vyapar’s software may generate a commercial invoice. Because of these capabilities, our clients’ businesses no longer have to rely on the Internet for accounting.

The only time a consumer has to connect to the internet or use the online edition of Vyapar is when they want their data to be synchronized across various devices.

Create a Positive Brand Image

Professional debit note formats and estimates formats during negotiations help to develop a strong brand image. You can also provide thorough disclosure about the transaction to establish trust.

Vyapar GST billing software assists you in developing a professional brand. A properly designed personalized invoice will help you stand out from the crowd and establish yourself as a professional seller.

You can add our company logo, style, font, and brand colours to your invoice to effectively reflect your firm’s identity. A buyer will likely purchase from a seller who uses professional custom non-GST or GST quotation formats rather than plain text.

Other Valuable Features of The Vyapar App

GST Billing and Invoicing

To establish a business in India, you must create GST-compliant, accurate invoices. Vyapar accepts several invoice types, including mixed, credit, and proforma. It is also useful in the production of debit and credit notes.

With the help of Vyapar GST note maker app, you can create GST bills that comply with India’s GST legislation. It automates your billing demands, which is advantageous in running your business.

You can create a GST bill in online and offline modes in a few simple steps, allowing you to keep your account up to date. The Vyapar app streamlines the process of sharing your invoice with other business owners and customers.

The software allows you to produce a free GST invoice format for your clients within minutes and print/share them. Debit notes must be in GST format, which you can do with our GST billing software.

Receivables and Payable

Customers can keep all transactional information in Vyapar’s GST debit note maker app. You can easily check their company’s cash flow. You can use Vyapar to keep track of payables and receivables by the party.

You may track how much money you “have to get” and how much you “have to pay.” You can obtain reports for customers who have not yet completed their payments. You can send payment reminders to these customers to ensure they pay their bills promptly.

You can send payment reminders to any party through email, SMS, or WhatsApp. To collect money more conveniently, you might provide various online payment options. It will also allow you to save time for daily tasks.

You can also save time by sending payment reminders to all of your clients at once if you use the bulk payment reminder option. Calculations are performed automatically by the GST Billing and Invoicing software.

Choose Themes

You strengthen your brand’s image and identity when you send professional invoice formats to your customers. Our Vyapar software includes two templates for thermal printers and twelve invoice themes for ordinary printers.

With the help of this debtor’s account format, you can rapidly improve the visual appeal of your invoice. The customisation options available are simple to utilize. You can prepare the client’s invoice quickly. Creating company bills may help you impress a client.

It is simple to use. Choose from the best GST invoice forms to meet your needs. Most businesses use our free debit note maker app to appear professional. It is the most effective method for developing a positive brand image.

Vyapar provides a wide range of themes for both thermal and conventional printers. Any business can use it. Retailers, pharmacies, gyms, restaurants, and a variety of other businesses are included on the list.

Extreme Security

Safety must always come first in any organization, especially in this digital age. Vyapar software has great security features to ensure data security and safe access.

It supports automatic backup to Google Disk and a manual backup to Google Drive, email, and a local drive. Using Vyapar ensures that your data is securely updated to servers.

You can also print and distribute debit notes to your consumers. You can use our free GST software in India to generate an automatic backup of your data, which will strengthen the security of the information you save there.

For added security, make a local backup now and then. You can safeguard your data by storing it on a hard disc or flash device. Accounting capabilities in Vyapar billing software allow you to ensure that you can assess your data even further.

Accounting Administration

You may effortlessly manage your company’s accounts using our free accounting software. It allows you to generate proper GST invoices, quotations, and estimations. The billing mechanism in the app makes it simple to turn invoices into debit notes.

You can then share immediately with your prospective party via the app. Our sophisticated GST debit note maker app makes creating sales or purchase orders simple. You can quickly set deadlines and keep track of your orders.

In addition, the user receives an auto stock adjustment to ensure inventory item availability. It helps with order fulfillment and promotes customer happiness. Vyapar’s auto stock feature supports you in maintaining sufficient reserve stock to fulfill the order.

You can use and convert your bills into any format that meets your requirements. Vyapar provides various formats in Excel, Word, and PDF. Using our GST debit note software, you may save time while preparing debit notes and invoices.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

The Debit Note Format in GST is used to modify previously issued invoices. An invoice may require changes due to invoice errors, excess products supplied, or goods returned due to defects or other causes.

According to the statute, only the supplier may issue a debit or credit note. Both notes can be issued with GST to increase or decrease the supplier’s GST burden.

An issuer can offer a debit note format without GST in Excel format.