Accounting Software For Dummies

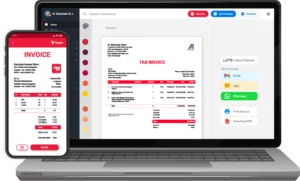

Simplify your business finances with ease using Vyapar’s intuitive interface. From invoicing and inventory management to expense tracking, this accounting software has you covered. Try Vyapar accounting software for dummies now with our free trial and experience hassle-free bookkeeping like never before!

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

What is Accounting?

Accounting is the systematic process of recording, summarising, analysing, and interpreting financial transactions of a business or individual. It involves tracking the flow of money and other financial resources into and out of the entity, organising this information into meaningful reports, and using the data to make the best possible financial decisions.

The main objectives of accounting are:

Recording Transactions:

Accountants record various financial transactions, such as sales, purchases, expenses, and investments, in a structured and organised manner.

Summarising Financial Data:

The recorded transactions are summarised into financial statements like the income statement, balance sheet, and cash flow statement.

Analysing And Interpreting Financial Information:

Accountants analyse financial statements to get insights into the financial health and performance of the business.

Financial Reporting:

Accounting involves preparing and presenting financial reports to stakeholders, such as business owners, investors, creditors, and regulatory authorities.

Decision Making:

The information provided by accounting is crucial for making important business decisions related to investments, expansions, cost-cutting, and resource allocation.

Accounting is essential for all businesses, regardless of size, to maintain accurate and transparent financial records, comply with tax laws and regulations, and assess their profitability and financial stability. It provides a foundation for businesses to manage their resources effectively, plan for the future, and communicate their financial position to various stakeholders.

Various Concepts Of Accounting

The concept of accounting revolves around systematically recording, summarising, analysing, and interpreting the financial transactions of a business or individual. It is based on several fundamental principles and concepts that guide the accounting process. Here are some key concepts of accounting:

1. Entity Concept:

The entity concept assumes that a business or an individual is a separate economic entity distinct from its owners or personal finances. It requires all financial transactions of the entity to be recorded separately from the personal transactions of its owners.

2. Dual Aspect Concept:

The dual aspect concept is the foundation of accounting’s double-entry system. It states that every transaction has two aspects: a debit and a corresponding credit. Total debits must equal total credits to maintain the accounting equation (Assets = Liabilities + Equity). It is mostly widely used concept.

3. Going Concern Concept:

This concept assumes that a business will continue to operate indefinitely unless there is evidence to the contrary. This principle allows assets and liabilities to be recorded at their historical cost, assuming they will be used for the foreseeable future.

4. Accrual Basis Concept:

The accrual basis of accounting recognises revenues and expenses when they are earned. It is regardless of when cash is received or paid. This concept helps match revenues with the expenses incurred to generate them, providing a more accurate representation of financial performance.

5. Consistency Concept:

The consistency concept requires businesses to use the same accounting methods and principles consistently from one period to another. This ensures the comparability of financial information over time.

6. Matching Concept:

The matching concept requires that expenses be matched with the revenues they help generate. It ensures that the cost of goods sold or services provided is accurately reflected in the same accounting period as the associated revenues.

What is Accounting Software For Dummies?

Accounting software for dummies is designed for individuals with limited accounting knowledge or experience. It aims to provide a user-friendly and simplified approach to managing financial tasks for small businesses or individuals who need basic accounting functionalities without the complexities of advanced software.

Accounting is a broad field that encompasses various types or branches of accounting, each serving a specific purpose and audience. The main types of accounting include:

Financial Accounting:

Financial accounting software focuses on the preparation and reporting of financial information to external parties, such as investors, creditors, regulators, and the general public. Financial accounting provides an overview of a company’s financial performance and position through financial statements like income statements and cash flow statements.

Managerial Accounting:

Also known as cost accounting, managerial accounting deals with the internal use of financial information to assist management in making informed decisions. It involves analysing and interpreting data to help with budgeting, cost control, pricing strategies, and performance evaluation within the organisation.

Tax Accounting:

Tax accounting is concerned with ensuring compliance with tax laws and regulations. It involves calculating and reporting taxes owed by the company or individual, filing tax returns, and advising on tax-related strategies to minimise tax liability while remaining within legal boundaries.

Auditing:

Auditing involves examining and verifying financial records and transactions to ensure their accuracy and compliance with accounting standards and regulations. External auditors, independent of the company, conduct audits to provide assurance to stakeholders that financial statements are reliable.

Why Should Small Businesses Use Accounting Software For Dummies?

Accounting software for dummies is designed to be easy to use and navigate. Its simplified interface, intuitive design, and clear instructions make it accessible to individuals with limited accounting knowledge.

It reduces the learning curve and allows small business owners to adapt quickly to the billing software. They can manage their finances effectively.

Accounting software for dummies focuses on essential accounting functions. It eliminates unnecessary complexities. It provides core features such as invoicing, expense tracking, bank reconciliation, and basic financial reporting.

Accounting software for dummies automates manual accounting tasks. It saves small business owners valuable time and effort. Features such as automated data entry, invoice generation, and bank reconciliation streamline processes and reduce the need for manual calculations.

Using accounting software for dummies helps small businesses maintain accurate and up-to-date financial records. It ensures that income, expenses, invoices, receipts, and other financial transactions are properly recorded and tracked.

Accounting software for dummies provides tools and reports that enable small businesses to analyse their financial data. It helps businesses assess their financial health, identify trends, and make informed decisions about budgeting, forecasting, and growth strategies.

Accounting software for dummies often provides comprehensive training materials, tutorials, and customer support options. These resources are specifically tailored to help individuals with limited accounting knowledge understand.

How To Choose The Best Small Business Accounting Software?

Choosing the right accounting software can seem overwhelming, especially for beginners in accounting. Here’s a simplified step-by-step guide to help you choose the best accounting software:

Identify Your Needs:

List down the specific accounting tasks you need the software to handle, such as invoicing, expense tracking, tax management, or inventory management.

Consider User-Friendliness:

Look for small business accounting software with a user-friendly interface, simple navigation, and easy-to-understand features. Avoid overly complex systems that might be challenging to use without prior accounting knowledge.

Cloud-Based Software Vs. Desktop:

Decide between cloud-based (online) or desktop accounting software. Cloud-based accounting software offers accessibility from any device with an internet connection, while desktop software requires installation on a specific computer.

Scalability And Growth:

Choose software that can scale as your business grows. Consider future needs, such as additional users, increased transaction volumes, and advanced reporting.

Data Security:

Prioritise data security. Ensure the software uses encryption and offers regular data backups to protect your financial information.

Integration Capability:

If you use other business tools like POS billing software/systems or inventory management software, check if the accounting software can integrate with them for seamless data flow.

Cost Consideration:

Compare the cost of different accounting software options. Consider the initial price and ongoing subscription fees, add-on costs, and potential hidden charges.

Customer Support And Training:

Look for software providers that offer good customer support, online resources, and training to help you get started and troubleshoot any issues.

Read Reviews and Testimonials:

Research customer reviews and testimonials to understand the experiences of other users, especially those with limited accounting knowledge. It is the best way to find what you are looking for.

Free Trials Or Demos:

Many small business accounting software providers, like the Vyapar accounting app, offer free trials. Take advantage of these offers to test the software’s features and see if it suits your needs.

Check For Updates And Support:

Ensure that the accounting software is regularly updated with bug fixes and improvements. Also, check the support channels available, such as email, phone, or live chat support.

Ask For Recommendations:

Seek recommendations from friends, colleagues, or online communities for accounting software that they have found easy to use and effective.

What Small Businesses Can Benefit From Using Vyapar Accounting Software For Dummies?

Vyapar accounting software is designed to cater to the needs of small and medium-sized businesses in India. It offers user-friendly features and functionalities that can be beneficial for small businesses and those new to accounting practices. Here are some types of small businesses that can benefit from using Vyapar accounting software:

Retail Stores:

Whether it’s a grocery store, boutique, or any retail establishment, Vyapar can help manage inventory, track sales, and handle billing efficiently. Accounting software allows retail stores to record and track their financial transactions, including sales, purchases, expenses, and payments. It automates the bookkeeping process, eliminating the need for manual data entry and reducing the likelihood of human errors.

Service-Based Businesses:

Small businesses offering services like consulting, repair services, or freelancing can use Vyapar to manage client billing, track expenses, and generate professional invoices. Service-based businesses can create professional invoices using Vyapar. They can customise invoices with their branding, add details about the services rendered, and specify payment terms. Vyapar also allows businesses to send invoices to clients directly through the software, reducing manual efforts and saving time.

Restaurants And Cafes:

Vyapar can aid in inventory management, keeping track of ingredients, and generating bills in the food service industry. It can generate sales reports that provide insights into the restaurant or cafe’s revenue over a specific period. Vyapar is designed for businesses in India. It includes features to help restaurants and cafes comply with Goods and Services Tax (GST) regulations. The software can generate GST-compliant reports and assist with tax filings.

Small Manufacturing Units:

For small-scale manufacturers, Vyapar can help with inventory control, tracking raw materials, and managing production expenses. Managing inventory is essential for manufacturing units. Vyapar enables businesses to keep track of their raw materials and finished goods inventory levels. The software can provide alerts when stock levels are low, ensuring that production doesn’t suffer due to shortages.

Wholesale Businesses:

Wholesalers can benefit from Vyapar’s features for handling bulk orders, tracking inventory, and generating purchase orders and invoices. Wholesale businesses often deal with bulk orders from retailers or other businesses. Accounting software can handle bulk order processing, including generating invoices for multiple items or clients simultaneously, saving time and effort.

Freelancers And Self-Employed Professionals:

Vyapar can be useful for individuals working independently, helping them manage their income, expenses, and taxes. Vyapar assists freelancers and self-employed professionals by simplifying invoicing, expense tracking, and tax calculations. With customisable invoices, easy expense management, and GST compliance features, Vyapar streamlines financial tasks, enabling better financial management for individual service providers.

Small Contractors:

Independent contractors and tradespeople can use Vyapar to keep track of project expenses, invoicing, and cash flow management. Vyapar aids small contractors in efficiently tracking project expenses through its comprehensive features. Contractors can create detailed and customised invoices for clients, accurately recording project costs. The software’s expense tracking functionality allows contractors to monitor various project-related expenses, such as materials, labour, and equipment.

Beauty Salons And Spas:

Small businesses in the beauty and wellness industry can utilise Vyapar to manage client appointments, inventory, and billing. Vyapar assists beauty salons and spas in managing their financial operations effectively. The software streamlines invoicing, tracks inventory for beauty products, and handles expense tracking. With mobile accessibility, GST compliance, and sales reporting, Vyapar empowers beauty businesses to optimise their finances, enhance customer service, and grow their establishments.

How Does Vyapar Accounting Software For Small Businesses Work?

Using Vyapar small business accounting software is a straightforward process. Here’s a step-by-step procedure to get started:

1. Download And Install:

Visit the Vyapar website or app store on your device. Download and install the Vyapar accounting software.

2. Create An Account:

Open Vyapar and sign up for a new account. You may need to provide your business name, contact details, and other necessary information.

3. Set Up Your Business Profile:

After creating an account, set up your business profile. Enter your business name, address, logo, and other relevant details to personalise your invoices.

4. Add Products/Services:

Go to the “Products & Services” section and add the items you sell or services you offer. Include details like product name, price, and tax rates.

5. Record Purchases:

In the “Purchase” section, record the items you purchase for your business, such as inventory and supplies. Include purchase details like date, vendor name, and purchase amount.

6. Create Invoices:

In the “Sales” section, create professional invoices for your customers. Add products or services from the list you created, specify quantities, and set tax rates if applicable.

7. Track Payments:

Record payments received from customers in the “Received Payments” section. Mark invoices as paid once you receive the payment.

8. Manage Expenses:

Record all business expenses in the “Expenses” section. Categorise expenses like rent, utilities, and other operational costs.

9. Generate Reports:

Vyapar provides various financial reports. Explore reports like profit & loss, balance sheet, and sales reports to gain insights into your business performance.

10. Set Up Gst:

If applicable, configure your GST settings. Ensure that your tax rates are accurate and compliant with local tax regulations.

11. Backup Data:

Regularly backup your data to prevent data loss and ensure you can restore your information if needed.

12. Explore Additional Features:

Vyapar offers other helpful features like inventory management, reminders for overdue payments, and customer management. Explore these features to make the most of the software.

Benefits Of Using Vyapar Accounting Software For Dummies:

Simplified Accounting

Our software for small businesses offers a straightforward and user-friendly interface. It makes it easy for small business owners to set up the software and start managing their finances. It does not require extensive training or accounting expertise.

Vyapar streamlines the process of creating and sending invoices. Users can generate professional-looking invoices with customisable templates. The software can automatically calculate taxes and send them directly to clients via email or other communication channels.

Our accounting software for dummies helps small business owners with no accounting knowledge reconcile their bank transactions with their accounting records. It allows users to identify any discrepancies. Using the Vyapar app, you can ensure that your financial data is accurate.

Save Cost And Time.

Vyapar automates many accounting tasks, such as generating invoices, tracking expenses, and reconciling bank transactions. It reduces the need for manual data entry and calculations. You can save time and minimise the risk of errors that could lead to financial discrepancies.

Our accounting software for small businesses can create professional invoices quickly using pre-defined invoice templates. It enables faster billing to clients and reduces the time spent on administrative tasks.

Vyapar bookkeeping accounting software can be a cost-effective solution for small and medium-sized businesses. It provides essential accounting functionalities without the overhead costs of additional staff or outsourcing fees.

Cloud-Based Software

Users can log in to Vyapar from any internet-connected device with cloud-based access. You can log in from a Windows or Macbook computer, Android tablet, or smartphone. The accessibility allows business owners and their team members to access financial data and perform accounting tasks from anywhere, anytime.

Cloud-based accounting software ensures that all data is stored and processed on the cloud server. This means that any changes made by one user are instantly reflected across the system. It helps to maintain consistency and accuracy of financial information.

Cloud-based software enables multiple users to access the same data simultaneously. This facilitates collaboration among team members, accountants, and other stakeholders. It enhances efficiency and reduces the need for file sharing and data transfer.

User-Friendly Interface

The user-friendly interface of Vyapar makes it easy for users to navigate and understand the software. The intuitive layout and clear menu options allow users to find and access the features they need quickly. It allows users to create invoices, record expenses, and generate financial reports with just a few clicks.

Vyapar’s user-friendly interface contributes to a positive user experience. Satisfied users are much more likely to continue the app and recommend it to others. It leads to increased customer retention and word-of-mouth referrals.

A user-friendly interface allows Vyapar to cater to a broader user base, including small businesses and entrepreneurs who may not have extensive accounting knowledge and can benefit from accounting software for entrepreneurs. This adaptability makes it an inclusive solution for various industries and business sizes.

Mobile App

The mobile app allows users to access Vyapar’s accounting features from anywhere with an internet connection. Business owners and accountants can view financial data, create invoices, record expenses, and perform other accounting tasks on their smartphones or tablets with a premium plan.

It provides them with mobility and flexibility in managing their finances. Business owners can create and send invoices to clients immediately after completing a job or sale. Clients can receive invoices on the spot and make payments online, accelerating the payment process and improving cash flow.

In areas with limited or no internet connectivity, the mobile app often supports offline access to certain features. Users can continue working on their accounting tasks, and the app will sync data to the cloud once an internet connection is available.

Easy Gst Compliance

Vyapar enables businesses to create GST-compliant invoices with all the necessary information, including the GSTIN of the supplier and recipient, HSN codes for goods, and applicable GST rates. This ensures that the invoices generated through Vyapar are in accordance with GST regulations.

Vyapar accounting software for small businesses automatically calculates the GST amounts based on the product or service and the applicable tax rates. This eliminates the need for manual calculations. It reduces the chances of errors in tax calculations.

Vyapar provides GST reports that help businesses track and monitor their GST liabilities and Input Tax Credit (ITC). These reports include GST sales, GST purchases, and tax summaries. It allows businesses to reconcile their GST data and ensure compliance. The software streamlines the process of filling out and filing these returns.

Advanced Features Of Our Accounting Software For Dummies:

Customised Invoicing

Vyapar allows users to customise the appearance of their invoices fully. Businesses can add their company logo, business name, and contact information to give the invoice a professional touch and enhance brand identity.

Our users can choose from a wide variety of pre-designed templates or create their own layouts. They can incorporate their preferred colours and fonts to match their branding. With Vyapar’s custom invoicing feature, users can easily itemise the products or services they are billing for.

The software provides a user-friendly interface where they can add descriptions, quantity, rates, taxes, discounts, and any other relevant details to each line item. The itemisation ensures clarity and transparency for both the business and its clients.

Vyapar’s custom invoicing feature includes an automatic tax calculation system that helps users accurately apply taxes based on their location and the nature of the goods or services provided. This saves time and reduces the risk of manual errors in tax calculations.

Expense Tracking

Users of Vyapar can keep track of and record a variety of company expenses. By accumulating all expenses in one convenient spot, businesses have a clear picture of their financial operations and are better equipped to make wise decisions.

The software has a user-friendly interface that makes entering expenses easier. The Vyapar mobile app allows users to enter expenses manually, import data from spreadsheets, or even take pictures of receipts using their smartphone’s camera.

Users of Vyapar can group expenses into numerous categories, such as utilities, marketing, travel, and office costs. Businesses can study spending trends and find areas where cost-cutting initiatives can be put in place with the help of this categorisation.

Businesses can track spending in real time with Vyapar’s expense tracking feature. Users can access updated data right away and get an understanding of their current financial situation. This function is essential for keeping budgets under control and guaranteeing financial stability.

Inventory Management

Vyapar software includes inventory management features. You can track stock levels. Business owners can easily monitor their inventory status, including available quantities, stock movement, and reorder points. It enables timely replenishment of stock and prevents stockouts.

Users can add new items, update existing records, and import data from spreadsheets or other sources. This streamlined process saves time and ensures accurate inventory records. It ensures uninterrupted operations and customer satisfaction.

Vyapar allows businesses to categorise and group their inventory items based on various criteria, such as product type, supplier, brand, or location. This categorisation facilitates quick and organised access to inventory data. It makes it easier to manage and analyse stock efficiently.

The inventory management feature seamlessly integrates with sales and purchase orders. When an order is processed, Vyapar automatically updates the inventory levels. Vyapar enables businesses to set custom stock alerts for each inventory item.

When the stock reaches the specified reorder point, the software automatically generates notifications, prompting users to place new purchase orders. It prevents stockouts and overstocking, optimising inventory levels.

Financial Reports At Your Fingertips

Vyapar’s financial reporting feature enables users to access their financial data in real time. The software generates up-to-date reports. It ensures that business owners have immediate access to the latest financial information.

Vyapar allows users to customise their financial reports based on their preferences and requirements. Users can customise from a wide range of report templates, modify the report structure, select specific time periods, and include or exclude relevant financial metrics to create personalised and actionable reports.

The financial reports provided by Vyapar cover a wide range of essential metrics, including profit and loss statements, balance sheets, cash flow reports, accounts receivable and payable reports, and more. These reports offer a holistic view of the company’s financial health and performance.

Vyapar presents financial data in a visually appealing manner through graphs, charts, and tables. These visual representations enhance data comprehension, enabling business owners to spot trends, patterns, and anomalies at a glance.

Supports Multiple Payment Methods

Vyapar improves client ease by accepting a variety of payment ways. With Vyapar, customers get a variety of payment options to select from, including cash on delivery, credit cards, debit cards, mobile wallets, and net banking. The adaptability encourages a satisfying client experience.

When it comes to payment options, different clients could have diverse preferences. Transactions can be performed more quickly and effectively with Vyapar’s support for many alternatives. This guarantees more fluid and streamlined payment processing, cutting down on the possibility of delays and increasing overall operational effectiveness.

Multiple payment methods help in diversifying payment sources. It lessens dependency on only one payment method. This can help firms manage their cash flow far better, assuring a consistent and stable flow of income.

Customers may differ in their preferences or limitations on making payments. By providing a variety of payment choices, it is less likely that customers may experience payment delays due to issues with a particular payment method. This helps the company’s financial stability improve.

Backup And Data Security

Vyapar employs robust data security measures. It ensures that all financial data and sensitive information are stored securely. The software uses encryption protocols to protect data from unauthorised access. It ensures that user information remains confidential and safe from potential cyber threats.

Vyapar offers cloud-based backup for user data. This means that all financial information and records are automatically stored within the cloud. Cloud-based backup ensures data redundancy. It eliminates the risk of data loss due to hardware failures or other unforeseen incidents.

Vyapar’s backup feature includes regular automatic backups at predetermined intervals. These backups are performed seamlessly in the background. Automatic backups save users the hassle of manual data backups.

The previous versions of financial data and records are preserved in the backup system. If there are any accidental data changes or errors, users can easily revert to a previous version. It maintains data accuracy and integrity.

Frequently Asked Questions (FAQs’)

Accounting software is a computer application designed to help businesses manage their financial transactions. It helps track income and expenses, create financial reports, and maintain accurate records of financial activities,financial records, expense challan, and much more.

Accounting software for dummies is a simplified financial tool designed for individuals and small businesses with little to no accounting experience. It offers user-friendly features for managing invoices, expenses, and basic bookkeeping tasks, making it easy for non-experts to handle their finances efficiently.

No. Our accounting software for dummies is user-friendly and designed for beginners. While basic accounting knowledge can be helpful, Vyapar accounting software comes with easy-to-use interfaces that require minimal accounting expertise.

There are various accounting software programs that people with limited accounting knowledge can use easily. One of the most popular software is Vyapar. Our app offers all features required for the seamless accounting needs of a business.

Accounting software offers various benefits for small businesses. It includes streamlined financial management, automated calculations, accurate reporting, simplified tax filing, and improved financial analysis.appen.

Yes. Vyapar accounting software includes features for creating and managing invoices and bills. You can easily generate professional-looking invoices and track payments using accounting software.mpany.

Related Posts: