Fund Accounting Software

Track and manage your organization’s funds effectively with Vyapar Fund Accounting Software. Ensure accurate financial records, compliance, and smooth fund allocation. Download now and streamline your financial management!

Top 4 Key Features of Fund Accounting Software

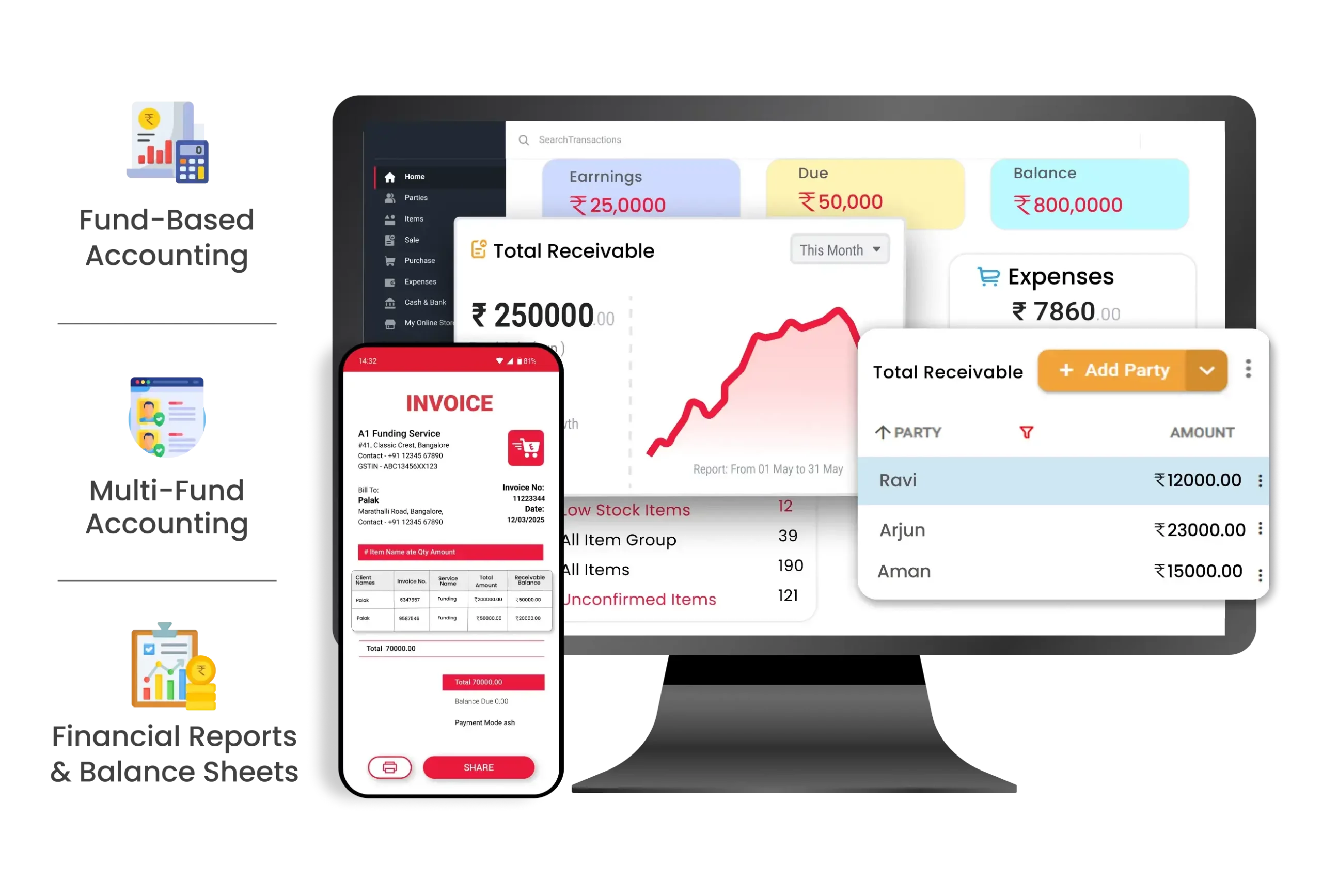

Fund-Based Accounting

This feature keeps financial transactions for each fund separate, preventing mismanagement and ensuring accountability. The best fund accounting software ensures clear fund tracking, compliance, and error-free record-keeping.

- Segregated Fund Management – Keeps financial records separate for each fund, ensuring funds are used only for their intended purpose.

- Regulatory Compliance – Helps organizations meet financial reporting standards and donor restrictions with accurate record-keeping.

- Accurate Financial Oversight – Provides a clear view of fund balances and transactions, making financial tracking more efficient.

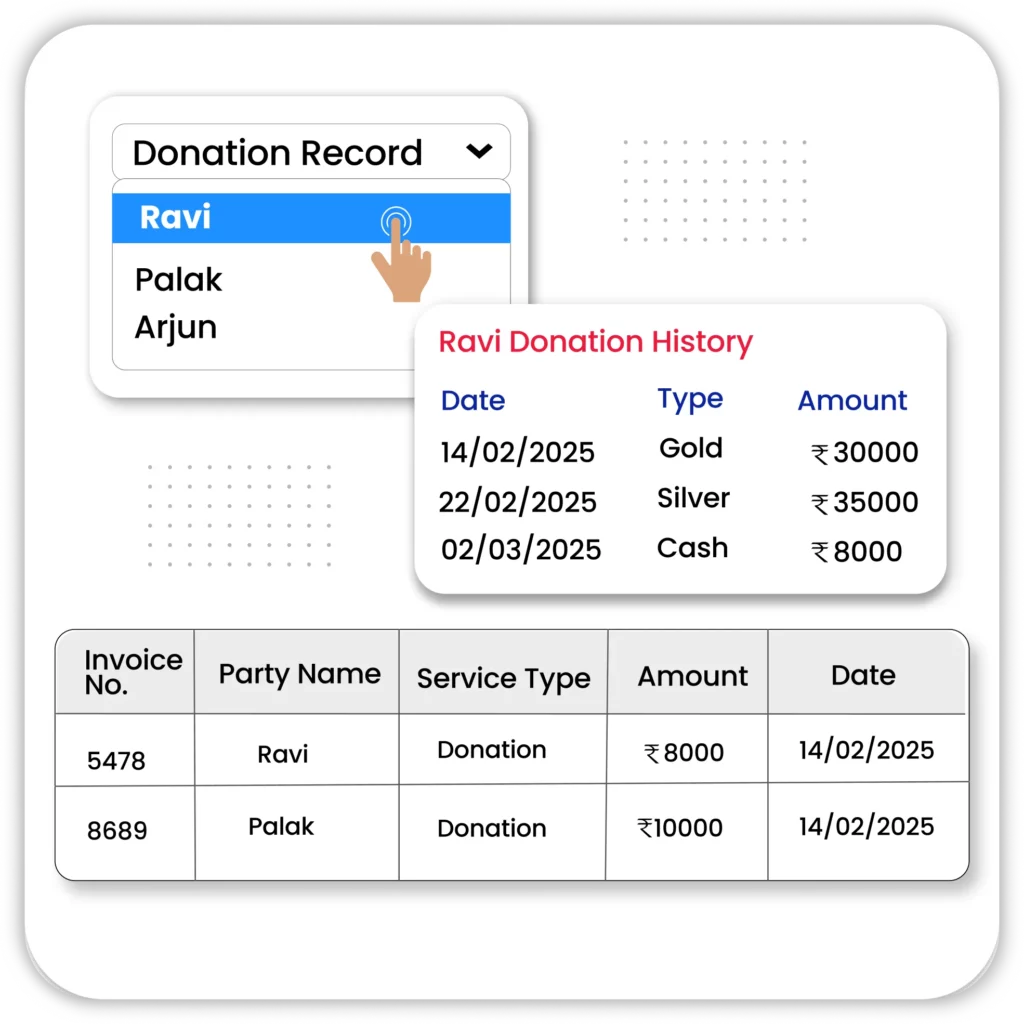

Grant & Donation Management

Organizations relying on grants and donations need structured fund allocation and tracking. Fund accounting software ensures that contributions are used as intended while simplifying compliance and reporting.

- Automated Tracking – Records grant funds separately and ensures they are spent as per specified terms.

- Real-Time Reporting – Generates reports instantly to showcase fund utilization, improving transparency.

- Compliance & Transparency – Maintains proper documentation to meet donor and regulatory requirements, reducing financial risks.

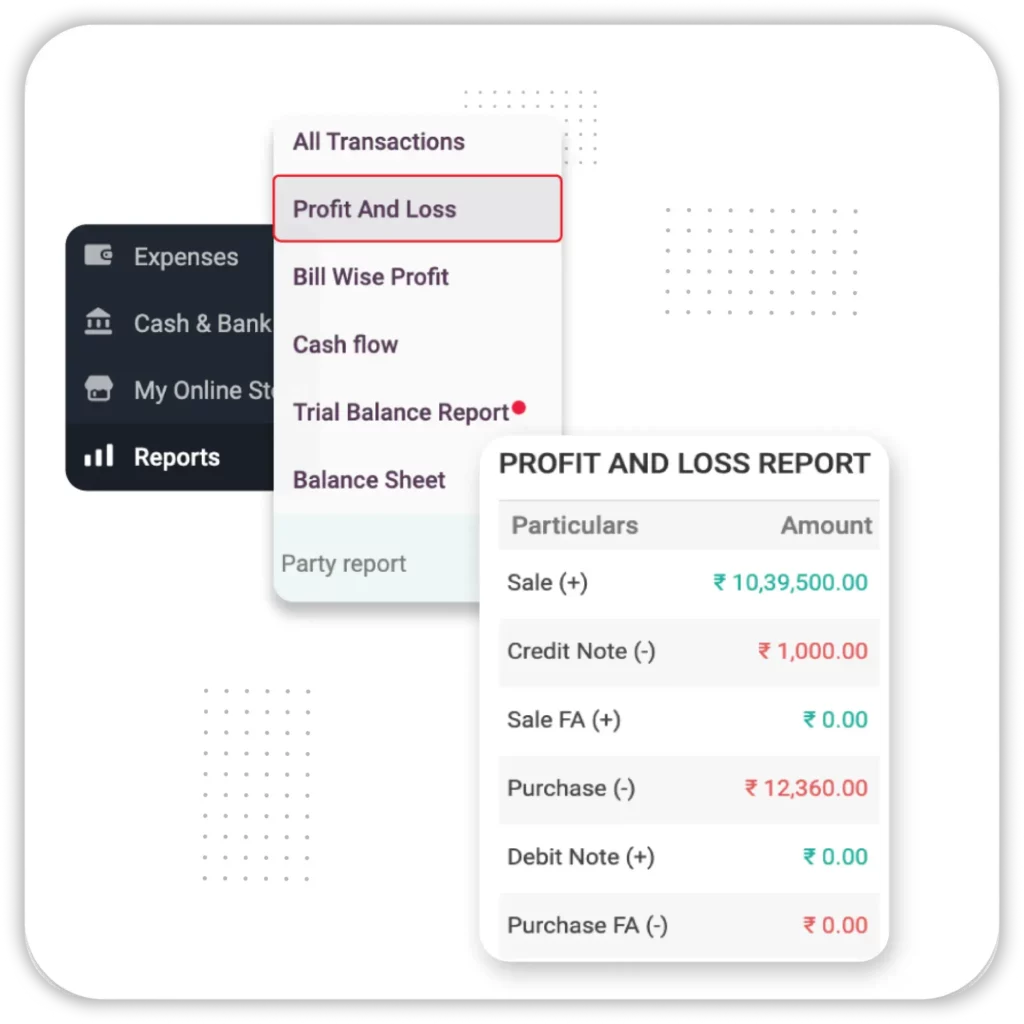

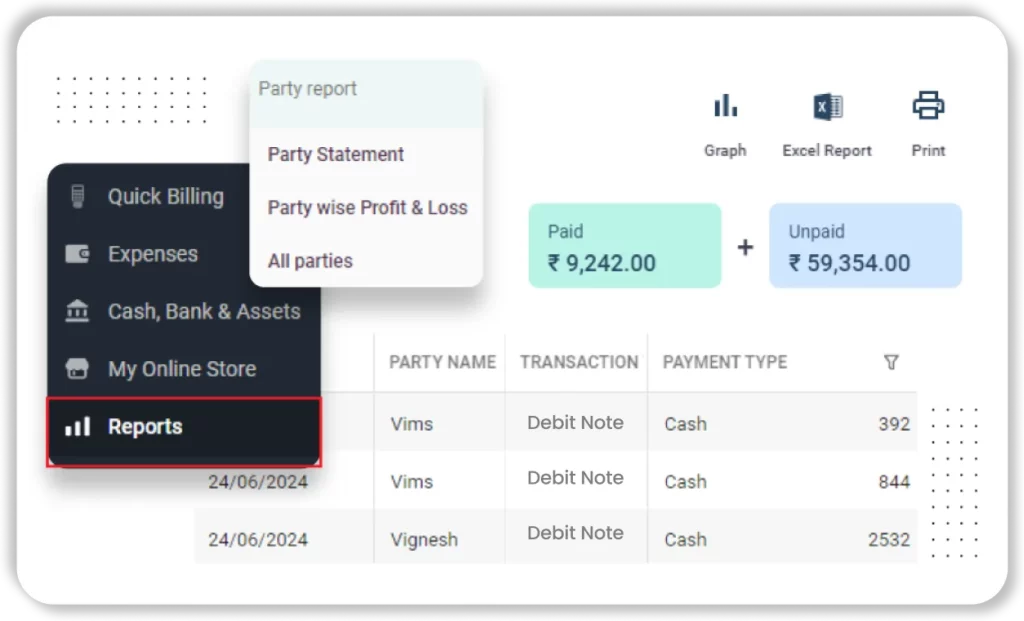

Financial Reports & Balance Sheets

Accurate financial reports help organizations analyze fund performance and maintain compliance. The best fund accounting software automates reporting, reducing manual errors and simplifying audits.

- Customizable Reports – Creates reports tailored to different fund categories for better financial analysis.

- Audit-Ready Statements – Ensures accurate record-keeping and simplifies audits with detailed financial statements.

- Balance Sheet Generation – Get a clear view of your organization’s assets, liabilities, and fund balances, ensuring accurate financial tracking.

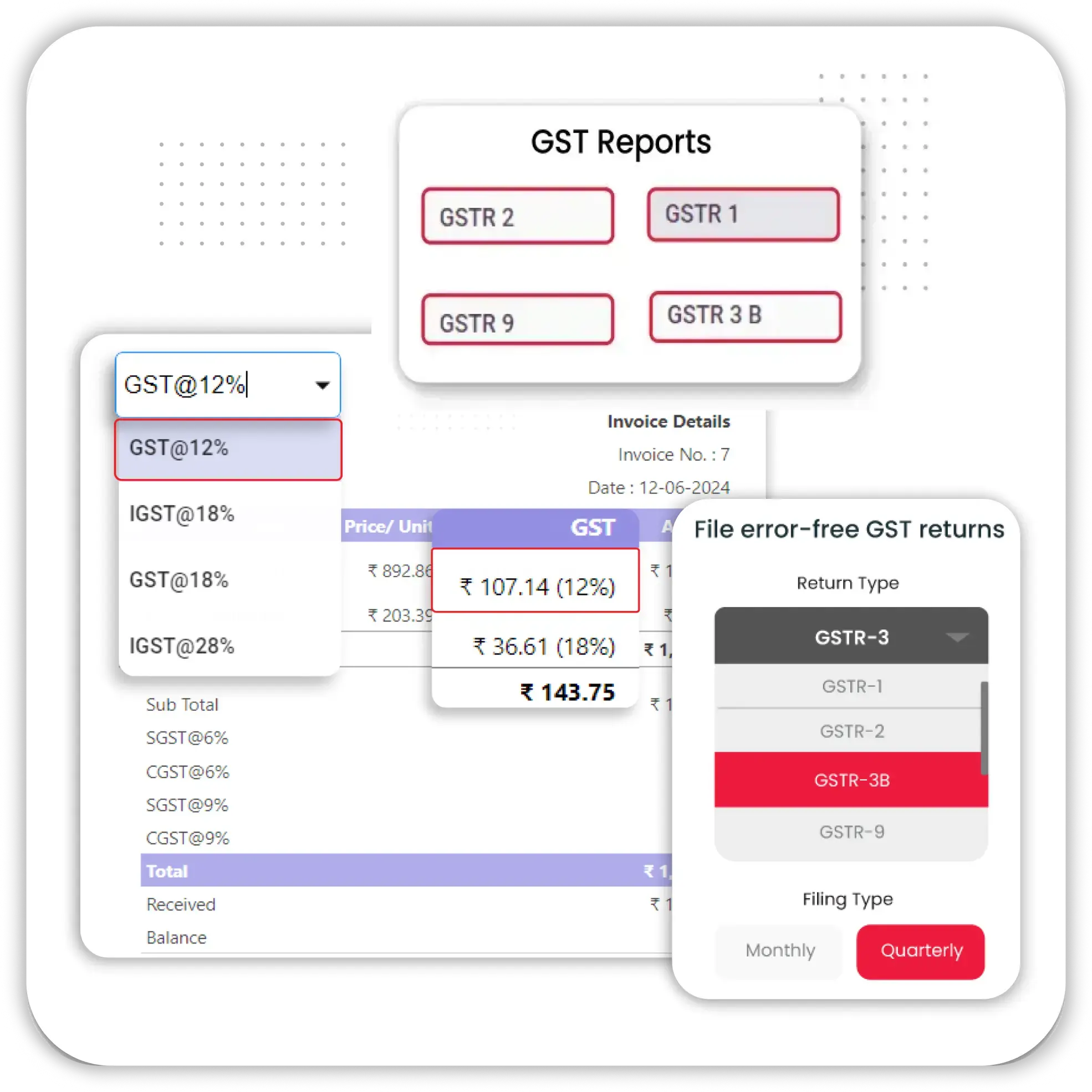

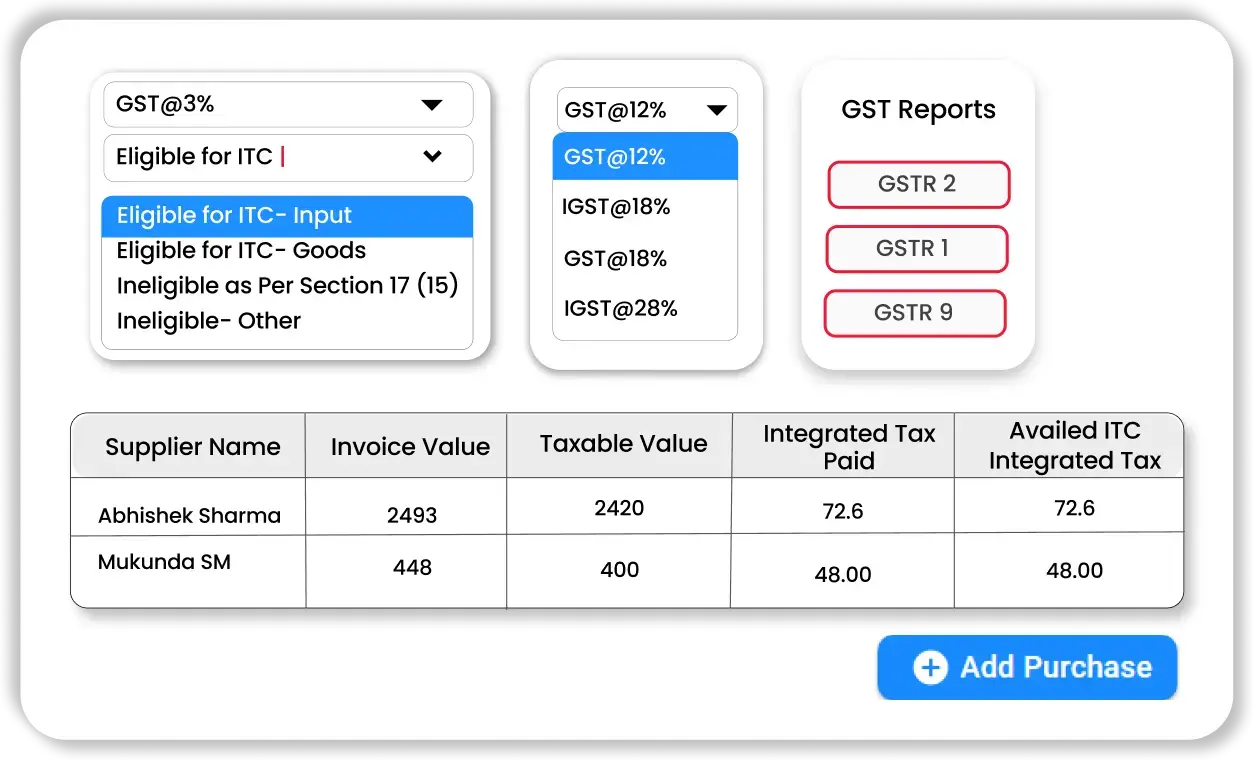

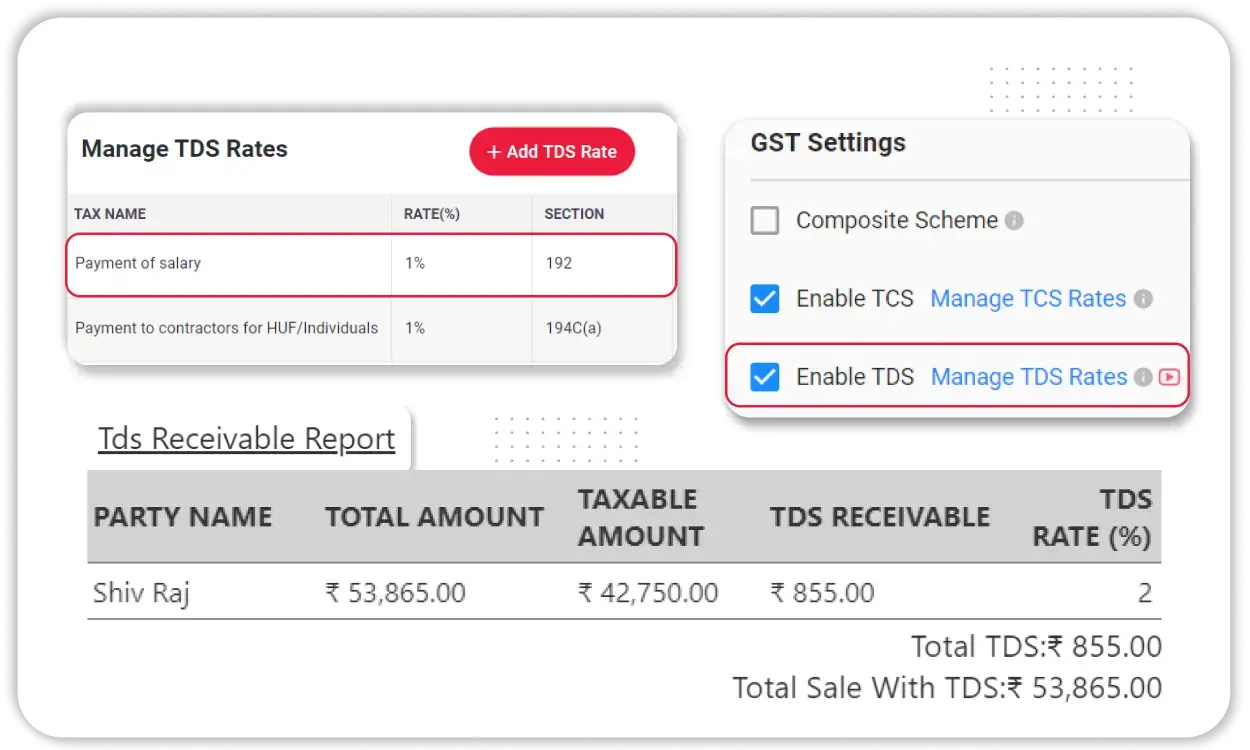

GST & Tax Compliance

Staying tax-compliant is simplified with the best fund accounting software that automates tax calculations and filings.

- GST Filing – Generate reports for GST returns, ensuring accuracy and reducing manual data entry.

- TDS Deduction Automation – Automatically calculates tax deductions at source for vendor payments.

- Compliance Dashboard – Provides a real-time overview of tax liabilities, helping organizations stay compliant.

Advanced Features in Vyapar Fund Accounting Software

Donor & Grantor Reporting

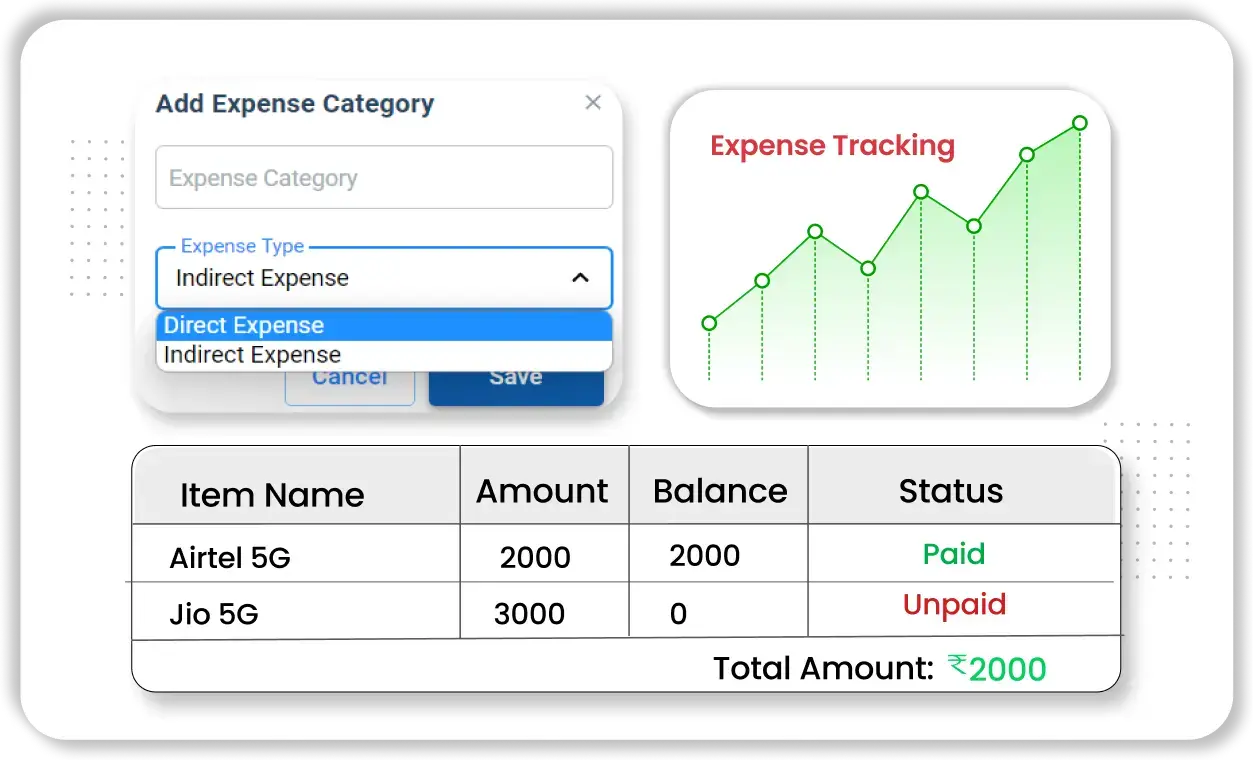

Expense Management

Comprehensive Payment Support

Tax & Compliance Support

Cloud Backup & Security

Multi-User Access

TDS Calculation

Scheduled Reports & Alerts

Mobile App Integration

E-Invoicing Integration

Custom Fund Accounting Software – Unlock More Features for Growth!

Donor & Grantor Reporting

Transparency in fund usage is key to maintaining donor trust and securing future funding. The best fund accounting software provides comprehensive donor and grant tracking.

- Detailed Fund Utilization Reports – Provides in-depth insights into how grants and donations are allocated and spent.

- Automated Donor Statements – Sends periodic financial reports to donors, improving transparency and fostering long-term relationships.

- Customizable Grant Reports – Generates reports tailored to grantor requirements, ensuring compliance with funding agreements.

Expense Management

Tracking expenses is essential to prevent overspending and misallocation of funds. Fast fund accounting software automates expense tracking, making financial control seamless.

- Automated Expense Categorization – Classifies expenses based on fund type, department, or purpose, making it easier to track spending.

- Approval Workflows – Implements a structured approval system, ensuring only authorized expenses are processed, reducing financial risks.

- Budget vs. Actual Analysis – Compares planned budgets with actual expenses, helping organizations optimize financial planning.

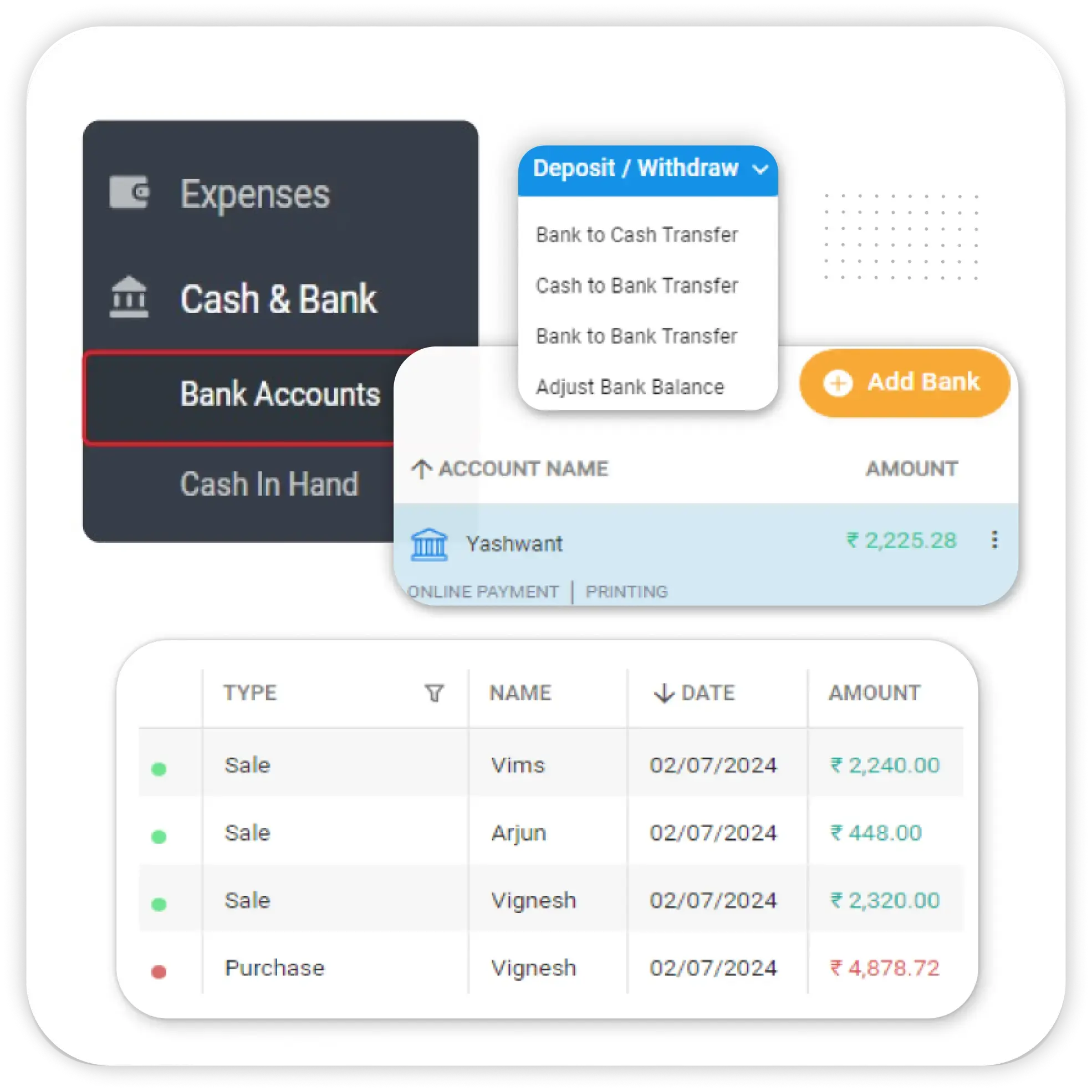

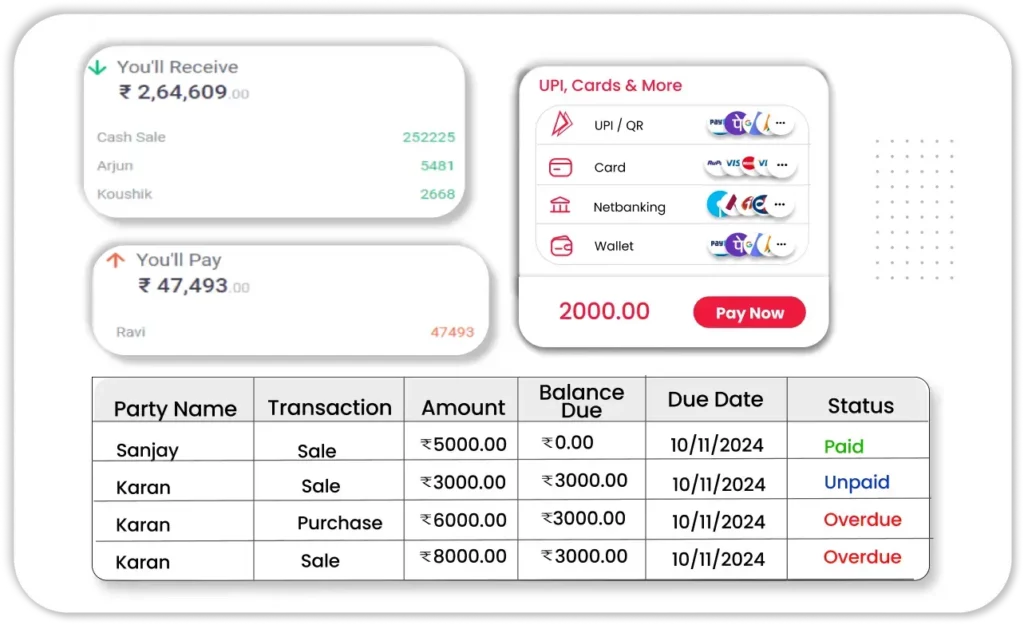

Comprehensive Payment Support

Handling online donations and fund transfers is easier with the best fund accounting software that provides multiple payment methods.

- Multiple Payment Options – Accepts UPI, credit cards, debit cards, and bank transfers for seamless fund collection.

- Instant Fund Settlement – Ensures that donations and payments are recorded quickly without delays.

- Automated Payment Tracking – Links transactions directly to the correct fund, improving accuracy and reducing reconciliation errors.

Tax & Compliance Support

Tax compliance can be complex, but GST & tax compliance features in fund accounting software help organizations meet legal requirements efficiently.

- Automated Tax Calculations – Automatically calculates applicable GST, TDS, and income tax, reducing manual effort and errors.

- Regulatory Compliance Reports – Generates tax-compliant financial statements required for audits and legal filings.

- Audit-Ready Documentation – Maintains well-organized tax records, simplifying regulatory inspections and audits.

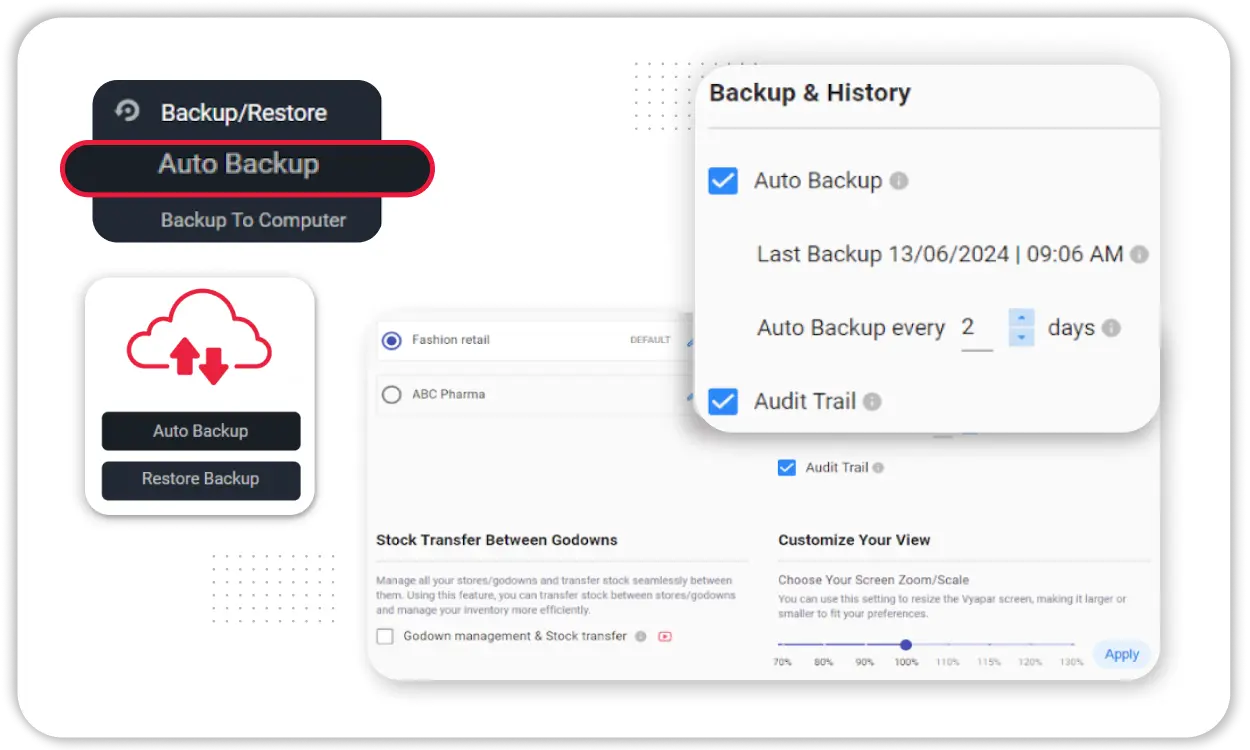

Cloud Backup & Security

Keeping financial data secure is a priority for any organization. The best fund accounting software offers cloud-based solutions for data protection.

- Automated Cloud Backup – Regularly backs up financial data, preventing accidental loss and ensuring business continuity.

- Data Encryption & Security – Protects sensitive financial information from cyber threats using advanced encryption protocols.

- Access Control & User Logs – Tracks user activities, ensuring accountability and minimizing security risks.

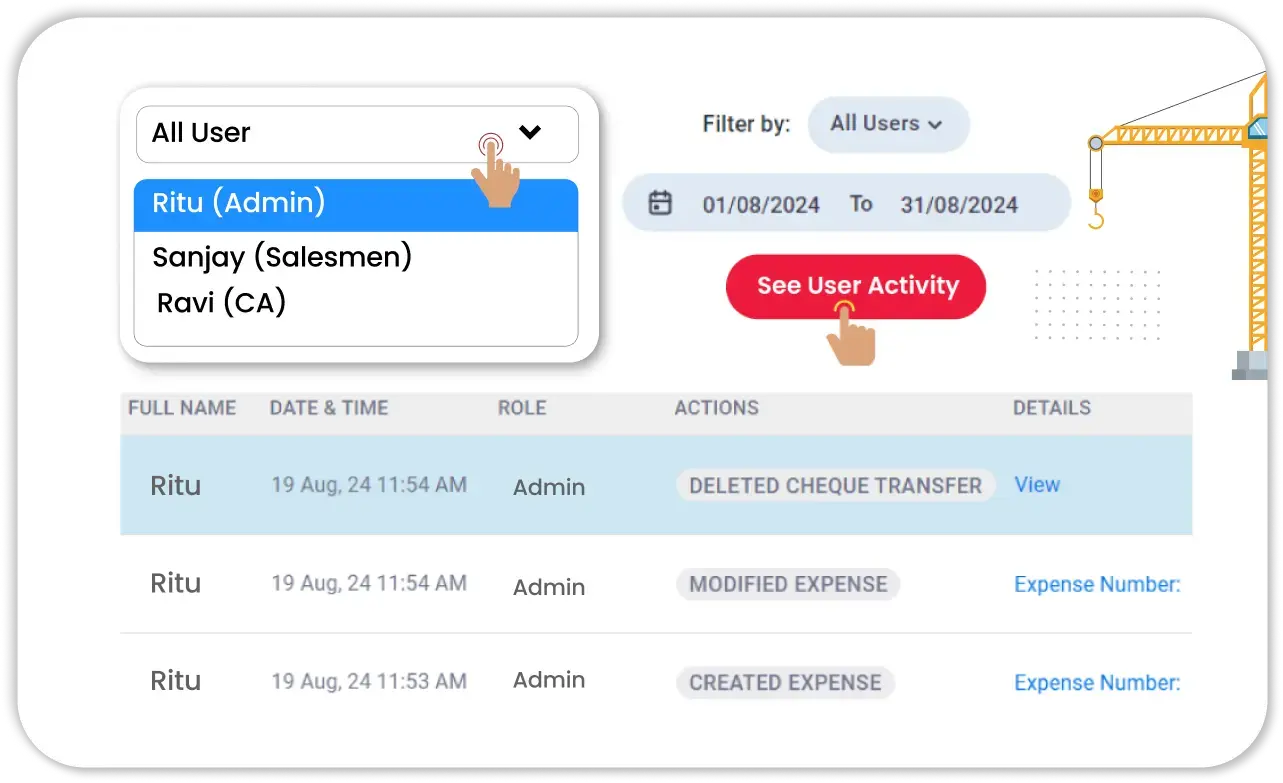

Multi-User Access with Role-Based Permissions

For organizations with multiple finance team members, fast fund accounting software ensures smooth collaboration with secure access controls.

- Custom User Roles – Assigns specific permissions to different users based on their responsibilities.

- Multi-User Collaboration – Allows teams to manage funds simultaneously without access conflicts.

- Approval & Workflow Controls – Restricts access to sensitive financial functions based on predefined roles.

TDS Calculation

For organizations handling payroll and vendor payments, fast fund accounting software ensures accurate tax calculations.

- Automated TDS Deduction – Ensures compliance by applying TDS rules automatically.

- TDS on Vendor Payments – Deduct TDS while making payments to vendors, service providers, or consultants and maintain accurate tax records.

- Comprehensive Tax Reports – Generates accurate reports required for tax filing and audits.

Scheduled Reports & Alerts

Timely financial reports and alerts help organizations monitor fund performance efficiently.

- Recurring Report Generation – Generated reports for donors, stakeholders, and auditors at regular intervals.

- Instant Fund Alerts – Notifies users about low fund balances or significant transactions.

- Threshold-Based Notifications – Sends alerts when fund usage exceeds predefined limits, preventing financial shortfalls.

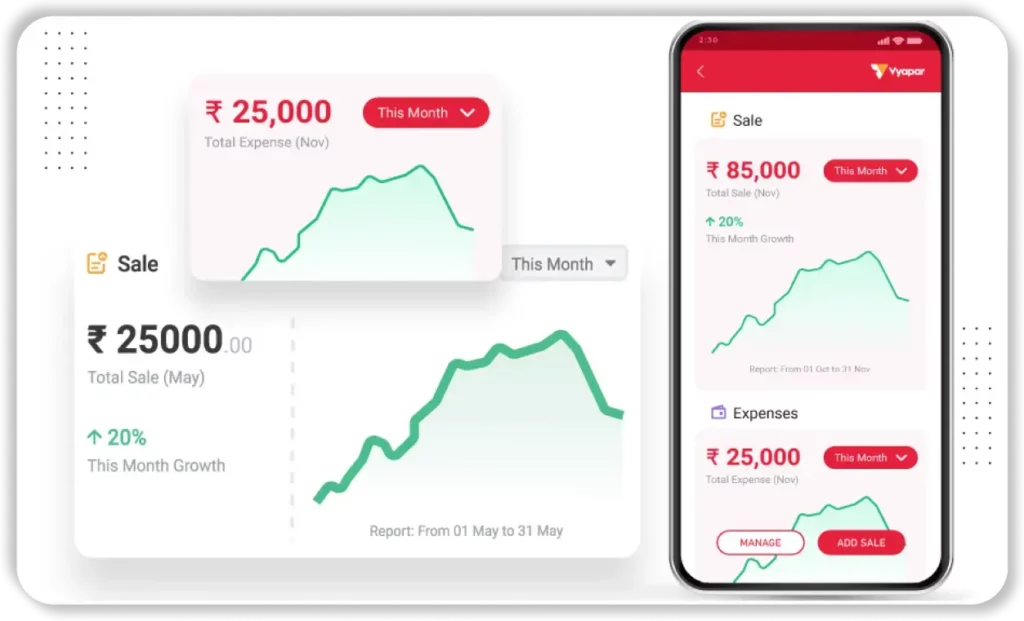

Mobile App Integration

A mobile-friendly fund accounting software ensures users can manage financial records from anywhere.

- Remote Access to Fund Data – Enables users to access fund details through mobile devices.

- Expense & Donation Entry on Mobile – Allows organizations to record expenses and donations instantly, even while traveling.

- Mobile Report Generation – Provides financial statements and reports on mobile apps.

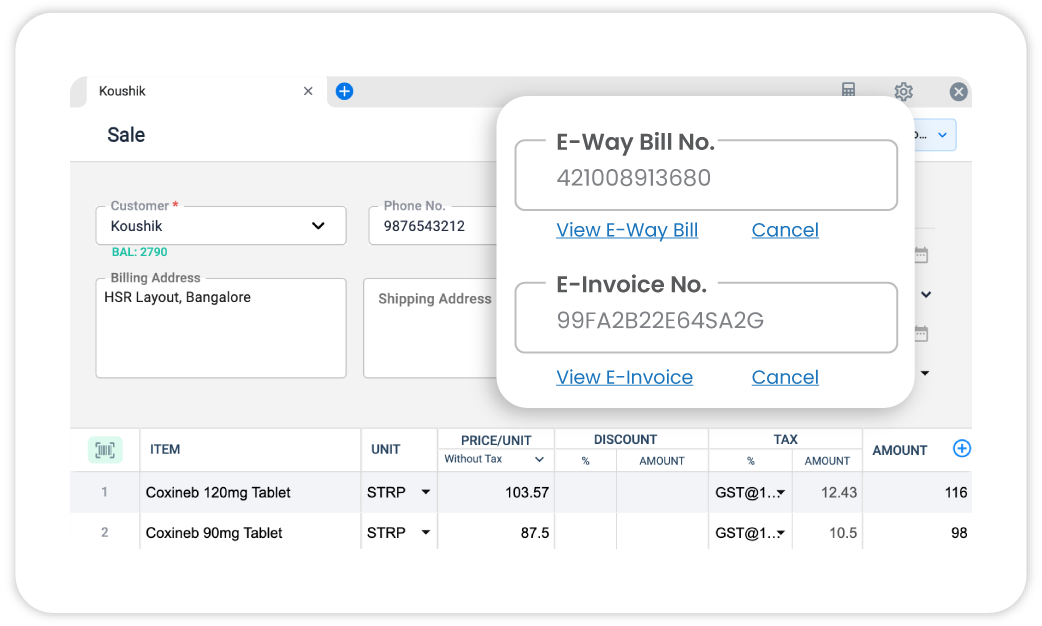

E-Invoicing Integration

For businesses handling procurement and logistics, tax-compliant documentation is essential. Open-source fund accounting software can offer customizable e-invoice generation.

- Automated E-Invoice Creation – Instantly generates GST-compliant invoices, reducing manual workload.

- E-Way Bill Integration – Creates and tracks transport documentation, ensuring smooth logistics operations.

- Real-Time Tax Reporting – Syncs financial transactions with tax portals for hassle-free filing.

Vyapar Accounting Software – Fast, Accurate Billing & Accounting On the Go!

Why Vyapar’s Fund Accounting Software is the Go-To Choice for Thousands of SMBs

Easy-to-Use Interface

Vyapar’s fund accounting software is designed with a simple and intuitive interface, making it easy for small and medium-sized businesses (SMBs) to manage multiple funds. From tracking income and expenses to generating financial reports, all features are accessible with just a few clicks.

No Training Required

Unlike complex accounting systems, Vyapar is built for easy adoption. Business owners and employees can start managing funds, tracking transactions, and generating invoices without any prior training, ensuring smooth financial management from day one.

Cost-Effective

Vyapar provides a budget-friendly fund accounting solution without requiring expensive software licenses or hardware. It runs seamlessly on mobile, desktop, and tablets, making it an ideal choice for SMBs looking to cut costs while improving financial accuracy.

Real-Time Fund Tracking

Keep track of multiple funds, donations, or revenue streams with Vyapar’s real-time fund tracking. Generate balance sheets, profit & loss statements, and cash flow reports instantly, giving SMBs a clear financial overview for better decision-making.

Reliable Assistance Anytime

Vyapar offers 7-day customer support via chat, email, and phone, ensuring quick assistance for all your accounting, fund tracking, and software-related queries. Get prompt resolutions to keep your business operations running smoothly without disruptions.

Scalable Solution for Growing SMBs

Whether managing a single-location business or multiple revenue streams, Vyapar’s fund accounting software grows with your needs. Its advanced reporting, automated billing, and seamless fund management make it the perfect choice for expanding SMBs.

How Fund Accounting Software & Apps Like Vyapar Empower Your Business

Mobile Access for On-the-Go Accounting

Managing funds from anywhere is now possible with Vyapar’s free fund accounting software mobile app. Users can handle fund transactions without being tied to a desktop.

- Remote Fund Tracking – View and update financial data from any device.

- Instant Expense Logging – Record transactions on the go to maintain accurate records.

- Mobile Reports & Notifications – Receive alerts on fund balances and generate reports instantly.

Free Fund Accounting Software Options

Vyapar’s free fund accounting software helps small businesses, startups, and non-profits manage finances efficiently with flexible, scalable features.

- Free Version for Small Businesses – Includes essential fund tracking and financial management tools at no cost.

- User-Friendly & Ready to Use – Requires no technical modifications, making it easy for businesses to get started.

- Scalable Solutions – Adapts to business growth, supporting both small and large-scale fund management.

Native Currency Support

Businesses handling multiple currencies need fund accounting software with native currency support for accurate transactions, seamless tracking, and compliance.

- Expense Tracking in Multiple Currencies – Record business expenses in the native currency and automatically adjust them in reports.

- Localized Financial Reports – Generates invoices and reports in the native currency.

- Seamless Online Payments – Supports multi-currency transactions for e-commerce and businesses.

Vyapar’s Growing Community

Take Your Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQs’)

Fund accounting software is designed to manage and track multiple funds separately, ensuring accurate financial reporting and compliance. It is essential for non-profits, government agencies, investment firms, and businesses handling restricted funds.

The best fund accounting software depends on your needs. Vyapar is a great choice for small businesses and non-profits, offering easy fund tracking, tax compliance, and automated financial reporting.

Several platforms offer chit fund accounting software free downloads, but it’s important to choose one that provides security, transparency, and automated financial tracking. Vyapar simplifies financial management, making it an excellent choice for fund-based accounting.

A fast fund accounting software automates transactions, generates real-time reports, and tracks expenses efficiently. This helps businesses and organizations make quick financial decisions without delays.

Yes, free fund accounting software options like Vyapar provide essential accounting tools for startups, including fund tracking, invoicing, and financial reporting without additional costs.

Hedge fund accounting software is designed for investment firms managing hedge funds. It tracks fund performance, calculates investor allocations, and ensures compliance with financial regulations.

Yes, investment fund accounting software helps track assets, monitor fund performance, and generate reports for investors, ensuring efficient portfolio management.

MIP fund accounting software (Modular Integrated Processing) is designed for non-profits and government organizations to manage grant funds, donations, and financial compliance effectively.

Mutual fund accounting software helps fund managers track NAV (Net Asset Value), process investor transactions, and generate reports, making mutual fund management efficient and transparent.

Pension fund accounting software tracks contributions, calculates payouts, and ensures compliance with financial regulations for pension management companies.

Private equity fund accounting software helps investment firms manage investor allocations, capital calls, and fund distributions, ensuring accurate financial reporting.

Yes, some open-source fund accounting software solutions allow businesses to customize their accounting processes. However, Vyapar provides a reliable, easy-to-use alternative with automation and tax compliance features.