What is a Debenture in Accounting? Explanation & More

Estimated reading time: 9 minutes

In accounting, a debenture is a type of loan or debt that a company uses to raise money. Think of it as a way for a business to borrow funds directly from people instead of a bank. When a company issues a debt, it borrows money. It promises to pay it back with interest on a set date.

This loan is official and supported by a written agreement. This agreement involves the issuing company and the investors, who often call themselves debt holders. Companies use debts to collect large amounts of money or raise capital, without giving away any ownership. This means the business can continue to grow while staying in control. Unlike stocks, debt does not give ownership to investors. Instead, they promise to make regular payments until they fully repay the loan.

Key Takeaways About Debentures

- A debenture is a type of loan or long-term debt instrument that companies use to get money.

- The issuing company pays back the principal amount (the original loan) plus interest.

- Debentures can be secured debts (backed by assets) or unsecured (based only on the company’s promise).

- Investors can convert some debts, like convertible debentures, into equity shares, which gives them ownership in the company.

How Debentures Work

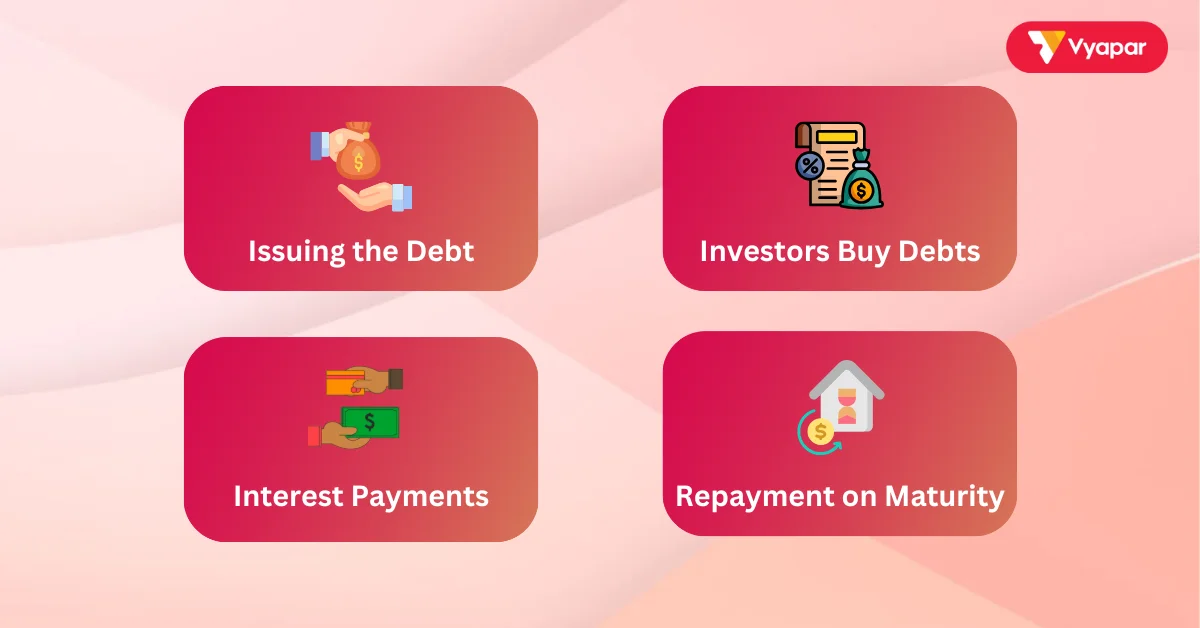

When a company needs funds, it can issue debt to investors. Here’s a simple way to understand the process:

- Issuing the Debt: The company decides to issue debt. It states the amount, interest rate, and fixed repayment dates. This document acts like a contract.

- Investors Buy Debts: Investors, whether individuals or institutions, buy these debts, essentially lending money to the company.

- Interest Payments: The company pays a fixed rate of interest to the debt holders. These payments might be monthly, quarterly, or annually.

- Repayment on Maturity: The company will pay back the principal amount to the investors on the maturity date. We agreed upon this date.

Types of Debentures

Debt comes in various types, each with specific features. Here’s a look at the main types:

- Secured Debts: Backed by company assets. If the company cannot pay back the loan, investors have a right to claim the assets.

- Unsecured Debentures: Not backed by any assets, so investors trust the company’s reputation and credit rating for repayment. These usually offer a higher interest rate because of the risk.

- Registered Debentures: Issued in the name of the investor. The company keeps a record of the debenture holder’s details, and only the registered holder can receive payments.

- Bearer Debentures: Do not carry the holder’s name, so whoever holds the debenture certificate can receive interest payments. This simplifies the process of transferring.

- Convertible debentures: Investors can convert convertible debentures into the firm’s equity shares in the future. This allows debt holders to become part-owners of the business.

- Non-Convertible Debentures: It cannot be converted into shares. They only provide regular interest until maturity.

- Perpetual Debentures: Also called irredeemable debentures, these do not have a set maturity date. The company that issues them pays interest for an unlimited time.

- Redeemable Debentures: These have a specific maturity date on which the company will repay the amount.

Each type of debt serves a different purpose, providing flexibility for the company and options for investors.

Why Do Companies Issue Debentures?

It helps companies in many ways:

- Raising Capital: Debentures help companies collect large sums of money without giving up ownership or control of the business.

- Fixed Interest Payments: Companies know exactly how much they’ll pay in interest, helping them plan their finances.

- Lower Cost Compared to Other Loans: Debentures usually have lower interest rates than bank loans. This is especially true for companies with a high credit rating.

- Flexibility: Companies can pick from various types of debt instruments. These include secured, convertible, and perpetual debentures. They can choose based on their needs.

- Attractive to Investors: Because debentures offer regular interest payments, they attract investors looking for steady income.

Importance of Debentures in Accounting

In accounting, debentures are important because they help companies manage long-term loans without disturbing ownership. The balance sheet lists debentures as liabilities, showing that the company owes money to the bondholders. Debentures also provide regular interest payments, and companies record these payments as expenses in the income statement.

In short, debentures are important for balancing a company’s debt and equity. They help the company grow while maintaining financial stability.

How Debentures Are Recorded in Accounting

Accounting for debts involves a few important steps:

- Issuing Debt: When the company issues a bond, it records the amount as a liability. This implies that it is indebted to the bondholders.

- Interest Payments: The company records the interest paid to bondholders as an expense. This reduces the company’s earnings.

- Repayment on Maturity: When the company pays back the principal amount, it removes this liability from the balance sheet.

For example, if a company issues a ₹50,000 loan with a 10% interest rate, the entries will look like this:

- Issuance:

Debit: Bank Account – ₹50,000

Credit: Long-term Liability – ₹50,000

- Interest Payment:

Debit: Interest Expense – ₹5,000 (10% of ₹50,000 annually)

Credit: Bank Account – ₹5,000

- Repayment:

Debit: Long-term Liability – ₹50,000

Credit: Bank Account – ₹50,000 This process keeps financial records clear and helps investors understand what the company owes.

Examples of Debts in Business

Here are some simple examples to explain how businesses use debt instruments:

- Secured Loan for a Construction Project: A corporation intends to construct new workspaces. It disburses a secured loan worth ₹1 crore. In case of non-repayment, bond owners have the right to seize assets such as real estate or machinery.

- Convertible Debt for a Tech Startup: A tech company issues convertible debt to raise funds for a new app. If successful, investors can choose to convert into equity shares and become part-owners.

- Perpetual Debenture for an Established Brand: A well-known brand issues perpetual debentures with no set repayment date. The company pays regular interest, while investors receive steady income without a maturity date.

These examples show how companies use debt instruments to meet their funding needs while offering different benefits to investors.

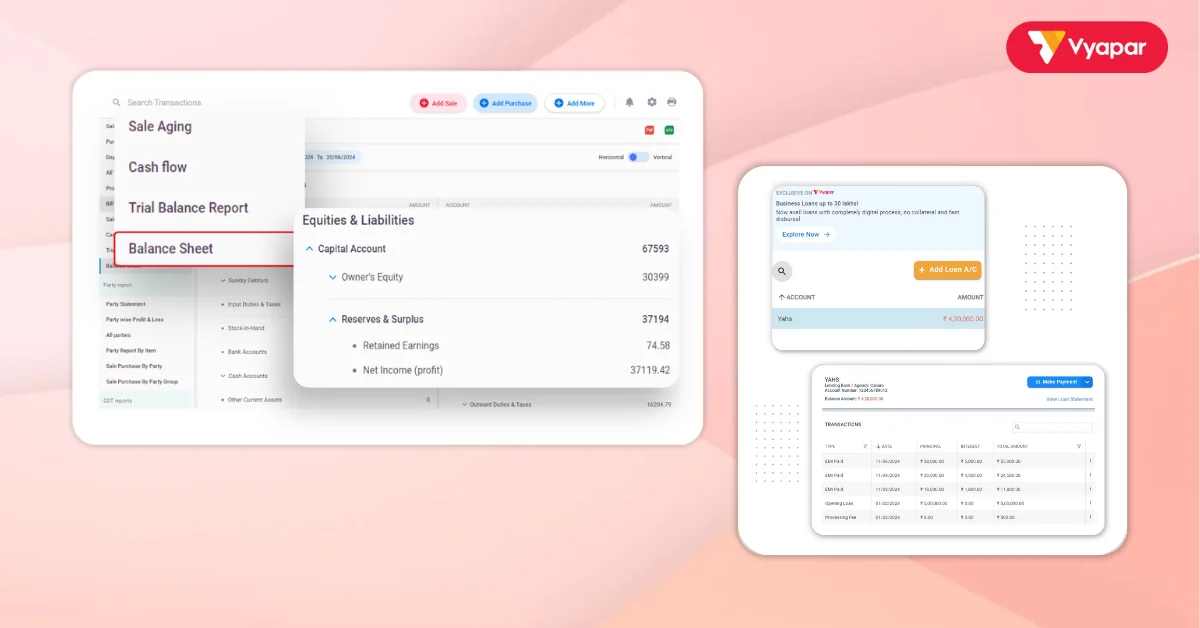

How Vyapar App Can Help Manage Debentures

Vyapar App is a useful tool that helps small businesses manage their finances, including debentures. Here’s how Vyapar can assist with debt management:

- Tracking Interest Payments: Vyapar records interest payments, helping businesses keep up with payment schedules.

- Debt Liability Management: Vyapar keeps a record of the company’s debt to bondholders, providing current liability information.

- Easy Financial Reports: Vyapar generates financial reports, helping business owners understand their interest expenses and overall financial position.

- Organized Record-Keeping: Vyapar keeps a record of every debt instrument, encompassing payment schedules, interest percentages, and conversion choices. This facilitates maintaining orderliness.

Using Vyapar for debt management helps business owners organize their finances. It also saves time on manual record-keeping.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free!

Try our Android App (FREE for lifetime)

FAQ’s

A debenture is a loan that a company issues to raise money, promising to pay it back with interest.

Companies issue bonds to raise funds without giving away ownership or paying high bank loan interest.

Types include secured, registered, bearer, convertible into equity, non-convertible, perpetual, and redeemable debentures.

Companies record debentures as liabilities and classify interest payments as expenses. The balance sheet removes them upon repayment.

Vyapar tracks debt payments, manages liabilities, and organizes financial records, making debt management simple and effective.