What is Capital in Accounting? A Simple Explanation

Estimated reading time: 9 minutes

In accounting, capital means the money or assets a business uses to operate and earn more income. These assets can include cash, property, equipment, and other resources like financial assets.

Capital is crucial for businesses. It helps them grow and invest in new projects. It also helps them manage daily expenses, like paying bills and buying supplies.

Capital can come from different sources. A business owner might invest their own money, which they call equity capital.

A business can secure loans from banking institutions or other lending entities. We call this debt capital. Kept and reinvested profits in the business also count as capital. All this money is what a business needs to survive and grow.

Key Takeaways of Capital in Accounting

- Capital accounts work to track how much money or assets a business has.

- It includes equity from the owner and borrowed money like bank loans.

- Capital is needed for everyday expenses and business expansion.

Understanding Capital in Accounting

Capital is like the engine that powers a business. The total money or assets a company has to keep things moving is essential. Businesses need capital for many things: buying new machines, hiring workers, or paying for rent and utilities. Without enough capital, a business would struggle to function.

For example, when you start a small business, the money you spend on supplies, rent, and other start-up costs is your capital. Bigger businesses may borrow money from banks, which adds to their capital account balance. This helps them fund large projects and continue operating smoothly.

Types of Capital

Equity Capital

Equity capital is the money invested by the business owners or shareholders. When you invest your personal funds into your enterprise, you call it equity. You document this sum in your equity accounts.

As the business grows, more equity may come from earnings. The company does not pay out these earnings as dividends. Instead, the business retains them for future growth.

Debt Capital

Debt capital comes from borrowing money. A business can take out bank loans to get the funds it needs to grow. We call this debt because the borrower must pay back the money with interest. The company records debt capital in its books as a liability because it owes that amount.

Working Capital

Working capital is the money a business uses for its everyday operations. You calculate it by subtracting what the business owes (liabilities) from what it owns (assets).

For example, if your business has ₹50,000 in cash and owes ₹20,000 in bills, your working capital is ₹30,000. If your working capital is positive, your business can pay its expenses. Should it be negative, you might find it challenging to settle your bills.

Fixed Capital

Fixed capital is the money spent on long-term assets, like buying a building, machinery, or vehicles. People use these assets, called capital assets, to produce goods or provide services. They are essential for any business because they help run daily operations.

Importance of Capital in Accounting

Having enough capital is important for a business to keep running smoothly. Without it, businesses may struggle to pay for their expenses, grow, or even stay open.

Growth and Expansion

Capital is key for business growth. It is needed to open a new location, buy new equipment, or add new products. Without it, businesses can miss out on opportunities.

Managing Cash Flow

Capital helps businesses manage their cash flow—the money coming in and going out. Having enough capital ensures you can pay for everyday expenses like rent, salaries, and buying goods and services. This helps avoid financial problems, like not being able to pay your bills on time.

Meeting Financial Obligations

Businesses need capital to pay back bank loans, cover employee wages, and pay suppliers. Without enough capital, a business might struggle to meet these obligations and harm its reputation.

How Capital is Used in Accounting

A business records capital in its financial statements, which show the overall financial health of the company. The balance sheet shows what the business owns (assets) and what it owes (liabilities).

Capital on the Balance Sheet

On the balance sheet, capital is listed in two places: equity and liabilities. The owner invests equity capital, and it appears under shareholders’ equity. Debt capital is money borrowed from banks or other lenders. The business lists it under liabilities because it must pay it back.

Capital and Financial Ratios

Businesses use financial ratios to understand how much of their capital comes from borrowing (debt) versus investment (equity). For example, the debt-to-equity ratio helps you see if a business is relying too much on loans, which can be risky.

Retained Earnings and Capital

Retained earnings are the profits a business keeps instead of paying out to owners or shareholders. The business adds these earnings to its capital to help it grow. Keeping more profits in the business over time increases total capital. This helps the company fund future projects without borrowing more money.

How Vyapar App Can Help with Accounting

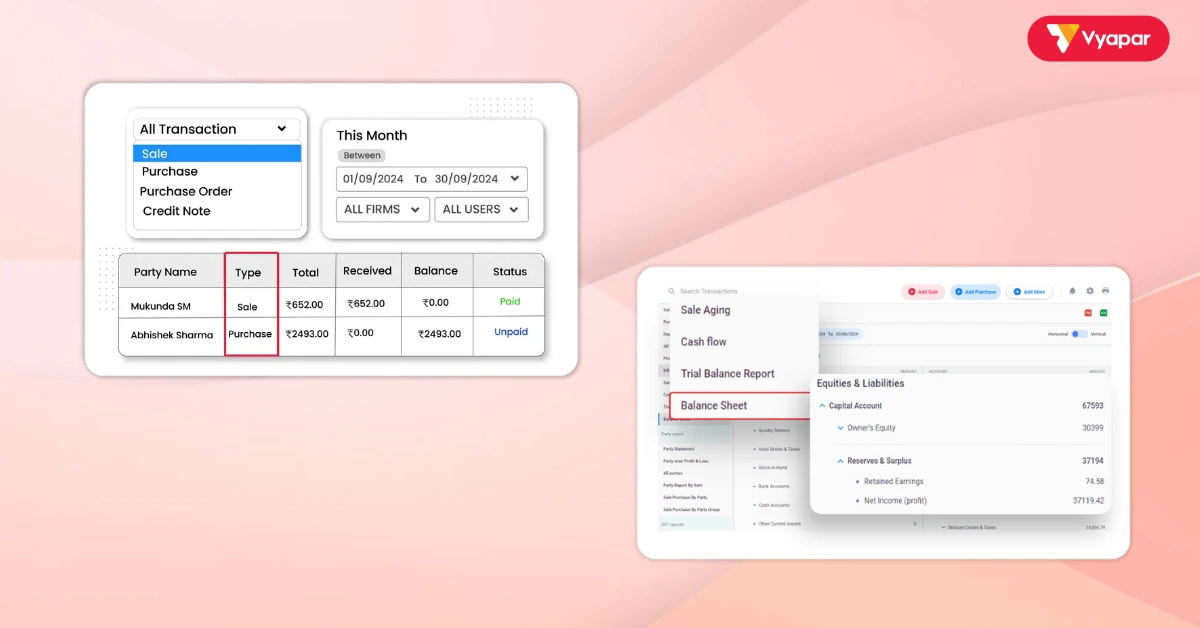

The Vyapar app is helpful accounting software for business owners. It helps track all the important things like capital account balances, transactions, and financial assets.

Tracking Transactions

Vyapar makes it easy to track every sale, purchase, and payment you make. This ensures that your financial records are always up-to-date, which helps you keep track of your money and avoid mistakes.

Creating Financial Statements

Vyapar can also automatically generate your important financial statements, like balance sheets and income statements. This helps understand your business’s overall financial health and whether you have enough capital to grow.

Managing Cash Flow

The app allows you to track your cash flow in real time, helping you see how much money you have coming in and going out. It even helps with setting financial goals by letting you compare your actual earnings with your targets.

Tax Management

Vyapar also simplifies tax management. It can create tax reports, including GST calculations. This helps you avoid mistakes and file your taxes on time.

Managing Shareholders’ Equity

Vyapar shows how much profit is being retained in the business and how much is being paid out as dividends. This helps you understand how you use your profits. It also shows if the business reinvests enough money.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free!

Try our Android App (FREE for lifetime)

FAQ’s

Capital in accounting is the money or financial assets that a business uses to operate and grow, including equity from the owner or bank loans.

Equity capital is money invested by the owners, while debt capital is money borrowed from a bank or other lender that must be repaid.

Working capital is the difference between a business’s current assets and its current liabilities. Used for day-to-day expenses like paying bills.

Capital is essential for paying bills, growing the business, managing cash flow, and meeting financial obligations like loans and wages.

Capital appears under shareholders’ equity and liabilities on the balance sheet. Equity is the owner’s share, and liabilities show money owed to others.

Working capital is calculated by subtracting current liabilities from current assets:

Working Capital = Current Assets – Current Liabilities.

Related Posts: