Table of Contents

- Key Takeaways of Journals in Accounting

- Understanding Journals in Accounting

- Types of Journals in Accounting

- Importance of Journals in Accounting

- How Journals are Used in Accounting

- Examples of Journal Entries in Accounting

- Different Categories of Journals

- How Vyapar App Can Help Manage Journal Entries

- FAQ’s

What is a Journal in Accounting? A Simple Explanation

Estimated reading time: 8 minutes

In accounting, a business records all its financial transactions in a journal. Consider it the central hub for all a company’s financial inflows and outflows. We document everything here, whether it’s cash transactions or credit amounts.

This helps business owners see how money moves in their business. This simplifies the process of monitoring and evaluating their financial situation.

The journal stays clear and organized. This is important for accurate bookkeeping. It also helps with future financial assessments, audits, and legal compliance.

Key Takeaways of Journals in Accounting

- A journal records every transaction first, capturing all essential details.

- It follows the double-entry bookkeeping method, meaning every transaction has both a debit amount and a credit amount.

- Journal entries lay the foundation for creating ledgers and financial statements like the balance sheet.

- Keeping an accurate journal makes financial tracking simple and helps in auditing.

Understanding Journals in Accounting

In accounting, people also refer to journals as books of original entry. This means that we first record every financial transaction here, in the order it happened. Once someone documents the entries in the journal, they later post them to specific accounts in the general ledger.

Each journal entry has a date. It also lists the account affected, like cash or an asset.

A description of the transaction exists. Finally, it shows the amounts for debits and credits. This system keeps each transaction easy to track and understand.

Types of Journals in Accounting

Different types of journals in accounting serve a unique purpose based on the type of transaction. Here are the main types:

- General Journal: This is the most used journal. This category is for transactions that do not fit into other categories.

- Sales Journal: Records all credit sales, helping businesses keep track of amounts customers owe.

- Purchases Journal: Logs all purchases made on credit, detailing what the business owes to its suppliers.

- Cash Receipts Journal: Tracks all incoming cash, including payments received from customers.

- Cash Disbursements Journal: Records all cash payments, such as expenses, supplier payments, and other outflows.

Each type of journal helps organize different transactions. This makes bookkeeping tasks easier and improves financial management.

Importance of Journals in Accounting

Journals are essential for the smooth functioning of a business’s accounting system. Here’s why:

- Financial Accuracy: By recording every transaction as it happens, businesses avoid missing entries or making mistakes, keeping financial records accurate.

- Compliance and Audit Preparation: A well-kept journal gives a clear record. This is important for legal compliance and audits.

- The base for Financial Examination: Accountants carefully examine ledger entries from journals. These entries are the basis for financial reports. This helps businesses understand their cash flow, expenses, and profits.

- Error Detection: Regular entries help spot errors early. This allows for corrections before finalizing financial reports.

How Journals are Used in Accounting

Journals play a key role in the accounting process. Here’s a look at how they’re used:

- Recording Transactions: In the journal, we note each transaction, whether it is significant or small. This helps track all financial activities.

- Double-Entry System: Each entry includes both a debit and a credit, balancing the accounts. This, known as the double-entry system in accounting, this method helps maintain accuracy.

Posting to Ledger: After the journal documents the entries, the entries move to the general ledger. Here, we sort them based on account categories like assets, liabilities, and expenditures. This setup helps create summaries like the balance sheet and other financial reports.

Examples of Journal Entries in Accounting

Different transactions lead to different types of journal entries. Here are a couple of examples:

- Cash Purchase of Supplies

Date: October 10

Account: Supplies – Debit ₹5,000

Account: Cash – Credit ₹5,000

Narration: Purchased office supplies for cash.

- Credit Sale to Customer

Date: October 12

Account: Accounts Receivable – Debit ₹8,000

Account: Sales Revenue – Credit ₹8,000

Narration: Sold goods on credit to ABC Corporation.

These examples show how businesses record cash or credit transactions, keeping a clear record of each activity.

Different Categories of Journals

You can divide journals into two main categories: specialized journals and general journals. Here’s how they differ:

- Specialized Journals: Used for repetitive, high-frequency transactions such as cash transactions, credit sales, and purchases.

- General Journal: Users utilize this for special or one-time transactions. These transactions do not fit into specific categories. Examples include depreciation adjustments, accruals, or correcting entries.

Both types of journals help businesses keep track of financial movements in an organized and detailed way.

How Vyapar App Can Help Manage Journal Entries

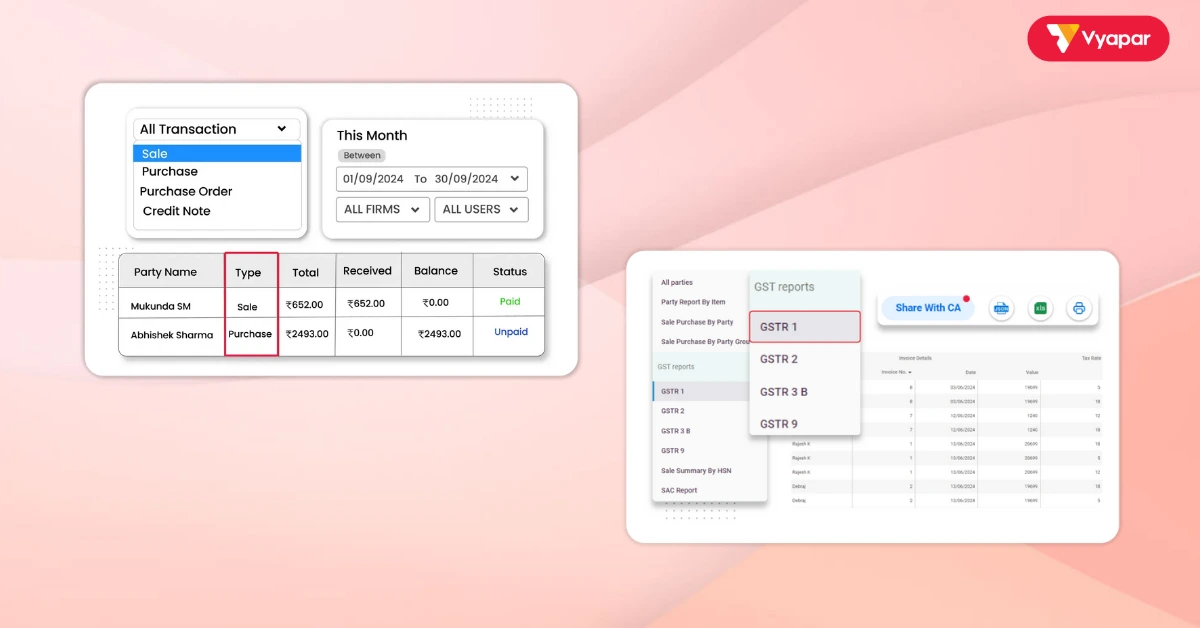

The Vyapar App is accounting software that helps small businesses. It makes managing journals easier and more accurate. It automates the process, reduces errors, and provides features that help track and manage financial transactions. Here’s how Vyapar can make a difference:

- Automated Transaction Recording: Vyapar records sales, purchases, and payments in real time, making journal entries less error-prone.

- Easy-to-Use Reports: Vyapar creates detailed reports from journal entries. This helps business owners see their cash flow, profits, and expenses.

- Accurate Depreciation Tracking: For long-term assets like equipment, Vyapar helps record depreciation, maintaining an accurate book value.

- Tax-Ready Reports: Vyapar produces tax-ready reports with clear entries, ensuring compliance and making tax filing straightforward.

Using Vyapar saves time and keeps accurate records. This allows business owners to focus on growing their businesses instead of spending too much time on bookkeeping.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free!

Try our Android App (FREE for lifetime)

FAQ’s

A journal is the main document where businesses record every transaction in the order it happens. It captures all financial movements accurately and helps in tracking and reviewing financial activities.

Journals ensure that all financial records are accurate, which is important for compliance, auditing, and making informed business decisions.

Common types of journals include the general journal, sales journal, purchases journal, cash receipts journal, and cash disbursements journal. Each type helps track specific transactions, making bookkeeping organized and efficient.

Vyapar automates journal entries, organizes ledgers, and provides clear financial reports. It makes journal management easier, faster, and more accurate, especially for small businesses.

A journal records transactions in the order they occur. A ledger organizes these transactions by account type, like assets or liabilities. It makes financial analysis easier.

After recording transactions in the journal, the accountant moves the entries to the general ledger. The ledger organizes accounts by type, such as asset accounts or cash accounts. This organization helps in preparing financial statements.

Related Posts: