Consultancy Invoice Format in Excel

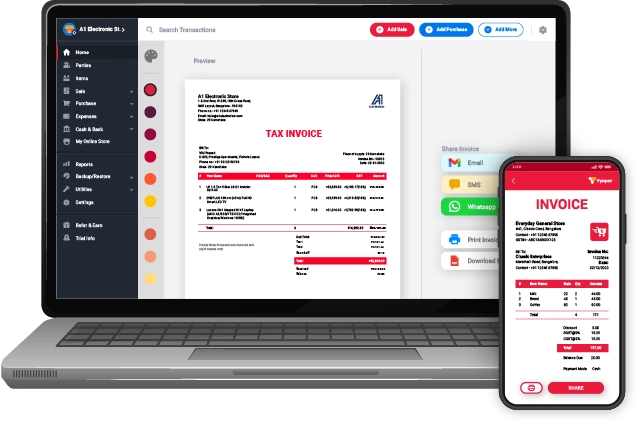

Vyapar free invoicing software is simple to use and does away with the need for multiple applications. With Vyapar, you can manage your business professionally and create consultant bills in various formats.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Consultancy Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Consultancy Bill Format in Excel

Download professional free consultancy bill format in excel, and make customization according to your requirements at zero cost.

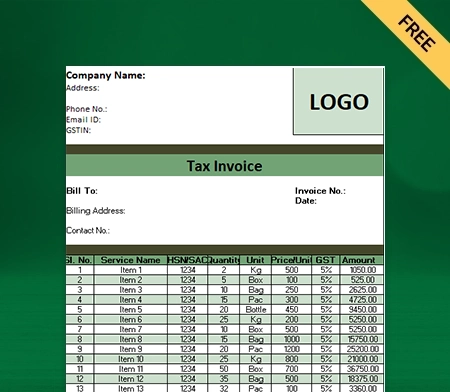

Type 1

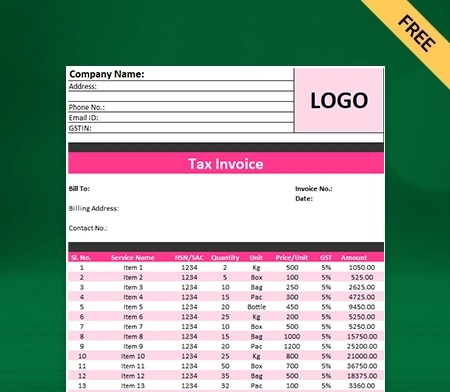

Type 2

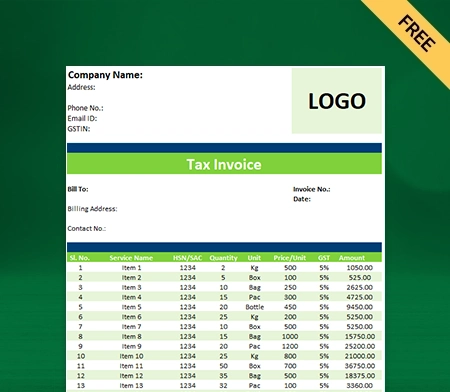

Type 3

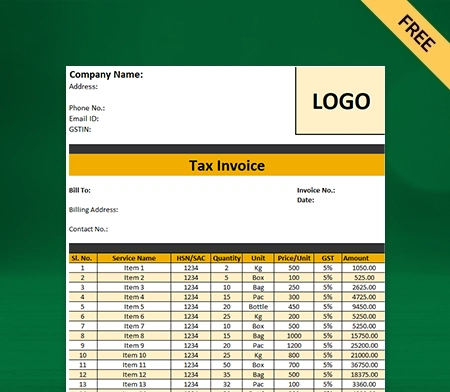

Type 4

Generate Invoice Online

What is a Consultant Bill?

A consultant is a professional who is an expert in a particular field. They give professional advice for a fee to individuals and businesses seeking their expertise on a contract basis.

An organisation that provides consultancy services comprises highly-qualified, experienced, and skilled people who do proper research and analysis to solve their client’s problems.

Consultant invoicing software by Vyapar offers this fantastic Consultant Bill Format to bill your clients efficiently and professionally. Most consulting agencies use the consultant bill format to make an official payment request.

Advantages Of Consultancy Business:

- As a consultant, every day poses a challenge for you, which makes routine life enjoyable. Additionally, it can be rewarding when you succeed in a project that adds to your company’s reputation.

- Consultants are often hired to resolve desperate situations. It is a very fast-paced and demanding job, so it fits perfectly with the challenge seekers.

- Consultants give expert advice to businesses that have problems. They must stay updated on market trends and adapt to new industry changes. Thus, they constantly keep learning.

- You can start your consulting work from home. This way you don’t have to pay office bills, electricity bills and other costs.

- Working from home gives you a lot of flexibility. You can set your work hours and decide your schedule. You can also take time off when you need it.

How To Bill Your Clients As A Consultant ?

Consultants must create a professional consultant service invoice that lists their services, hours worked, and the amount owed. Here’s a step-by-step guide to invoicing clients as a consultant:

Track Your Hours:

Generally, in the Consulting business, consultants charge their clients per hour. As a consultant, if you also charge hourly, you must develop a system to track the total hours of services. By recording the billable hours, you don’t waste any potential revenue. Thus, tracking your hours worked is a consultant’s first step in invoicing.

Include A Header:

Create a standard header for your consultant bill format, which appears on every invoice you write. Here’s the information that you should include:

- Mention the word invoice at the top, so your clients know about the document

- Your business logo

- Name of your agency, address, contact details, and email address

Include Contact Details Of Your Client:

Enter the client’s information below the header. You must mention the customer’s name, address, and preferred mode of payment. It makes the bill personalised and also helps you get paid faster.

Invoice Date And Number:

List the date you’re preparing the invoice under the client’s contact information. This will make it easier for you and the client to file the invoice for bookkeeping purposes. Moreover, assign every bill a unique invoice number. When you number a bill, it is easier to track and refer to it in the future.

A consistent numbering system also aids in the filing of invoices and the organisation of your records. The most convenient way to number invoices is sequential. For example, your first invoice could be Invoice #001, and your second invoice could be Invoice #002, and so on. You can create a numbering system that includes the invoicing date if you prefer.

List Your Services Precisely:

Create a list of services that you provide. It helps in organising and simplifying the information. The list must include:

- Description of each service

- Total number of hours

- Your hourly rate

- Subtotal of charges

State Your Payment Terms:

It is good to discuss payment terms with clients before signing the project. Your payment terms should entail terms of advance payment, terms for late payment, and preferred mode. Your mode of payment can include cheques, cash, credit/debit cards, bank transfer, UPI transfer, and other such methods. Discussing terms and conditions beforehand prevents surprises and ensures smooth working.

Mention The Due Date For Payments:

In your invoice, highlight the payment due date so your client can’t miss it. Make sure it pops; use a different font or colour. It serves as a reminder to customers and ensures timely payments.

Add Total Amount:

Include the total amount owed, including any applicable taxes and sales taxes, on the invoice. Make the whole due section stand out on the page, just like the payment due date, using larger, bolder, or more colourful fonts.

Create your first invoice with our free invoice Generator

Benefit Of Using A Consultant Bill Format In Excel By Vyapar

Effortless And Saves Time:

Vyapar requires no specialised accounting knowledge. Because of the app’s user-friendly structure, consultants can easily use consultant bill formats. You can instantly transfer data from a mobile device to a desktop computer and vice versa.

Manual bookkeeping takes time and is prone to human error. Automation speeds up the process while removing human error. You can focus your attention on other tasks while saving a significant amount of time. It will generate the reports you require precisely.

The Vyapar app records all of your transaction data automatically. You can quickly review the reports and analyse your company. It also sends reminders to collect payments and refund debts, which aids in the prevention of future issues.

Business Reports:

Consulting services providers must make sound judgments. Managing the money needed for daily operations, analysing data, and evaluating business activity can be challenging. Vyapar can assist you with all of these concerns.

Vyapar allows you to create more than 37 different types of reports. Balance sheets, spending or income reports, and GST reports can all be created. You can maintain the agency’s cash flow and avoid workflow disruptions.

You can examine the reports to see how the company is performing. It enables you to determine which product is in high demand and stock up on it. You can use the Vyapar app to make income tax filing easier.

Life-Long Free Basic Usage:

The essential features of our business accounting application are free. The free services are available to Android users indefinitely. Free access is part of our goal of bringing millions of small business owners into the digital economy.

You can use the accounting software for free if you register and get a free copy from the Play Store. On the other hand, a business can use a subscription to access the deluxe functions and desktop programs.

Following each transaction, you and your client will receive a free SMS with transaction details such as credit and debit values. It keeps both parties transparent and on the same page.

Excellent Bookkeeping:

You don’t need any other bookkeeping accounting software to use the Vyapar consultant bill generator. The app provides a streamlined user interface for managing all of your small business’s financial needs.

Handwriting entries are required for manual bookkeeping and bill production. You will spend most of your time filling cash registers and spreadsheets as a bookkeeper.

You can use the Vyapar consultant bill format to automate the procedure for your company. Data can be transferred instantly from mobile to desktop and desktop to mobile. Vyapar is available to businesses that are both GST-registered and unregistered.

Backups Help To Keep Data Safe:

You can set up an automatic data backup using our billing software in India, allowing you to protect the data stored in the app. You can also make a local backup for added security.

Data security is a top priority for any business today, as it is the backbone of the consultant industry. You can generate reports and analyse sales data for future growth prospects using your sales data.

Losing data can harm your business and sales figures, so you must create backups to ensure that all data is safe. Vyapar software in India enables you to set up an automatic data backup, ensuring the safety of the data stored in the app.

Provide A Variety Of Payment Options:

If you offer multiple payment options for convenience, your customers are less likely to default on payments. A consultant can offer options such as UPI, QR, NEFT, IMPS, e-wallet, and credit/debit cards.

Customers value convenience, and the essential convenience you can provide is the ability for them to choose how they pay you. You can create a consulting invoice template with multiple payment options using the Vyapar invoicing app.

You can choose which payment options your customers will likely prefer, or you can offer them all. You can mention your bank account details within the app as one of the payment options.

Other Valuable Features Of The Vyapar App:

Online And Offline Billing:

Our software does not require you to halt billing operations due to poor internet connectivity. Our software does not require you to halt billing operations due to poor internet connectivity. The Vyapar app allows you to generate invoices for your customers without staying online.

When you connect your database to the internet, you can rely on our consultancy business accounting software to validate and update your transactions. Using our billing software features, you do not have to halt your business operations because of poor internet connectivity.

You can generate bills for your clients as soon as they hire you for services using our GST accounting software. The Vyapar app’s online invoicing and offline features are helpful in rural areas where connectivity and network issues are common.

Clients benefit from the app’s features because they no longer have to wait for their invoices. Furthermore, it simplifies the billing process because they can record transactions as soon as they occur without making additional efforts.

Regular And Thermal Printer:

This free billing software is ideal if you need your invoice in the perfect consultant bill format. Vyapar is compatible with thermal and regular (laser) printers and can help you get the printout you need in minutes.

Vyapar’s invoicing and accounting software/app is a quick and easy way to print invoice formats and bills. You can generate prints in any size, including regular paper sizes A4 and A5, thermal paper sizes 2″ and 3″, and custom paper sizes.

Pair our app with your regular/thermal printer via Bluetooth or plug-in to begin printing invoices. You can create and send professional invoices to your customers using the Vyapar app. You can also use digital methods such as email, SMS, or WhatsApp.

Using the free consultant billing app, you can select from various Excel, Word, or PDF formats, create an invoice with full customisation, and print it out for your customers. The process is smooth, and fees have recently been reduced to an all-time low.

Bank Accounts:

Consultants can quickly add, manage, and track online and offline payments. The tasks become more manageable if they use an easy-to-use free GST billing app for mobile. You can quickly enter data into the free billing software whether your revenue comes from banks or e-wallets.

You can manage your cash flow by sending and receiving money from bank accounts and performing bank-to-bank transfers. As a result, it is ideal for businesses that use the Vyapar invoicing app for all cash-ins and cash-outs.

To use the bank accounts feature within the app, you must first add a business account in your bank to the GST Accounting Software. Furthermore, it lets you easily withdraw or deposit funds from your bank accounts.

The Vyapar App has open cheques, allowing users to deposit or withdraw funds and close them quickly. We allow you to keep track of cheque payments in addition to many other payment options available in the app.

Send Estimates And Quotations:

You can easily create valuable documents with our free billing software. It includes accurate GST invoices, quotations, and estimates. The GST billing app’s built-in features allow you to send quotes/estimates to clients anytime.

It eliminates errors in quotes and estimates. You can also set a due date for tracking invoices seamlessly. You can also convert your estimates and quotations into invoices at any time. Billing is as simple as a few clicks with the Vyapar software.

Vyapar free billing software provides businesses with a comprehensive solution for saving time and receiving instant quotes. Accounting software allows you to manage your business more efficiently.

The billing app promotes professionalism for your valued customers to entice them to return. Choosing advanced GST billing software is one of the best investments you can make for your company. Our Billing Software aids in the simplification of the billing process.

Choose Invoice Themes:

Maintaining and sharing professional invoices with your clients can help improve your brand’s identity. For thermal printers, the thermal printer billing app includes two invoice themes. It also includes twelve invoice themes for standard printers.

You can quickly improve the appearance of your invoice with this GST invoice software. It is simple to use the available customisation options. You can prepare an invoice for your client in a professional manner. Creating business bills can help you impress a client.

Select the best consultant bill formats to meet your business needs. Most businesses use our free billing software to help them present a professional image. It is an excellent method for establishing a positive brand image.

This free billing app is effective for achieving the highest invoice standard quickly. It offers a variety of themes for both thermal and standard printers. GST Invoicing Software is appropriate, and all themes are completely customisable.

GST Invoicing:

GST billing software that automates your billing needs is an excellent addition to your consultation business. It can help small and medium-sized businesses save time on accounting.

Business owners can quickly complete tasks such as GST return filing, business management, invoicing, and billing with the help of free billing software with GST.

Our free accounting application allows businesses to tailor the fields to their specific needs. In less than 20 seconds, you can generate commercial invoices for your clients and print/share them.

Businesses should prepare bills in the GST invoice format, which our GST billing software supports. The free invoicing app creates multiple parties to handle all customers efficiently.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A consultant invoice also records the consultant’s services and sales to the client for future reference. Many consultants use consultant bill format in Excel for easy calculation and time savings. A consultant bill is simple to create in Microsoft Excel. Choose and customise the template that best meets your needs. You can create an outstanding invoice for your customers in minutes using Vyapar’s free excel invoice formats.

The consultant bill format must clearly describe the services consultants provide to their clients. It should have several hours, an hourly rate, and the total amount.

Consultants provide their expert services to clients and solve their problems. They can charge on an hourly basis or per project.

Consultants are essentially hired to share their expertise and knowledge to assist businesses in achieving their goals and solving problems.