Printable Invoice Template

Using the app to create printable invoice templates using accessible formats is effortless. The best part is that using the word debit notes by Vyapar requires no technical knowledge.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Invoice Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

Download Free Printable Invoice Format

Download free Printable invoice templates, and make customization according to your requirements at zero cost.

Customize Invoice

Printable Invoice Template Type I

Printable Invoice Template Type II

Printable Invoice Template Type III

Printable Invoice Template Type IV

Generate Invoice Online

What is a Printable Invoice Template?

An invoice is a commercial document that records a transaction between a buyer and a seller. Printing an invoice means keeping or storing the hard copy of the sale transaction. The business owner should first carefully check the whole invoice before printing it.

Nowadays, computer-generated invoices are more prevalent. These printable invoices can be prepared using the word, excel, and pdf templates and printed out using both regular and thermal printers available in your store.

After being printed, it is then sent to the customer on his demand. A hard copy of the invoice or physical invoice copy is not required if the invoice is created per rule 48(4) of the CGST Rules and has a Quick Response Code and an Invoice Reference Number.

Why do you Need a Printable Invoice Template?

A printable invoice template makes it easier to print suitable invoices for your customers. Here are some key reasons why you should use the printable invoice:

- It provides accuracy: If you choose to provide a daily, bi-weekly, or monthly invoicing schedule can significantly increase the accuracy of your invoicing. Letting bills on hold or sending them at odd times leads to a significant amount of work going unbilled and could lead to double-billing customers. Printable invoice formats can be used in the Vyapar app to make automated calculations for accuracy.

- Increase cash flow: It is not a hidden thing from you that invoicing your clients and customers leads to getting paid more regularly. Customers are more likely to pay if you offer them smaller bills, and customers are also more likely to pay when they await a bill. Invoicing means getting a more predictable cash flow, which can help you pay your bills, meet your payroll, and grow your business.

- It helps maintain records: Keeping track of your invoices is easier when you use a template to create invoices. The printable invoice helps you when a customer has a question about a payment or services, as well as your records, bookkeeping, and taxes.

- It shows your professionalism: Invoicing adds professionalism to your business or can be regarded as a professional invoice. A consistent process and system reduces errors, saves time and money, and adds organisation to your business.

- It is easy to read: Printed invoices are easy to read if we compare them to the electronic invoice of this modern era. It will be easier and more convenient for older people who are not acclimated to modern electronic invoices and find the printed invoices easier and quicker.

Create your first invoice with our free Invoice Generator

Where is the Printable Invoice Template Used?

Any business can use printable invoices to provide details of the transactions to their customers. The use of printable invoices these days is prevalent in the following sectors:

- Retail sector.

- Restaurants.

- Healthcare sector.

- Transport.

- Supermarkets.

In these following places, you will see the use of printed invoices. However, the printable invoice templates work well with all other industries too.

Contents on the Printable Invoice Template

While selecting the best invoice template for your business’s invoicing, it’s essential to think about the supplies, services, and your client’s requirements. Further, you should keep your company’s business objectives in check.

Choosing the best invoice boils down to selecting a format that allows you to bill for your products and services while still receiving payment on time.

You can bill your clients for sales or supplies and get paid correctly. Further, you can arrange account details and have all the necessary information, including tax details, in a professional invoice.

Receiving payment and charging for your supplies, customers, and clients can be easy with a suitable free invoice template. You should first format and customize your invoice to meet your requirements.

You should format your invoice with all pertinent information to ensure you get paid correctly and on time. This knowledge not only helps your clients pay you but also helps you arrange your company finances. Your invoice would be more structured and streamlined if you use the proper template.

Apart from business and customer needs, the organization must obey e-invoicing rules and the GST laws wherever it applies.

A well-prepared printable invoice will have the following contents:

- It will have a header with your business name and logo.

- Contains your business location and information.

- Contains an invoice number or a unique identifier.

- Invoice date.

- It will have the description of products or services sold and the quantity.

- Contains additional charges, fees or taxes.

- Due dates.

- Total amount due.

- Payment terms.

A tax invoice should be accommodated with the following components:

- It holds the name, address, and GSTIN of the supplier or seller.

- It accommodates the HSN code or SAC for goods and services.

- It carries the name, address, and GSTIN of the recipient or buyer if it’s registered under GST.

- Type of invoices such as a supplementary invoice, tax invoice, or revised invoice.

- It holds invoice numbers, serially numbered and unique in every financial year.

- Description of products or services supplied.

- Contains tax rate for every item on the invoice.

- It holds units or quantities of products and services.

- State of supply and place of supply.

- Carries the total amount of products and services supplied.

- Amount of IGST, CGST, SGST, or UTGST in separate columns.

- It will have a delivery address, in case it is not the same as the place of supply.

- Contains the digital signature of the supplier or any authorized person.

- In case a reverse charge is applicable, then it must be duly mentioned.

How to Create a Printable Invoice by Using the Vyapar App?

Here’s a simple way to create printable invoices in the Vyapar app. Follow the points listed below and create one yourself.

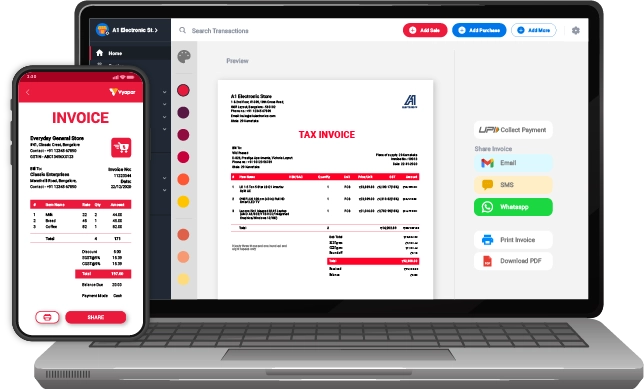

- In the Vyapar app, Click on the add sale button. The sale form will be opened. (You can also use the shortcut key Alt+D to open the sale form.)

- Over here, you first need to select a cash or credit sale. For now, we are creating a credit sale.

- After that, select the customer name. You can select the customer name from the list if you have already selected the customer details. The customer details would get filled over here automatically.

- Suppose you are creating an invoice for any customer for the first time. Type out the name and press the tab key. It creates the party, and you can later enter and edit the party details. Enter the party’s phone number and address.

- On the right side, you can see the invoice number, invoice date, and place of supply, which can be changed if needed.

- Now you need to add items to the invoice. For this, you need to go to the item line and select the item. Along with this, you can see the item quantity price per unit, discount, tax and amount. These can be changed if needed. Similarly, you need to add the other items too.

- After this, you can select the payment type. If you need to ensure, enter any additional details in the invoice. You can use the description box for it. You get an image option over there, with the help of which you can add any invoice-related document, items or any needed images.

- You can add shipping, packaging, or other charges to the right side of your transaction total. You must turn on this option in your transaction set before adding these charges.

- You can round off the invoice amount if needed using the round-off option. This option also has to be turned on from the transaction set.

- Now, you can note it down in the received amount column. Then click on the Save button.

Your sales invoice is ready, and you can print it and share it with your customers.

Additional Benefits of Using the Vyapar App:

Secured database management:

Vyapar’s free GST software in India allows you to set up automatic data backups of their data. It allows you to secure previous information stored in the app. You can also make a local backup for an additional layer of security.

It also facilitates quick and easy access, file search, and retrieval. Your information/data is always synced and protected by advanced encryption algorithms.

Multiple payment solution

This app accepts a variety of payment methods. Cash substitutes include UPI, eWallet, QR, NEFT, IMPS, and credit/debit cards. Customers are less likely to default when they are geared with multiple suitable payment options. Vyapar allows you to generate bills for your customers without staying online.

Online/Offline software

The printable invoice maker app by Vyapar allows you to perform your business operations online and offline. You don’t need to stop your activities because of a poor internet connection. The sellers face this problem in hilly regions or densely forested areas.

You can use the printable invoice templates available in the app to send and create professional printable invoices for your customers. You can manage invoices, record expenses, and cash books, all using one app.

Instant inventory status checks:

Using the Vyapar app, you can know your exact inventory and receive notifications when some stocks are low. You can simplify purchasing, digitally tracking all orders and inventory on a single platform.

For extensive inventories, users may directly import items through word or excel sheets and can add the stock information based on the given format. You can also use Vyapar’s powerful stock control system and gain visibility over your operation process most of the time.

Speed And Accuracy:

Speed is necessary for online business, especially in this modern technological era. Generation GST-compliment invoices, setting bill payments, and estimates on the go are something we need to do. Vyapar app for desktop here lets you do this seamlessly.

Thus, with the help of the Vyapar app, you can add speed to your business operations and achieve your goals. Further, automation will eliminate the possibility of making errors while creating debit notes.

Other Valuable Features of Using the Vyapar App:

Multiple Themes:

This app includes two thermal invoice themes and twelve regular printer invoice themes. The Vyapar app allows you to customize and improve the look of your invoice. You can amplify your brand identity by using professional themes for creating invoices.

Vyapar app has multiple theme options for thermal and regular printers. GST invoicing software is available for free to all businesses, including retailers, gyms, restaurants, and pharmaceutical companies. Further, all themes are fully customisable to meet unique business requirements.

Online-store:

You can set up your online catalogue store using GST billing software. You can list all of the products or services you sell to your customers. It will assist you in presenting a catalogue of all the services/products to customers. It will help you to amplify your online sales seamlessly.

The best part of using Vyapar’s easy billing software online store features is you don’t have to pay an additional dime for using this feature. These features help you in taking your business online. You can directly send the link to your online store to your customers, and your computers can pick products and place orders online from your store.

GST Billing/ Invoicing:

A professional invoice these days represents the identity of a company. Using Vyapar billing software, you can create GST bills that comply with India’s GST law. Vyapar automates your billing requirements which is a great help for businesses. This app effectively assists medium and small businesses to save more time in accounting.

By using the Vyapar app, you can create a GST bill online and offline in a few steps and keep your accounts updated. Sharing your invoices with other business owners and customers is quicker and easier in the Vyapar app. Unlike other billing software, the Vyapar app will allow you to send GST invoices format. You can create and send invoices to your customers within a concise period.

Receivables and Payable:

Vyapar’s free invoicing software allows you to record receivables and payables party-wise. The Vyapar app’s printable invoice maker lets you track money you owe and money owed to you in the business dashboard.

The Vyapar app can keep all the transaction details secure and issue printable invoices seamlessly. With the help of this software, you can set up payment reminders to ensure your customers pay on time, and users can send payment reminders to any party via SMS, email or WhatsApp. You can save time by sending payments to all of your customers using the payment reminder feature of the Vyapar app.

Frequently Asked Questions (FAQs’)

To make a printable invoice, you must have the program containing the invoice fully visible on your screen. Then you must select “File” from the upper menu bar and “Print” from the drop-down menu. You will then be taken directly to the print screen, where you can choose how many copies you want. Then select “print”, and your printable invoice will be ready.

Printable invoice means storing or keeping a hard copy of the sale transaction. A business owner must first check the invoice thoroughly before printing it. Nowadays, there are more computer-generated invoices, and they are then printed and sent to the customer on his demand.

Emailing an invoice

Into the invoice details, click the email button at the top of the page.

On the screen that appears, you review and finalize the email.

The Send to box contains the contact’s email address by default.

Attach the invoice saved in pdf printable format and mail it.

To create a new printable invoice in Microsoft Word, click File > New From Template. You should be presented with many options of downloadable invoice templates and unique design styles, depending on your industry and the type of services rendered.

Issuing an invoice is essential in any business transaction. You can use Vyapar invoice and billing software or invoice templates to create bills on your MacBook. You can customize the layouts and create invoices quickly without much effort.

Yes, the Vyapar e-invoicing software provides options to download or export invoices in various formats such as PDF, Excel, or Word.

A printable invoice is a pre-built format for creating customised invoices. It’s a preset customisable template offered by the Vyapar app that businesses can use repeatedly to invoice their customers.

Printable invoice templates by the Vyapar app are free and fully editable to suit almost any business. Other than physical prints, you can print them as PDFs and share them over WhatsApp or e-mail.

Printable invoice formats are perfect for small businesses and freelancers who want to create professional invoices but don’t want the hassle of designing them from scratch. A printable invoice makes your professional life simpler by boosting productivity.

A Printable Invoice Template PDF is a document that businesses can use to bill their clients. It’s a pre-designed form that you can download, fill out, and then send to your clients. However, modifying a PDF invoice requires specialised software like Vyapar app.

While PDF invoices are professional-looking and easy to use, they lack flexibility. They are used to take out printouts of the invoices that can be shared with customers once the sale is finalised.

For more flexibility and convenience, businesses often use tools or software like Vyapar app. These tools allow you to create, send, sign, and share your invoices all in one place with full customisability.

A printable invoice template in Word is a fully customisable document for billing clients. Users can easily modify colour schemes and design elements in a printable Word format. Businesses often use professional invoicing software like the Vyapar app for more flexibility.

A printable Word invoice template includes all essential invoice elements. Even though Word is great for creating good-looking documents, you may have to put in extra effort to add line items, calculate totals, and understand taxes.