Voucher Format

Download the Voucher Format to boost sales for your business. Or use the Vyapar app for billing and accounting easily and grow your business faster. Avail of a 7-day Free Trial Now!

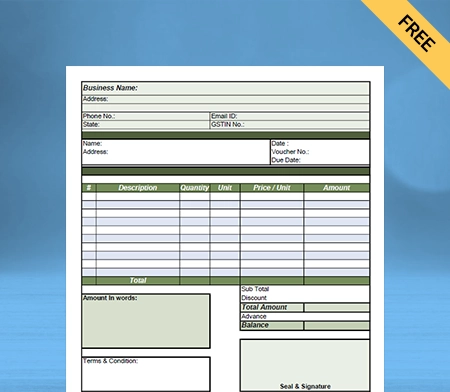

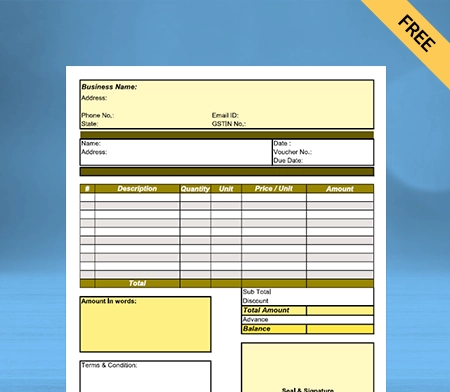

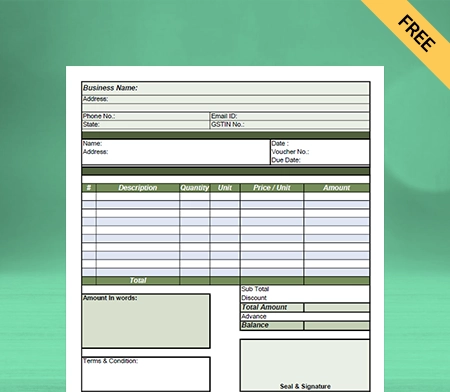

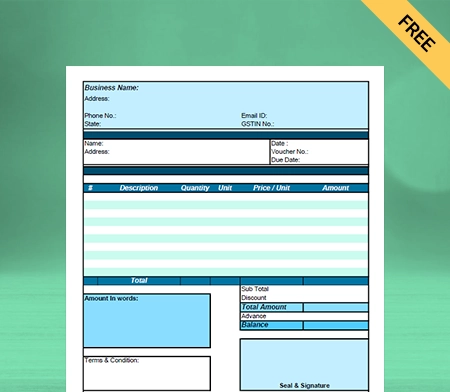

Download Free Customizable Voucher Format

Voucher Format in Word

Voucher Format in Google Docs

Voucher Format in Google Sheets

Highlights of Voucher Format

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print-friendly

Built from scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Voucher?

A voucher is a document that the accounts payable department issues to authorize payments in accounting. It proves the payment of the liability. A voucher can also be referred to as a redeemable coupon or a ticket. A supplier can use a voucher to gather and verify all the other pertinent documentation. The proper control system is also set up with the help of the accounting vouchers.

The accounts payable department insurance that payment is made to the supplier is authorised appropriately, the goods and services are received against proper consideration, and the payment is made per the pre-existing agreement. It is implied that all the prerequisites are fulfilled when a voucher is issued for payment.

The supplier’s invoice, the amount owed, the due date, general ledger accounts, and shipment receipts can all be found in a voucher. All outstanding voucher amounts are reported as accounts owing on the balance sheet as one lump sum. Governments and commercial companies use vouchers, which can be redeemed for various goods and services.

What are Various Types of Vouchers?

Sales Voucher

A sales voucher is a type of receipt or piece of paper frequently provided to a customer of supplies or products. When a supplier has to order or deliver the items later, it often acts as evidence of purchase.

A sales voucher is used to process every purchase of products and services. The sales voucher is generated to document the organisation’s credit and cash sales. The sales account is credited, and the related debtor account is debited. The sales voucher verifies and records the organisation’s sales transaction for goods and services.

Purchase Voucher

Every time you use a service or make a purchase of a good, you create a purchase entry. The purchase voucher includes documentation of this.

There are two options for purchase vouchers: voucher mode and invoice mode. You can choose whichever of the two you think is more suited. You may print off the invoice sheet you or the other party supplied.

Receipt Voucher

A receipt voucher is a document of bank or cash receipts. There are two receipt vouchers: the cash receipt voucher and the bank receipt voucher. A registered person must issue a Receipt Voucher as proof of receipt of any advance payment for the supply of goods, services, or both upon receiving it.

For the amount of cash received, a cash receipt voucher is made using the cash receipt voucher format. The demand draught or check is recorded as having been received on the bank receipt vouchers. It suggests that the money is received in the bank rather than in cash.

Payment Voucher

A payment voucher is a tool for your organisation to keep track of payments it has made in the past to suppliers. Payment vouchers show transactions with an outflow of funds. The goal of creating payment vouchers is to keep track of all bank and cash transactions that need to be paid.

Payment vouchers are of two types: bank payment vouchers and cash payment vouchers. A cash payment voucher template records payments made to an organisation, while a bank voucher records payments made via demand draft or check.

Journal Voucher

A journal voucher is the equivalent backup document for a transaction that doesn’t include money movement. Journal vouchers are used for transactions that do not involve cash, banking, or the inflow or outflow of money. They serve as documentary evidence of the transaction.

The journal voucher, for instance, is generated for a transaction where the products are sold on credit, and there is no instant cash or bank transaction. The sales amount is debited from the debtor and credited to the sales account.

Debit & Credit Voucher

A debit voucher is a record that certifies the completion of a financial transaction. It proves that the business has paid its dues to the vendors and third parties. You can transact with this payment voucher using cash or a bank account.

A credit voucher, which includes cash payments, is a transaction record created when a payment is made. A credit voucher serves as proof of a cash or check payment. Credit vouchers are made if someone gives us cash.

What is Required to Prepare Professional Vouchers?

With vouchers, the auditor can quickly confirm that all the goods or services paid for by the company were received by it. The company’s cash payments are thus justified and documented using vouchers.

The vouchers are used internally to lower the possibility of employee wrongdoing and discourage them from banding together to steal business property. The vouchers establish a paper trail that lists each person participating in that specific transaction along with their roles in that transaction.

Vouchers are crucial for the accuracy of documents. Vouchers are number-coded to prevent errors and maintain records’ chronological order. Due to their simplicity in locating, completion, and validity, vouchers facilitate bookkeeping.

Accountant’s Responsibilities for Creating Vouchers

The voucher serves as the basis for the entire accounting system. The accountant must take great care when preparing the vouchers. A voucher serves as the first document in the accounting system. Every component will be inaccurate if a mistake is made when constructing the voucher. Therefore, an accountant must perform the following actions when making the vouchers:

- Verify all pertinent information on the supporting documents, including the date, amount, kind of transaction, etc.

- The supporting documents require approval from the proper authority.

- Choose the type of voucher you want to use for the transaction.

- The accountant must be well-versed in accounting principles.

- Ensure the totals on the voucher’s credit and debit sides are equivalent.

- The different accounting headings that must be debited or credited by the accountant must be under their control.

Difference Between Voucher and Invoice

A voucher is a written record that is the foundation for the company’s accounting records. In contrast, a written commercial document known as an invoice is one that a seller issues to a customer. It outlines the specifics of the selling of goods or services.

Sellers make invoices at the time of sale, while A voucher is created when three documents match. The purchase order, invoice, and receiving report are these documents.

Voucher issuance signifies that the invoice has undergone verification. Additionally, it confirms that the firm will pay the invoice. We can, therefore, state that the voucher depends on the invoice.

Vouchers are official records that back up the transactions listed in the books of accounts. In contrast, the foundation for creating vouchers is an invoice.

Vouchers include information on total amounts, the ledger account in which the entry is made, and the total of the purchased goods. On the other hand, an invoice contains information on the things bought from a specific business.

How to Prepare Vouchers?

Here are the documents required for the preparation of the voucher:

- The company’s invoice that the supplier gets

- The supplier’s information, including name, address, and phone number

- The payment information, such as the total, any discounts, or the deadline for payment.

- The information about the first purchase order the business placed with the supplier

- The transactional receipt attesting to the fact that the company got the products or services specified in the invoice

- the specifics of the ledger accounts involved in that transaction in question

- the receipt of payment and the authorised signatory of the business attesting to the acquisition of goods or services

- The payment evidence that is included in the voucher’s supporting paperwork

The company first contacts the supplier to order the necessary raw materials or semi-finished goods. The company places the order and verifies the amount once the supplier accepts the order’s specifications.

The business inspects the goods for defects or damage, loads them into the consignment, and then sends the consignment order to the company. The order must adhere to the standards, and the quality control staff must guarantee this.

A voucher, including the pertinent information and supporting documentation necessary for the transaction, is created when the company is satisfied with the submitted order.

All parties must carefully review the voucher and any supporting paperwork to ensure no mistakes. By paying the supplier for the consignment, the business completes the transaction.

Features that Make Vyapar App Best for Your Business

Track Voucher Receivables and Payables

With the help of the voucher number, users can easily retain all transactional details and keep tabs on the company’s cash flow. The way you protect the details of your transactions has changed.

The dashboard area of the voucher maker software allows you to monitor the party’s payables and receivables. You can quickly see who failed to repay you in the dashboard.

You can create payment reminders to ensure that these consumers pay their debts on time. Email, SMS, and WhatsApp payment reminders are free for all parties in Vyapar.

Additionally, you may save time by sending payment reminders to all of your clients at once, utilising the bulk payment reminder option. Vyapar automatically performs the necessary calculations.

Plan Your Business’s Inventory Space

Managing inventory is crucial for businesses that sell a variety of products. Our free business management app is helpful in these instances. The inventory management tools in the Vyapar software can help you keep track of the stock in your store.

Our account and management system allows you to set up low inventory notifications so that you may arrange advance purchases and keep an eye out for theft. Regular inspections can aid in identifying inventory discrepancies.

With a professional tool, you can perfectly control the inventory in your warehouse. You may organise your room and save space by removing the items you no longer require.

Using the best system for creating reports, you may generate sales records and understand how much inventory is optimum based on previous sales.

Send your Clients Estimates and Quotes

Using our free system, you may rapidly produce bids, estimates, and precise financial bills. Vyapar voucher maker software will make your documents look polished.

You can deliver customer quotes, item details and estimates via WhatsApp, email, SMS, or printing. The technology allows users to automate the majority of operations, removing errors from quotations and estimations.

The business now has a comprehensive alternative for quickly obtaining instant quotes and saving more time, thanks to the free financial accounting software from Vyapar.

Additionally, you can convert your bids and estimates into sales vouchers anytime. Using automated voucher maker software will help you manage your firm more effectively.

Create Voucher Reports

Every day, business owners must make decisions. Balancing your operational and financial responsibilities at once might take time.

With the Vyapar automated accounting system, you may make informed decisions. The Vyapar app’s accounting feature enables you to create more than 40+ reports.

Using the Vyapar software, you can view balance sheets, total spending or income reports, and GST business reports. You can analyse accounting reports to evaluate the company’s financial data.

You can adjust the price of your goods and services to consider the market. The app might make tax preparation easier. It is possible to maintain cash flow while avoiding interruptions in the process.

Print Voucher in Regular/Thermal Printer

Vyapar voucher maker app can assist you in getting the printout you require in just a few minutes and is compatible with thermal and standard (laser) printers.

Vyapar billing software makes printing bill format and bills quick and simple. The thermal paper sizes 2” and 3” and other custom paper size options are available. You have a superior choice for swiftly producing prints in all suitable formats.

Connect our app through Bluetooth or plug it into your regular/thermal printer to start printing vouchers. Using the Vyapar voucher format maker app, you can make and deliver polished coupons to your clients.

When creating an invoice using printing bill types, you may choose from several Excel, Word, or PDF forms, fully customise it, and print it out for your clients. The procedure is simple and practical.

Create GST Vouchers

Using the free Vyapar app, business owners could effectively execute various duties, including filing returns and managing inventory, generating invoices, and doing billing.

Businesses can modify the fields in our free app to suit their needs. Using the software, you can quickly generate GST vouchers for your clients that you can print and distribute.

It is usually encouraged to utilise the GST voucher format for bills you can make using our complaint form. With the help of the barcode scanner, you may expedite the invoicing procedure.

A free mobile software program generates many parties to manage each client effectively. Any firm may instantly find any past-due payments thanks to the Vyapar app.

Create your first invoice with our free Invoice Generator

Various Benefits of Using Vyapar App

Variety of Payment Options

Make it simple for new and existing clients to pay online using their favourite payment method by starting to accept all digital payments. Additionally, the manufacturing firm Vyapar voucher maker enables you to email and Whatsapp bills to your clients.

One QR code that takes all forms of payment can be used. Cash, credit cards, debit cards, UPI, NEFT, RTGS, QR codes, e-wallets, pay later options, and other payment options are all acceptable.

Customers desire convenience, and giving them the option to select how to pay you is the most crucial convenience you can offer. Using the voucher format by Vyapar, you may produce vouchers of the highest quality with various payment alternatives.

Personalised Voucher Formats

The voucher formats offered by Vyapar are customisable. To present your brand’s identity to its fullest, you can incorporate your company’s logo, style, font, and brand colours in your invoice.

Everything should be present on the voucher, so your customer understands how much you charge and why. With the help of a voucher format generator, you can create professional-looking coupons and give your clients thorough information about their purchases.

Your business may distinguish itself from the competition by using customised GST-compliant vouchers. Create editable voucher templates to help you include your business requirements while making a professional invoice formats.

Flexible and Time-Saving

Vouchers must be created and distributed to clients by a firm using automated, user-friendly software. They also have to process payments quickly and precisely. Vyapar’s automatic payment processing software helps streamline the procedure.

All relevant calculating tools are included in the Vyapar voucher formats. The business avoids many hours of gruelling labour. Additionally, it guarantees that the data in your records is updated often and is correct.

The business may focus on managing its goals rather than worrying about accounting. Flexibility is also needed when processing payments. Our Vyapar credit format processes transactions swiftly and efficiently.

Helps Automate Business Processes

The automation of an online system is one of its most important benefits. An online app will help prevent invoicing the wrong client or processing the incorrect amounts.

Follow-up emails to your clients can serve as a reminder for them to make payments. It allows you to focus on growing your company because it saves you time. Using the Vyapar app, you can manage your vouchers in one location. ‘

You can use it to manage outstanding vouchers, print invoices, and remind customers to pay. You can use it to help you keep track of all open orders and ensure they are delivered on schedule.

Information Security and Privacy

You may make local, external, or online backups of your Google Drive data with our free app. To protect the security of the data kept in the application, you may configure an automatic data backup in the free voucher format maker.

Using the Vyapar voucher format, you may periodically execute secure backups or set up automatic backups to ensure your company’s security.

No team members at Vyapar have access to your company’s data. Utilising a variety of backup alternatives will allow you to create data backups that meet your needs and increase the security of your data.

Free Basic Use for Life

The core functions of our accounting app are free. Android users can use the app’s accessible credit voucher types by utilising the free services.

You can use the Vyapar system without spending any money if you register and download it free from the Play Store. However, a business can use a subscription to access the premium features and desktop applications.

After each transaction, you and your client will receive a free SMS with transaction information, such as the credit and debit values. It keeps the parties in touch and on the same page.

Frequently Asked Questions (FAQs’)

A professional voucher format is used to document financial transactions in a standard format. It helps to keep track of the payments, receipts, and transfers made by a business or an individual.

A voucher format can be created using tools like Word, Spreadsheets, and Templates. The choice depends on the preference and convenience of the user. It can be printed, emailed, or stored digitally with the necessary information and authorisation.

To make a professional voucher format, you can follow these simple steps:

Step 1: Select a suitable template offered by Vyapar or create your own using tools like Word or Spreadsheet.

Step 2: Update the template with your company logo and the details of the payer and the payee, such as name, address, and GSTIN.

Step 3: Enter the invoice details, payment details, description of goods and services, and the total amount involved in the transaction.

Step 4: Add the rate and amount of GST and other taxes, if applicable, and the place of supply.

Step 5: Sign or digitally sign the voucher and print, email, or store it digitally.

Using a professional voucher format can make the entire process faster. After all, you can cover everything you need in your voucher using the format and customise it to meet specific business needs.

The voucher format includes the supplier’s details like name, address and contact number, item description, the payment details like the amount, discounts or the due date of payment.

A voucher is a redeemable transaction bond with a fixed monetary value and may only be used to purchase specified items or for particular purposes. Housing, transportation, and food coupons are a few examples.

The nine types of vouchers are as follows:

Sales Voucher

Purchase Voucher

Payment Voucher

Voucher

Contra Voucher

Journal Voucher

Debit Note Voucher

Supporting voucher

Voucher documents are official records that serve as proof of every transaction.

You can easily create vouchers in Excel format for free using the best voucher formats provided by Vyapar. You can also make the Excel vouchers from scratch if you need them to contain specific details to meet your business needs.

To create a voucher format in Excel from scratch, you can follow these steps:

Step 1: Open a new workbook and enter the details, such as date, number, amount, payee, description, etc.

Step 2: Format the cells to add borders, colours, fonts, etc. It will help make the voucher format look professional.

Step 3: Add the formulas or functions to calculate the total, balance, or other values.

Step 4: Save the workbook as a pre-defined format, template, or file you can reuse.

Further, do check out and download free voucher templates by Vyapar. You can use them to create a professional voucher format in Excel.

No, invoice format and voucher format are not the same. These formats are used to create invoices and vouchers, respectively, with notable differences. Here are some common differences between invoices and vouchers created using these formats:

– An invoice is a written document the seller issues to the buyer during a credit sale. A voucher is a written document the company uses to record a financial transaction internally.

– An invoice is generated at the time of sale, while a voucher is created after the invoice is received and verified.

– An invoice is a source document showing the details of the goods or services sold, the amount due, and the payment method. A voucher is documentary evidence showing the details of the payment, receipt, or transfer and the accounts involved.

– An invoice is used to prepare vouchers, while vouchers support entries shown in the books of accounts.

– An invoice is sent to the customer, while the company keeps a voucher for internal purposes.

All individuals making a payment must prepare a proper payment voucher and follow the guidelines below:

Choose a proper voucher for payment, such as a cash payment voucher, a bank payment voucher, or a payment voucher (if no separate coupons are prepared for cash or bank payment).

* Write the payment details date on the voucher.

* Designate a serial number for the payment voucher.

* Write the total in both figures and words.

* Debit the account heads correctly.

* Credit the cash account if the payment is made in cash.

* Credit the bank account if the payment is made by check (always include the name of the bank).

* The money receiver must mark the voucher.

* The authorized person with the authority to inform the cashier to pay the cash must sign the voucher.

* Accompany the payment voucher with an appropriate source document.