Accounts Receivable Management Software

Managing your accounts receivable can be challenging. Vyapar’s Accounts Receivable Management Software helps you track invoices, send payment reminders, and reduce overdue payments efficiently. Download Now and simplify your cash flow!

Must-Have Features in an Accounts Receivable Management Software

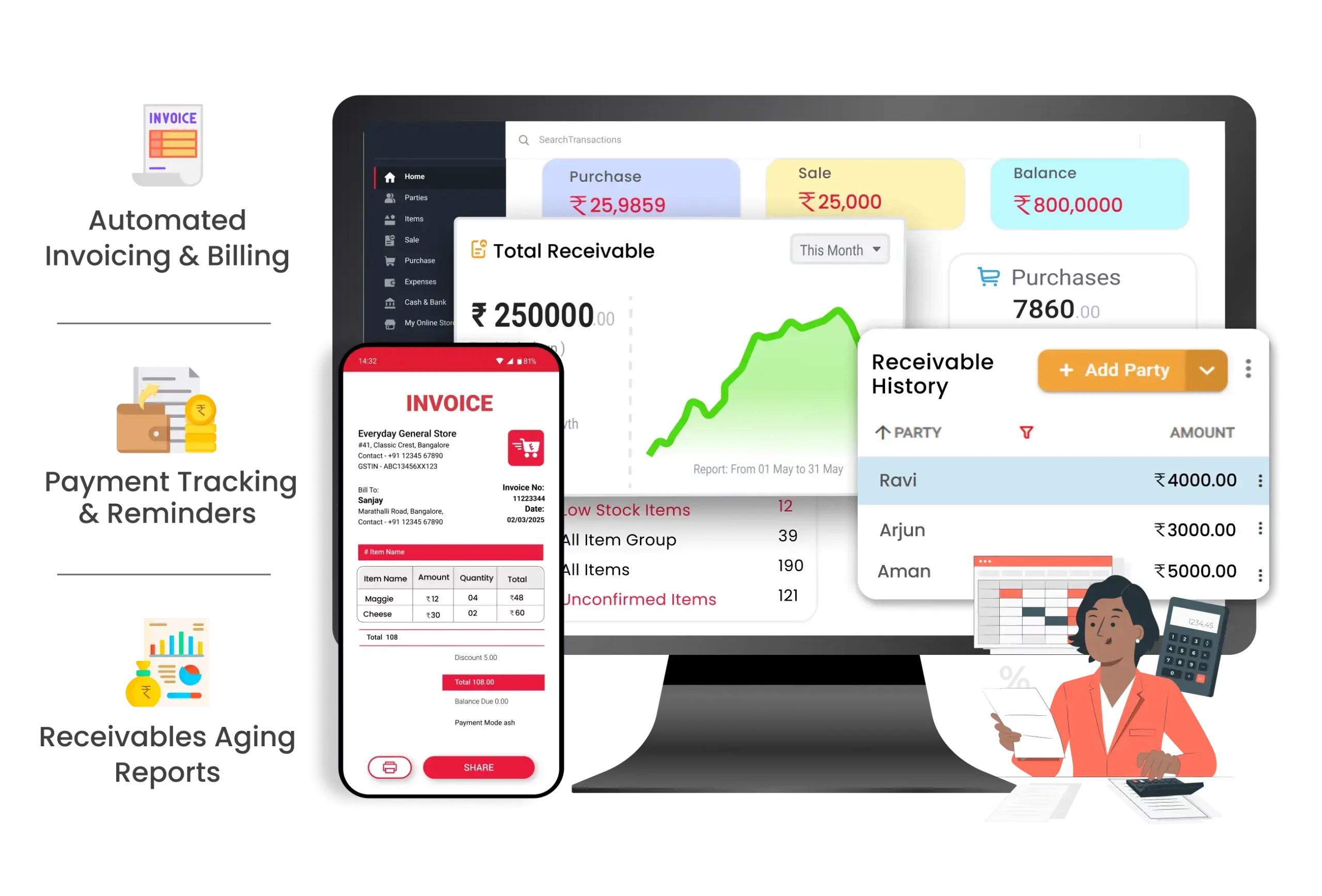

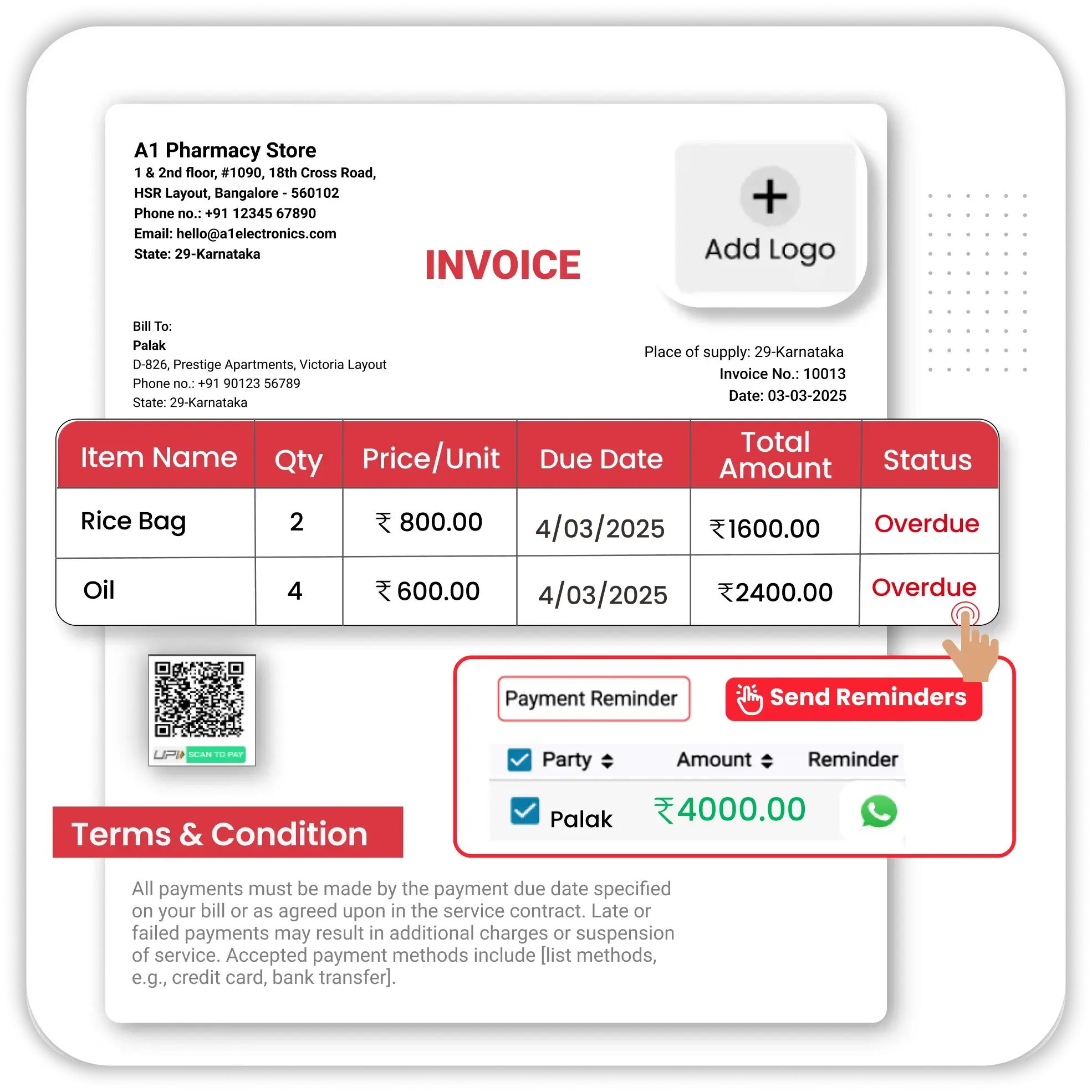

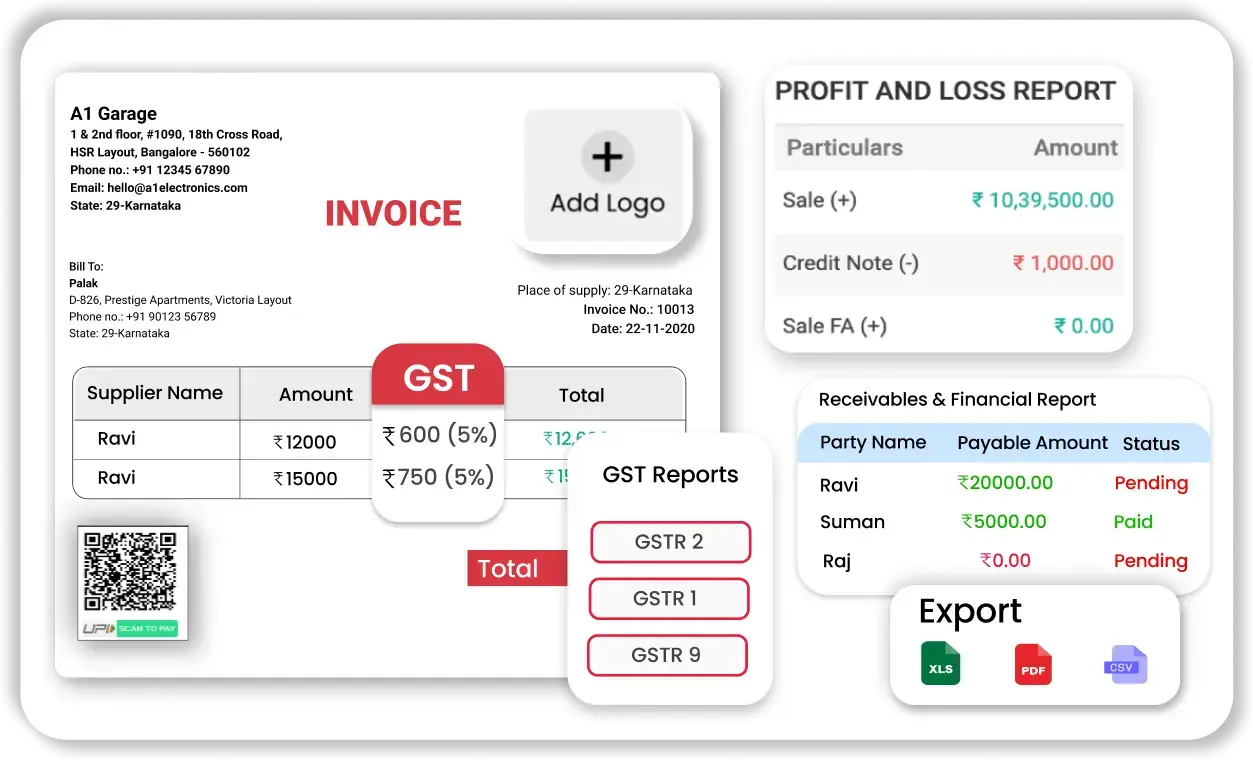

Automated Invoicing & Billing

Vyapar’s software for accounts receivable enables businesses to generate invoices effortlessly, ensuring accuracy and faster payment processing.

- Quick Invoice Generation – Generate invoices with pre-filled customer details, due dates, and outstanding balances to ensure accurate receivables tracking.

- Duplicate & Edit Invoices for Pending Payments – Easily duplicate previous invoices and modify them to send updated payment requests for overdue accounts.

- Customizable Invoice Templates – Personalize invoices with payment terms and automatic due date reminders to encourage timely payments.

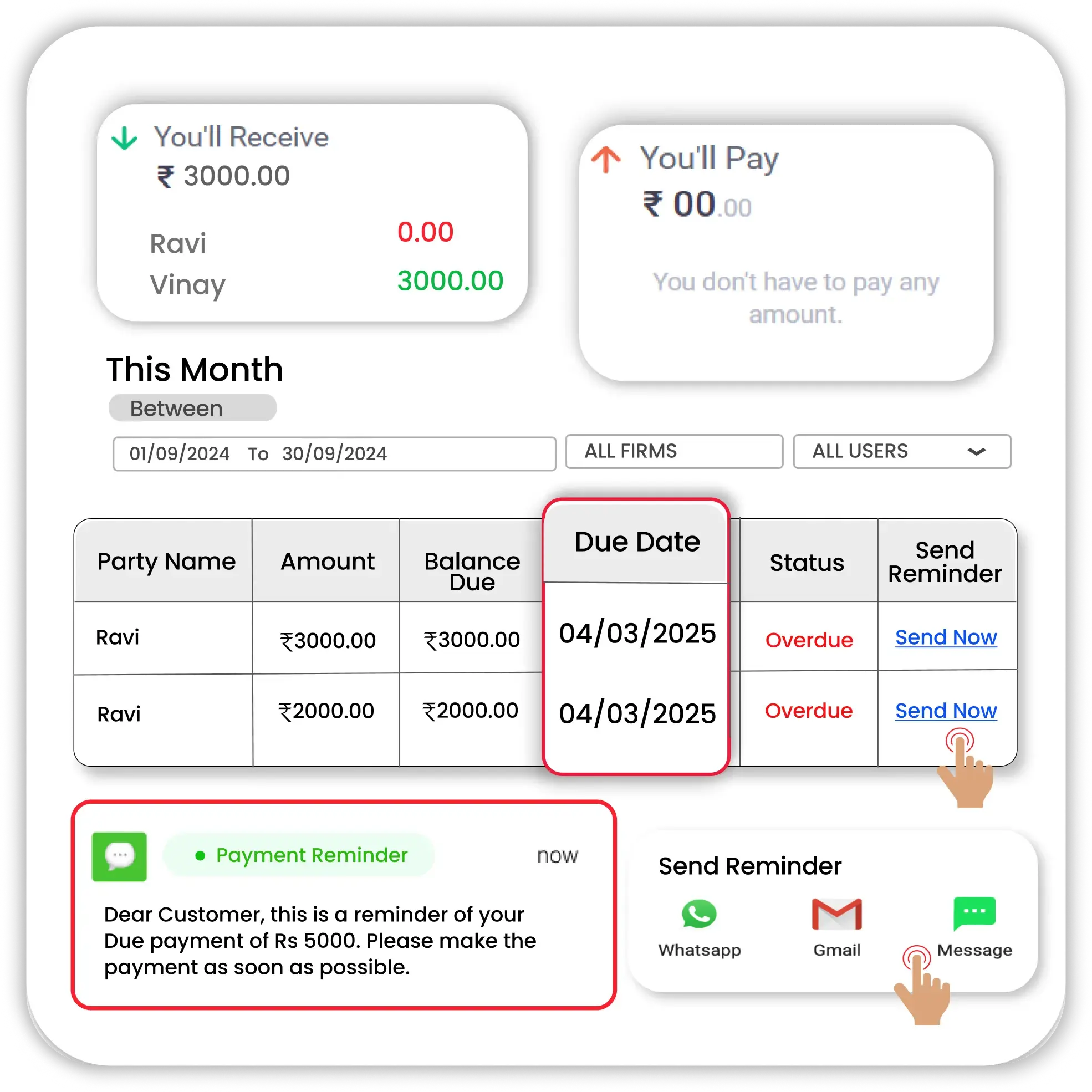

Payment Tracking & Reminders

Vyapar’s accounts receivable automation software enables businesses to track payments in real-time and follow up on pending dues.

- Live Payment Status Monitoring – Track all paid, partially paid, and overdue invoices from a single dashboard to manage receivables efficiently.

- Auto Follow-Up Messages – Send automated payment reminders via SMS and WhatsApp directly from the app to follow up on pending dues.

- Upcoming Due Alerts – Get notified about upcoming payments to take proactive collection actions.

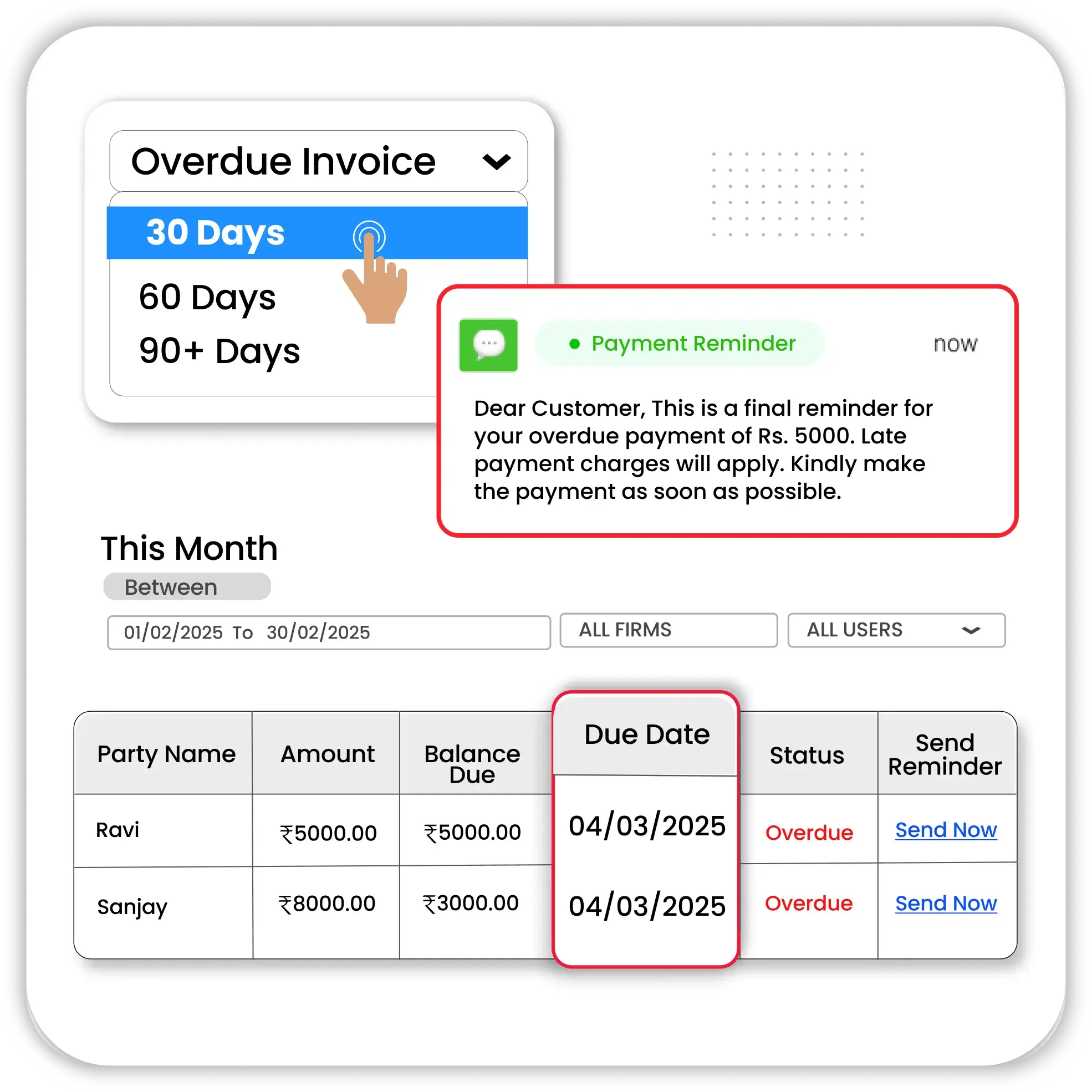

Receivables Aging Reports

Vyapar’s accounts receivable management software provides insightful reports to categorize outstanding payments by age.

- Overdue Invoice Reports – Automatically segment unpaid invoices into 30, 60, 90+ day overdue groups for better follow-ups.

- Customer Credit Risk Insights – Identify customers with frequent late payments and adjust credit limits or payment terms accordingly.

- Collection Performance Analysis – Check how well your business collects payments, identify delays, and improve follow-up strategies to get paid faster.

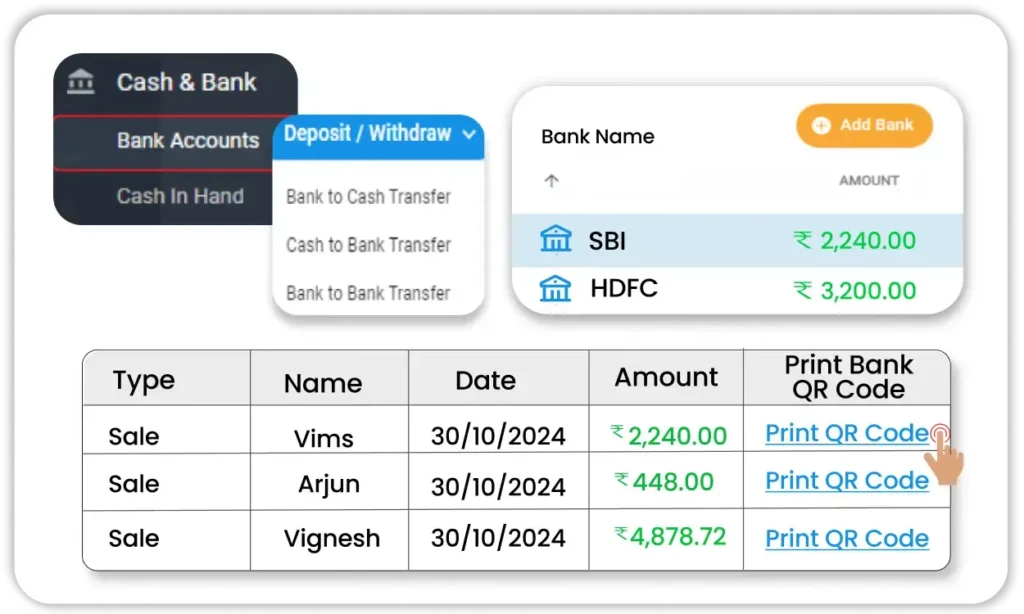

Seamless Payment Collection

Vyapar’s software for accounts receivable makes it easy to collect payments on time by supporting multiple payment methods and accurate record-keeping.

- Accept Digital Payments – Receive payments via UPI, Google Pay, PhonePe, and other digital wallets directly from invoices.

- Bank and Cash Transfer Recording – Easily record payments made through NEFT, RTGS, online banking and cash for accurate tracking.

- QR Code for Credit Invoices – Generate a UPI QR code based on your bank details within Vyapar and automatically include it in credit invoices, allowing customers to scan qr code and pay instantly.

Key Features of Vyapar’s Accounts Receivable Software

Receivables Dashboard

Interest Calculation

Bulk Invoice Sending

Custom Credit Limits

Advance Payment Tracking

Multi-Currency Support

Customer Relationship Management

Role-Based Access

Automated Account Statements

Instant GST Calculation

Offline Payment Entry

Financial Summary

The Ultimate Software for Accounts Receivable Management

Customer Ledger Management

Vyapar’s software for accounts receivable helps businesses maintain a detailed record of all customer transactions and outstanding balances.

- Comprehensive Transaction History – Track all invoices, payments, and credit notes in one place for each customer.

- Auto-Updated Account Balances – View real-time pending amounts as payments are recorded, ensuring accurate receivables tracking.

- Custom Notes & Tags – Add notes and categorize customers based on payment behavior for better follow-ups.

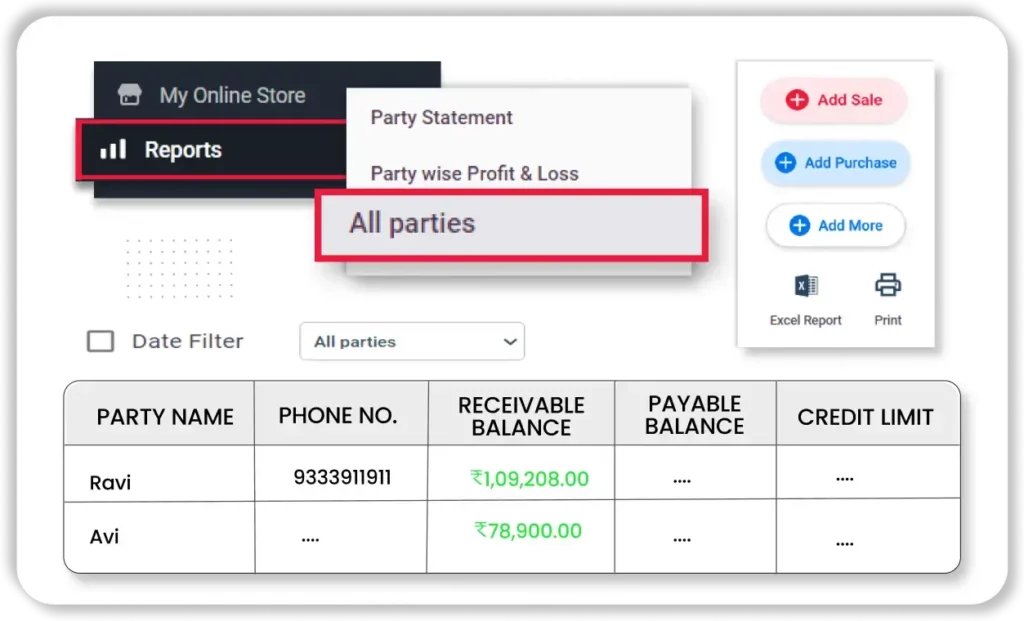

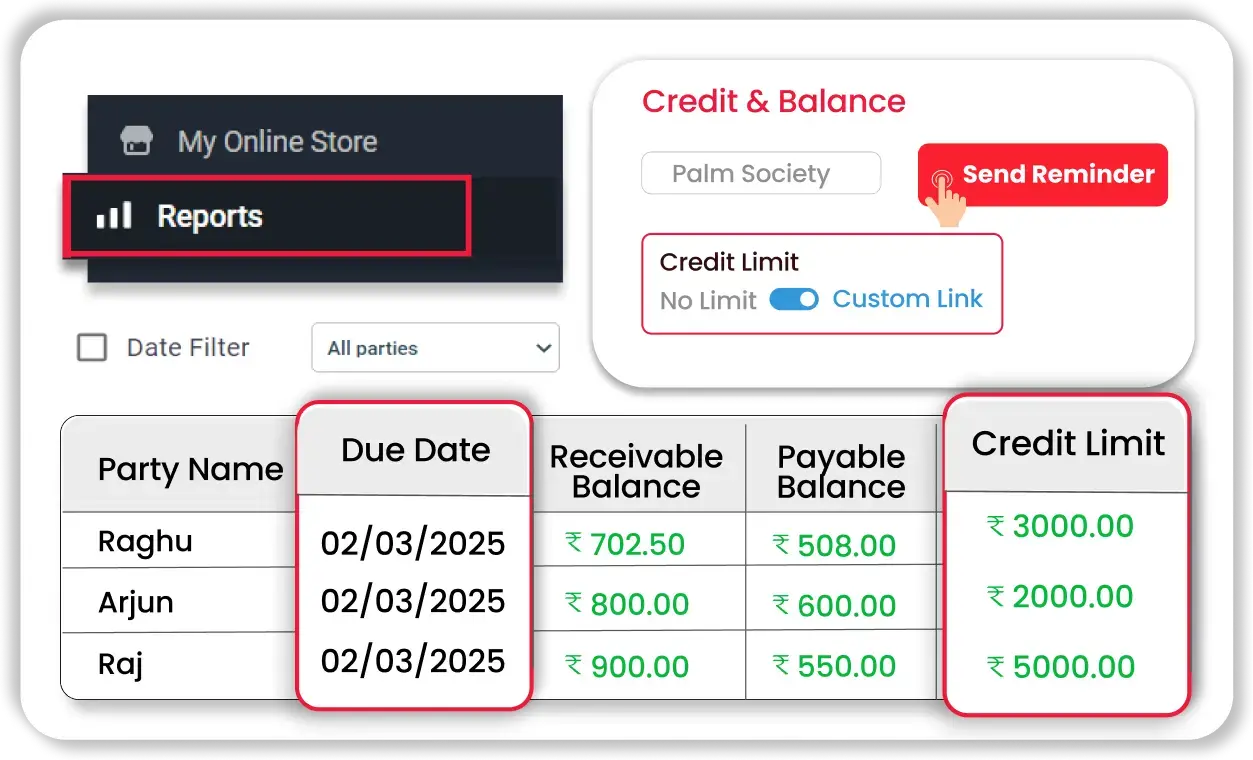

Credit Limit & Due Date Management

Vyapar’s software for accounts receivable helps businesses set credit limits, track due dates, and manage outstanding payments efficiently.

- Individual Credit Limits – Define credit limits for each customer based on their payment history to prevent excessive outstanding balances.

- Track Outstanding Credit Usage – Monitor how much credit a customer has used and their remaining limit to control risk.

- Payment Due Date Tracking – Easily check upcoming due dates in the customer ledger to follow up on pending payments.

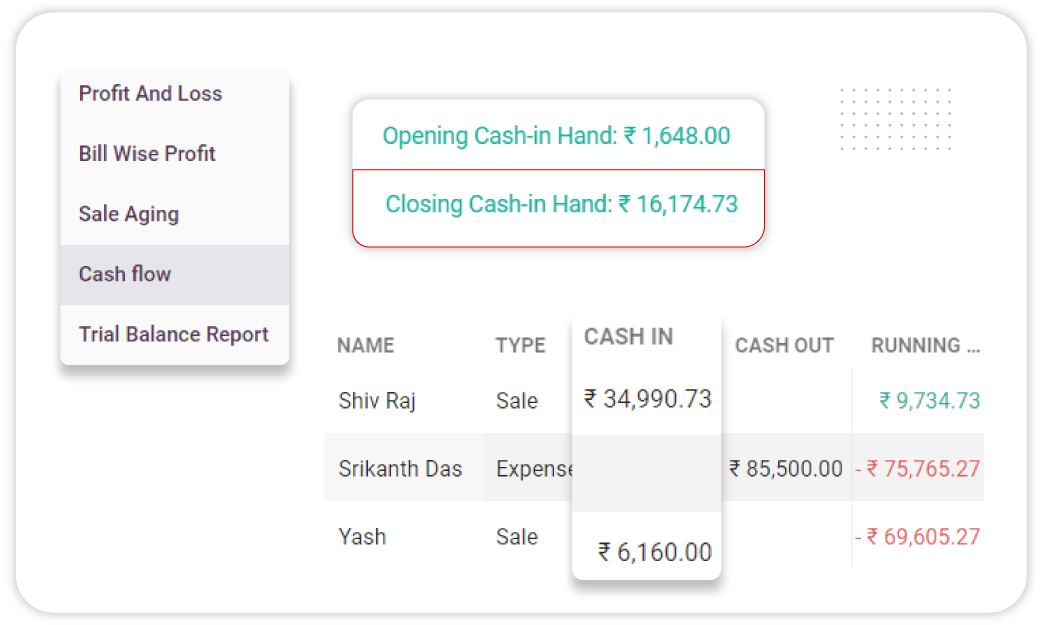

Cash Flow Insights & Reports

Vyapar’s software for accounts receivable provides real-time insights into outstanding payments and cash flow to help businesses make informed financial decisions.

- Outstanding Receivables Report – View a summary of all unpaid invoices and track pending amounts across customers.

- Receivables vs. Collections Report – Analyze the difference between total receivables and actual collections to measure payment recovery efficiency.

- Daily & Monthly Cash Flow Reports – Monitor incoming payments and expected cash inflows based on pending dues to manage finances effectively.

Multiple Bank Account Management

Vyapar’s software for accounts receivable allows businesses to track and manage payments across multiple bank accounts efficiently.

- Bank-Wise Transaction Tracking – Record and monitor payments received in different bank accounts for better financial control.

- Discrepancy Identification – Cross-check recorded payments with bank deposits to ensure accurate financial data.

- Multi-Bank Account Overview – View all incoming and outgoing transactions across multiple accounts in one place.

Integration with Accounting Software

Vyapar’s accounting software for accounts receivable comes with built-in accounting features to help businesses track receivables and generate financial reports.

- Receivables & Financial Report Export – Download reports in Excel, PDF, and CSV formats for easy record-keeping and tax filing.

- GST & Tax-Compliant Invoicing – Generate GST-compliant invoices with automatic tax calculations for accurate financial reporting.

- Ledger & Profit/Loss Tracking – Maintain a detailed ledger and monitor business performance with profit and loss statements.

Discount & Late Fee Management

Vyapar’s software for accounts receivable helps businesses offer payment incentives and set flexible terms to improve collections.

- Early Payment Discounts – Apply manual discounts on invoices for customers who make payments before the due date.

- Custom Payment Terms – Set due dates and credit periods based on customer profiles to manage receivables efficiently.

- Manual Late Fee Tracking – Record late payment charges manually to track overdue balances and encourage timely payments.

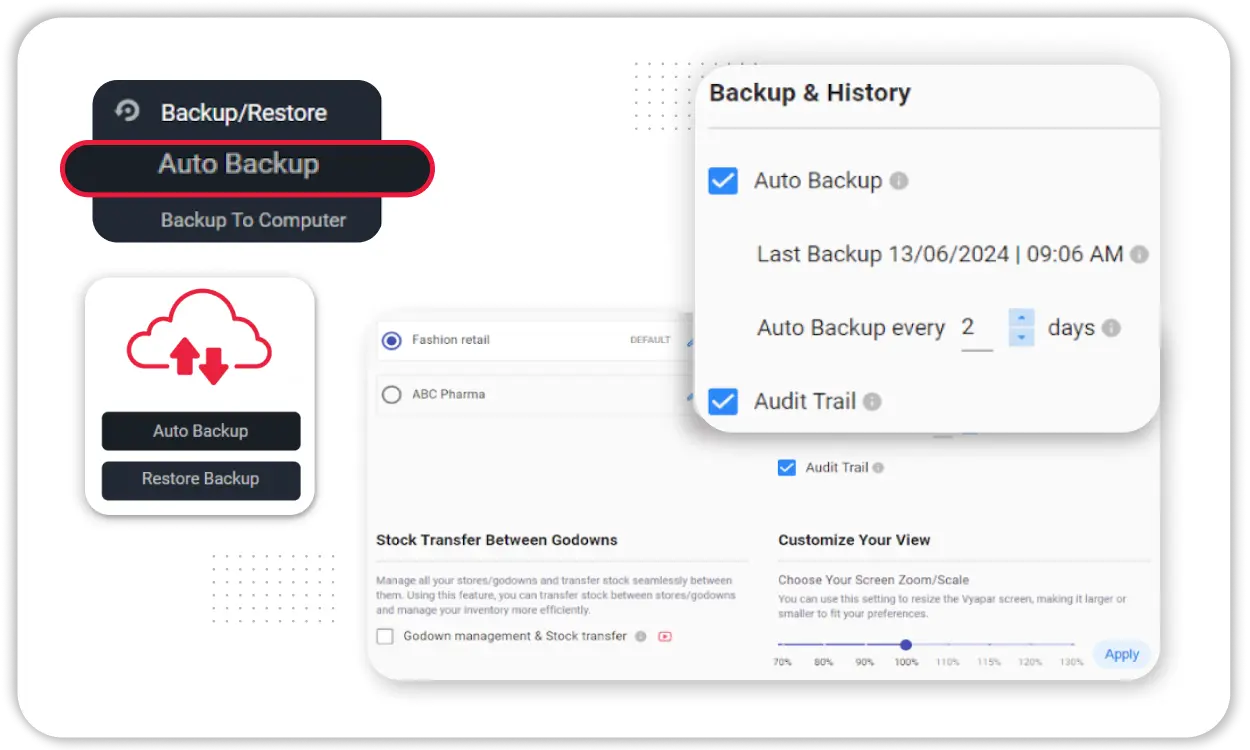

Secure Cloud Backup & Data Protection

Vyapar’s software for accounts receivable ensures the safety of your financial data with secure backup options and controlled user access.

- Automatic Data Backup – Keep your records protected with daily cloud backups.

- Easy Data Restoration – Restore backed-up data anytime to prevent loss due to accidental deletion or device failure.

- Local Backup Storage – Save a copy of your financial data directly on your device for added security.

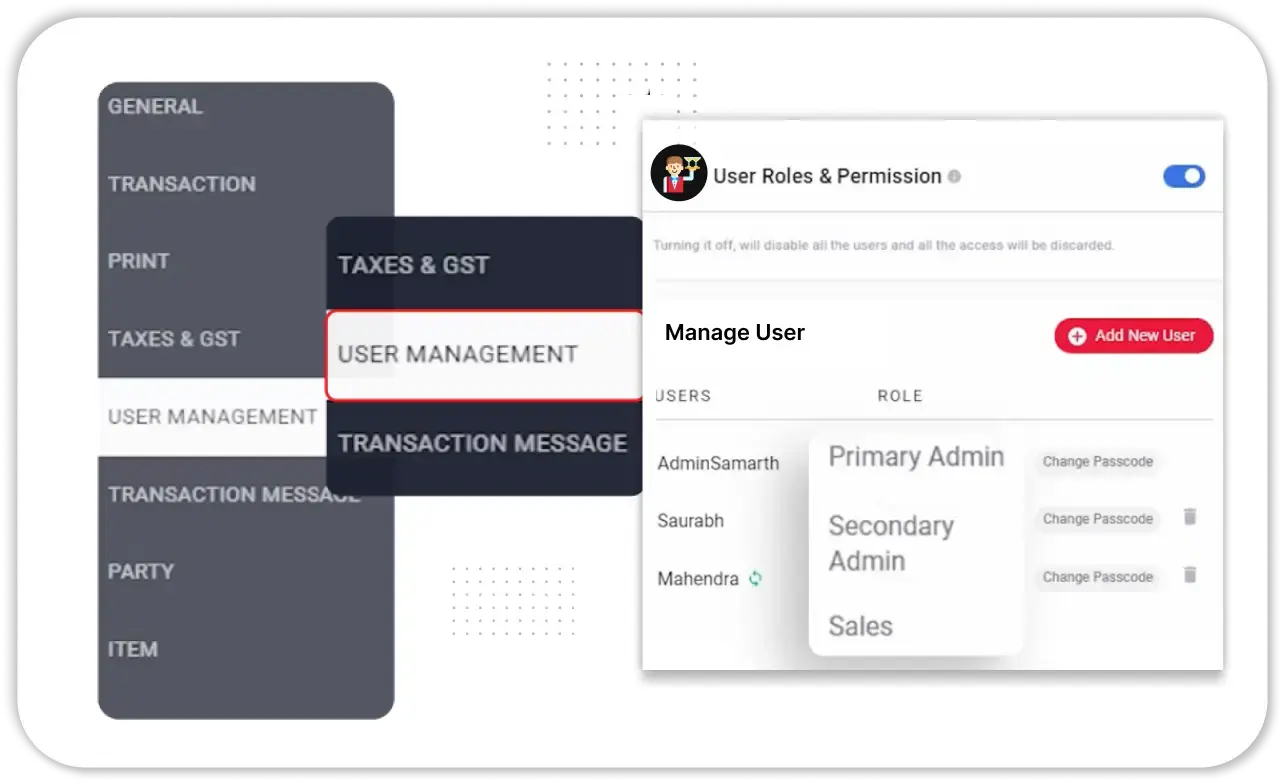

Multi-User Access & Role Management

Enable team collaboration while maintaining security over sensitive financial data.

- Role-Based User Permissions – Assign different access levels to staff members to limit their control over financial data.

- Activity Monitoring – Track key actions performed within the software to maintain transparency and security.

- Secure Single-Device Access – Ensure that only authorized users can manage accounts receivable from a single device.

🚀 Streamline Your Receivables & Get Paid Faster with Vyapar!

Why Businesses Need AR Automation Software for Faster Payments

Improved Cash Flow Management

Vyapar’s best accounts receivable software helps businesses maintain a steady cash flow by automating payment tracking and reminders. With real-time insights into outstanding invoices, businesses can ensure timely collections and reduce financial bottlenecks.

Efficient Payment Collection

With the power of AR automation software, businesses can streamline invoice generation, send automated reminders, and accept payments through multiple modes. This reduces delays in collections and ensures a smooth financial process.

Reduced Administrative Workload

Managing invoices and tracking payments manually can be time-consuming. Vyapar’s accounts receivable systems automate the entire process, minimizing paperwork and allowing businesses to focus on growth rather than manual follow-ups.

Better Financial Transparency & Control

Vyapar’s best account receivable software provides businesses with clear reports on outstanding payments, overdue invoices, and customer-wise balances. This transparency helps business owners make informed financial decisions and plan better.

Lower Risk of Bad Debts

By using Vyapar’s accounts receivable software free, businesses can reduce the chances of unpaid invoices piling up. With automated reminders and detailed aging reports, companies can take proactive steps to recover dues before they become bad debts.

Increased Business Growth & Profitability

With efficient receivables management, businesses can reinvest collected funds into expansion and operations. Vyapar’s best accounts receivable software ensures that payments are received on time, enabling higher growth and profitability.

Vyapar’s Growing Community

Take Your Big Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQs’)

Accounts receivable software helps businesses track outstanding invoices, send automated payment reminders, and streamline collections. Vyapar’s best accounts receivable software automates invoicing, provides real-time reports, and ensures timely payments, improving cash flow and reducing overdue accounts.

AR automation software like Vyapar helps businesses get paid faster by automating invoice generation, tracking due payments, and sending reminders via SMS and WhatsApp. This reduces payment delays, improves cash flow, and ensures better financial stability.

Vyapar is one of the best accounts receivable software for small businesses as it offers automated invoicing, payment tracking, customer ledger management, and seamless bank reconciliation. It also supports multiple payment modes like UPI, bank transfers, and cash, making collections easier.

Yes, Vyapar offers a free version of its accounts receivable software, allowing businesses to manage invoices, track payments, and send automated reminders without any upfront costs. For advanced features like GST invoicing and multi-user access, businesses can upgrade to the premium version.

Accounts receivable systems like Vyapar reduce overdue invoices by automating reminders, setting credit limits, and generating aging reports to track outstanding payments. Businesses can take timely action and improve collection efficiency with real-time insights.

Yes, Vyapar’s AR automation software ensures data security with cloud backup, encrypted transactions, and role-based access control. Businesses can safely track payments, reconcile bank transactions, and manage receivables without the risk of data loss.

When choosing the best account receivable software, look for features like automated invoicing, multi-payment acceptance, real-time reports, customer ledger management, and bank reconciliation. Vyapar offers all these features, helping businesses optimize their receivables process efficiently. managing multiple business accounts.

Vyapar’s accounts receivable automation software integrates seamlessly with accounting tools, allowing businesses to sync invoices, track payments, and generate financial reports in one place. This simplifies bookkeeping and ensures smooth tax compliance.