Cash Flow Statement Format

in Excel, PDF

Manage your cash flow with clarity and confidence. Use our easy cash flow statement format to keep your financial records clear and organized. But why only format when a software can manage your cash flow?

Download Free, Ready-to-Use Cash Flow Statement Format

Whether you prefer Excel or PDF, just download, fill, and stay in control of your cash flow with professionally designed cash flow statement formats.

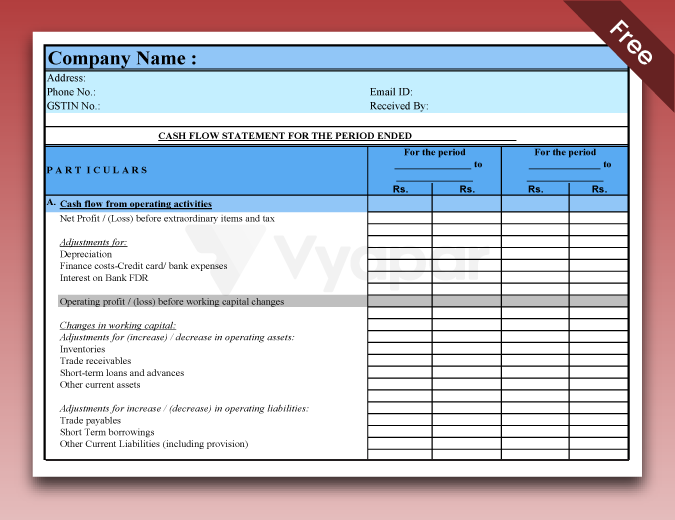

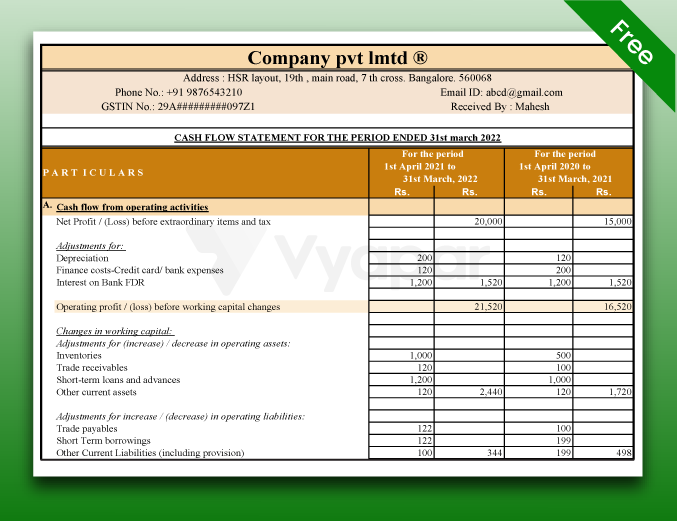

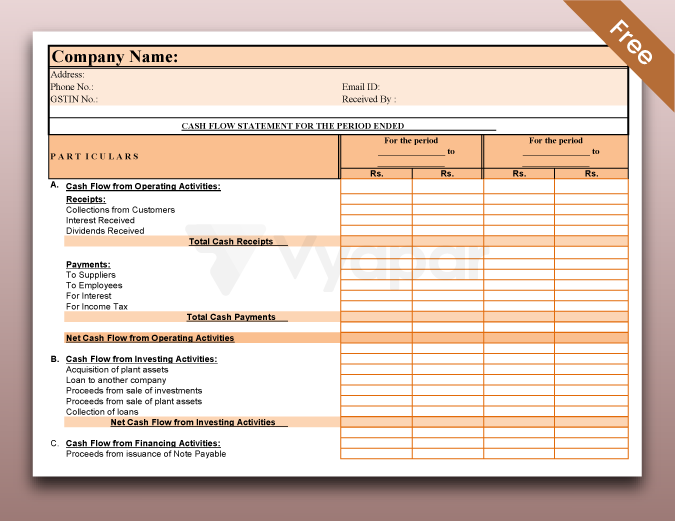

Cash Flow Statement Format PDF-01

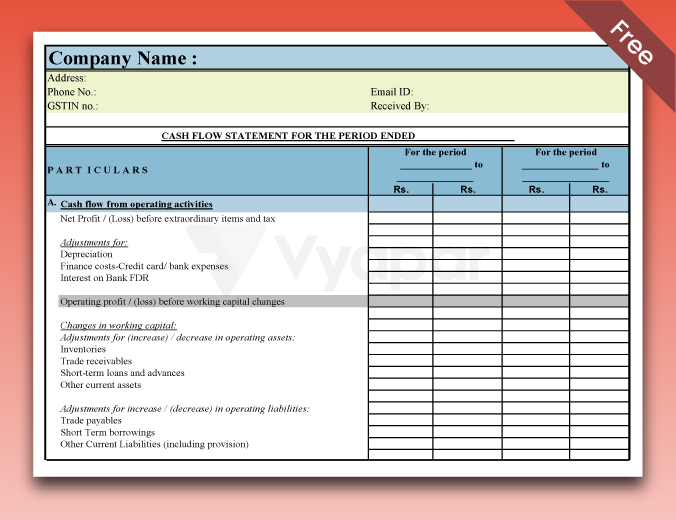

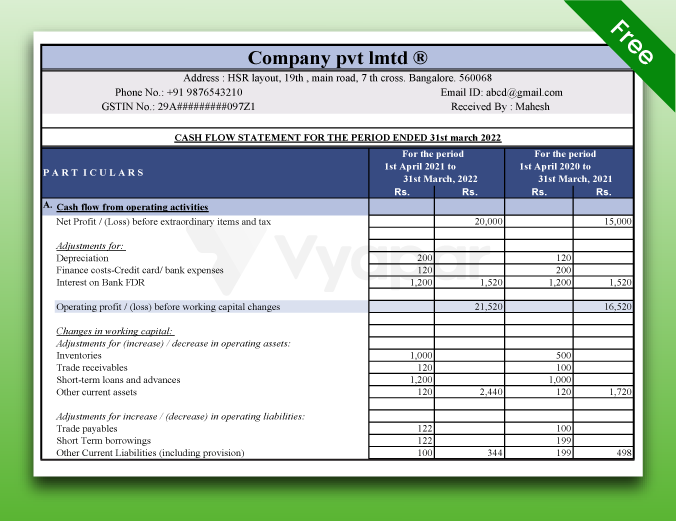

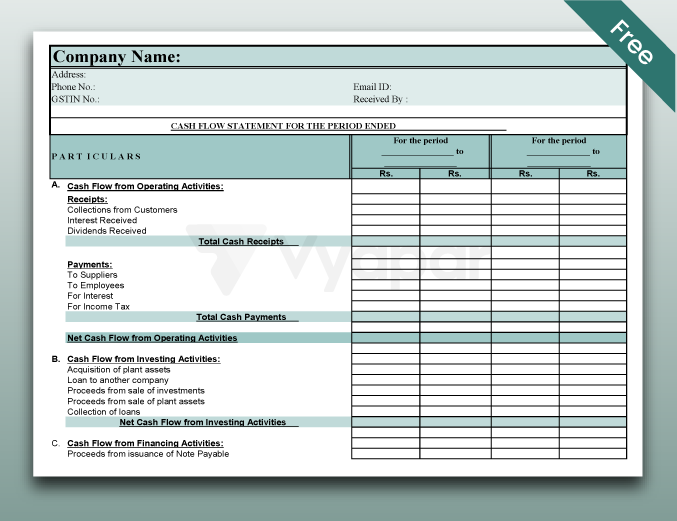

Cash Flow Statement Format PDF-02

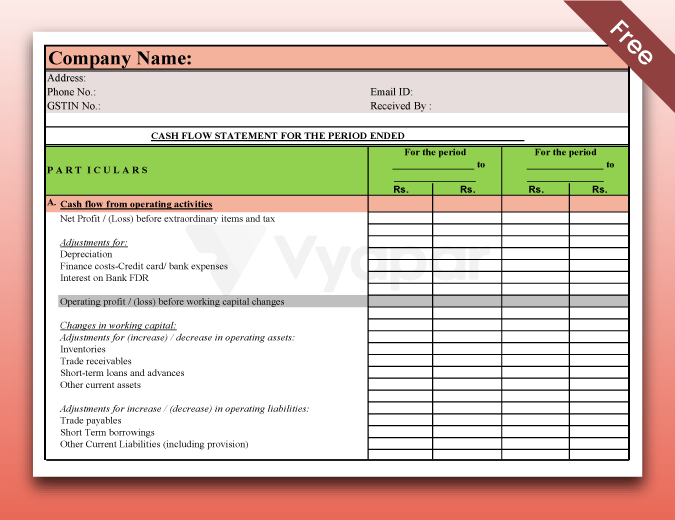

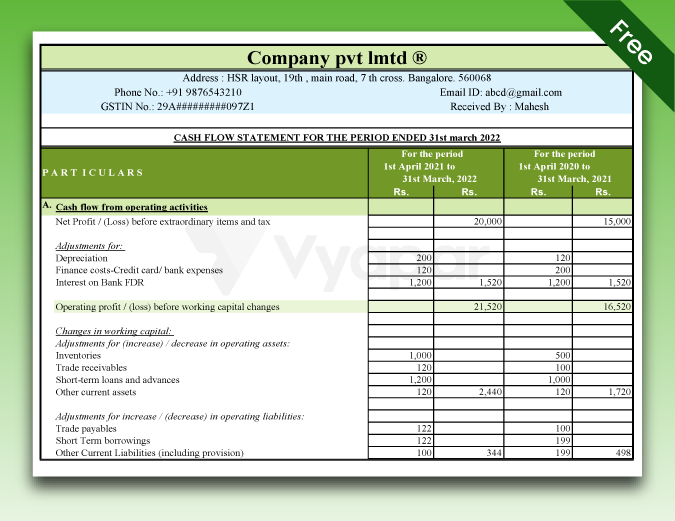

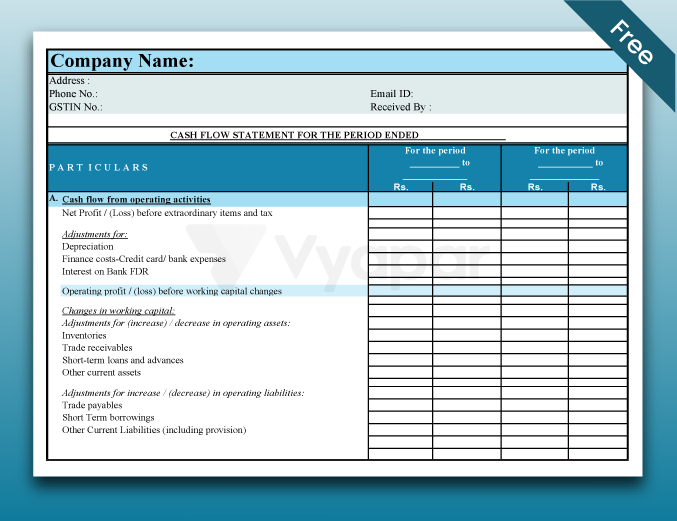

Cash Flow Statement Format PDF-03

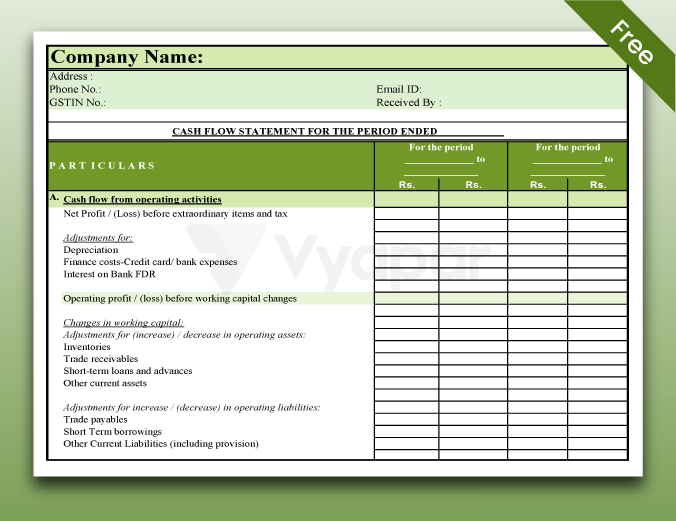

Cash Flow Statement Format in Excel-01

Cash Flow Statement Format in Excel-02

Cash Flow Statement Format in Excel-03

Cash Flow Statement Format VS Vyapar App

Features

Cash Flow Statement Format

Real-time Cash Flow Summary

Link to Actual Transactions

Calculates Closing Balance

Shows Cash Flow by Date Range

Share Via WhatsApp/Email

Integrated with Sales & Expenses

Track UPI & Digital Payments

Works Offline

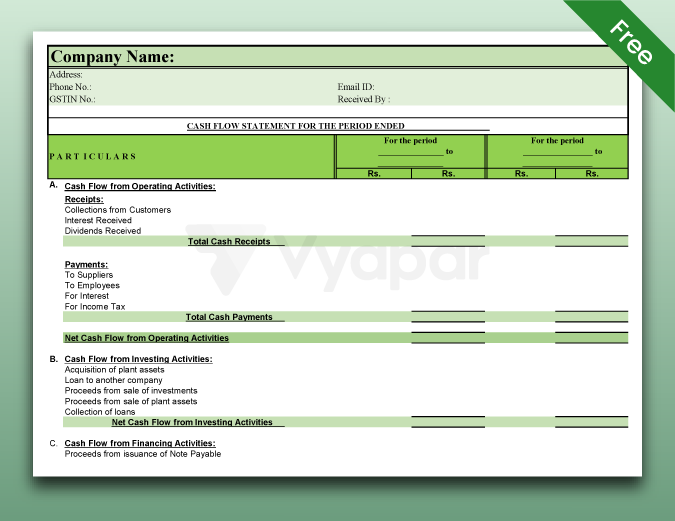

Cash Flow Statement Format in Direct Method

The direct method of the cash flow statement shows actual cash transactions, such as money received from customers and money paid to suppliers.

Choose Your Format Here!

Cash Flow Statement Format Direct Method-1

Cash Flow Statement Format Direct Method-2

Cash Flow Statement Format Direct Method-3

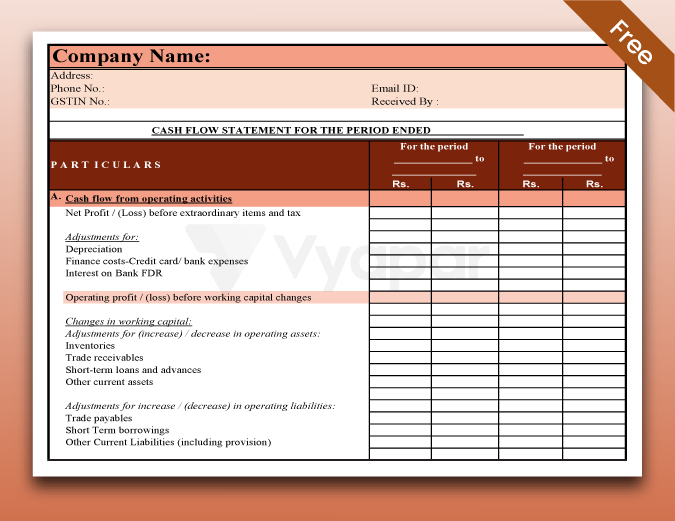

Cash Flow Statement Format in Indirect Method

The indirect cash flow statement format begins with net profit and adjusts it for non-cash items and changes in working capital (such as receivables, inventory, and payables).

Choose Your Format Here!

Cash Flow Statement Format Indirect Method-1

Cash Flow Statement Format Indirect Method-2

Cash Flow Statement Format Indirect Method-3

What is a Cash Flow Statement

A cash flow statement is a financial document that shows how cash moves in and out of a business during a specific period. It helps you understand whether your business is actually making money or just showing profits on paper.

Unlike the profit and loss statement, which includes non-cash items like depreciation, the cash flow statement format focuses purely on actual cash transactions. It answers the most important question: “Do I have enough cash to keep the business running smoothly?”

In accounting, this statement plays a crucial role in understanding the health of a business.

Components of a Cash Flow Statement

Operating Activities

This section includes cash from your core business operations. Sales, supplier payments, rent, salaries, and tax payments all fall under this.

Investing Activities

This part shows the cash your business spends or earns from buying and selling long-term assets like land, equipment, or investments.

Financing Activities

It indicates how your company raises and pays back funds to finance operations or growth, such as loans, investor money, or payments.

Benefits of Using a Cash Flow Statement Format

Cash flow control is just a click away!

How Vyapar app Makes Your Cash Flow Management Better

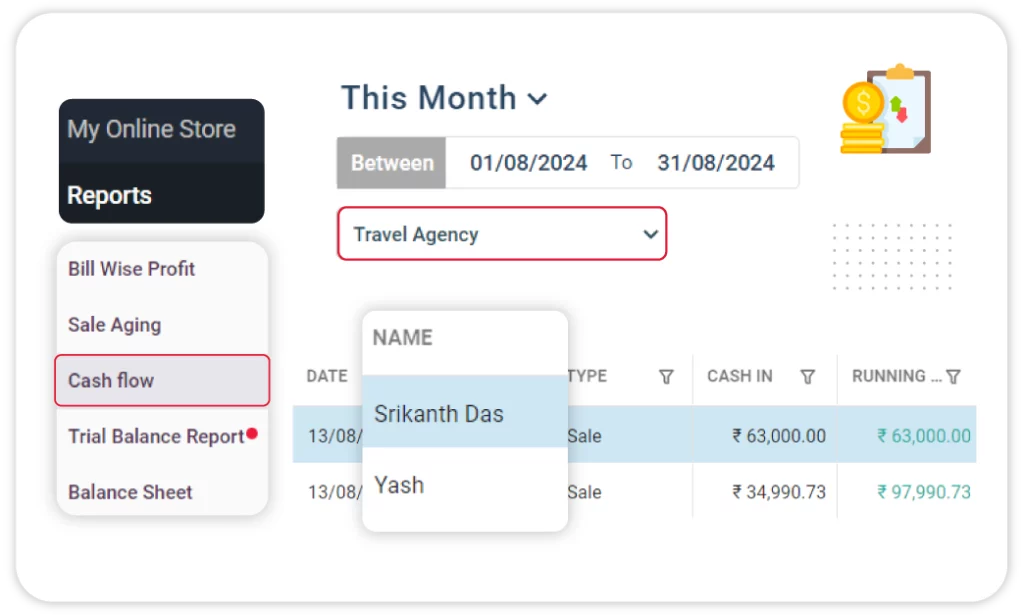

Cash Flow Reports

- Provides an overview of cash flow: money in, out, and cash on hand.

- Tracks inflows and outflows to assess liquidity at all times.

- Helps with purchase planning and cost control for healthy cash flow.

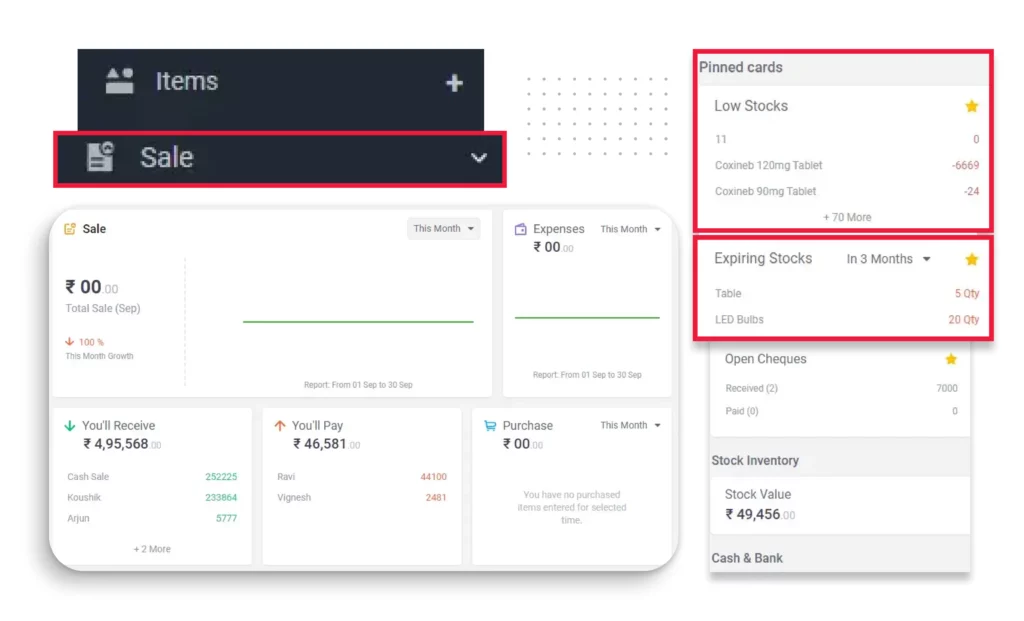

Business Dashboard

- Displays key info: cash-in-hand, bank balance, stock value, receivables/payables.

- Allows quick evaluation of your financial position.

- Helps make fast decisions, avoiding surprises, and controlling cash flow.

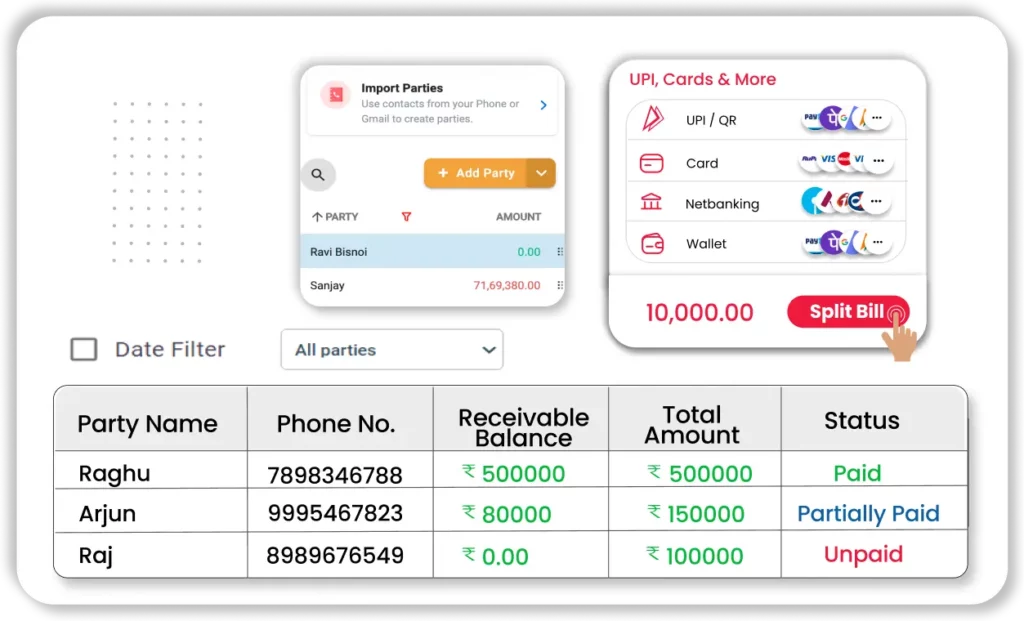

Payment-In & Out Tracking

- Monitors incoming and outgoing payments linked to invoices.

- Tracks paid, unpaid, and partially paid bills.

- Improves working capital management and cash flow visibility.

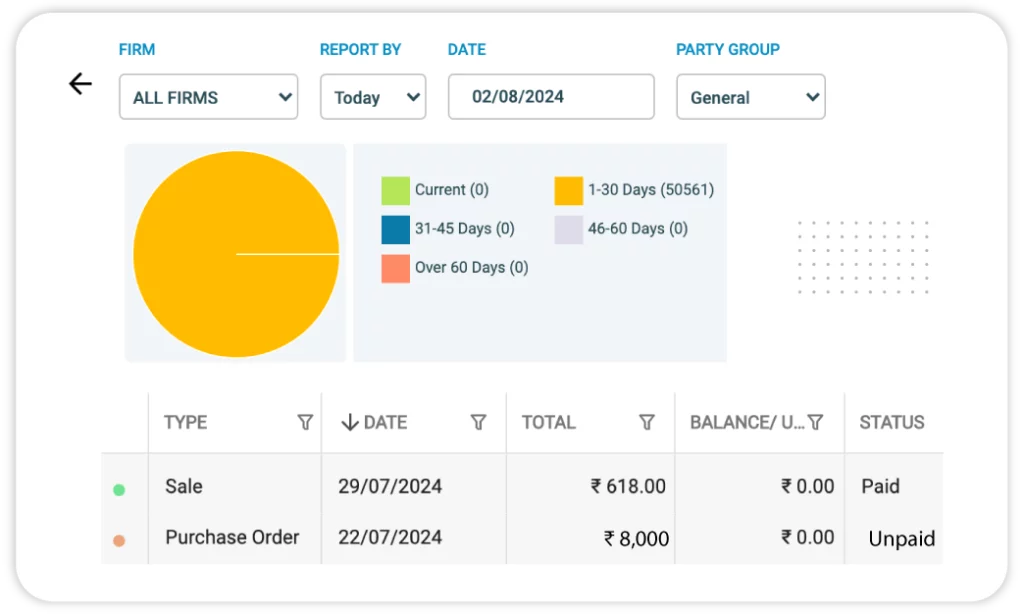

Bill-by-Bill Payment Tracking

- Tracks payments on a bill-by-bill basis for better control.

- Sends automated payment reminders via WhatsApp or SMS.

- Reduces overdue payments, improving cash flow and minimising bad debts.

Multiple Payment Modes

- Supports payments via Cash, UPI, Cheque, and Bank Transfer.

- Displays payment modes on invoices for customer convenience.

- Enables quicker online payments for efficient collections and liquidity.

Profit & Loss and Balance Sheet Reports

- Provides Profit & Loss and Balance Sheet reports for cash flow planning.

- Shows business income, assets, and liabilities for evaluation.

- Facilitates informed decision-making for long-term financial health.

Frequently Asked Questions (FAQ’s)

What is the purpose of a cash flow statement?

Where can I download a cash flow statement format in Excel?

Which method is better—direct or indirect cash flow format?

Can I use Vyapar to manage my business cash flow?

What’s included in a standard cash flow statement format?

Is there a PDF format of the cash flow statement format available?

Can I track both GST and non-GST expenses in Vyapar?

Does Vyapar work offline too?

How does Vyapar help improve my cash flow?

Can Vyapar generate a cash flow statement automatically?

What is the difference between cash flow and fund flow statement format?