Accounting Software for Lending Business

Elevate your lending business with Vyapar accounting software! Streamline loan management, track transactions, and stay compliant effortlessly. Experience tailored accounting solutions for lenders. Free trial – Sign up now!

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

Best Features of Vyapar Accounting Software for Travel Agency

Loan Management Capabilities

For lenders managing the loan payments, and interests, and taking care of the entire loan process is time-consuming. This feature of Vyapar’s accounting software for lending business streamlines the entire loan lifecycle. By updating the loan details such as borrower information, loan amounts, interest rates, and collateral, the software can track payment schedules, automate calculations like interest accrual, and even help to decide on loan approvals.

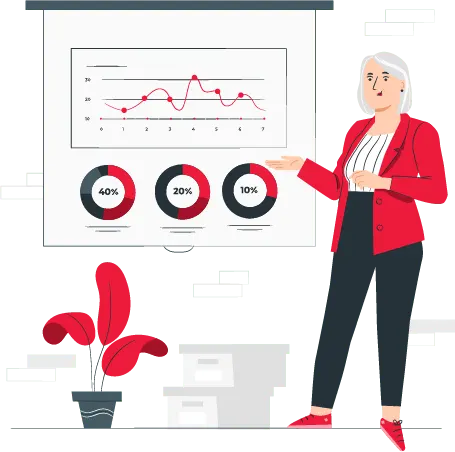

Compliance and Reporting

Money lending accounting app generate financial statements, regulatory reports, and customized reports for internal analysis. This includes real-time analytics, insights into the business’s financial health, reports for lenders, and loan performance. The software supports compliance with financial regulations and standards relevant to the lending industry.

Secure Access Control

The safety and security of data play a crucial role in the lending business. Vyapar’s loan account management software ensures the confidentiality and integrity of your financial data. Secure access control uses features like role-based access by restricting what users can see and do and audit trails that track who accessed what data and when. This is essential for building trust with borrowers and investors.

Key Features of Accounting Software for Lending Business

Invoicing and Customisation

Credit Points

Multi Payment Processing

Cash Flow Tracking

Customer Management

Vyapar Lending Accounting App Enhances Efficiency of Lenders

Access great features from the Vyapar accounting app to make your accounting processes seamless. The following features of Vyapar lending business accounting apps makes it the best-suited software compared to other apps..

Professional Invoicing and Customisation

Establish your brand’s image by providing excellent lending services to your customers. A good billing and accounting app can help your lending business prove authenticity and build trust among customers. With lending accounting software create professional invoices and you can customise by adding your brand’s logo, colour combinations, style, and font to send the right message to your target audience.

Cash Flow Tracking

Tracking the net cash flow is the most crucial requirement in the lending business. Cash runs a lending business, and by using the Vyapar accounting app dashboard, you can verify that you can sustain the current expenditure for a month or two in advance. You can send repayment reminders to your borrowers to ensure they do not default on payments.

Credit Points

Provide credit points to customers each time they pay back their credit. You can provide them with a way to use them as discount coupons. It encourages customers to use your credit features more and come back to claim rewards. Credit points are a convenient way to treat your customers with special incentives, which can turn them into loyal customers.

Customer Management

The customer management feature in lending accounting software includes comprehensive customer profiles, loan history tracking, and managing communication through integrated communication tools like email, SMS, and Whats App.

The app facilitates efficient handling of borrower information, loan applications, and customer interactions, enhancing relationship management. This feature ensures timely follow-ups, personalized communication, and improved customer service, which is crucial for maintaining strong borrower relationships and streamlining loan processes.

Multi Payment Processing

The multi-payment processing feature in accounting software for lending agencies supports various payment methods, including bank transfers, credit/debit cards, and mobile UPI payments. You can automate payment collection, track transactions in real-time, and schedule payment alerts.

This flexibility ensures borrowers can choose their preferred payment method, improving convenience and ensuring timely loan repayments, while also simplifying the lender’s cash flow management and reconciliation processes.

Streamline Loans & Simplify Accounting. Get Your Free Lending Software Trial Today!

Free Accounting Software for Lending Business

Vyapar business accounting software lets businesses manage their finances. Vyapar is the best accounting software for lending agencies. Using the app ensures that you do not have to waste time on simple tasks. Further, you can send repayment reminders to your borrowers using WhatsApp or Email directly through the Vyapar accounting app. It will ensure that they do not default on payments. You can let them know about late charges in case they miss the due date.

An Accounting App Built for Your Lending Business!

Every lending business needs one easy to use accounting software. Vyapar accounting app helps lending partners create professional GST invoices within minutes. It comes with a feature to send invoices to clients over email and provide them with digital payment options.

Lending agencies love to use Vyapar’s simplified expense tracking system for seamless cash flow management. You can keep track of your business expenditure by adding external payments. Further, you can monitor all of your spending in the dashboard to ensure that you have enough cash flow to keep your business operations running smoothly.

Take Accounting in Your Lending Business to The Next Level!

Vyapar invoicing and accounting app are highly customisable to meet any business requirements. The app comes with a 7-day free trial to test the features of the app. Once tested, you can go for any one of the annual plans.

Vyapar app is specifically designed for use in businesses like lending companies. The app comes with a friendly interface that makes it easier to send professional bills and estimates to customers. You can manage the expenses of your business and accept payments in multiple ways using the Vyapar app itself.

Why is The Vyapar Accounting App a Great Choice for Lending Businesses in India?

Using Vyapar, you can discover the easiest way to keep account of your monthly transactions and file taxes. It is designed as accounting software that caters to all the basic needs of lending agencies. Any employee in your branch can use the Vyapar app to generate invoices for your customers. Further, the app provides you with great insights through sales reports.

Saves You Time

Using the Vyapar app, you can create bills for your customers with perfection without wasting much time. You can track your monthly expenses and use the GST invoices to create reports. Vyapar automates the billing process by filling out redundant information itself. Further, you can use the app to send automated payment reminders.

Look Professional

You can create completely custom bills for your customers with the Vyapar billing tool. In the invoices, you can add your business logo, terms and conditions, payment methods, font styles, and colours to represent your brand in the best way. By creating a professional invoice, you can stand out among competitors and get the attention of your potential leads.

Get Paid Quicker

Vyapar allows you to include both cash and digital payment options in your bill. Vyapar app comes with a feature to generate a QR code and add a payment QR option in the invoice for the convenience of your customers. You can enable UPI, NEFT, RTGS, debit card, credit card, and other payment options.

Benefits of Using The Vyapar Accounting App for Your Lending Business

Vyapar app helps businesses make highly informed decisions about their financial plans by using year-long sales data to create reports. Using data analysis, you can understand which decisions can help you scale up your business.

Vyapar software includes complete accounting facilities in a single app, and it works best for a small or medium size lending business. Here are some benefits associated with using Vyapar accounting software.

Multiple Features

The specialty of Vyapar is that we provide every recommended feature in the app. We also add some unique features that can get you to have access to good positive investments. Further, the app reduces the chances of errors from the manual handling of sales and expense records.

GST Invoicing

Vyapar app makes GST invoicing painless for all lending partners. Vyapar comes with features that allow businesses to request payments, send payment reminders, manage inventory, set up schedules, and automate redundant processes. Vyapar allows you to manage interest on lending using Debit note transactions. It was made to keep the growth interests of Indian lending partners and business owners in mind.

Monitor Business

Check your business performance any time and let us know. Was there a link to any external payment in cash or through a bank account? Using the app, you can monitor your business from anywhere. Your expenses are automatically imported and used to provide a better overview of account receivables and payables at any point in time. Keep a check on your budget and know exactly how much you spend.

Choosing the Right Accounting Software for Your Lending Business

Lending agencies lookout for a solution that they feel is safe and secure. For most businesses, it should be affordable and provide the best way to cater to the needs specific to the tourism industry.

Using the Vyapar app, you can list your online store with complete details of all the products and services you sell. Make sure to check out the features provided by the free accounting app. You can give a shot at a free 7-day trial of the Vyapar app to try out its features before moving on towards yearly payments.

Recommended by Leading Industry Experts

5.0/5.0

4.4/5.0

4.6/5.0

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

Vyapar is the best accounting app for any business. Vyapar app lets you keep track of your business anywhere. The accounting software comes with many features to help you boost your business growth.

No. The Vyapar app is available only on MacBook, Android smartphones and Windows desktop devices.

Yes, the premium features are available for a 7-day free desktop trial. After that, you can move to small yearly payments.

The Vyapar app comes with a lifetime free Android app. Premium features in the Vyapar accounting app come with a small yearly fee. The premium features on the app are free for a 7-day trial period.

An employee can create bills using the Vyapar app easily with a single training session. The app is simple to use, and anyone with little knowledge of using a computer can use the Vyapar app to create bills.

Accounting Software for All Businesses:

Accounting Software for freelancers

Accounting software for construction business

Accounting software for church

Accounting software for travel agency

Accounting software for growing business

Accounting software for daycare

Accounting software for food manufacturers

Accounting software for consultants

Accounting software for advertising agencies

Accounting software for bookkeeping

Accounting software for lending

Accounting software for real estate

Accounting software for architecture firm

Accounting software for property investors

Accounting software for healthcare organisation

Accounting software for interior designer

Accounting software for diamond industry