What is a Company? A Simple Guide

Estimated reading time: 10 minutes

A company is a special type of business that is separate from the people who own it. People work together in a company to sell goods or services and earn money

The law sees a company as its person. This means it can have its own money, debts, and rules. The owners are not personally responsible if the company has problems.

In India, companies are registered under the Companies Act, 2013. Knowing how a company works helps small and medium businesses choose the right setup, serve customers better, and stay safe from personal losses.

Definition and Explanation

A company is a type of business that helps owners manage their activities in an organized manner. One person can own it, like a one-person company (OPC). Multiple people can also own it, as in limited liability companies (LLCs) or public companies.

For example:

If a group of friends starts a bakery, they can register it as a private limited company. This helps them reduce their risk, make profits together, and concentrate on sales and marketing to grow their customer base.

Key Takeaways on a Company

It is a legal business entity that sells goods or services to customers.

It protects owners by limiting personal liability for debts and obligations.

It can improve customer service and grow through better planning.

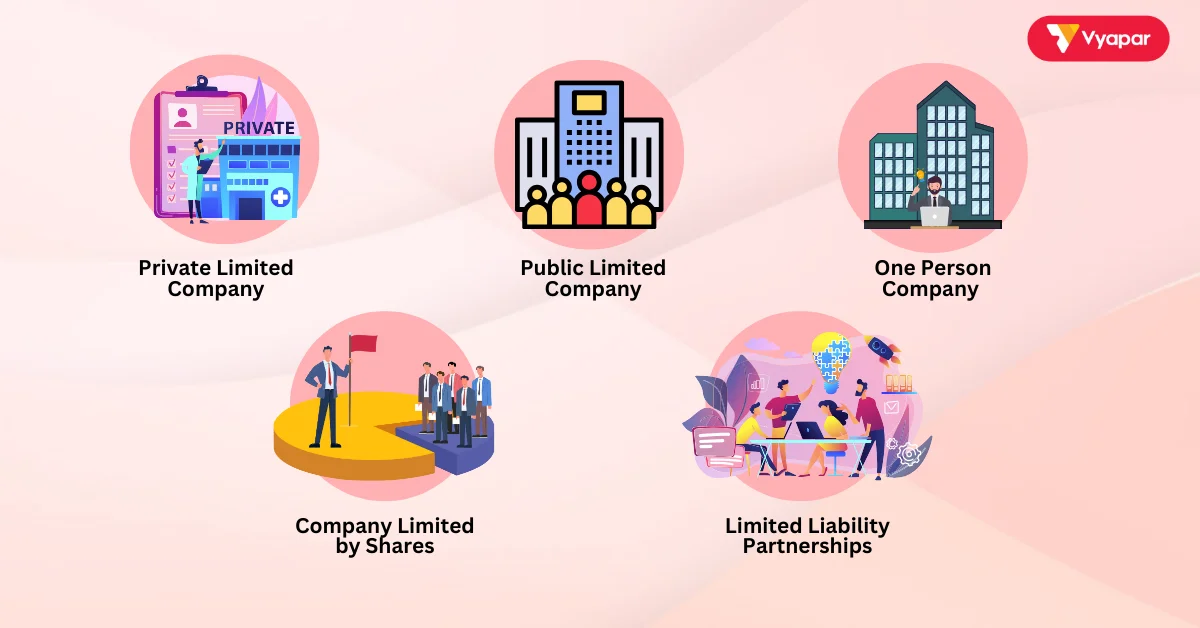

Types of Companies

Companies can have different forms based on ownership and purpose. Here are some common types:

Private Limited Company

- Owned by a small group, such as family members or friends.

- Shareholders limit their liability to the amount they invested.

- Suitable for startups focusing on their product or service offerings.

Public Limited Company

- Shareholders can purchase or offload shares on equity markets.

- Allows businesses to raise large amounts of funding from the public.

- Popular among larger organizations with a strong focus on long-term assets and growth.

One Person Company (OPC)

- Owned and managed by a single individual.

- Ideal for solo entrepreneurs who want limited liability while maintaining full control of the company culture and direction.

Limited Liability Partnerships (LLP)

- A mix of partnerships and companies.

- Owners are not personally liable for business debts.

- Works well for professionals and small businesses offering specialized goods and services.

Company Limited by Shares

- Owners are only responsible for company debts up to the value of the shares they hold.

- Helps secure the personal income and assets of the owners.

Importance of a Company

Forming a company offers many advantages, such as better organization of operating activities, improved credibility, and financial safety.

- Separate Legal Entity: A company’s assets and debts are distinct from those of its owners. This ensures that personal income and savings are not at risk if the company struggles to manage its goods or services.

- Limited Liability: Owners are only responsible for the money they have invested in the business. Unlike partnerships with unlimited liability, it protects owners from losing personal wealth because of business risks.

- Easier Access to Funding: Companies, especially public companies, can raise funds by selling shares on stock exchanges. This funding helps businesses focus on expanding their sales and marketing efforts.

- Improved Company Culture and Reputation: A registered organization helps create a professional image. This builds customer trust, encourages employee engagement, and supports a positive company culture.

Benefits of a Company for SMEs in India

Small and medium-sized businesses in India can gain significant advantages by forming a company:

- Personal Asset Protection: A company with limited liability keeps the owner’s personal money and things safe if the business loses money. This is helpful for small businesses that sell special products or services.

- Tax Benefits: Companies can save on taxes by showing business costs like rent, salaries, or bills. This helps them use more money to grow.

- Attracting Investors: People are more likely to invest in companies that are registered. This helps small businesses get money to buy big things like machines or buildings.

- Building a Professional Image: A registered company looks more trustworthy. Customers feel more confident, and employees feel proud and happy to work there.

How Companies Are Used in Business Activities

- Accounting: Organizations are required to maintain accurate records of all their financial transactions, including sales, expenses, and profits. This helps them track their operating activities and ensure compliance with tax laws. Tools like Vyapar make it simple to automate accounting and generate financial reports.

- Inventory Management: Keeping track of stock levels ensures that companies can meet customer demands for their goods or services. Vyapar provides real-time updates on stock, preventing overstocking and wastage while ensuring customer satisfaction.

- Billing and Compliance: They must issue proper bills and adhere to taxation rules like GST. Using Vyapar, businesses can generate GST-compliant invoices and maintain records to ensure smooth audits.

- Sales and Marketing: They use effective sales and marketing strategies to promote their products or services. This includes leveraging tools like social media to reach a wider audience, build brand awareness, and drive customer interest.

How to Choose a Business Structure

Choosing the right ownership structure for your company depends on the type of business activity and goals. Here’s how to decide:

- For Small-Scale Businesses: Choose an OPC or private limited company if you are starting small. These structures are easy to manage and offer protection from being personally liable.

- For Large-Scale Growth: Consider a public company if your goal is to raise funds by selling shares on stock exchanges. This allows you to invest in long-term assets and scale faster.

- For Professionals or Partnerships: If you run a professional service with a partner, an LLP is the best choice. It combines flexibility with limited liability to safeguard owners’ income.

- For Risk Protection: Avoid general partnerships, as they come with unlimited liability. Instead, choose a limited liability company (LLC) or an LLP for better safety and control.

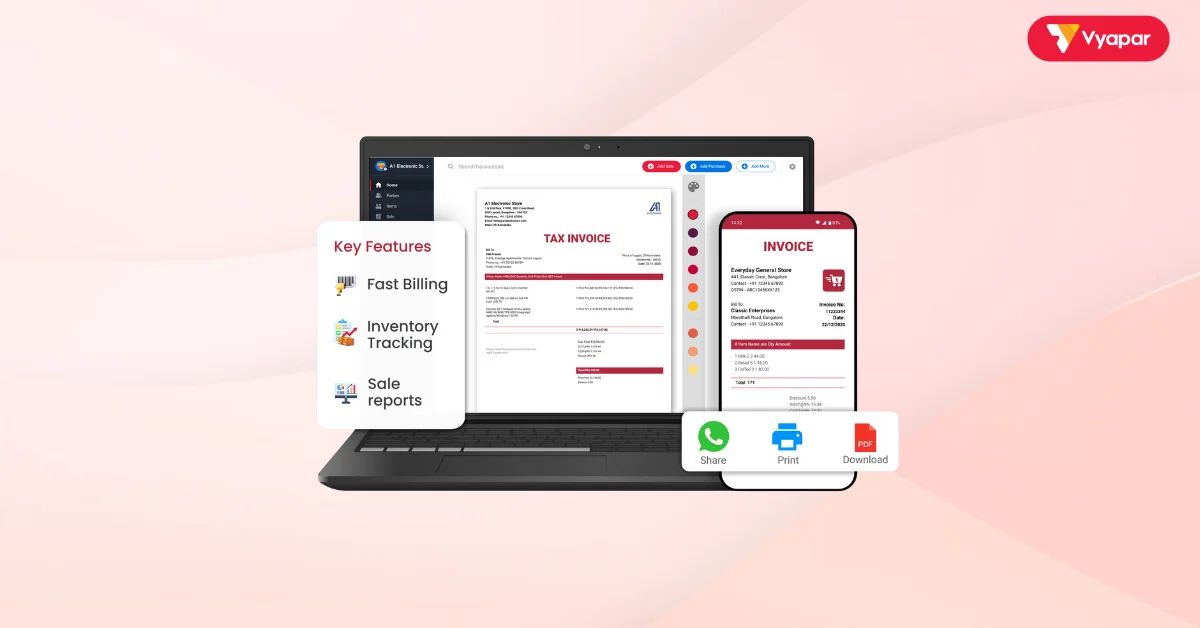

How Vyapar Helps Companies

Vyapar simplifies running a company by offering tools for key business activities like accounting, inventory management, and reporting.

- Invoicing: Vyapar allows organizations to create professional invoices in minutes. You can customize these to align with the company culture and easily share them with customers.

- Accounting: Tracking business activity is easier with Vyapar App’s automated tools. It generates real-time financial reports to help businesses monitor cash flow and profits.

- Inventory Management: Vyapar helps track stock levels and alerts businesses when inventory is low. This ensures they can continue offering their goods or services without delays.

- Sales and Marketing Insights: Vyapar offers reports that help companies look at sales trends. These reports help businesses change their sales and marketing strategies. This data helps businesses make informed decisions and improve customer service.

Are you a Business Owner?

Take your business to the next level with Vyapar! Use free trail!

Try our Android App (FREE for lifetime)

FAQ’s

Private companies have a small number of members. They don’t make their shares available for public acquisition. In contrast, public limited companies raise money by selling shares to anyone.

Yes, a single person can start a company under the One Person Company (OPC) structure.

LLCs protect owners from being personally liable for business debts, keeping their income and savings safe.

It means owners are only responsible for the company’s debts up to the value of their shares, not beyond.

Vyapar automates tax calculations, generates GST-compliant invoices, and stores records, making compliance hassle-free.

Related Posts: