Accounting Software For Small Business

Vyapar offers free accounting software for small businesses providing accounting solutions for 1 Cr+ SMEs in India. Download and Try the Free Trial!

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

How to Use Vyapar Accounting Software for Small Business in India

Vyapar accounting software is trusted by 1Cr+ small business owners in India. Easy installation, easy user interface, high-rated accounting app on Google Play Store and easy understanding gain customers trust to use.

Our Accounting software is compatible with desktop, mobile, and MacBook. Watch the video to learn how to use the Vyapar App for your accounting needs.

Take Control of Your Finances Efficiently

Explore a wide range of features, including billing, invoicing, and reporting. You can produce tax invoices, sync your expenses, and balance your books to make the taxation process seamless. Vyapar’s simplified user interface makes it the best accounting package software for businesses.

Why Use Accounting Software for Small Businesses in India?

Keeps Accurate Records

Keeping track of cash flow will be easier and ensure the documents will be ready to file taxes. Our application automates all the necessary bills without missing them which can cause issues down the line.

Monitors Business Health

Tracking finances has never been so straightforward! You can have an overview of sales and expenses with simplified charts. As soon as you update a deal or expanse, the data gets updated without delay. It will help you make relevant decisions to boost the growth of your business.

Get Payment Faster

Concerned about overdue payments? Utilize the app’s automated reminders to prompt customers and facilitate direct UPI payments to your bank account. Speed up your payment process, ensuring faster transactions and enabling you to professionally manage outstanding payments.

Looks Professional

Issuing GST invoices not only simplifies your taxation but also enhances your professional image and customer service. It offers a transparent view of your sales, leaving a positive impression on your customers’ perception of your business.

Save Time and Money

Traditional accounting is time-consuming, often requiring multiple hires. Digital accounting with the Vyapar app streamlines the process. Any team member can handle it, reducing the risk of calculation errors. Time is precious for small businesses, and the Vyapar app saves you plenty of it.

Grow Your Business Faster

Using the small business accounting software, you can be assured about the accounts of your business. It will allow you to make plans for the future by using data and give you enough time to look after other aspects of your business.

Accounting Software Features to Run Your Small Business

Business Performance Dashboard

Send Estimate & Quotation

Regular/ Thermal Printer

GST Filing

Delivery Challan

Manage Expenses

Multiple Themes

Mobile & Desktop Compatible

Reporting

Easy Invoicing

Multi Payment Option

Inventory Management

Sale/Purchase Orders

Record Payments and Transactions

Data Security & Backup

Small business owners require one of the finest accounting software in India to make their lives easy. Here are some of the best features of the Vyapar software:

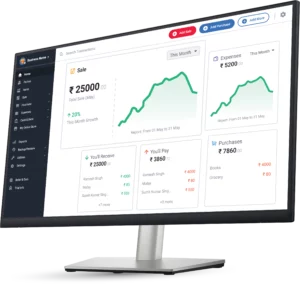

Business Performance Dashboard

Easily monitor your business performance with the Vyapar app’s dashboard. Track sales, purchases, cash on hand, stock value, expenses, open cheques, and loan amounts at a glance. Our app is tailored with the right features for your business needs, offering you the flexibility to access real-time data from anywhere with live status tracking.

Easy Invoicing

Simplify your business invoicing with customized invoices through invoicing software. Use ready-to-use templates and tailor them to match your business requirements. Just input your items, and the software generates your invoice. This streamlined process reduces the chances of manual billing errors, ensuring accuracy in your financial transactions.

Inventory Management

Effectively handling inventory poses a significant challenge for small businesses. Keep track of the items, products, or equipment crucial for your services to prevent disruptions. This ensures smooth operations by avoiding shortages. Additionally, stay informed about excess inventory to make informed decisions and prevent unnecessary purchases.

Reporting

Vyapar assists you in generating various business reports, including transaction, GST, business status, party, item/stock, and finance reports such as expense, sale/purchase order, and loan reports – all conveniently accessible from the app. Optimize timely actions and maintain workflow efficiency by utilizing the reporting feature.

Send Estimates & Quotations

If you have a potential lead asking for a quotation, you can send a detailed estimate of the overall bill to boost your sales. You can not only send them the total amount of the service but also give them accurate information about what you will deliver at that price.

Multi Payment Option

You can get paid online by including the UPI QR code on the Invoice or you can link your bank accounts and get paid in them directly through UPI. Record cheque payments seamlessly in the app, track their status, and mark them as closed once the bank processes the transaction. Additionally, easily log cash payments in the app to update outstanding amounts and receive reminders with the latest payment status.

Regular / Thermal Printer

You can print your invoices using a regular or thermal printer through the app. It allows you to set a default setting for the type of printer you are using. It will help you create a better quality invoice that will be specifically generated for the printer you are using.

GST Filing

Through Vyapar, filing GST becomes much simpler. You get all the required options to generate GST reports as per your business requirements. You can get a GST detail report for sales, purchases, or CDN through a simple click using the app.

Delivery Challan

Many businesses encounter challenges in generating shipping challans for their goods. Vyapar apps offer exclusive features that provide comprehensive information about each item, making the process hassle-free. On the Accounting App, you can create, customise and download the delivery challan format to share with your customer.

Sale/Purchase Orders

Vyapar app provides a separate section for purchase and sale orders so that you can manage them separately. It will help you have better control over the bills of your customers and suppliers. You can track the payments and make outstanding payments from the app itself.

Manage Expenses

Evaluate and control costs effectively with the app’s dedicated expense management feature. Easily identify areas of high spending, allowing you to trim unnecessary costs and enhance profitability for better business management.

Record Payments and Transactions

Update the payments and transactions in the app when you receive them. This ensures organised payment records, streamlining the tax process. Additionally, easily track outstanding payments for timely reminders, ensuring you get paid without any delay.

Multiple Themes

Choose from various theme options to customise your experience. You can go to print settings and choose from different colour schemes and looks of the invoice.

Data Security & Backup

Ensuring data backup and security is a top priority for businesses. With the Vyapar app, easily back up your data to your internal storage or email address. This feature enables you to restore your data effortlessly by installing the backup whenever needed.

Mobile & Desktop Compatible

Vyapar App is well crafted to be compatible with mobile phones, laptops, or desktop computers. The app’s mobile version is entirely free to use, and the accounting software for the desktop version is compatible with Windows and MacBook and comes at a price after a 7-day free trial.

Vyapar Free Accounting Software Suits Many Businesses

Grocery Stores

Managing accounts for your grocery store gets more straightforward with our free accounting software. You can keep track of all your sales and purchase orders and tally your accounts with ease. Vyapar helps you create invoices with complete transaction information that makes it easier for you to create GST reports for filing taxes.

Transport Business

A transport business deals with multiple consignments, and you have to deliver them to the right place. You need to keep track of your consignments’ location so that they are not lost on their way. Using Vyapar, you can create a delivery challan for each consignment to track them at every moment and use them as an invoice once they are delivered.

Supermarket

A supermarket sells during all working hours to multiple customers at the same time. To maintain book records and keep the sales in check, you have to employ the best accounting software for a supermarket. Vyapar accounting app is free for a lifetime for all supermarkets.

Startup Business

Startups focus on growing business and learning from previous mistakes. Analysing yearly balance sheets and sales reports, you can make the right decisions for your startup. Vyapar accounting software for startups is the best fit as it helps fulfil all accounting requirements for any business.

Stationery

With so many items to sell, creating invoices with accounting app can help save the time and effort of entering redundant information. Vyapar, an accounting management tool, works best for stationery businesses to manage accounts and keep records of sales seamlessly.

Paint Shop

Easily manage all the orders in your paint shop with our free accounting software. You can keep track of all the paint types and shade options available in your store. It will help you deliver the best services to your customers.

Provision Store

A wide variety of food products and daily essentials are sold in a provisional store. Customers often come with orders for multiple items, and you need to keep track of your inventory to make sure you have enough supplies to meet demand. Using the free accounting software for food manufacturers in India, you can manage all financials for a provision store and plan supply purchases according to the demand for products.

Salon

By using Vyapar accounting application for a salon, you can analyse the sales of various cosmetic products and services. It will help you upsell the right products and services that your customers like more.

Mobile Shop

A wide variety of smartphones are sold at a mobile shop. Since the cost of many smartphones is high, you need to keep track of each model’s units available in your store. It will allow you to make purchases of models with higher demand and avoid those already in stock.

Hardware Business

Using the Vyapar accounting tool for hardware businesses, you can manage your equipment seamlessly. From listing items and spare parts as small as a bolt to those as big as a vehicle, you can keep track of your inventory.

Electrical Shop

Keep all account receivables and payables in check using the Vyapar accounting app. By maintaining the cash flow, you can place your orders with suppliers for the running orders. You can keep track of equipment and tools available in your shop not to purchase items you have in stock.

Automobile Shop

Use the Vyapar accounting app for automobile shops to keep your sales in check. You can create GST reports to save time while filing for taxes. The Vyapar app comes in handy to keep track of spare parts, tools, and vehicles available in your store.

Healthcare Organization

Every healthcare center needs to meet many financial assists. Vyapar’s accounting software for healthcare organizations is tailored to meet the unique needs of the healthcare industry and ensures accurate financial tracking, seamless billing, and compliance management. You can set up automated alerts to know when the expiry of medicine is near or when you are about to run out of stock.

Apparel Shop

The best apparel accounting app should help you fulfil all the financial and accounting requirements of a business. You can analyse the sales and order different cloth sizes and product styles according to demands. It will help you save money and maximise profits.

Footwear Shop

Using free software for accounting in a footwear shop, you can plan to place orders as per the demand for products. You can analyse what footwear style your customers like and the most common size among customers.

Furniture Store

Managing space is crucial to make profits out of a furniture business. By understanding what products sell more, you can choose the items from the best categories to stay on display. Vyapar can fetch the sale trends that can help you make informed decisions.

Construction Material

Vyapar accounting software for the construction business and general contractors is a perfect tool to keep accounts for construction materials. You can use our software to track all the required raw materials and set up alerts to place pre-orders.

Retail Shops

Billing a lot of customers can become a challenge for retail shop owners. Vyapar allows you to automate the billing process to a large extent. It helps retail shop owners keep track of all the purchase and expense transactions. Our Android app for retail shop accounting software is free for a lifetime.

Recommended by Leading Industry Experts

5.0/5.0

4.4/5.0

4.6/5.0

So What are you waiting for?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

Accounting software automates financial tasks like recording transactions, tracking income/expenses, generating reports, and managing budgets. It improves efficiency, reduces errors, and provides insights into financial health.

Accounting software makes the process efficient. You can complete your bookkeeping with a few steps. As you enter the transactions in the Vyapar app, it computes all totals itself.

Accounting software allows simple data entry and generates comprehensive financial reports. It will enable automated record keeping. Using Vyapar improves efficiency and increases accuracy by eliminating manual procedures.

Vyapar is among the most used accounting software in India. It is available in mobile and desktop versions which make it accessible to all types of businesses.

The software that can resolve all accounting requirements of a business and simplify the process is the best. Over the years, Vyapar has gained trust among businesses.

Simplicity is the reason why Vyapar is considered the easiest accounting tool. Using it is as simple as using a social media app.

Accountants of small businesses prefer using Vyapar to deal with their accounting requirements. It covers more minute details than any competitive app in the market.

Accounting refers to recording a financial transaction of a business. It is vital for creating a summary and analyzing sales and creating summary reports. You can report these transactions to file taxes or make a plan for the next year.

Yes, Vyapar accounting software for large business comes with compatible features that suit your large business needs.

Vyapar is a comprehensive accounting tool that offers a free version with no monthly fee. It includes features like income and expense tracking, invoicing, inventory management, financial reporting, GST compliance, and more. It’s suitable for small businesses, freelancers, and entrepreneurs looking for efficient and user-friendly accounting solutions without recurring costs.

Vyapar is the best option if you are looking for free accounting software that offers robust features to manage finances, including income and expense tracking, invoicing, inventory management, financial reporting, GST compliance, and more. It is suitable for small businesses, freelancers, and entrepreneurs seeking a comprehensive and user-friendly accounting solution at no cost.

Vyapar offers a free version of its accounting software that users can access without any time limit or expiration. However, it’s essential to note that the free version may have limitations on features or usage compared to premium versions. Users can upgrade to premium plans with additional features and support if needed.

Special Purpose Accounting Software for All Businesses:

Accounting Software for freelancers

Accounting software for construction business

Accounting software for church

Accounting software for travel agency

Accounting software for growing business

Accounting software for daycare

Accounting software for food manufacturers

Accounting software for consultants

Accounting software for advertising agencies

Accounting software for bookkeeping

Accounting software for lending

Accounting software for real estate

Accounting software for architecture firm

Accounting software for property investors

Accounting software for healthcare organisation

Accounting software for interior designer

Accounting software for diamond industry

Accounting software for photography