What is Overdraft? A simple guide

Estimated reading time: 8 minutes

An overdraft is a service provided by banks. It lets account holders take out more money than they have in their account.

You can permit this up to a predetermined overdraft limit. It functions like a brief loan. It provides immediate access to funds for unforeseen expenses, cash flow problems, or business opportunities.

For small and medium-sized enterprises (SMEs) in India, borrowed money is crucial. They keep operations running smoothly during financial difficulties. They allow businesses to maintain business flow and meet urgent commitments like payroll or supplier payments without delay.

Definition and Explanation

A bank account, such as a current or savings account, links to a credit facility. It enables the account holder to withdraw funds exceeding the account balance up to a specified limit. The bank usually sets this limit. They consider the customer’s credit history, transaction patterns, and overall financial health.

One of the major benefits of this credit facility is its flexibility. Lenders charge interest only on the amount used, not on the total limit. This makes it a cost-effective choice for short-term financial needs.

Example Scenario:

A small business owner in Chennai is waiting for a substantial payment from a customer. They will shortly need to cover rent and payroll costs. By using this short-term credit facility, the business can fulfill these commitments on time without disrupting operations.

Key Takeaways on Overdraft

✅ Flexible Access to Funds: Credit facilities let businesses take out money even if they go over their account balance. They can withdraw up to a set limit that someone approved in advance.

✅ Interest on Utilized Amount: You only pay interest on the amount you use. This makes it a smart choice for short-term financing.

✅ No Fixed Repayment Schedule: Businesses can repay the borrowed amount based on their cash flow. This offers flexibility without fixed EMIs.

✅ Quick Approval Process: Compared to traditional loans, overdrafts often involve simpler documentation and faster approvals with better bank offers.

✅ Secured and Unsecured Options: Businesses can avail credit facility with or without collateral, catering to their different financial needs.

Types of Overdraft

Overdrafts are categorized based on the security or collateral provided:

- Secured Overdraft: This requires collateral, such as fixed deposits, property, or other financial assets. Secured overdrafts often have lower interest rates because of reduced risk for the lender.

- Unsecured Overdraft: In this category, there’s no need for collateral. The bank evaluates the customer’s creditworthiness to determine eligibility. This borrowed money typically has higher interest rates and varies from bank to bank.

- Overdraft Against Assets: Businesses can use their assets, like fixed deposits, insurance policies, or shares, as collateral. This helps them get secured credit with better terms.

Each type serves a different purpose and caters to varying financial needs, offering flexibility and convenience to businesses.

Importance of Overdraft

Credit facilities are vital for businesses as they provide a financial cushion to deal with immediate and unforeseen requirements. Here’s why overdrafts are crucial for SMEs:

- Cash Flow Management: Borrowed money helps businesses handle short-term cash flow issues. It allows them to pay for expenses like payroll, rent, and utilities.

- Opportunity Utilization: They provide immediate liquidity to seize new business opportunities or make timely investments.

- Emergency Support: An overdraft amount serves as a financial safety net. It helps during unexpected events like equipment breakdowns or urgent repairs.

Benefits of Overdraft for SMEs

- Immediate Liquidity: Provides quick access to additional funds during financial crunches, ensuring smooth business operations.

- Cost-Effective Solution: Banks charge interest only on the utilized amount, making it an economical alternative to loans.

- Flexible Repayment Terms: Businesses can repay borrowed funds without strict EMIs, just like credit card EMIs. This lets them match repayments to their cash flow.

- Simplified Application Process: Overdraft loans generally involve minimal documentation and faster processing compared to traditional loans.

How Overdrafts are Used in Business Operations

Overdrafts are versatile tools that can be used in various aspects of business:

- Working Capital Management: They help manage routine expenses like employee salaries, rent, and operational costs during lean periods.

- Inventory Purchase: This credit facility helps businesses buy more inventory when demand is high. They can also use them for bulk purchase discounts.

- Emergency Expenses: Businesses can use short-term credit to handle unplanned expenses like equipment repairs or sudden operational needs.

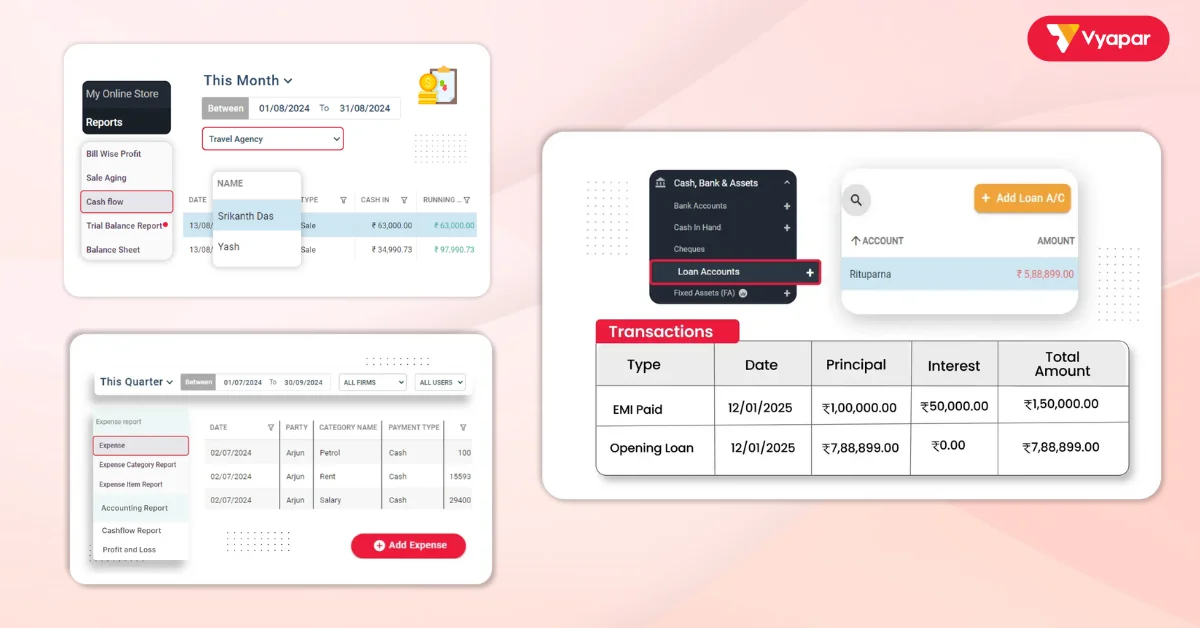

How Vyapar Helps with Overdraft Management

Vyapar, a comprehensive business accounting and invoicing software, helps SMEs manage their finances effectively, ensuring better utilization of overdraft facilities.

- Real-Time Cash Flow Tracking: Vyapar helps businesses check their account balances and cash flow. This allows them to make smart choices about using borrowed money.

- Loan Account Management: Vyapar tracks interest, repayment schedules, and balances, simplifying loan management and reducing manual effort.

- Expense Categorization: The software categorizes expenses, which makes it easy to track how you utilize borrowed funds.

By using Vyapar in your business, you can keep accurate financial records. This will help you make the most of your credit facility.

Are you a Business Owner?

Take your business to the next level with Vyapar! Use free trail!

Try our Android App (FREE for lifetime)

FAQ’s

An overdraft facility lets account holders take out more money than they have in their account. You can use this up to a set limit, and it works like a short-term loan.

Lenders charge interest only on the withdrawn money and calculate it daily, considering the remaining balance.

Overdrafts provide immediate liquidity, flexibility in repayments, and cost-effective borrowing for short-term financial needs.

A secured overdraft needs collateral like property or fixed deposits. An unsecured overdraft does not need collateral but usually has higher interest rates.

Vyapar helps businesses track cash flow, track loan payments, and categorize expenses, simplifying the management of overdraft facilities.

Related Posts: