Invoice Receipt Software

Tired of managing receipts manually? Vyapar’s free invoice receipt software simplifies billing, tracks payments, and sends receipts instantly. Download the best receipt app for small business now!

Top 4 Key Features of Invoice Receipt Software

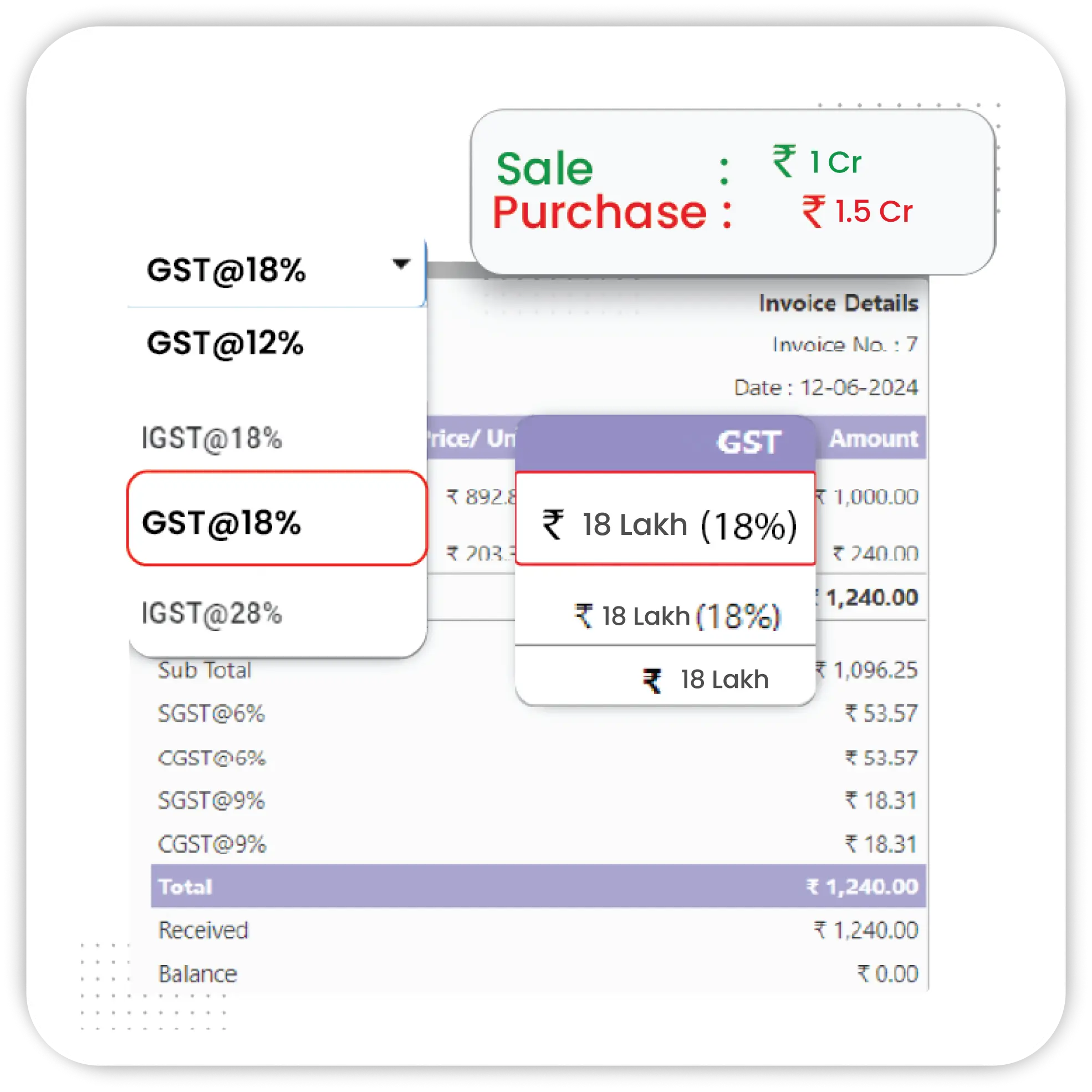

Professional GST Invoicing

Vyapar’s Invoice Receipt Software offers GST-compliant invoicing, so you stay 100% tax-ready and legally compliant.

- Auto GST Calculations: Vyapar applies CGST, SGST, or IGST automatically based on buyer’s location. This saves time and ensures error-free billing.

- HSN & SAC Code Support: Add HSN/SAC codes effortlessly to meet GST compliance. Vyapar keeps your business audit-ready with correct classifications.

- Custom GST Rates: Set specific GST rates for different items. Vyapar helps you stay compliant, even with non-standard tax slabs.

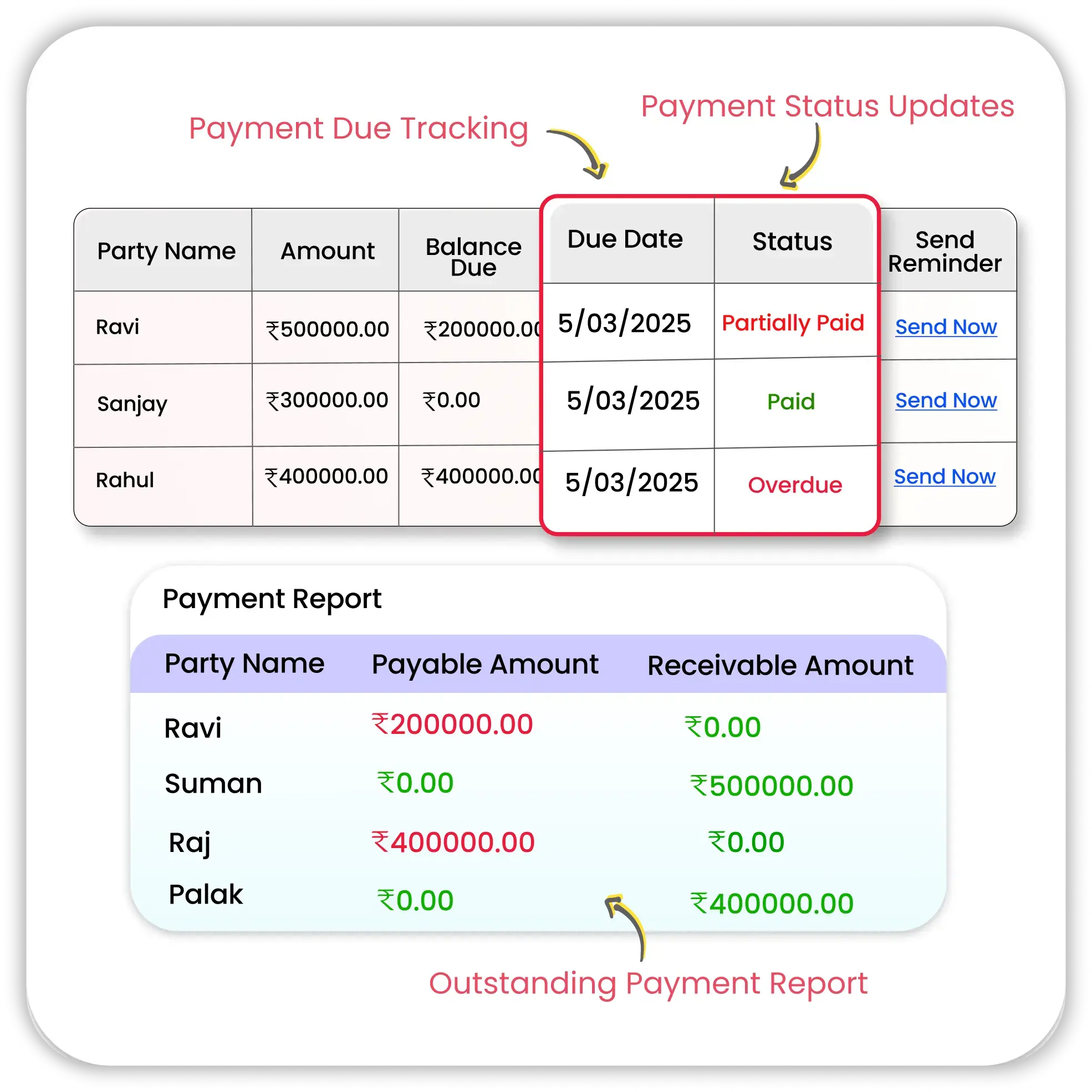

Receipts & Payment Tracking

Vyapar tracks every payment and receipt, so you never lose track of what’s paid and what’s due.

- Payment Receipt App: Generate and send receipts instantly via WhatsApp or SMS. It acts as both a billing and a receipt tracking tool.

- Outstanding Dues Dashboard: View pending payments and follow up with one click. The dashboard gives full visibility into unpaid invoices.

- Smart Reminders: Schedule automatic reminders to clients for due payments. Improve collections without sounding pushy.

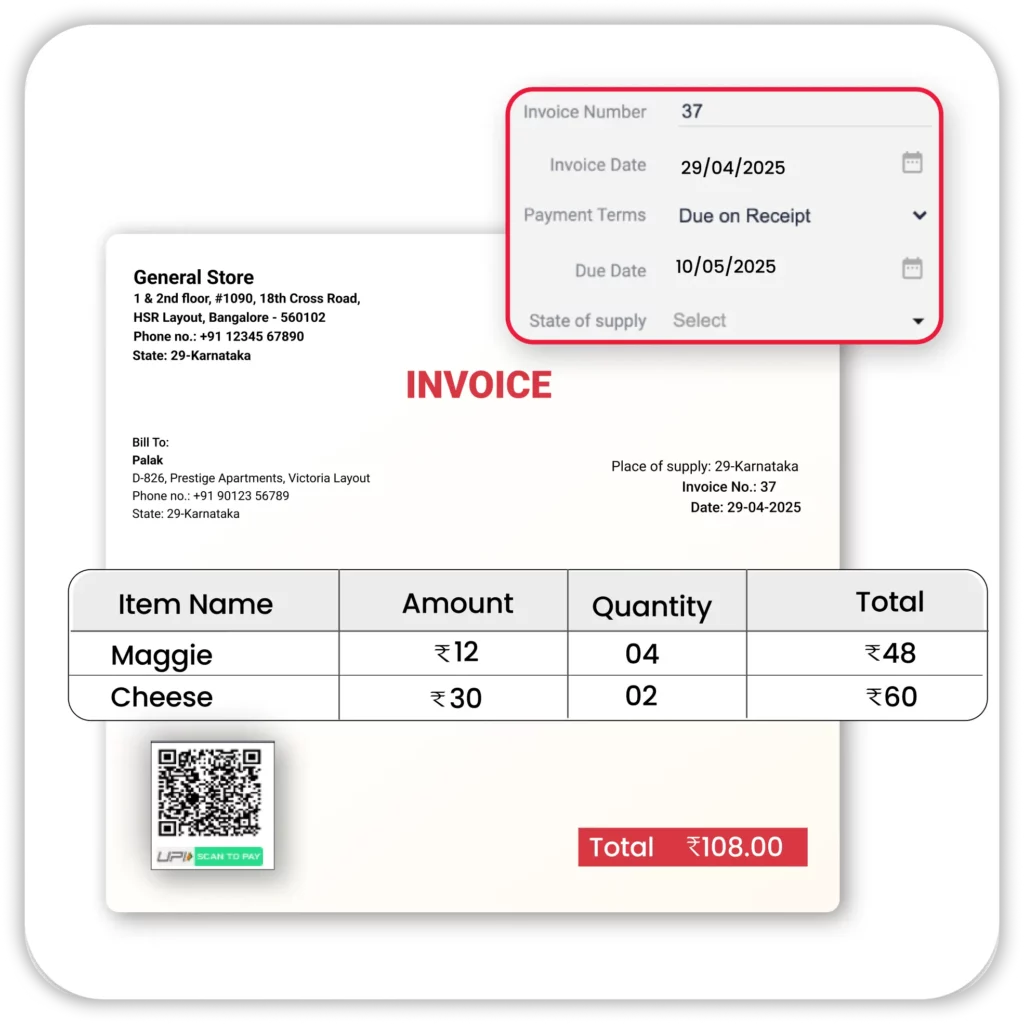

Custom Invoice Templates

Vyapar offers customizable invoice templates, so your documents match your business identity.

- Branded Bills: Add your logo, signature, and brand colors to each invoice. Impress customers with professional-looking documents.

- Invoice Receipt Software for PC: Use Vyapar on your desktop for easy editing and printing. Perfect for businesses preferring a PC-based workflow.

- Save & Reuse Templates: Create once and reuse the same format for all clients. It’s fast, consistent, and saves tons of time.

Automatic Invoice Numbering

Never miss a sequence again. Vyapar auto-generates invoice numbers to keep your billing neat and professional.

- Auto-Series Generation: Automatically create numbered invoices with custom prefixes. Keeps billing organized and easy to reference later.

- Error-Free Billing: Avoid duplicate invoice numbers with built-in checks. Keeps records clean and reduces human errors for audit-ready invoicing.

- Legal Compliance: Invoice formats follow India’s tax rules and audit standards. Keep your business safe and regulation-ready.

Add-On Features of the Vyapar Invoice Receipt Software

Estimates to Invoice Conversion

Multiple Payment Modes Support

Outstanding Receivables Report

Inventory Linked Invoicing

Barcode Scanning for Quick Billing

Multi-User Access & Permissions

Offline Billing Capability

Safe & Secure Data Storage

Smart Business Reports

Expense Tracking

Inventory Management

Send Invoices via WhatsApp & Email

Why Businesses Should Choose Vyapar Invoice Receipt Software for Their Requirements?

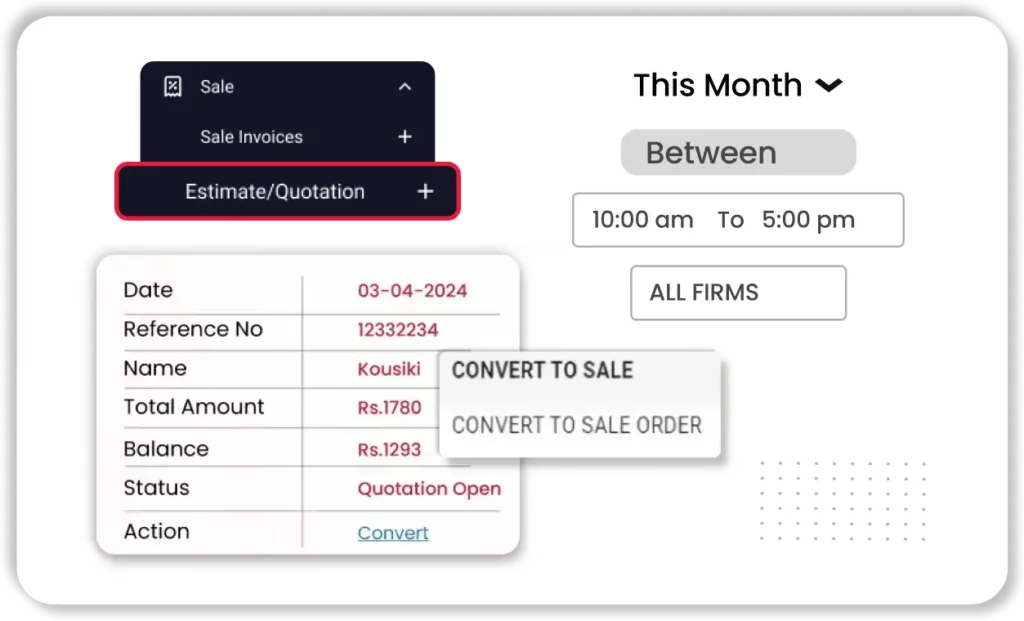

Estimates to Invoice Conversion

Convert quotes into invoices instantly with Vyapar’s invoice receipt software, reducing manual work and billing errors.

- Instant Conversion: Instantly convert estimates into tax-ready invoices with a single tap. This receipt software for small businesses helps save time and avoid data mistakes.

- Edit Before Finalizing: Update item details, discounts, or tax rates before sending. It’s a flexible receipt management app for growing businesses.

- Professional Templates: Use branded invoice designs for all your documents. Vyapar doubles as a digital receipt app that keeps things consistent.

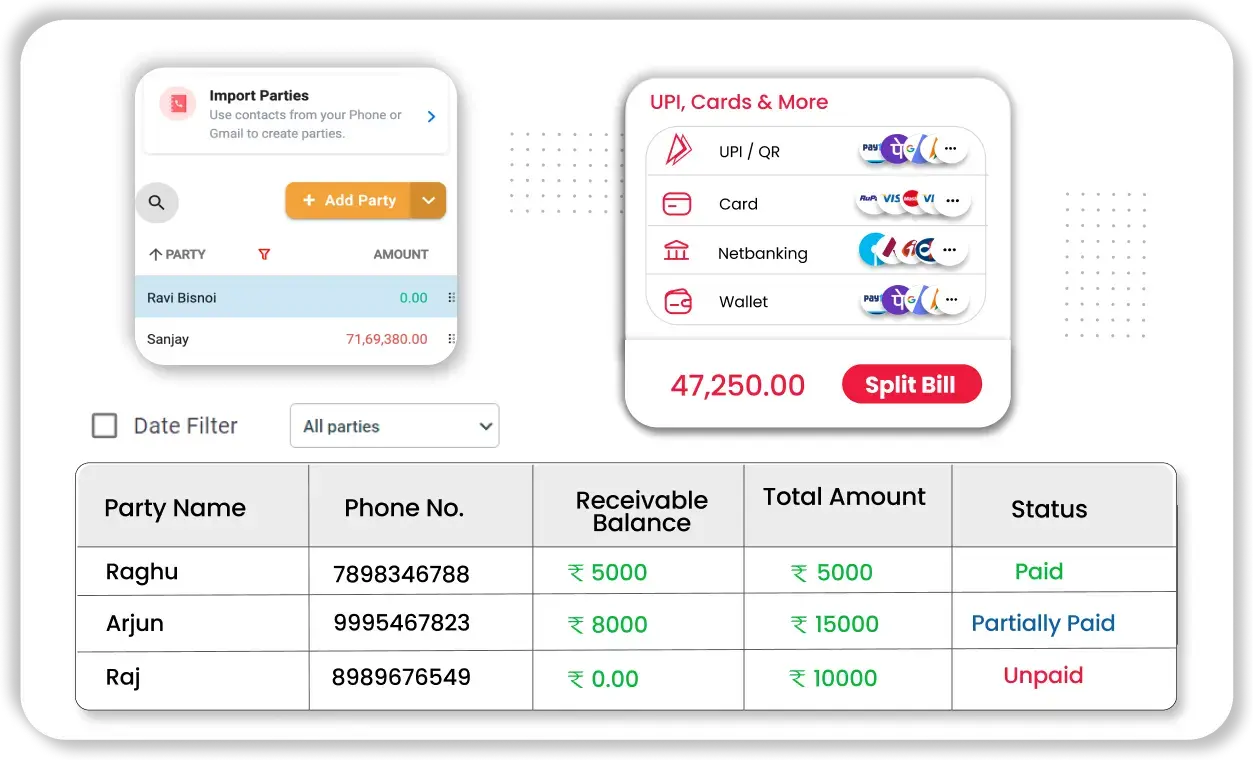

Multiple Payment Modes Support

Accept and manage all payment methods with this robust payment receipt software, boosting convenience and cash flow.

- Cash, UPI, Cards, and Bank Transfers: Vyapar supports various payment types, making it a versatile payment receipt app for clients with different preferences.

- Track Mode-Wise Payments: Analyze collections by payment method with Vyapar’s intuitive receipt software for PC and mobile.

- Custom Notes: Add UTR numbers, cheque info, or bank references to your bills. It’s all managed easily in this receipt organizer software.

Outstanding Receivables Report

Get a clear picture of pending payments with this feature-packed receipt management software.

- Auto-Generated Reports: Vyapar automatically tracks unpaid invoices, making it the ideal invoice receipt software for busy professionals.

- Customer-Wise Breakdown: Identify which clients owe you and how much. This receipt software helps prioritize collections effortlessly.

- Export Options: Download reports in PDF or Excel from your business receipt app. Share them with your accountant or staff.

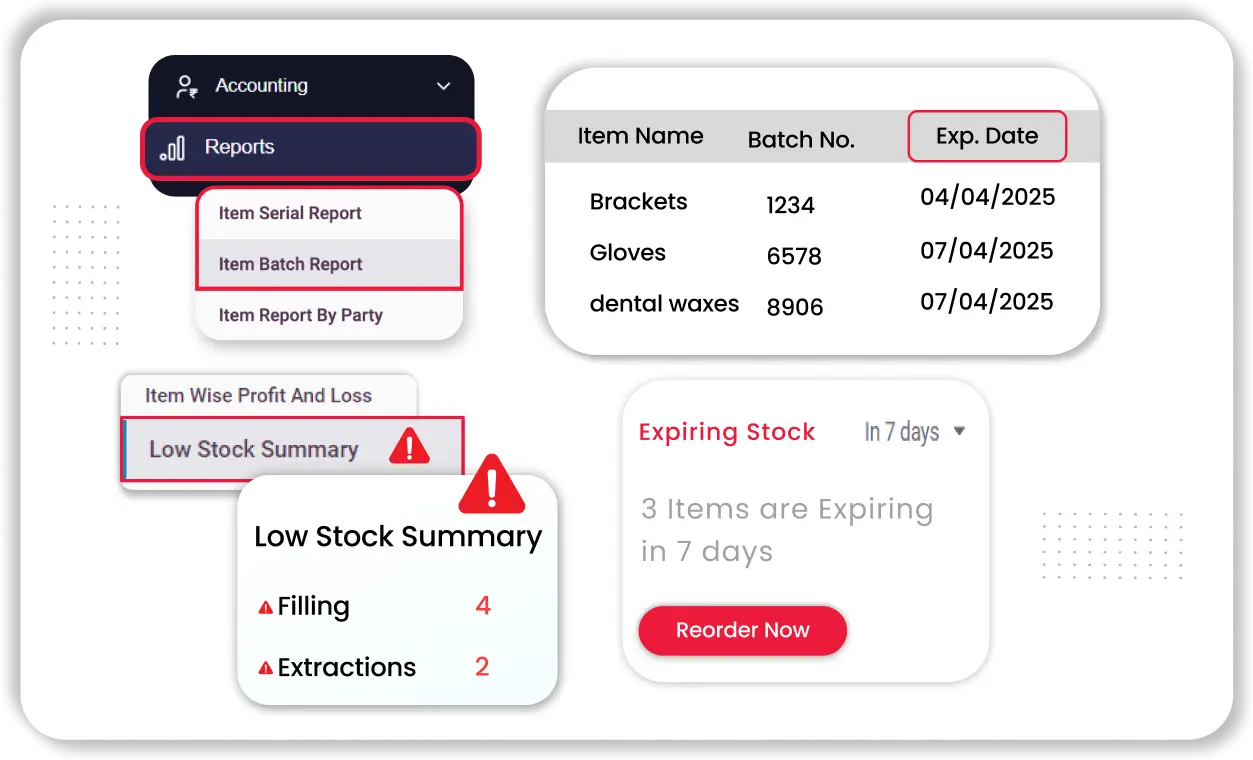

Inventory Linked Invoicing

Link inventory with billing using Vyapar’s integrated receipt software for small business users.

- Real-Time Stock Sync: Automatically adjust stock with each invoice. A powerful feature that sets this receipt app free apart.

- Low Stock Alerts: Get notified before you run out of products. Ideal for users relying on receipt software for PC or mobile.

- Auto Item Lookup: Add saved items with auto-complete. This receipt software speeds up billing and improves accuracy.

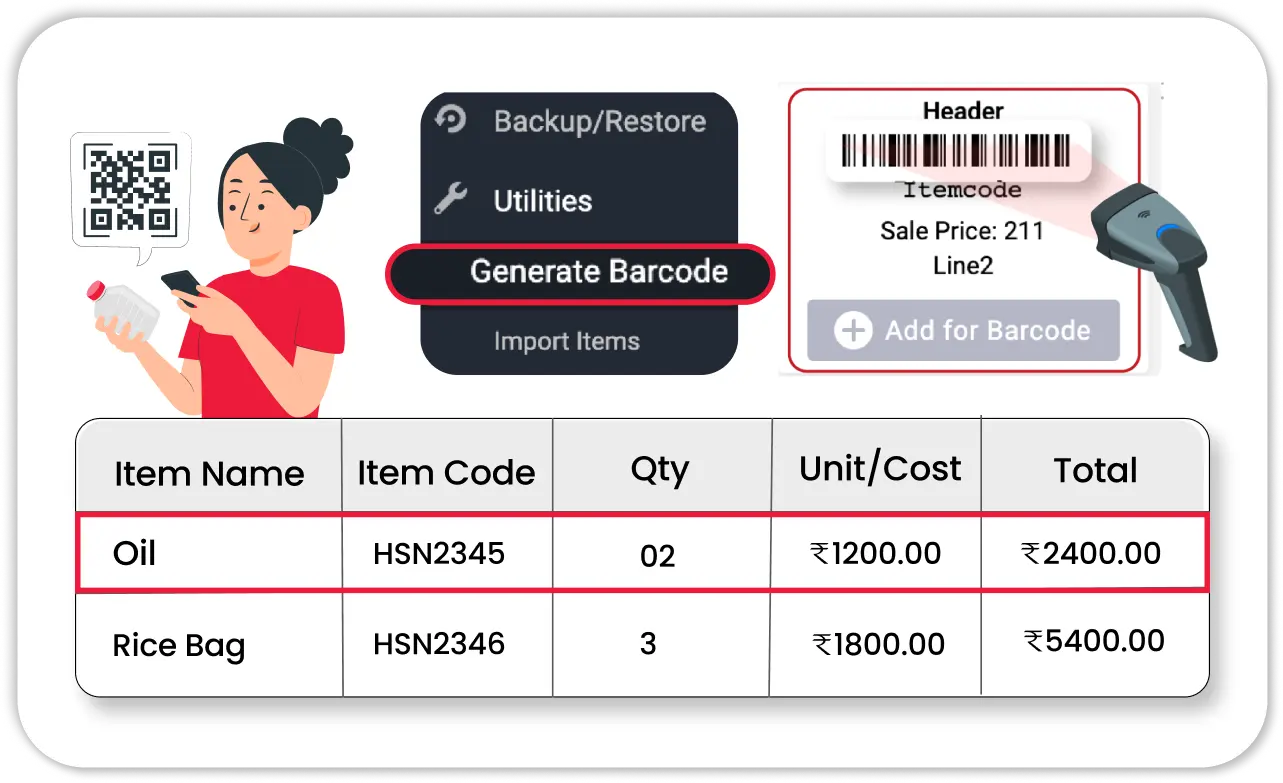

Barcode Scanning for Quick Billing

Boost efficiency with Vyapar’s digital receipt app that supports barcode scanning.

- Fast Item Entry: Scan items using your mobile camera or scanner. Makes Vyapar an ideal receipt software free download for retail shops.

- Error-Free Identification: Prevent mistakes during billing with precise barcode matching. A must-have in any receipt app free for small business.

- Custom Barcode Setup: Generate and manage your own codes easily. Vyapar truly acts as a modern receipt management software.

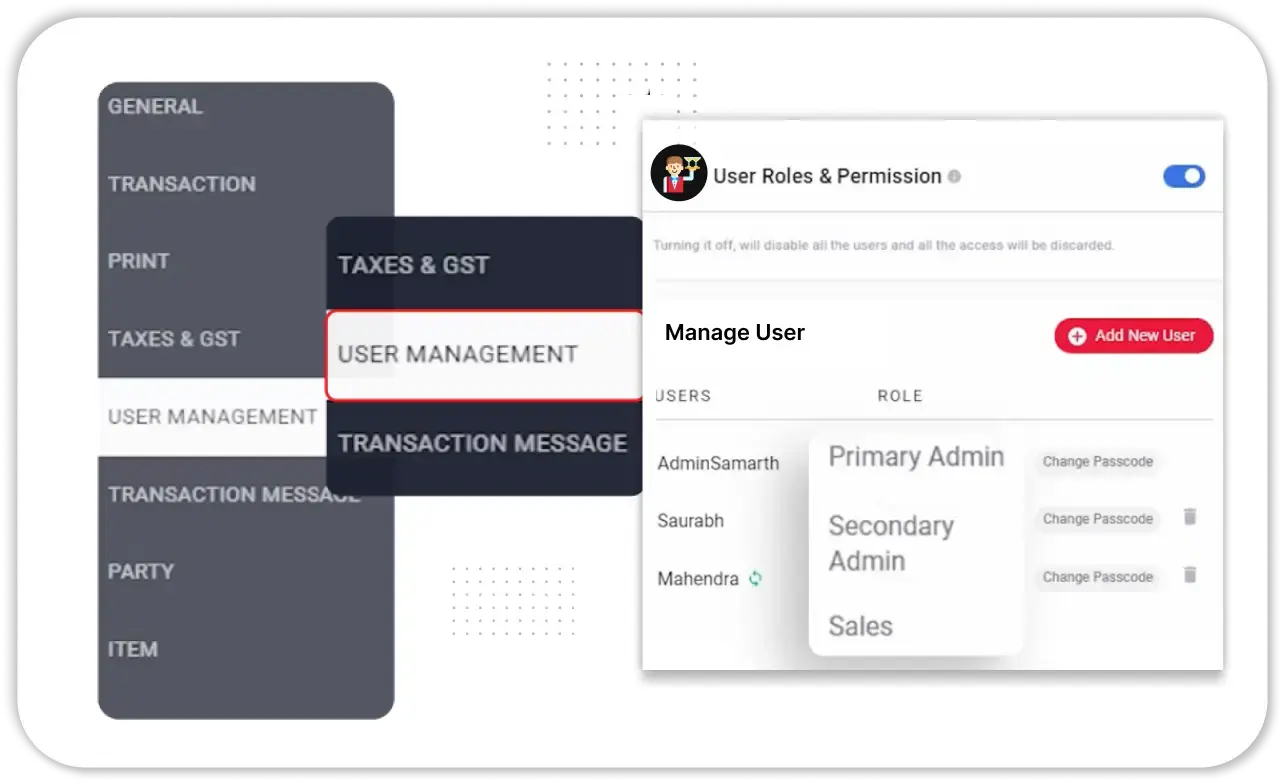

Multi-User Access & Permissions

Manage your team securely with Vyapar’s role-based receipt software access features.

- Assign Roles: Let your staff access the system based on their job function. It’s a secure business receipt app with layered control.

- Track User Activity: Monitor what each user edits or views. This is essential in any trusted payment receipt software.

- Secure Login: Each team member gets personal login credentials. Protect your data with this privacy-first receipt management app.

Offline Billing Capability

Continue using the free receipt app for business even without an internet connection.

- 100% Offline Mode: Create and save invoices offline—ideal for remote areas. Vyapar is a fully capable receipt software for small business needs.

- Auto-Sync Later: Sync all data when you’re back online. A must-have function in a reliable digital receipt app.

- No Interruptions: No Wi-Fi? No problem. Vyapar keeps your invoice receipt software running smoothly.

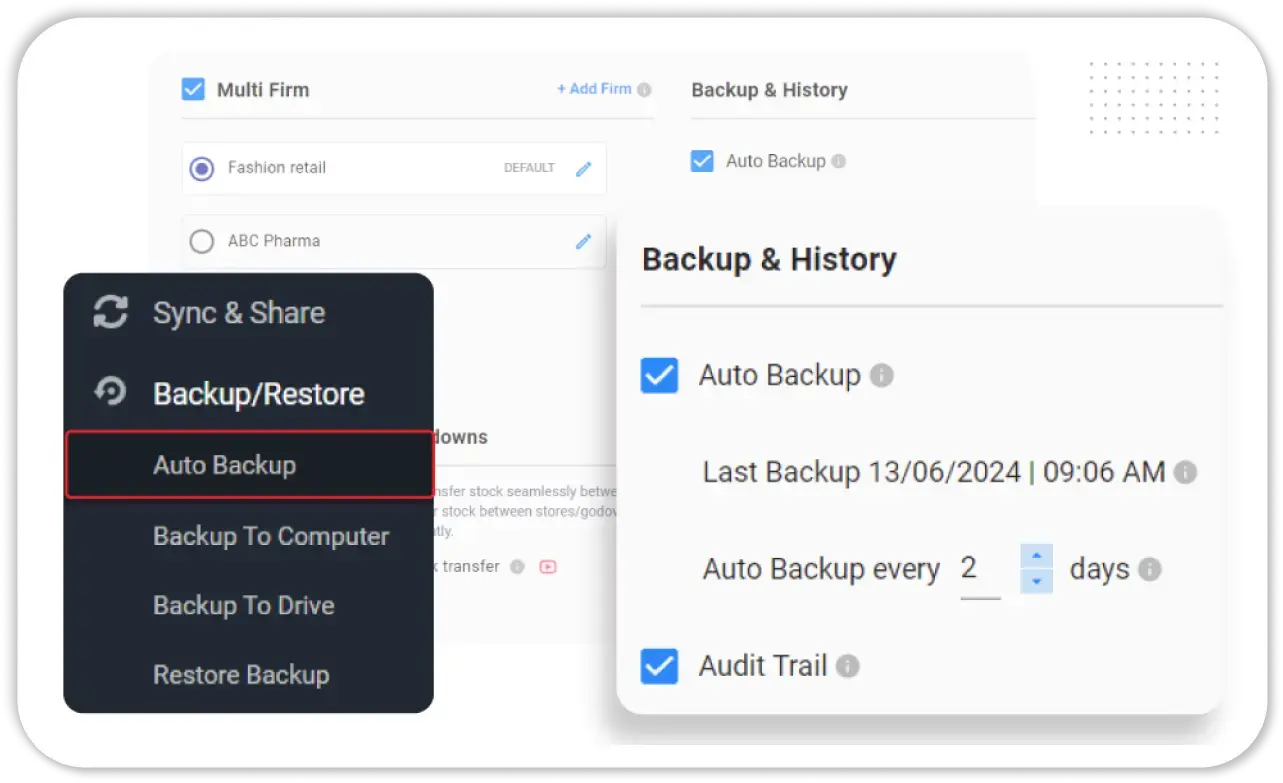

Safe & Secure Data Storage

Protect your sensitive data with Vyapar’s encrypted receipt software system.

- Local & Cloud Sync: Your data is safe and available on PC and mobile. This makes Vyapar a trusted receipt software for PC and app users.

- Auto Backup: Enjoy daily backups that prevent accidental data loss. A true asset in any receipt organizer software.

- Privacy-First: Only you control access to your business records. Vyapar’s receipt software free download respects your privacy.

Smart Business Reports

Make informed decisions using Vyapar’s reporting-rich receipt management software.

- Profit & Loss Summary: View earnings and expenses instantly. An essential part of smart invoice receipt software.

- Tax Reports: File your GST returns without hassle. Vyapar doubles as a payment receipt app and tax assistant.

- Customer Reports: Know your best buyers and trends with one tap. Vyapar is not just a receipt software, it’s a growth tool.

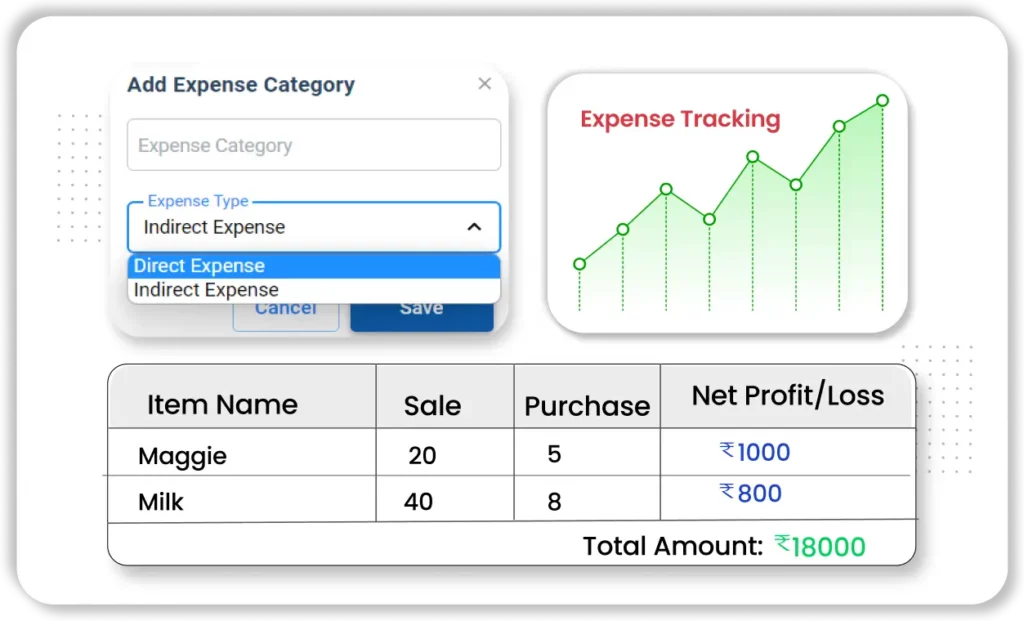

Expense Tracking

Track every business expense with ease using this all-in-one receipt software for small businesses.

- Attach Receipts: Add images of bills for proof and auditing. Vyapar is your go-to receipt management app.

- Sort by Type: Classify spending for better financial insights. A core tool in this intuitive receipt app free.

- Expense Reports: Get detailed reports of all your expenses, categorized and time-stamped. Helps you analyze spending and manage budgets better.

Inventory Management

Monitor and manage your stock easily with this robust receipt software solution.

- Stock Adjustment: Update stock for damaged or returned goods. Vyapar is built for real-world small business use.

- Multiple Warehouses: Manage inventory across different locations. Ideal for franchises using a single business receipt app.

- Batch Tracking: Track items by batch or expiry date. A must-have for pharma or FMCG sellers using receipt software for PC.

Send Invoices via WhatsApp & Email

Use Vyapar’s modern invoice receipt software to share digital bills instantly.

- One-Tap Share: Send invoices via WhatsApp or email in seconds. It’s a top-rated free receipt app for business.

- Digital Invoice Formats: Choose PDF or soft copy invoices to suit customer preferences. Makes Vyapar a standout digital receipt app.

- Delivery Confirmation: Know when clients view your invoice. Offers real-time insights like the best receipt app for small business should.

Run Your Business Smarter – Experience Best Invoice Today!

Why Vyapar is the Best Invoice Receipt Software for Businesses

✅ All-in-One Billing Solution

With Vyapar, you don’t need separate tools. It combines receipt software, inventory tracking, tax calculation, and reporting—perfect for streamlining tasks in any small business.

🔔 Smart Payment Reminders

Using Vyapar’s built-in payment receipt software, you can automate follow-ups for unpaid invoices. This helps reduce outstanding amounts and ensures smoother cash flow.

🇮🇳 Made for Indian Businesses

Designed to align with India’s billing and tax system, Vyapar’s receipt software for small business supports GST billing, local compliance, and even works in multiple Indian languages.

⚡ Instant Online Billing

Send bills instantly through WhatsApp, email, or SMS. Whether you’re on a smartphone or using receipt software for PC, Vyapar lets you bill anytime, anywhere.

📱 Seamless Mobile Accessibility

Vyapar’s accounting app works offline and online, making it the go-to payment receipt app for shop owners, freelancers, and service providers on the move.

💻 Multi-Platform Access

Easily switch between desktop and mobile with real-time syncing. Whether it’s for daily operations or monthly reports, this receipt software free download keeps your data consistent.

Vyapar’s Growing Community

Take Your Business to the Next Level with Vyapar App! Try Free!

Frequently Asked Questions (FAQs’)

Vyapar is considered the best invoice receipt software for small businesses due to its user-friendly design, offline access, GST integration, and ability to create, share, and track receipts—all from one platform.

Yes! Vyapar doubles as a reliable payment receipt software, helping you track incoming payments, send auto-reminders, and generate professional receipts instantly.

Absolutely. Vyapar is available as both a desktop version and a mobile app. So whether you need receipt software for PC or mobile, Vyapar keeps your billing synced across devices.

Yes! Vyapar offers a receipt software free download for Android and Windows. You can try the free version before upgrading for additional features.

Definitely. Vyapar is trusted as an all-in-one receipt software for small business operations—covering invoicing, GST filing, inventory, and payment tracking.

Vyapar functions as a complete receipt management software, organizing all your bills, invoices, and payment proofs in one dashboard for easy tracking and reporting.

Yes, Vyapar serves as a powerful business receipt app with offline mode, instant sharing, and mobile invoicing features—ideal for entrepreneurs on the go.

Vyapar’s real-time sync, auto-backups, and category-wise sorting make it an excellent receipt management app for businesses needing organized financial records.

Vyapar offers a free receipt app for business use with basic features like invoice creation and payment tracking. Paid plans unlock advanced functionalities.

Yes, Vyapar works as a digital receipt app and receipt organizer software, allowing you to store, categorize, and retrieve receipts digitally without the paperwork mess.