Job Work Bill Format

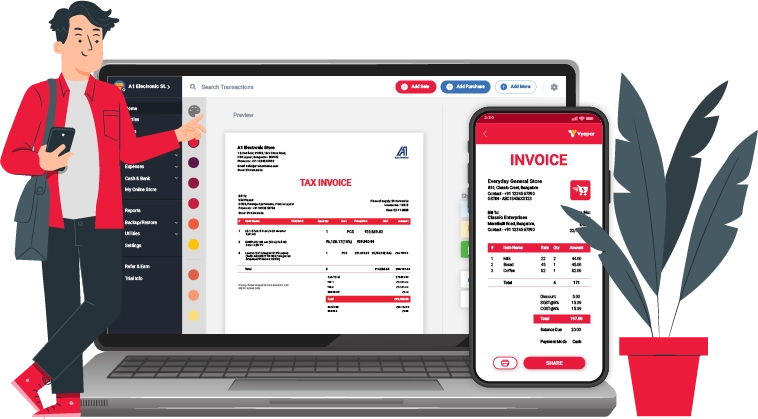

Download the Job Work Bill Format to invoice your customers. Or use the Vyapar App to do billing, inventory, and accounting easily and grow your business faster! Avail 7 days Free Trial Now!

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Job Work Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Job Work Bill Format

Download professional free job work bill formats, and make customization according to your requirements at zero cost.

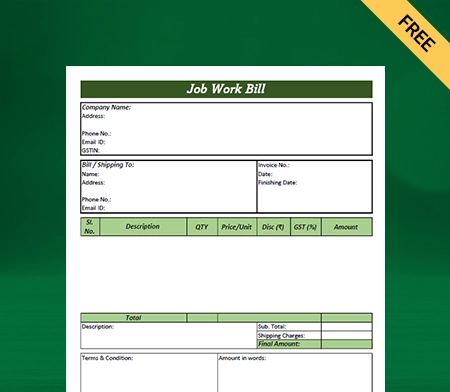

Job Work Bill Format – 1

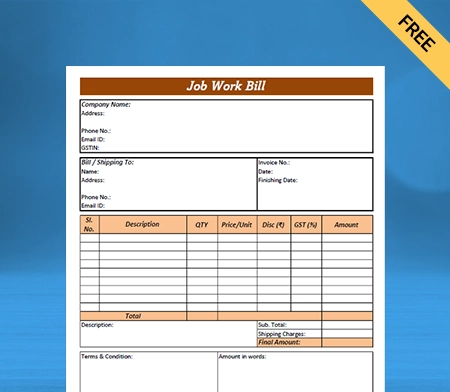

Job Work Bill Format – 2

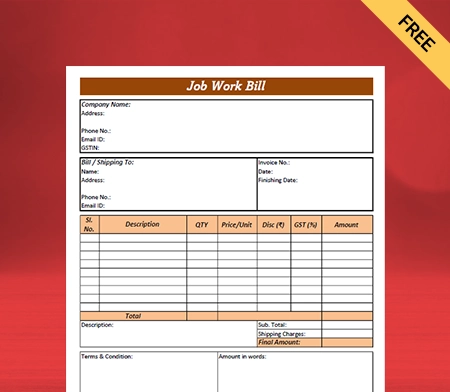

Job Work Bill Format – 3

Generate Invoice Online

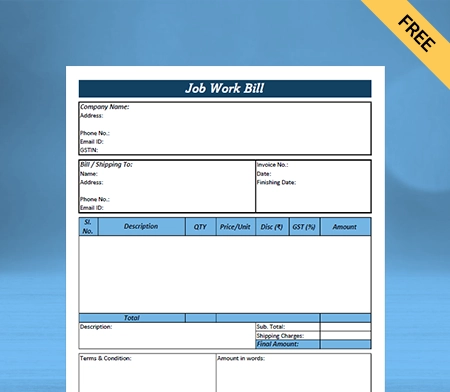

Job Work Bill Format – 4

What is a Job Work Bill Format?

Professionals and brands use a job work bill format to create bills. Like any other professional, you might want to grow in your industry. To grow and get more clients to hire you, you need to work on your image as a brand or professional.

Brand image is an integral factor that helps in convincing customers to choose you over competitors. Offering a job work bill is a simple yet effective practice to establish an authentic brand image.

Every huge brand doesn’t matter which industry it is in, offers invoices to customers. It’s because this practice reflects the idea of professionalism. So when you submit your clients a job work bill, you indirectly portray yourself or your business as professionals.

When it comes to job-work projects, customers generally look for experts with a sense of professionalism in their behaviour or actions. You might want to use the Vyapar accounting app to create your first job work bill. It has a pre-designed job work bill format, which you can use to create unlimited job work bills.

What are the Important Contents of a Job Work Bill Format?

If it’s your first time creating a job work bill, you might want to ensure your format has everything necessary. So here are some important contents of a job work bill format:

Your Name or Business Name, Brand Logo and Address

The first basic thing you need to make sure your job work bill format has is your name. How weird will it look when you offer customers a bill, but they cannot identify it? That’s why having your name or brand name in the job work bill format is important.

In addition to brand names, we must remember brand logos. It’s an important part of branding your business, which cannot be ignored. Therefore try to include this detail as well. Besides, this is an option, but many experts recommend it, i.e. business address. Having your address is completely optional.

Client’s Name and Contact Details

Now that we have covered the details about your brand let’s talk directly about your customers. The two important details you must pay attention to at any cost are the name of the client and their contact details. These details are important in many ways, but it mostly important for your own good.

Having customers’ names and details will make it easy for you to differentiate bills. In other words, it will make your overall accounting a little less hassle. Imagine having so many bills with no names on them. Now imagine yourself recording those bills. You can’t imagine having yourself in such a bizarre situation, right? Include these details, then.

Invoice Number

Making records of your bills can become easier with invoice numbers. Therefore, it’s recommended that you include a dedicated column for an invoice number in your job work bill format. Invoice number is also helpful during the accounts auditing process.

It promotes convenience for accountants to access any bill without the hassle of going through the sack of documents one by one. Besides, things will become simpler if your billing system is integrated with accounting software. You can enter the invoice number into the software and access the bill in seconds.

GST Number

GST number is one of those details you must include in your business invoice. If your business is registered with GST or you pay income tax, including the GST number on your bill is integral. Doing this will help you track income and the tax associated with it.

Moreover, it also helps the accounting department file taxes for the right amount. If you file taxes wrong, you might have to face certain charges. The consequences can range from fines to severe penalties. To avoid such scenarios, it’s best to include the GST number in your bill.

Description Of Service And Product Processed

Including a dedicated “services and product processed” section in your job work bill format is highly important. First, it educates the customers about the resources, materials or services you have created/processed for them. Although most customers will be aware of this detail, it’s best to be safer.

This component of the job work bill format isn’t only crucial for customers and you. It helps you maintain the sales record. In addition, it makes it easier for you to track how many resources are utilised, when and on which customers.

Quantity of Product/Service and Its Price

When you add a product/service description column, mention another column named quantity. It looks incomplete when you mention services/products processed, but there’s no mention of quantity.

Having a quantity column in your job work bill format makes your bill transparent. Include a price column in your job work bill format. Service/product description, quantity and price are a trio that completes your bill’s sales detail.

Details of Applicable Taxes and Discounts

For years, it has become a rule that brands should include tax amounts in their bills. It’s not like every business follows this approach, but many well-known brands have seen doing it. And we recommend you should definitely consider including the amount of taxes in your bills.

Instead of reflecting the total bill amount, try segmenting the price. Mention all the taxes and discounts applied to that sales price. This approach of segmenting the total bill amount reflects transparency. Being transparent is a unique quality that customers look for in a brand. This detail can help you attain that.

Terms and Conditions, and Your Signature

It will do a lot of damage to your brand image if it’s highlighted that the terms and conditions weren’t clear. To avoid that situation, highlight the terms and conditions at the bottom of your job work bill format.

This will add points to the transparency factor, decreasing the risk of any legal consequences. Just like there’s a starting point to a job work bill format. There’s an ending as well. The end of your job work bill format is signature. Make sure there’s a dedicated section where you can place your e-signature or actual one in the hard copy.

Payment Information

Including payment information will help you maintain the accuracy of your bookkeeping. Plus, it also facilitates the overall accounting process. Including payment information on your bill makes it easy to track income.

Thus, when you know how to track these two elements of accounts, you can keep the books accurate and free from any errors. Also, having payment information is good from the customers’ perspective. It gives them an idea of how much they have spent and when.

Delivery Information

Let’s suppose you inform the customer about the delivery of their finished goods. But what are the chances that they will not forget about it? Well, humans tend to forget things pretty quickly, and it’s normal. Having delivery information on your bill will keep customers reminded about the delivery.

Therefore, they can always refer to the bills even if they forget the delivery time or wish to confirm it. It promotes convenience and hence the overall customer experience. Improved customer experience will make you win your customer’s trust, giving you more business.

Why is it Important to Offer a Job Work Bill?

In the job-work profession, offering customers a bill is highly important. Here are important reasons of justification for that:

Record of the Transaction

The biggest reason why you should be offering a job work bill is also its biggest advantage. When you issue a job work bill, it becomes a legal document. This document is the record of the transaction done between you and the customers. It will help you in legal scenarios as a brand or professional.

Suppose someone refuses to pay your bill or doesn’t accept that you have served them. In such cases, you will take the matters to court. In court, your biggest leverage will be your job work bill that you issued against the customers. It will have all the details of your deal, giving you a great advantage.

Tracking Down Resource Utilisation

Whether you run a business or are a professional individual, tracking your resources is an important task of the day. But it’s also one of the toughest and most time-consuming jobs to take care of. But it can become a little less stressful with job work bills. When you have a dedicated record of a job work bill, tracking down resources is merely a responsibility.

If you scroll up to the job work bill format content, you’ll notice that it has a dedicated section of services and products utilised. With this detail in your job work bill, you can analyse which all resources were used to serve the customers. Since the human brain cannot remember everything, relying upon job work bills is an ideal approach to resource tracking.

Crucial For Material Management

Material management is a necessary process for a business. If your material isn’t managed properly, you might not be able to serve customers the best experience. Material management starts with understanding the utilisation of inventories. Where, when and how are inventories being utilised throughout a financial year?

Manually managing your materials is already a hassle. Things can become super complex if you don’t know when and how they are used. Having job work bills can help a lot. They will offer you a 360-degree view of your inventory usage. Plus, if you combine a job work bill with small business accounting software, material management can become efficient.

Helps You Maintain Accurate Accounts

Do you know that improperly managed accounts are why many businesses don’t grow well in their sector? Your poorly managed records are what’s resisting your business growth as well. When we talk about accounts, we refer to records of funds utilised earned. Using the app helps you understand when and where are funds used and earned.

Offering a job work bill is a great practice that makes account management simple and convenient. When you have job work bills, you don’t have to use your memory to remember sales. You can simply use them to record the sales and save them for future reference. According to many accounts, having job work bills has made their job easier.

Leaves a Professional Impression

Regarding job work, 90% of clients prefer brands and experts with a professional image. Having a professional image reflects a sense of reliability and trustworthiness. If you want your customers to choose you over your competitors, establishing a professional image is highly important.

With a job work bill, you can accomplish that goal. When you offer customers job work bills, you make an impression of professionalism. This could be great practice if you are a small business because it’ll be unexpected for your customers.

Create your first invoice with our free invoice Generator

How to Access the Job Work Bill Format in Vyapar?

There are two ways to create Job Work Bills, i.e. manually or using a Job Work Bill format. The first approach is traditional and time-consuming. On the other hand, using a Job Work Bill format is the most effortless and efficient way of creating bills.

You can use the expert’s designed Job Work Bill format by the Vyapar app. Vyapar is India’s best and most preferred accounting software. To find the Job Work Bill format and use it without any waste of time, here are the steps you should follow:

- Login into Vyapar and tab on the + icon on the homepage.

- A dialogue box with multiple options will appear. Tap on the SALE INVOICES button.

- Fill in these two details – CUSTOMER NAME and PHONE NUMBER.

- Tap on the ADD ITEMS icon below the PHONE NUMBER column.

- Enter the details of services and products delivered to the customer.

- Now fill in the COST and TAX and tap on SAVE AND NEXT.

- Choose customer-prefered PAYMENT TYPE and tap on SAVE.

- Preview your bill and pick a theme.

- Tap on the ARROW button and share the bill.

These are steps to use Vyapar’s Job Work Bill format. If you follow these steps as they are mentioned above, you will be able to create your first Job Work Bill easily. Also, once you are done with choosing the themes and carrying forward the process, you’ll be offered multiple invoice-sharing options.

If your customers want a hard copy, you can scroll through these options to find the PRINT button. Tap on it, and you’ll be able to print your bills. Besides, all these steps are the same for web applications as well. Therefore if you are using the Vyapar web app instead of the mobile app, follow these steps to access the job work bill format.

What are the Important Contents of a Job Work Bill Format?

Vyapar is the best accounting business software to create job work bills. Here are some key advantages of using Vyapr’s job work bill format:

Time-Efficient Solution

Creating a job work bill with Vyapar accounting software saves time. The solution has a job work bill format designed by experts for effortless bill creation. If you use this format to create job work bills, it won’t take more than a few minutes to get it done. The application is clean and straightforward, making it easy to navigate, saving time here too.

Now, if you look at the other part of the story, you can create job work bills by building a format from scratch. Do you have that many resources to put in? Being a business owner, you have to use your resources right. With Vyapar’s job work bill format, you can create bills in a time-efficient and cost-saving manner. Since it’s free, you don’t have to worry about any upfront or back-end costs.

Better For Bill Creation

Vyapar’s job work bill format is designed to keep the user’s primary concerns in mind. What do you expect from a job work bill format? It should be easy to use and customise and save you time on bill creation. You have got everything in the job work bill format Vyapar offers. You can create as many job work bills for absolutely free.

What’s the better choice of these two – creating job work bills from a format specially designed for job work professionals OR spending time to create your own job work bill format and then use it to cater to your needs? Of course, the first approach is the right one. It does not just save you time but unnecessary effort as well.

Multiple Sharing Options

Customers these days have diverse and evolving expectations. Their demand keeps changing with time – it doesn’t matter if it’s towards products, services or support. Therefore, preparing yourself to cater to the diverse requirements of your customers is always best. When it comes to working job bills, Vyapar successfully caters to distinct customer needs.

The application offers a wide range of invoice-sharing options. Therefore, if your customers don’t prefer softcopy, Vyapar provides the chance to print bills as. In other words, the solution is perfect for satisfying the expectation of your clients in terms of invoice sharing. Whatever bill-sharing medium they ask for, Vyapar has got it.

Wide Options For Designs

Design is an integral part of a bill. It acts as a medium to leave a desired impression on the customers. If you have been offering basic black-and-white bills to customers, it’s time to adapt to change. Vyapar app offers job work bill format with multiple designs. You can choose any design depending on your brand image or goals.

For establishing a professional impression, these designs are highly effective. Moreover, they are versatile and easily adapted by businesses with different niches. With attractive designs, you can make a good impression on your customers. This will increase the chances of them choosing you again for their purchase needs.

Effortless Customisation

When discussing job work bill format, most businesses need help to customise their formats. It’s because most of those formats are either made in Word or Excel. Even though both of these formats are good, they are pretty tough to customise or edit. You will have to spend a good amount of time editing it.

With the Vyapar app, customisation is effortless. Vyapar’s job work bill format is easy to edit and customise. So even if you make a mistake or want to update some changes, you can do that without any issues. Time is money, and you want to save your money on formats that are easy to customise. Therefore, choose Vyapar for an effortless accounting experience.

Better Than Manual Creation

You can always create a job work bill format manually from scratch. But to manually generate a job work bill format, you’d need to hire an expert, spend your time on it, use multiple resources, make lots of effort and much more.

Then comes the Vyapar app, which offers a pre-designed job work bill format. You would not need to invest in any of the above things when working with Vyapar. You can download the app for free and use a pre-existing format to create unlimited bills. Plus, it has multiple designs to make your bills eye-catching.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A job work bill format is used to create job work bills. You can access the exceptionally designed job work bill format on Vyapar. The application, as well as the job work bill format, is free to access. Try it now!

Vyapar app offers a pre-designed job work bill format, with easy customisation benefits. You can use this format to create as many job work bills as you want for absolutely free. Plus, with multiple design options, you can give attractive looks to your bills.

Yes, you get access to multiple sharing options if you use the Vyapar app’s job work bill format to create your bill—for example, Gmail, WhatsApp, AirDrop, SMS, and so much more.

With the Vyapar app, the cost of creating a job work bill is ZERO. You can create an account with Vyapar for FREE and access the excellently designed job work bill format for no cost. Try Vyapar’s job work bill format now!

There’s no limit to creating a job work bill format with the Vyapar app. You can use this accounting solution to create as many job work bills as you want. So what are you waiting for now? Download the app now!

You can add as many columns as you want in your job work bill format. The number of columns totally depends upon your personal preference. However, ensure only to include a handful to keep the bill clean and not stuffed.

Yes, you can download the job work bill in PDF format. Once you are done creating your bill with the job work bill format, you can tap on the ARROW icon on your app. You will have multiple invoice-sharing options, including PDR. Tap on it and share the PDF!

If you create a job work bill format manually from scratch, it will take you a lot of time. Therefore, you should try the Vyapar app’s job work bill format. It’s the most time-efficient method of creating job work bills.

Special Purpose Invoice Formats: