Sweet Shop Bill Format

Every Indian’s life revolves around the sweet shop. Mithai, a dessert with various variants, is deemed sattvic because it is made of sugar and pure milk that everyone may eat. Almost every state in India has its specialty sweet.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Sweet Shop Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Sweet Shop Bill Format

Download professional free sweet shop bill formats, and make customization according to your requirements at zero cost.

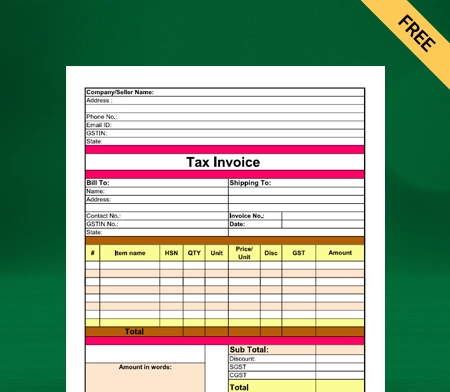

Sweet Shop Bill Format – 1

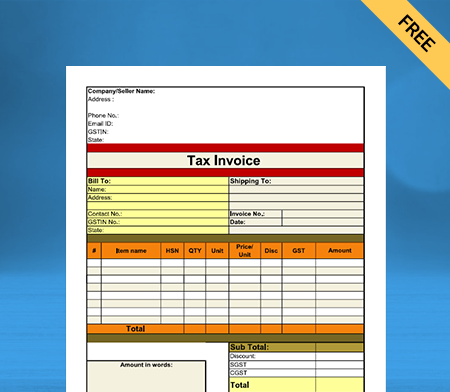

Sweet Shop Bill Format – 2

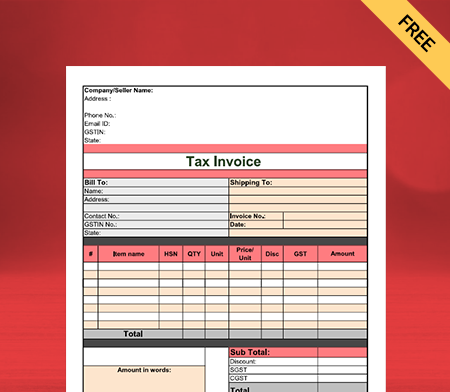

Sweet Shop Bill Format – 3

Generate Invoice Online

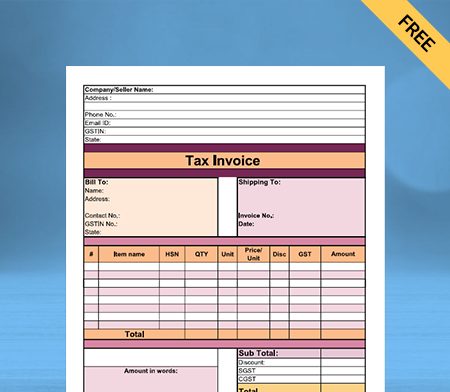

Sweet Shop Bill Format – 4

What is a Sweet Shop Bill?

India is the land of festivals. There is always some celebration, and sweets are an inseparable part of all the rituals. Mithais (sweets) are essential to every festival, celebration, or event. The sweet industry is rapidly rising each year, and with the crowds that gather around a sweet shop at every festival, it is clear that the Sweetshop is very profitable.

Confectioners are const`antly looking for new ways to dazzle people with their sweets. They don’t have time to do time-consuming administrative tasks like invoicing. You can use a sweet shop bill format to make bills for your customers and request payment for your goods or any services you provide. It includes special orders, customisation, etc.

Benefits of Having A Sweet Shop

Who doesn’t like hours and hours spent surrounded by sweet sugary delicacies? Almost all types of sweets, including Barfi, Gulab Jamun, and others, are available at any primary sweet shop. Halwai’s (Confectioners) have created new thrilling mouth-watering exotic flavoured sweets by their design and flavour originality.

Here are other advantages of running a sweet shop:

- Sweets make everyone happy, and having a sweet store allows you to give everyone that joy. People love halwa, jalebi, laddu, and all the other sweets. They order sweets for marriages, festivals, birthdays or other events.

- If someone likes your sweet taste, you get free mouth publicity. And thus you gain popularity in the market.

- Almost all the states in India have their special sweets. While following recipes is part of your job, decorating them with unique designs and flavours shows your creativity.

- Sweet Shop owners also meet with customers to determine what sweets they require for upcoming occasions. As a result, it allows artists to participate in the creative process of event planning.

- Another advantage of having a sweet shop is that you may frequently grow as the business requires. There is a chance to relocate to a larger space or to expand your current facilities.

- Even if you do not expand the physical size of your business, you may frequently increase the variety of sweets you provide. In deciding whether or not to expand, careful sales monitoring and consideration of ingredient prices are critical.

What Are the Contents of the Bill Raised by the Sweet Shop Store Owner?

A sweet shop bill format must include the following details:

Title

Every invoice should have a proper title with the words ‘Invoice’, ‘Tax Invoice,‘ or any other applicable title.

Name, Logo, and Tagline

Owners must put their names at the top of the invoice. If it has any logo, it must include it as well. This way, anyone can know your brand, which helps in marketing. Catchy Tagline gives an invoice a unique identity and elevates the brand’s name.

Address and Contact Details

The following item that shops must include on their bills is their address and contact information. You should also mention if you have any branches in different areas. Your email address, phone number, mailing address, and other contact information should be displayed below the store’s name. It allows customers to contact you and place orders more rapidly.

Customer Details

The sweet shop bill format must also include the client’s name and information such as their address, contact number, email, and GSTIN. The customer details make it personalised.

Date of Bill

The invoice date refers to the date you create the bill. It is essential to provide the invoice date because contract payment terms and conditions sometimes depend on it.

Invoice Number

An invoice number is a serial number that stores use to refer to an invoice. Remember to include the year and month you raised the invoice when numbering invoices. For example, an invoice raised in August 2022 could have an invoice numbering such as 12345/08/2022.

Description of Sweets

The next step is listing the sweets your customer purchased. The invoice should include the name of the sweet, quantity, rate, and amount. For instance, in the description area, you can write Barfi, 2kg in the quantity, 600Rs/kg, and the total amount, including GST.

Tax Rates

If the store has a GST registration and is required to pay tax on the services provided, each item’s tax rate and amount due should be specified separately. Ensure that you levy CGST and SGST separately.

Total Amount

In the end, the total amount will be the sum of the items multiplied by the unit/hourly rate plus any applicable GST.

Create your first invoice with our free invoice Generator

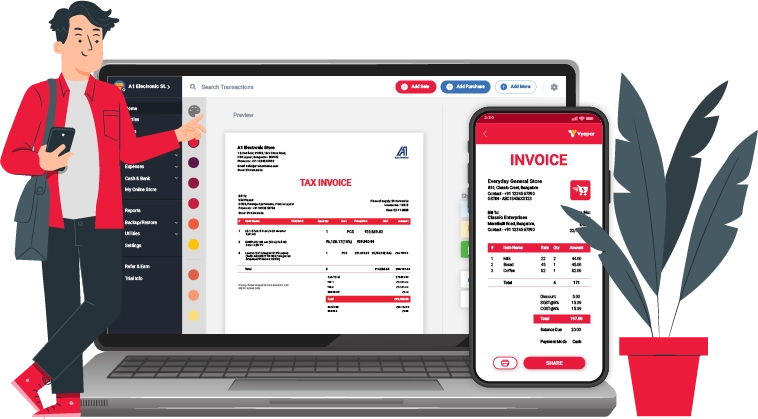

How Do You Create a Sweet Shop Bill Format in the Vyapar App?

Sending beautiful invoices to your clients may improve the perception of your brand. It does not take long to create an invoice for a customer.

In three simple steps, you can create a professional-looking invoice with Vyapar.

STEP 1: Enter Information

Include the billing date and other relevant information about your store and customers. In Vyapar, you may add any items and write notes on the invoice to ensure everything is clear.

STEP 2: Examine

After inputting the details, you can get a preview of your invoice to see how it will look. You can switch to the previous tab in the online invoice builder if you need to make any changes.

STEP 3: Share/Download

Advantages of Sweet Shop Bill Format by Vyapar App

Easy to Use and Saves Time

Vyapar does not require any specialised accounting knowledge. Sweet shop owners can easily use sweet shop bill formats thanks to the app’s user-friendly structure. Data can be transferred instantly from a mobile device to a desktop computer and vice versa.

Manual bookkeeping is time-consuming and prone to human mistakes. Automation expedites the process while eliminating human errors. You can devote your attention to other tasks while saving significant time. It will precisely generate the reports you desire.

The Vyapar app automatically records all of your transaction data. You can quickly go over the reports and analyse your business. It also sends reminders to collect payments and refund debts, which helps prevent future problems.

Shop Administration

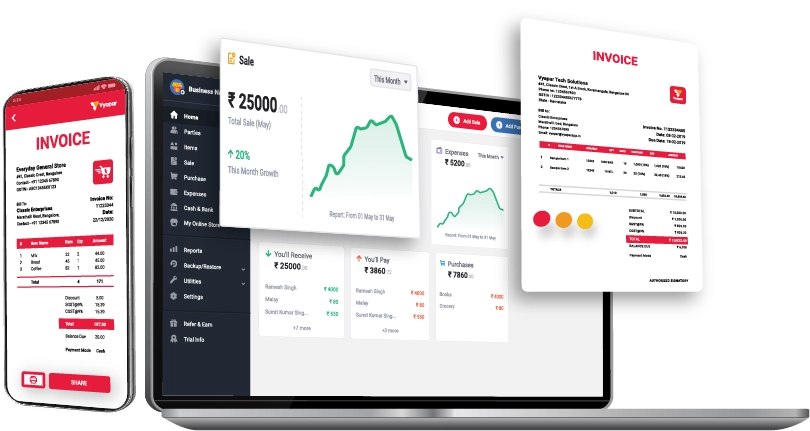

The Vyapar sweet shop billing software can assist you in better managing your store. With Vyapar’s comprehensive dashboard, you can track and analyse your business operations in real-time. The Vyapar app’s simple user interface may help you increase business efficiency.

This software can help you manage your costs, bookkeeping, and inventories. Because of the format’s simplicity and accessibility, keeping track of all transactions is simple. The software eliminates the need to generate invoices manually for each sale.

On the Vyapar app, you may customise your company’s features and other information. You may also use the inventory count app to manage your inventory and restock sweets on customer demand.

Interactive Dashboard

The desktop software and mobile app from Vyapar provide a comprehensive company dashboard that displays all vital data from your everyday business activities in one place.

Everything may be analysed quickly, from cash in hand to stock value, bank balance, and sales orders. It allows you to manage, among other things, low-stock inventory, purchase orders, delivery challans, and expired sweets.

It is the most efficient inventory and order management, billing, and invoicing system. This complete setup will allow you to monitor your business’s financial health and make informed decisions.

Personalised Bills

Stores must strengthen their reputation through their actions. Bills and invoices are no exception. The main advantage of our app is that you can tailor the bills to your store’s needs. Custom sweet shop bill formats allow you to create a more detailed invoice.

It allows you to display branding components for your service, such as logos, style, headers, footers, colour, etc. Custom invoices can also be used as a powerful marketing tool. You make mouth-watering sweets as a confectioner. Therefore it’s only natural that your invoice shows your skill.

Customer-specific messages, additional services, and any other information your client requires can all be included. You can generate sales invoices in 20 seconds. They can be printed or sent to buyers via WhatsApp or email.

Data Entry is Made Simple

Manual bookkeeping and bill production necessitate handwriting entries. You will spend most of your time filling cash registers and spreadsheets as a bookkeeper. You may automate the procedure for your business by using the Vyaar sweet shop bill format.

Fortunately, the Vyapar app automates these time-consuming activities, freeing you up to focus on what is most important to you. Your bill amounts may be changed and tracked by the billing and invoicing software.

The app’s user-friendly UI makes it simple to use. Data can be instantly transferred from mobile to desktop and desktop to mobile. Vyapar is available to both GST-registered and unregistered businesses.

Offline Accessibility

Because the Vyapar App operates offline, you do not need internet access or connectivity to utilise it. Using the app’s offline billing capabilities, you may produce bills for your sweet.

You can create invoices for your business using the Vyapar app even if you are not connected to the internet. When you connect Vyapar to the internet, it validates your transactions and refreshes your database instantaneously.

In rural areas where network and connectivity challenges are common, the Vyapar app’s online and offline capabilities are beneficial. You may keep your sweet running without an internet connection by utilising numerous invoice-generating application capabilities.

Additional Features Of Vyapar App

GST Invoicing

All-in-one GST sweet billing software automates your billing needs, making it an excellent addition to your sweet shop. It is pretty helpful in assisting small and medium-sized businesses in saving time on accounting.

With the help of free billing software with GST, business owners can easily do various tasks such as GST return filing, inventory management, invoicing, and billing.

Our free accounting software allows sweet sellers to customise the fields to meet their specific requirements. The software lets you generate commercial invoices for your clients in less than 20 seconds and print/share them.

Businesses should prepare bills in the GST invoice format, which our GST billing software allows you to do. The free invoicing app creates several parties to handle all customers efficiently.

Online Shop

With our sweet bill maker app, you can set up an online business in a couple of hours. Using our sweet bill style, you can list any sweet you sell to your customers online. It will assist you in displaying a catalogue of all the things you sell and increase your online sales.

Furthermore, there are no expenses for using online store features that help you take your business online using Vyapar billing software. You may expand your local customer base by putting your business online with the Vyapar online store.

You can connect your online store to your clients, and they can use the link to place orders online and pick up the product or service immediately from your store.

By having the package ready for your buyers before they arrive, using the online shop feature in the GST billing and invoicing app for your business will help you save time at the store counter.

Sweets Management

There are several store management tools available in the Vyapar app. Confectioners can track their total sales with the app. It allows you to make the best use of your inventory space.

All sweets have a shorter shelf life. Business reports can assist you in evaluating the performance of your management. Items that do not sell can be removed to make way for new items.

Vyapar inventory management makes creating invoices more manageable by providing a due date for easy tracking. Inventory products are always available when auto stock adjustment is enabled.

Vyapar assists you in keeping enough reserved stock on hand to execute the order. Vendors who sell a wide variety of products must adequately manage their inventories. Using Vyapar’s features, you may detect theft in your store.

Various Payment Options

Sweet store owners must create an appropriate invoice to obtain timely payments. You may produce invoices with various payment choices using the Vyapar invoicing tool. Vyapar’s multiple payment options make purchasing much more accessible.

Payment default is less likely if you provide your consumers with various simple payment options. In the Vyapar app, you can use UPI, QR, NEFT, IMPS, e-wallets, and credit/debit cards.

Buyers are more inclined to buy from you if you allow them to pay per their preferred mode. Customers will put their trust in you and choose you over competitors who do not provide a diverse choice of solutions.

Customers want convenience, and the flexibility to select how to pay you is a crucial convenience you can provide. Allowing your consumers or consumers to pay in their preferred manner strengthens customer ties.

Receive Detailed Reports

Owners of small businesses must make sound decisions. It can be challenging to manage all operational responsibilities and funds simultaneously. Vyapar is the answer to all of these issues.

Vyapar lets you create over 40 different sorts of reports. GST reports can generate sales or purchase reports, expense or revenue reports, and balance sheets.

By studying the reports, you may assess the company’s status. It allows you to locate and stock the most popular goods.

The app can make it easier to file your taxes. You can keep the company’s cash flow steady while avoiding workflow disruptions.

Choose Themes and Customise Invoices

You reinforce your brand’s image and identity when you send outstanding bills to your clients. Our Vyapar software provides two thermal printer templates and twelve invoicing styles for standard printers.

You may quickly increase the visual appeal of your invoice by using this sweet shop bill format. The customisation options are simple to use. You can rapidly prepare the client’s proforma invoice. Making business bills can help you impress a customer.

It is easy to use. Choose the most acceptable bakery invoice formats offered by Vyapar’s bakery shop billing software that suits your needs.. Many businesses use our free sweet shop bill format app to appear professional. It is the most effective way to build a positive brand image.

The most significant advantage of our app is the ability to customise it for your sweet shop. Confectioner custom bill book formats allow you to create a more detailed invoice. Customer-specific messages, additional services, and any other information your client requires can all be included.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

Confectioners always look for new methods to impress their customers with their sweets. They can use a sweet shop bill format to create invoices for their customers and seek payment for their goods or services. It covers special orders, customisation, and so on.

The sweet shop bill format must include a description and price of sweets sold, quantity, and accepted mode of payment. You can also list the extra services you provide in the goods and service invoice template.

Microsoft Word is the best tool for business owners to use for day-to-day tasks. A word-formatted online invoice generator would also be helpful. Vyapar gives you quick access to free sweet shop bill word templates.

Here’s how to go about it:

– Choose from various options to choose a word invoice template that is appropriate for your sweet shop.

– Adjust the Word invoice format to the demands of your business.

– The shop name, item list, client information, invoice date and number, total cost, and contact information should all be changed.

– You can change your invoice’s fonts, logos, and colours to suit your needs.

– Save the bill format for future use.

Many businesses demand Excel capabilities in invoices for easy calculation and time savings. A sweet bill is relatively easy to make in Microsoft Excel. Vyapar, on the other hand, provides an accessible sweet shop bill format in MS Excel.

Select and customise the template that best meets your requirements. Using free Excel invoice forms from Vyapar, you may create an outstanding invoice for your customers in minutes.

Special Purpose Invoice Formats: