Export Invoice Format in PDF

Vyapar’s export invoice formats in PDF enable you to generate error-free invoices quickly, while also providing a high level of customization and automation to streamline your export invoicing process.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of PDF Export Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Export Invoice PDF Templates

Download professional free PDF export invoice templates, and make customization according to your requirements at zero cost.

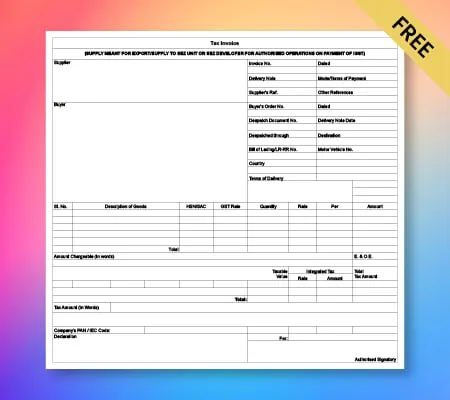

Export Invoice Format – 01

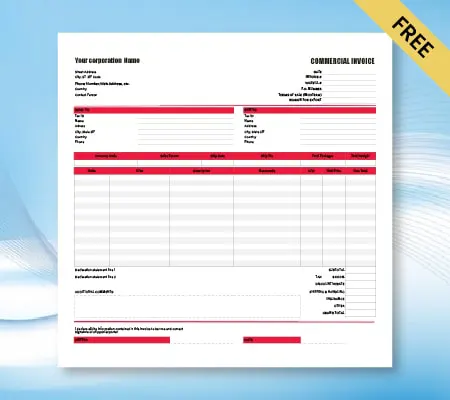

Export Invoice Format – 02

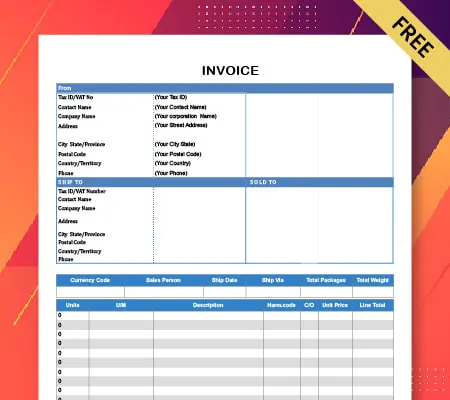

Export Invoice Format – 03

Generate Invoice Online

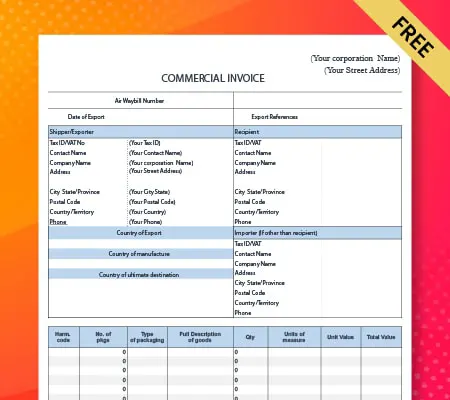

Export Invoice Format – 04

GST export invoice format in PDF

The main aspect of a GST Tax invoice is the data provided to your customer by you. This information must be accurate and precise so that the text is readable.

In a GST invoice export PDF format, the following information must be provided:

- Customer details (All details related to the customer like the name and address)

- Invoice number

- All the information about the goods/services (description/quantity/cost/amount to be paid)

- Company details (All the details related to the company)

- Bank details (Account holder name/account number/IFSC code)

- Payment terms and estimated payment date

- Company details (name/address/postal code/telephone number and e-mail address)

- Effective GST tax and total at the end

- Customer details (name/address/contact details)

- According to your records, invoice number.

- Detailed information about the goods/services

- Payment terms estimated payment date code and)

- Bank details (name/account number/IFSC code)

- Total GST at the end

What is an Export Invoice Format in PDF?

A seller needs to create an export invoice if they want to export goods/services. The description, sellers, and buyers of the goods are identified by the export invoice. It helps identify the value of goods/services and mentions the expected conditions of sale.

You can use the data collected from the export transactions and add them to the Vyapar app to keep account of taxes and manage business finances efficiently.

How to Create an Export Invoice Format in PDF?

Export invoice format can also be created in PDF. Follow the following steps to create an invoice in PDF:-

1. Start by creating a new PDF document.

2. Choose an invoice template

3. Customize the invoice template

4. Save the invoice

5. Send the invoice

Create your first GST quotation with our free Quotation Generator

Why Do Small Businesses Require Export Invoice Format in PDF?

Invoices are the basis of an accounting system. An invoice shows what amount your customers still need to pay you, when the payment is payable, and what services you have rendered. Invoices are the business documents with which organizations manage their business finances, which makes them essential for small businesses.

When you enter the details of the worth of exported goods for your customers or clients, check them one by one. If any mistakes are found in those details, then correct them immediately with necessary corrections.

After adding all your details, recheck them one by one. If any mistakes are found in those details, then correct them immediately with necessary corrections.

Enter all the details mentioned in this document, such as order number, date of selling product, value in Indian rupees, and foreign currency.

Create a new document as per the above requirements and name it. It will be your GST Export Invoice Format.

Why Do Small Businesses Require GST Export Invoice Format?

A GST Export Invoice Format for small businesses helps them maintain a record of their business transactions, thus ensuring that time-consuming audits do not cripple their business. A GST Export Invoice Format for small businesses also helps them file taxes on time. It is the responsibility of any business organization to keep proper records or documents containing essential information such as the name and registration number of the firm, names of partners, addresses, PAN number (if applicable), date of incorporation or registration, and date on which cancellation of registration applies.

Additional essential documents like invoice and credit records of the supplier, the recipient’s debit note, or other legal documents related to the transaction can help make it easier to create and export invoices. In an export invoice form, there should be the availability of both required and optional elements. To approve the request in the GST system, all the important elements must be filled out.

The supplier must withdraw all the export invoices produced within 24 hours after they are issued. They should also cancel the export invoices manually on the GST site before submitting returns. Please note that Vyapar does not provide export invoice formats, but you can use the Vyapar app to manage your business finances and add export transactions externally to keep track of your finances seamlessly.

Features of Vyapar Export Invoice Formats in The PDF

Here are some of the most useful features of the Vyapar free & professional Invoice format for businesses:

Invoicing and Printability

It takes much less time to create a professional estimate and invoice using the Vyapar app. All you need to do is tap, type, and send. Handling a small company invoicing becomes much easier with an invoice format. Keep in mind that you cannot use a general Vyapar invoice format for your export transactions. However, using this way you will spend less time checking your money and getting the payments. Further, you can use the app to create invoices for local businesses in India.

Personalized Invoice Templates

While making an invoice don’t forget to include your standard remarks, the company’s signature, and a picture with the help of the Vyapar PDF invoice format maker. This will make your invoices professional. You can use our highly customisable Vyapar invoice templates to make the process seamless for anyone.

Create Multiple Transactions

With the help of Vyapar, you can easily make a large number of invoices in a very short period. Our unique GST software for billing allows you to create and monitor sales and purchases in a simpler way. This is very much useful in making your customer satisfied as you can rapidly complete orders.

Free Accessibility for a Lifetime

With the help of the Vyapar invoicing application, you will easily generate invoices, track stock, make your dashboard up to date, and also use other features for free. A PDF user can easily use all the accounting products for the rest of their lives. To get all this accessibility all you need to do is to buy a premium service and desktop applications, which you will be needing.

Track Expenses

GST billing software helps you to keep track of your billing and accounting requirements. It is designed to manage your company’s invoices smoothly. This software keeps track of all the expenses in your business. GST Invoicing Software makes it easier for you to file income tax returns. It helps you in saving time as you can track all your business expenses in one place.

Accounting Management

Free professional billing and accounting software allows users to track every detail and balance in their cash book. You now have a more secure way to store your transaction information.

Seamless Shipping

The invoice formats in PDFs will make the shipment of your product easy and fast. It reaches its destination without any hustle. The free GST invoicing app also generates delivery challans. You will also receive all the confirmation of your delivery with this app.

Frequently Asked Questions (FAQs’)

The desktop version of the Vyapar app is not free but comes with a 7-day trial period. The basic version for the mobile is free to use for a lifetime. You can buy the premium version to get access to all the features. Some other subscriptions like one year and three years are also available, and you can purchase them as per your business requirements.

Here are some things to add to in export invoice format

* The full names, addresses, and telephone numbers of the seller and the buyer.

* The commercial invoice number and issue date.

* The number and date the pro forma invoice, purchase order, or sales contract was issued.

* Price, method of payment, currency, and any discounts or extra fees.

The export invoice is a legally binding bill that confirms the sale between a buyer and seller. It contains all the information about the transaction. It also helps in receiving payments and defines what you are exporting. It includes key transaction information, and you can create it using an export format.

Commercial invoices are included with all commercial exports. It provides information on the content of the package and the shipments. They are legally enforceable custom documents.

Special Purpose Invoice Formats: