Bill to Ship to Invoice Format

Invoice creation is streamlined by the Vyapar app. Using a bill to ship to invoice format you can quickly create invoices for your business.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Bill to Ship to Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Bill to Ship to Invoice Format

Download professional free bill to ship to invoice formats, and make customization according to your requirements at zero cost.

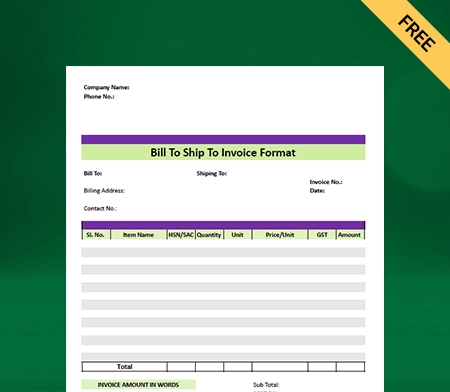

Bill to Ship Format – 1

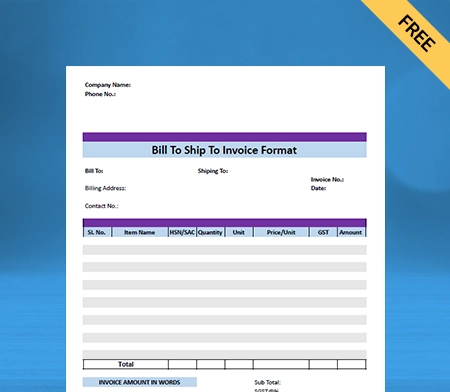

Bill to Ship Format – 2

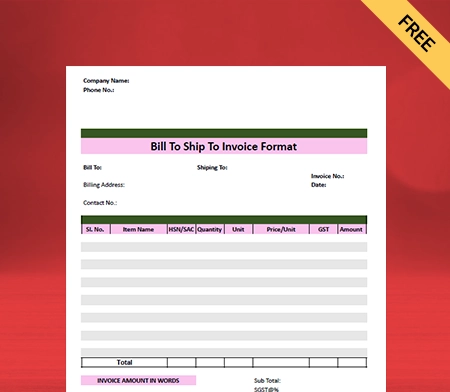

Bill to Ship Format – 3

Generate Invoice Online

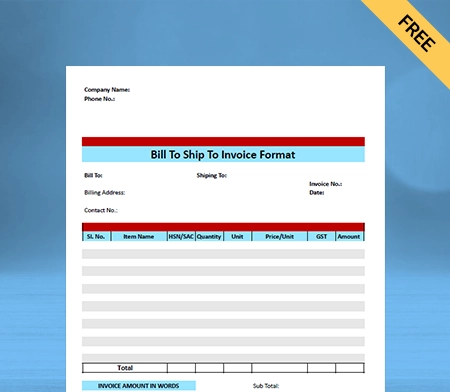

Bill to Ship Format – 4

What is Bill To Ship To?

Usually, when a customer orders, the supplier directly ships the goods from his business place to the shipping address. However, sometimes the supplier may not have stock of the goods that the customer ordered, or he does not deal with them. In these situations, he can ask the third party to ship the goods directly to the customer. A transaction like this is called a Bill To Ship To transaction.

The party to whom the invoice is sent differs from the person who receives the products or services. For instance, customer “X” places an order with supplier “Y” for the supply of goods, and “Y” doesn’t have such goods in stock, so he directs the order to “Z” to supply such goods to “X.”

Here Two invoices are produced as a result of the transaction for use in GST returns:

- Invoice -1 would be issued by ‘Z’ to ‘Y.’

- Invoice -2 would be issued by ‘Y’ to ‘X.’

Invoice 1

Where e-Way Bill is generated by ‘Y,’ he shall fill the following fields in Part A of GST FORM EWB-01:

- Bill Form: Mention the details of ‘Y’ in this field.

- Dispatch Form: It is where the actual delivery of the goods takes place. It can be ‘Y’s’ primary or secondary location of business.

- Bill To: Mention the details of ‘X’ in this field.

- Ship To Addresses: Here, mention the address of ‘Z.’

- Invoice Details: Enter all the other details of the invoice, like quantity, price, and the tax rate of products.

Invoice 2

Where e-Way Bill is generated by ‘X,’ he shall fill the following fields in Part A of GST FORM EWB-01:

- Bill Form Mention the details of ‘X’ in this field.

- Dispatch Form It is where the actual delivery of the goods takes place. It can be ‘Y’s’ primary or secondary location of business.

- Bill To Mention the details of ‘Z’ in this field

- Ship To Addresses Here, mention the address of ‘Z.’

- Invoice Details Enter all the other details of the invoice, like quantity, price, and goods and services tax.

Place of Supply in Case of Bill To Ship To Invoice

Under the IGST Act, Section 10(1)(b) will determine the place of supply on the Bill to ship to the transactions. In this method, the supplier delivers the goods to the recipient under the direction of a third party.

As an agent, the supplier transfers title documents to the goods before or during their movement. The place of supply of those goods is the principal place of business of that third party.

Thus, the recipient’s location is not the place of supply but the principal provider’s principal place of business, per Section 10, Subsection 1, Clause (b) of the IGST law.

E Way Bill

You must prepare an E-way bill whenever there is any movement of goods per the GST regulations. Even though there are two invoices in the Bill-to and Ship-to scenario, the actual transportation of the goods only occurs once. Thus the E-way bill must be created only once and could be based on either of the invoices.

There are two sections under “TO” in the e-way bill form. On the left is a “Bill To” section in which you should mention GSTIN and trade name. On the right side is a “Ship To” section in which you need to write the destination of the goods. The other details depend upon the invoice.

Suppose the Ship to state is different from Bill to State. The tax components are entered as per the billing state party. The IGST is entered if the supplier’s Bill to location is interstate, and the CGST and SGST are entered if the supplier’s Bill to Party location is intrastate.

Here are the reasons why it is essential to determine the proper place of supply:

- According to sections 19 of the IGST Act and section 70 of the CGST Act, incorrectly classifying a supply as interstate rather than intrastate or vice versa may cause difficulty for the taxpayer.

- Based on the revised/proper classification, the taxpayer must pay the correct tax amount and interest for the delay.

- Additionally, correctly knowing the supply site will help us determine the tax incidence.

- If incorrect taxes were paid based on a mistaken classification, the taxpayer would need to request a refund.

Advantages of the E-Way Bill

- It would considerably reduce the documentation requirement for goods movement and the hassles of carrying and safe-keeping the physical papers.

- By promoting appropriate invoicing and decreasing tax evasion, electronic billing lowers the cost of logistics. Additionally, the ratio of logistics costs to GDP, which is now quite high compared to other nations, is anticipated to decrease.

- The e-way Bill’s introduction has significantly increased the speed and effectiveness of the entire transportation network. It decreased the “n” number of checkpoints that crossed state lines and interstates.

- E-way bill generation is simple and quick because it takes place online using a government-established platform. The portal and e-way bill system are incredibly straightforward and user-friendly.

Create your first invoice with our free invoice Generator

Input Tax Credit in case of Bill To Ship To Invoice Format

According to Section 16(2) of the CGST Act, 2017, the following are the person who can claim the input tax credit:

- Registered person who has a tax invoice or debit note issued by a supplier registered under this Act, or such other taxpaying documents as may be prescribed;

- Registered person who has received the goods or services or both.

A registered person is deemed to have received goods when the supplier delivers them to a recipient or any other person acting on their behalf. The supplier may act as an agent before or during the movement of goods by transferring title or possession.

For example, the consideration is paid by Y to X and Z to Y for their respective inward supplies. Hence the recipient for the supply of goods in Supply 1 is Y, and Supply 2 is Z.

Thus, even though the products haven’t been “physically” delivered to Y, in the event of “Supply-1” kind of transactions, Y would be qualified to receive credit for the invoice raised by X.

When it comes to Z, he will only be qualified to claim ITC on the invoice Y raised if the products have been delivered to him.

How to Generate an Invoice Using the Bill to Ship to Invoice Format?

By providing your clients with appealing invoices, you can enhance their view of your brand. It need not take much time to create an invoice for your client.

Create professional invoices in three easy steps with Vyapar.

Step 1: Enter Details

Include the billing date and other pertinent information about your company and clients. To ensure everything is clear, you can add more items and make notes regarding the invoice in Vyapar.

Step 2: Preview

After entering the necessary information, you may check the invoice preview to see how it will look. In the primary tab of the online invoice creator, you can make any necessary adjustments.

Step 3: Share/Download

You may either print and download the finished invoice you created using the Vyapar online invoice generator or send it to your client.

Create Invoices in Word Format

The most useful tool for daily tasks used by business owners is Microsoft Word. An online invoice maker with a Word format would also be useful. You may instantly obtain Word invoice templates from Vyapar.

Use the Word invoices that work best for your business with the Vyapar invoicing tool. It has all the required fields you should fill out with information about your organization. Show your level of professionalism to your clients to make a positive impression.

Here’s how you can do it:

- Find a word invoice template that suits the nature of your business by choosing from a selection of options.

- Adjust the Word invoice format to meet the needs of your business.

- Change the firm name, the item list, the client details, the invoice date, and number, the total cost, and the contact details.

- You can change your invoice’s fonts, logos, and colours to suit your requirements.

- Save the delivery invoice so you can refer to it later.

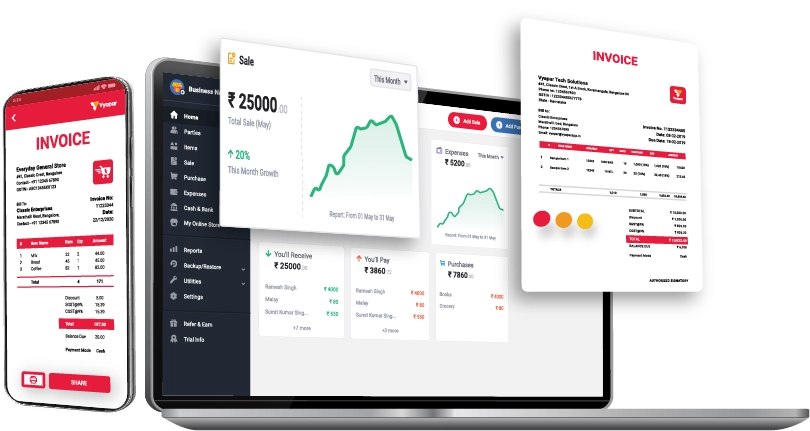

Benefits of Using the Vyapar Accounting App

Online/Offline Invoicing

You can continue running your business without an online connection by utilizing several specific invoice maker program features.

With the use of offline billing software, you may collect payments. The most effective options for India’s remote locations are eWallets because they don’t require an internet connection. You may also create invoices for your clients offline using the Vyapar app.

Our business accounting software automatically checks and updates your transactions when you connect your database to the internet. As soon as a customer uses our platform to make a purchase, you may produce an invoice for them.

Less Manual Error

An invoicing error could cost you a lot of money. It is crucial to choose the right software to manage your business effectively. Using Vyapar, your company can handle data much more swiftly.

Automation simplifies the process and eliminates human Error. You may focus on other chores and save a lot of time. The Vyapar ledger balance sheet formats‘ user interface is simple.

Data can be imported and exported from compatible programs. It also sends reminders to collect payments and reimburse debts, which helps avert further disputes.

Business Reports

Business owners need to choose carefully. It could be challenging to manage the money needed for daily operations, analyze data, and assess business activity. You can resolve each of these problems by using Vyapar.

Using Vyapar, you can create 40+ distinct types of reports. Reports, including balance sheets, expense or income reports, and GST reports, are all possible to prepare. You can maintain the company’s cash flow and stop workflow interruptions.

You can review the reports and determine how the company is doing. By doing this, you may find out which product is popular and stock up on it. Making income tax filing simple may involve using the Ledger balance sheet structure.

Make Personalized Invoices

With Vyapar, you can create invoices rapidly. The software allows you to modify your bills and impress your clients. Utilizing the application to fill out repetitive debit entries automatically will save you time.

Create a unique bill to ship to invoices with the help of the app’s features. You might include your name, address, phone number, payment choices, personalized themes, and company logo on the invoice.

You can communicate with your customers as you like with this technology. You’ll react speedily and provide your customers with a better experience.

Lifetime Free Basic Usage

You can make personalized invoices quickly by using our user-friendly invoice format. You may manage your dashboard and track inventory items as well.

The core functions of our business accounting application continue to be offered without cost. The free services are available to Android mobile users for life. Our mission to include millions of small company owners in the digital economy includes providing free access.

You may register to utilize the accounting software for nothing and get a free copy from the Play Store. However, a business can use a subscription to access the deluxe functions and desktop applications.- Read less

Various Payment Methods

With the help of the Vyapar free invoicing software, you can create invoices with multiple payment options. Users can make regular client payments to you through bank transfers (NEFT, RTGS, IMPS).

To make it easier for your customers to send money to the UPI ID linked, you may create a QR code and add it as one of the payment alternatives inside the invoice.

Acceptable payment methods include cash, cheques, debit cards, and credit cards. Your ability to provide your customers more excellent credit will encourage them to work with you more frequently.

Other Valuable Features of Vyapar Software

Send Estimates & Quotations

Use our free invoicing software to generate practical quotations and precise estimates. Using the tools that are included in the software, you may easily create accurate GST invoices format. Because they are devoid of errors, your invoices and quotes appear more professional.

You may use the app to print the quotations and send the documents to clients by email, SMS, or WhatsApp. Since Vyapar automates most processes, creating invoices utilizing its free templates is simple.

Using Vyapar, you may create invoices in a matter of minutes. Businesses may manage their operations more efficiently and save time. Setting a due date allows you to track invoices as well quickly.

The billing software can help you wow your clients and entice them to come back. The most excellent GST billing software is one of the best investments you can make for your company.

Safety and Security

Any business must prioritize safety, especially now that everything is moving digital. The Vyapar program for invoicing enables you to set up an automatic data backup, allowing you to safeguard the data in the application.

Our free GST software in India allows you to set up an automatic backup of your data, enhancing the security of the data you save there.

For additional security, you can occasionally create a local backup. You might secure your data by storing it on a hard disc or flash drive.

You can further ensure that you can evaluate your data with the accounting functions of the Vyapar billing software. After viewing the company reports, you can create a business strategy.

GST Invoicing / Billing

You may create GST invoices for your clients using the Vyapar App and tailor them to your specifications. The app’s great features enable the recipient to produce invoices quickly and share them with the supplier.

Our free GST billing software will help you automate your billing requirements, greatly benefiting your organization. Small and medium-sized enterprises can significantly reduce their accounting time thanks to it.

The barcode scanner and shortcut keys can speed up repeated tasks during the billing process. Bill-wise payment, which makes it easier to link payments to sales invoices, is one of the critical features of the Vyapar app.

The app’s ability to generate and manage many parties simultaneously makes it easier to quickly access older bills whenever necessary to keep track of all the invoice due dates. The Vyapar app allows any company to identify any unpaid invoices quickly.

Business Management

The Vyapar GST billing tool can help you operate your business with ease. You may track and analyse your company’s operations in real-time with Vyapar’s comprehensive dashboard.

The Vyapar app’s intuitive design may enable you to boost business productivity. You can manage expenditures, bookkeeping, and inventory with this software.

It is simpler to keep track of all business transactions thanks to the format’s simplicity and accessibility. The software eliminates the need to create invoices for every shipment manually.

You can customize your company’s features and extra information on the Vyapar app. The program also helps you track the stock on hand and place your subsequent order per your requirements.

Scanner Compatibility

Vyapar barcode billing software can facilitate faster invoicing since clients create their invoices. The characteristics of Vyapar decrease the time and effort needed for the billing process.

The software allows you to access your PC’s product details from a barcode scanner. The method does away with manually entering each item’s name, quantity, and price.

During the manual billing process, there is a risk of errors; you could omit anything or add the same thing twice. By utilising the barcode feature of Vyapar, you can minimise those errors.

You may access your business dashboard from any location by downloading the Android app. You can set up a company dashboard on your Windows computer with an associated barcode reader and quickly create invoices with Windows invoicing software assistance.

Receivables and Payable

Users of Vyapar can track their company’s cash flow in real time and save all transaction details. Using the software, you can keep track of the party’s payables and receivables. Users can now secure their transaction data in a better way.

You may keep track of the money you “have to receive” and the money you “have to pay” using the business dashboard in the app. Using Vyapar’s cash flow management system enables you to prevent taking on excessive debt and reassessing your business.

You can identify the offender without any difficulty. You can set up payment reminders to ensure that these clients pay their invoices on time. The software enables you to email, SMS, or WhatsApp payment reminders to any recipient.

Additionally, you may save time by sending payment reminders to all of your clients at once, utilizing the bulk payment reminder option. The GST Billing and Invoicing software makes calculations for you automatically.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

Bill To Ship To is a supply model that involves three persons in a transaction. Billing occurs between the consignor and consignee. However, the goods move from the consignor to the third party per the consignee’s request.

In the Bill to ship to model format, two supplies are involved, and two tax invoices are required to be issued:

1. Invoice -1 would be issued by a third party who sends goods on behalf of the supplier. 2. Invoice -2 would be issued by the supplier to the customer.

The e-way bill form has two sections under “To.” You should include your GSTIN and trade name in the “Bill To” field on the left. On the right, the “Ship To” section is where you should enter the shipment’s location. The invoice determines the rest of the information.

Under the “Bill To Ship To” model, three persons are involved in a transaction:

1. a supplier, 2. a customer, 3. a third party who sends goods to the customer on behalf of the supplier.

To create a “bill to ship to” invoice, follow these steps:

1. Include company and customer billing details.

2. Add shipping details for the order (Ship To).

3. Enter invoice number, date, and payment terms.

4. Include item details, quantity, price, and total amount.

5. Calculate and include applicable taxes.

6. Add any additional notes or terms.

7. Save, send to the customer, and keep a copy for records.

If you encounter any difficulties while creating a “bill to ship to” invoice or need further assistance, you can connect with Vyapar for guidance and support. Our team can provide expertise and help you navigate through the invoice creation process to ensure accuracy and compliance with billing and shipping details.

The “bill to ship to” rule allows for different billing and shipping addresses in sales transactions. The billing address is for payment, while the shipping address is where goods are delivered. This rule is used for efficient order processing and accurate documentation, especially in drop-shipping scenarios.

In a “bill to ship to” scenario under GST:

1. Intra-state transactions (same state) attract CGST and SGST.

2. Inter-state transactions (different states) attract IGST.

3. Exceptions apply for specific transactions like exports and SEZ supplies.

4. Consulting tax professionals ensures accurate GST treatment.

For a “bill to ship” transaction under GST:

1. Intra-state transactions’ place of supply is the supplier’s location (billing address).

2. Inter-state transactions’ place of supply is the recipient’s location (as per GST registration).

3. Accurate documentation of billing and shipping addresses is crucial for determining GST applicability.

The “bill to” address is where the invoice is sent for payment, representing the customer. The “ship to” address is where the goods are physically shipped, representing the delivery location. Both are crucial for accurate documentation and logistics in business transactions.

Special Purpose Invoice Formats: