What Is the Business Cycle? #

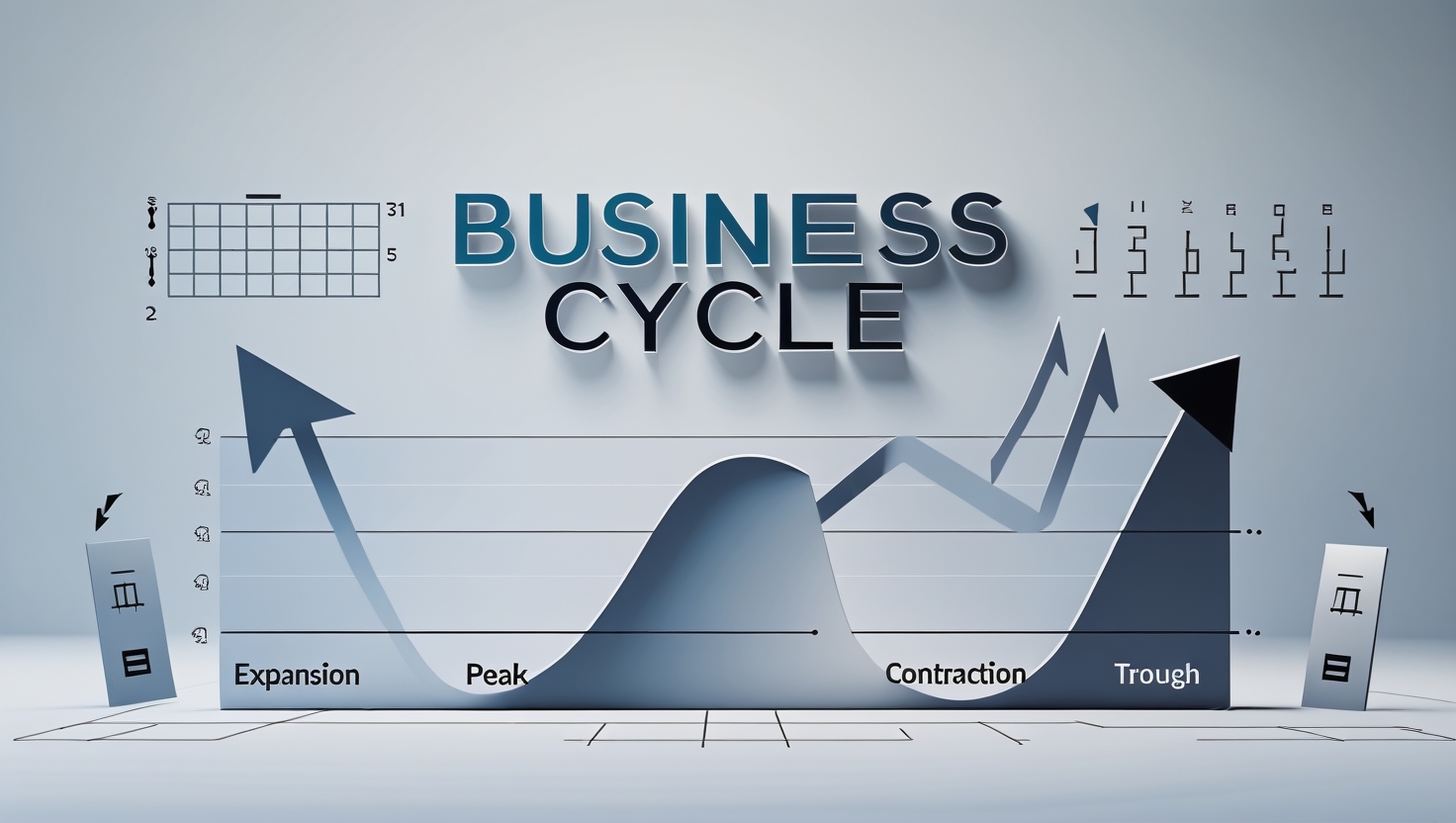

The business cycle is the regular pattern of growth (ups) and decline (downs) in the economy. Imagine a wave; it goes up, reaches a peak, comes down, and then rises again. The business cycle has four main stages:

- Expansion: The “good times” when the economy grows.

- Peak: The top of the wave when growth slows down.

- Contraction: The “not-so-good times” when the economy shrinks.

- Trough: The bottom of the wave when things are at their lowest point.

Each stage impacts your business differently, from sales and hiring to how much money you’ll have left at the end of the month.

The Four Stages Explained #

1. Expansion: The Growth Phase

Expansion is when businesses and people are doing well. The economy grows, and things like jobs and sales increase. During this time:

- People are spending more money.

- Businesses can hire more staff.

- New opportunities, like expanding to new markets, come up.

As a small business owner, this is your chance to invest in innovative ideas, build up your products, and reach more customers.

2. Peak: The Highest Point

The peak is the economy’s tipping point. Things are great, but at some point, they stop growing or get too expensive. Key things to remember during the peak:

- Demand for your products or services may stay strong but start levelling off.

- Costs, like rent or wages, often rise.

- Resources (like supplies or labour) might be harder to get.

You should watch your spending and avoid taking on too much risk. Saving money during this phase can help you later.

3. Contraction: The Downhill Phase

Contraction happens when the economy slows down. People may spend less, causing businesses to cut back. In this stage:

- Sales might drop.

- You might need to cut costs or delay hiring.

- Cash flow could get tight.

While this phase can be tough, it’s also a good time to focus on improving efficiency and reducing waste.

4. Trough: The Lowest Point

The trough is the bottom of the cycle. The economy is at its weakest, but this is also the point where things begin to improve. During this stage:

- Sales might be slow, but you can try to innovate or prepare for recovery.

- Some suppliers or opportunities may be available at lower costs.

- Smart businesses use this time to rework their plans and get ready to grow again.

Why the Business Cycle Matters for Indian Small Businesses #

India’s economy is fast-changing, and business owners often feel the effects of each phase. However, understanding these cycles can help you run your business better. Here’s why the business cycle matters:

- Demand Changes: When the economy grows, customers buy more. When it slows, they cut back. Knowing these patterns helps you plan your inventory and sales.

- Cash Flow: When the economy contracts, your cash flow might shrink. Preparing in advance can help you stay stable.

- Smart Decisions: Understanding where the economy is headed helps you choose when to hire, invest, or save.

Economic Indicators You Should Watch #

Economic indicators are numbers or data points that show how the economy is doing. By keeping an eye on them, you can figure out which stage of the cycle we’re in. Here are three key indicators:

- GDP (Gross Domestic Product): This measures the total value of everything the economy produces. If it’s growing, the economy is expanding.

- Unemployment Rates: When fewer people have jobs, they spend less, which is a sign of contraction.

- Consumer Confidence Index: This shows how confident people are about the economy. If confidence is high, people are likely to spend more.

Understanding these indicators doesn’t require a finance degree—just pay attention to updates in the news or reports.

Types of Business Cycles #

Business cycles don’t all look the same. Some are short, while others last for decades. Let’s break it down:

- Short-Term Cycles: These last from a few months to a few years. Sudden market changes, natural disasters, or political decisions often cause them.

- Long-Term Cycles: These cycles can last for many decades. Major changes, like inventions or global economic trends, affect them.

For example, India’s IT industry grew as technology advanced. This shows how a long-term cycle can change an entire economy.

What Affects Business Cycles? #

Several factors help push the economy up or down. Here are some common ones:

- Government Policies: Steps like tax changes or interest-rate adjustments can speed up or slow down cycles.

- Global Events: If India’s export markets slow down, businesses tied to those markets may feel the pinch.

- Innovation: Breakthroughs in technology or production can lead to new market opportunities and create new cycles of growth.

As a business owner, you don’t need to worry about controlling these factors, but understanding them helps you plan better.

Benefits of Understanding the Business Cycle #

Knowing how the business cycle works can give your business an edge. Here’s how it helps:

- Better Planning: You can plan your business activities. This includes hiring staff, launching products, and managing expenses. You should base these plans on our current cycle.

- Risk Management: Being ready for tough times (like contraction and trough phases) means you can weather financial storms.

- Wise Investments: If you know a contraction is coming, you might hold off on significant financial purchases. But during a growth phase, it might make sense to spend on marketing or production.

- Improved Customer Service: Understanding your customers’ needs at different stages helps you keep them happy. This can make them loyal, regardless of the economy.

Practical Tips for Small Business Owners #

Here’s what you can do to handle every stage of the business cycle:

- Watch the Numbers: Keep an eye on economic data like GDP, job reports, and consumer confidence.

- Save During the Good Times: Build up savings while the economy is growing. This will help your business during slower phases.

- Be Flexible: Adjust hiring, production, and spending to match current economic conditions.

- Diversify Income: Offer different products or services to protect your business from slowdowns in one area.

- Stay Close to Customers: Communicate with your customers and solve their problems quickly. This builds trust and keeps sales strong.

- Focus on Efficiency: Find ways to cut unnecessary costs while still delivering value.

- Think Ahead: Use slow periods to try new ideas or plan for the next growth phase.

Common Challenges (and How to Beat Them) #

Dealing with business cycles isn’t always easy. Here are some common hurdles and tips to overcome them:

- Timing Is Hard: Predicting exactly when things will change is tough. Stay informed and adjust as changes happen.

- Managing Resources: Don’t overcommit by hiring too many people or spending too much during expansion. Plan carefully.

- Handling Sudden Costs: Interest rates or other unexpected expenses can hurt your budget. Keep an emergency fund for such times.

- Shifting Demand: Consumer preferences can change quickly. Always listen to your customers and adapt to their needs.

Real-Life Examples #

Here are a few examples of how businesses in India have tackled the business cycle:

- Local Shops: A small clothing store noticed an economic slowdown. They focused on affordable, locally made products to keep customers shopping.

- Tech Startups: Startups worked through downturns by focusing on innovative products and seeking funding from forward-thinking investors.

- Manufacturing: Some factories shifted their focus to products in demand during tough times, like essentials or budget-friendly items.

- Service Providers: Restaurants and salons introduced online booking options and deals to keep regular customers coming back.

How Vyapar App Helps #

The Vyapar App is a handy tool that helps small businesses handle economic ups and downs more easily. Here’s how it can help you:

- Track Finances: Monitor income and expenses to control cash flow.

- Manage Inventory: Adjust stock levels to avoid overbuying or running out.

- Gain Insights: Use business reports to see trends and plan better.

- Stay Organized: Access automated reminders, invoices, and payment tracking.

The app simplifies complex tasks, giving you more time to focus on growing your business.

FAQ’s: #

What are the stages of the business cycle?

The four stages are Expansion, Peak, Contraction, and Trough.

How long do cycles last?

Short cycles last months to years; long ones can last decades.

Is it possible to “predict” the business cycle?

You can’t predict it perfectly, but watching economic data helps you prepare.

What should I do during a recession?

Cut unnecessary expenses, focus on customer retention, and save funds.

How can I survive tough times?

Build up savings, innovate, and focus on efficiency.

Conclusion #

Understanding business cycles must be uncomplicated. With the right knowledge and tools like the Vyapar App, you can prepare for whatever the economy throws your way. Whether the market booms or slows, staying flexible and informed will keep your small business on the path to success.

Use Vyapar App to handle billing, stock & payments all in one place.

Make bills, track stock, and handle payments in one place.