What is the Cash Conversion Cycle? #

The Cash Conversion Cycle (CCC) is a financial metric used to determine how quickly a business can transform its inventory investments into actual cash flow. In simpler terms, it begins when a business purchases goods for sale and concludes when customers pay for those goods.

For small-scale enterprises, especially within India, understanding the timing of cash inflows and outflows is essential. A shorter CCC reflects efficient cash usage, aiding in improved financial planning and facilitating faster growth.

Why Does CCC Matter for Small Businesses? #

Small businesses often operate on limited capital, which makes careful money management essential. Knowing your CCC helps you handle your cash better.

- You may not need to rely heavily on loans.

- Timely payment of bills becomes easier.

- You can reinvest in inventory more confidently.

- Strategic planning becomes more practical.

If you own a small store or company, understanding CCC gives you a competitive edge.

How the CCC Affects Business #

CCC offers more than just a number; it helps you identify what’s working and where you need to make changes.

Ask yourself:

- Are your products moving off the shelves fast enough?

- Are your customers taking too long to pay?

- Are you paying suppliers earlier than necessary?

By reviewing your CCC, you gain useful insights that support smarter decisions for improving operations.

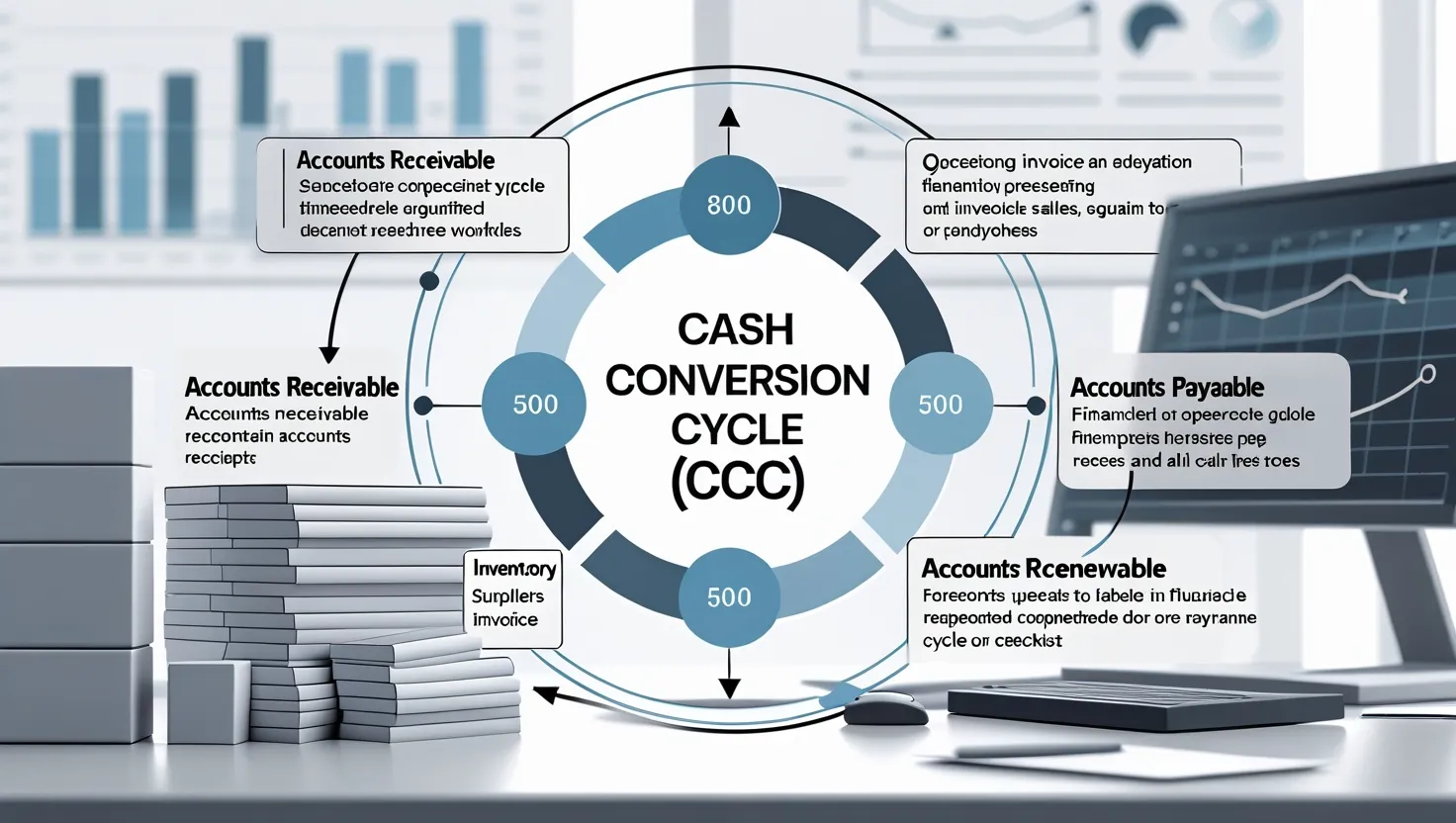

The Three Main Parts of CCC #

1. Inventory Turnover

Inventory turnover refers to how quickly a business can sell the goods it has purchased or produced. For instance, imagine you own a clothing store, and you buy 100 T-shirts. If you manage to sell all of them within a week, that indicates a high turnover rate.

A high inventory turnover is a positive sign. It means that products do not sit on the shelves for too long, which helps free up money that businesses can use to buy more stock or cover other expenses. On the other hand, if your inventory moves slowly, you tie up your money in unsold goods. This can limit your ability to make new purchases, take advantage of sales opportunities, or respond to changes in customer demand.

Efficient inventory turnover means better inventory management and more agile business operations. By tracking how fast your goods are selling, you can adjust your purchasing decisions, reduce waste, and better match supply with demand.

2. Accounts Receivable

Accounts receivable represent the money owed to your business by customers who have received goods or services but haven’t paid yet. Suppose your business gives regular customers 10 days to pay after receiving their order. If those customers delay payment beyond that time, it can disrupt your cash flow.

When unpaid invoices hold your money, they limit your ability to cover daily expenses or invest in new opportunities. This is especially risky for small businesses that depend heavily on a steady cash flow to survive and grow.

To keep your receivables in check, it’s important to set clear payment terms, send invoices promptly, and follow up with customers when payments are overdue. Offering small discounts for early payment or charging a fee for late payment can also encourage customers to pay on time.

Managing accounts receivable effectively ensures that you maintain sufficient cash to run your business smoothly, pay your bills, and avoid unnecessary borrowing.

3. Accounts Payable

Accounts payable refers to the amount of time your business takes to pay its suppliers for goods or services you’ve already received. For example, if your supplier gives you 30 days to make a payment, and you utilize that full period without harming your relationship or delaying delivery, it’s generally beneficial for your business.

Taking full advantage of your credit terms allows you to hold on to your cash longer, which improves your liquidity. You can use that money for daily operations, unexpected expenses, or even short-term investment opportunities. However, it’s important not to delay payments beyond the agreed terms, as this can damage your reputation and make suppliers less willing to offer favorable terms in the future.

Strategically managing your accounts payable helps maintain a healthy cash flow and can give your business greater financial flexibility. It also opens the door to negotiating better deals or discounts with trusted suppliers.

Other Helpful Terms You Should Know #

- Days Inventory Outstanding (DIO): Measures how long goods stay in stock before being sold. A low DIO means faster sales.

- Days Sales Outstanding (DSO): This reflects the number of days it takes for customers to pay. A lower DSO is preferable.

- Days Payable Outstanding (DPO): Indicates how many days you take to pay suppliers. A higher DPO allows you to conserve cash longer.

So, How Do You Figure Out Your CCC? #

Use this formula:

CCC = DIO + DSO − DPO

Example:

- DIO = 30 days (you hold inventory for 30 days)

- DSO = 20 days (customers take 20 days to pay)

- DPO = 15 days (you take 15 days to pay suppliers)

CCC = 30 + 20 − 15 = 35

This means it takes 35 days for your business to turn investment into cash.

A lower CCC is always more beneficial.

Why Lower CCC is Good #

- Speeds up cash returns

- Reduces need for credit or loans

- Helps scale your business faster

- Enhances cash control and financial predictability

Tips to Make Your CCC Better #

- Sell Faster: Avoid overstocking. Use inventory management tools to identify fast-selling items.

- Encourage Timely Payments: Define clear payment terms, send invoices promptly, and follow up as needed.

- Optimize Supplier Payments: Negotiate favorable payment terms. Pay within agreed timelines—neither too soon nor too late.

- Monitor CCC regularly: Analyze CCC monthly. Identify and resolve inefficiencies quickly.

Significant Advantages of Knowing CCC #

- Improved Cash Flow: Stay aware of your cash position to avoid shortages.

- Smarter Business Choices: Time your inventory purchases and discounts more effectively.

- Room to Expand: With extra cash, consider hiring, upgrading equipment, or expanding your services.

- Risk Reduction: Detect issues early—like overstocking or delayed payments—and take corrective action.

- Better Supplier Terms: With sound cash management, suppliers may offer extended credit or discounted rates.

- Competitive Advantage: Regularly analyzing CCC positions your business ahead of those that ignore it.

Common CCC Problems & How to Fix Them #

- Excess Inventory: Avoid buying more than needed. Rely on sales data to guide decisions.

- Late Customer Payments: Invoice promptly and send reminders to ensure on-time payments.

- Early Supplier Payments: Stick to your agreed terms. Paying too early can harm cash flow.

- Infrequent CCC Checks: Make CCC reviews a monthly routine. This helps track progress and fix problems early.

Best Habits to Keep Your CCC Healthy #

- Conduct regular audits and reviews

- Train your team to understand CCC basics

- Use accounting tools to track metrics efficiently

- Prepare for both optimistic and pessimistic scenarios

- Maintain good communication with vendors and clients

- Learn from industry peers

- Balance inventory levels—avoid excess and shortages

- Predict future cash requirements proactively

Real-Life Examples #

Retail Store in Bangalore

A local shop began focusing on fast-selling products and asked customers to make quicker payments. This improved their festive-season cash flow significantly.

Factory in Mumbai

A manufacturing unit started checking CCC each month. They discovered they were overstocking raw materials. After reducing excess and negotiating better payment terms with vendors, they freed up cash to invest in new equipment.

Service Business in Delhi

By requesting quicker payments and offering discounts for early payers, this service firm improved operations and client satisfaction.

E-commerce Startup in Pune

Though the company was growing fast, cash flow challenges were slowing progress. After analyzing CCC and adjusting inventory strategies, they expanded without needing extra loans.

How Vyapar App Helps #

- Real-Time Cash Flow: Know how much money is coming in and going out at any time.

- Inventory Made Simple: See which items sell fast and which don’t. Buy smarter.

- Quick Invoicing: Send bills to customers right away. The sooner they get the bill, the sooner they pay.

- Easy Payment Alerts: Send payment reminders. No more missing dates.

- Automatic Reports: Get your CCC and other numbers without doing the math.

- Simple to Use: It is made for small business owners. You don’t need to be a finance expert!

FAQ’s: #

What is CCC in simple words?

The time between buying something and getting paid for it is crucial.

What is a good CCC?

You prefer shorter cycles because they don’t tie up your money for long.

Why is CCC important?

It helps track where your money is and allows better planning.

How can I check my CCC?

Use the formula: CCC = DIO + DSO – DPO

Should I check my CCC every month?

Yes. Regular monitoring allows you to spot and fix problems early.

Conclusion #

Effectively managing your Cash Conversion Cycle is crucial for business success. It provides a clear view of your financial flow, enables strategic decision-making, and lays the groundwork for sustainable growth.

By understanding CCC, you can:

- Set realistic prices

- Maintain organized records

- Satisfy your customers

- Improve long-term profitability

Use Vyapar App to handle billing, stock & payments all in one place.

Make bills, track stock, and handle payments in one place.